ADP Bundle

Can ADP Continue Its Reign in the HCM Arena?

From its humble beginnings in 1949, ADP SWOT Analysis has transformed from a payroll processor to a global HCM powerhouse. With a market cap exceeding $130 billion as of 2025, ADP's journey is a testament to its adaptability and strategic vision. But what does the future hold for this industry titan, and how does its current ADP growth strategy position it for sustained success?

This ADP company analysis dives deep into ADP's evolving business model, scrutinizing its ADP future prospects within the competitive HR tech landscape. We'll explore the key drivers behind its ADP market share, analyze its strategic acquisitions, and examine how ADP leverages innovation to navigate the ever-changing demands of the global workforce. Understanding ADP’s financial performance and its long-term vision is crucial for investors and business strategists alike.

How Is ADP Expanding Its Reach?

The company's expansion strategy focuses on strengthening its position in the Human Capital Management (HCM) market. This involves a multi-pronged approach, including strategic acquisitions, organic growth through product development, and strategic partnerships. The goal is to enhance its service offerings and enter new markets, particularly in the global HCM and HRO sectors. This is a critical aspect of the overall Marketing Strategy of ADP.

A key element of the expansion strategy is the growth of its international HCM and HRO businesses. This is often achieved through collaborations with local software solutions and cloud-based multi-country solutions. The company's focus on scaling its presence in regions like Europe, Latin America, the Middle East, and North Africa highlights its commitment to global expansion. This strategy is designed to meet the evolving needs of a diverse client base and capitalize on emerging market opportunities.

Strategic acquisitions are a significant component of the expansion strategy. These acquisitions allow the company to quickly enter new markets and broaden its service offerings. The acquisition of WorkForce Software in October 2024 is a prime example of this strategy. This acquisition is expected to contribute to revenue in fiscal year 2025, emphasizing the immediate impact of these strategic moves.

This acquisition, completed in October 2024, is aimed at expanding the company's global enterprise HCM solutions, especially in workforce management. The integration of WorkForce Software is expected to boost the company's capabilities and market reach. This strategic move is anticipated to generate revenue in fiscal year 2025, demonstrating the immediate impact of such acquisitions.

The company is also focused on organic growth through product development and strategic partnerships. An example is the partnership with the American Heart Association to integrate CPR education into the ADP Mobile Solutions app. This initiative leverages its platform for broader impact, potentially reaching its 14 million active monthly users. These efforts are designed to drive long-term growth and strengthen its market position.

The company's expansion efforts are underpinned by a three-tier business strategy, focusing on delivering a comprehensive suite of cloud-based HCM and HR Outsourcing solutions. These initiatives are designed to address the changing needs of clients and drive sustainable growth. The focus on international expansion and strategic acquisitions reflects a proactive approach to capitalize on global market opportunities.

- Expanding international HCM and HRO businesses.

- Strategic acquisitions to enter new markets and enhance offerings.

- Organic growth through product development and partnerships.

- Focus on cloud-based HCM and HR Outsourcing solutions.

ADP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ADP Invest in Innovation?

Innovation and technology are at the heart of ADP's plans for sustained growth in the Human Capital Management (HCM) market. The company is heavily focused on digital transformation and automation to improve its offerings and internal processes. This includes a strong emphasis on integrating advanced technologies, especially Artificial Intelligence (AI).

ADP is actively incorporating generative AI across various business areas, such as recruitment, to automate tasks and boost efficiency. They are also exploring how AI can reduce service and implementation costs while streamlining international platforms. This forward-thinking approach is designed to maintain and enhance its competitive edge in a rapidly evolving market.

ADP's commitment to innovation is also evident in its product development, specifically in crafting human-centric HR and Payroll products. The company is continuously investing in its ADP iHCM product to bring shared innovative products to clients. This includes exploring AI to analyze employee skills, support engagement and retention, and provide insights for managers. This dedication to innovation is a key part of their overall strategy.

ADP is using generative AI to automate tasks in recruitment and improve efficiency. They are also exploring AI to reduce service and implementation costs.

ADP focuses on creating human-centric HR and Payroll products. They are continuously investing in ADP iHCM to bring innovative products to clients.

ADP is exploring AI to analyze employee skills, support engagement, and provide insights for managers. This helps improve employee retention and performance.

ADP has been recognized as a Core Leader in the 2024 Fosway 9-grid for Cloud HR. This is partly due to its ongoing innovation and advancements like the ADP Assist GenAI assistant.

The company's strategic focus includes leveraging technology and AI to improve its offerings and internal operations. This supports its long-term growth strategy.

ADP plans to continue investing in innovation and technology to meet the changing needs of its clients. This includes expanding its global presence and leveraging data analytics for growth.

ADP's strategic initiatives are designed to enhance its market position and drive future growth. For instance, the company's investment in AI and automation aims to streamline operations and improve client services. The company's approach to innovation is further detailed in Mission, Vision & Core Values of ADP. This commitment to technological advancement and client-focused solutions is a key component of ADP's strategy to maintain its leadership in the HR tech market, ensuring it remains competitive and responsive to the evolving demands of its customer base.

ADP's technology strategy focuses on several key areas to drive growth and enhance its market position.

- AI Integration: Implementing AI across various functions, including recruitment, to automate tasks and improve efficiency.

- Product Innovation: Continuously developing human-centric HR and Payroll products, with a focus on user experience and client needs.

- Data Analytics: Leveraging data analytics to provide insights for managers, support employee engagement, and improve retention rates.

- Global Expansion: Using technology to support its global payroll and HR solutions, expanding its reach in international markets.

- Cost Reduction: Exploring AI and automation to reduce service and implementation costs, improving profitability.

ADP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ADP’s Growth Forecast?

The financial outlook for ADP in fiscal year 2025 appears promising, with the company forecasting revenue growth between 5% and 6%. This anticipated growth is coupled with expectations for sustained margin expansion and earnings per share (EPS) growth. The company's strong performance in fiscal year 2024, with total revenue reaching $19.2 billion, a 6.61% increase, and net income rising by 9.96% to $3.75 billion, sets a solid foundation for future success. The first quarter of fiscal year 2025 showed continued momentum, with consolidated revenue of €1,486 million, reflecting a 12.2% increase compared to the same period in 2024, driven by growth across all segments.

ADP's commitment to shareholder value is evident through its dividend payouts, with $2.2 billion distributed in fiscal 2024. The company anticipates steady income growth, which will support consistent dividend payments. The company's net profit margin for the quarter ending March 31, 2025, was 19.79%, and the average net profit margin for 2024 was 19.64%, a 3.92% increase from 2023. The recurring EBITDA is expected to grow by more than 7.0% in 2025. Furthermore, the average yearly investment spending (capex) for the group is projected to reach up to €1.4 billion in 2025.

Analyst projections for 2025 estimate an average annual revenue growth of 5.4% over the next three years. This positive outlook is supported by ADP's strategic initiatives and its ability to adapt to the evolving needs of its clients. The company's focus on innovation and technology, along with its strong market position, positions it well for continued growth in the HR tech market. For more details on the company's target market, you can refer to Target Market of ADP.

Key drivers include new client acquisitions, expansion of services to existing clients, and growth in the global payroll market. ADP's business model focuses on recurring revenue streams, which provide stability and predictability. The company's market share is significant, contributing to its financial performance.

Strategic acquisitions have played a role in ADP's growth strategy, expanding its service offerings and market reach. These acquisitions help ADP address the changing needs of its clients by providing a broader range of solutions. The impact of these acquisitions is reflected in revenue growth and market share expansion.

ADP invests heavily in innovation and technology to enhance its service offerings and maintain a competitive edge. This includes investments in cloud-based solutions, data analytics, and AI. These investments are crucial for ADP's future prospects, especially in the payroll industry.

ADP has a strong global presence, with operations in numerous countries, allowing it to serve multinational clients effectively. The company's ability to provide payroll and HR solutions worldwide is a key factor in its growth. ADP plans to expand its global presence further through strategic initiatives.

ADP's financial performance is characterized by consistent revenue growth, strong profitability, and a commitment to shareholder value. The company's long-term vision includes continued investment in technology and expansion of its service offerings.

- Revenue growth of 5% to 6% expected in fiscal year 2025.

- Recurring EBITDA growth of more than 7.0% in 2025.

- Average annual revenue growth of 5.4% projected over the next 3 years.

- Dividend payments of $2.2 billion in fiscal 2024.

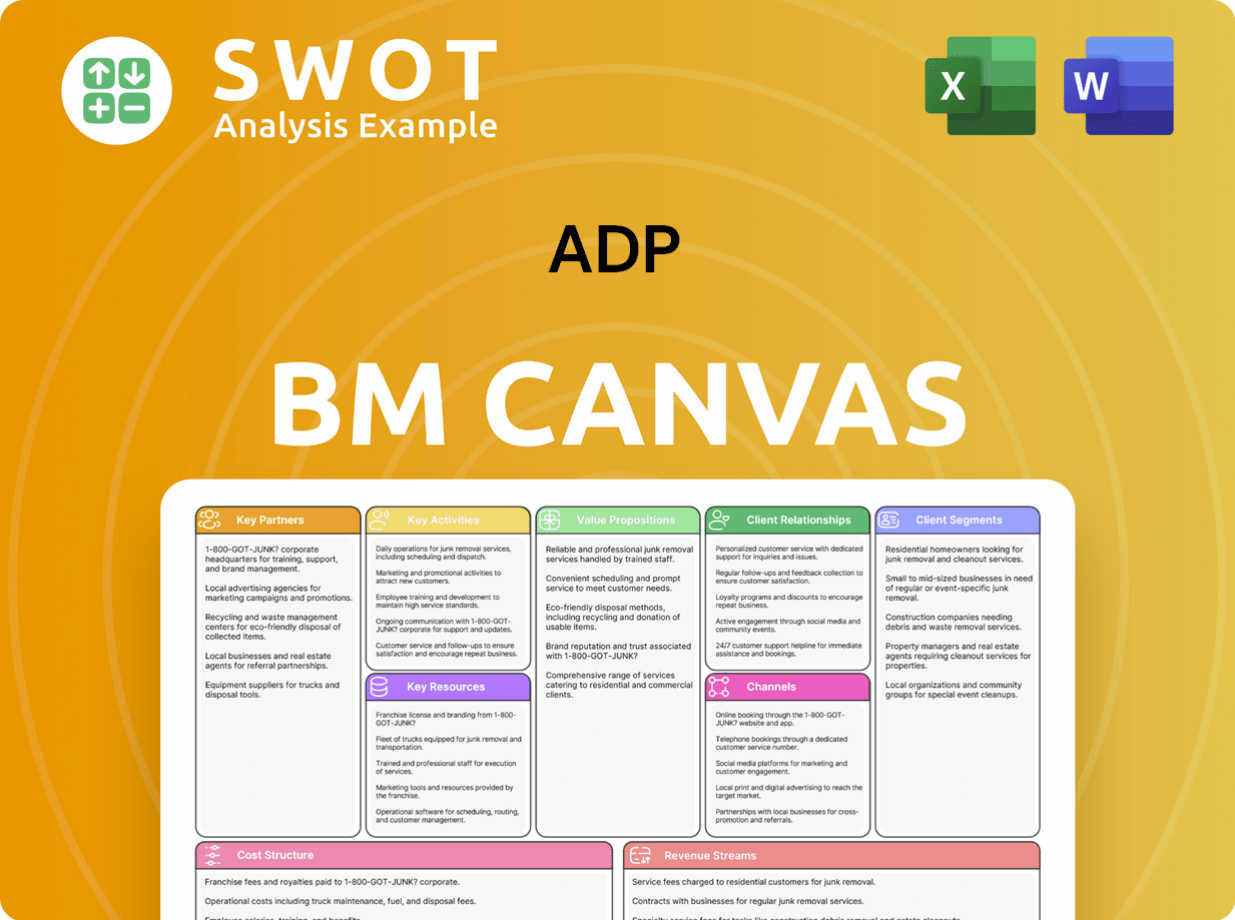

ADP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ADP’s Growth?

Despite its strong position, the company faces several potential risks. These challenges could impact its ADP future prospects and overall performance. Understanding these risks is crucial for a comprehensive ADP company analysis.

Market competition is a significant hurdle, with more payroll and HCM software providers emerging. This could lead to pricing pressures and the need for increased innovation. Regulatory changes, particularly regarding AI in hiring, present an evolving risk that requires proactive compliance efforts.

Internal resource constraints and rising expenses also pose challenges. Increased talent costs and investments in acquisitions and transformation projects can impact financial performance. The company's ability to maintain its competitive edge depends on effectively managing these risks.

The payroll and HCM market is competitive, with several companies vying for market share. This competition can lead to pricing pressures and the need for continuous innovation to attract and retain clients. Addressing these challenges is vital for maintaining ADP's market share and ensuring ADP growth strategy.

Regulatory changes, especially concerning AI in hiring and employment practices, pose a risk. Compliance with evolving regulations requires ongoing investment and adaptation. The company must stay ahead of these changes to maintain its position and avoid potential penalties.

Internal resource constraints and rising expenses, such as talent costs, can impact growth. Investments in acquisitions and transformation projects also require careful financial management. Efficiently managing these resources is crucial for sustainable growth and financial health.

Economic downturns can affect client spending and demand for services. The company needs to prepare for potential economic fluctuations. Diversifying services and client base can help mitigate the impact of economic uncertainties.

The rapid pace of technological change can disrupt the market. The company needs to continuously invest in innovation and adapt to new technologies. Staying current with technological advancements is essential for maintaining a competitive edge and ensuring long-term success.

Cybersecurity threats pose a significant risk to the company's operations and client data. Protecting sensitive information requires robust security measures and ongoing vigilance. Implementing and maintaining strong cybersecurity protocols is critical for maintaining client trust and avoiding financial and reputational damage.

The company's current ratio at the end of the third quarter of fiscal 2025 was lower than the industry average. However, it remained above 1, indicating its ability to meet short-term obligations. This demonstrates a level of financial stability, but continuous monitoring is essential. For more details, you can explore a Brief History of ADP.

The company has a history of overcoming obstacles, such as navigating the Covid-19 pandemic. This resilience highlights its ability to adapt to changing market conditions. Continuous monitoring and adaptation to the evolving market and regulatory landscape are critical for sustained success.

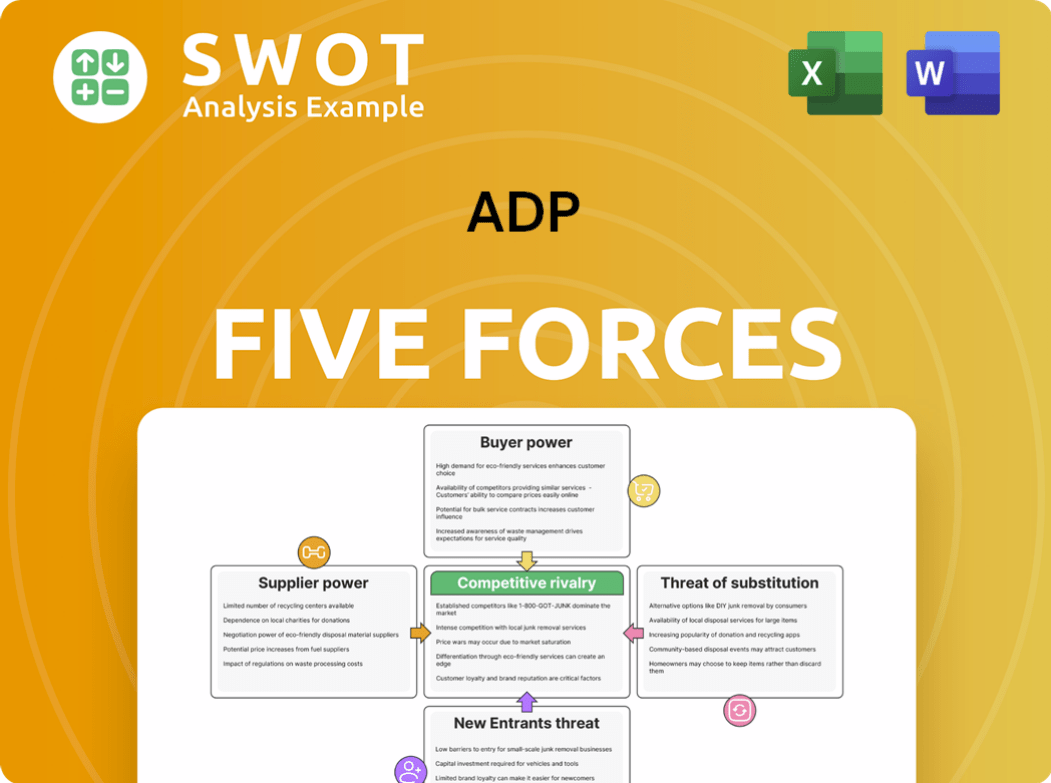

ADP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.