ADP Bundle

How Does ADP Stay Ahead in the HCM Game?

Automatic Data Processing, Inc. (ADP), a titan in human capital management, consistently demonstrates its prowess with impressive financial results. In its recent Q3 2025 earnings, ADP showcased robust growth, with revenues climbing and earnings per share exceeding expectations. But what fuels ADP's enduring success, and how does it maintain its leadership position in a competitive market?

ADP's comprehensive suite of ADP SWOT Analysis services, including ADP payroll, HR, and benefits administration, caters to businesses globally, driving its financial performance. Understanding the intricacies of ADP's operations, from ADP payroll processing steps to ADP employee self-service features, is key to appreciating its impact. This analysis will explore how ADP company leverages its strengths and navigates challenges to remain a dominant force in the ADP workforce management landscape, offering insights into its ADP services and future prospects.

What Are the Key Operations Driving ADP’s Success?

The ADP company creates value through its cloud-based Human Capital Management (HCM) solutions. These solutions integrate essential HR functions such as payroll, talent management, time and attendance, tax, and benefits administration. This approach serves businesses of all sizes globally, streamlining HR tasks and improving data accuracy.

Key products include ADP Workforce Now, a comprehensive suite for payroll, compliance, benefits, and talent management, particularly suited for mid-to-large businesses. Operational processes are driven by technology development and efficient service delivery. The company focuses on continuous innovation, exemplified by its acquisition of WorkForce Software and the introduction of ADP Lyric HCM, a global human capital management platform.

The value proposition of ADP lies in its ability to provide data-driven insights, enabling informed business decisions and fostering exceptional workplaces. The integrated nature of its HCM platforms streamlines various HR processes, offering comprehensive workforce management insights. This integrated functionality, coupled with ADP's extensive experience, strong brand reputation, and customer-centric approach, sets it apart from competitors.

ADP's core operations revolve around delivering HCM solutions via a cloud-based platform. This includes payroll processing, talent management, time and attendance tracking, and benefits administration. The company's technology streamlines HR tasks, reducing administrative overhead and improving data accuracy.

ADP empowers clients with data-driven insights, enabling informed business decisions and fostering exceptional workplaces. The integration of its HCM platforms streamlines various HR processes, providing comprehensive workforce management insights. This results in significant customer benefits and market differentiation.

ADP Workforce Now is a key product, offering a comprehensive suite for payroll, compliance, benefits, and talent management. ADP Lyric HCM is another significant offering, a global human capital management platform. These products cater to a wide range of business sizes and needs.

ADP's strategic advantages include its extensive experience, strong brand reputation, and customer-centric approach. High client retention rates reflect its ability to capitalize on its market position. These factors differentiate ADP from competitors and contribute to its success.

ADP offers a range of features designed to streamline HR processes and improve efficiency. These include automated payroll processing, talent acquisition tools, and personalized learning experiences. The company focuses on providing a competitive advantage through its innovative solutions.

- Automated Payroll Processing: Simplifies payroll calculations and tax filings.

- Talent Acquisition Tools: Helps businesses find and hire top talent.

- Personalized Learning Experiences: Enhances employee development and engagement.

- Comprehensive HCM Platform: Integrates various HR functions for better management.

For more insights into the financial aspects of ADP, you can explore Owners & Shareholders of ADP.

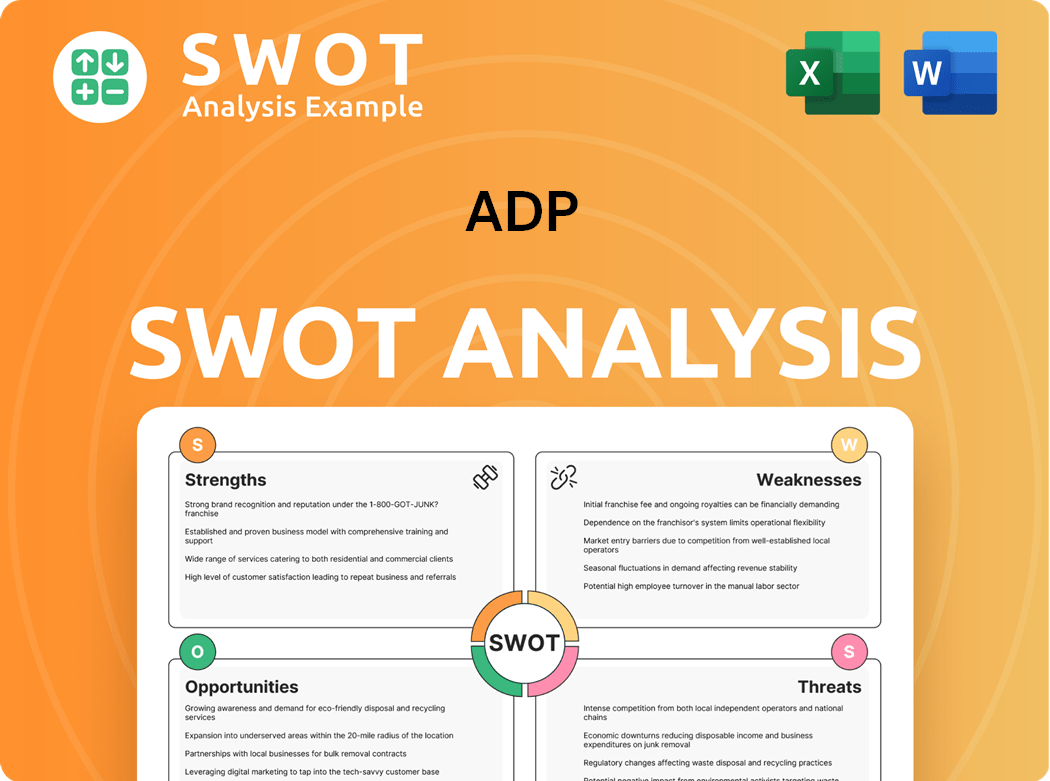

ADP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ADP Make Money?

The company, a leading provider of human capital management (HCM) solutions, generates revenue through its comprehensive services. These services include payroll processing, tax and benefits administration, talent management, and HR outsourcing, which are primarily categorized under Employer Services and Professional Employer Organization (PEO) Services.

In the third quarter of fiscal year 2025, the company demonstrated strong financial performance, highlighting its robust revenue streams. This growth is fueled by a combination of subscription-based models, transaction fees, and strategic cross-selling initiatives, making it a key player in the HCM market.

The company's revenue streams are diversified and designed to cater to a wide range of business needs. This approach ensures a stable financial outlook, as demonstrated by the company's recent financial results and future projections.

The company's financial success is driven by its diverse revenue streams and strategic monetization strategies. In Q3 fiscal 2025, total revenues reached $5.6 billion, marking a 6% increase. The Employer Services segment saw a 5% rise, while the PEO Services segment grew by 7%. A significant portion of revenue comes from interest earned on client funds.

- In Q3 fiscal 2025, interest on client funds increased by 11% to $355 million.

- Average client funds balances rose by 7% to $44.5 billion.

- The average interest yield on client funds increased to 3.2%.

- For fiscal year 2025, the company anticipates client funds interest revenue between $1.115 billion and $1.135 billion.

- The projected growth in client funds balances is between 3% and 4%, with an average yield increasing to 3.1%.

The company employs several monetization strategies to maximize revenue. These include subscription-based models for its cloud-based HCM solutions and transaction fees for services like payroll processing. The company also uses tiered pricing to accommodate businesses of all sizes and leverages cross-selling opportunities. For fiscal year 2025, the company projects an overall revenue growth of 6% to 7%, with adjusted diluted EPS growth of 8% to 9%. To understand more about the company's strategic direction, you can read about the Growth Strategy of ADP.

ADP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ADP’s Business Model?

The evolution of the ADP company has been marked by significant milestones and strategic initiatives. Recent developments include the acquisition of WorkForce Software, a move aimed at enhancing its workforce management solutions, and the introduction of ADP Lyric HCM, a human capital management platform. These moves, announced in Q1 fiscal 2025, underscore the company's commitment to innovation and expansion within the HCM market.

ADP has consistently demonstrated resilience and adaptability in a competitive market. Despite facing challenges such as platform migrations and increased competition, the company has maintained strong revenue retention and improved operating margins. This consistent financial performance has allowed for continued investment in innovation, acquisitions, and global expansion, solidifying its position in the industry. Read about the Growth Strategy of ADP.

ADP's competitive edge is built on its extensive experience and strong brand reputation in the HCM sector. The company benefits from high client switching costs and a scale-based cost advantage. Furthermore, its integrated HCM platforms streamline HR processes and provide comprehensive insights, differentiating it from competitors. The company is also investing in AI to enhance its HCM offerings, with applications such as automated payroll processing and talent acquisition, which are expected to improve efficiency and provide a competitive advantage.

The acquisition of WorkForce Software in Q1 fiscal 2025 is a key milestone, expanding ADP's capabilities in workforce management. The introduction of ADP Lyric HCM also marks a significant step in providing flexible and intelligent HCM solutions. These strategic moves are designed to drive innovation and client acquisition, further strengthening the company's position in the market.

ADP's strategic moves include investments in service and client experience, and the expansion of generative AI tools and intelligent automation. These initiatives aim to improve efficiency and provide a competitive advantage. The company's focus on client satisfaction and market-leading product offerings is a core element of its growth strategy.

ADP has a strong brand reputation and extensive experience in the HCM sector. The company benefits from high client switching costs and a scale-based cost advantage. Integrated HCM platforms, which streamline HR processes, differentiate ADP from competitors. The company's consistent financial performance, with steady revenue growth and profitability, enables it to invest in innovation, acquisitions, and global expansion.

ADP has demonstrated resilience in navigating market challenges. The company has maintained high revenue retention and improved operating margins over the past decade. Consistent financial performance, with steady revenue growth and profitability, has enabled it to invest in innovation, acquisitions, and global expansion. The company's strategic focus on client satisfaction and market-leading product offerings further positions it for continued growth.

ADP's competitive advantages stem from its extensive experience and strong brand reputation in the HCM sector. High client switching costs and a scale-based cost advantage further strengthen its position. The company's integrated HCM platforms streamline HR processes and provide comprehensive insights, differentiating it from competitors.

- Extensive experience and strong brand reputation in the HCM sector.

- High client switching costs and a scale-based cost advantage.

- Integrated HCM platforms that streamline HR processes.

- Investments in AI for automated payroll processing and talent acquisition.

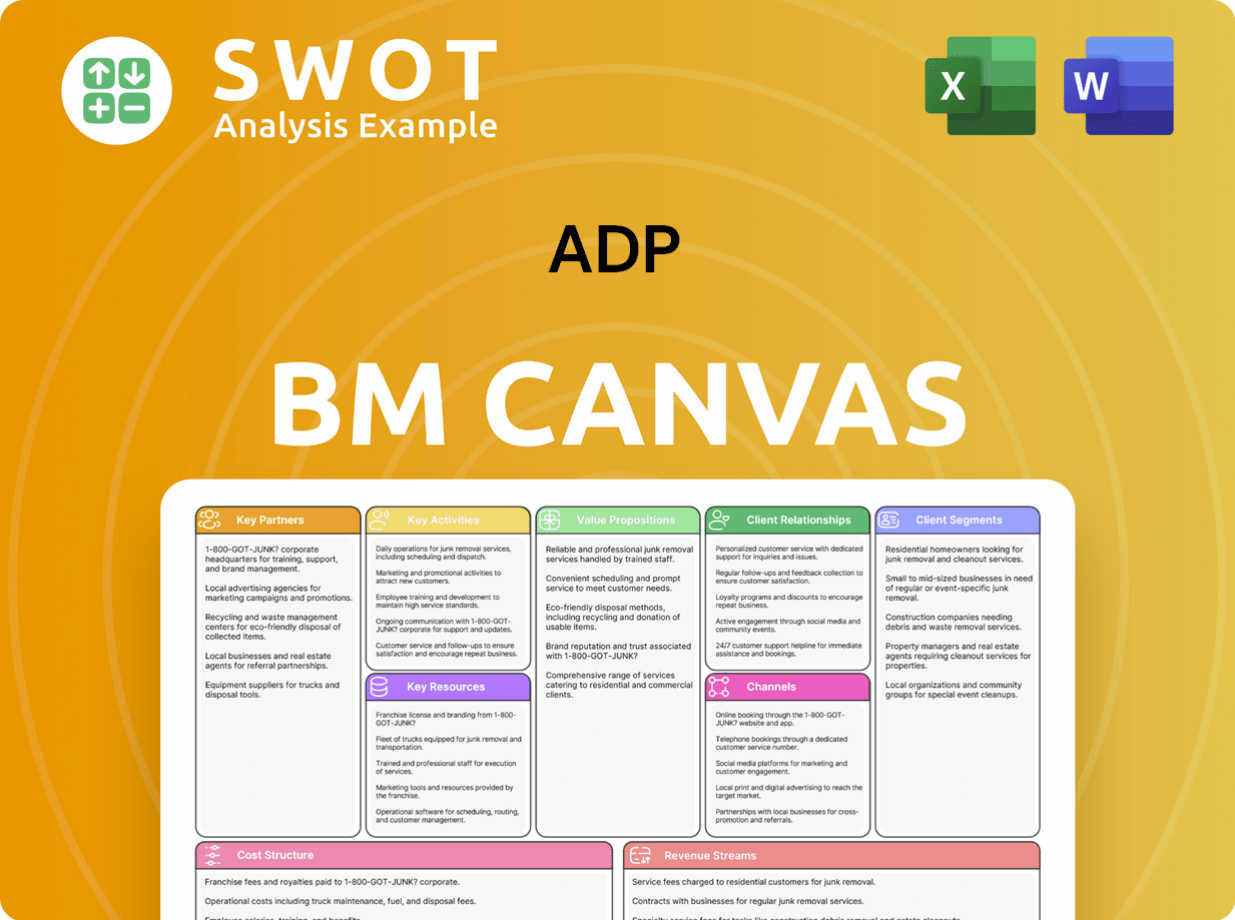

ADP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ADP Positioning Itself for Continued Success?

The ADP company holds a strong position in the global human capital management (HCM) solutions market. It serves businesses of all sizes worldwide, with a leading market share in North America, the Pacific Rim, Europe, and Latin America. Its established brand, extensive experience, and comprehensive HCM solutions differentiate it from competitors. For example, while Paychex often focuses on small and medium-sized businesses (SMBs), and Workday emphasizes AI-driven solutions, ADP payroll caters to a broader range of businesses.

Despite its strong market position, ADP faces several risks, including fluctuating interest rates, potential economic downturns, and increased competition. Cybersecurity threats and regulatory changes also pose challenges. The company must continually adapt to new competitors and technological disruptions to maintain its market leadership. The Competitors Landscape of ADP provides further insights into the competitive environment.

ADP is a leading provider of HCM solutions globally. It serves a diverse customer base across various industries and sizes. ADP's market position is strengthened by its comprehensive suite of services, including ADP payroll, workforce management, and benefits administration.

Key risks include economic downturns, increased competition, and cybersecurity threats. Fluctuating interest rates can impact financial performance. Regulatory changes and technological disruptions also pose ongoing challenges to ADP's operations.

ADP aims to sustain growth through continued investment in its business and innovation. The company is focused on expanding its HCM offerings and adapting to changing market conditions. For fiscal year 2025, revenue growth is projected at 6% to 7%.

ADP is leveraging AI to enhance its HCM offerings. The company is also investing in its workforce to drive high employee satisfaction and retention. Strategic initiatives include client satisfaction and market-leading product offerings.

ADP's financial performance reflects its strong market position and strategic initiatives. The company's focus on client satisfaction and market-leading product offerings supports its growth. ADP anticipates adjusted diluted EPS growth of 8% to 9% for fiscal year 2025.

- Revenue growth projected at 6% to 7% for fiscal year 2025.

- Anticipated adjusted diluted EPS growth of 8% to 9% for fiscal year 2025.

- Strategic focus on innovation and expanding HCM offerings.

- Continued investment in workforce and client satisfaction.

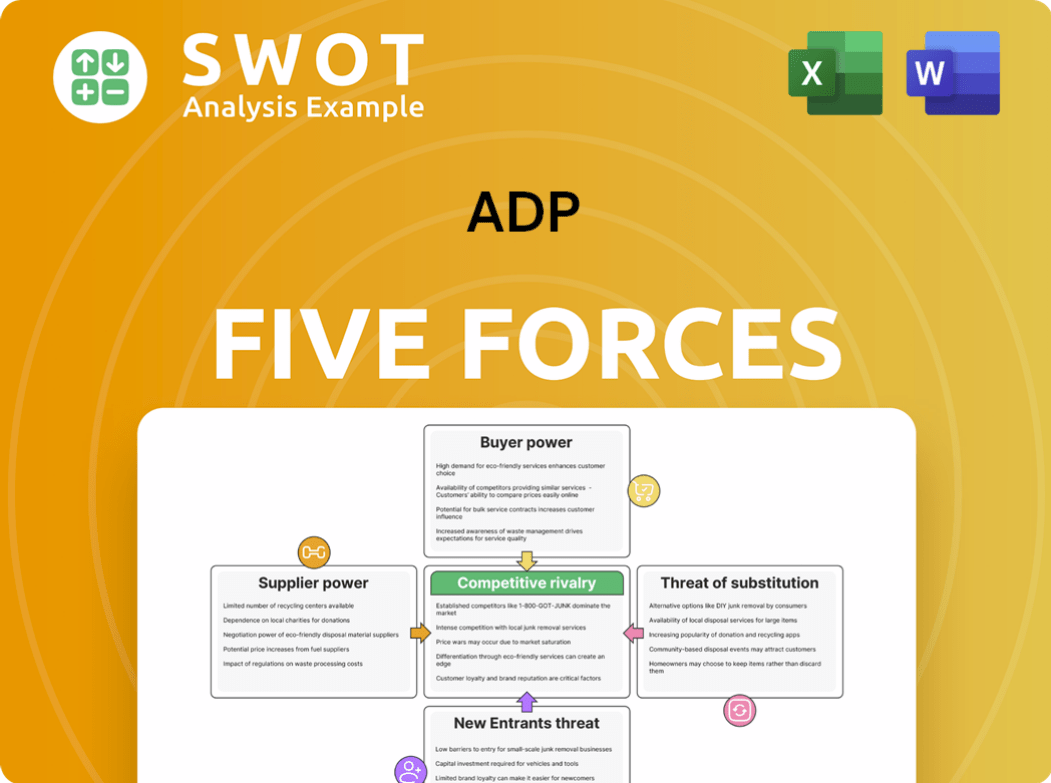

ADP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ADP Company?

- What is Competitive Landscape of ADP Company?

- What is Growth Strategy and Future Prospects of ADP Company?

- What is Sales and Marketing Strategy of ADP Company?

- What is Brief History of ADP Company?

- Who Owns ADP Company?

- What is Customer Demographics and Target Market of ADP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.