Adven Bundle

What's Next for Adven Company in the Energy Transition?

Adven Company, a key player in sustainable energy, is making waves with its innovative approach to energy solutions. With over 50 years of experience, Adven is at the forefront of providing efficient and cost-effective energy services across multiple sectors. This analysis dives into Adven's Adven SWOT Analysis, growth strategy, and future prospects.

Adven's strategic planning focuses on expanding its market share through business development and investments in renewable energy technologies. The company's commitment to sustainability and its strong financial planning position it well for future growth. This exploration will delve into Adven Company's market analysis, strategic goals, and the opportunities that lie ahead in the evolving energy landscape, examining its long-term growth strategy and impact on the industry.

How Is Adven Expanding Its Reach?

The Adven Company is actively pursuing a robust growth strategy, focusing on both geographical expansion and service diversification, particularly within the sustainable energy sector. This approach is designed to capitalize on the increasing demand for renewable energy solutions and strengthen its market position. The company's strategic initiatives are geared towards long-term growth and sustainability, reflecting its commitment to providing innovative and environmentally friendly energy solutions.

A core element of Adven's business development strategy involves strategic acquisitions and partnerships. These moves are aimed at enhancing its capabilities, expanding its reach, and improving its service offerings. By integrating new businesses and forming strategic alliances, Adven aims to accelerate its growth and create value for its stakeholders. The company's focus on mergers and acquisitions is a key component of its overall strategic planning.

Adven’s future prospects look promising, driven by its strategic focus on sustainable energy and its commitment to innovation. The company's expansion initiatives, coupled with its strong financial performance, position it well for continued growth in the coming years. The company’s strategic goals and objectives are clearly aligned with the evolving demands of the energy market.

Adven's growth strategy includes strategic acquisitions to expand its operations. In November 2024, Adven acquired Österlens Kraft, a Swedish company, to grow its district heating operations. This acquisition, finalized in early 2025, leverages Österlens Kraft's 50 years of experience in the sector.

In February 2025, Adven Oy acquired Kaskisten Energia Oy, a district heat company in Finland. This acquisition strengthens Adven's position in Finland, where it already operates in over 20 locations. Significant investments are planned for boiler refurbishment and automation improvements.

Adven is involved in strategic partnerships and new project developments. In October 2024, Adven partnered with Nobian to build a new electric caustic soda facility in Delfzijl. Also, in May 2025, a new investment was announced with Outokumpu, doubling recovered waste heat for Avesta residents.

Adven restructured its organization in December 2024, implementing a country-based approach. This restructuring aims to enhance efficiency and collaboration. The new structure supports growth by aligning business segments with local operations, fostering clearer ownership and accountability.

Adven's expansion initiatives include acquisitions, strategic partnerships, and organizational restructuring. These initiatives are designed to boost the company's market share and improve its service offerings. The company's approach to business development is focused on sustainable energy solutions.

- Acquisition of Österlens Kraft to expand district heating operations.

- Acquisition of Kaskisten Energia Oy to strengthen presence in Finland.

- Partnership with Nobian for a new electric caustic soda facility.

- Organizational restructuring to enhance efficiency and collaboration.

Adven SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Adven Invest in Innovation?

The innovation and technology strategy of the company is central to its Growth strategy, particularly in the energy sector. This strategy focuses on leveraging advanced technologies to provide resource-efficient and environmentally friendly energy solutions. The company aims to drive the energy transition by increasing the use of renewable and recycled fuels.

A key element involves adapting plants for flexible and sustainable fuel mixes, including the use of residual heat and by-products. The company also emphasizes digital transformation and automation to enhance operational efficiency and reliability. This approach supports the company's goal of offering customized and cost-efficient energy solutions, designed to minimize environmental impact. This strategy is crucial for Adven Company's Future prospects.

The company's commitment to long-term partnerships is essential for driving sustainable impact and fostering future opportunities in the energy and industrial water sectors. The company's strategic focus is on building comprehensive solutions tailored to customer needs, underscoring its innovative approach to energy as a service. This is part of the company's broader Business development plan.

The company actively promotes the use of renewable and recycled fuels. This includes transitioning plants to accommodate sustainable fuel mixes. The company's approach helps in reducing the carbon footprint and promoting environmental sustainability.

The company incorporates geoenergy-based heating and cooling solutions. These solutions can be integrated with other renewable sources like solar and water energy. This approach enhances energy efficiency and reduces reliance on conventional energy sources.

The company is focused on digital transformation and automation. This includes integrating systems into a 24/7 operational center. This focus improves operational reliability and security.

The company offers customized and cost-efficient energy solutions. These solutions include industrial steam, refrigeration, heating, cooling, gas, and electricity. The goal is to minimize environmental impact.

The company emphasizes long-term partnerships to drive sustainable impact. These collaborations are crucial for fostering future possibilities in the energy and industrial water sectors. Partnerships are key to Adven Company's Strategic planning.

The company is committed to smart grid principles. This involves integrating information and communication technology to improve the efficiency and sustainability of energy distribution. This commitment supports the company's long-term growth strategy.

The company's approach to innovation and technology is multifaceted, with a strong focus on sustainability and efficiency. This includes integrating various renewable energy sources and enhancing operational capabilities through digital solutions. For more details, read about the Revenue Streams & Business Model of Adven.

- Renewable Energy Integration: The company focuses on integrating renewable energy sources like solar, water, and excessive heat recovery.

- Digitalization: Digital transformation is a key element, with plans to integrate the Kaskinen district heating plant into a 24/7 operational center.

- Fuel Flexibility: The ability to adapt plants for flexible and sustainable fuel mixes, including the use of residual heat and by-products, is crucial.

- Customer-Centric Solutions: The company provides customized energy solutions, including industrial steam, refrigeration, heating, cooling, gas, and electricity.

Adven PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Adven’s Growth Forecast?

The financial outlook for the company is influenced by its focus on sustainable energy solutions and its strong operational model. While specific financial projections for 2024-2025 are not readily available in recent reports, the company's historical performance and strategic moves offer insights into its financial trajectory. This includes the company's strategic approach to business development and its long-term growth strategy.

In 2014, the company generated an EBITDA of EUR 30 million. The company's total balance sheet is €1.320 million, with an annual turnover of €337 million, demonstrating a solid financial foundation. These figures underscore the company's capacity for strategic planning and its commitment to market analysis.

The company's ownership structure and investor base also reflect its financial stability and potential for growth. The company was acquired by institutional investors advised by J.P. Morgan Asset Management in 2020, following previous ownership by EQT Infrastructure, AMP Capital, and Infracapital. These ownership changes indicate ongoing investor confidence and a focus on long-term growth in the sustainable energy infrastructure sector. These changes are part of the company's strategic goals and objectives.

Under previous ownership, the company experienced significant growth. Total capital expenditure exceeded EUR 120 million between 2012 and 2016. This investment led to a nearly 50% growth in employees and over a 35% decrease in CO2 emissions, showcasing its commitment to sustainability initiatives.

Recent acquisitions, such as Österlens Kraft in November 2024 and Kaskisten Energia in February 2025, demonstrate continued investment in expanding their asset base and market presence. These moves are part of the company's market expansion plans.

The company's 'energy as a service' model, which involves long-term contracts, provides a stable revenue stream. This supports future financial growth and contributes to the company's competitive advantages. This approach is key to understanding the future of the company in the renewable energy sector.

The company is actively investing in district heating networks, including boiler refurbishment and automation improvements. This focus highlights the company's future investment opportunities and its impact on the industry. The company's leadership and vision are evident in these strategic investments.

The company's financial stability is further supported by its ownership by institutional investors. This structure ensures a focus on long-term growth and sustainability, addressing challenges and opportunities within the market. For more insights, you can check out the article on the company's growth strategy.

The company's long-term contracts within its 'energy as a service' model provide a stable revenue stream. This approach supports financial growth and contributes to the company's competitive advantages. This is a key element of the company's long-term growth strategy.

Adven Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Adven’s Growth?

The success of the Adven Company, hinges on its ability to navigate several potential pitfalls. These challenges range from intense competition in the energy-as-a-service market to the ever-shifting landscape of environmental regulations. Understanding and preparing for these risks is critical for the company's sustained growth and market leadership.

Market dynamics and technological advancements are key factors that could influence the company's trajectory. The volatility in energy markets, amplified by global events, presents both hurdles and opportunities. Moreover, internal factors, such as the ability to attract and retain skilled professionals, could impact project execution and operational efficiency.

Adven's strategic approach involves proactive measures to mitigate risks and capitalize on opportunities. The recent organizational restructuring, implemented in December 2024, aims to enhance efficiency and collaboration. This initiative is designed to strengthen the company's culture, leadership, and strategic direction for 2025 and beyond.

The energy as a service market is highly competitive, attracting various players. This competition can put pressure on pricing and market share. The company must continuously innovate and differentiate its offerings to stay ahead.

Changes in environmental policies and energy production standards could require significant adjustments. Compliance with evolving regulations, especially in the diverse legal frameworks of the Nordic and Baltic countries, is essential. These changes can impact operational costs and investment strategies.

Supply chain disruptions for renewable and recycled fuels could pose operational and financial risks. Fluctuations in the availability or pricing of these resources can affect Adven's ability to deliver cost-efficient solutions. The company needs to manage its supply chain effectively.

The ongoing geopolitical landscape and energy market volatility, are significant challenges. Such events can escalate the need for drastic actions in energy markets. This can create both challenges and opportunities for the company.

Rapid advancements in energy technologies could shift market dynamics. New forms of energy storage or more efficient distributed energy resources may require continuous adaptation. This necessitates ongoing investment in innovation to stay competitive.

Attracting and retaining skilled personnel in a specialized field can affect project execution and operational efficiency. The company's ability to compete depends on its workforce. This includes investing in employee training and development.

Adven’s strategic planning must account for these risks through diversification and proactive measures. This includes exploring new markets and technologies. The company's ability to adapt to change will be critical for long-term sustainability and success.

Continuous market analysis is crucial for understanding competitive pressures and emerging trends. Monitoring competitors, regulatory changes, and technological advancements is essential. This helps in making informed decisions and adjusting strategies.

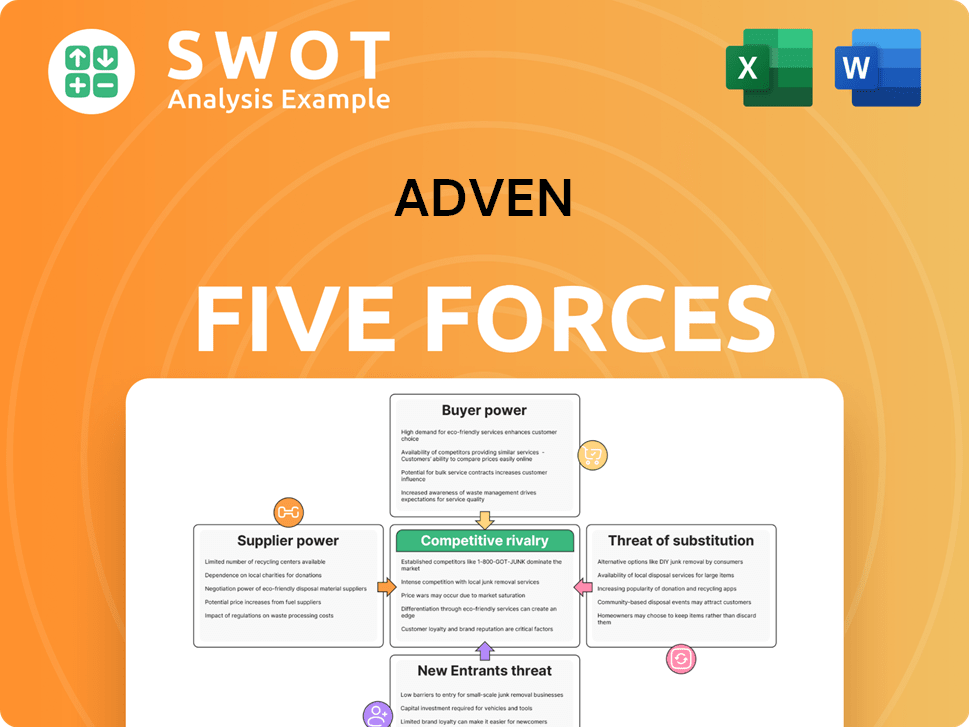

Adven Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Adven Company?

- What is Competitive Landscape of Adven Company?

- How Does Adven Company Work?

- What is Sales and Marketing Strategy of Adven Company?

- What is Brief History of Adven Company?

- Who Owns Adven Company?

- What is Customer Demographics and Target Market of Adven Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.