Adven Bundle

How Does Adven Company Thrive in the Energy Transition?

Adven Company, a leader in sustainable energy solutions, is reshaping the energy landscape across Northern Europe. With over 50 years of experience, Adven provides critical energy infrastructure and services, focusing on sustainability and efficiency. Its 'Energy as a Service' model and commitment to renewable energy initiatives make it a compelling case study for investors and industry professionals.

This deep dive into the Adven SWOT Analysis will explore the company's core operations, revenue strategies, and competitive advantages within the evolving energy sector. Understanding the Adven business model is crucial, especially given the increasing demand for sustainable energy and the projected growth of the sustainable energy sector. We'll examine how Adven services are driving the energy transition and its impact on the environment.

What Are the Key Operations Driving Adven’s Success?

The core operations of the Adven Company revolve around its 'Energy as a Service' (EaaS) model. This model allows the company to design, build, own, and operate energy infrastructure for its clients. This approach enables clients to focus on their primary business operations while Adven manages their energy needs, offering services like heating, cooling, steam, and water treatment.

The company serves a diverse customer base across Northern Europe, including industries, real estate, and municipalities. Adven provides tailored solutions, such as biomass and waste heat recovery for industries. For real estate clients, particularly shopping centers and office properties, geoenergy-based heating and cooling systems are a key offering, often combined with solar or water energy and heat recovery. Municipalities benefit from Adven's provision of sustainable district heating for households and businesses.

The operational processes are comprehensive, covering the design, construction, operation, and maintenance of energy plants and networks. The supply chain emphasizes sustainable solutions, boosting renewables, recycled energy, and energy efficiency. Their commitment to long-term contracts, typically spanning 5-10 years, ensures consistent energy prices for clients and stable, predictable revenue for the company.

The EaaS model allows Adven to handle all aspects of energy infrastructure. This includes design, construction, ownership, and operation. Customers benefit by focusing on their core business while Adven manages their energy needs.

The company serves industries, real estate, and municipalities across Northern Europe. Services include heating, cooling, steam, and water treatment. Tailored solutions like biomass and waste heat recovery are provided to industries.

Operations include designing, building, operating, and maintaining energy plants and networks. The supply chain focuses on sustainable solutions, renewables, and energy efficiency. Long-term contracts provide consistent energy prices.

Adven uses a technology-agnostic approach to select the best solutions for customers. They act as a risk and investment partner, owning and operating infrastructure. Stringent Service Level Agreements (SLAs) ensure performance.

The 'Energy as a Service' model offers cost efficiency, reduced environmental impact, and reliable energy delivery. This approach differentiates Adven in the market. Adven's district heating projects are key to their sustainability efforts.

- Cost savings through optimized energy solutions.

- Reduced carbon footprint by using renewable energy sources.

- Reliable energy supply with guaranteed performance.

- Focus on long-term partnerships and customer satisfaction.

For more insights, you can explore the Marketing Strategy of Adven. This article provides a deeper understanding of the company's strategies. Adven's commitment to sustainable development is evident in its approach to energy efficiency and renewable energy initiatives. The company's financial performance reflects its success in the EaaS model. Adven's latest news and updates show its continued growth and expansion in the European market. The company's project development process ensures efficient and effective delivery of energy solutions. Adven's impact on the environment is significant, contributing to a greener future. The company's partnerships and collaborations further enhance its ability to provide innovative energy solutions. Adven's technology and innovation drive its competitive advantage. Opportunities for career growth are available within the company.

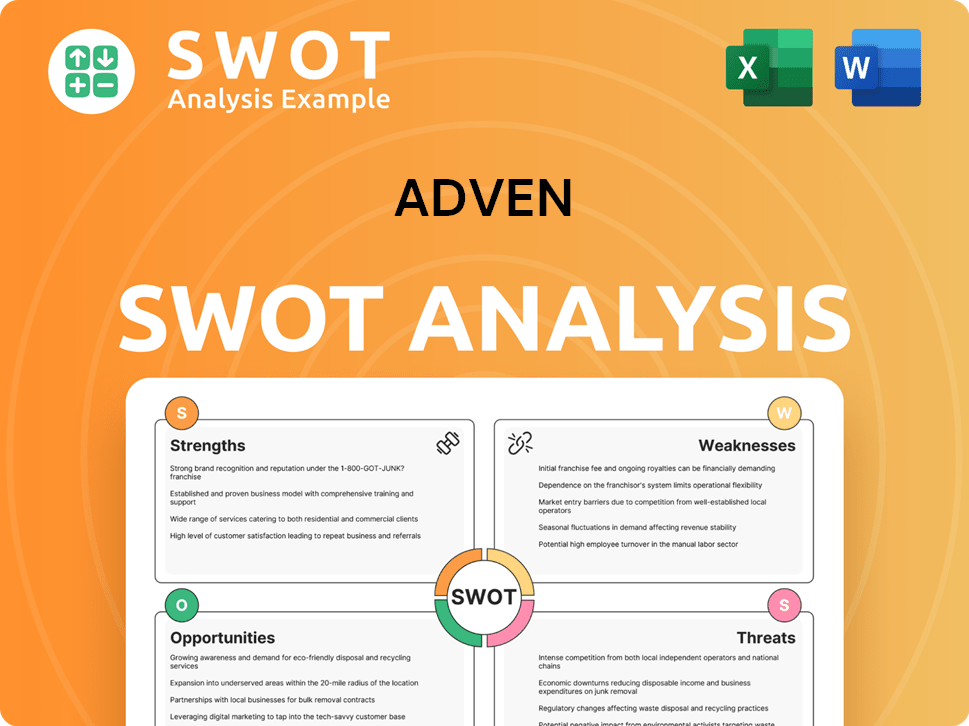

Adven SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Adven Make Money?

The Growth Strategy of Adven relies heavily on its 'Energy as a Service' (EaaS) model, which provides a stable revenue stream. This approach involves long-term contracts for designing, building, owning, and operating energy infrastructure. This model is central to how the Adven Company generates income.

In May 2025, the company's annual revenue was estimated at approximately $750 million. A significant portion of this, about 70% in 2024, came from these long-term contracts, usually spanning 5-10 years. The focus on long-term agreements ensures a predictable financial outlook for Adven.

The core of Adven's monetization strategy involves providing customized and cost-effective energy solutions. They emphasize energy efficiency and the use of renewable fuels to reduce client costs. Their pricing model prioritizes energy usage, which removes the need for upfront infrastructure investments.

The company's approach is designed to boost revenue through direct sales and strategic partnerships. Direct sales accounted for 65% of Adven's revenue in 2024, with partnerships contributing the remainder. The company also aims to increase revenue by 15% through strategic partnerships.

- Energy as a Service (EaaS) Model: This model provides long-term contracts for energy infrastructure, ensuring stable revenue.

- Cost-Efficient Energy Solutions: Adven focuses on energy efficiency, waste heat utilization, and renewable fuels to reduce client costs by an average of 15% (2024 data).

- Pricing Model: Pricing is based on energy usage, removing the barrier of upfront infrastructure costs.

- Sales and Partnerships: Direct sales and strategic partnerships are key to revenue generation, with direct sales contributing 65% of revenue in 2024.

- Sustainability Focus: Capitalizing on the growing demand for sustainable energy, with the renewable energy sector growing by 15% in 2024.

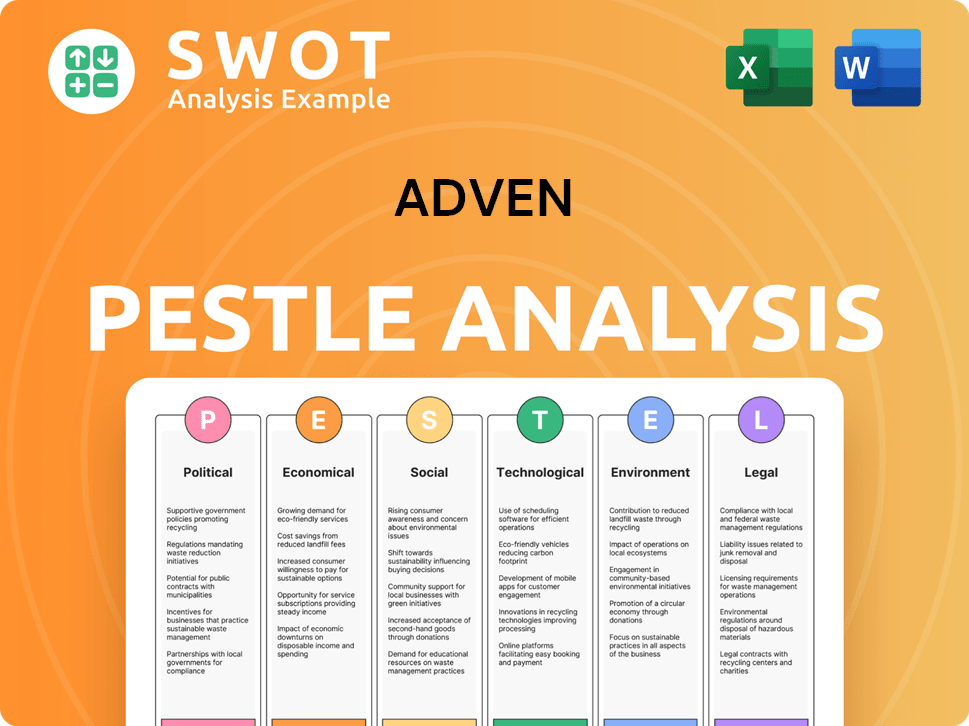

Adven PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Adven’s Business Model?

The journey of the Adven Company has been marked by significant milestones and strategic shifts, shaping its market position. A key move in December 2024 involved a restructuring to a country-based organizational model, designed to boost efficiency and collaboration across its business segments. This followed the appointment of Jonas Sjölander as CEO in November 2024. The restructuring aims to empower teams, improve collaboration, and foster agility, with a clear focus on strengthening culture, leadership, and strategic direction for 2025.

The company has expanded its geographical reach and service offerings through various initiatives. For instance, Adven acquired district heating operations in Kungsör, Sweden, in June 2025, and Kaskisten Energia in Finland in February 2025, demonstrating its strategic expansion in key markets. The company has also made strategic investments in new technologies, such as the electric boiler investment for Suominen's nonwoven plant in Nakkila, Finland, which will supply steam energy using two boilers starting in fall 2025. This highlights Adven's commitment to electrification in energy production. Similarly, Adven will commence construction of a new wood chip boiler house in Vändra, Estonia, planned to supply most of Vändra with heat by spring 2025, further utilizing biomass as a primary fuel source.

The company's competitive edge is rooted in its 'Energy as a Service' model, which allows it to form long-term partnerships and provide stable, predictable revenue streams. Its focus on sustainability and the energy transition, promoting renewables and energy efficiency, strengthens its competitive position and brand perception. The company's diversified customer base across Northern Europe and its broad service offerings, including heating, cooling, steam, and water treatment, reduce risks associated with reliance on a single customer type or market. Adven's ability to offer customized solutions and take on technology risks and upfront capital expenditure for clients further differentiates it from competitors. The company continues to adapt to new trends by investing in innovative waste heat recovery and new geoenergy applications, targeting a growing market driven by rising energy costs and environmental regulations.

Recent acquisitions and investments highlight Adven's expansion strategy. The acquisition of district heating operations in Kungsör, Sweden, and Kaskisten Energia in Finland, shows its focus on growing its footprint in key markets. Investments in new technologies, such as electric boilers and biomass plants, demonstrate a commitment to sustainable energy solutions.

Adven's 'Energy as a Service' model fosters long-term partnerships and stable revenue streams. The company's diversified customer base across Northern Europe and its broad service offerings reduce risks. Adven's ability to offer customized solutions and take on technology risks further differentiates it from competitors.

Adven prioritizes sustainability and the energy transition, promoting renewables and energy efficiency. Investments in renewable energy sources, such as biomass and waste heat recovery, are central to its strategy. This focus strengthens its competitive position and brand perception.

Adven's competitive edge lies in its 'Energy as a Service' model, long-term partnerships, and focus on sustainability. Its diversified customer base and broad service offerings reduce risks. Adven's ability to offer customized solutions and take on technology risks further differentiates it from competitors.

Adven's strategic moves include geographic expansion, technological investments, and organizational restructuring. Acquisitions such as the district heating operations in Sweden and Finland have expanded its market presence. Investments in electric boilers and biomass plants reflect a commitment to sustainable energy. The country-based organizational structure aims to enhance efficiency and collaboration.

- Acquisition of district heating operations in Kungsör, Sweden, in June 2025.

- Acquisition of Kaskisten Energia in Finland in February 2025.

- Investment in an electric boiler for Suominen's plant, starting in fall 2025.

- Construction of a wood chip boiler house in Vändra, Estonia, by spring 2025.

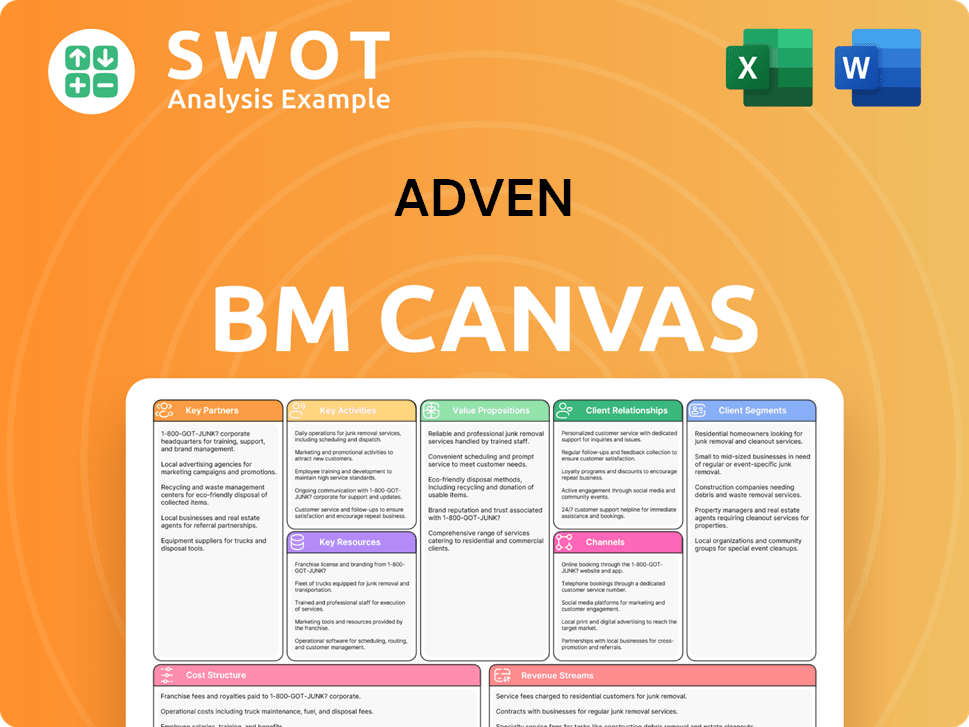

Adven Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Adven Positioning Itself for Continued Success?

The Adven Company holds a strong position in Northern Europe as a key provider of sustainable energy infrastructure and services. Operating over 350 sites across multiple countries, the company benefits from a diversified customer base, which includes industries, real estate, and municipalities. This diversification helps to mitigate risks associated with relying on a single market segment. The company's focus on the energy transition and its 'Energy as a Service' model provides a competitive edge in an industry increasingly prioritizing sustainability.

Despite its strong position, Adven faces several risks. The energy sector is capital-intensive, requiring substantial investments in infrastructure. Additionally, the company operates in a competitive landscape with volatile energy prices and regulatory changes. Supply chain risks and geopolitical instability also add pressure. The rapid evolution of the energy sector presents the risk of technological disruption, where failure to adopt new technologies could render existing infrastructure obsolete. For more insights into the company's ownership, consider exploring Owners & Shareholders of Adven.

Adven's strong foothold in Northern Europe, serving diverse sectors, positions it well. The 'Energy as a Service' model and focus on sustainability provide a competitive edge. This approach is crucial in an industry increasingly focused on environmental solutions, with sustainable energy projected to reach $2.1 trillion by 2025.

The energy sector is capital-intensive, requiring significant infrastructure investments. Volatile energy prices and regulatory changes can threaten profits. Supply chain issues, such as equipment delivery delays, and geopolitical instability add pressure. Technological disruption also poses a risk, with investments in energy storage solutions increasing by 40% in 2024.

Adven is well-positioned to capitalize on the growing demand for renewable energy. Strategic initiatives include expanding into new geographies and segments, potentially boosting revenue by 15% through strategic partnerships. The new organizational structure, implemented in December 2024, aims to accelerate growth and improve operational efficiency.

The company is focused on expanding into new geographies and segments. The new organizational structure, implemented in December 2024, is designed to accelerate growth. Increasing the proportion of energy production from renewable sources and utilizing waste and heat in circular economy models are key to sustaining profitability.

Adven's success hinges on several key strategies, including expanding into new markets, focusing on renewable energy, and improving operational efficiency. These strategies are designed to capitalize on the growing demand for sustainable energy solutions and maintain a competitive edge in the market. The company's commitment to renewable energy is crucial for long-term growth.

- Expansion into new geographies and segments.

- Increasing energy production from renewable sources.

- Utilizing waste and heat in circular economy models.

- Improving operational efficiency through a new organizational structure.

Adven Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Adven Company?

- What is Competitive Landscape of Adven Company?

- What is Growth Strategy and Future Prospects of Adven Company?

- What is Sales and Marketing Strategy of Adven Company?

- What is Brief History of Adven Company?

- Who Owns Adven Company?

- What is Customer Demographics and Target Market of Adven Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.