AECOM Bundle

Can AECOM Continue to Build a Better Future?

AECOM, a titan in the infrastructure sector, is charting its course for sustained expansion and profitability. This AECOM SWOT Analysis highlights the company's strategic initiatives, designed to capitalize on the global surge in infrastructure development. Understanding AECOM's growth strategy is key to unlocking potential investment opportunities and anticipating market trends.

From its inception, AECOM has demonstrated a commitment to growth, evolving into a global leader with a significant market position. This AECOM company analysis delves into the core of its business model, exploring its financial performance and future prospects within the dynamic engineering and construction market. We will examine AECOM's expansion plans in infrastructure, including its long-term growth outlook, and assess the impact of government spending and international expansion strategy on its project backlog and outlook.

How Is AECOM Expanding Its Reach?

The expansion initiatives of AECOM are designed to capitalize on favorable market trends and leverage its existing expertise. A core aspect of the AECOM growth strategy involves focusing on high-margin, lower-risk design consulting and program management services. This strategic shift aims to improve profitability and reduce exposure to the more volatile aspects of the construction market. The company is actively pursuing growth in specific sectors, such as the Water & Environment Advisory business.

AECOM's future prospects are closely tied to its ability to execute these expansion plans effectively. This includes securing new projects, integrating acquisitions, and maintaining a strong financial position. The company's focus on sustainable solutions and digital transformation initiatives positions it well to meet the evolving demands of the infrastructure market. AECOM’s business model is evolving to meet the demands of a changing market.

Geographically, AECOM is involved in significant projects globally, demonstrating its international expansion efforts. For instance, the company is providing program management services for the multi-billion dollar expansion of San Diego International Airport, which includes a new terminal and modernized infrastructure. AECOM's strategic initiatives 2024 are geared towards sustained growth and market leadership.

AECOM is prioritizing high-margin services like design consulting and program management. This strategic shift aims to improve profitability and reduce risk. This focus is a key element of the AECOM company analysis and its long-term growth outlook.

The company is targeting specific sectors for growth, such as the Water & Environment Advisory business. The goal is to double net service revenue in this area over the next three years. This targeted approach is crucial for AECOM's market position and revenue growth drivers.

AECOM is involved in major projects worldwide, showcasing its international expansion strategy. Examples include the San Diego International Airport expansion and rail projects in the Asia Pacific region. These projects highlight AECOM's expansion plans in infrastructure.

AECOM is making strategic investments and forming partnerships to support its expansion. This includes key hires and project collaborations to enhance its service offerings. These investments are essential for AECOM's competitive landscape analysis.

AECOM's commitment to digital transformation initiatives and sustainability strategy further enhances its long-term growth outlook. The company's project backlog and outlook remain strong, supported by its diverse portfolio and global presence. For more information on AECOM's history and evolution, you can read Brief History of AECOM.

AECOM's expansion strategy includes focusing on high-margin services, targeting specific sectors, and expanding its global presence. The company is investing in digital transformation and sustainability to meet market demands. These strategies are designed to drive AECOM's financial performance and secure its future prospects.

- Prioritizing high-margin services.

- Targeting growth in the Water & Environment Advisory business.

- Participating in significant global infrastructure projects.

- Investing in digital transformation and sustainability.

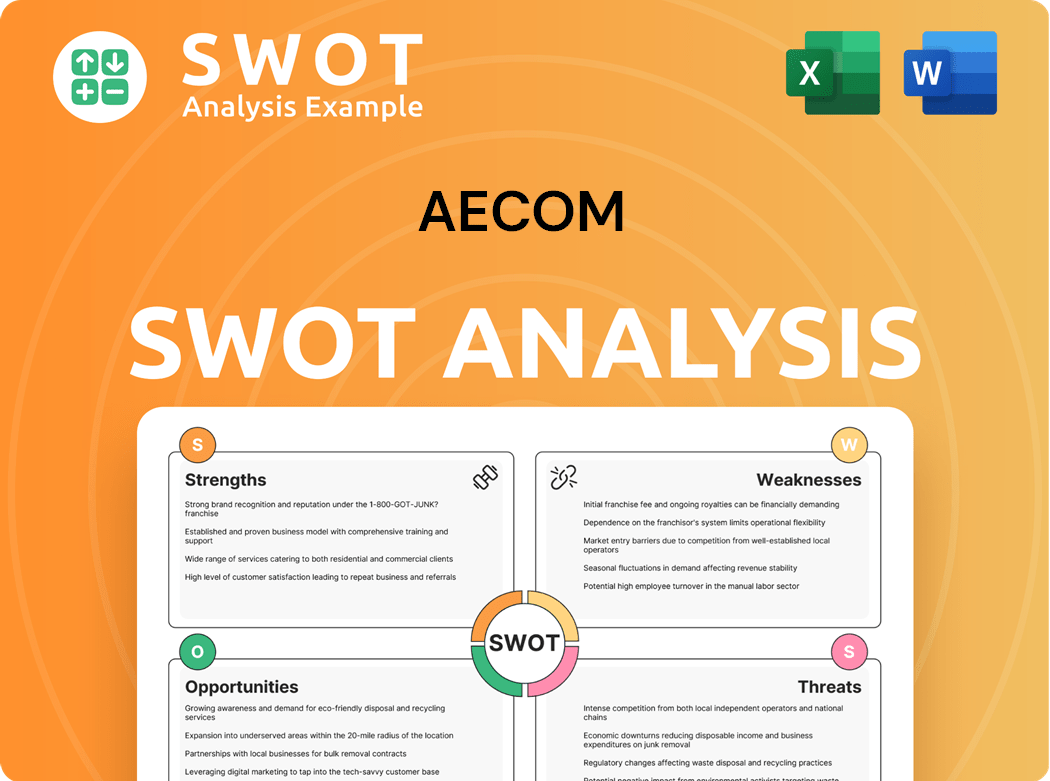

AECOM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AECOM Invest in Innovation?

AECOM is actively integrating technology and innovation to enhance its service delivery and drive growth, focusing on digital transformation and the use of cutting-edge technologies like AI. This strategic shift is designed to improve efficiency and optimize processes across its operations. The company's approach to innovation extends to developing digital platforms and tools, such as the Cool Tool, to streamline operations.

Over the past 18 months, AECOM has increased its use of AI and digital tools, particularly in optimizing processes and improving efficiency. For instance, AI is being utilized in a significant portion of bids and proposals, which allows teams to concentrate on the technical aspects of projects. This focus on technology is part of AECOM's broader strategy to maintain a competitive edge in the engineering and construction market.

AECOM also emphasizes sustainable and resilient solutions, incorporating ESG action plans on major projects to reduce carbon impact. They are involved in projects that utilize innovative technologies and materials, such as the application of ultra-high strength steel in infrastructure projects. This shows a commitment to leveraging technology for competitive advantage and growth, aligning with broader industry trends.

AECOM is undergoing a digital transformation, integrating advanced technologies like AI to improve efficiency. This includes using AI in bids and proposals to streamline processes and allow teams to focus on technical aspects. The company's digital initiatives are designed to enhance project delivery and operational effectiveness.

The use of AI is expanding within AECOM, particularly in optimizing processes and improving efficiency. AI tools are used in a significant portion of bids and proposals. This allows teams to concentrate on the technical aspects of projects, improving overall productivity and outcomes.

AECOM is focused on sustainable and resilient solutions, integrating ESG action plans into major projects. This includes reducing carbon impact and utilizing innovative technologies and materials. The company's sustainability efforts are a key part of its growth strategy and market position.

AECOM is involved in projects that use innovative technologies and materials, such as ultra-high strength steel in infrastructure projects. This focus on innovation is a key driver of its competitive advantage. These initiatives support AECOM's long-term growth outlook.

The development of digital platforms and tools, like the Cool Tool, streamlines operations. This tool standardizes and digitizes the invoicing process. This is part of AECOM's broader strategy to improve efficiency and operational effectiveness.

While specific R&D investment figures are not readily available, AECOM's focus on digital transformation, AI integration, and sustainable practices indicates a strong commitment to leveraging technology. This investment supports AECOM's strategic initiatives 2024 and beyond.

AECOM's innovation and technology strategy is centered around digital transformation, AI integration, and sustainable practices. These initiatives are designed to improve efficiency, reduce environmental impact, and enhance project delivery. This approach supports the company's Target Market of AECOM and long-term growth prospects.

- Digital transformation is a core focus, with AI being integrated to optimize processes.

- Sustainable solutions and ESG action plans are integral to major projects.

- Innovative technologies and materials are being used to enhance project outcomes.

- The development of digital platforms and tools streamlines operations.

- These strategies collectively support AECOM's competitive advantage and future growth.

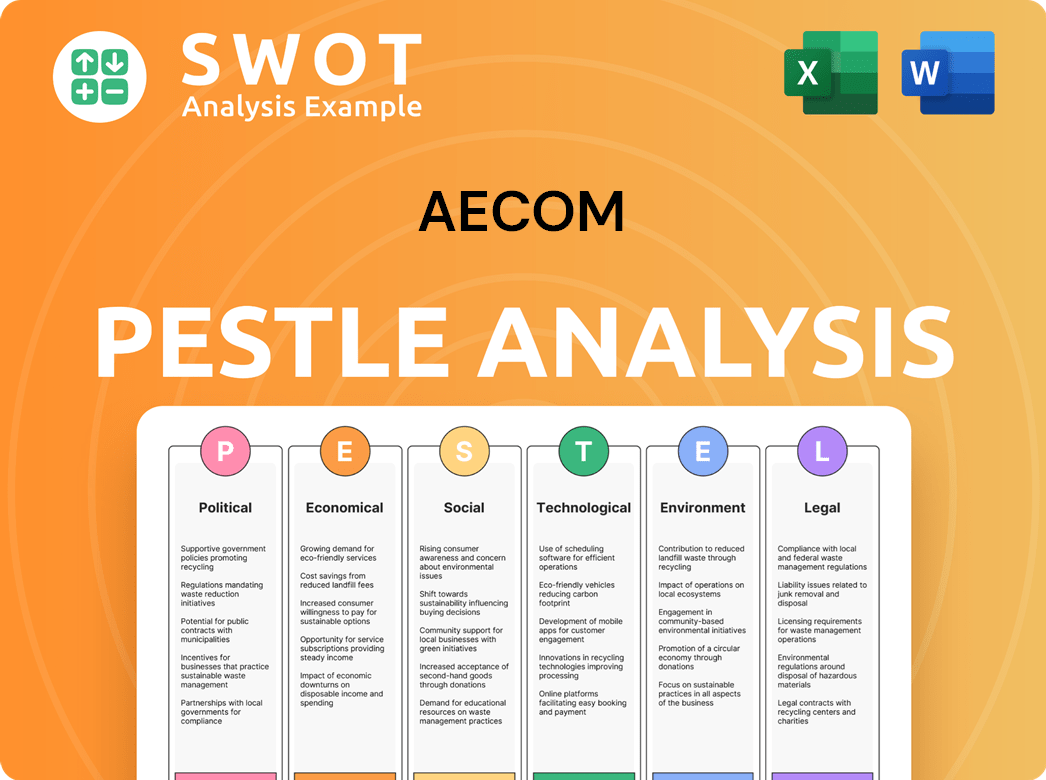

AECOM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AECOM’s Growth Forecast?

The financial outlook for AECOM is positive, reflecting a strong AECOM growth strategy and promising AECOM future prospects. The company's projections for fiscal year 2025 indicate continued expansion across key financial metrics. This positive outlook is supported by a robust backlog and strategic initiatives.

AECOM's financial performance is expected to be robust, driven by organic growth and strategic initiatives. The company is focused on delivering value to its shareholders and maintaining its position as a leader in the engineering and construction industry. This focus is evident in its financial targets and operational strategies.

The company's commitment to sustainable practices and innovative solutions is also a key factor in its financial outlook. AECOM's focus on sustainability and technological advancements positions it well for long-term growth and market leadership. For more information about the company's core values, you can read this article about Mission, Vision & Core Values of AECOM.

AECOM anticipates organic NSR growth of 5% to 8% in fiscal year 2025. This growth is a key indicator of the company's expansion in the market and its ability to secure new projects. This growth is a key indicator of the company's expansion in the market and its ability to secure new projects.

Adjusted EBITDA is projected to be between $1,180 million and $1,210 million. This represents a 9% increase at the midpoint compared to fiscal year 2024. This growth reflects improved operational efficiency and profitability.

Adjusted EPS is anticipated to be between $5.10 and $5.20, a 14% increase at the midpoint from fiscal year 2024. This indicates strong earnings growth and improved shareholder value. This growth reflects improved operational efficiency and profitability.

AECOM anticipates expanding its adjusted EBITDA margin by 30 basis points to 16.3% in fiscal year 2025. The company is targeting a 17%+ adjusted EBITDA margin exiting fiscal year 2025. This margin expansion demonstrates improved operational efficiency and cost management.

Free cash flow conversion is expected to be over 100%. This strong cash flow generation supports the company's ability to invest in growth and return capital to shareholders.

As of March 31, 2025, AECOM had $1.6 billion in cash and cash equivalents and total debt of $2.55 billion. This financial position provides flexibility for strategic investments and managing financial obligations.

AECOM's backlog reached a new record high, providing confidence in their ability to deliver on fiscal year 2025 guidance. This strong backlog supports the company's revenue projections and indicates continued demand for its services. This strong backlog supports the company's revenue projections and indicates continued demand for its services.

- The record backlog ensures a solid foundation for future revenue.

- The backlog reflects strong market demand and successful project wins.

- This provides a clear view of AECOM's market position and growth potential.

- The high backlog supports the AECOM business model and AECOM financial performance.

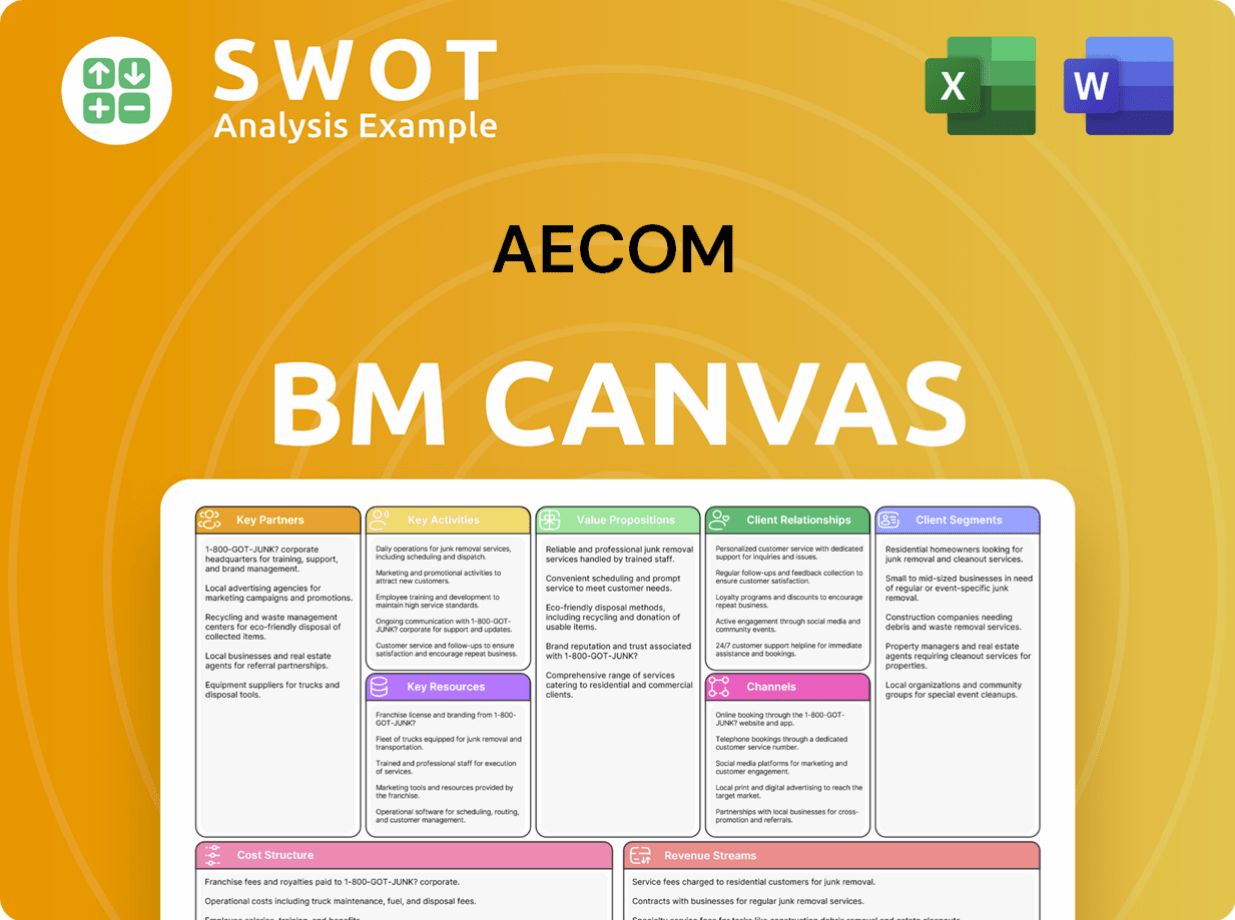

AECOM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AECOM’s Growth?

The path to growth for any global company like AECOM is often paved with potential risks and obstacles. Understanding these challenges is crucial for assessing the company's long-term viability and investment potential. A comprehensive AECOM company analysis must therefore include a detailed examination of the hurdles it faces.

These risks can stem from various sources, including economic conditions, regulatory changes, and operational challenges. The ability to navigate these complexities will significantly influence AECOM's future prospects and its capacity to execute its strategic initiatives.

Global market conditions, such as inflation and fluctuating material costs, present significant concerns for AECOM. Regulatory changes and political instability in various countries can also pose challenges, impacting project timelines and profitability. These factors require careful monitoring and strategic adaptation to ensure sustained AECOM growth strategy.

Inflation and material cost fluctuations can directly impact project budgets and profitability. Economic downturns in key markets could reduce demand for infrastructure projects. Currency exchange rate volatility can affect international project revenues and costs.

Changes in government regulations and policies can affect project approvals and timelines. Political instability in regions where AECOM operates can disrupt projects and increase security risks. Trade restrictions and tariffs can impact the cost of materials and equipment.

Workforce constraints, including a shortage of skilled workers, can delay project completion and increase labor costs. Supply chain disruptions can lead to delays and higher material costs. Project cancellations or adjustments can affect the company's backlog and revenue.

Legal claims and litigation can result in significant financial losses. Inadequate insurance coverage can leave the company exposed to substantial liabilities. Cybersecurity threats can disrupt operations and compromise sensitive data.

Intense competition from other engineering and construction firms can put pressure on margins. The loss of key contracts to competitors can impact revenue growth. Failure to innovate and adopt new technologies can make AECOM less competitive.

Geopolitical tensions and conflicts can disrupt supply chains and increase project costs. Sanctions and trade wars can limit access to certain markets and materials. Political instability can affect project security and investor confidence.

AECOM's strategic initiatives in 2024 and beyond will need to address these risks proactively. The company’s ability to manage its project backlog and outlook will be critical. The company’s focus on high-margin and lower-risk projects, along with its risk management frameworks, demonstrates its commitment to mitigating these challenges. For a deeper dive into how AECOM approaches its marketing efforts, consider reading the Marketing Strategy of AECOM.

Diversification across different geographies and sectors to reduce reliance on any single market. Implementation of robust risk management frameworks to identify, assess, and mitigate potential risks. Investment in technology and innovation to improve efficiency and competitiveness.

Analyzing AECOM's financial performance, including revenue growth drivers, is crucial. Understanding its market position within the competitive landscape is essential. The company's ability to maintain a strong project backlog and secure new contracts will be key indicators of its success.

Government spending on infrastructure projects significantly influences AECOM's revenue. Understanding the impact of government policies and spending priorities is important. Analyzing international expansion strategy and market trends provides insights into growth potential.

Evaluating AECOM's long-term growth outlook involves assessing its ability to adapt to changing market conditions. Examining its sustainability strategy and digital transformation initiatives provides insights into its future prospects. Analyzing its stock forecast and investment potential offers valuable information for investors.

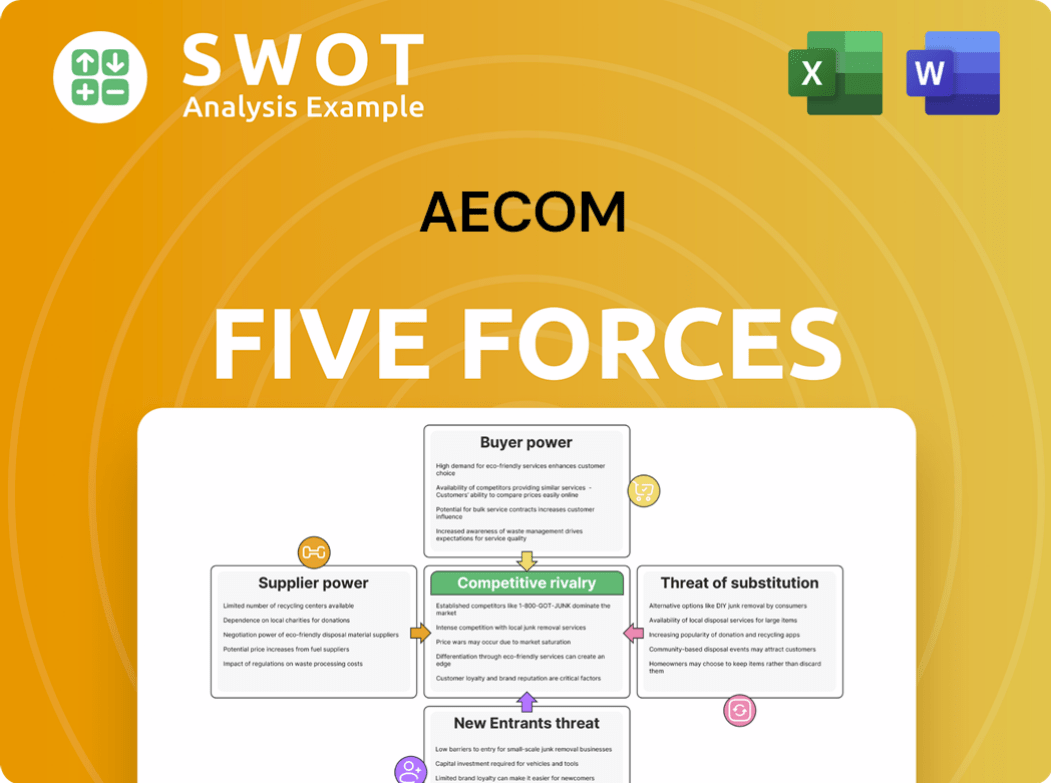

AECOM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AECOM Company?

- What is Competitive Landscape of AECOM Company?

- How Does AECOM Company Work?

- What is Sales and Marketing Strategy of AECOM Company?

- What is Brief History of AECOM Company?

- Who Owns AECOM Company?

- What is Customer Demographics and Target Market of AECOM Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.