amana Bundle

Can amana Inc. maintain its visual communication dominance?

Founded in 1991, amana inc. has evolved from a stock photography pioneer to a visual communication powerhouse. Its journey reflects the critical importance of a robust amana SWOT Analysis in navigating the ever-changing visual content landscape. This article delves into amana's strategic roadmap, exploring how this industry leader plans to secure its future.

This analysis will examine the amana growth strategy, dissecting its business model, and providing a detailed amana market analysis. We'll also scrutinize amana company future prospects, including its financial performance and expansion plans. Understanding the key drivers behind amana's success and its approach to sustainability will be crucial in assessing its long-term viability in a competitive market.

How Is amana Expanding Its Reach?

The core of the amana's growth strategy revolves around a multi-faceted expansion plan. This approach focuses on both broadening its geographical footprint and diversifying its service offerings to meet evolving market demands. The company is actively seeking to enter new international markets, with a particular emphasis on Southeast Asia, where digital content consumption is rapidly increasing.

This international expansion is complemented by a strong product pipeline. The company is focused on introducing new visual communication tools and platforms. For instance, the company is investing in AI-driven content creation tools and personalized visual marketing solutions, with several new product launches anticipated in late 2024 and early 2025.

Strategic mergers and acquisitions are also a key component of amana's expansion strategy. The company has a history of acquiring smaller, specialized visual content agencies. These initiatives are designed to not only access new customer segments and diversify revenue streams but also to stay ahead of rapid technological advancements and shifting industry trends.

The company is targeting Southeast Asia. This region is experiencing significant growth in digital content consumption. This expansion is part of amana's broader strategy to increase its global presence and tap into high-growth markets.

New product launches are planned for late 2024 and early 2025. These products include AI-powered content creation tools and personalized visual marketing solutions. These initiatives aim to meet evolving client needs and to enhance the company's competitive edge.

The company is actively pursuing strategic mergers and acquisitions. This strategy is used to integrate new capabilities and expand market share. This approach allows amana to quickly adapt to technological advancements and industry changes.

Significant investments are being made in AI-driven content creation tools. This investment is designed to improve content creation efficiency and to offer more personalized visual marketing solutions. This focus on AI is expected to drive future growth.

The company's expansion initiatives are driven by several key factors. These include the need to access new customer segments, diversify revenue streams, and stay ahead of technological advancements. These strategies are designed to ensure long-term growth and market leadership.

- Penetrating new international markets, particularly in Southeast Asia.

- Launching innovative visual communication tools powered by AI.

- Strategically acquiring specialized visual content agencies.

- Adapting to rapid technological advancements and evolving industry trends.

amana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does amana Invest in Innovation?

Innovation and technology are crucial elements of the amana growth strategy, driving its competitive edge through substantial investments in research and development (R&D). The company's focus is on leveraging advanced technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and advanced data analytics to enhance its operational capabilities and service offerings.

This strategic approach involves automating content production and distribution, streamlining workflows, and improving client experiences via intuitive digital platforms. This digital transformation is designed to increase efficiency and open new revenue streams. Recent reports indicate that a significant portion of the 2024 budget has been allocated to AI-driven initiatives.

These initiatives aim to develop proprietary algorithms for image recognition, video synthesis, and automated content tagging. These technological advancements are expected to significantly contribute to growth objectives by enabling the creation of more diverse and higher-quality visual assets at scale. Furthermore, the company is recognized for its leadership in sustainability initiatives within the visual content space, incorporating eco-friendly practices into its production processes.

Developing proprietary algorithms for image recognition, video synthesis, and automated content tagging.

Integrating IoT for integrated visual solutions in smart environments.

Utilizing advanced data analytics for personalized content delivery.

Automating content production and distribution processes to improve client experiences.

Incorporating eco-friendly practices into production processes.

Allocating a substantial portion of the 2024 budget to AI-driven initiatives.

The integration of AI, IoT, and advanced data analytics is expected to boost the company's financial performance and market position. These technologies are central to the amana company future and its ability to meet evolving market demands. The company's commitment to innovation is evident in its strategic investments.

- AI for enhanced content creation and curation.

- IoT for integrated visual solutions.

- Advanced data analytics for personalized content delivery.

- Automation of content production and distribution.

amana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is amana’s Growth Forecast?

The financial outlook for amana reflects its ambitious amana growth strategy, with projections indicating continued revenue growth and healthy profit margins. While specific forward-looking financial guidance for 2025 is not publicly detailed in recent reports, the company's historical performance and strategic initiatives suggest a positive trajectory. The company's focus on high-value custom content creation and subscription-based services is expected to bolster recurring revenue streams.

Analyst forecasts for companies within the visual communication sector generally predict a compound annual growth rate (CAGR) of approximately 8-10% through 2027, driven by increasing demand for digital content. amana's recent quarterly reports have highlighted stable revenue performance, with strategic investments in technology and expansion initiatives being carefully managed to ensure long-term profitability. Furthermore, amana has a history of prudent financial management, which is crucial for supporting its capital-intensive innovation and expansion plans.

Any future funding rounds or changes in financial strategy will likely be geared towards accelerating technological advancements and market penetration, aiming to solidify its financial position within the global visual content industry. The company's ability to adapt to market changes and leverage emerging technologies will be critical for achieving its amana company future goals. The amana prospects appear promising, supported by its strong market position and strategic initiatives.

The visual communication sector is experiencing significant growth, with a projected CAGR of 8-10% through 2027. amana is well-positioned to capitalize on this trend by focusing on high-value custom content and subscription services. This strategic approach is expected to drive consistent revenue growth.

Recent financial reports indicate stable revenue performance, with strategic investments managed to ensure long-term profitability. Prudent financial management is a key factor in supporting capital-intensive innovation and expansion plans. The company's focus on efficiency and cost control contributes to healthy profit margins.

Future funding rounds and changes in financial strategy will likely focus on accelerating technological advancements and market penetration. These investments are aimed at solidifying amana's position in the global visual content industry. The company's ability to adapt to market changes and leverage new technologies is crucial.

An amana market analysis reveals the company's strong position in the visual content sector. Demand for digital content is increasing, creating significant opportunities for growth. amana's strategic initiatives are designed to capitalize on these market dynamics and maintain a competitive edge.

The company's financial performance over the last few years has been stable, with consistent revenue streams. This stability is a result of prudent financial management and strategic investments. The amana financial performance is expected to continue on a positive trajectory.

The amana business model focuses on high-value custom content creation and subscription-based services, which contribute to recurring revenue. This model provides a stable foundation for financial growth and allows the company to adapt to changing market demands. The business model supports long-term sustainability.

amana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow amana’s Growth?

The future trajectory of amana is subject to potential risks and obstacles. The visual communication industry is highly competitive, with both global and local players vying for market share. Technological advancements, particularly in generative AI, present both opportunities and threats, necessitating continuous adaptation and substantial R&D investments to remain competitive. These factors could influence the overall amana growth strategy.

Regulatory changes concerning data privacy, intellectual property rights, and content usage across various jurisdictions could create compliance challenges and increase operational costs. Supply chain vulnerabilities, though less pronounced in digital content, could emerge in specialized areas requiring specific equipment or external collaborations. Addressing these challenges is crucial for amana company future success.

Internally, resource constraints, especially the availability of highly skilled talent in AI and advanced visual technologies, could hinder innovation and expansion. Amana prospects depend on its ability to mitigate these risks through strategies like a diversified service portfolio and a strong risk management framework. The company has demonstrated resilience in the past, adapting to shifts in content consumption and economic downturns by continuous innovation and strategic realignment. For more insights, explore the Marketing Strategy of amana.

The visual communication industry faces intense competition from both established global firms and emerging local players. The market is dynamic, with new entrants and innovative business models constantly appearing. Companies must continually differentiate themselves through unique offerings, pricing strategies, and customer service to maintain their market position. According to recent market analysis, the global visual communication market is projected to reach $300 billion by 2027, highlighting the competitive landscape.

Rapid technological advancements, particularly in generative AI, pose both opportunities and threats. AI-driven tools can enhance content creation and personalization, but also require significant investments in R&D and talent acquisition. Companies must stay ahead of the curve by adopting new technologies and integrating them into their existing business models. The investment in AI by leading companies in the visual communication sector has increased by over 40% in the last two years, indicating the importance of technological adaptation.

Changes in data privacy regulations, intellectual property rights, and content usage across different jurisdictions can create compliance challenges. Companies must navigate complex legal landscapes and ensure their operations adhere to international standards. Failure to comply can result in significant penalties and reputational damage. The implementation of stricter data protection laws in several regions has led to a 20% increase in compliance costs for businesses in the digital content sector.

The availability of highly skilled talent in AI and advanced visual technologies can be a constraint. Companies need to attract, retain, and train professionals with specialized expertise to drive innovation and expansion. Competition for skilled workers is fierce, and companies must offer competitive compensation packages and professional development opportunities. The demand for AI specialists has increased by over 35% in the last year, making talent acquisition a critical challenge for many firms.

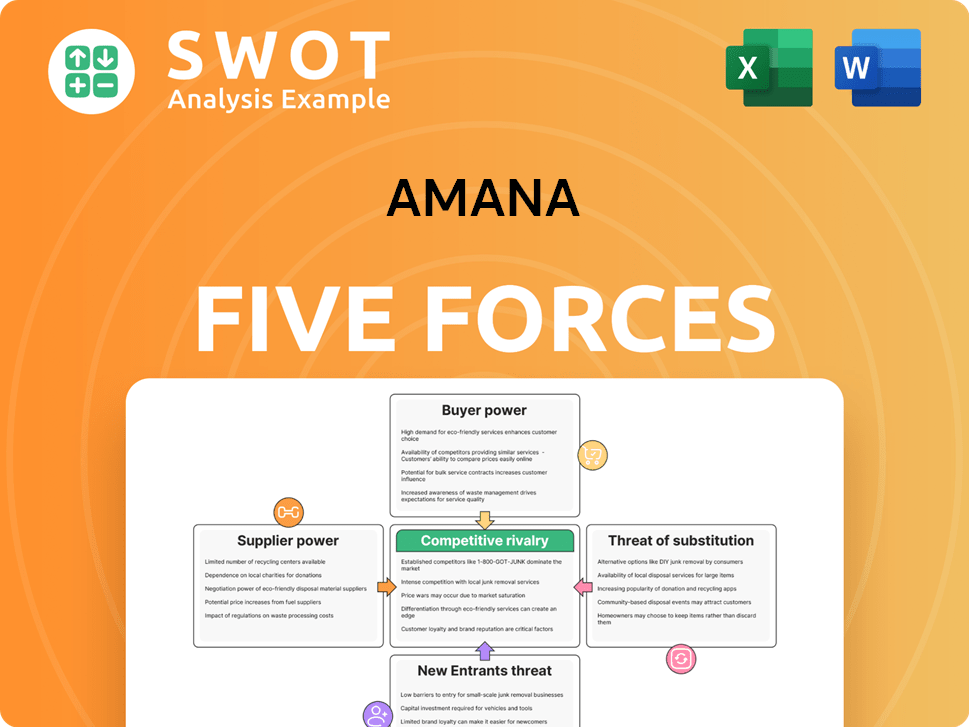

amana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of amana Company?

- What is Competitive Landscape of amana Company?

- How Does amana Company Work?

- What is Sales and Marketing Strategy of amana Company?

- What is Brief History of amana Company?

- Who Owns amana Company?

- What is Customer Demographics and Target Market of amana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.