amana Bundle

Who Really Owns Amana?

Understanding a company's ownership is crucial for investors and stakeholders alike. For amana inc., a visual communication leader, recent events have dramatically reshaped its ownership landscape. Following its delisting from the Tokyo Stock Exchange, the question of who controls amana inc. has become even more pertinent.

From its origins as Urban Publicity inc. in 1979 to its current form, the amana SWOT Analysis reveals a company shaped by strategic shifts. This article explores the amana company ownership, tracing its evolution and identifying the key players influencing its future. We'll examine the impact of the Infinity brand capital inc. acquisition and delve into the amana brand's history, providing insights into the current amana appliances owner and the company's strategic direction in the competitive visual communication market.

Who Founded amana?

The journey of the amana company, began in April 1979 as Urban Publicity Inc., marking its initial venture into the world of visual content creation. While the specifics of the founders and their initial equity distribution remain largely undocumented, the company's early activities highlight a commitment to building a strong foundation in advertising photography. This initial focus set the stage for its later expansion and diversification in the visual communications sector.

In January 1987, amana broadened its scope by establishing an Aoyama Office in Tokyo. This expansion was pivotal, as it introduced the stock photography sales and planning business. This strategic move was a crucial step in the company's evolution, laying the groundwork for its future growth as a major player in visual communication. The early diversification into stock content showcased a forward-thinking approach to content creation.

The company's evolution continued with a name change to IMA Co., Ltd. in April 1991. Later, in November 1997, it merged with Camera Tokyo Service, officially becoming amana inc. These structural shifts underscore a strategic effort to consolidate and broaden its capabilities within the visual communication industry. The founding team's vision, although not explicitly detailed in terms of individual contributions, was evident in the company's consistent pursuit of comprehensive visual content solutions, spanning planning, production, and distribution.

The transformation of Urban Publicity Inc. into amana inc. involved several strategic moves. The establishment of the Aoyama Office in Tokyo in 1987 marked a significant expansion into stock photography sales and planning. The company's name changed to IMA Co., Ltd. in April 1991, followed by a merger with Camera Tokyo Service in November 1997, which formally created amana inc., demonstrating its strategic consolidation and expansion in visual communication.

- The initial focus was on commissioned advertising photography.

- The Aoyama Office was established to expand into stock photography.

- The company rebranded to IMA Co., Ltd.

- The merger with Camera Tokyo Service led to the formation of amana inc.

For more insights into the company's strategic direction, consider exploring the Growth Strategy of amana. This article provides a deeper look at the company's evolution and market positioning.

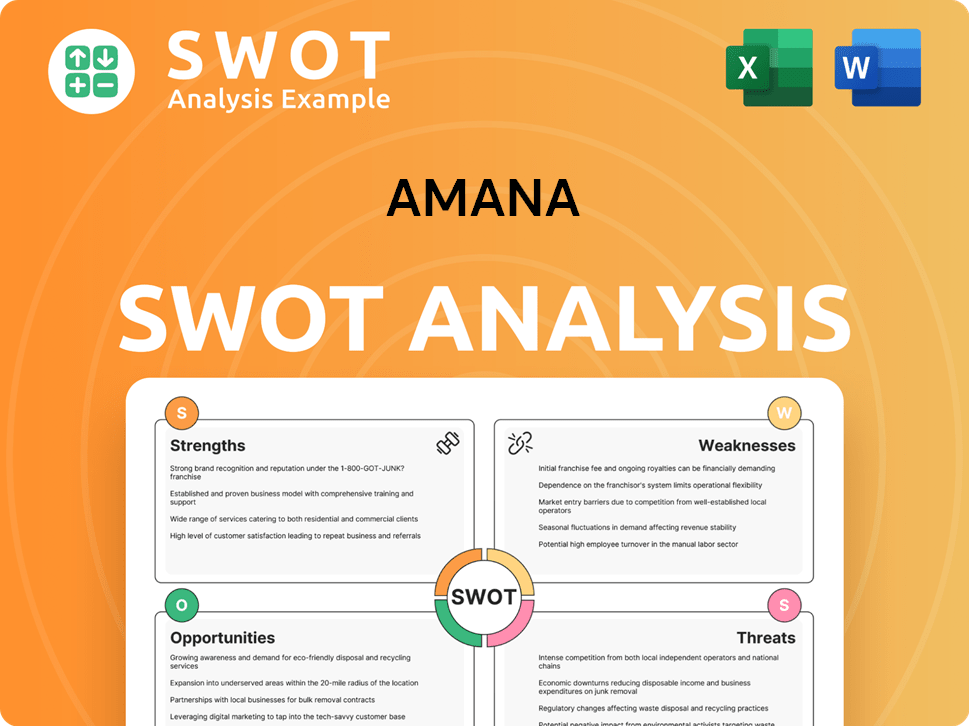

amana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has amana’s Ownership Changed Over Time?

The amana company ownership structure has undergone a significant transformation. Initially listed on the Tokyo Stock Exchange (TSE) Mothers market under the code 2402 on July 1, 2004, the amana brand experienced a pivotal change in late 2023 and early 2024. This shift is crucial for understanding who owns amana and the implications for its future.

A major ownership change occurred in December 2023 when Infinity brand capital inc. became the parent company of amana inc. This was achieved through a third-party allotment of shares. Consequently, amana corporation was delisted from the Tokyo Stock Exchange Growth Market on January 29, 2024. The delisting was a direct result of a reverse stock split combined with the issuance of new shares through a third-party allotment.

| Event | Date | Impact |

|---|---|---|

| Listing on TSE Mothers Market | July 1, 2004 | Initial public offering. |

| Infinity brand capital inc. becomes parent company | December 2023 | Shift in control to a new parent company. |

| Delisting from TSE Growth Market | January 29, 2024 | Transition to a privately held company. |

Following the delisting, amana appliances owner is now primarily Infinity brand capital inc. While the exact ownership percentage isn't publicly available, the parent company status indicates a controlling stake. This transition from a publicly traded entity to a privately held company under Infinity brand capital inc. likely concentrates decision-making and strategic direction. Information regarding amana appliance company ownership history and the current stakeholders is limited due to the private nature of the company.

The ownership of amana has shifted significantly, moving from public to private control. Infinity brand capital inc. now holds the primary stake, centralizing decision-making. This change marks a new chapter for the amana appliance company.

- Public to Private Transition

- Infinity brand capital inc. as Parent Company

- Concentrated Decision-Making

- Delisting from Tokyo Stock Exchange

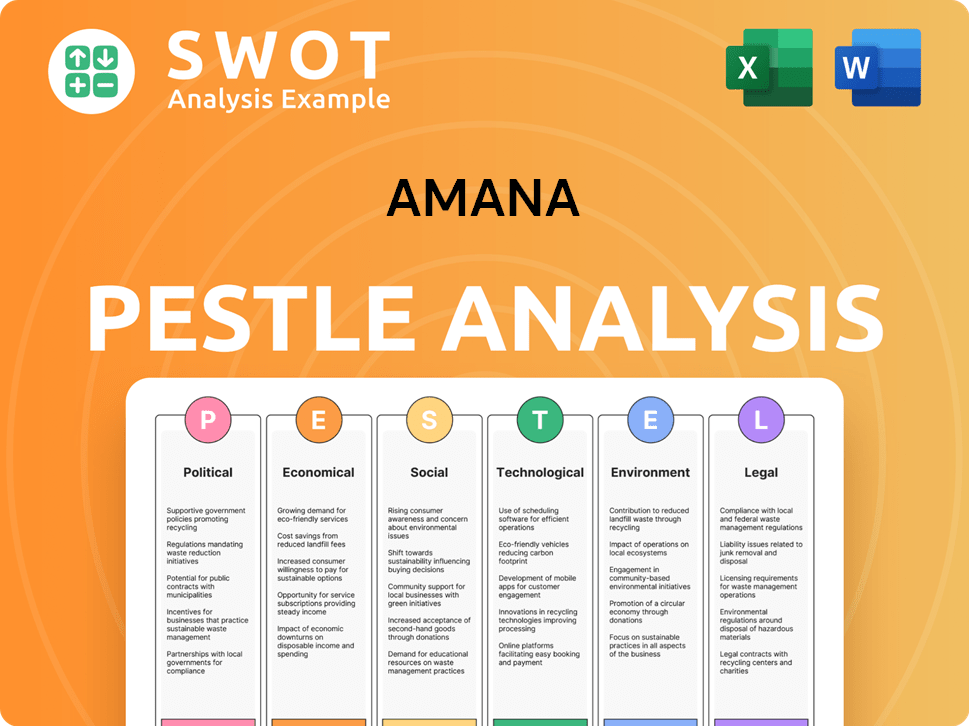

amana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on amana’s Board?

As of April 2025, the current leadership of the amana company includes Yoshiaki Kaneko, who holds the position of President. The board of directors comprises Kotaro Ujihara, Yosuke Matsushima, and Koya Furuta. The specifics of major shareholder representation or independent board seats aren't publicly available, as the company is privately held. This structure suggests a direct link between board members and the controlling shareholder.

Following the acquisition by Infinity brand capital inc. through a third-party share allotment and the delisting from the Tokyo Stock Exchange in January 2024, Infinity brand capital inc. likely wields considerable influence over the board's composition and strategic direction. Unlike publicly traded companies with standardized voting rights, the private status of amana means details about voting structures, special rights, or golden shares remain undisclosed. There have been no public reports of proxy battles or governance disputes in 2024-2025, which is consistent with its private ownership.

| Board Member | Title | Notes |

|---|---|---|

| Yoshiaki Kaneko | President | Representative of the Company |

| Kotaro Ujihara | Director | Board Member |

| Yosuke Matsushima | Director | Board Member |

| Koya Furuta | Director | Board Member |

Understanding the amana company ownership structure is important for anyone interested in the Growth Strategy of amana. The transition to private ownership through Infinity brand capital inc. has significantly altered the governance landscape. While the exact voting power distribution isn't public, it's clear that Infinity brand capital inc. has a strong influence. The absence of public governance issues since the delisting indicates a stable, albeit less transparent, operational environment.

The current ownership structure of amana is private, with Infinity brand capital inc. as the parent company.

- Yoshiaki Kaneko is the President.

- The board of directors includes Kotaro Ujihara, Yosuke Matsushima, and Koya Furuta.

- The company's private status means detailed voting information isn't publicly available.

- There have been no recent public governance controversies.

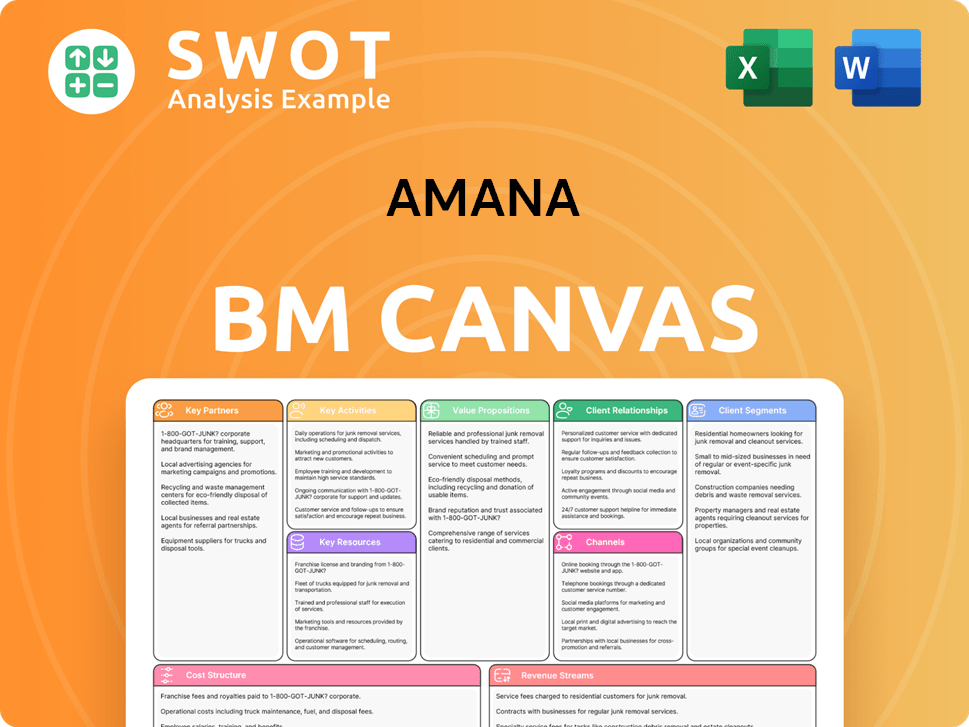

amana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped amana’s Ownership Landscape?

Over the past few years, the ownership structure of the amana company has seen significant shifts. A pivotal change occurred on January 29, 2024, when the company was delisted from the Tokyo Stock Exchange Growth Market. This followed a share allotment that led to Infinity brand capital inc. becoming the parent company in December 2023. This strategic move effectively privatized the company, transferring ownership from public shareholders to concentrated control under Infinity brand capital inc.

Prior to delisting, the company underwent internal reorganizations and asset transfers. In 2022, amanaiamges inc. was transferred to Numazawa, Iizuka, and Nagai for Kimberley. In 2023, Ca Design, inc. was dissolved, and its share of YellowKorner Japan inc. was transferred to FLATLABO inc. Further restructuring included the transfer of The Culinary Laboratory & Production Inc. in February 2024, and a merger with amanaphotographyinc. in April 2024. These actions indicate a streamlining of its business segments.

| Year | Event | Ownership Change |

|---|---|---|

| 2022 | Transfer of amanaiamges inc. | Ownership shifted to Numazawa, Iizuka, and Nagai for Kimberley. |

| 2023 | Delisting from Tokyo Stock Exchange | Infinity brand capital inc. became the parent company. |

| 2023 | Dissolution of Ca Design, inc. | Share of YellowKorner Japan inc. transferred to FLATLABO inc. |

| 2024 | Transfer of The Culinary Laboratory & Production Inc. | Ownership transferred. |

| 2024 | Merger with amanaphotographyinc. | Business segment consolidation. |

Industry trends like increased institutional ownership are less relevant now that the company is private. Its current status under Infinity brand capital inc. suggests a trend toward consolidation and strategic ownership. This may allow for more agile decision-making. For additional insights into the company's operations, consider reading about the Revenue Streams & Business Model of amana.

The delisting and subsequent privatization of the company indicate a shift towards concentrated ownership.

Internal reorganizations and asset transfers reflect a strategic streamlining of business segments.

The current ownership structure under Infinity brand capital inc. allows for more agile decision-making.

Public statements about future ownership changes are unlikely for a private entity.

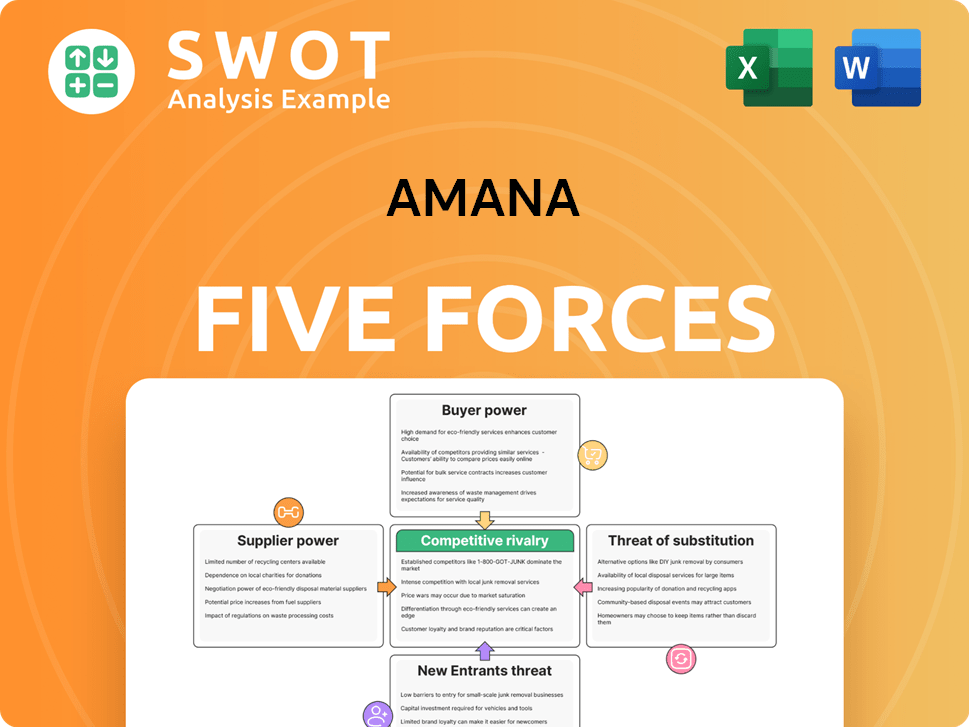

amana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of amana Company?

- What is Competitive Landscape of amana Company?

- What is Growth Strategy and Future Prospects of amana Company?

- How Does amana Company Work?

- What is Sales and Marketing Strategy of amana Company?

- What is Brief History of amana Company?

- What is Customer Demographics and Target Market of amana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.