AUDI Bundle

How is AUDI steering its future in the dynamic automotive market?

The automotive industry is undergoing a massive transformation, and AUDI is at the forefront of this evolution. From its humble beginnings, AUDI has become a global leader, renowned for its blend of luxury, performance, and cutting-edge technology. This AUDI SWOT Analysis will help you understand the company's strategic direction.

This exploration of AUDI's

How Is AUDI Expanding Its Reach?

The AUDI growth strategy is focused on expanding its presence in key markets and diversifying its product portfolio. This includes a significant push into electric vehicles (EVs) and digital services. The company aims to meet the increasing global demand for sustainable mobility and comply with stricter emission regulations.

A core component of this strategy is the systematic rollout of new electric models. For example, the Q6 e-tron began production in March 2024. Audi plans to have over 20 fully electric models by 2027. The goal is to achieve a global sales share of approximately 50% for fully electric vehicles by 2030.

Geographically, Audi is strengthening its position in major markets like China, which remains its largest single market. The company is adapting its product offerings to local preferences and accelerating the development of intelligent, connected vehicles specifically for the Chinese market. Furthermore, Audi is exploring new business models beyond traditional vehicle sales, including subscription services and on-demand features, to access new customer segments and diversify revenue streams.

Audi is aggressively expanding its electric vehicle lineup to meet growing demand and regulatory requirements. The Q6 e-tron, which started production in March 2024, is a key model in this expansion. This move is crucial for Audi's future prospects in the automotive industry.

China is Audi's largest single market, and the company is adapting its strategies to cater to local preferences. This includes developing intelligent, connected vehicles specifically for the Chinese market. Audi is also exploring new business models to increase its AUDI market share.

Audi is looking beyond traditional vehicle sales by exploring subscription services and on-demand features. This strategy aims to diversify revenue streams and reach new customer segments. This is a key part of the AUDI business model.

Collaborations, such as the partnership with SAIC in China, are vital for accelerating development and market entry. These partnerships help Audi stay competitive in the rapidly evolving EV landscape. This is crucial for long-term growth forecast.

Audi's expansion initiatives are designed to secure future market share and stay ahead of industry changes. The company is focusing on electric vehicle development, particularly the Q6 e-tron, which began production in March 2024, and aims to have more than 20 fully electric models by 2027.

- Aggressive EV Rollout: Launching new electric models to meet demand and regulations.

- China Focus: Strengthening presence and adapting products for the Chinese market.

- New Business Models: Exploring subscription services and on-demand features.

- Strategic Partnerships: Collaborating with companies like SAIC to accelerate development.

AUDI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AUDI Invest in Innovation?

The growth trajectory of the company is heavily influenced by its innovation and technology strategy. This approach focuses on electric mobility, digitalization, and sustainable production methods. The company's future prospects are closely tied to these advancements, positioning it as a leader in the automotive industry.

A crucial aspect of the company’s strategy involves substantial investments in research and development. This commitment ensures the continuous evolution of its products and services, driving its competitive edge in the global market. This focus is essential for maintaining and increasing its market share.

By integrating cutting-edge technologies and sustainable practices, the company aims to not only enhance product appeal but also set new industry standards. This strategy is designed to attract environmentally conscious consumers and support its long-term growth objectives. For a deeper understanding, consider the perspectives of Owners & Shareholders of AUDI.

The development of advanced EV platforms is central to the company's strategy. The Premium Platform Electric (PPE), co-developed with Porsche, is a prime example.

Digital transformation is another key area of focus. This involves integrating advanced software solutions and connectivity features into vehicles.

The company is committed to sustainable practices, aiming for net carbon-neutral production sites by 2025. This includes increasing the use of recycled materials.

R&D expenditure for the group in 2023 reached €7.3 billion, a significant increase from €6.8 billion in 2022. This investment supports the continuous innovation in its products and services.

The company is exploring cutting-edge technologies such as artificial intelligence for autonomous driving and advanced driver-assistance systems. These innovations enhance vehicle capabilities and user experience.

The company is investing in circular economy initiatives to reduce waste and promote sustainability. This includes increasing the proportion of recycled materials in its vehicles.

The company’s strategy is built on several key pillars, including advanced EV platforms, digital transformation, and sustainable production. These initiatives are crucial for its long-term growth and competitive positioning.

- EV Platforms: The PPE platform, designed for high-performance EVs, features 800-volt technology, powerful electric motors, and efficient battery management.

- Digitalization: Integration of advanced software, connectivity features, and data-driven services to enhance the in-car experience and offer predictive maintenance.

- Sustainability: Commitment to net carbon-neutral production by 2025 and increasing the use of recycled materials.

- Autonomous Driving: Development of advanced driver-assistance systems and exploration of AI for autonomous driving functions.

- Financial Performance: Significant R&D investments, with €7.3 billion spent in 2023, supporting continuous innovation.

AUDI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AUDI’s Growth Forecast?

The financial outlook for the company is shaped by its strategic shift towards electric vehicles and digitalization. This transition involves significant investments in future technologies and new models, impacting short-term profitability while setting the stage for long-term growth. The company's financial health is a key aspect of its AUDI growth strategy, ensuring it can fund its ambitious plans.

For the fiscal year 2023, the company reported a revenue of €69.9 billion and an operating profit of €6.3 billion. This strong performance, with an operating margin of 9.0%, highlights the company's current financial strength. Despite anticipating a slight decrease in operating profit for 2024 due to strategic investments, the company is focused on maintaining a robust financial position.

The company's commitment to financial discipline is evident in its projections and targets. The company aims to achieve a net cash flow of between €2.5 billion and €3.5 billion in 2024, even with high investment levels. This financial strategy is crucial for the company's AUDI future prospects, supporting its expansion and innovation in the automotive industry.

In 2023, the company achieved a revenue of €69.9 billion. The operating profit for the year was €6.3 billion, reflecting a strong operating margin. This performance underscores the company's solid financial foundation.

The company projects an operating return on sales of 9-11% for 2024. Despite investments in future technologies, the company aims for a net cash flow between €2.5 billion and €3.5 billion. These figures demonstrate the company’s focus on sustainable financial health.

The company's investment strategy prioritizes cost optimization and efficiency improvements. The company plans to generate cumulative net cash flow of €25-30 billion by 2027. This approach supports the company's long-term financial goals.

By 2027, the company aims to achieve a cumulative net cash flow of €25-30 billion. This target reflects the company's commitment to financial sustainability. The company's financial strategy supports its AUDI company analysis and overall growth.

The company's financial success is measured by several key indicators. These include revenue, operating profit, operating margin, and net cash flow. These metrics are essential for understanding the company's financial health and its ability to invest in future growth.

- Revenue: €69.9 billion (2023)

- Operating Profit: €6.3 billion (2023)

- Operating Margin: 9.0% (2023)

- Net Cash Flow: €2.5-3.5 billion (projected for 2024)

AUDI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AUDI’s Growth?

The path to growth for the company is not without its challenges. Several potential risks and obstacles could impede its progress, particularly in the dynamic automotive industry. Understanding these hurdles is crucial for a comprehensive company analysis and evaluating its future prospects.

Intense competition and evolving regulations pose significant threats. The company must navigate these complexities while striving to maintain its market share and drive innovation. Strategic planning and proactive risk management are essential to ensure sustained success.

The automotive industry faces a rapidly changing landscape with increasing competition, especially in the electric vehicle (EV) segment. The company's growth strategy must account for these market dynamics to maintain its competitive edge. The company's ability to adapt and innovate will be critical for its long-term success.

The automotive industry is highly competitive, with numerous established players and new entrants vying for market share. This competition puts pressure on pricing and necessitates constant innovation in technology and design. The company must differentiate itself to succeed.

Evolving emission standards and environmental regulations globally require continuous adaptation. The transition to electric vehicles necessitates significant investments in charging infrastructure and battery technology. These changes can impact production costs and product development timelines.

Disruptions in the supply of key components, such as semiconductors, can lead to production delays and increased costs. Global events can exacerbate these vulnerabilities. Robust supply chain management and diversification are crucial for mitigating these risks.

Rapid advancements in autonomous driving, advanced connectivity, and electrification require continuous R&D investment. Failure to keep pace with technological innovation can result in a loss of market share. The company must stay at the forefront of these advancements.

Economic recessions can significantly impact consumer demand for luxury vehicles, affecting sales performance and financial indicators. The company needs strategies to navigate economic fluctuations. Diversifying its product portfolio can help mitigate these impacts.

Geopolitical events and trade tensions can disrupt global supply chains and impact market access. The company's global presence exposes it to these risks. Diversifying production locations and markets can help manage these challenges.

The company addresses these risks through a multi-faceted approach. This includes diversifying its product portfolio to appeal to a broader customer base. Robust risk management frameworks are in place to anticipate and mitigate potential disruptions. Strategic partnerships are also formed to secure supply chains and accelerate technological development.

The company engages in scenario planning to anticipate various market and regulatory changes. This proactive approach helps in preparing for potential challenges and mitigating their impact. The company's goal is to ensure its growth ambitions remain achievable despite external pressures. For example, during the semiconductor shortage of 2021-2022, the company implemented measures to optimize chip allocation and production planning.

The company's success depends on navigating these challenges effectively. A strong understanding of the competitive landscape, proactive risk management, and continuous innovation are essential for achieving its long-term goals. For a deeper dive into the financial aspects, consider exploring the Revenue Streams & Business Model of AUDI.

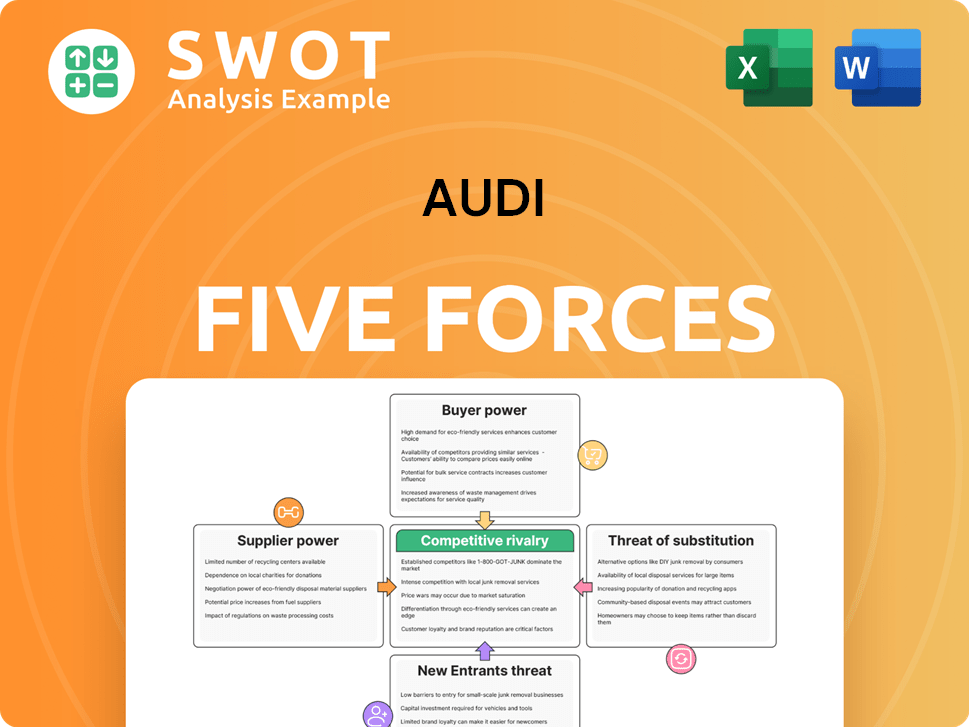

AUDI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AUDI Company?

- What is Competitive Landscape of AUDI Company?

- How Does AUDI Company Work?

- What is Sales and Marketing Strategy of AUDI Company?

- What is Brief History of AUDI Company?

- Who Owns AUDI Company?

- What is Customer Demographics and Target Market of AUDI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.