Avis Budget Group Bundle

Can Avis Budget Group Drive Ahead in the Evolving Mobility Landscape?

Avis Budget Group, a titan in the car rental industry since 1946, is facing a rapidly changing market. From its humble beginnings, the company has grown into a global force, offering a wide array of rental services through its Avis, Budget, and Zipcar brands. Understanding its Avis Budget Group SWOT Analysis is key to grasping its strategic moves.

This exploration delves into the Growth Strategy Avis employs to stay competitive, analyzing its Avis Budget Group Future prospects amidst technological disruptions and changing consumer behaviors. We'll examine how Avis Budget Group plans to navigate the complexities of the Car Rental Industry, focusing on its strategic initiatives, financial performance, and potential for long-term growth. A thorough Market Analysis Avis will reveal the company's position and future trajectory, including the impact of electric vehicles and customer acquisition strategies.

How Is Avis Budget Group Expanding Its Reach?

Avis Budget Group is actively pursuing several expansion initiatives to strengthen its market presence and diversify its revenue streams. The company is focused on strategic partnerships and exploring new business models to meet evolving consumer demands. This approach is crucial for navigating the dynamic car rental industry and ensuring long-term growth.

The company's expansion strategy involves a multi-faceted approach, including geographical expansion, service diversification, and technological advancements. These initiatives are designed to enhance customer experience, increase market share, and adapt to the changing landscape of the car rental industry. Understanding the Owners & Shareholders of Avis Budget Group is key to understanding the company's direction.

A key component of Avis Budget Group's growth strategy involves strategic partnerships. For instance, Loopit has partnered with prominent franchisees like Aero Corporation in North America. This collaboration aims to modernize car rental operations and offer flexible mobility solutions beyond traditional short-term rentals, such as long-term leases and subscription-based models.

Partnerships are central to Avis Budget Group's expansion. These collaborations allow the company to integrate new technologies and services, enhancing its offerings and customer experience. They also facilitate entry into new markets and segments.

Avis Budget Group is expanding its footprint globally. The company is focusing on emerging markets where demand for vehicle rental and sharing services is growing. This includes strategic investments and partnerships in high-growth regions.

The company is diversifying its services beyond traditional vehicle rental. This includes car-sharing services and tailored solutions for corporate clients. The goal is to offer a broader range of mobility options.

Avis Budget Group is investing in technology to improve its operations and customer experience. This includes automation, biometric identity verification, and real-time vehicle management tools. These advancements enhance efficiency and customer satisfaction.

Avis Budget Group's expansion initiatives are designed to drive growth and adapt to market changes. These initiatives include strategic partnerships, geographic expansion, and service diversification to enhance its position in the car rental industry.

- Partnerships: Collaborations with companies like Loopit to offer new mobility solutions.

- Geographic Growth: Expansion in both the Americas and International segments, with notable growth in North America (15%) and International markets (12%).

- Service Diversification: Expanding beyond traditional rentals to include car-sharing and corporate solutions.

- Technological Integration: Implementing advanced technologies for improved customer experience and operational efficiency.

Avis Budget Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Avis Budget Group Invest in Innovation?

The car rental industry is constantly evolving, and Avis Budget Group (ABG) is actively shaping its future through strategic innovation and technological advancements. The company's Growth Strategy Avis focuses on leveraging technology to enhance operational efficiency, improve customer service, and adapt to emerging trends in the automotive sector. This approach is crucial for maintaining a competitive edge in the dynamic Car Rental Industry.

Avis Budget Group Future is heavily influenced by its investments in technology. These investments are aimed at optimizing fleet management, personalizing customer experiences, and expanding into new markets. By embracing digital solutions and data analytics, ABG seeks to streamline its operations and provide superior services to its customers. This proactive stance is vital for sustained growth and profitability.

ABG's strategy involves significant investments in various technological areas. This includes artificial intelligence (AI) and machine learning, big data analytics, cloud computing, connected car technology, and the Internet of Things (IoT). These technologies are used to improve fleet allocation, reduce downtime, and enhance customer service, particularly through tools like chatbots, which handle a substantial portion of customer inquiries. Predictive analytics is also a key component, helping to forecast rental demand and maintain vehicle availability, contributing to cost efficiency and service reliability.

ABG utilizes AI and machine learning to optimize fleet management and personalize customer interactions. This includes using algorithms to predict demand and allocate vehicles efficiently.

Big data analytics are used to gain insights into customer behavior, market trends, and operational performance. This data-driven approach informs strategic decisions.

Cloud computing provides scalable and flexible infrastructure for managing data and applications. This improves efficiency and reduces IT costs.

Connected car technology enhances the rental experience through features like remote vehicle access and real-time vehicle data. This improves operational efficiency.

IoT devices are used to monitor vehicle performance and track vehicle location, which helps in fleet management and maintenance.

Chatbots are used to handle a significant portion of customer inquiries, improving customer service and reducing the workload on human agents.

In 2024, ABG's investments in fleet management technology helped reduce operational costs by 15%. The company is also exploring emerging trends such as electric vehicles (EVs) and autonomous vehicles (AVs), and connected car technology to shape the future of car rentals. This includes experimenting with EV leasing models and forming partnerships with manufacturers like BYD to integrate more affordable EVs into their fleet. ABG's annual ICT spending was estimated at $450.2 million for 2023, with internal development and maintenance accounting for the highest channel spending and software for the highest external spending. The company aims to continuously enhance its digital platforms, including mobile apps and self-service kiosks, to provide seamless and personalized rental experiences. For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of Avis Budget Group.

- Fleet Management Technology: ABG uses technology to optimize fleet allocation, reduce downtime, and improve vehicle maintenance.

- Electric Vehicles (EVs): The company is investing in EVs and exploring EV leasing models to meet growing demand and reduce its carbon footprint. Partnerships with manufacturers like BYD are crucial.

- Digital Platforms: ABG is enhancing its mobile apps and self-service kiosks to provide seamless and personalized rental experiences.

- Predictive Analytics: This is used to forecast rental demand and maintain vehicle availability, contributing to cost efficiency and service reliability.

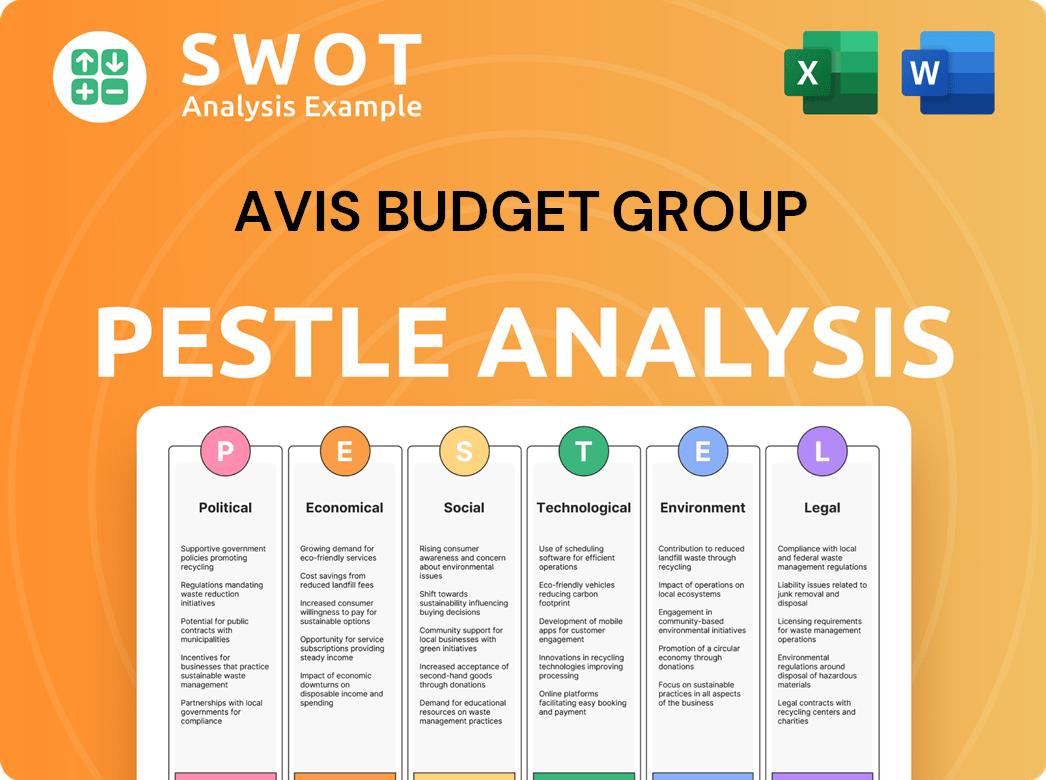

Avis Budget Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Avis Budget Group’s Growth Forecast?

The financial landscape of Avis Budget Group in 2024 presented a complex picture, marked by both challenges and strategic initiatives. The company navigated a year of significant changes, including fleet adjustments and market realignments. Understanding the financial performance of Avis Budget Group is crucial for investors and stakeholders to assess its future prospects and growth strategies.

Avis Budget Group's performance in the car rental industry reflects broader trends and competitive pressures. The company's strategic decisions and operational efficiency are key factors influencing its financial outcomes. The following financial analysis provides insights into the company's recent performance and future outlook, focusing on revenue, profitability, and strategic goals.

For the full year ended December 31, 2024, Avis Budget Group reported revenues of $11.8 billion, slightly down from $12.0 billion in 2023. The company faced a net loss of $1.8 billion for the same period, largely due to a non-cash impairment charge of $2.3 billion related to fleet rotations in the Americas segment. However, the Adjusted EBITDA for 2024 was $628 million, indicating underlying operational strength. This performance highlights the impact of strategic fleet management decisions on the company's financial results.

Avis Budget Group's 2024 revenue was $11.8 billion, a decrease from $12.0 billion in 2023. This slight decline reflects the dynamic nature of the car rental industry and the impact of strategic decisions.

The company reported a net loss of $1.8 billion in 2024, primarily due to non-cash charges. Despite this, Adjusted EBITDA reached $628 million, showcasing operational resilience.

Q1 2025 saw a revenue decrease of 4.7% to $2.43 billion and a widened net loss of $505 million. These figures reflect ongoing challenges and strategic adjustments.

Avis Budget Group aims for an Adjusted EBITDA of at least $1 billion in 2025. Analysts project a return to profitability with an EPS forecast of $8.73.

Looking ahead to 2025, Avis Budget Group is focused on achieving an annual Adjusted EBITDA of no less than $1 billion. This target is supported by initiatives to optimize fleet costs and improve operational efficiencies. Despite a challenging first quarter in 2025, the company remains committed to its strategic goals, including fleet rotation and cost reduction. The company anticipates Q2 Adjusted EBITDA to exceed $200 million.

Avis aims to reduce per unit fleet costs to approximately $300 by Q4 2025, down from $400 per unit per month in Q1 2025. This strategy is crucial for improving profitability.

The company's liquidity at the end of Q4 2024 was approximately $1.1 billion, with an additional $2.8 billion of fleet funding capacity. In September 2024, Avis announced a $500 million senior notes offering.

Key initiatives include fleet rotation and cost optimization to improve financial performance. These strategies are designed to enhance the company's competitive position.

Analysts project a return to profitability for the full year 2025, with an EPS forecast of $8.73 and revenue growth of 1.65% to $11.98 billion. This indicates a positive outlook.

The car rental industry faces various challenges, including fluctuating demand and operational costs. Avis Budget Group is adapting to these changes through strategic planning.

The company's long-term growth projections depend on its ability to execute its strategic initiatives and adapt to market changes. This includes focusing on customer acquisition and operational efficiency.

Avis Budget Group's financial strategy involves managing fleet costs, enhancing operational efficiency, and maintaining a strong liquidity position. These elements are critical for achieving sustainable growth.

- Fleet Management: Optimizing fleet size and composition to meet demand.

- Cost Control: Implementing measures to reduce operational expenses.

- Revenue Generation: Focusing on strategies to increase revenue per rental.

- Strategic Investments: Allocating resources to support long-term growth initiatives.

The financial outlook for Avis Budget Group highlights the importance of strategic decision-making and operational efficiency in the competitive car rental industry. The company's ability to navigate challenges and capitalize on opportunities will be key to its future success. For further insights into the company's history and evolution, consider reading the Brief History of Avis Budget Group.

Avis Budget Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Avis Budget Group’s Growth?

The Avis Budget Group faces several risks that could hinder its growth. The Car Rental Industry is highly competitive, and changing consumer preferences add to the challenges. Financial and operational hurdles also pose significant threats to the company's strategic goals.

Financial risks are substantial, including a recent $2.3 billion impairment charge in Q4 2024 related to fleet rotation. This led to a net loss of nearly $2 billion for the quarter and $1.8 billion for the full year. Debt levels and rising interest rates further strain profitability. The company's ability to adapt to these financial pressures will be crucial.

Operational challenges encompass escalating fleet costs, labor shortages, and geopolitical volatility. The new CEO appointment introduces a period of strategic uncertainty. Navigating these diverse challenges will be critical for Avis Budget Group's future success and its ability to maintain and grow its market share.

The Avis Budget Group competes with major players like Hertz, Enterprise, and Sixt. The Avis Budget Group must differentiate itself to gain a competitive edge. Intense competition could limit its Growth Strategy Avis.

The company’s financial health faces risks from high debt, with total debt at $10.4 billion as of Q3 2023. Rising interest rates increase vehicle interest costs, impacting profitability. The impairment charge in Q4 2024 further highlights financial vulnerabilities.

Fleet costs are rising, with new vehicle prices up 30% year-over-year in 2024. Depreciation risks also exist due to falling used car values. Efficient fleet management is critical for Avis Budget Group to control costs.

Labor shortages, especially for auto technicians, are driving up wages by 15% since 2021. Geopolitical volatility and macroeconomic factors also impact costs. These operational issues could hinder Budget Car Rental operations.

The transition of CEO Joe Ferraro to a Board Advisor role and Brian Choi taking over as CEO on July 1, 2025, introduces uncertainty. This leadership change could affect strategic direction. The new CEO's strategy will be key to the Avis Budget Group Future.

Changing consumer preferences, including a growing demand for sustainable and eco-friendly transportation, present a challenge. The company needs to adapt its service offerings to meet these evolving demands. Understanding market dynamics is crucial for Market Analysis Avis.

To mitigate risks, Avis Budget Group must stabilize fleet management practices. Enhancing financial disclosures and rebuilding investor confidence are also critical. These initiatives will support long-term growth and stability.

Geopolitical instability and macroeconomic conditions pose additional risks. Potential tariffs on vehicle acquisitions and a U.S. economic downturn could further impact costs. These external factors require careful monitoring and proactive strategies.

Avis Budget Group needs to adapt to changing consumer demands, including sustainability. Investing in electric vehicles and other eco-friendly options could attract new customers. Innovation is key to staying ahead.

Understanding the competitive landscape is essential for Avis Budget Group. Analyzing competitors' strategies and market trends will guide decision-making. Further insights can be found in the Marketing Strategy of Avis Budget Group.

Avis Budget Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Avis Budget Group Company?

- What is Competitive Landscape of Avis Budget Group Company?

- How Does Avis Budget Group Company Work?

- What is Sales and Marketing Strategy of Avis Budget Group Company?

- What is Brief History of Avis Budget Group Company?

- Who Owns Avis Budget Group Company?

- What is Customer Demographics and Target Market of Avis Budget Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.