Avis Budget Group Bundle

Who Really Controls Avis Budget Group?

Understanding the ownership of a company like Avis Budget Group is crucial for investors and strategists alike. From its humble beginnings as Avis Airlines Rent-a-Car Systems to its current status as a global mobility leader, the evolution of Avis's ownership has been a fascinating journey. This exploration will unravel the key players and pivotal moments that have shaped the destiny of this major player in the car rental industry.

The Avis Budget Group SWOT Analysis reveals critical insights, but understanding the Avis ownership structure is equally vital. Knowing who owns Budget car rental and the broader Avis parent company provides a deeper understanding of its strategic direction and financial performance. As a publicly traded company, understanding who holds Avis Budget Group stock is key to evaluating its future potential, including the influence of major institutional investors and the impact of market dynamics on its operations. This article aims to answer questions like "Who is the CEO of Avis Budget Group?" and "Is Avis Budget Group a public company?"

Who Founded Avis Budget Group?

The story of Avis Budget Group begins with Warren Avis, who founded Avis in 1946. He started the company with an initial investment of $85,000, a sum he borrowed to establish the first car rental operation at Willow Run Airport in Detroit, Michigan. This marked the beginning of a new service tailored to the growing air travel industry.

Avis's early years saw significant changes in ownership. Warren Avis sold the company in 1954 for $8 million. Later, in 1956, an investment group led by Amoskeag Company acquired Avis, forming Avis, Inc. as a formal holding company. Richard Robie also invested $500,000 that same year.

Over the years, the company changed hands several times, including acquisitions by Lazard Frères & Co. in 1962, ITT Corporation in 1965, Norton Simon Inc. in 1977, and Esmark Inc. in 1983. In 1987, Avis transitioned to employee ownership through an Employee Stock Ownership Plan (ESOP) for $750 million.

Warren Avis identified a need for car rentals at airports, capitalizing on the rise of air travel. His strategy created a new market segment.

The initial $85,000 investment highlighted the financial commitment required to enter the car rental business. Richard Robie's investment of $500,000 also shows the early interest.

The series of acquisitions and sales reflects the dynamic nature of the business landscape. This shows the company's growth and financial challenges.

The ESOP in 1987 aimed to boost employee engagement and enhance customer service. This strategy also affected the company's culture.

Each ownership change brought new strategies and financial approaches. This indicates the evolution of the company's business model.

The company's ability to adapt to market changes is evident through its ownership changes. This highlights the competitive nature of the car rental industry.

The early history of Avis Budget Group, marked by its founding and subsequent changes in ownership, showcases its adaptability and strategic evolution within the car rental industry. Understanding the Marketing Strategy of Avis Budget Group can provide further insights into its operational and financial strategies.

- Warren Avis's initial investment set the stage for the company's growth.

- Multiple ownership changes reflect the company's financial and strategic adjustments.

- The ESOP aimed to align employee interests with company performance.

- The company's history illustrates its response to market dynamics and competition.

Avis Budget Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Avis Budget Group’s Ownership Changed Over Time?

Avis Budget Group, Inc. (ABG) is a publicly traded company listed on the NASDAQ under the ticker symbol CAR. The company's initial public offering (IPO) occurred on September 15, 1983. As of April 25, 2025, the market capitalization of Avis Budget Group is approximately $2.42 billion. This market valuation reflects investor confidence and the overall financial health of the company within the competitive car rental industry.

The ownership structure of Avis Budget Group is diverse, with a significant presence of institutional investors, mutual funds, and index funds. These entities, along with individual shareholders and company insiders, collectively shape the company's strategic direction and financial performance. Understanding the ownership dynamics provides insights into the stability and potential growth prospects of the company. The company's financial performance, including its stock price and market capitalization, is closely monitored by these stakeholders.

| Major Shareholders (March 31, 2025) | Shares Held | Percentage of Shares |

|---|---|---|

| SRS Investment Management, LLC | 17,430,882 | Not Available |

| Pentwater Capital Management LP | 2,320,000 | Not Available |

| Fmr Llc | 2,199,910 | Not Available |

| UBS Group AG | 1,931,115 | Not Available |

| BlackRock, Inc. | 1,720,441 | Not Available |

| Vanguard Group Inc. | 1,610,186 | Not Available |

Key events have significantly impacted the Avis ownership structure. The spin-off from Cendant Corporation in 2006, which formed Avis Budget Group, was a pivotal moment. The 2011 acquisition of Avis Europe plc reunited the global operations of the Avis brand. Moreover, leadership transitions, such as the appointment of Brian Choi as CEO effective July 1, 2025, can influence investor sentiment and the company's strategic direction. For more insights into the company's strategic initiatives, consider reviewing the Growth Strategy of Avis Budget Group.

Avis Budget Group's ownership is primarily held by institutional investors, with significant holdings by SRS Investment Management, LLC, and others. Institutional investors hold approximately 102.10% of the shares, while mutual funds hold 26.19% as of April 2025. Insider holdings remained at 0.89% in April 2025.

- Institutional investors play a crucial role in influencing the company's direction.

- The company's market capitalization is around $2.42 billion as of April 25, 2025.

- Key events like the 2006 spin-off and the 2011 acquisition have reshaped the company.

- Leadership changes, such as the new CEO, can influence investor confidence.

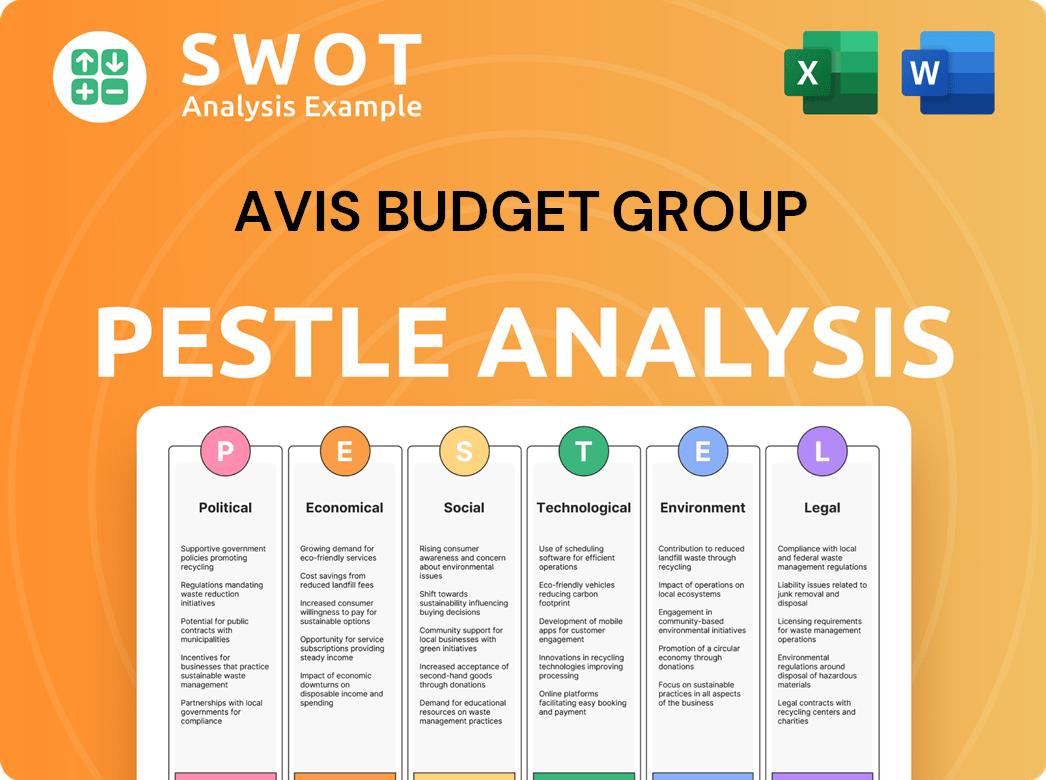

Avis Budget Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Avis Budget Group’s Board?

As of February 2025, the Board of Directors of Avis Budget Group included several key figures. Jagdeep Pahwa, a board member since 2018 and Chairman since May 2024, transitioned to Executive Chairman on March 1, 2025. Joe Ferraro, the outgoing CEO, is scheduled to transition to a Board Advisor role effective June 30, 2025. Brian Choi, formerly Chief Transformation Officer, will become CEO on July 1, 2025. Bernardo Hees, who served as Chairman until May 2024, remains on the board. Other board members include Lynn Krominga, Glenn Lurie, and Karthik Sarma.

The composition of the board reflects strategic considerations, with Jagdeep Pahwa and Karthik Sarma's nominations aligned with cooperation agreements, indicating their representation of major shareholders. Jagdeep Pahwa's role as President of SRS Investment Management, a significant institutional shareholder, further highlights the influence of key investors in the company's governance. Understanding the Avis Budget Group board structure is crucial for investors and stakeholders alike, as it directly impacts strategic decisions and company direction. You can learn more about their target market.

| Board Member | Role | Notes |

|---|---|---|

| Jagdeep Pahwa | Executive Chairman | Transitioned March 1, 2025; Represents SRS Investment Management |

| Joe Ferraro | Board Advisor | Transitioning June 30, 2025; Outgoing CEO |

| Brian Choi | CEO | Effective July 1, 2025; Formerly Chief Transformation Officer |

| Bernardo Hees | Board Member | Former Chairman (until May 2024) |

The voting structure for Avis Budget Group generally follows a one-share-one-vote principle. However, specific agreements can influence voting power. For example, SRS Investment Management, LLC, a major beneficial owner, agreed on December 23, 2022, to vote its shares in favor of the company's nominees and proposals, subject to certain limitations. If SRS's beneficial ownership exceeds 35%, they are committed to exercising excess voting rights proportionally. Shareholders holding shares through employee savings plans vote as directed, and if no instructions are received, the trustees vote proportionately. This structure helps maintain a balance of power among shareholders, ensuring that no single entity can exert undue influence.

The board includes Jagdeep Pahwa as Executive Chairman and Brian Choi as the incoming CEO. Voting follows a one-share-one-vote principle, but agreements can influence power.

- Jagdeep Pahwa represents SRS Investment Management.

- Joe Ferraro transitions to Board Advisor.

- Shareholders in employee savings plans vote as directed.

- SRS Investment Management has voting agreements in place.

Avis Budget Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Avis Budget Group’s Ownership Landscape?

Over the last few years, several key developments have influenced the ownership landscape of Avis Budget Group. In 2024, the company repurchased approximately 550,000 shares of common stock, totaling $45 million, under its share repurchase program. By March 31, 2025, quarterly stock buybacks reached 3.00 million shares. These actions reflect a strategic approach to managing shareholder value and capital allocation.

Leadership transitions have also played a significant role. Joe Ferraro, after 45 years with the company, is transitioning from CEO to Board Advisor, effective June 30, 2025. Brian Choi, formerly the Chief Transformation Officer, will take over as CEO on July 1, 2025. Additionally, Jagdeep Pahwa became Executive Chairman on March 1, 2025. These changes signal a focus on future growth and operational efficiency. A one-time non-cash impairment of $2.3 billion in 2024, related to fleet rotations in the Americas segment, further shaped recent financial performance.

| Metric | Value | Date |

|---|---|---|

| Shares Repurchased (2024) | Approximately 550,000 | 2024 |

| Share Repurchases (Q1 2025) | 3.00 million shares | March 31, 2025 |

| Impairment | $2.3 billion | 2024 |

| Adjusted EBITDA Target (2025) | No less than $1 billion | 2025 |

Industry trends indicate increasing institutional ownership within Avis Budget Group. Major investment firms, including Vanguard Group, BlackRock, and State Street Corporation, hold significant stakes. While there have been no major proxy battles recently, the substantial holdings of institutional investors suggest their influence on governance and strategic decisions remains considerable. The company aims to achieve no less than $1 billion of Adjusted EBITDA in 2025, supported by strong travel demand. To understand more about the company, you can read about the Revenue Streams & Business Model of Avis Budget Group.

Avis Budget Group is a publicly traded company, which means its stock is available for purchase on the open market. The ownership is primarily held by institutional investors, such as mutual funds and investment firms.

Budget Car Rental is a subsidiary of Avis Budget Group. Therefore, the ultimate parent company of Budget is Avis Budget Group, which manages both Avis and Budget brands.

The stock price of Avis Budget Group (CAR) fluctuates based on market conditions, financial performance, and investor sentiment. Investors can monitor the stock price through financial news outlets and brokerage platforms.

The parent company of Avis is Avis Budget Group. This structure allows for centralized management and strategic decision-making across both the Avis and Budget car rental brands.

Avis Budget Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Avis Budget Group Company?

- What is Competitive Landscape of Avis Budget Group Company?

- What is Growth Strategy and Future Prospects of Avis Budget Group Company?

- How Does Avis Budget Group Company Work?

- What is Sales and Marketing Strategy of Avis Budget Group Company?

- What is Brief History of Avis Budget Group Company?

- What is Customer Demographics and Target Market of Avis Budget Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.