BAIC Motor Bundle

Can BAIC Motor Company Drive to the Forefront of the Global Automotive Market?

BAIC Motor Company, a prominent Chinese car manufacturer, is charting an ambitious course in the rapidly evolving automotive industry. Established in 1958, BAIC has transformed from a domestic player into a significant force, producing a diverse range of vehicles, including electric vehicles, and automotive components. With impressive 2024 sales figures, the company is now poised for its next phase of expansion.

This article dives deep into BAIC Motor SWOT Analysis, exploring the growth strategy BAIC is employing to navigate the challenges and opportunities within the Automotive Industry China. We'll analyze BAIC's future prospects, examining its investments in new technologies, its financial performance, and its approach to the competitive landscape. Understanding the Chinese Car Manufacturer's strategic trajectory is crucial for investors and industry watchers alike, offering insights into its potential for long-term growth and market share gains.

How Is BAIC Motor Expanding Its Reach?

BAIC Motor Company, a prominent player in the Automotive Industry China, is implementing a comprehensive growth strategy to strengthen its position in the market. This strategy focuses on geographical expansion, product development, and strategic partnerships. The company aims to capitalize on the growing demand for vehicles, particularly New Energy Vehicles (NEVs), both domestically and internationally. Understanding BAIC's Market Analysis and future prospects is crucial for investors and stakeholders.

The company's expansion initiatives are designed to diversify revenue streams and increase its global footprint. By entering new markets and introducing innovative products, BAIC Motor seeks to enhance its competitiveness and achieve sustainable growth. The company's strategic moves, including investments and collaborations, are geared towards achieving its ambitious sales targets and solidifying its presence in the automotive sector. For a deeper understanding of their marketing approach, consider exploring the Marketing Strategy of BAIC Motor.

BAIC Motor's future prospects look promising, driven by its strategic initiatives and adaptation to market trends. These initiatives are a testament to BAIC's commitment to innovation and its vision for long-term growth. BAIC Motor Company is actively pursuing a multi-faceted expansion strategy to enhance its market presence and diversify its revenue streams.

BAIC Motor is expanding its global presence by entering new geographical markets. In May 2024, the company launched three new models in Cairo, Egypt, and opened its first flagship store there. This move marks a significant step in its Middle Eastern expansion. The company also introduced its BJ30 SUV to the UAE market in 2024.

The company is focused on product pipeline development to meet market demands. In 2024, BAIC Motor launched several new energy vehicle models, including the Magic Core Electric Drive Super Drive Solution and the BJ30 hybrid product. These initiatives aim to increase the company's market share in the NEV segment.

BAIC Motor is building strategic partnerships to enhance its capabilities and market reach. In December 2024, BAIC Capital and Hyundai Motor jointly invested $1.095 billion in their joint venture, Beijing Hyundai. Additionally, BAIC Group announced a strategic investment of $70.35 million in autonomous driving company Pony.ai in November 2024.

In the commercial vehicle segment, Foton Motor completed construction of its Thai production plant in 2024, which also rolled off its 1 millionth export-ready vehicle. BAIC Motor also put its EU5 electric vehicle model onto the Colombian market in December 2024, with plans to deepen local partnerships and expand into the taxi sector.

BAIC Motor's expansion strategy includes entering new markets, developing its product pipeline, and forming strategic partnerships. The company aims to achieve over 3 million units in annual vehicle sales by 2027, with over 50% of these sales coming from NEVs. The ARCFOX premium New Energy Vehicle (NEV) brand has officially entered Europe, the Middle East, and Southeast Asia.

- Geographical expansion into the Middle East, Southeast Asia, and Latin America.

- Focus on NEV development, with new models and technologies.

- Strategic investments and collaborations to enhance competitiveness.

- Expansion of commercial vehicle production and sales.

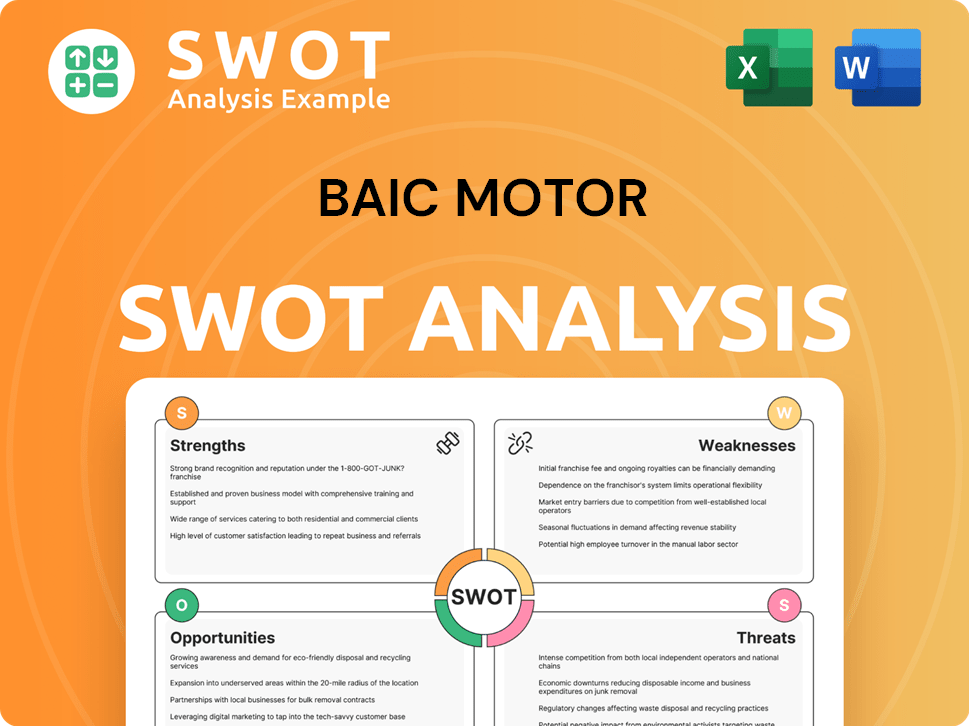

BAIC Motor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BAIC Motor Invest in Innovation?

BAIC Motor Company's growth strategy heavily relies on innovation and technological advancements, especially in new energy vehicles (NEVs) and intelligent technologies. The company is making significant investments in research and development (R&D) to stay competitive in the rapidly evolving automotive industry in China.

This strategic focus is critical for its future prospects, as it aims to capture a larger share of the market and expand its global presence. The company's commitment to sustainability and strategic partnerships further strengthens its position in the automotive sector.

BAIC Motor Company's approach involves substantial R&D spending, strategic partnerships, and a strong focus on sustainability. This positions the company for long-term growth and success in the automotive industry.

BAIC Motor is heavily investing in R&D to drive innovation. R&D spending exceeded 13 billion yuan in 2024. Over the next five years, BAIC Group plans to invest at least 50 billion RMB in R&D, with a strong focus on new energy and intelligent technologies.

The company's innovation strategy focuses on seven key areas. These include intelligent driving, intelligent cockpit, electronic control, electric drive, hybrid power, battery technology, and key technologies for off-road vehicles. BAIC aims for technological upgrades by 2025.

BAIC plans to achieve breakthroughs in key areas by 2028 and a world-leading position in core technologies by 2030. In 2025, BAIC is set to introduce advanced connectivity options, including real-time traffic updates and enhanced safety features using AI technology.

BAIC is committed to sustainability through its 'BLUE Plan,' announced in June 2022. The plan aims to achieve peak carbon dioxide emissions by 2025 and complete decarbonization of all products by 2050. This includes transitioning to new energy product platforms.

BAIC Group plans to build one or two zero-carbon factories by 2025. This initiative supports the company's sustainable development goals and commitment to reducing its environmental footprint. This is a key aspect of BAIC's long-term growth potential.

BAIC Motor collaborates with various partners to enhance its innovation capabilities. Key partnerships include Huawei for the STELATO NEV brand, and Pony.ai and Horizon Robotics for intelligent driving solutions. These collaborations are crucial for BAIC's future prospects.

The ARCFOX premium NEV brand, featuring models such as the α S5, α T5, and KAOLA, saw a remarkable 170% year-on-year sales increase in 2024. The ARCFOX Alpha T5, a pure electric SUV, won the 2025 iF DESIGN AWARD. BAIC Group's innovation extends to electric drive solutions and intelligent systems.

- BAIC launched the Magic Core Electric Drive Super Drive Solution.

- The company showcased the Polaris all-digital high-end electric platform.

- An AI large model embodied intelligent system was also presented at the 2024 Beijing International Automotive Exhibition.

- These advancements highlight BAIC's commitment to staying at the forefront of the Automotive Industry China.

- The focus on NEVs and intelligent technologies is central to the Growth Strategy BAIC.

For more insights into the company's performance, consider exploring resources on Owners & Shareholders of BAIC Motor to understand the financial and strategic decisions driving BAIC's growth and its position in the Chinese Car Manufacturer market.

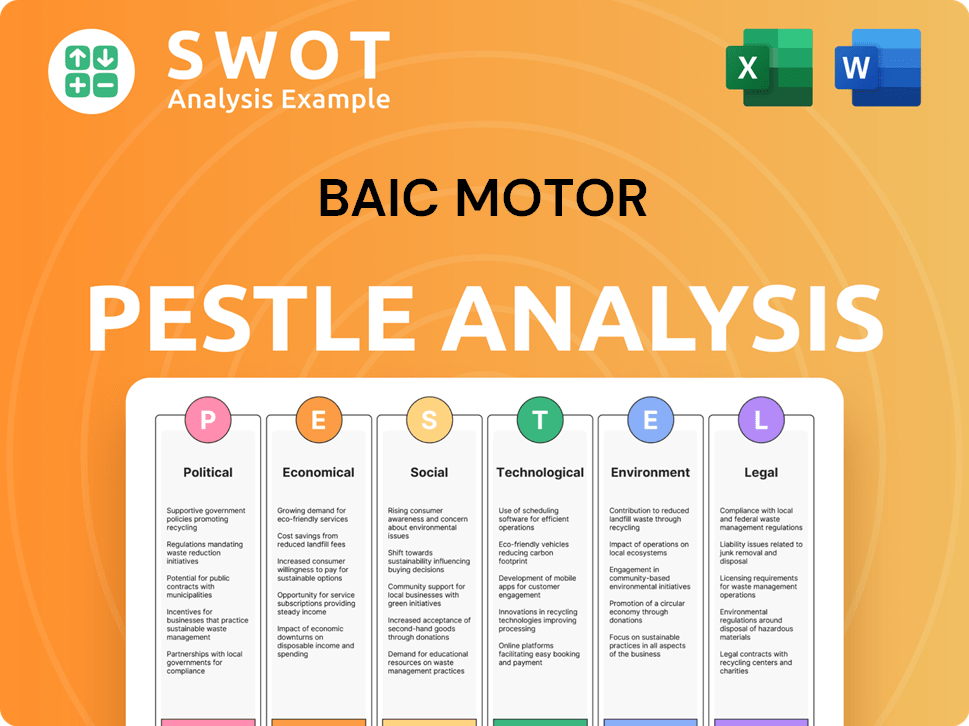

BAIC Motor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is BAIC Motor’s Growth Forecast?

The financial outlook for BAIC Motor Company (BAIC Motor) is promising, supported by its recent performance and strategic investments. In 2024, the BAIC Group, the parent company, achieved strong results, with annual vehicle sales exceeding 1.71 million units and annual revenue surpassing 480 billion yuan. This robust performance sets a solid foundation for future growth, particularly within the Automotive Industry China.

BAIC Motor Corporation Limited reported sales of CNY 192,495.61 million and a net income of CNY 955.84 million for the year ended December 31, 2024. Basic earnings per share from continuing operations were CNY 0.12. These figures highlight the company's financial stability and its ability to generate profits despite the competitive landscape.

Looking at the Growth Strategy BAIC, analysts forecast that BAIC Motor will experience substantial growth in the coming years. Earnings are expected to increase by 24.6% annually, while revenue is projected to grow by 3.2% per annum. The Earnings per share (EPS) is anticipated to rise by 25.5% annually, with a forecasted return on equity of 6.4% in three years. These projections indicate a positive trajectory for BAIC Motor Company, especially in terms of earnings growth, which is predicted to outpace the Hong Kong market's forecast of 10.3% per year.

BAIC Group plans to invest at least 50 billion RMB in research and development over the next five years, with a focus on new energy and intelligent technologies. In 2024 alone, the group invested over 13 billion yuan in R&D, demonstrating a strong commitment to innovation. This investment is crucial for the Future Prospects of BAIC, particularly in the rapidly evolving automotive market.

The company has secured significant financing to support its growth initiatives. BAIC BJEV received over 10 billion yuan in financing, and Beijing Hyundai received a capital increase of 8 billion yuan in 2024. Furthermore, BAIC Capital and Hyundai Motor jointly invested an additional $1.095 billion (approximately 8 billion yuan) into their joint venture, Beijing Hyundai, in December 2024, to enhance competitiveness. These capital injections are vital for expanding production capacity and developing new models.

As of December 31, 2024, BAIC Group had undrawn short-term and long-term banking facilities of approximately RMB 13,527 million and RMB 2,100 million, respectively. This strong financial position provides the company with ample resources to meet its working capital requirements and pursue its strategic objectives. This financial strength is crucial for navigating the challenges facing BAIC Motor Company.

The strategic investment in Beijing Hyundai, a joint venture, highlights BAIC's approach to leveraging partnerships for growth. These collaborations are crucial for accessing technology, expanding market reach, and mitigating risks. Further insights into BAIC's target market can be found in the Target Market of BAIC Motor analysis.

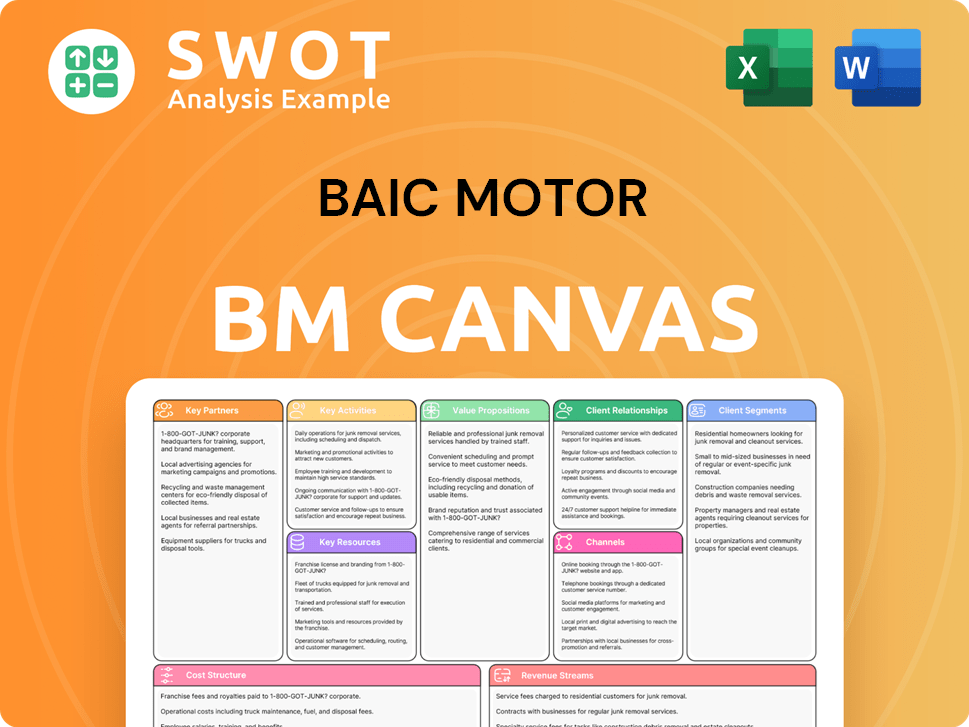

BAIC Motor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow BAIC Motor’s Growth?

The BAIC Motor Company's ambitious growth strategy faces several potential risks and obstacles. These challenges are inherent in the dynamic automotive industry, particularly within China's competitive market. Understanding these risks is crucial for assessing the company's future prospects and long-term sustainability.

The automotive industry in China is characterized by intense competition. Rapid technological advancements and evolving consumer preferences add to the complexity. Navigating this environment requires strategic agility and proactive risk management.

BAIC Motor Company must navigate a landscape of potential pitfalls to achieve its growth targets. These include market competition, regulatory shifts, supply chain vulnerabilities, and the need for continuous technological innovation. The company's ability to address these challenges will determine its success.

The Chinese automotive market is highly competitive, with numerous domestic and international players vying for market share. The NEV segment, in particular, is experiencing rapid growth, attracting both established automakers and new entrants. This 'fierce competitiveness' puts pressure on pricing, innovation, and market positioning for BAIC Motor Company.

Government policies and incentives significantly influence the NEV market in China. Changes in subsidies, emission standards, and other regulations can impact consumer demand, production costs, and the overall market environment. These shifts require BAIC Motor Company to remain adaptable and responsive to regulatory changes.

The global automotive industry has faced supply chain disruptions, including semiconductor shortages and raw material price fluctuations. These vulnerabilities can affect production volumes, lead times, and profitability. BAIC Motor Company must manage its supply chain effectively to mitigate these risks.

Rapid advancements in autonomous driving, connectivity, and battery technology require substantial R&D investments. Failure to keep pace with these innovations could lead to a loss of market share. BAIC Motor Company needs to invest strategically in these areas to remain competitive. For example, BAIC Group is investing heavily in R&D, with over 13 billion yuan in 2024.

Attracting and retaining top talent in specialized areas, such as AI and EV battery development, can be challenging. The effective management of its diverse portfolio of brands and joint ventures also presents an ongoing operational challenge. These internal constraints could impede BAIC Motor Company's growth.

Managing a diverse portfolio of brands and joint ventures, like Beijing Benz and Beijing Hyundai, presents ongoing operational challenges. These challenges include coordinating production, maintaining quality standards, and adapting to market-specific demands. These factors can impact the overall efficiency and profitability of BAIC Motor Company.

BAIC Motor Company employs several strategies to mitigate these risks. Diversification across product categories, including sedans, SUVs, EVs, and commercial vehicles, helps spread risk. Strategic partnerships and investments, such as the joint venture with Hyundai Motor in Beijing Hyundai, aim to enhance competitiveness. The investment in Pony.ai supports autonomous driving development.

The company launched the 'Three-Year Leap Action' strategy in 2024 and the 'BLUE Plan' for decarbonization by 2050, which demonstrates proactive scenario planning. Collaborations, such as the battery cell factory with CATL and Xiaomi, aim to secure critical components. These measures illustrate BAIC Motor Company's commitment to long-term sustainability and navigating future challenges. For more details, you can read about the Revenue Streams & Business Model of BAIC Motor.

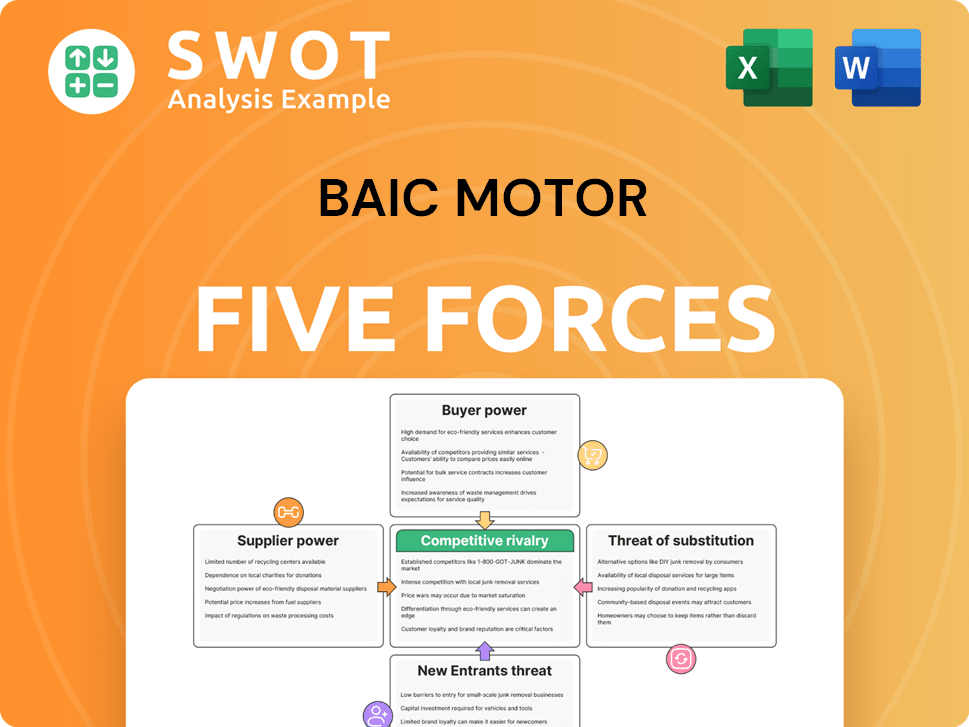

BAIC Motor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BAIC Motor Company?

- What is Competitive Landscape of BAIC Motor Company?

- How Does BAIC Motor Company Work?

- What is Sales and Marketing Strategy of BAIC Motor Company?

- What is Brief History of BAIC Motor Company?

- Who Owns BAIC Motor Company?

- What is Customer Demographics and Target Market of BAIC Motor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.