BAIC Motor Bundle

How Does BAIC Motor Company Thrive in the Global Automotive Arena?

BAIC Motor Company, a powerhouse in the Chinese automotive industry, has rapidly expanded its reach globally. From its humble beginnings in 1958, BAIC has become a major player, producing a wide range of vehicles, including a significant focus on electric vehicles (EVs). Its strategic moves and financial performance make it a compelling subject for anyone interested in the BAIC Motor SWOT Analysis.

This exploration into BAIC operations and its business model will unravel the strategies behind its success. We'll examine its diverse brand portfolio, including ARCFOX, and its commitment to research and development. Understanding BAIC Motor Company's history and evolution, its electric vehicle strategy, and its impact on the Chinese economy is key to grasping its future trajectory within the Chinese automotive industry and beyond.

What Are the Key Operations Driving BAIC Motor’s Success?

BAIC Motor Company creates value by manufacturing and selling a wide array of vehicles, with a strong focus on technological advancement and diverse product offerings. The company's core business revolves around passenger vehicles, including sedans, SUVs, and a growing portfolio of electric vehicles (EVs). Their strategy caters to various customer segments, offering fuel-efficient options for everyday use and premium EVs for those seeking advanced features and sustainability.

BAIC operations are built on sophisticated manufacturing facilities, strategic component sourcing, continuous technological development, and efficient logistics. Key partnerships, like the collaboration with CATL and Xiaomi for a battery cell factory, highlight their commitment to key EV components. Joint ventures, such as Beijing Benz Automotive Co. (BBAC) and Beijing Hyundai Motor, are crucial for production and market penetration. The company's approach combines traditional fuel vehicles with aggressive expansion into new energy vehicles (NEVs), alongside investments in intelligent driving and smart cockpit technologies.

The value proposition of BAIC Motor Company lies in its ability to offer a diverse product portfolio that meets evolving customer preferences. This includes smarter, more energy-efficient, and safer vehicles. This approach provides a competitive edge through value for money and innovative features. The company's focus on both traditional and new energy vehicles positions it well in the evolving automotive market.

BAIC's main products include sedans like the U5 PLUS and D50, SUVs such as the BJ40, BJ60, BJ80, X55, and X7, and a growing range of electric vehicles. The company aims to meet diverse customer needs by offering a wide variety of models. This diverse product range is a key part of their strategy.

BAIC's operations involve advanced manufacturing, strategic component sourcing, and continuous technology development. They maintain strong partnerships, including collaborations for key EV components. Joint ventures with companies like Beijing Benz Automotive Co. (BBAC) and Beijing Hyundai Motor are also essential.

BAIC serves a broad range of customers, from those looking for fuel-efficient sedans to buyers interested in premium electric vehicles and robust off-road models. This diverse customer base is supported by a wide range of vehicle options. Their offerings cater to different needs and preferences.

BAIC offers a diverse product portfolio that meets evolving customer preferences for smarter, more energy-efficient, and safer vehicles. They provide value for money and innovative features, giving them a competitive edge. The company is focused on both traditional and new energy vehicles.

BAIC's strategy involves a dual focus on traditional fuel vehicles and aggressive expansion into new energy vehicles (NEVs). They are also investing heavily in intelligent driving and smart cockpit technologies. This approach aims to meet the changing demands of the automotive market.

- Electric Vehicle Strategy: BAIC is increasing its focus on electric vehicle manufacturing to meet growing market demand.

- Technological Advancement: Continuous investment in intelligent driving and smart cockpit technologies is a priority.

- Partnerships and Joint Ventures: Strategic collaborations, such as the one with CATL and Xiaomi, are key to their supply chain.

- Market Expansion: BAIC aims to strengthen its presence in both domestic and international markets.

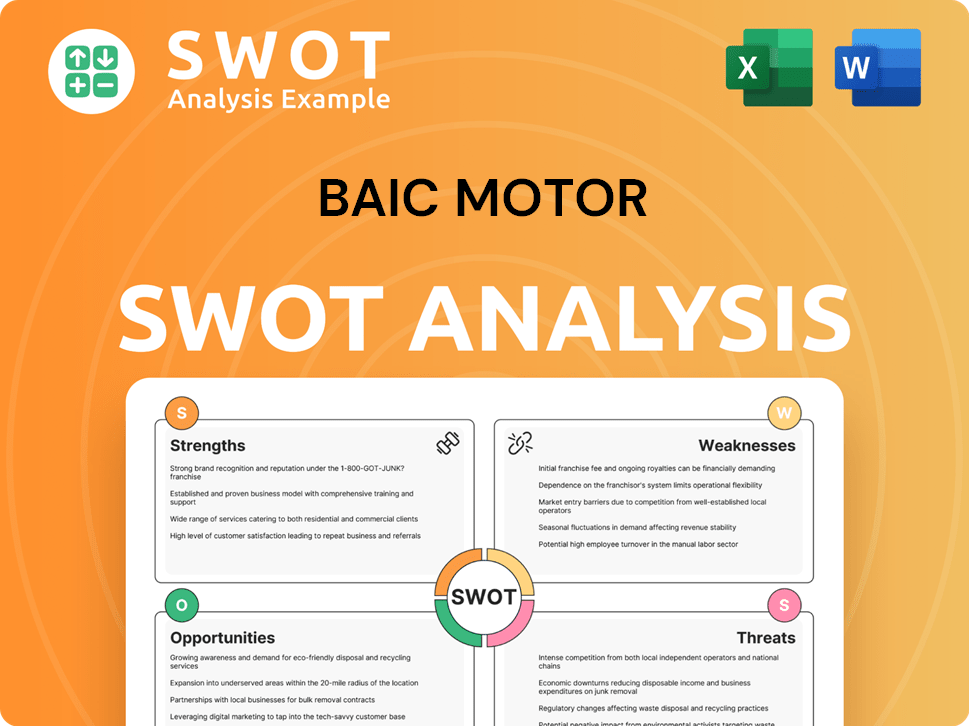

BAIC Motor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BAIC Motor Make Money?

BAIC Motor Company's revenue streams are primarily driven by the manufacturing and sale of passenger vehicles, engines, and auto parts. The company, along with its subsidiaries, generates substantial revenue through diverse operations within the Chinese automotive industry. Understanding the BAIC business model involves analyzing its various revenue sources and how it monetizes its products and services.

The company's financial performance is a key indicator of its success. In 2024, BAIC Motor Corporation Limited reported a revenue of CNY 192,495.61 million. Furthermore, the BAIC Group, which includes BAIC Motor and other entities, achieved annual revenue exceeding 480 billion yuan in 2024, showcasing its significant market presence.

BAIC's monetization strategies include a diverse product lineup and expansion into international markets. These strategies are crucial for sustaining growth and competitiveness in the dynamic automotive sector. For more information on the company, you can read about Owners & Shareholders of BAIC Motor.

BAIC Motor Company's revenue generation is multifaceted, encompassing various segments within the automotive industry. Key revenue streams include sales of conventional fuel vehicles and new energy vehicles (NEVs), with a growing emphasis on the latter. The company also benefits from its joint ventures and commercial vehicle sales.

- Sales of Passenger Vehicles: This is the primary revenue source, including both traditional fuel vehicles and NEVs. The company's diverse product range caters to various market segments.

- New Energy Vehicles (NEVs): The NEV segment is a significant growth area, with brands like ARCFOX experiencing substantial increases in sales. For example, ARCFOX's annual sales surged by 170% year-on-year in 2024.

- Commercial Vehicles: Through Foton Motor, BAIC generates substantial revenue from commercial vehicle sales. Foton Motor achieved annual sales of over 610,000 vehicles in 2024.

- Joint Ventures: Partnerships such as Beijing Benz and Beijing Hyundai contribute significantly to the overall group revenue. Beijing Benz reported revenue of 21,747 million euros for the year ended December 31, 2024.

- Auto Parts and Components: Sales of engines and auto parts also contribute to the overall revenue stream, supporting both internal production and external sales.

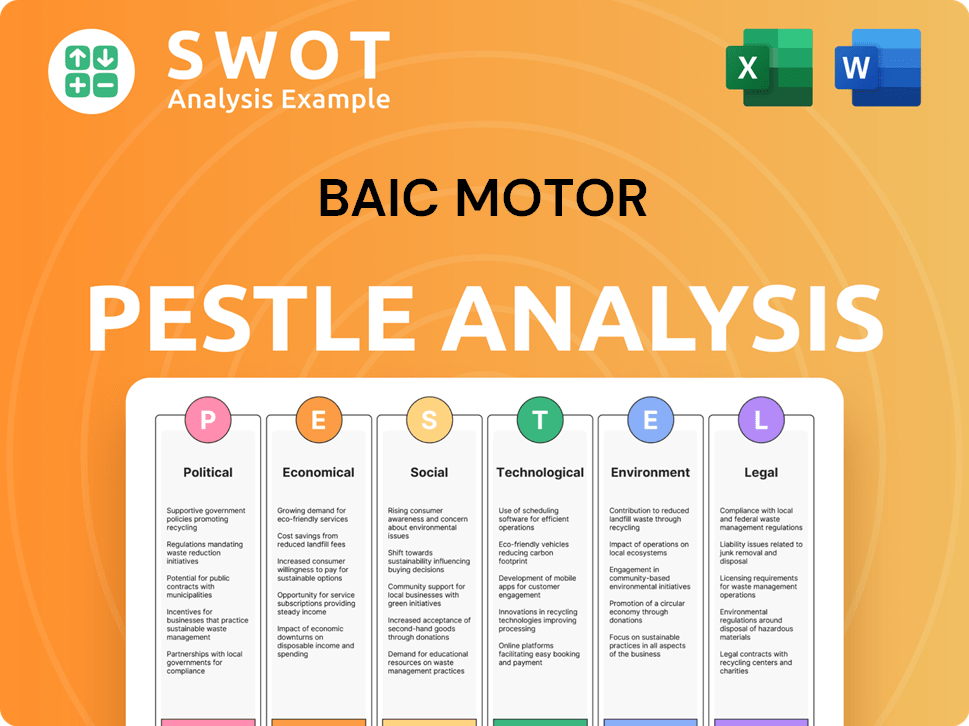

BAIC Motor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped BAIC Motor’s Business Model?

BAIC Motor Company has navigated a dynamic landscape, marked by strategic shifts and significant milestones. The company's trajectory reflects its commitment to innovation and expansion within the Chinese automotive industry. Key decisions and partnerships have been instrumental in shaping its competitive position and future prospects.

In 2024, BAIC Group launched its 'Three-Year Leap Action' strategy. This initiative aims to boost annual vehicle sales to over 3 million units by 2027, with more than half being new energy vehicles (NEVs). This strategic pivot underscores BAIC's focus on the rapidly evolving electric vehicle manufacturing sector. The company's consistent investment in research and development, exceeding 13 billion yuan in 2024, supports this ambitious plan.

BAIC's strategic moves include forging partnerships and expanding its global footprint. Collaborations with Huawei, Pony.ai, and Horizon Robotics highlight its commitment to technological advancements, especially in intelligent driving solutions. The expansion of the ARCFOX brand into Europe, the Middle East, and Southeast Asia, along with Foton Motor's Thai production plant completion, demonstrates BAIC's global ambitions.

BAIC's history and evolution include significant milestones. In 2024, the company focused on NEV development and global expansion. The launch of the 'Three-Year Leap Action' strategy is a key milestone, aiming for substantial sales growth by 2027.

Strategic moves have been crucial for BAIC's business model. Partnerships with tech companies like Huawei, Pony.ai, and Horizon Robotics are vital. Expanding the ARCFOX brand globally and establishing production facilities are also important strategic steps.

BAIC's competitive edge stems from its brand strength and technology leadership. Joint ventures like Beijing Benz contribute significantly. By April 2024, BAIC had applied for approximately 35,000 patents, placing it in the industry's top tier.

The company faces challenges like intense competition in the NEV market. BAIC adapts by investing in product development, technology, and global expansion. Focusing on electrification and intelligentization is key for maintaining its business model.

BAIC's competitive advantages include brand strength, technology leadership, and economies of scale. The company's joint ventures, such as Beijing Benz, have been highly successful. The focus on R&D and global expansion is critical for future growth.

- Brand Strength: Leveraging established joint ventures like Beijing Benz.

- Technology Leadership: Approximately 35,000 patents applied for by April 2024.

- Economies of Scale: Benefits from being a large state-owned manufacturer.

- Strategic Focus: Prioritizing electrification and intelligentization.

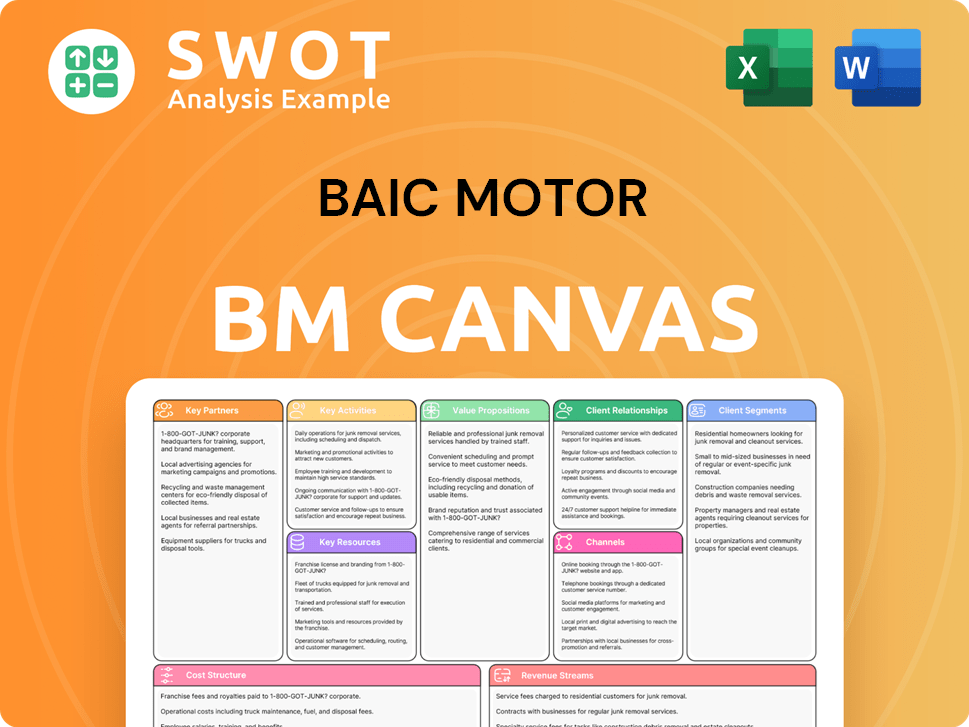

BAIC Motor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is BAIC Motor Positioning Itself for Continued Success?

As a major player in the Chinese automotive market, BAIC Motor Company (Beijing Automotive Industry Holding Co) holds a significant position. The company's diverse portfolio, including brands like BAIC BJEV and Beijing Hyundai Motor, allows it to compete across various segments. The company's operations have expanded significantly, with notable growth in exports and strategic partnerships.

BAIC's business model includes a focus on product innovation and quality, aiming to maintain customer loyalty and expand its global reach. Despite facing challenges such as intense competition and technological disruptions, the company is actively pursuing ambitious strategic initiatives to ensure sustainable growth. The company's future plans and outlook are centered on innovation and market expansion.

In 2024, BAIC Group's annual vehicle sales exceeded 1.71 million units, securing its position in the competitive Chinese automotive industry. BAIC's market share is distributed across various segments through brands like BAIC BJEV, BAIC Motor, and Beijing Hyundai. The company's focus on customer satisfaction and product innovation helps it maintain a strong market presence.

Key risks include intense competition in the new energy vehicle market, leading to price wars and shrinking profit margins. BAIC BluePark's expanded net loss in the first half of 2024 highlights the financial pressures. Technological advancements in autonomous driving and battery technologies also pose challenges, demanding significant R&D investments.

BAIC aims for annual vehicle sales exceeding 3 million units by 2027, with over 50% being new energy vehicles. The company plans to invest at least 50 billion RMB in R&D over the next five years. BAIC's future involves continuous technological innovation, strategic partnerships, and aggressive international market expansion.

The 'Three-Year Leap Action' plan is a key strategic initiative, aiming to increase sales and expand the new energy vehicle segment. BAIC is focusing on intelligent driving, intelligent cockpits, and battery technologies. The company is also expanding its global presence, with exports reaching 270,000 vehicles in 2024, a 44% year-over-year increase.

BAIC Motor Company's strategy for future growth involves several key initiatives. These include technological innovation, strategic partnerships, and international market expansion. The company is also focused on sustainable development and smart mobility solutions, positioning itself for long-term success.

- Continued technological innovation in electric vehicle manufacturing and intelligent driving.

- Deepening strategic partnerships, such as those with Huawei and CATL.

- Aggressive expansion into international markets, including Europe and Southeast Asia.

- Prioritizing sustainable development and smart mobility solutions.

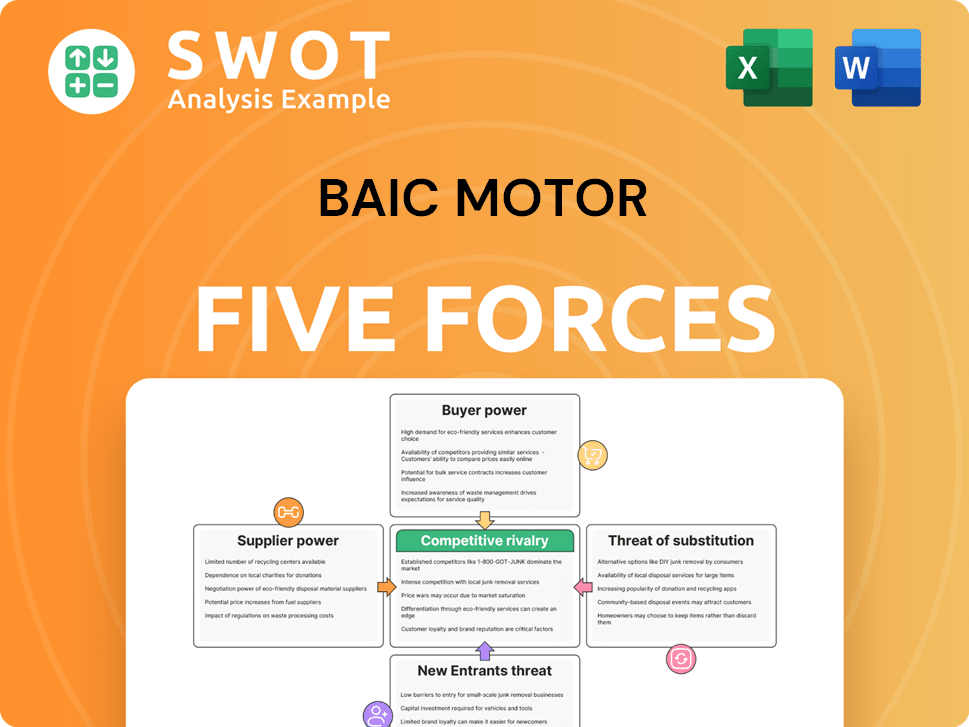

BAIC Motor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BAIC Motor Company?

- What is Competitive Landscape of BAIC Motor Company?

- What is Growth Strategy and Future Prospects of BAIC Motor Company?

- What is Sales and Marketing Strategy of BAIC Motor Company?

- What is Brief History of BAIC Motor Company?

- Who Owns BAIC Motor Company?

- What is Customer Demographics and Target Market of BAIC Motor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.