Bank Muscat Bundle

Can Bank Muscat Maintain Its Dominance in Oman's Banking Sector?

Established in 1982, Bank Muscat has become Oman's leading financial institution, significantly impacting the Sultanate's economic development. From its humble beginnings, the bank has grown to offer a comprehensive suite of financial services, solidifying its market leadership. This journey highlights the critical role of strategic planning in navigating the dynamic financial landscape, making it crucial to understand its Bank Muscat SWOT Analysis.

Bank Muscat's proactive approach, consistently introducing new services and technologies, has allowed it to maintain its competitive edge within the Oman banking sector. As of early 2024, the Bank Muscat company continues to hold a significant market share, reflecting its extensive network and diverse product offerings. Understanding the Bank Muscat growth strategy and its future prospects is key to assessing its financial performance and potential for future investment opportunities, particularly considering the bank's expansion plans and digital banking initiatives.

How Is Bank Muscat Expanding Its Reach?

The growth strategy of Bank Muscat heavily emphasizes strategic expansion, both geographically and in terms of product and service diversification. The bank is actively exploring opportunities to deepen its penetration within the Omani market while also considering potential regional ventures. Specific international expansion timelines are not publicly detailed for 2024-2025, but the focus remains on sustainable growth within the existing operational framework.

A key driver for expansion is the ongoing development of new product categories, particularly in digital banking and Sharia-compliant financial solutions. This approach aims to capture new customer segments and diversify revenue streams beyond traditional banking services. The bank's strategic plan includes continuous enhancements to its Islamic banking window, Meethaq, to cater to the growing demand for Sharia-compliant products in Oman. This diversification is crucial for maintaining a competitive edge within the Oman banking sector.

In terms of product pipelines, Bank Muscat is focused on developing innovative financial solutions that leverage emerging technologies to enhance customer convenience and service delivery. This includes expanding its digital payment ecosystem and introducing new wealth management products tailored to different customer segments. Partnership strategies are also crucial, with the bank actively seeking collaborations with fintech companies and other industry players to co-create solutions and extend its reach. For a deeper understanding of the bank's target market, you can refer to the article on Target Market of Bank Muscat.

Bank Muscat is heavily investing in digital banking to improve customer experience and operational efficiency. This includes enhancements to its mobile banking app and online platforms. The bank aims to increase the adoption of digital channels, with a target to have over 75% of transactions conducted digitally by the end of 2025.

Meethaq, the Islamic banking arm, is expanding its range of products and services to meet the growing demand for Sharia-compliant banking. This includes new deposit accounts, financing options, and investment products. The goal is to increase Meethaq's contribution to the bank's overall revenue by 15% by 2025.

Bank Muscat is actively seeking partnerships with fintech companies to enhance its service offerings and reach. These collaborations focus on areas such as digital payments, data analytics, and customer relationship management. The bank plans to form at least 3 new strategic alliances in 2024 to drive innovation.

The bank is introducing new wealth management products tailored to different customer segments, including high-net-worth individuals and retail investors. This includes investment advisory services and portfolio management solutions. The aim is to increase assets under management by 20% by the end of 2025.

The overarching goal of these expansion initiatives is to maintain its leading market position by anticipating customer needs and staying ahead of industry changes, ensuring sustained growth in a competitive environment. The bank aims to increase its market share in key business segments. The bank is also focused on improving customer service and operational efficiency.

- Increase digital transaction volume by 25%.

- Expand the branch network by 5% in strategic locations.

- Achieve a customer satisfaction score of over 90%.

- Enhance cybersecurity measures to protect customer data.

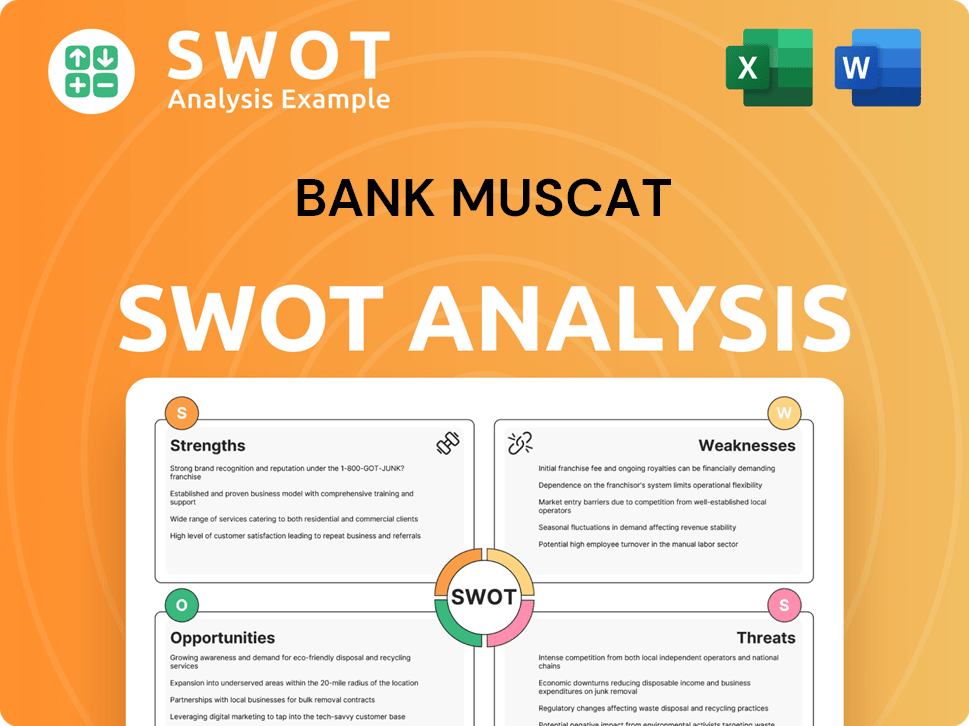

Bank Muscat SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bank Muscat Invest in Innovation?

Innovation and technology are central to the Bank Muscat growth strategy, driving its future prospects. The company is heavily investing in digital transformation to streamline operations and enhance customer experiences. This commitment is crucial for maintaining a competitive edge within the Oman banking sector.

The bank's approach involves continuous development of its mobile banking and online services, ensuring accessibility and convenience for its customers. It is also actively adopting advanced technologies like artificial intelligence (AI) for data analytics and personalized customer service. This strategy is designed to meet the evolving demands of its diverse customer base.

The bank is exploring emerging technologies such as blockchain for secure transactions, although large-scale implementations for 2024-2025 are still in the developmental stages. This forward-thinking approach supports Bank Muscat's goal of creating a seamless and secure digital banking ecosystem.

Significant investments are being made in digital transformation to modernize operations and improve customer service. This includes upgrading core banking systems and enhancing digital platforms.

AI is being leveraged for data analytics to personalize customer service and improve decision-making. This involves using AI-powered tools to analyze customer behavior and preferences.

Continuous improvements are being made to mobile banking platforms to provide customers with convenient and secure access to banking services. This includes adding new features and improving user interfaces.

The bank is exploring the potential of blockchain technology for secure transactions, though large-scale implementations are still in development. This could lead to more efficient and secure financial processes.

Bank Muscat combines in-house development with strategic collaborations to build specialized capabilities and accelerate the time-to-market for new solutions. This hybrid approach allows the bank to leverage external expertise.

Automating internal processes contributes to operational efficiency and cost reduction, supporting the bank's growth objectives. This includes automating tasks to improve productivity.

A key element of Bank Muscat's technology strategy is its hybrid approach, combining in-house development with strategic collaborations. This allows the bank to build specialized capabilities while also tapping into external expertise, speeding up the time-to-market for new solutions. The bank's commitment to digital transformation extends to automating internal processes, contributing to operational efficiency and cost reduction. For more insights into the ownership structure and financial performance, you can read about Owners & Shareholders of Bank Muscat.

Bank Muscat is focused on several key technological advancements to enhance its services and maintain a competitive edge. These advancements are critical for driving Bank Muscat's future prospects.

- AI-Driven Personalization: Implementing AI to personalize customer experiences and offer tailored financial products.

- Enhanced Mobile Banking: Upgrading mobile banking platforms with new features and improved security.

- Blockchain Pilot Projects: Exploring blockchain technology for secure and efficient transactions.

- Process Automation: Automating internal processes to improve efficiency and reduce costs.

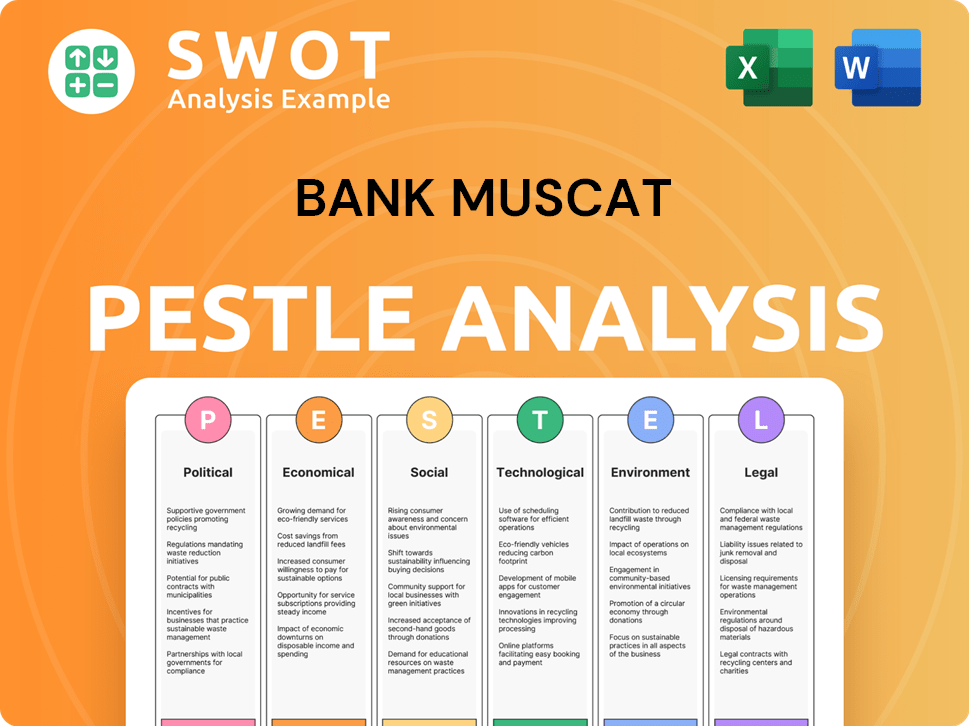

Bank Muscat PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bank Muscat’s Growth Forecast?

The financial outlook for Bank Muscat for 2024-2025 is projected to be stable, supported by its strong market position and strategic growth initiatives. While specific detailed financial targets for the full 2024-2025 period are subject to official announcements, the bank has consistently demonstrated robust financial results. The bank's financial performance is a key indicator of its overall success and future potential within the Oman banking sector.

For the first quarter of 2024, Bank Muscat reported a net profit of OMR 52.34 million, indicating a positive start to the year. This performance aligns with analyst expectations, which generally anticipate continued profitability driven by steady loan growth and effective cost management. The bank's commitment to digital transformation and infrastructure upgrades is expected to continue, supporting its long-term growth objectives. Understanding the Marketing Strategy of Bank Muscat provides further insights into how the bank plans to achieve its financial goals.

Bank Muscat's financial ambitions are often benchmarked against its historical performance, which has shown resilience even during economic fluctuations. The bank's capital adequacy ratios remain strong, providing a solid foundation for future expansion and risk absorption. While no major funding rounds or significant capital raises have been announced for 2024-2025, the bank’s internal capital generation is typically sufficient to support its growth plans. The overall financial narrative for Bank Muscat is one of sustained growth, prudent financial management, and a commitment to delivering value to its shareholders, all of which underpin its strategic plans for continued market leadership.

Bank Muscat's financial performance is a key indicator of its success. The bank's ability to maintain profitability and revenue growth is crucial for its long-term viability. Analyzing the financial performance helps in understanding the bank's strategic plan.

Bank Muscat's market share in Oman is a significant factor in its growth strategy. The bank's competitive advantage is often linked to its strong presence in the local market. Maintaining or increasing market share is a key objective.

Bank Muscat's expansion plans for 2024 include strategic initiatives to increase its footprint and service offerings. These plans are essential for achieving future investment opportunities. The bank's growth strategy analysis includes these expansion plans.

Bank Muscat's digital banking initiatives are pivotal for enhancing customer service and operational efficiency. Technological advancements play a crucial role in the bank's strategy. These initiatives support the bank's long-term growth.

Improving customer service is a continuous focus for Bank Muscat. Enhancements in customer service contribute to customer loyalty and satisfaction. These improvements are part of the bank's strategic plan.

Bank Muscat employs robust risk management strategies to mitigate potential financial risks. These strategies are essential for ensuring the bank's stability. Effective risk management supports the bank's financial performance.

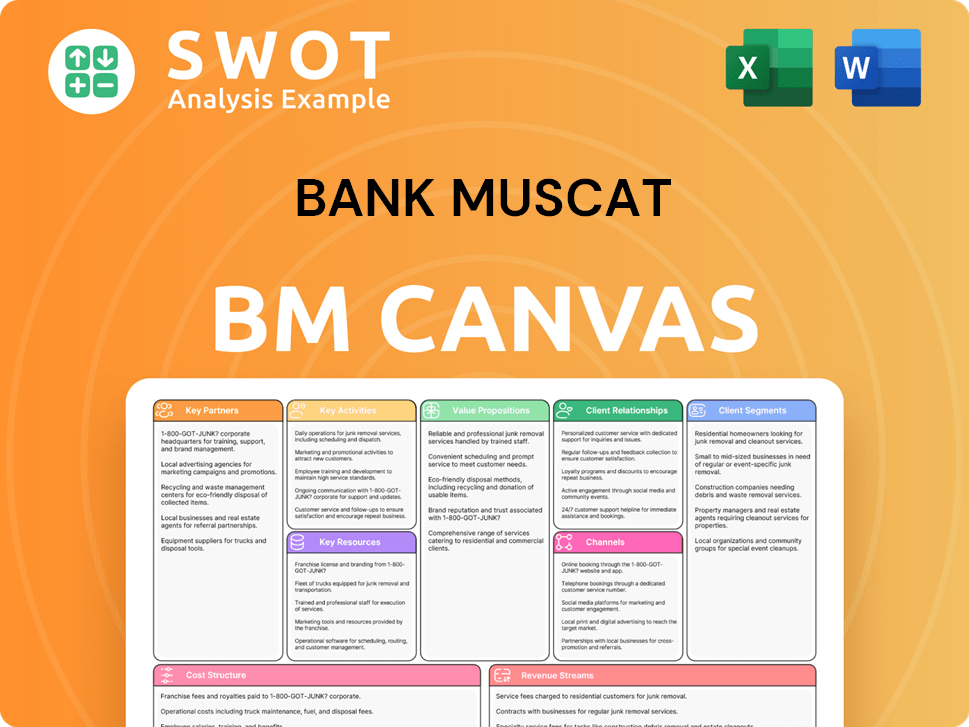

Bank Muscat Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bank Muscat’s Growth?

The growth strategy of Bank Muscat, like any major financial institution, faces several potential risks and obstacles. These challenges can stem from both internal and external factors, impacting the bank's ability to achieve its ambitious goals and maintain its strong position within the Oman banking sector. Understanding these risks is crucial for investors, stakeholders, and the bank itself to ensure sustainable financial performance.

Market competition, regulatory changes, and the evolving geopolitical landscape are external factors that could affect Bank Muscat's future prospects. Internally, the bank must manage technological advancements, cybersecurity threats, and maintain a skilled workforce. These factors require proactive risk management strategies and continuous adaptation to ensure long-term success for the Bank Muscat company.

Bank Muscat's strategic plan must navigate these challenges to capitalize on future investment opportunities. The bank's ability to adapt and innovate will be critical for maintaining and enhancing its market share in Oman and beyond. The financial performance review of Bank Muscat will be closely tied to how effectively it manages these risks.

Intense competition from local and international banks, along with the emergence of fintech companies, poses a significant threat. These competitors vie for market share, potentially impacting Bank Muscat's profitability and revenue growth. The competitive landscape necessitates continuous innovation and customer service improvements to retain and attract customers.

Changes in regulations, particularly those related to capital requirements, consumer protection, and cybersecurity, could necessitate substantial operational adjustments. Compliance costs can increase, and the bank must adapt quickly to maintain its operational efficiency. These changes have a direct impact on Bank Muscat's strategic plan and financial performance.

The evolving geopolitical landscape in the Middle East and global economic uncertainties present external risks. These factors can affect the bank's operating environment, impacting its international operations and overall financial stability. The impact of economic changes requires proactive risk management strategies.

Rapid technological adoption requires significant investment and a skilled workforce to support digital transformation initiatives. Bank Muscat's digital banking initiatives must evolve to meet customer expectations and remain competitive. The ability to leverage technological advancements is crucial for long-term success.

Cybersecurity threats are an ever-present concern, necessitating continuous investment in robust security frameworks. Protecting customer data and maintaining trust are paramount. Bank Muscat's risk management strategies must include proactive measures to mitigate these risks and ensure the bank's reputation.

Managing rapid technological adoption and ensuring a skilled workforce to support digital transformation initiatives could present resource constraints. This includes the need for ongoing training and development programs. Bank Muscat must ensure it has the necessary resources to support its growth strategy.

Bank Muscat employs a comprehensive risk management framework to address these challenges. This includes diversifying its product portfolio and customer base to mitigate concentration risks. The bank also engages in scenario planning to prepare for various economic and regulatory eventualities. These strategies are crucial for ensuring the bank's resilience and sustained financial performance.

The bank's history demonstrates a proactive approach to adapting to market changes and mitigating potential threats. Continuous innovation in areas such as digital banking and customer service is essential. Bank Muscat's ability to adapt and innovate is critical for maintaining its competitive advantage and ensuring future investment opportunities.

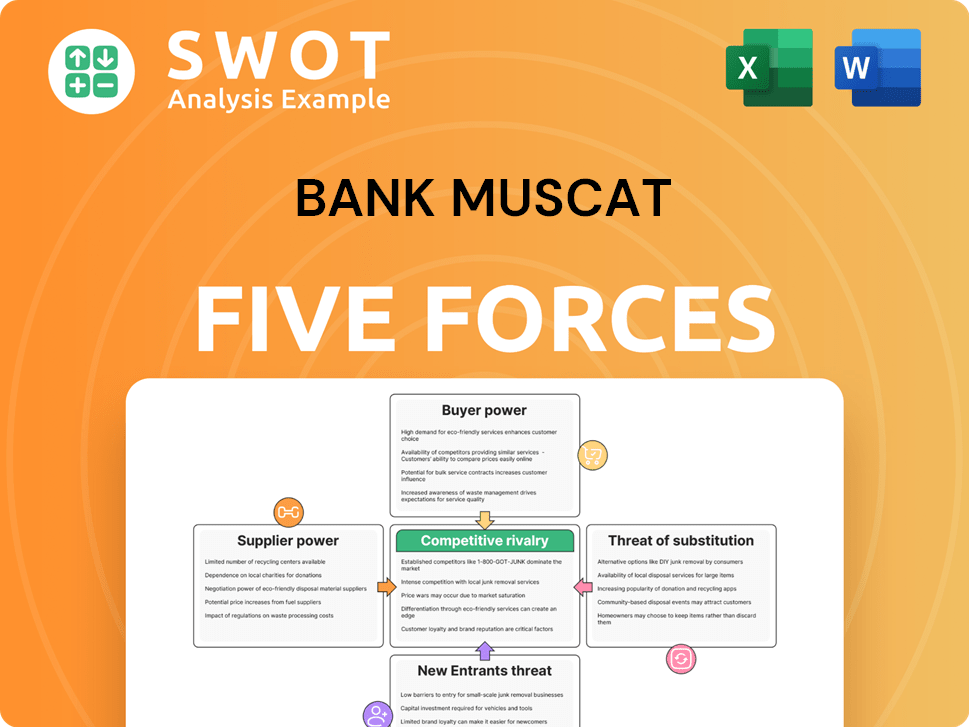

Bank Muscat Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bank Muscat Company?

- What is Competitive Landscape of Bank Muscat Company?

- How Does Bank Muscat Company Work?

- What is Sales and Marketing Strategy of Bank Muscat Company?

- What is Brief History of Bank Muscat Company?

- Who Owns Bank Muscat Company?

- What is Customer Demographics and Target Market of Bank Muscat Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.