Bank Muscat Bundle

How Does Bank Muscat Thrive in Oman's Financial Landscape?

Bank Muscat, a titan in the Omani banking sector, isn't just a financial institution; it's a cornerstone of the Sultanate's economy. With a remarkable 6.2% profit increase to RO 225.58 million in 2024, the bank's performance speaks volumes about its influence. Holding nearly a third of the market share, Bank Muscat stands as the largest of all Oman banks, demonstrating its dominance and strategic prowess.

This article unravels the intricacies of Bank Muscat SWOT Analysis, exploring its core Bank Muscat operations, diverse Bank Muscat services, and strategic initiatives. From retail and corporate banking to investment and Islamic banking, Bank Muscat caters to a broad spectrum of clients. Understanding the bank's revenue streams, market position, and future prospects is essential for anyone interested in Muscat financial institutions and the broader banking landscape in Oman.

What Are the Key Operations Driving Bank Muscat’s Success?

Bank Muscat, a prominent player among Oman banks, creates and delivers value through a comprehensive suite of financial products and services. These offerings cater to a diverse clientele, including individuals, businesses, and government entities. Its core operations span retail banking, corporate banking, investment banking, and Islamic banking, ensuring a broad spectrum of financial solutions.

The bank's value proposition centers on providing accessible, efficient, and customer-centric financial services. This approach is supported by a robust operational framework that leverages a wide network of branches and electronic channels. Bank Muscat's commitment to digital transformation and customer service distinguishes it in the competitive landscape of Muscat financial institutions.

Bank Muscat's commitment to innovation and customer service is evident in its strategic initiatives. The bank continues to enhance its digital capabilities, such as the implementation of FinnOne Neo® Collections in December 2024. This focus on digital solutions and customer proximity translates into secure and efficient banking transactions for its customers, reinforcing its position as a leading financial institution in Oman.

Bank Muscat provides a wide array of retail banking services designed to meet the needs of individual customers. These include consumer loans, credit cards, deposit accounts, and a variety of e-banking services. The bank's retail offerings are designed to provide convenient and accessible financial solutions.

For businesses and corporations, Bank Muscat offers specialized financial solutions. These include payment processing, liquidity management, and international trade services. The 'Integrated Transaction Banking' platform supports these services.

Bank Muscat emphasizes digital transformation to enhance customer experience and operational efficiency. The successful implementation of FinnOne Neo® Collections in December 2024 is a prime example. This advanced digital lending product streamlines collections operations.

The bank focuses on a customer-centric strategy to improve accessibility and service quality. Expanding its service center network, such as the new center in Karsha inaugurated in July 2024, demonstrates this commitment. This approach enhances the customer experience.

Bank Muscat's operations are characterized by a strong focus on digital innovation and customer service. This strategy has allowed the bank to maintain a leading position in the market. For more information on the bank's history, you can read Brief History of Bank Muscat.

- Implementation of FinnOne Neo® Collections in December 2024 to streamline collections.

- Expansion of service center network, including the new center in Karsha, to improve accessibility.

- Continuous investment in digital channels to enhance customer experience.

- Focus on providing secure and efficient banking transactions.

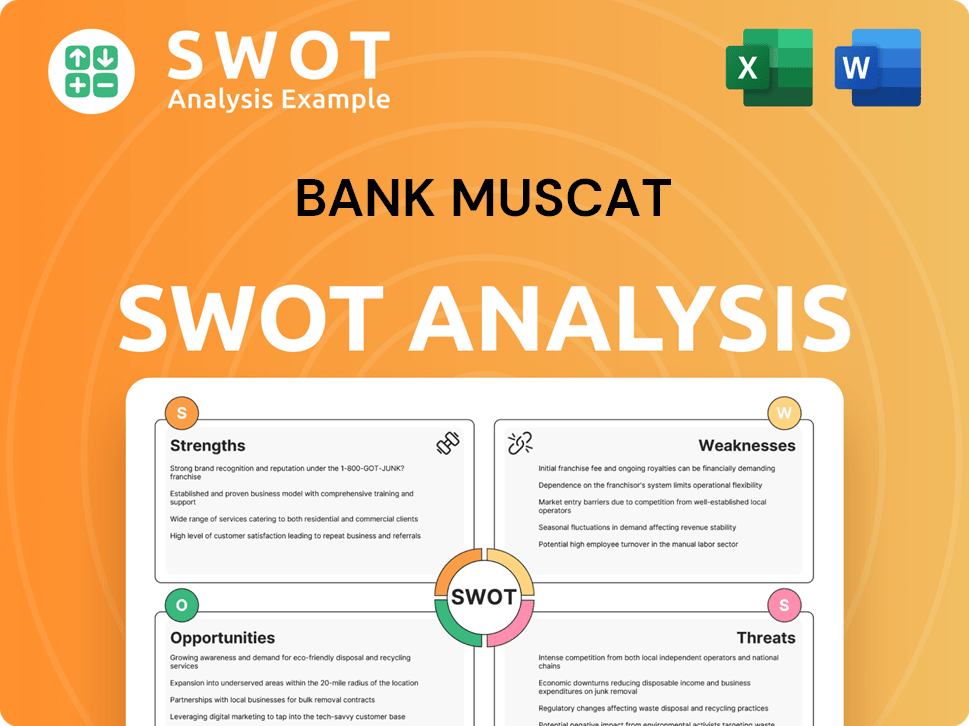

Bank Muscat SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bank Muscat Make Money?

Bank Muscat's revenue streams are primarily derived from its conventional banking operations and Islamic financing services. The bank strategically monetizes its services through a variety of fees and charges, ensuring diverse income sources. This approach allows the bank to capitalize on various financial activities, contributing to its overall financial performance.

The bank's financial performance reflects its effective monetization strategies. In 2024, the combined net interest income from conventional banking and net income from Islamic financing reached RO 397.70 million, a 6.1% increase from RO 374.82 million in 2023. Furthermore, non-interest income grew by 5.1% to RO 145.00 million in 2024, compared to RO 138.00 million the previous year.

In the first quarter of 2025, Bank Muscat maintained this positive trajectory. The net interest income from conventional banking and net income from Islamic financing was RO 102.00 million, marking a 6.9% rise compared to the same period in 2024. This growth was mainly fueled by increased loan volumes. Non-interest income for Q1 2025 was RO 38.67 million, a 3.8% increase from Q1 2024.

Bank Muscat employs several strategies to generate revenue and optimize its financial performance. These include leveraging its diverse product portfolio and expanding its customer base. The bank's focus on both conventional and Islamic banking services, along with its robust asset management capabilities, contributes to its financial success. For more insights, consider reading about the Growth Strategy of Bank Muscat.

- Net Interest Income: This is a primary source of revenue, driven by interest earned on loans and investments, and is a core aspect of Bank Muscat operations. In Q1 2025, this income stream showed a 6.9% increase.

- Non-Interest Income: This includes fees and commissions from various services. Non-interest income increased by 5.1% in 2024, reflecting the bank's ability to generate revenue from diverse sources.

- Fees and Charges: These are associated with transactions, services, and potentially commissions from bancassurance and investment banking activities.

- Islamic Banking: The significant increase in Islamic customer deposits by 24.9% in 2024 highlights the importance of Islamic banking services to the bank's revenue mix.

- Asset Management: Managing assets totaling RO 1.36 billion (approximately US $3.5 billion) as of Q1 2025 generates revenue through asset management fees, serving institutional, corporate, and retail customers.

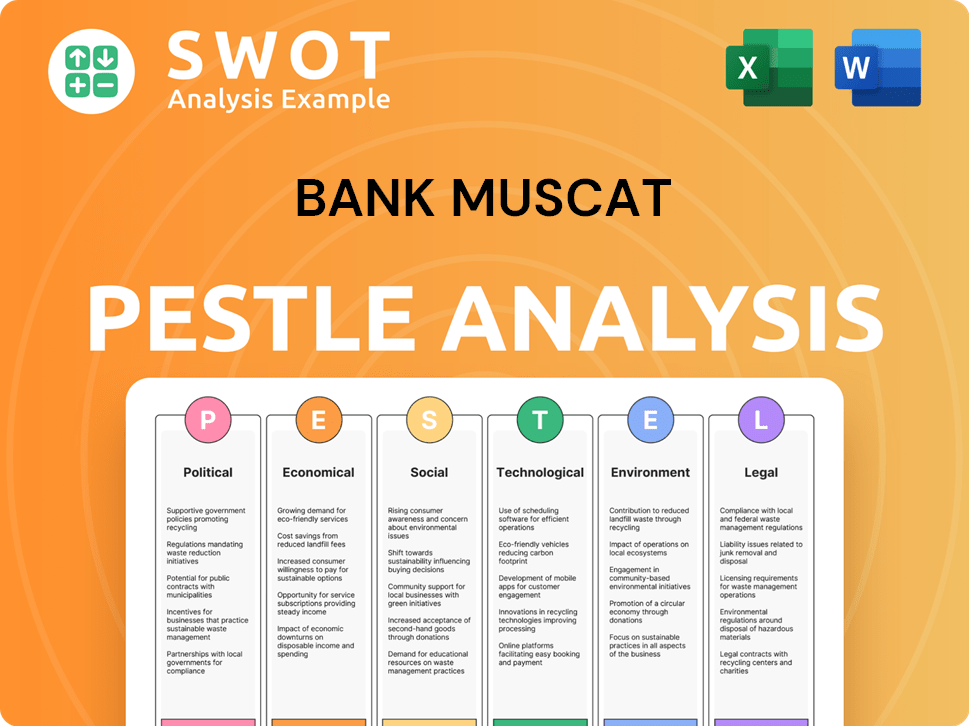

Bank Muscat PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bank Muscat’s Business Model?

Bank Muscat has achieved significant milestones and strategic moves that have shaped its operations and financial performance. A key operational milestone is its ongoing digital transformation, including the successful implementation of FinnOne Neo® Collections in December 2024, which aims to streamline operations and enhance customer experience. The bank also continues to expand its physical presence, inaugurating new service centers like the one in Karsha in July 2024, which underscores its commitment to customer accessibility.

In 2024, Bank Muscat was recognized as one of the 'Best Places to Work,' reflecting its efforts in fostering a positive work environment and human resource development. These initiatives highlight Bank Muscat's commitment to operational excellence and customer-centric services within the dynamic landscape of Oman banks.

The bank's competitive advantages stem from its dominant franchise in Oman, holding nearly 33% of the market share as of mid-2024. This strong market position is supported by its robust financial metrics, solid liquidity, and strong capitalization. Bank Muscat's continuous adaptation to new trends is evident in its investment in modern technology and its focus on financial inclusion, aiming to reach a larger customer base.

Successful implementation of FinnOne Neo® Collections in December 2024. Inauguration of new service centers, such as the one in Karsha in July 2024. Recognition as one of the 'Best Places to Work' in 2024, reflecting a commitment to human resource development.

Ongoing digital transformation to streamline operations and enhance customer experience. Expansion of physical presence through new service centers to improve customer accessibility. Investment in modern technology and focus on financial inclusion to reach a larger customer base.

Dominant market share in Oman, holding nearly 33% as of mid-2024. Robust financial metrics, solid liquidity, and strong capitalization. Capital Adequacy Ratio (CAR) of 20.52% as of March 31, 2024, well above regulatory minimums.

Stable asset quality with non-performing loans (NPLs) expected to hover around 3.6%-3.8% in the next 12-24 months. Strong capitalization and liquidity position, ensuring financial stability. Continuous focus on adapting to new trends and customer needs.

Bank Muscat's strengths include its strong market position, robust financial metrics, and strategic initiatives in digital transformation and customer service. These elements contribute to its competitive advantage in the Oman banks sector.

- Dominant market share and strong financial performance.

- Focus on digital transformation and customer-centric services.

- Commitment to employee development and a positive work environment.

- Strategic expansion and adaptation to market trends.

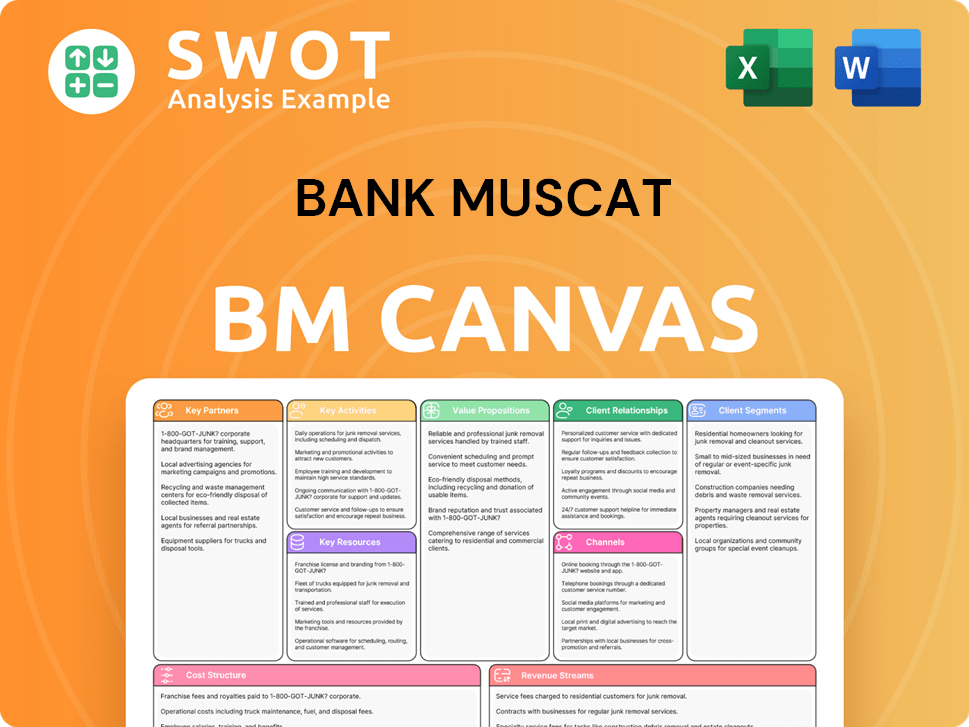

Bank Muscat Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bank Muscat Positioning Itself for Continued Success?

This chapter explores the industry position, risks, and future outlook for Bank Muscat. As a leading financial institution in Oman, understanding these aspects is crucial for investors and stakeholders. The analysis will cover the bank's market standing, potential challenges, and strategic initiatives to ensure a comprehensive view of its operational environment.

Bank Muscat is a major player in Oman's banking sector, holding a significant market share. The bank's future plans are aligned with national strategies, focusing on technological advancements and enhanced customer experiences. With the Omani banking sector showing resilience, Bank Muscat is positioned to maintain its revenue generation and support economic growth.

Bank Muscat holds a dominant position in Oman's banking sector. As of mid-2024, it held approximately 33% of the market share. This strong position is bolstered by high customer loyalty and a wide reach across various customer segments, making it a key player among Oman banks.

The bank faces risks such as concentration risk due to large borrowers and single-sector exposure. Regulatory changes and technological disruptions also pose challenges. Continuous investment in digital transformation is necessary to mitigate these risks and maintain competitiveness within Muscat financial institutions.

Bank Muscat's future strategies align with Oman Vision 2040, emphasizing sustainable development and societal well-being. The bank plans to invest in technology, cultivate its workforce, and enhance customer experiences. The bank aims to expand its reach for financial inclusion.

The bank's leadership is committed to maintaining leadership and excellence. Anticipated lending growth is around 5% in 2025, supported by a stable profitability outlook for Omani banks. For more details, you can read about the Growth Strategy of Bank Muscat.

Bank Muscat's strategic initiatives focus on digital transformation, workforce development, and customer experience enhancement. These initiatives are designed to improve its services. The bank is also expanding its digital channels to facilitate banking services and broaden financial inclusion. These efforts are aimed at reinforcing its position in the market.

- Investing in modern technology to enhance services.

- Cultivating the workforce through training and development.

- Expanding digital channels for banking services.

- Focusing on financial inclusion to reach a wider customer base.

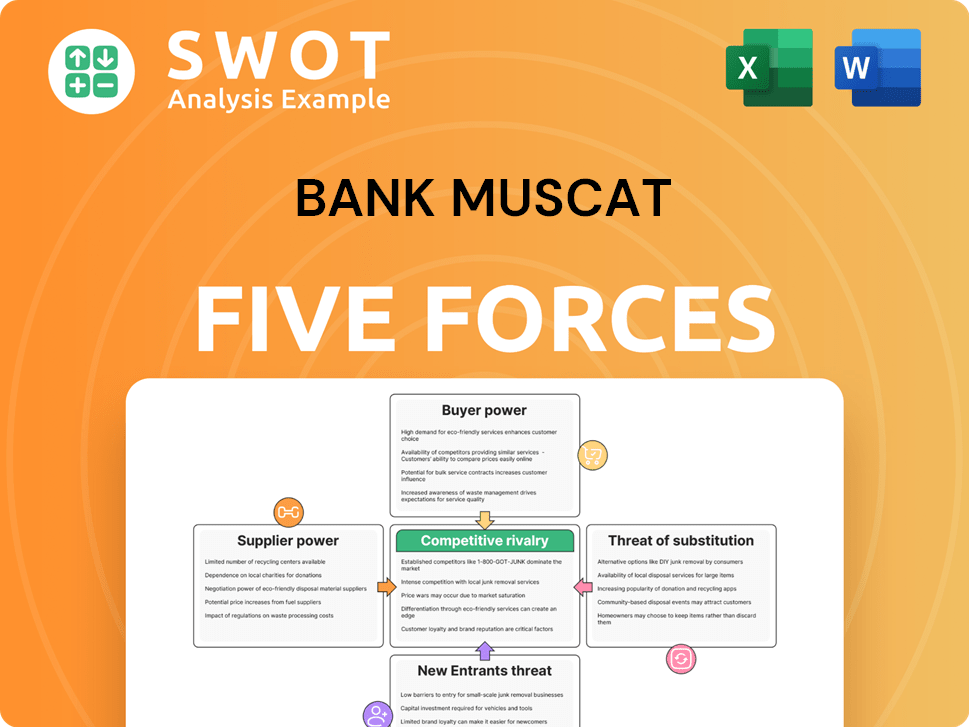

Bank Muscat Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bank Muscat Company?

- What is Competitive Landscape of Bank Muscat Company?

- What is Growth Strategy and Future Prospects of Bank Muscat Company?

- What is Sales and Marketing Strategy of Bank Muscat Company?

- What is Brief History of Bank Muscat Company?

- Who Owns Bank Muscat Company?

- What is Customer Demographics and Target Market of Bank Muscat Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.