Basic-Fit Bundle

Can Basic-Fit Continue Dominating the European Fitness Market?

Basic-Fit, a prominent European gym chain, has revolutionized the Basic-Fit SWOT Analysis by offering affordable fitness solutions. Founded in 2010, the company's commitment to accessibility has fueled its impressive expansion across six countries. With over 1,600 clubs and millions of members, understanding Basic-Fit's growth strategy and future prospects is crucial for anyone interested in the fitness industry.

This analysis delves into Basic-Fit's strategic initiatives, examining its expansion plans and how it leverages innovation to enhance member experience. We'll explore the company's market share, financial performance, and the challenges it faces. Ultimately, this exploration aims to provide a comprehensive overview of Basic-Fit's investment potential and its ability to maintain its competitive advantage in the evolving gym chain landscape.

How Is Basic-Fit Expanding Its Reach?

The expansion strategy of Basic-Fit focuses on both geographical growth and capital efficiency. The company aims to open approximately 100 new clubs annually in both 2025 and 2026. This approach balances growth with financial prudence, maintaining its position as a leading fitness operator in Europe. This strategy is crucial for the company's future prospects.

Key markets like France, Spain, and Germany are central to this expansion, where Basic-Fit has experienced significant membership growth. In the first quarter of 2025, Basic-Fit opened 41 new clubs, with 17 in France, 11 in Spain, and 9 in Germany. This demonstrates a strong commitment to increasing its presence in these key regions.

A major component of Basic-Fit's expansion strategy involves the launch of a franchise platform in 2025. This initiative is designed to require limited capital expenditure, opening opportunities for expansion into new countries through partnerships with experienced franchisees. This approach is expected to accelerate growth and potentially allow entry into new markets beyond its current six operating countries. The company's Owners & Shareholders of Basic-Fit are closely monitoring these developments.

Basic-Fit is also enhancing its current club offerings to drive growth. This includes extending 24/7 opening hours in France, Spain, and Germany. By early 2025, 333 clubs in France already operated around the clock. These initiatives are designed to boost membership and revenue.

- The extension of 24/7 opening hours is estimated to cost approximately €35 million in 2025.

- The company anticipates these costs will be offset by increased membership levels in these clubs by 2026.

- Basic-Fit introduced a new three-tier membership structure (Comfort, Premium, and Ultimate) at the end of 2024.

- This new structure aims to offer a more balanced price-to-value proposition and drive revenue growth.

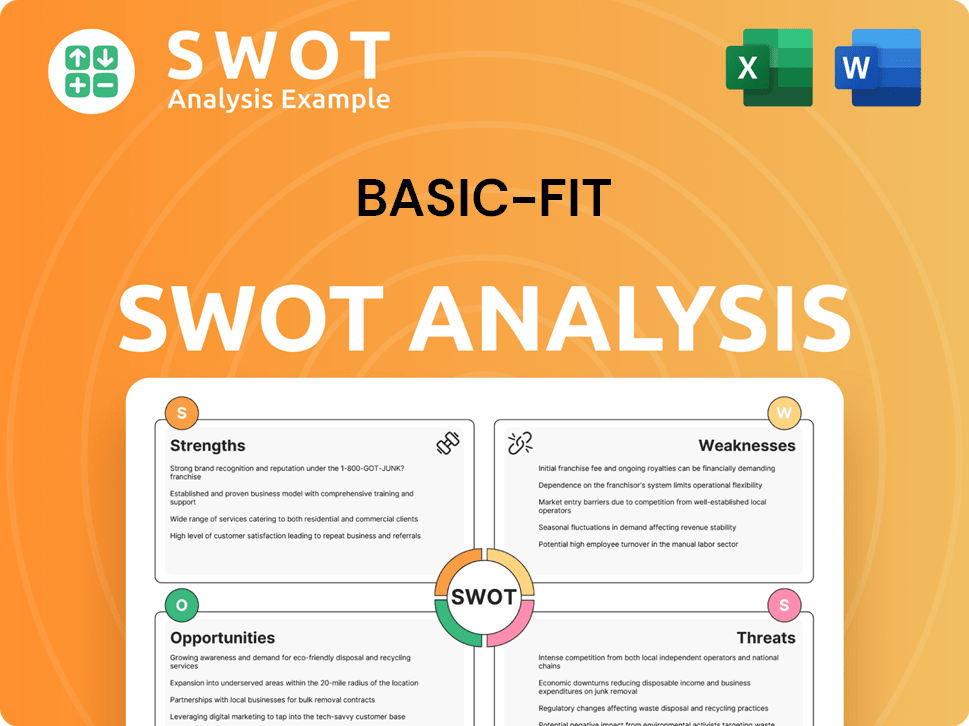

Basic-Fit SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Basic-Fit Invest in Innovation?

The company strategically uses technology and innovation to boost its service offerings and operational efficiency. This approach is a key part of its sustained growth within the competitive Fitness Industry. The company's commitment to these areas helps it stay ahead in the market.

A core element of the company's strategy involves providing access to its clubs along with a comprehensive app. This app is packed with digital features designed to help members achieve their fitness goals. By continually updating its products and making them scalable, affordable, and personalized through advanced technology, the company aims to make working out a fundamental part of everyone's life.

The company's focus on a low-cost, high-value model relies heavily on efficient, technology-driven operations. While specific details on R&D investments or patents aren't readily available in recent reports, the continuous improvement of its digital platform and the addition of features like massage chairs show an ongoing dedication to enhancing the member experience through innovation.

The company consistently updates its digital platform to improve user experience and add new features. This includes enhancements to the app, making it more user-friendly and offering a wider range of functionalities.

The expansion of clubs with 24/7 staffing reflects a commitment to catering to evolving member needs. This operational innovation, driven by technology and a flexible staffing model, optimizes club utilization.

The exploration of a franchise platform indicates the company's ambition to leverage its technology, brand, and know-how for expansion. This strategic move is supported by a strong technological infrastructure.

The introduction of features like massage chairs in clubs demonstrates an ongoing commitment to enhancing the member experience. These additions aim to provide greater value and satisfaction.

Extended hours in countries like Spain and Germany are part of the operational innovations. This allows the gym chain to cater to a wider range of schedules and preferences.

The company integrates technology into various aspects of its operations. This includes enhancing its app, optimizing club management, and supporting its expansion plans.

The company's approach to innovation and technology is multifaceted, focusing on enhancing member experience, operational efficiency, and expansion capabilities. This includes continuous improvements to its digital platform, introduction of new features, and strategic use of technology to support its growth strategy.

- Digital Platform: Ongoing updates and enhancements to the app, offering a wide range of features such as training programs, podcasts, virtual lessons, and nutritional advice.

- Operational Innovations: Implementation of 24/7 staffed club openings in some locations and extended hours in others to cater to evolving member needs and optimize club utilization.

- Franchise Platform: Exploring how to leverage its technology, brand, and know-how for its upcoming franchise platform, indicating a technological backbone supporting its expansion ambitions.

- Member Experience: Introduction of features like massage chairs in clubs to enhance the overall member experience and provide greater value.

- Technology Integration: Utilizing technology to streamline operations, improve member engagement, and support its low-cost, high-value business model.

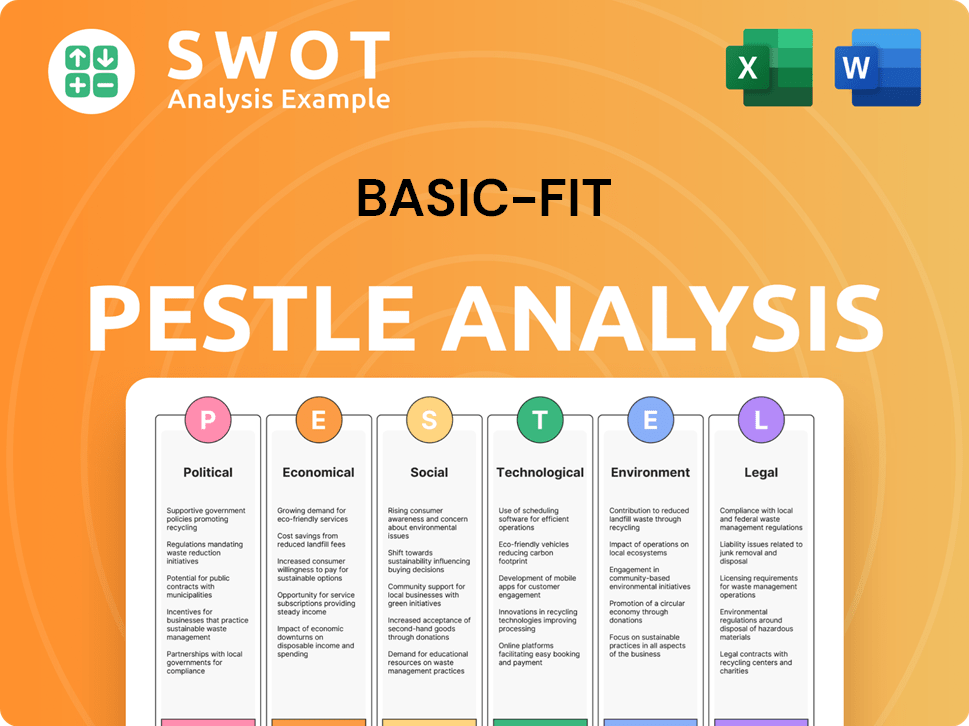

Basic-Fit PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Basic-Fit’s Growth Forecast?

The financial performance of Basic-Fit demonstrates a strong trajectory, particularly in revenue and profitability. The company's ability to increase revenue while managing costs effectively highlights a robust business model. This performance is critical for understanding the Growth Strategy and Future Prospects of the company within the competitive Fitness Industry.

In 2024, Basic-Fit achieved significant financial milestones, including substantial revenue growth and improved profitability. These results set a positive foundation for future expansion and strategic initiatives. The company's focus on operational efficiency and strategic investments is key to its continued success as a leading Gym Chain.

Basic-Fit's financial outlook for 2025 indicates continued growth and improved financial health. The projections for increased revenue and EBITDA, along with strategic financial moves like a share buy-back program, reflect a commitment to sustainable growth. These financial strategies are crucial for supporting the company's Expansion Plans and maintaining its competitive edge.

In 2024, Basic-Fit's revenue surged by 16% to €1,215 million, up from €1,047 million in 2023. This increase underscores the company's strong market position and effective customer acquisition strategies. This growth is a key indicator of the company's successful Growth Strategy.

Underlying EBITDA less rent increased by 20% to €313 million in 2024, compared to €261 million in 2023. This improvement highlights the company's ability to manage costs and increase profitability. This is a crucial factor in assessing the Basic-Fit's Future Prospects.

The net result for the full year 2024 was a profit of €8 million, a significant improvement from a loss of €2.7 million in 2023. This turnaround demonstrates the company's enhanced financial management and operational efficiency. Understanding this is key to analyzing the Basic-Fit's market share.

For 2025, Basic-Fit anticipates revenue to be between €1.375 billion and €1.425 billion. This forecast reflects the company's confidence in its continued expansion and ability to attract new members. These projections are vital for evaluating Basic-Fit investment potential.

Underlying EBITDA less rent is projected to be between €330 million and €370 million in 2025. This indicates continued profitability and operational efficiency. This is essential for understanding Basic-Fit's financial performance.

Overhead, including marketing costs as a percentage of revenue, is expected to decrease to between 11.5% and 12.0% in 2025. This improvement in operating leverage will enhance profitability. This is critical for assessing Basic-Fit's competitive advantage.

Basic-Fit plans to launch a €40 million share buy-back program in 2025, reflecting confidence in its financial health. This strategic move will benefit shareholders. The program is an important part of the Basic-Fit growth strategy analysis.

The company aims to reduce leverage to below 2.0x adjusted EBITDA by 2026, demonstrating a commitment to financial stability. This is a key indicator of Basic-Fit's long-term sustainability.

In Q1 2025, revenue increased by 17% year-over-year to €332 million, showing sustained growth. This strong start to the year sets a positive tone for the full year. This growth is a key component of Basic-Fit's international expansion strategy.

- Average revenue per member increased to €24.25 from €23.57, indicating improved customer value.

- The company secured a new €200 million revolving credit facility, maturing in June 2027, to support its financial strategy.

- These financial achievements are crucial for understanding the Basic-Fit's customer acquisition strategy.

For a deeper dive into the strategic initiatives driving Basic-Fit's success, consider exploring the Marketing Strategy of Basic-Fit. This provides a comprehensive view of the company's approach to customer engagement and market positioning.

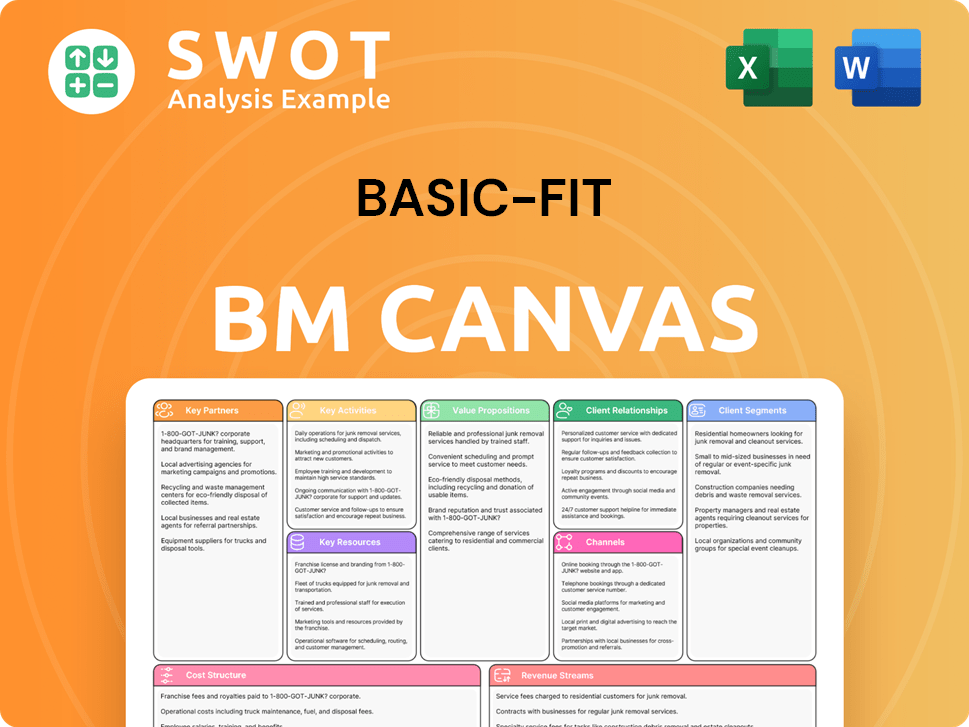

Basic-Fit Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Basic-Fit’s Growth?

The Basic-Fit growth strategy faces several potential risks and obstacles that could impact its future prospects. These challenges span market competition, economic conditions, regulatory changes, and operational complexities. Understanding these risks is crucial for assessing the company's ability to execute its expansion plans and maintain its position in the competitive fitness industry.

Intense competition in the low-cost fitness sector requires constant innovation and operational efficiency. External factors, such as economic downturns, and internal factors, such as resource constraints, could hinder growth. These elements demand strategic agility and proactive risk management to navigate the evolving landscape effectively.

The company's ambitious expansion plans are subject to internal and external challenges that need careful management. The company's reliance on debt and the need for capital-efficient approaches underscore the importance of financial prudence in achieving its goals. These factors necessitate a comprehensive approach to mitigate risks and ensure sustainable growth.

The fitness industry is highly competitive, with new entrants constantly challenging existing players. Despite being the European market leader, Basic-Fit must continuously innovate and maintain efficiency to retain its competitive advantage. The presence of well-funded competitors poses a significant threat to its market share and growth prospects.

Economic downturns and shifts in consumer sentiment can significantly impact consumer spending and membership growth. The company's experience in France at the start of 2024 highlights the sensitivity of the fitness sector to economic fluctuations. Although Basic-Fit considers itself resilient due to its low-cost model, economic pressures can still affect its performance.

Regulatory changes can pose operational challenges, especially for unstaffed 24/7 operations. Local regulations, such as those affecting clubs in France, may require adjustments to the business model. Adapting to these changes is crucial for maintaining operational flexibility and ensuring compliance across different markets.

Supply chain disruptions, particularly in light of global geopolitical developments and increased digitization, can lead to increased costs and operational challenges. The company's decarbonization efforts and the procurement of greener materials add complexity to its supply chain management. Cybersecurity threats to digital supply chains are also a growing concern.

Internal resource constraints and execution risks, such as delays in launching franchise platforms, can hinder expansion plans. Effectively managing these constraints is crucial for successful growth. Basic-Fit must ensure that its internal capabilities align with its ambitious expansion goals.

Reliance on debt to finance growth presents financial risks. However, the company actively monitors its long-term cash flow and maintains sufficient liquidity to mitigate these risks. Basic-Fit aims to reduce its net debt to adjusted EBITDA ratio below 2x by 2026, demonstrating a commitment to financial stability.

Basic-Fit employs proactive strategies to manage its risks. These include continuous monitoring of market developments, flexible club opening strategies, and maintaining ample liquidity. The company also implements internal control frameworks, including those for sustainability reporting, to address data-related risks. The company's financial strategy includes a shift towards a capital-efficient approach to generate significant cash and reduce leverage, aiming for a net debt to adjusted EBITDA ratio below 2x by 2026.

The company's financial performance is closely tied to its ability to manage these risks. By 2026, Basic-Fit aims to reduce its net debt to adjusted EBITDA ratio to below 2x. This target reflects the company's commitment to financial stability and its strategy to balance growth with prudent financial management. The company's focus on cost management and operational efficiency is critical for achieving its financial goals.

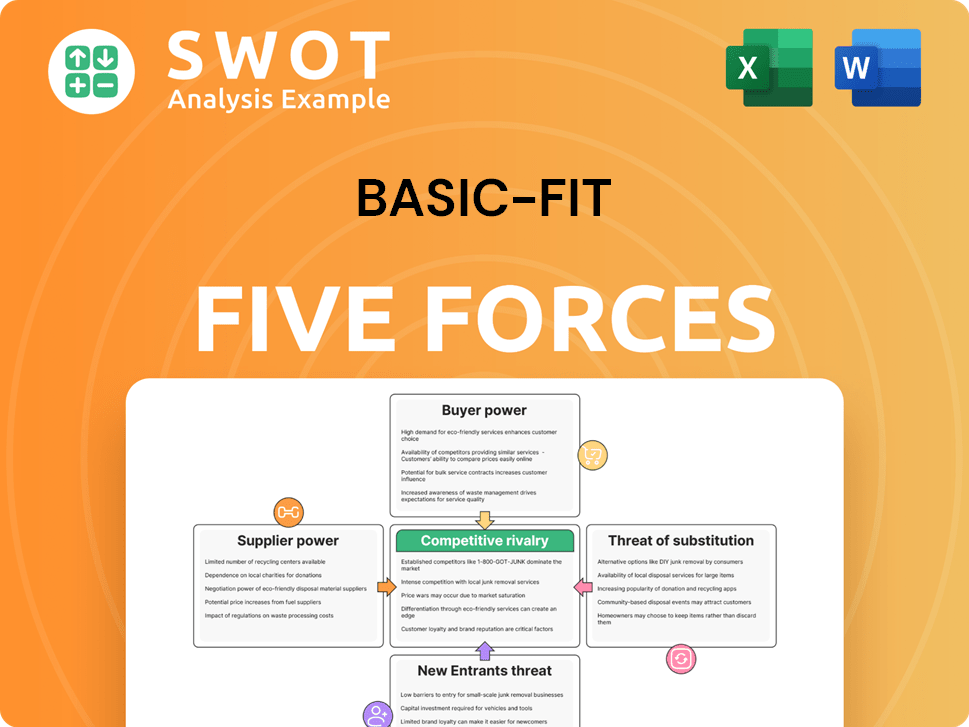

Basic-Fit Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Basic-Fit Company?

- What is Competitive Landscape of Basic-Fit Company?

- How Does Basic-Fit Company Work?

- What is Sales and Marketing Strategy of Basic-Fit Company?

- What is Brief History of Basic-Fit Company?

- Who Owns Basic-Fit Company?

- What is Customer Demographics and Target Market of Basic-Fit Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.