Basic-Fit Bundle

How Does Basic-Fit Thrive in the Fitness Industry?

Basic-Fit, a dominant player in the European fitness market, has captured the attention of investors and fitness enthusiasts alike. With impressive revenue growth of 16% in 2024, reaching €1,215 million, the company demonstrates a robust business model. Its strategic expansion, including 173 new club openings, underscores its commitment to providing accessible and affordable fitness solutions.

This analysis will explore the inner workings of Basic-Fit, from its Basic-Fit SWOT Analysis to its strategies for attracting and retaining its 4.46 million members by February 2025. Whether you're curious about the Basic Fit membership cost, the Basic Fit equipment available, or how to cancel your Basic Fit membership, we'll uncover the key elements driving its success. Understanding Basic-Fit's approach can provide valuable insights for anyone considering a gym membership or investing in the fitness club sector.

What Are the Key Operations Driving Basic-Fit’s Success?

The core of Basic-Fit's operations revolves around providing accessible and affordable fitness solutions. This is achieved through a standardized, high-volume, and low-cost operational model. The company focuses on offering a consistent experience across all its locations, ensuring that members can expect the same quality of equipment and services.

Basic-Fit's value proposition centers on providing convenient, high-quality fitness options at a competitive price. The company targets a broad customer base, including fitness enthusiasts, budget-conscious individuals, and those new to exercise. This approach allows them to cater to a wide range of needs and preferences, making fitness accessible to more people.

Key offerings include access to modern fitness equipment, a variety of group classes, and virtual training programs via its app. The company's focus on efficiency and cost-effectiveness is evident in its operational processes. This includes opening clubs in high-density urban areas and standardizing facilities and procedures across all locations.

Basic-Fit provides state-of-the-art fitness equipment from brands like Matrix and Technogym. They standardize facilities and operating procedures across all locations to benefit from economies of scale. This ensures a consistent experience for all members, regardless of the location they visit.

Technology plays a significant role in enhancing the user experience and streamlining operations. Automated check-in systems and digital fitness resources are key features. The company's app provides virtual training programs, adding to the convenience for members.

Basic-Fit aims for an unstaffed, 24/7 model in some regions. In the Benelux, 75% of clubs operate this way. In France, 24/7 staffed clubs have expanded to 333 locations by early 2025, demonstrating operational efficiency.

The company's operational efficiency translates into low-cost memberships, convenient locations, and consistent quality. The average membership length is 22 to 23 months, nearly double the industry average. This highlights effective customer retention.

Basic-Fit's operational model is designed for efficiency and scalability, focusing on standardization and technology. Strategic partnerships and supply chain management ensure high-quality equipment and cost-effective operations. This approach allows them to offer competitive Basic Fit membership options.

- Strategic partnerships with equipment suppliers.

- Focus on high-density urban locations.

- Use of technology for streamlined operations.

- Emphasis on unstaffed, 24/7 models in certain regions.

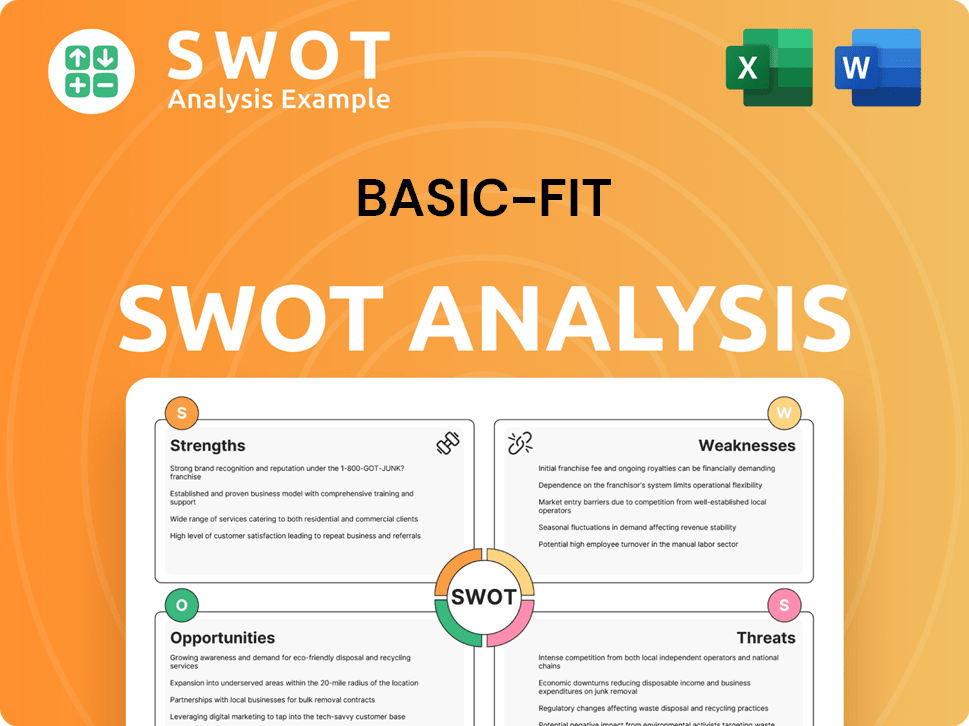

Basic-Fit SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Basic-Fit Make Money?

The revenue model of Basic-Fit centers on its membership structure, complemented by several additional income streams. In 2024, the company's revenue increased significantly, with a notable rise in fitness revenue, primarily from memberships.

The average revenue per member per month saw an increase, reflecting the effectiveness of its pricing strategies. The company continues to refine its monetization approaches, including adjustments to membership options and the introduction of new services.

The company's main revenue streams are diverse, encompassing membership fees, personal training, merchandise sales, advertising, and franchising, which is set to launch in 2025.

The primary source of revenue for Basic-Fit comes from its Basic Fit membership fees. Additional revenue streams include personal training, sales of merchandise, advertising, and franchising. The company has strategically expanded its revenue sources to maximize profitability and enhance the member experience.

- Membership Fees: This is the primary revenue source, with members paying recurring fees for access to clubs, equipment, and classes. Basic-Fit offers tiered pricing, including Comfort, Premium, and Ultimate memberships. As of Q3 2024, a Basic membership was €4.99 a week, a Comfort membership €6.99 per week, and a Premium €7.99 per week, though the Basic membership option was removed in France at the end of 2024. Premium memberships are particularly popular, accounting for a significant portion of revenue, representing 43% of the total membership base in H1 2024.

- Personal Training Services: Members can purchase personal training sessions, adding to the revenue generated per member.

- Sales of Branded Merchandise and Nutritional Products: Revenue is generated from the sale of items like energy drinks and nutritional bars through vending machines and the webshop.

- Advertising: Basic-Fit sells advertising space on in-club digital screens to international consumer brands. From January 1, 2025, PRN will manage and monetize Basic-Fit's digital in-store advertising network in France, aiming for over 110 million impressions annually across more than 5,000 displays.

- Franchising: The company plans to launch a franchise platform in 2025. Monetization from franchising is expected to begin in 2026 or 2027.

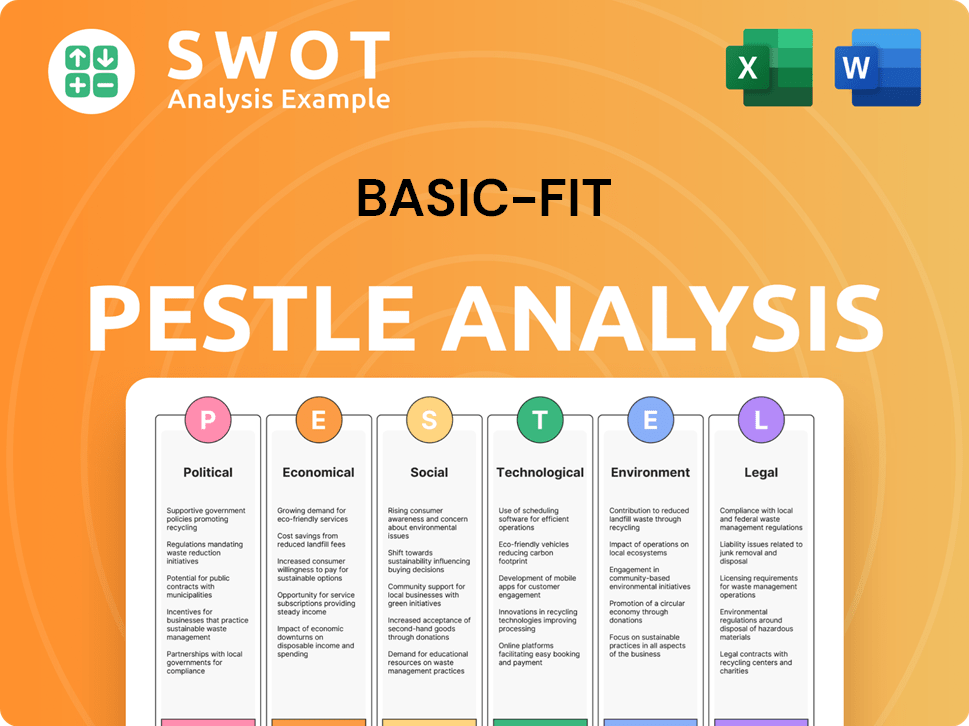

Basic-Fit PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Basic-Fit’s Business Model?

Basic-Fit has achieved several significant milestones that have shaped its operational and financial performance. A pivotal strategic move was its initial public offering (IPO) in 2016, which provided capital for expansion and growth. The company's journey includes navigating market challenges and adapting to changing consumer needs, solidifying its position in the competitive fitness industry.

In 2024, Basic-Fit demonstrated robust growth, with substantial increases across key financial metrics. The expansion of its club network and membership base underscores its successful strategy. Strategic acquisitions and operational adjustments have further strengthened its market presence and enhanced member satisfaction.

Basic-Fit's competitive advantages are rooted in its brand strength, operational efficiency, and value proposition. By offering a 'high-value, low-price' (HVLP) model, the company attracts a broad customer base, making fitness accessible to a wide range of people. This approach, combined with strategic investments, has enabled the company to maintain a competitive edge.

Basic-Fit's IPO in 2016 was a critical step in its growth trajectory. In 2024, the company saw a 16% increase in revenue, reaching €1,215 million. The acquisition of RSG Spain in early 2024 added 47 clubs, significantly boosting its presence in the Spanish market.

The company expanded its network by 173 net clubs, reaching 1,575 clubs. By early 2025, 333 clubs in France operated 24/7. Basic-Fit is also extending opening hours in Spain and Germany to enhance member convenience and satisfaction.

Basic-Fit's 'high-value, low-price' proposition attracts a broad customer base. The company's standardized facilities and efficient operations allow for significant economies of scale. Basic-Fit leverages technology for seamless self-service and digital fitness resources, enhancing the member experience.

Underlying EBITDA less rent increased by 20% to €313 million. The membership base grew to 4.25 million. The company's focus on generating free cash flow and reducing leverage reflects its commitment to financial stability.

Basic-Fit faced challenges such as the COVID-19 pandemic, which impacted club openings and membership growth. Despite these challenges, clubs opened during the pandemic have continued to gain memberships. The company has made targeted investments to enhance member satisfaction, especially in France, leading to higher review scores.

- The company is adapting to new trends by exploring franchise opportunities for international expansion.

- Basic-Fit's efficient operational model and economies of scale provide a cost advantage.

- The company leverages technology for seamless self-service and digital fitness resources.

- Average membership lengths are between 22-23 months. For more details, read about the Growth Strategy of Basic-Fit.

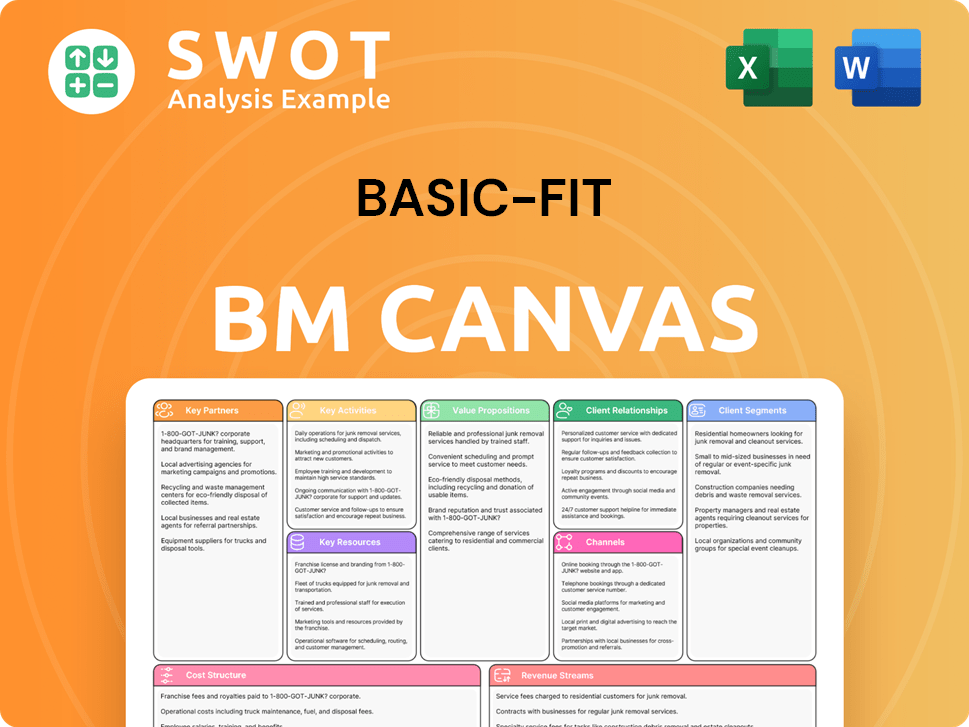

Basic-Fit Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Basic-Fit Positioning Itself for Continued Success?

The company, a leading player in the European fitness market, holds a strong position with over 1,600 clubs across six countries and more than 4.4 million memberships by May 2025. Its high-value, low-price model has fostered customer loyalty, with an average membership duration of 22 to 23 months. This longevity is nearly double the industry standard, demonstrating its success in retaining members.

Despite its strong market presence, the company faces risks such as economic downturns that could affect consumer spending on fitness. Regulatory changes, especially concerning unstaffed clubs, and competition from new entrants and technological disruptions are ongoing challenges. Changing consumer preferences, including the rise of at-home fitness solutions, also pose a threat to membership demand, requiring the company to adapt and innovate to maintain its competitive edge.

The company is the largest and fastest-growing fitness operator in Europe. It has a significant market share, particularly in France, which accounts for 46.1% of its net sales. The company's strategy focuses on value, offering affordable gym memberships to attract a broad customer base.

Economic downturns could impact consumer spending, while regulatory changes, especially concerning unstaffed clubs, might increase operational costs. Competition from new entrants and technological disruption are ongoing threats, as are evolving consumer preferences, such as the growing popularity of at-home fitness solutions.

The company plans to continue expanding its network, albeit at a slightly slower pace, aiming for approximately 100 new clubs annually in 2025 and 2026. It expects to generate positive free cash flow in 2025 and has announced a €40 million share buy-back program. The company anticipates revenue between €1.375 billion and €1.425 billion in 2025.

The company aims to enhance member experience by increasing 24/7 clubs and extending opening hours, which will cost approximately €35 million in 2025. It plans to launch a franchise platform in 2025 to facilitate expansion with limited capital expenditure. The long-term goal is to reach 3,000 to 3,500 clubs in existing markets.

The company's strategic initiatives include network expansion and enhanced member experiences, with the goal of increasing revenues and improving operational efficiency. These efforts are supported by financial projections that show a positive outlook, including revenue targets and a share buy-back program.

- Network expansion with about 100 clubs annually in 2025 and 2026.

- Anticipated revenue between €1.375 billion and €1.425 billion in 2025.

- Launch of a franchise platform in 2025 to facilitate expansion.

- Share buy-back program of €40 million.

- The long-term goal is to reach 3,000 to 3,500 clubs in existing markets.

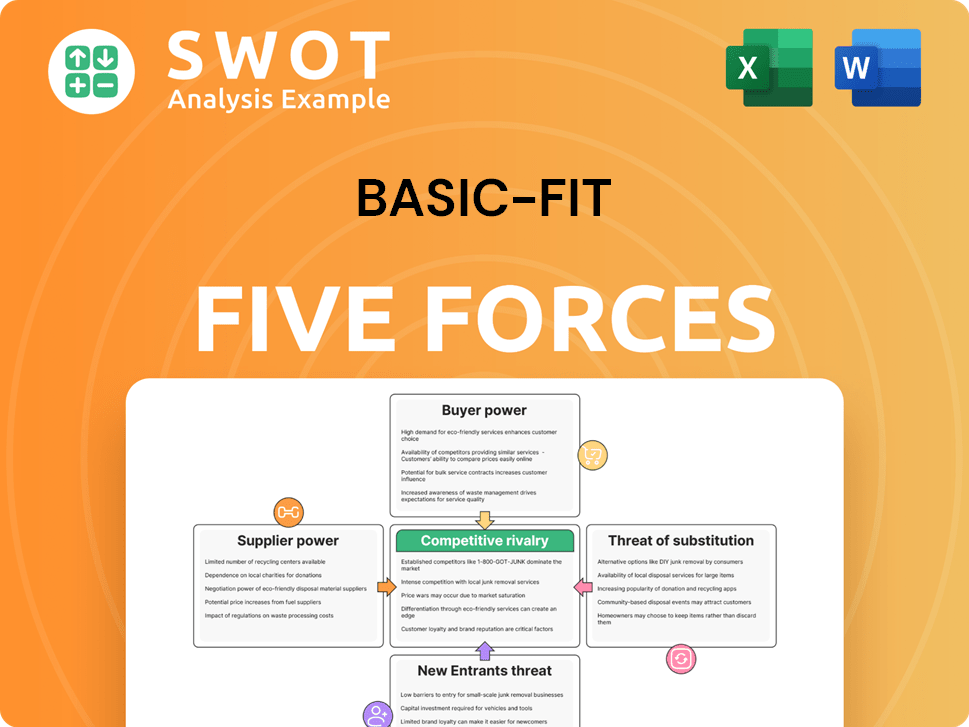

Basic-Fit Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Basic-Fit Company?

- What is Competitive Landscape of Basic-Fit Company?

- What is Growth Strategy and Future Prospects of Basic-Fit Company?

- What is Sales and Marketing Strategy of Basic-Fit Company?

- What is Brief History of Basic-Fit Company?

- Who Owns Basic-Fit Company?

- What is Customer Demographics and Target Market of Basic-Fit Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.