BIM Birlesik Magazalar Bundle

Can BIM Birlesik Magazalar Maintain Its Dominance?

BIM Birlesik Magazalar, a powerhouse in the discount retail sector, has revolutionized the grocery landscape, particularly in Turkey. Its success story, built on a simple yet effective model, has made it a leader in the BIM Birlesik Magazalar SWOT Analysis. But can this retail giant sustain its impressive growth trajectory?

This analysis dives deep into the BIM Birlesik Magazalar growth strategy and uncovers its BIM future prospects. We'll explore its expansion plans within the Turkish market and beyond, examining how business development initiatives will shape its future. Understanding BIM's strategies is crucial for anyone interested in the retail industry and its impact on the economy.

How Is BIM Birlesik Magazalar Expanding Its Reach?

The Mission, Vision & Core Values of BIM Birlesik Magazalar centers around aggressive expansion, both domestically and internationally. This strategy is key to the company's overall growth strategy. BIM Birlesik Magazalar focuses on increasing its store count in existing markets while strategically entering new geographies to boost its market share.

In Turkey, the company continues to open new stores, aiming to increase market penetration, particularly in underserved areas. This expansion is a core component of its business development. Internationally, BIM has established a notable presence in Morocco and Egypt, demonstrating its commitment to expanding its footprint in North Africa.

The company's approach involves replicating its successful low-cost, high-volume model in these new markets, adapting its product assortment to local preferences while maintaining its core value proposition. BIM's expansion initiatives are characterized by a disciplined approach to site selection, efficient logistics, and a strong emphasis on maintaining cost controls, which are crucial for its discount retail model.

BIM Birlesik Magazalar continues to prioritize growth within Turkey, its primary market. This involves opening new stores to reach a wider customer base and increase market penetration. The focus is on both urban and underserved rural areas, ensuring accessibility for a broad demographic.

BIM has strategically expanded into North Africa, particularly Morocco and Egypt. The company aims to diversify its revenue streams and tap into growing consumer markets in these regions. This expansion leverages the successful discount retail model established in Turkey.

Beyond geographical expansion, BIM focuses on optimizing its existing product categories and potentially introducing new service offerings. This includes increasing private label offerings to meet evolving consumer needs and preferences. The company continually assesses its product assortment to remain competitive.

BIM's expansion strategy is underpinned by operational efficiency and strict cost control. This includes disciplined site selection, efficient logistics, and maintaining low operational costs. These measures are crucial for sustaining the discount retail model and ensuring profitability.

BIM's growth strategy focuses on both domestic and international expansion, leveraging its successful discount retail model. This involves opening new stores in existing markets and selectively entering new geographies, such as Morocco and Egypt. The company also emphasizes operational efficiency and cost control to maintain its competitive edge.

- Aggressive store openings in Turkey to increase market penetration.

- Strategic expansion into North Africa, focusing on Morocco and Egypt.

- Optimization of product offerings, including increased private label brands.

- Disciplined approach to site selection and efficient logistics.

BIM Birlesik Magazalar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BIM Birlesik Magazalar Invest in Innovation?

The core of the BIM Birlesik Magazalar (BIM) growth strategy revolves around leveraging technology and innovation to enhance operational efficiency. This strategy is critical in maintaining its low-cost, high-value retail model within the competitive retail industry. The company's focus is on applying technology to streamline processes and improve customer experience, particularly within the Turkish market.

BIM's approach to technology is strategic, ensuring that investments directly contribute to cost reduction and operational effectiveness. This approach is evident in its supply chain management and inventory optimization efforts. The company's commitment to sustainability also influences its technological choices, such as optimizing delivery routes to reduce fuel consumption.

BIM's success in the discount retail sector implicitly demonstrates its effective application of operational innovation and technology. The company's ability to maintain a highly efficient and profitable model, without significant investment in high-tech product development, underscores its strategic use of technology for business development.

BIM uses technology to boost operational efficiency. This includes advanced data analytics for demand forecasting and inventory management. The goal is to minimize waste and maximize product availability.

BIM invests in logistics and inventory management systems. These systems support the company's ability to manage stock levels and optimize store layouts. The aim is to reduce costs and enhance efficiency.

Digital transformation efforts focus on streamlining internal processes and improving customer experience. This includes implementing efficient point-of-sale systems and enhancing internal communication platforms.

BIM integrates environmentally friendly practices into its operations. This involves optimizing delivery routes to reduce fuel consumption and implementing energy-efficient solutions in stores. Technology enables these sustainability efforts.

The application of technology is strategic, focusing on cost reduction and operational effectiveness. This approach leads to faster inventory turns and reduced operational overhead. The focus is on impactful, subtle advancements.

BIM uses technology to improve the customer experience. This includes more efficient point-of-sale systems. The goal is to enhance the shopping experience within its discount model.

BIM prioritizes investments in technologies that directly support its core business model. This includes data analytics for demand forecasting and inventory management, which helps minimize waste and maximize product availability. Other investments focus on supply chain optimization and improving the customer experience.

- Data Analytics: Used for demand forecasting, stock level management, and store layout optimization.

- Supply Chain Management Systems: To improve logistics and inventory control.

- Point-of-Sale Systems: Enhance customer service and streamline transactions.

- Internal Communication Platforms: Improve internal efficiency.

- Sustainability Technology: Such as route optimization for delivery vehicles.

BIM Birlesik Magazalar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is BIM Birlesik Magazalar’s Growth Forecast?

The financial outlook for BIM Birlesik Magazalar (BIM) remains strong, supported by its aggressive expansion strategy and efficient operational model. BIM has consistently demonstrated robust revenue growth, primarily driven by an increasing store count and high sales volume. This strong performance is a key indicator of BIM's successful growth strategy within the competitive retail industry.

In Q4 2023, BIM reported a substantial increase in sales revenue, indicating continued strong performance. For the fiscal year 2023, BIM's net sales surged by 75.3% compared to the previous year, reaching TRY 234,704 million. This growth significantly outpaced inflation, highlighting the company's ability to expand its real sales volume within the Turkish market.

BIM's profitability also reflects its financial health. The company maintains healthy profit margins due to its stringent cost controls, an efficient supply chain, and a focus on private label products. In 2023, BIM's net profit increased by 31.8% year-on-year, reaching TRY 10,034 million. This strong financial performance allows BIM to self-fund much of its expansion initiatives, reducing reliance on external financing.

BIM's revenue growth is a key indicator of its financial health. The company's consistent ability to increase sales demonstrates a successful growth strategy. This is further supported by the company's ability to expand its real sales volume, reflecting its strong market position.

BIM maintains healthy profit margins due to cost controls and efficient supply chain management. The increase in net profit by 31.8% in 2023 demonstrates the company's ability to generate strong profits. This financial performance supports BIM's expansion plans.

BIM's financial strength allows it to self-fund expansion initiatives. The company's disciplined investment levels are geared towards sustainable expansion. BIM's focus on maximizing shareholder value supports its long-term strategic plans.

BIM's financial strategy is characterized by a conservative approach to debt. The company focuses on consistent operational performance and strategic growth. This approach enables BIM to continue its market penetration and explore new growth avenues.

Analyst forecasts generally project continued positive growth for BIM. The company's disciplined investment levels are geared towards sustainable expansion. BIM’s financial strategy is characterized by a conservative approach to debt and a focus on maximizing shareholder value through consistent operational performance and strategic business development. For more insights, you can read about the Marketing Strategy of BIM Birlesik Magazalar.

BIM Birlesik Magazalar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow BIM Birlesik Magazalar’s Growth?

The BIM Birlesik Magazalar's ambitious growth strategy and promising BIM future prospects are not without potential pitfalls. The retail industry is fiercely competitive, and the company must navigate numerous challenges. Several factors could impede the company's progress, from market dynamics to internal operational hurdles.

In the Turkish market and its international ventures, the company faces intense competition from both traditional supermarkets and emerging discounters. Regulatory changes and supply chain vulnerabilities also pose significant risks. Furthermore, the company must adeptly manage its rapid expansion while maintaining operational efficiency and its unique company culture.

Economic instability and high inflation in Turkey present ongoing challenges, impacting consumer purchasing power and operational costs. Addressing these diverse risks requires a multifaceted approach, including diversification, robust risk management, and a flexible operational model.

The BIM Birlesik Magazalar operates in a highly competitive retail industry. Maintaining a pricing advantage and customer loyalty against both established supermarkets and other discount retailers is crucial. The competitive landscape necessitates constant adaptation and strategic vigilance to protect its market share.

Changes in regulations, particularly concerning food safety, labor laws, and import/export rules, pose a risk. Compliance failures or unfavorable shifts in regulations could lead to increased operational costs or restrictions on the company's expansion plans. Adapting to these changes is essential for sustained operations.

As a discount retailer, the company relies heavily on an efficient supply chain. Disruptions due to geopolitical events, natural disasters, or commodity price fluctuations could severely impact its ability to stock shelves and maintain competitive prices. Effective supply chain management is critical.

While less direct than for tech companies, the company could be impacted if competitors leverage advanced e-commerce or delivery models. Though its current model relies less on extensive digital engagement, the company must consider how to adapt to evolving consumer expectations and technological advancements in the retail industry.

Managing rapid expansion while maintaining operational efficiency and preserving its unique company culture can be challenging. Ensuring consistent quality across numerous stores and managing a vast workforce requires robust internal controls and talent management strategies. Maintaining a strong company culture is vital.

Economic instability and high inflation in Turkey present ongoing challenges, impacting consumer purchasing power and operational costs. The company’s ability to navigate these economic headwinds will significantly affect its financial performance. The company's resilience is tested by these economic pressures.

To mitigate these risks, BIM Birlesik Magazalar employs several strategies. These include diversifying its supplier base to reduce supply chain vulnerabilities and implementing robust inventory management systems. Furthermore, the company focuses on international market diversification to reduce reliance on the Turkish market. Strong risk management frameworks and a flexible operational model are also key to adapting to changing economic conditions.

Understanding the BIM Birlesik Magazalar's competitive landscape is crucial for assessing its future prospects. Detailed analysis of competitors, including their strategies and market positioning, is essential. For deeper insights, refer to Competitors Landscape of BIM Birlesik Magazalar to understand the competitive dynamics in the retail industry.

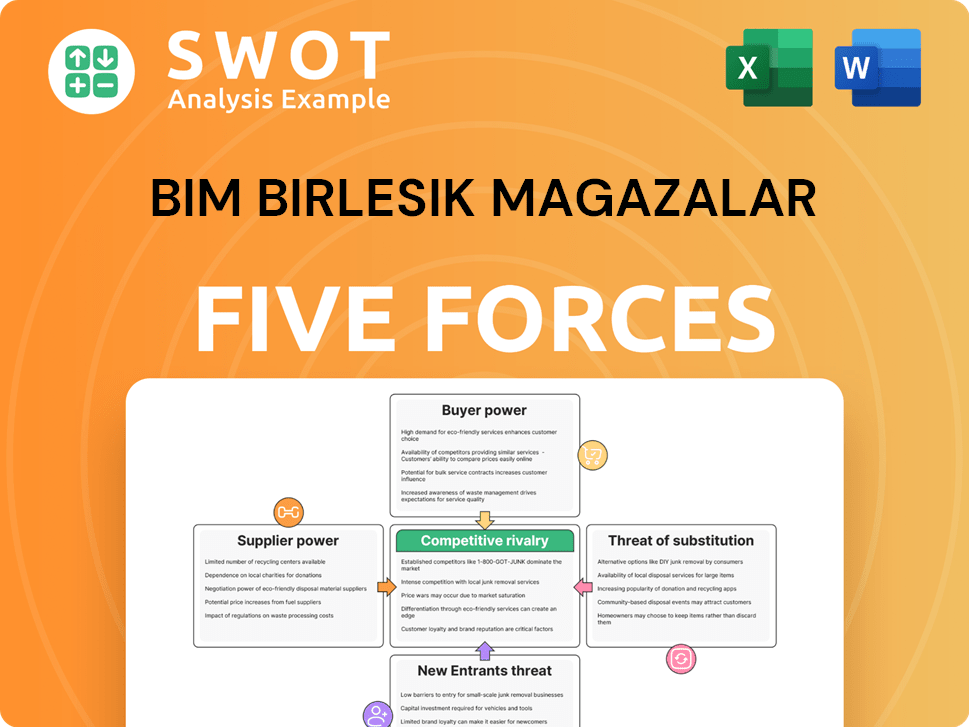

BIM Birlesik Magazalar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BIM Birlesik Magazalar Company?

- What is Competitive Landscape of BIM Birlesik Magazalar Company?

- How Does BIM Birlesik Magazalar Company Work?

- What is Sales and Marketing Strategy of BIM Birlesik Magazalar Company?

- What is Brief History of BIM Birlesik Magazalar Company?

- Who Owns BIM Birlesik Magazalar Company?

- What is Customer Demographics and Target Market of BIM Birlesik Magazalar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.