BIM Birlesik Magazalar Bundle

How Does BIM Birlesik Magazalar Thrive in the Turkish Retail Market?

Explore the remarkable journey of BIM Birlesik Magazalar, a dominant player in the Turkish retail landscape since 1995. From its humble beginnings with just 21 stores, the BIM Birlesik Magazalar SWOT Analysis reveals the strategies behind its impressive growth to over 13,583 stores across Turkey, Morocco, and Egypt. This comprehensive analysis unveils the secrets of BIM's success, making it an essential read for anyone interested in the discount stores Turkey model.

Understanding the BIM business model is key to grasping its impact on the Turkish economy. With a focus on cost efficiency and a limited assortment of essential products, BIM Turkey has carved a niche by offering competitive prices, especially crucial during periods of economic fluctuation. This examination will delve into how BIM operates, covering aspects like BIM store locations, what products does BIM sell, and BIM's supply chain, to offer a comprehensive understanding of its operations and financial performance.

What Are the Key Operations Driving BIM Birlesik Magazalar’s Success?

The core of the BIM Birlesik Magazalar business model centers on offering high-quality, essential goods at the lowest possible prices. This value proposition is achieved through a meticulously streamlined operational approach. The company focuses on cost minimization and efficient supply chain management to maintain its competitive edge in the Turkish retail market.

BIM's strategy involves a carefully curated product selection, typically around 600-900 essential items. This limited assortment allows for increased purchasing power with suppliers and facilitates constant price reductions. A significant portion of sales comes from private label products, which further reduces costs and strengthens the BIM brand. For instance, approximately 65% of BIM Turkey's sales are attributed to private-label products.

Operationally, BIM employs a lean model. Its stores are generally small and strategically located in high-traffic residential areas, minimizing real estate expenses. Each store operates with a small number of full-time employees, contributing to low operating costs. BIM's supply chain emphasizes direct negotiations with manufacturers, economies of scale in purchasing, and efficient distribution networks. The company continuously invests in its warehouse and vehicle fleet to ensure supply sustainability. This disciplined approach to cost management and a superior procurement strategy allows BIM to offer affordable products year-round, translating directly into customer benefits through lower prices and a convenient, no-frills shopping experience.

BIM's product portfolio is intentionally limited to around 600-900 essential items. This allows the company to negotiate better prices with suppliers. The focus is on frequently purchased, everyday goods, making it easier to manage inventory and reduce waste.

BIM stores are typically small and located in high-traffic residential areas. This strategy minimizes real estate costs and reduces the need for extensive advertising. Each store operates with a small team, further contributing to low operating expenses.

BIM emphasizes direct negotiations with manufacturers and efficient distribution networks. The company invests in its warehouse and vehicle fleet to ensure supply sustainability. This disciplined approach to cost management allows BIM to offer affordable products.

A significant portion of BIM's sales comes from private label products. This strategy helps reduce costs and strengthens the BIM brand. Approximately 65% of BIM Turkey's sales are from private-labeled products.

BIM's success in the discount stores Turkey market is built on several key operational strategies designed to minimize costs and maximize efficiency.

- Strategic store locations in high-traffic areas.

- Lean store operations with minimal staff.

- Direct negotiations with manufacturers.

- Emphasis on private-label products.

BIM Birlesik Magazalar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BIM Birlesik Magazalar Make Money?

The primary revenue stream for BIM Birlesik Magazalar (BIM) comes from sales within its chain of discount supermarkets. The company focuses on a limited assortment of food and consumer products. A significant portion of its revenue is generated by private label products, which contribute to better profit margins and competitive pricing.

BIM's business model centers on cost minimization to offer competitive prices, attracting a large customer base, particularly during inflationary periods. While the majority of sales occur in physical stores, BIM has also explored online sales of non-food products through its mobile application, though this remains a small part of overall revenue.

As of March 31, 2025, BIM reported a trailing 12-month revenue of $15.6 billion. In the full year ended December 31, 2024, sales reached TRY 519.57 billion, a 9.57% increase. Quarterly revenue for Q4 2024 was TRY 128 billion, a 54% year-on-year increase. For the first quarter ended March 31, 2025, sales were TRY 147.72 billion.

BIM's financial performance demonstrates strong operational efficiency and profitability. The company's monetization strategy is supported by its ability to maintain stable margins and generate substantial net income.

- For the full year 2024, BIM's EBITDA margin was 7.5%.

- Net income for the full year 2024 was TRY 18.59 billion.

- BIM's focus on discount retail and efficient operations has made it a significant player in the Turkish retail market. Read more about the company's operations in this article about BIM Birlesik Magazalar.

BIM Birlesik Magazalar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped BIM Birlesik Magazalar’s Business Model?

Established in 1995, BIM Birlesik Magazalar (BIM) pioneered the hard discount retail model in Turkey, drawing inspiration from German discounter Aldi. This strategic move set the foundation for its growth. The company's initial footprint of 21 stores has expanded significantly over the years, establishing it as a key player in the Turkish retail market.

BIM's journey includes pivotal strategic decisions, such as its public listing on Borsa Istanbul in July 2005. This move enhanced its financial capabilities and visibility. International expansion followed, with operations commencing in Morocco in 2008 and Egypt in 2012, demonstrating its ambition to broaden its market presence.

In 2015, BIM introduced the 'File' brand, entering the hard discount supermarket market with a broader product range. By the end of 2024, BIM had a total of 13,583 stores globally, including 12,376 in Turkey (including File stores), 789 in Morocco, and 418 in Egypt. In Q1 2024 alone, BIM opened 268 new BIM stores and 8 File stores in Turkey, 24 stores in Morocco, and 9 in Egypt, reaching a consolidated number of 12,791 stores.

BIM's competitive edge is built on a strong brand, cost leadership, and economies of scale. This allows it to offer 'everyday low prices,' supported by a high penetration of private-label products.

The company maintains stable EBITDA margins, such as the 7.5% recorded in 2024, despite economic challenges. BIM strategically locates stores in high-traffic urban areas with lower rent and minimal marketing expenses.

BIM emphasizes strong supplier relationships and continuous investment in its supply chain. Looking ahead, BIM plans to generate 25% of its electricity through its own facilities by 2025, aligning with sustainability goals and enhancing cost control. For more insights, consider exploring the Marketing Strategy of BIM Birlesik Magazalar.

BIM's focus on cost leadership and private-label products, which constitute 65% of sales in Turkey, makes it a preferred choice for consumers, especially during periods of economic uncertainty. This strategy helps BIM maintain its strong position in the Turkish retail sector.

BIM Birlesik Magazalar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is BIM Birlesik Magazalar Positioning Itself for Continued Success?

The Owners & Shareholders of BIM Birlesik Magazalar holds a leading position in Turkey's organized retail grocery sector. BIM company achieved an 18.7% market share in 2021, according to Euromonitor International, and increased its market share by 1.4% in 2022. Its 'everyday low price' strategy and private-label offerings strengthen customer loyalty, especially in inflationary periods. BIM's operations also extend to Morocco and Egypt, contributing to its diversification.

Despite its strong market position, BIM Turkey faces several risks. These include intense competition within the retail sector, potential shifts in consumer preferences, and macroeconomic volatility, such as inflation and currency fluctuations. Regulatory changes and supply chain disruptions also pose potential challenges. However, BIM's robust financial standing and experience enable it to take timely measures to mitigate these risks effectively.

BIM Birlesik Magazalar leads the organized retail grocery sector in Turkey. It held an 18.7% market share in 2021, as reported by Euromonitor International. The company's focus on everyday low prices and private-label products enhances customer loyalty.

BIM faces risks from intense competition, changing consumer preferences, and macroeconomic volatility. Inflation, currency fluctuations, regulatory changes, and supply chain issues also pose challenges. However, BIM's strong financial position helps mitigate these risks.

BIM plans further store expansion both domestically and internationally. For 2025, BIM anticipates a 45% top-line growth, excluding inflation, and an 8% growth with inflation. Capital expenditures are projected at 2.5-4% of sales. The company also focuses on operational optimization and sustainability.

BIM is focused on continuous store expansion in Turkey and international markets. The company is also investing in sustainable practices, such as generating 25% of its electricity from its own facilities by 2025. These strategies aim to sustain and expand profitability.

BIM is actively expanding its store network both in Turkey and internationally. The company is also prioritizing sustainability through initiatives like generating its own electricity.

- Continued store expansion is a key strategic focus.

- Investment in sustainable practices, including renewable energy.

- Aiming to maintain and grow profitability through strategic initiatives.

- Focus on operational optimization and cost efficiency.

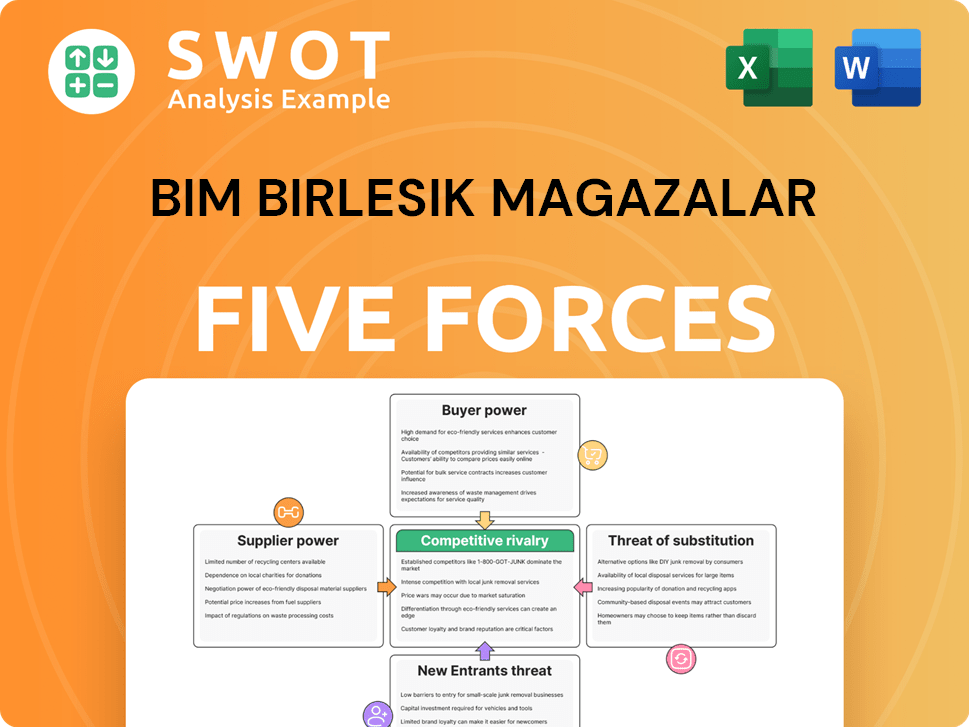

BIM Birlesik Magazalar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BIM Birlesik Magazalar Company?

- What is Competitive Landscape of BIM Birlesik Magazalar Company?

- What is Growth Strategy and Future Prospects of BIM Birlesik Magazalar Company?

- What is Sales and Marketing Strategy of BIM Birlesik Magazalar Company?

- What is Brief History of BIM Birlesik Magazalar Company?

- Who Owns BIM Birlesik Magazalar Company?

- What is Customer Demographics and Target Market of BIM Birlesik Magazalar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.