Brookshire Brothers Bundle

Can Brookshire Brothers Thrive in the Evolving Grocery Landscape?

In the dynamic world of grocery retail, understanding a company's growth strategy is crucial for investors and strategists alike. Brookshire Brothers, a regional supermarket chain, presents a compelling case study in adapting to market shifts. This analysis delves into Brookshire Brothers' future prospects, examining its strategic initiatives and how it plans to navigate the competitive terrain.

From its roots as a single general store, Brookshire Brothers has consistently expanded, showcasing a commitment to growth within the regional supermarket chain sector. This Brookshire Brothers SWOT Analysis can provide deeper insights into its strengths and weaknesses. The company's strategic diversification, including various store formats and service offerings, reflects its proactive approach to retail market trends. Exploring Brookshire Brothers' company analysis reveals how it aims to maintain its competitive edge and capitalize on future opportunities, including potential grocery store expansion.

How Is Brookshire Brothers Expanding Its Reach?

The expansion initiatives of Brookshire Brothers are primarily focused on solidifying its presence within its existing operational areas of Texas and Louisiana. This strategy involves a multi-faceted approach, including the opening of new supermarkets and smaller store formats. This allows the company to cater to diverse customer segments and increase market share, a key element of the overall Brookshire Brothers growth strategy.

The company's approach to expansion includes both traditional supermarkets and smaller convenience or express stores. This multi-format strategy enables Brookshire Brothers to meet a wide range of consumer needs, from comprehensive weekly shopping to quick, on-the-go purchases. The continued investment in fuel and pharmacy services at select locations further demonstrates a commitment to providing comprehensive retail destinations.

While specific announcements about large-scale mergers or acquisitions by Brookshire Brothers in 2024-2025 are not readily available, the company's historical growth pattern indicates an openness to strategic partnerships or smaller acquisitions that align with its regional focus. For instance, in 2024, the company continued refining its store portfolio, indicating ongoing strategic adjustments to optimize its market presence. This reflects a proactive stance in response to retail market trends.

Brookshire Brothers is expanding through the opening of new supermarkets and smaller format stores. This strategy allows the company to penetrate various customer segments and increase market share. The smaller formats, like convenience stores, cater to on-the-go purchases, complementing the larger supermarkets.

The primary focus of expansion remains within the existing geographic footprint of Texas and Louisiana. This strategic decision allows for leveraging existing infrastructure and brand recognition. This approach is a key aspect of the Brookshire Brothers future prospects.

Brookshire Brothers is investing in fuel and pharmacy divisions within select locations. These additions aim to provide more comprehensive retail destinations. This strategy enhances customer convenience and potentially increases foot traffic.

The company is open to strategic partnerships or smaller acquisitions that align with its regional focus. This approach allows for opportunistic growth and market consolidation. This is a part of the overall Brookshire Brothers company analysis.

Brookshire Brothers' expansion strategy focuses on new store openings, particularly in Texas and Louisiana. The company is also exploring smaller format stores to reach more customers. Further, they are enhancing services like fuel and pharmacy to increase customer convenience.

- Opening new supermarkets and smaller format stores to reach diverse customer segments.

- Focusing on geographic expansion within Texas and Louisiana.

- Investing in fuel and pharmacy services to create comprehensive retail destinations.

- Considering strategic partnerships and acquisitions to enhance market presence.

Brookshire Brothers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Brookshire Brothers Invest in Innovation?

The innovation and technology strategy of Brookshire Brothers focuses on enhancing operational efficiency, improving customer experience, and driving sustained growth. While specific details about R&D investments or proprietary technological breakthroughs are not publicly available, the company's digital transformation efforts are evident through its online presence and services. This includes streamlining online ordering, enhancing in-store technologies, and potentially exploring automation within its supply chain and store operations to optimize efficiency and reduce costs. The integration of digital platforms aims to meet evolving consumer expectations for convenience and accessibility.

The company's commitment to customer service and community engagement, coupled with its adoption of relevant technologies, contributes to its growth objectives by fostering customer loyalty and attracting new shoppers. Brookshire Brothers is likely investing in data analytics to better understand customer purchasing habits and optimize inventory management, similar to other grocery chains. This strategic approach helps the company adapt to the dynamic retail market trends and maintain a competitive edge.

As a regional supermarket chain, Brookshire Brothers' growth strategy incorporates digital initiatives to stay competitive. These initiatives are crucial in a market where e-commerce is significantly impacting the grocery sector. The company's ability to adapt to these changes is essential for its future prospects and overall Brookshire Brothers company analysis.

Brookshire Brothers is focused on digital transformation to enhance customer experience and streamline operations. This includes online ordering systems and in-store technology upgrades. These efforts are critical for the company to compete effectively in the evolving retail landscape.

Data analytics plays a key role in understanding customer behavior and optimizing inventory. This data-driven approach helps the company make informed decisions about product offerings and store layouts. This is a common strategy among regional supermarket chains.

The company may explore automation within its supply chain and store operations to optimize efficiency and reduce costs. This can include automated inventory management and streamlined logistics. Such strategies are vital for managing costs and improving profitability.

Enhancing customer experience is a priority, with digital platforms designed to meet consumer expectations. This includes user-friendly online ordering and convenient in-store technologies. Customer loyalty programs are also likely part of this strategy.

Brookshire Brothers' commitment to customer service and community engagement supports its growth objectives. This approach fosters customer loyalty and attracts new shoppers. This focus is a key element of their brand identity.

Integrating e-commerce is crucial for adapting to the changing retail landscape. This involves online ordering, delivery services, and other digital offerings. This is a critical component of Brookshire Brothers' strategic initiatives 2024.

Brookshire Brothers' technology strategy focuses on enhancing operational efficiency, improving customer experience, and driving growth. The company's approach involves a blend of digital platforms, data analytics, and potential automation, all geared towards meeting evolving consumer demands. These initiatives are crucial for the company's long-term success, especially in the context of Mission, Vision & Core Values of Brookshire Brothers.

- Online Ordering and Digital Platforms: Streamlining online ordering and enhancing digital platforms to meet the growing demand for convenience.

- Data Analytics: Utilizing data analytics to understand customer purchasing habits and optimize inventory management, which is essential for Brookshire Brothers' market share Texas.

- Supply Chain Optimization: Exploring automation within the supply chain and store operations to improve efficiency and reduce costs.

- Customer Service Technologies: Implementing technologies to enhance customer service and foster customer loyalty.

Brookshire Brothers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Brookshire Brothers’s Growth Forecast?

The financial outlook for Brookshire Brothers, a regional supermarket chain, appears stable and growth-oriented, although detailed financial data isn't publicly available due to its private ownership. The company's strategy involves a multi-format approach, including various store types and service offerings like pharmacies and fuel stations, which aim to diversify revenue streams. This diversification is crucial in the competitive retail market, helping to cushion against economic fluctuations and changing consumer preferences. The Revenue Streams & Business Model of Brookshire Brothers highlights the company's approach to generating income and adapting to market dynamics.

The company's growth is supported by its strategic focus on operational efficiency and expansion within its core markets of Texas and Louisiana. This regional focus allows for better supply chain management and targeted marketing efforts, which are critical for maintaining profitability. Industry trends in 2024 and 2025 indicate that grocery retailers are prioritizing supply chain optimization and inflation management to maintain profit margins. Brookshire Brothers' ability to adapt to these challenges and maintain a strong presence in competitive markets demonstrates its financial resilience and potential for future growth.

Brookshire Brothers' long-term financial goals likely include increasing market share, improving operational efficiencies, and delivering consistent profitability to support further expansion and modernization. The company's ability to adapt to changing consumer behaviors, such as the increasing demand for online grocery shopping, will be crucial for its continued success. The focus on community involvement and customer loyalty programs also contributes to its financial stability by fostering strong relationships with customers and local communities.

Brookshire Brothers' strategic initiatives in 2024 and beyond likely include expanding its store network, enhancing its online presence, and optimizing its supply chain. The company may also focus on introducing new products and services to meet evolving customer needs. These initiatives are designed to drive growth and maintain a competitive edge in the retail market.

The company aims to increase its market share within its operational regions by offering competitive pricing, high-quality products, and excellent customer service. Brookshire Brothers' competitive advantages include its strong brand reputation, local community focus, and diversified service offerings. These factors help the company attract and retain customers.

While specific financial data is not public, the company's consistent presence and expansion indicate a healthy financial performance. Brookshire Brothers likely focuses on maintaining profitability through efficient operations and strategic investments. The company's financial health is supported by its diverse revenue streams and strong customer base.

Brookshire Brothers is expected to continue its expansion plans, potentially focusing on new store openings in both existing and new markets. The company may also invest in modernizing its existing facilities to enhance the shopping experience. Expansion into rural areas could be a key part of its growth strategy.

The company might be incorporating sustainability practices into its operations, such as reducing waste, conserving energy, and sourcing sustainable products. Sustainability initiatives can enhance the company's brand image and attract environmentally conscious consumers. These practices can also improve operational efficiency.

Brookshire Brothers faces challenges such as increasing competition from national chains and the growth of e-commerce. However, opportunities exist in expanding its market share, enhancing its online presence, and offering unique products and services. Adapting to changing consumer behaviors and market trends is crucial for future success.

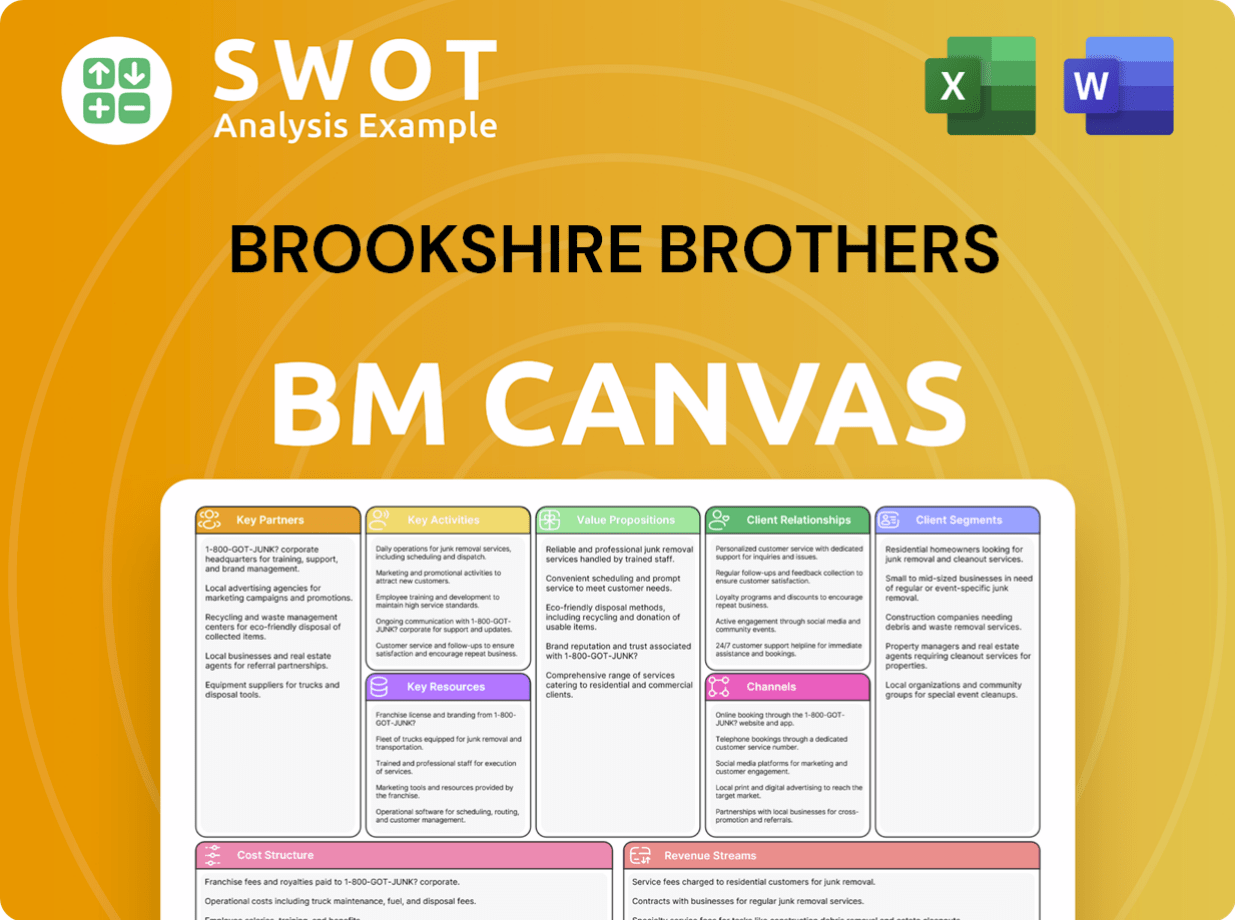

Brookshire Brothers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Brookshire Brothers’s Growth?

The Owners & Shareholders of Brookshire Brothers faces several hurdles as it pursues its growth strategy. These challenges include intense competition, regulatory changes, supply chain vulnerabilities, and the need to adapt to technological advancements. Understanding these risks is crucial for evaluating the company's future prospects and potential for success in the retail market trends.

One of the primary obstacles is the competitive landscape. The company must contend with larger national chains, discount retailers, and the growing presence of online grocery services. Successfully navigating this environment requires continuous adaptation and strategic initiatives. The company's ability to maintain and grow its market share in Texas and other regions will be a key indicator of its performance.

Furthermore, the company must manage internal operational challenges. These include overseeing a diverse portfolio of store formats and service offerings. Effective resource allocation and supply chain management are essential for mitigating risks and ensuring operational efficiency. The company's long-term success hinges on its ability to address these internal and external challenges effectively.

The company operates in a highly competitive market, facing pressure from larger national grocery chains, discounters like Aldi and Lidl, and online retailers such as Amazon. This competition can impact the company's market share and profit margins. The company must differentiate itself through unique offerings, competitive pricing, and exceptional customer service to thrive.

Changes in regulations related to food safety, labor laws, and environmental standards can increase operational costs and complexity. The company must stay compliant with all relevant regulations. This includes investing in new technologies and processes to meet evolving standards. Failure to adapt can lead to fines, legal issues, and reputational damage.

Supply chain disruptions, such as those experienced during the COVID-19 pandemic, pose a significant risk. Disruptions in sourcing, transportation, or logistics can lead to product shortages, increased costs, and reduced customer satisfaction. The company needs to maintain a robust supply chain management system to mitigate these risks. Diversifying suppliers and building strong relationships with partners are crucial.

The rapid evolution of e-commerce, delivery models, and in-store technologies requires the company to adapt quickly. Failure to keep pace with competitors in these areas can lead to a loss of market share. Investing in online grocery services, in-store technology, and data analytics is vital. Recent trends show a significant increase in online grocery shopping, with a projected continued growth.

Managing a diverse portfolio of store formats and service offerings requires robust operational oversight and resource allocation. Different store formats may have varying needs, and ensuring consistency across all locations can be challenging. The company must streamline operations and improve efficiency to maintain profitability. This includes implementing standardized processes and investing in employee training.

Economic downturns can impact consumer spending, potentially leading to reduced sales and profit margins. The company may need to adjust its pricing strategies and product offerings to remain competitive during economic uncertainty. Economic indicators, such as inflation rates and unemployment figures, should be closely monitored. The company can also focus on value-added services to attract and retain customers.

The company has been investing in online grocery services and delivery options to meet evolving consumer preferences. The expansion of these services can be seen as a proactive response to the growing demand for convenience. The company's ability to integrate its online and in-store experiences will be critical. The company's investment in technology is essential to compete with other retailers.

The company likely employs strategies to mitigate supply chain risks, such as diversifying its suppliers and building strong relationships with its partners. Diversification and strong partnerships can help to reduce the impact of disruptions. The company's proactive approach to supply chain management is crucial for maintaining product availability and controlling costs. The company's ability to manage its supply chain is essential for its long-term success.

Brookshire Brothers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Brookshire Brothers Company?

- What is Competitive Landscape of Brookshire Brothers Company?

- How Does Brookshire Brothers Company Work?

- What is Sales and Marketing Strategy of Brookshire Brothers Company?

- What is Brief History of Brookshire Brothers Company?

- Who Owns Brookshire Brothers Company?

- What is Customer Demographics and Target Market of Brookshire Brothers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.