Brookshire Brothers Bundle

Who Really Owns Brookshire Brothers?

Uncover the ownership secrets behind Brookshire Brothers, a regional grocery store chain that has thrived for over a century. Unlike many competitors, this Texas grocery store success story boasts a unique ownership structure that has shaped its identity and community impact. Understanding Brookshire Brothers SWOT Analysis is crucial for investors and strategists.

This exploration into Brookshire Brothers ownership will reveal how its structure influences its strategic direction and its ability to adapt to market changes. From its humble beginnings as a general store to its current status as a significant regional player, the company's history offers valuable insights. Discover the key stakeholders, board of directors, and recent ownership trends that define this enduring business. Understanding Who owns Brookshire Brothers is key.

Who Founded Brookshire Brothers?

The story of Brookshire Brothers began in 1921. Wood T. Brookshire and his brother, Virgil Brookshire, were the founders, starting with a general mercantile store in Lufkin, Texas. This initial venture was the foundation for what would evolve into a significant regional grocery store chain.

Early ownership of Brookshire Brothers was centered around the founding family. While specific details on equity splits from the beginning are not publicly available, the company's early structure indicates a family-focused ownership model. The founders' vision was to serve their local community with quality products and personalized service, a philosophy that has remained consistent throughout the company's history.

Unlike many modern businesses, Brookshire Brothers didn't depend on external investors early on. Its growth was primarily organic and self-funded, with profits reinvested to facilitate expansion. This early self-reliance likely contributed to the company's ability to maintain a closely held ownership structure for many years.

The early years of Brookshire Brothers saw a focus on operational growth within a family-centric structure. This approach allowed the company to build a strong foundation rooted in community service and quality. Here's a breakdown:

- Founding: Established in 1921 by Wood T. Brookshire and Virgil Brookshire.

- Initial Business: Started as a general mercantile store in Lufkin, Texas.

- Ownership Model: Primarily family-owned and operated.

- Funding: Relied on self-funding and reinvestment of profits.

- Growth Strategy: Focused on organic expansion and community-focused service.

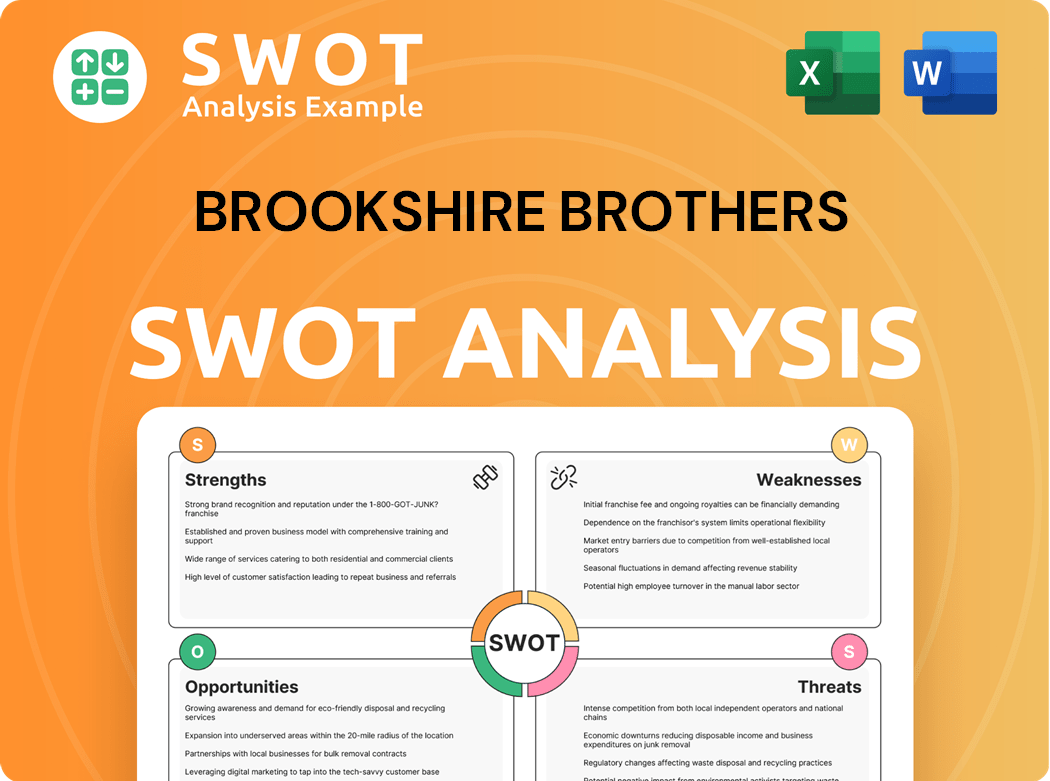

Brookshire Brothers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Brookshire Brothers’s Ownership Changed Over Time?

The ownership structure of Brookshire Brothers, a well-known Texas grocery store chain, has significantly evolved since its inception. Initially, the company was under family ownership. A key turning point in its history occurred in 1999 when Brookshire Brothers transitioned to an Employee Stock Ownership Plan (ESOP). This strategic move fundamentally changed the company's ownership, making its employees the primary stakeholders. This shift is a crucial element in understanding Brookshire Brothers ownership.

The ESOP model allows eligible employees to gradually acquire ownership shares in the company, which promotes a strong sense of collective responsibility and shared success. This structure has had a lasting impact on the company's operations and culture, distinguishing it from many other grocery store chains. The decision to become employee-owned reflects a commitment to its workforce and a unique approach to business management. For more insights, you can explore the Marketing Strategy of Brookshire Brothers.

| Event | Year | Impact on Ownership |

|---|---|---|

| Founding of Brookshire Brothers | Early 1920s | Family-owned and operated. |

| Transition to ESOP | 1999 | Employees become primary stakeholders. |

| Ongoing ESOP Management | 1999-Present | Employee ownership and company performance tied together. |

As a private, employee-owned company, Brookshire Brothers does not have publicly traded stock. Therefore, detailed SEC filings regarding major shareholding shifts are not available. The ESOP structure means that the major stakeholders are, collectively, the company's employees. The ESOP is managed by a trustee, and the value of employee shares is tied to the company's performance, assessed through annual valuations. While specific percentages of ownership held by individual employees are not disclosed, the ESOP ensures broad-based employee ownership. This model contrasts sharply with publicly traded companies, where institutional investors often hold significant influence. The transition to an ESOP has profoundly impacted company strategy and governance, aligning employee interests directly with the company's long-term success and fostering a culture of ownership and accountability.

Brookshire Brothers ownership is primarily held by its employees through an ESOP, a unique structure within the grocery industry. This model promotes employee engagement and aligns interests with the company's long-term success.

- Employee ownership fosters a strong sense of responsibility and shared success.

- The ESOP structure impacts company strategy and governance.

- Brookshire Brothers is not a public company, so there is no stock price.

- The company's headquarters is located in Lufkin, Texas.

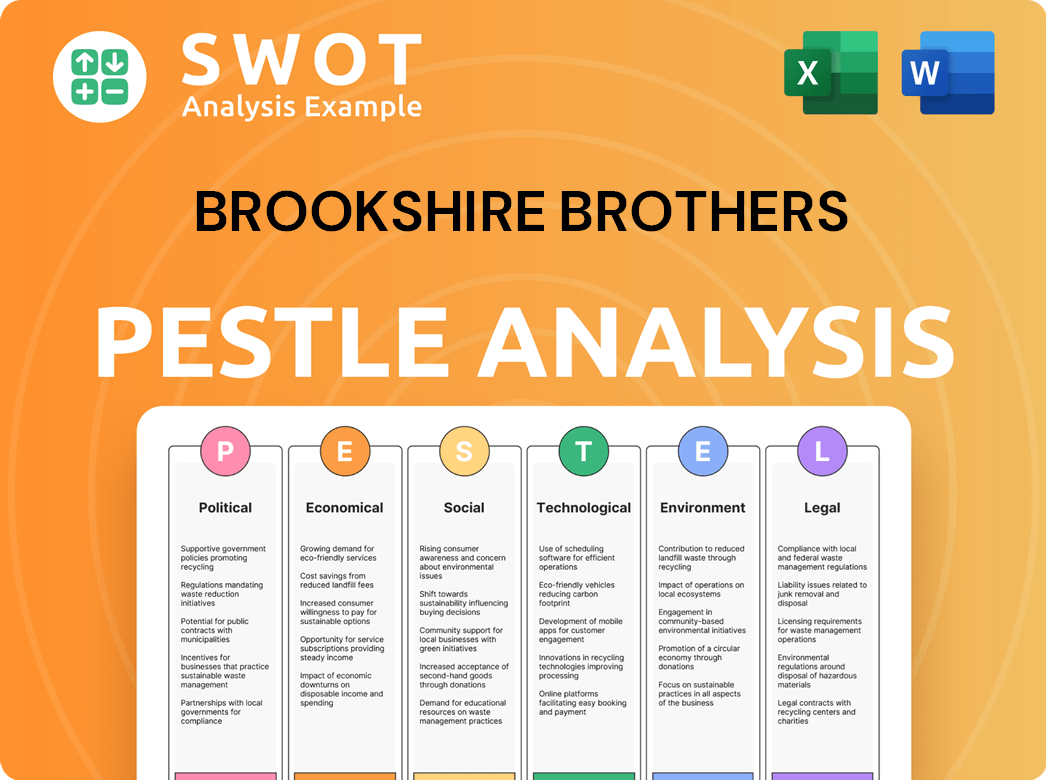

Brookshire Brothers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Brookshire Brothers’s Board?

As a privately held, employee-owned entity, the specifics of the current Board of Directors at Brookshire Brothers are not publicly available. The board's primary responsibility is to represent the interests of the employee-owners and steer the company's strategic course. The composition typically includes internal executives from the company's leadership and potentially independent directors who bring external expertise and oversight. The board's role is crucial in ensuring the Brookshire Brothers continues to operate effectively, maintains its financial health, and adheres to its mission.

The governance structure of Brookshire Brothers, being an ESOP-owned company, centers on employee ownership. While employees don't directly vote on day-to-day operational matters, their ownership through the ESOP means the Board of Directors is accountable to the collective employee-owners. Major corporate decisions, such as significant acquisitions or sales, would likely require approval from the ESOP trustee, acting on behalf of the employee-owners. Information on dual-class shares, special voting rights, or governance controversies is not publicly available, reinforcing the private, employee-owned nature of the company and its governance structure.

| Aspect | Details | Status |

|---|---|---|

| Board Composition | Mix of internal executives and potentially independent directors. | Private |

| Employee Ownership | Operates under an Employee Stock Ownership Plan (ESOP). | Active |

| Voting Rights | Board accountable to employee-owners; major decisions require ESOP trustee approval. | Private |

Brookshire Brothers, a Texas grocery store chain, is structured to prioritize employee interests. The Board of Directors oversees operations, financial performance, and adherence to the company's mission. This structure is typical of an employee-owned business model, ensuring that the company's direction aligns with the collective interests of its employee-owners.

- The board is responsible for the company's strategic direction.

- Employee ownership is facilitated through an ESOP.

- Major corporate actions require ESOP trustee approval.

- Governance details are not publicly available, reflecting its private status.

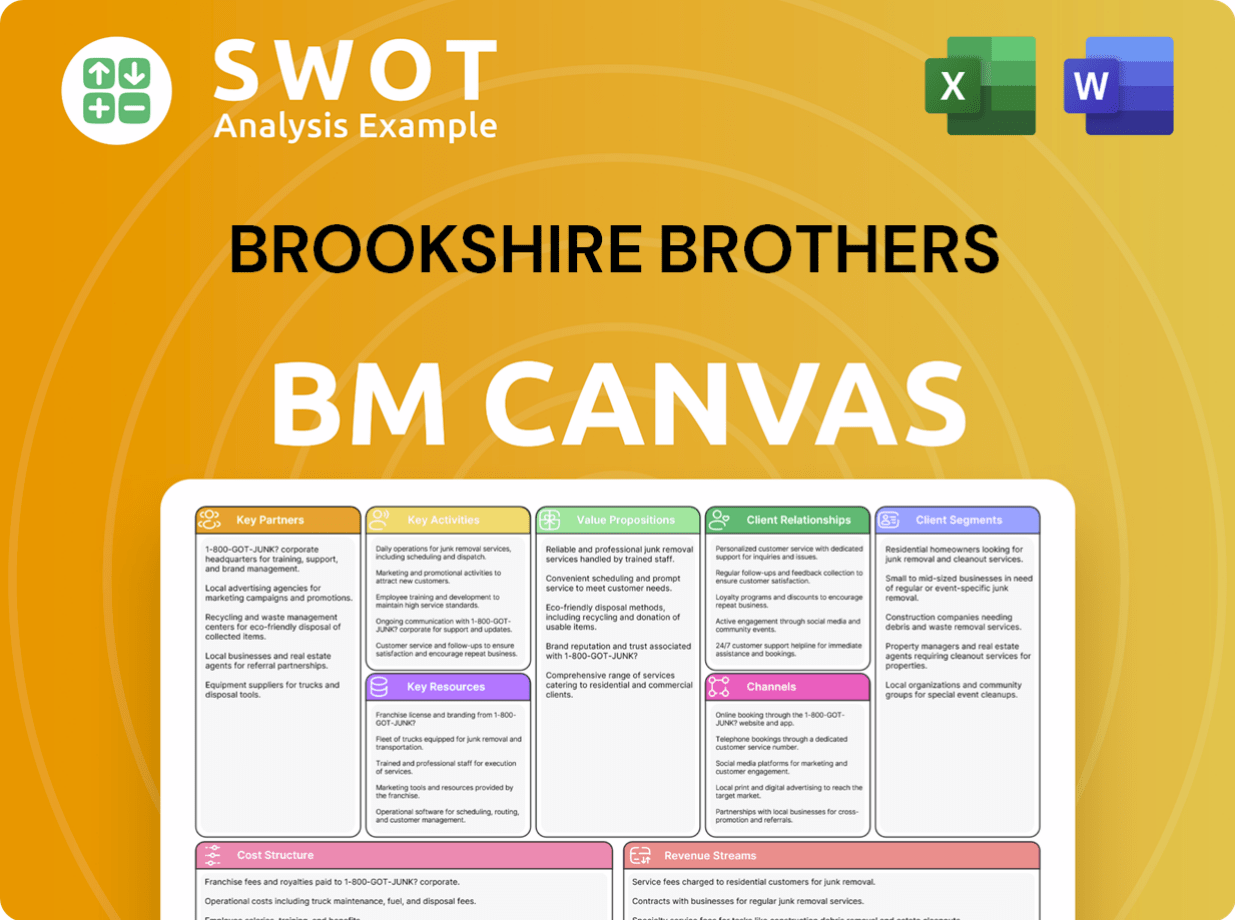

Brookshire Brothers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Brookshire Brothers’s Ownership Landscape?

In the past few years, Brookshire Brothers has maintained its employee-owned structure, a distinctive feature in the competitive grocery industry. This ownership model has remained stable, allowing the company to concentrate on organic growth and community engagement. This contrasts with many publicly traded grocery chains that often experience frequent share buybacks or mergers and acquisitions.

Recent developments at Brookshire Brothers have centered around strategic expansions and operational enhancements within its existing markets in Texas and Louisiana. The company has continued to invest in its store formats, including traditional supermarkets, convenience stores, and express stores, and has emphasized its pharmacy, fuel, and foodservice divisions. The company's consistent presence and adaptation to consumer trends indicate ongoing internal investment. The employee stock ownership plan (ESOP) ensures a broad, distributed ownership base among employees, and there have been no public announcements regarding leadership changes that would significantly alter the ownership structure.

| Aspect | Details | Status |

|---|---|---|

| Ownership Structure | Employee-Owned (ESOP) | Stable |

| Recent Investments | Store format upgrades, pharmacy, fuel, and foodservice divisions | Ongoing |

| Public Listing | Not a public company | N/A |

The private ownership of Brookshire Brothers means there are no public statements about potential privatization or public listing, reinforcing its commitment to its current structure. Industry trends like increased institutional ownership and founder dilution, common in public companies, do not directly apply due to its unique ESOP model.

The employee-owned structure of Brookshire Brothers has remained consistent over the past few years. This stability provides a distinct advantage in the grocery industry. Unlike public companies, Brookshire Brothers is not subject to the pressures of quarterly earnings reports.

The company is focused on organic growth, store modernizations, and community engagement. Brookshire Brothers has been investing in its store formats and emphasizing key divisions. This approach allows for long-term strategic planning.

As a private company, Brookshire Brothers does not release detailed financial figures publicly. Information about specific investment amounts is not readily available. This contrasts with the financial reporting of publicly traded companies.

The ESOP model ensures a broad, distributed ownership base among employees. There are no public statements about potential privatization or public listing. This ownership structure is a key differentiator.

Brookshire Brothers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Brookshire Brothers Company?

- What is Competitive Landscape of Brookshire Brothers Company?

- What is Growth Strategy and Future Prospects of Brookshire Brothers Company?

- How Does Brookshire Brothers Company Work?

- What is Sales and Marketing Strategy of Brookshire Brothers Company?

- What is Brief History of Brookshire Brothers Company?

- What is Customer Demographics and Target Market of Brookshire Brothers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.