Burlington Coat Factory Bundle

Can Burlington Coat Factory Maintain Its Momentum?

Burlington Stores, a cornerstone of the off-price retail sector, has navigated the competitive landscape with a strategic focus on value. From its inception in 1972, Burlington's evolution reflects a dynamic growth strategy, expanding beyond its initial coat offerings to encompass a wide array of merchandise. This journey highlights the company's adaptability and commitment to providing savings to its customers across the United States.

This exploration delves into the Burlington Coat Factory SWOT Analysis, examining its growth strategy and future prospects. Understanding Burlington's business model, market share, and financial performance is crucial for assessing its long-term growth potential. We will analyze its expansion plans, competitive advantages, and the impact of economic factors on its future outlook, providing a comprehensive investment analysis for decision-makers.

How Is Burlington Coat Factory Expanding Its Reach?

The off-price retailer, formerly known as Burlington Coat Factory, is aggressively pursuing an expansion strategy focused on increasing its store footprint across the United States. This strategy is a key component of its overall growth strategy. The company aims to capitalize on the robust consumer demand for off-price merchandise by opening new, smaller format stores.

This expansion is designed to enhance market penetration and accessibility for customers. The company's long-term vision includes reaching a total of 2,000 stores, a significant increase from its current count of over 1,000 stores. The company's focus remains firmly within the domestic market, with no current plans for international expansion. This strategic approach is detailed further in an article about Owners & Shareholders of Burlington Coat Factory.

Burlington's real estate strategy includes converting larger stores into smaller, more efficient formats or relocating them to more favorable locations. Alongside these conversions, the company is actively opening entirely new, smaller stores. These initiatives are intended to reach new customer demographics and improve convenience. The company's product offerings, which include apparel, footwear, accessories, and home goods, are continuously updated to provide customers with fresh merchandise and value.

Burlington plans to open approximately 120 net new stores in fiscal year 2024. This is a key part of its expansion plans. The company is focused on opening smaller-format stores to maximize productivity and returns.

The real estate strategy involves converting larger stores into smaller, more efficient formats. This includes relocating stores to better locations. The company is also opening entirely new smaller stores to expand its reach.

The product pipeline focuses on core offerings like apparel, footwear, accessories, and home goods. These products are constantly updated. This ensures the company offers newness and value to its customers.

The company is concentrating on maximizing its presence within the domestic market. There are no current plans for international expansion. The focus is on increasing market share within the United States.

Burlington's expansion strategy is centered on opening new, smaller stores to increase market penetration and accessibility. The company aims to reach 2,000 stores long-term, significantly growing from its current footprint.

- New store openings are a primary driver of growth.

- Real estate strategy includes conversions and relocations.

- Product offerings are consistently refreshed.

- The focus remains on the domestic market.

Burlington Coat Factory SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Burlington Coat Factory Invest in Innovation?

The success of Burlington Stores, including its growth strategy, hinges on its ability to adapt and innovate within the retail sector. They leverage technology to improve operations and enhance the customer experience. This approach supports their off-price business model, which relies on efficient in-store processes rather than a strong e-commerce presence.

Burlington's focus is on optimizing its supply chain and inventory management. This enables them to offer a diverse and ever-changing selection of merchandise. The company's commitment to operational technology is crucial for streamlining processes and reducing costs.

Technological advancements play a key role in Burlington's expansion plans. These advancements support rapid store growth by speeding up inventory turnover and improving merchandise flow. This focus helps Burlington to maintain its competitive edge in the market.

Burlington invests in technology to enhance its supply chain, including distribution centers. This is vital for supporting its rapid store expansion strategy. Efficient supply chain management is a core element of their Revenue Streams & Business Model of Burlington Coat Factory.

Technology helps Burlington manage inventory effectively, ensuring a fresh and varied assortment of products. This is particularly important for their off-price model, which relies on a constantly changing selection to attract customers. Effective inventory management directly impacts the company's financial performance.

Burlington's digital transformation prioritizes efficient in-store operations. This focus supports the "treasure hunt" experience that defines their business. Streamlined in-store processes are crucial for customer satisfaction and operational efficiency.

While Burlington has a limited e-commerce presence, its technology investments are primarily geared towards in-store improvements. This strategy aligns with its off-price model, which is centered on the in-store shopping experience. The company's focus remains on optimizing physical store performance.

Technology helps streamline processes, reducing costs and improving efficiency. This contributes to faster inventory turnover and better merchandise flow. These improvements are essential for achieving growth objectives and enhancing profitability.

Investments in technology support Burlington's rapid store expansion plans. These investments help manage the increasing volume of merchandise and optimize distribution. This strategy is key to the company's long-term growth potential.

Burlington's technology strategy centers on improving supply chain capabilities and in-store operations to support its business model. These investments are crucial for maintaining its competitive advantages and achieving its growth strategy. The company's focus on operational technology is a key factor in its success.

- Supply Chain Technology: Investments in distribution centers and logistics systems.

- Inventory Management Systems: Technology to track and manage inventory flow.

- In-Store Systems: Point-of-sale systems and other technologies to improve the customer experience.

- Data Analytics: Use of data to optimize merchandise selection and store performance.

Burlington Coat Factory PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Burlington Coat Factory’s Growth Forecast?

The financial outlook for Burlington Stores remains positive, driven by its aggressive store expansion strategy. This strategy is a key component of the company's overall Burlington Coat Factory growth strategy, aiming to increase its market presence and capture a larger share of the off-price retail sector. The company's focus on disciplined inventory management and efficient operations is expected to maintain healthy profit margins, contributing to its financial performance.

For fiscal year 2024, the company anticipates comparable store sales to be in the range of flat to up 2%. Total sales are expected to increase by 9% to 11%. This growth is supported by the company's plan to reach 2,000 stores, indicating significant

Burlington projects adjusted earnings per share (EPS) to be between $7.00 and $7.60 for fiscal year 2024. This projection reflects the company's confidence in its operational efficiency and ability to navigate the competitive retail landscape. Analyst forecasts generally align with Burlington's positive outlook, recognizing the potential for growth through its store expansion and efficient operating model. This financial narrative underscores the company's commitment to expanding its market presence and delivering value to shareholders.

Burlington's primary growth driver is its aggressive store expansion plan. The company aims to reach 2,000 stores, significantly increasing its market share. This strategy is crucial for driving revenue growth and enhancing its competitive position.

For fiscal year 2024, Burlington projects comparable store sales to be flat to up 2%. Total sales are expected to increase by 9% to 11%. Adjusted EPS is projected to be between $7.00 and $7.60, demonstrating strong financial health.

Burlington emphasizes disciplined inventory management and efficient operations. This focus helps maintain healthy profit margins within the off-price sector. Efficient operations are key to sustaining profitability.

The company has historically demonstrated strong cash flow generation. This financial strength supports capital expenditures for new store openings and supply chain investments. This is critical for long-term growth.

Analyst forecasts generally align with Burlington's positive outlook. They recognize the potential for growth through store expansion and efficient operating models. This positive sentiment supports the company's investment appeal.

Burlington's long-term financial goals are underpinned by its plan to reach 2,000 stores. This expansion strategy is expected to drive significant revenue growth. The company's commitment to expansion is a key factor.

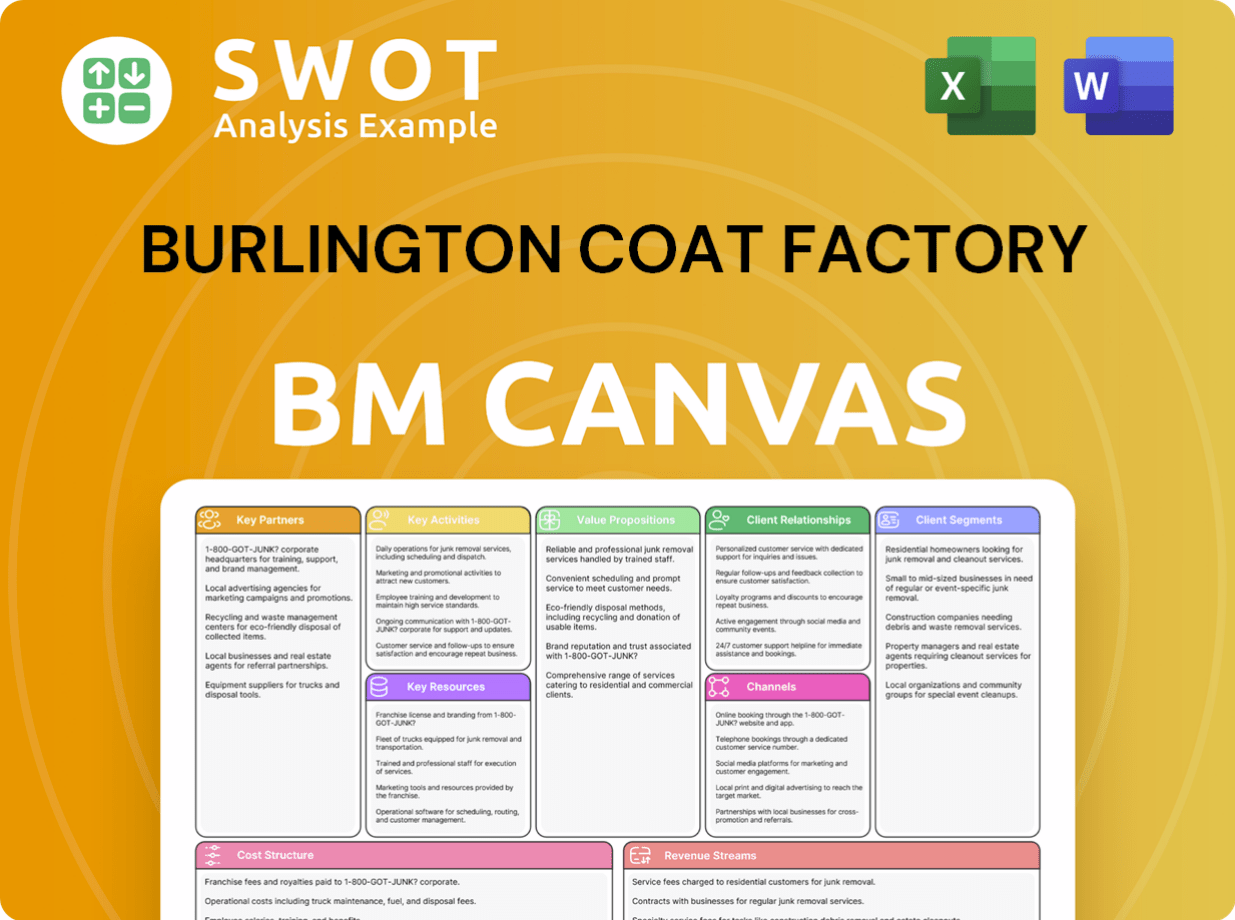

Burlington Coat Factory Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Burlington Coat Factory’s Growth?

The future prospects of Burlington Stores are subject to several potential risks and obstacles. The company's growth strategy and financial performance are influenced by external factors like market competition and shifts in consumer behavior. Understanding these challenges is crucial for a comprehensive Burlington Coat Factory analysis and assessing its long-term growth potential.

Burlington faces significant competition in the off-price retail sector, where differentiation and adaptability are key. Furthermore, the company's reliance on an efficient supply chain and its ability to manage costs are critical for maintaining its market share and achieving its expansion plans. The impact of economic downturns and evolving consumer preferences also pose challenges.

To mitigate these risks, Burlington employs strategies such as diversified vendor relationships and robust inventory management. The company's focus on smaller store formats and efficient supply chain management is also a strategic response to optimize resource allocation and minimize operational complexities. The company's ability to adapt quickly to changing market conditions and consumer preferences remains crucial for overcoming these obstacles and sustaining growth.

The off-price retail sector is highly competitive, with major players like TJX Companies (TJ Maxx, Marshalls, HomeGoods) and Ross Stores. These competitors offer similar value propositions, leading to intense price competition. Burlington must constantly differentiate its merchandise assortment to maintain its competitive advantage.

Supply chain disruptions, whether from geopolitical events, natural disasters, or labor shortages, can impact inventory flow and merchandise availability. This is a significant risk that can affect the company's ability to meet customer demand and maintain sales. Managing these risks is crucial for the company's financial performance.

Burlington's opportunistic buying strategy exposes it to risks related to merchandise quality and consistency. Ensuring consistent quality across a diverse range of products is essential for maintaining customer satisfaction. This is a critical factor in the company's long-term growth potential.

Changes in labor laws or import tariffs can increase operational costs. Staying compliant with evolving regulations requires careful planning and resource allocation. These changes can impact the company's profitability and its ability to invest in expansion plans.

Consumer spending habits, which are influenced by economic downturns or shifts in discretionary income, can significantly affect sales performance. Understanding and adapting to these shifts is vital for maintaining sales growth. This is a key aspect of the Burlington Coat Factory growth strategy in the retail industry.

Economic downturns can decrease consumer spending, which directly impacts Burlington's sales. The company must be prepared to adapt to changing economic conditions. The impact of economic downturns is a crucial factor in the company's future outlook 2024.

Burlington mitigates risks through diversified vendor relationships and robust inventory management systems. The company focuses on smaller store formats and efficient supply chain management to optimize resource allocation. These strategies support the company's expansion plans and improve its financial performance.

The ability to quickly adapt to changing market conditions and consumer preferences is crucial for overcoming obstacles. This includes adjusting merchandise assortments, pricing strategies, and marketing efforts. Adaptability is key to maintaining Burlington's market share.

Burlington Coat Factory Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Burlington Coat Factory Company?

- What is Competitive Landscape of Burlington Coat Factory Company?

- How Does Burlington Coat Factory Company Work?

- What is Sales and Marketing Strategy of Burlington Coat Factory Company?

- What is Brief History of Burlington Coat Factory Company?

- Who Owns Burlington Coat Factory Company?

- What is Customer Demographics and Target Market of Burlington Coat Factory Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.