Charter Communications Bundle

Can Charter Communications Dominate the Future of Connectivity?

Charter Communications, operating under the Spectrum brand, is a major player in the telecommunications industry, providing cable television, internet, and phone services. As the second-largest cable operator in the U.S., serving over 32 million customers as of February 2025, Charter's growth strategy is critical. A potential $34.5 billion acquisition of Cox Communications, announced in May 2025, could reshape the competitive landscape.

From its inception in 1993, Charter Communications SWOT Analysis has evolved into a $51.5 billion company, strategically integrating high-speed broadband, video, and mobile services. Its future prospects depend on navigating the evolving telecommunications industry, expanding its customer base, and innovating with new services. This article delves into Charter's expansion plans, competitive landscape, and long-term investment potential, providing a comprehensive analysis of its growth strategy.

How Is Charter Communications Expanding Its Reach?

Charter Communications is actively pursuing several expansion initiatives to drive future growth, focusing on new market entry, product diversification, and strategic acquisitions. These initiatives are designed to strengthen its position in the telecommunications industry and enhance its long-term value. The company's strategy involves significant investments and strategic moves to capitalize on emerging opportunities.

A key aspect of Charter's expansion strategy is its rural broadband initiative. This involves leveraging federal and state subsidies to build out network infrastructure in underserved areas. The company aims to bridge the digital divide and expand its customer base by providing broadband connectivity to these communities.

Product and service diversification, particularly through Spectrum Mobile, is another crucial element. Strategic acquisitions also play a significant role in Charter's expansion plans, enabling the company to access new customers and diversify its revenue streams.

Charter is investing in rural broadband to expand its network in underserved areas. By the end of 2024, the company invested $5.5 billion in subsidized rural construction, activating approximately 813,000 passings. The company is on track to activate approximately 450,000 subsidized rural passings in 2025, marking its largest year for rural expansion.

Spectrum Mobile has been a significant growth driver for Charter. The company reached a milestone of 10 million mobile lines within six years of its launch by February 2025. This rapid growth is attributed to its bundling strategy, offering mobile services to all Spectrum Internet customers with 5G access and no contracts.

Spectrum Business is expanding its offerings with new flexible internet packages. These packages include guaranteed pricing for up to three years. This expansion targets the small business segment, providing them with reliable and cost-effective internet solutions.

Strategic acquisitions are central to Charter's expansion strategy. The proposed acquisition of Cox Communications for $34.5 billion, announced in May 2025, will significantly expand Charter's customer footprint to 37.6 million in the US. In November 2024, Charter acquired Liberty Broadband, with stockholders approving the merger in February 2025 and an expected close date of June 30, 2027.

Charter's expansion initiatives are multifaceted, including rural broadband deployment, product diversification, and strategic acquisitions. These strategies are designed to increase its market share and revenue streams. The focus is on enhancing its competitive position and offering comprehensive services to a broader customer base.

- Rural Broadband: Investing in underserved areas to expand network reach.

- Spectrum Mobile: Leveraging bundling strategies to grow mobile subscribers.

- Spectrum Business: Offering flexible internet packages for small businesses.

- Strategic Acquisitions: Expanding the customer base through mergers and acquisitions.

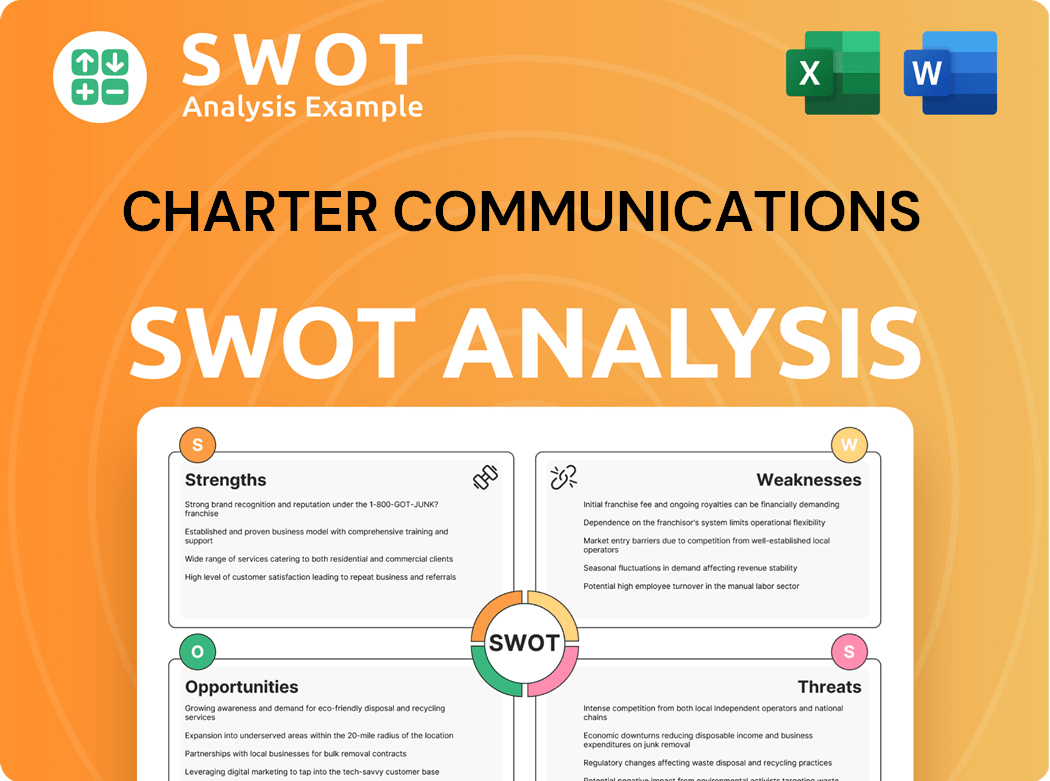

Charter Communications SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Charter Communications Invest in Innovation?

Understanding the innovation and technology strategy of Charter Communications is crucial for assessing its future prospects. This strategy focuses on leveraging technological advancements to enhance customer experience, expand service offerings, and maintain a competitive edge in the telecommunications industry. Charter's approach involves significant investments in network infrastructure, digital transformation, and the development of new products and platforms.

The company's commitment to innovation is evident in its capital expenditures, which are primarily directed towards upgrading its broadband infrastructure. This includes deploying advanced technologies like DOCSIS 4.0 and Distributed Access Architecture (DAA) to deliver faster and more reliable internet speeds. These investments are essential for meeting the growing demands of customers and staying ahead of competitors like Comcast.

Charter Communications' growth strategy is heavily reliant on technological advancements and strategic initiatives. For a deeper dive into how Charter approaches marketing, consider exploring the Marketing Strategy of Charter Communications.

Charter is investing heavily in upgrading its broadband infrastructure to offer symmetrical and multi-gigabit speeds. This includes the deployment of DOCSIS 4.0 and DAA technologies. By May 2025, 15% of the network had been upgraded to 1.2 GHz.

Digital transformation is a key component of Charter's strategy, with the deployment of CBRS in 23 markets. This helps optimize network traffic and supports the growth of its mobile services.

Spectrum Mobile expanded its offerings to include satellite-based services through a partnership with Skylo. This enhances its converged network strategy, providing more comprehensive mobile solutions.

In September 2024, Charter launched its new brand platform, 'Life Unlimited,' which emphasizes reliable connectivity and exceptional service. This initiative includes new pricing and packaging strategies.

Charter has secured deals with major programmers to include streaming applications like Max, Disney+, ESPN+, Paramount+, and Peacock in its Spectrum TV packages. This provides up to $80 per month in free access to these ad-supported streaming apps.

While specific R&D expenditure figures for 2024-2025 are reported as $0, the company's capital expenditures reflect its commitment to network evolution and expansion.

Charter's technological advancements and strategic initiatives are crucial for maintaining its competitive edge in the telecommunications industry. These efforts are designed to improve customer satisfaction, expand service offerings, and drive sustainable growth.

- Network Upgrades: Investment in DOCSIS 4.0 and DAA technologies to deliver faster internet speeds.

- Digital Transformation: Deployment of CBRS to optimize network traffic and support mobile services.

- Mobile Expansion: Partnerships to enhance mobile offerings, including satellite-based services.

- Content Integration: Bundling streaming services to provide added value to customers.

- Brand Platform: Launch of 'Life Unlimited' to emphasize reliable connectivity and service.

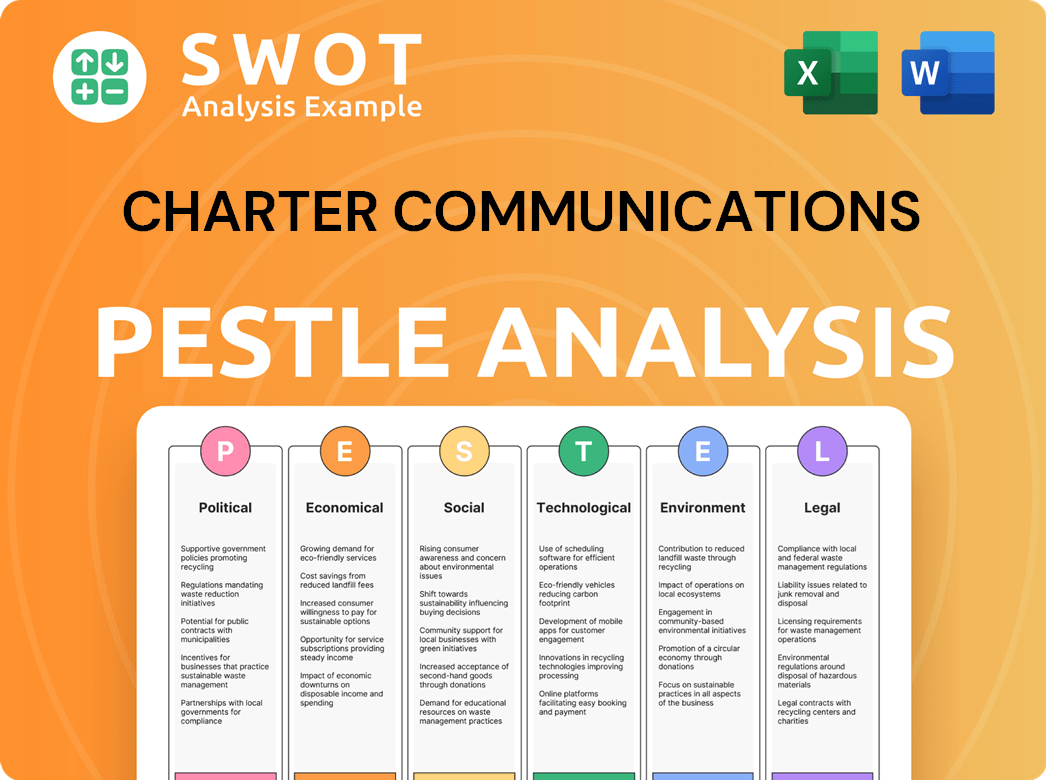

Charter Communications PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Charter Communications’s Growth Forecast?

Charter Communications' financial strategy focuses on significant capital investments and strategic revenue growth, positioning it for future expansion within the telecommunications industry. The company's financial performance in 2024 and early 2025 highlights its approach to balancing investment with financial discipline. This includes a strong emphasis on expanding its network and enhancing its service offerings to maintain a competitive edge.

The company's financial outlook is shaped by its commitment to infrastructure upgrades and strategic initiatives. These investments are designed to increase its market share and improve customer satisfaction. By focusing on both revenue growth and efficient financial management, Charter aims to create long-term value for its shareholders.

For a deeper understanding of the company's origins and evolution, consider exploring the Brief History of Charter Communications.

In 2024, Charter reported total revenue of $55.1 billion, marking a 0.9% increase from the previous year. Net income reached $5.1 billion, demonstrating the company's profitability. Adjusted EBITDA for the year was $22.6 billion, reflecting a 3.1% increase, which indicates the company's operational efficiency and profitability.

Charter plans to invest approximately $12 billion in capital expenditures in 2025, which is expected to be a peak investment year. This includes around $4.2 billion for line extensions, particularly for rural broadband expansion, and $1.5 billion for network evolution. These investments are aimed at enhancing its infrastructure and expanding its service reach.

In the first quarter of 2025, Charter's residential mobile service revenue increased by 33.5%, and residential internet revenue grew by 1.8%. Total revenue for Q1 2025 was $13.7 billion, a 0.4% increase year-over-year. Net income for the quarter was $1.2 billion, with Adjusted EBITDA growing by 4.8% to $5.8 billion.

Analysts project Charter's annual earnings growth rate at 13.77%, with earnings expected to reach $5.55 billion in 2025. The company aims to maintain its debt-to-EBITDA ratio in the low-4x area through 2026 and around 4.0x in 2027. Free cash flow (FCF) for 2024 was $4.3 billion, and is projected to reach nearly $8.0 billion by 2027.

Charter's revenue growth is supported by residential mobile services, which saw a significant increase. Advertising sales also contributed positively, showing strong growth in Q4 2024. These revenue streams help to offset declines in internet customer numbers.

The company's capital expenditures are strategically allocated to expand its network, especially in rural areas, and to evolve its existing infrastructure. These investments are crucial for maintaining its competitive position in the telecommunications industry.

Charter is committed to managing its debt levels to support its growth strategy. The company's goal is to maintain a sustainable debt-to-EBITDA ratio, ensuring financial stability while investing in future growth opportunities. This approach is key to long-term investment potential.

The telecommunications industry is competitive, with companies like Comcast as key players. Charter's strategy includes expanding its services and enhancing its network to compete effectively. The company's expansion plans are focused on both customer acquisition and retention.

While there was a decline in internet customers in Q4 2024, Charter is focusing on growing its customer base through mobile services and strategic expansion. This includes offering competitive internet speed and pricing to attract and retain customers.

Charter is investing in technological advancements to improve its services and enhance customer satisfaction. This includes network evolution and the introduction of new services. These advancements are crucial for maintaining its competitive edge.

Charter Communications Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Charter Communications’s Growth?

The growth strategy and future prospects of Charter Communications face significant challenges. These obstacles span market competition, regulatory changes, financial burdens, and operational hurdles. Understanding these risks is crucial for assessing the company's long-term viability and investment potential.

Competition from fixed wireless access (FWA) and fiber-to-the-home (FTTH) providers intensifies the pressure. Regulatory shifts and a substantial debt load further complicate the landscape. Operational issues, such as natural disasters and integration challenges, add to the complexity.

The telecommunications industry, including Charter Communications, is in a state of constant evolution. The competitive environment and regulatory landscape require careful navigation to ensure sustained growth. For a deeper dive, consider the Target Market of Charter Communications to understand its customer base.

Fixed wireless access (FWA) providers are gaining significant market share, primarily due to their competitive pricing and easy setup. They are projected to add approximately 3.5 million subscribers annually through 2026. Fiber-to-the-home (FTTH) providers are also expanding rapidly.

The expiration of the Affordable Connectivity Program (ACP) in mid-2024 led to a decline of 177,000 internet customers in Q4 2024. Ongoing regulatory changes at federal, state, and local levels could increase costs and competition. There is also a risk of reclassifying internet services as regulated telecommunications services.

Charter Communications carries a substantial debt burden, reported at approximately $93.8 billion at the end of 2024. The debt-to-equity ratio is nearing 4.77, which could limit the company's ability to invest in infrastructure, especially with rising interest rates.

Natural disasters, such as the California wildfires in January 2025, caused lost passings and customer relationships. This resulted in one-time bill credits and infrastructure rebuild costs. The proposed acquisition of Cox Communications presents integration risks.

FTTH expansion is expected to cover 65%-70% of Charter's footprint in the next 2-3 years, up from slightly over 50% today. This increased coverage could intensify competition and impact customer acquisition.

Integrating Cox Communications, with its higher broadband average revenue per user (ARPU), presents challenges. Rebranding and unifying pricing and packaging require careful execution to avoid customer churn and maintain revenue streams.

Charter Communications Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Charter Communications Company?

- What is Competitive Landscape of Charter Communications Company?

- How Does Charter Communications Company Work?

- What is Sales and Marketing Strategy of Charter Communications Company?

- What is Brief History of Charter Communications Company?

- Who Owns Charter Communications Company?

- What is Customer Demographics and Target Market of Charter Communications Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.