Charter Communications Bundle

Who Really Owns Charter Communications?

Understanding the ownership structure of a telecommunications giant like Charter Communications is key to grasping its strategic moves and market dominance. The massive 2016 acquisition of Time Warner Cable and Bright House Networks, a deal exceeding $65 billion, dramatically reshaped the cable industry. This pivotal merger solidified Charter's position as a leading force, but who truly benefits from its success?

Charter Communications, operating primarily under the Spectrum brand, has a complex ownership landscape. Founded in 1993, with roots tracing back to 1980, Charter has evolved significantly. This evolution is crucial for understanding its current market position and future prospects. Discover the key players shaping Charter's destiny and how their influence impacts its direction. For a deeper dive into the company's strategic positioning, consider exploring the Charter Communications SWOT Analysis.

Who Founded Charter Communications?

The story of Charter Communications, Inc., begins in 1993, with its formal incorporation. The company was established by Barry Babcock, Jerald Kent, and Howard Wood, who brought extensive experience from Cencom Cable Television.

Their combined expertise in cable operations was crucial in the early stages of the company. Charter initially focused on acquiring cable systems, particularly in less-served rural areas, setting the stage for its future growth.

Early financial backing came from Crown Media Inc., a subsidiary of Hallmark Cards Inc., which invested in the company's initial phase.

Charter Communications was founded by Barry Babcock, Jerald Kent, and Howard Wood. They were all former executives from Cencom Cable Television.

Crown Media Inc., a subsidiary of Hallmark Cards Inc., provided early financial backing. They made an initial investment and received a significant non-voting stake.

In 1998, Paul Allen acquired a controlling interest in Charter. This acquisition was a major turning point, significantly boosting Charter's subscriber base.

Under Paul Allen's leadership, Charter pursued an aggressive acquisition strategy. The company made numerous acquisitions in a short period.

The acquisition by Paul Allen in 1998 marked a pivotal moment for Charter. Allen's investment of $4.5 billion, combined with the merger of Marcus Cable, propelled Charter into a phase of rapid expansion. By 1998, Charter had grown its subscriber base to one million customers. This set the stage for an aggressive acquisition strategy, with over ten major acquisitions in 1999 alone, solidifying its position in the cable industry. To learn more about the company, you can explore the Target Market of Charter Communications.

The early years of Charter Communications were defined by strategic acquisitions and significant investments. These factors were instrumental in shaping the company's growth trajectory.

- Founding in 1993 by former Cencom executives.

- Initial backing from Crown Media Inc.

- Paul Allen's $4.5 billion acquisition in 1998.

- Rapid subscriber growth to one million by 1998.

- Aggressive acquisition strategy in 1999.

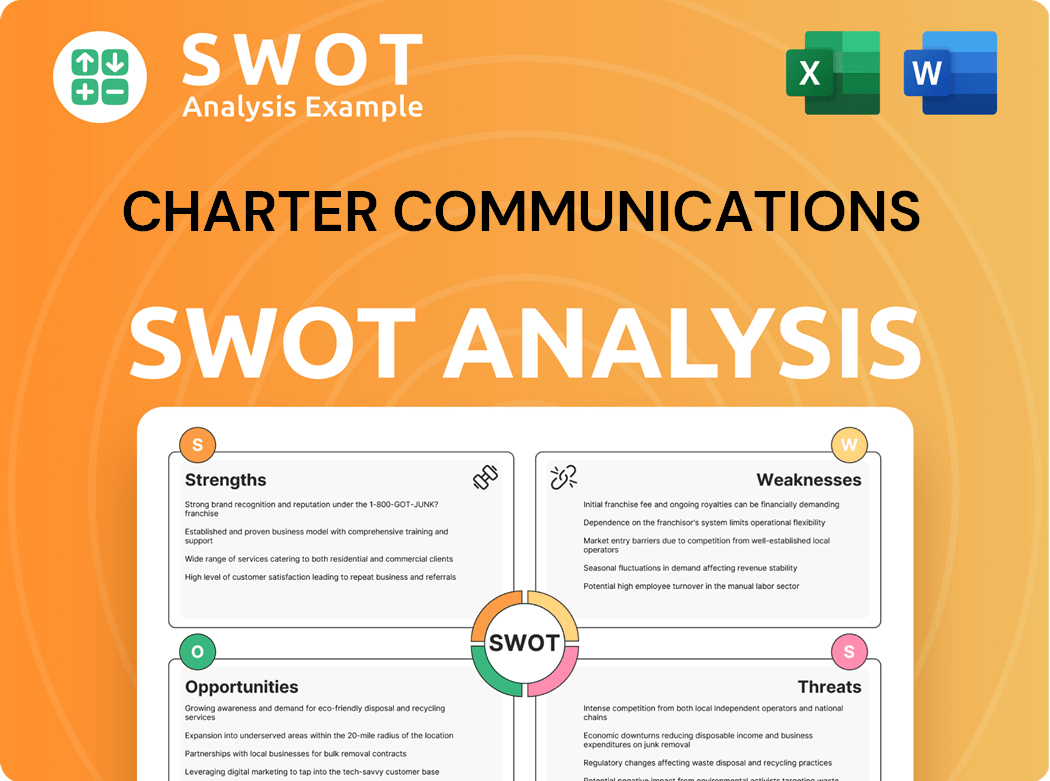

Charter Communications SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Charter Communications’s Ownership Changed Over Time?

The evolution of Charter Communications' ownership has seen significant shifts since its initial public offering (IPO) in November 1999. The IPO, which occurred on the NASDAQ under the ticker symbol CHTR, raised approximately $3.5 billion by selling 170 million shares at $19 each. This marked the beginning of its journey as a publicly traded company and set the stage for future ownership changes.

A pivotal moment occurred in late 2012 and early 2013 when Liberty Media, led by John C. Malone, became Charter's largest shareholder with a 27.3% stake. This was later restructured, with Liberty's holdings spun off into Liberty Broadband Corporation in November 2014. More recently, in May 2025, Charter announced a merger with Cox Communications, which is set to reshape its ownership structure once again.

| Shareholder | Approximate Stake (May 2025) | Notes |

|---|---|---|

| Liberty Broadband Corporation | 31.8% | Largest shareholder as of May 2025. |

| Advance Publications, Inc. | 14.2% | Second-largest shareholder. |

| Cox Enterprises (Post-Merger) | 23% | Projected stake after the merger with Cox Communications. |

As of May 2025, Liberty Broadband Corporation remains the primary shareholder, holding approximately 31.8% of Charter Communications' shares. Advance Publications, Inc. holds about 14.2%. Other significant institutional investors include Dodge & Cox, Capital Research and Management Company, The Vanguard Group, Inc., BlackRock, Inc., and State Street Global Advisors, Inc. The planned merger with Cox Communications is expected to significantly alter this landscape, with Cox Enterprises projected to own approximately 23% of the combined entity. This strategic move is poised to create the nation's largest cable and broadband provider. For more insights, you can check out the business model of Charter Communications.

Charter Communications has undergone significant ownership changes since its IPO.

- Liberty Broadband Corporation is currently the largest shareholder.

- The merger with Cox Communications will reshape the ownership structure.

- Advance Publications, Inc. is a major shareholder.

- The company is publicly traded on the NASDAQ under the symbol CHTR.

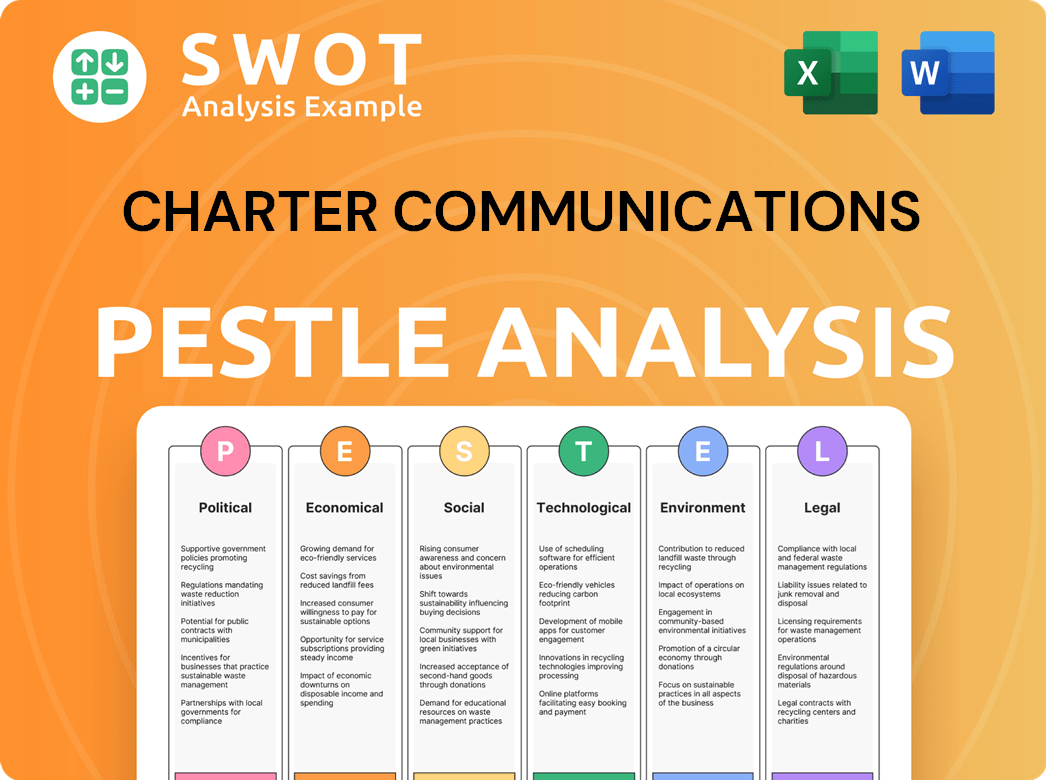

Charter Communications PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Charter Communications’s Board?

The current Board of Directors for Charter Communications, also known as Spectrum, includes Eric L. Zinterhofer as Non-Executive Chairman. Other board members are W. Lance Conn, Kim C. Goodman, John D. Markley, Jr., David C. Merritt, Steven A. Miron, Balan Nair, Michael A. Newhouse, Martin E. Patterson, Mauricio Ramos, Carolyn J. Slaski, and J. David Wargo. Christopher L. Winfrey serves as the President, Chief Executive Officer, and Director. This diverse board oversees the strategic direction of the company, ensuring alignment with shareholder interests and regulatory requirements.

The board's composition reflects a blend of experience in telecommunications, finance, and media. This mix is crucial for navigating the complex landscape of the industry, including technological advancements, competitive pressures, and evolving consumer preferences. The board's decisions significantly impact the company's performance and its ability to deliver value to its stakeholders. Understanding the board's structure and the influence of major shareholders is key to grasping the dynamics of Charter ownership.

| Board Member | Position | Key Role |

|---|---|---|

| Eric L. Zinterhofer | Non-Executive Chairman | Oversees board activities, ensures effective governance. |

| Christopher L. Winfrey | President, CEO, and Director | Leads the company's operations and strategic initiatives. |

| W. Lance Conn | Director | Contributes to strategic planning and oversight. |

| Kim C. Goodman | Director | Provides expertise in various areas, including finance. |

| John D. Markley, Jr. | Director | Offers insights on industry trends and competitive landscape. |

| David C. Merritt | Director | Brings experience in telecommunications and technology. |

| Steven A. Miron | Director | Contributes to strategic planning and oversight. |

| Balan Nair | Director | Provides expertise in technology and operations. |

| Michael A. Newhouse | Director | Offers insights on media and content distribution. |

| Martin E. Patterson | Director | Contributes to strategic planning and oversight. |

| Mauricio Ramos | Director | Offers insights on industry trends and competitive landscape. |

| Carolyn J. Slaski | Director | Brings experience in finance and governance. |

| J. David Wargo | Director | Contributes to strategic planning and oversight. |

Major shareholders like Liberty Broadband and Advance Publications wield considerable influence over Charter Communications. With the proposed merger with Cox Communications, Cox Enterprises is set to become the largest shareholder with a 23% equity stake. Alex Taylor, CEO of Cox Enterprises, will join the board as Chairman, while Eric Zinterhofer will become the lead independent director. This shift in ownership structure underscores the importance of understanding the company's shareholder base when assessing its strategic direction and future performance. For more insights, explore the Marketing Strategy of Charter Communications.

Understanding who owns Charter and the structure of its board is crucial for investors and stakeholders.

- The board includes experienced individuals from various sectors.

- Major shareholders influence strategic decisions.

- The ownership structure is evolving with the proposed merger.

- Knowing the board members helps to understand the company's direction.

Charter Communications Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Charter Communications’s Ownership Landscape?

Recent developments significantly influence the ownership profile of Charter Communications. In 2024, the company reported revenues of $55.1 billion and a net income of $5.1 billion. The first quarter of 2025 saw revenues reach $13.7 billion, a slight increase year-over-year. The company's services included 30.0 million Internet customers and 10.4 million mobile lines as of March 31, 2025. Furthermore, the company added 514,000 mobile lines in Q1 2025, demonstrating continued growth in this area. These financial and operational metrics provide a snapshot of the company's performance and its position in the market.

A major change on the horizon is the planned merger with Cox Communications, announced on May 16, 2025, valued at $34.5 billion. This transaction will see the combined entity retain the Cox Communications name but adopt Charter's Spectrum branding for consumer-facing operations. Post-merger, Cox Enterprises will hold 23% of the combined company, and Liberty Broadband will no longer be a direct shareholder in Charter. This merger is expected to reshape the competitive landscape and influence the ownership structure of the company.

| Metric | 2024 | Q1 2025 |

|---|---|---|

| Revenue (Billions) | $55.1 | $13.7 |

| Net Income (Billions) | $5.1 | N/A |

| Internet Customers (Millions) | N/A | 30.0 |

| Mobile Lines (Millions) | N/A | 10.4 |

Institutional ownership in the telecommunications sector is on the rise. As of June 12, 2025, Charter Communications had 1669 institutional owners, collectively holding 134,831,045 shares, which represents approximately 61.1% of the company's shares. In 2024, the company repurchased 4.3 million shares of its Class A common stock and Charter Holdings common units for around $1.3 billion. Looking ahead, Charter Communications plans capital expenditures of approximately $12 billion in 2025, with a focus on network evolution and expansion initiatives. The company is also planning to launch a streaming bundle for TV Select customers in the first half of 2025, indicating its strategic moves in the market. For more insights into the company's strategies, consider the growth strategy of Charter Communications.

Institutional investors hold a significant portion of Charter Communications' shares, reflecting confidence in the company's future. The upcoming merger with Cox Communications will also reshape the ownership structure.

Charter Communications reported strong revenues in 2024 and a slight increase in Q1 2025. The company continues to invest heavily in network expansion and evolution.

The company is focusing on network expansion and is set to launch a streaming bundle. The merger with Cox Communications is a major strategic move.

Charter Communications is positioned for continued growth, with a focus on expanding its customer base and service offerings. The merger will significantly impact the company's future.

Charter Communications Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Charter Communications Company?

- What is Competitive Landscape of Charter Communications Company?

- What is Growth Strategy and Future Prospects of Charter Communications Company?

- How Does Charter Communications Company Work?

- What is Sales and Marketing Strategy of Charter Communications Company?

- What is Brief History of Charter Communications Company?

- What is Customer Demographics and Target Market of Charter Communications Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.