Clean Harbors Bundle

Can Clean Harbors Continue Its Dominance in the Environmental Services Sector?

Clean Harbors, a titan in environmental and industrial services, has charted an impressive course since its inception in 1980. From its early days providing hazardous waste disposal, the company has evolved, notably through the 2012 Safety-Kleen acquisition, into a comprehensive environmental solutions provider. Today, Clean Harbors stands as a multi-billion dollar enterprise, serving a diverse clientele across North America.

This article delves into the Clean Harbors SWOT Analysis, exploring its ambitious Clean Harbors growth strategy and examining the Clean Harbors future prospects within the dynamic environmental services market. We'll analyze how Clean Harbors plans to navigate the complexities of the waste management industry, including stringent regulations and growing sustainability demands, to maintain its leadership position. The exploration will cover strategic initiatives, technological advancements, and financial planning, providing insights into the company's long-term growth potential and its ability to overcome potential hurdles.

How Is Clean Harbors Expanding Its Reach?

The company's expansion strategy focuses on broadening its market presence and service capabilities. This involves both organic growth and strategic acquisitions. The company aims to enhance its ability to serve a wider array of clients by entering new geographical markets, particularly in regions with increasing industrial activity and environmental compliance needs.

A key element of the company's strategy involves entering new geographical markets. The company is committed to developing and offering new solutions that address emerging environmental challenges and customer requirements. This includes expanding its offerings in areas such as industrial cleaning, emergency response, and specialized waste streams, aiming to provide a more holistic suite of environmental services.

Mergers and acquisitions (M&A) are a cornerstone of the company's expansion strategy. These initiatives are primarily driven by the need to diversify revenue streams, enhance competitive advantage, and stay ahead of industry changes. The company frequently assesses potential targets that align with its strategic objectives, such as those that can bolster its hazardous waste management capabilities or expand its industrial services portfolio.

The company actively seeks to expand its footprint in key industrial corridors across North America. This expansion enhances its ability to serve a wider array of clients. The focus is on regions with growing industrial activity and increasing environmental compliance needs.

The company is committed to developing and offering new solutions. This includes expanding offerings in industrial cleaning, emergency response, and specialized waste streams. The goal is to provide a more comprehensive suite of environmental services to meet evolving customer needs and address emerging environmental challenges.

M&A remains a crucial part of the company's expansion strategy. The company frequently assesses potential targets that align with its strategic objectives. These acquisitions aim to diversify revenue streams and enhance competitive advantage within the environmental services market.

The company's capital allocation strategy supports expansion efforts. Investments are focused on initiatives that promise strong returns and contribute to long-term sustainable growth. This strategic approach ensures resources are directed towards opportunities that maximize value and support the company's future prospects.

The company's growth strategy includes geographic expansion, service diversification, and strategic acquisitions. These initiatives are supported by a robust capital allocation strategy. The company's focus on environmental remediation services and waste disposal facilities positions it well for long-term growth.

- Entering new geographical markets to increase market presence.

- Developing and offering new environmental services to meet customer needs.

- Strategic mergers and acquisitions to enhance capabilities and market share.

- Investing in initiatives that promise strong returns and sustainable growth.

Clean Harbors SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Clean Harbors Invest in Innovation?

Clean Harbors' growth strategy heavily relies on innovation and technology to maintain its competitive edge in the environmental services market. The company continually invests in research and development (R&D) to improve its operational efficiency and develop advanced solutions for waste management and environmental remediation. This approach is crucial for addressing the complex challenges of hazardous waste disposal and meeting evolving regulatory requirements.

The company's commitment to digital transformation and sustainability initiatives further underscores its forward-thinking approach. By implementing automation, data analytics, and exploring technologies like IoT, Clean Harbors aims to optimize its operations and reduce its environmental footprint. These efforts are designed to enhance service delivery and support clients in achieving their sustainability goals, driving long-term growth potential.

Clean Harbors' focus on in-house development and potential collaborations with external innovators allows it to introduce new platforms and technical capabilities. This strategy strengthens its competitive position and contributes directly to its growth objectives. The company's continuous investment in technological upgrades and process improvements highlights its dedication to maintaining leadership in the environmental services sector.

Clean Harbors allocates resources to research and development to refine waste treatment processes. This includes exploring advanced methods for waste reduction, recycling, and resource recovery. These investments align with broader sustainability goals and enhance operational efficiency.

The company is implementing digital solutions across its operations. Automation in facilities and logistics optimizes workflows and reduces costs. Data analytics and IoT (Internet of Things) are used for real-time monitoring of waste streams and equipment.

Clean Harbors integrates environmentally sound practices into its core business model. It explores innovative solutions for a circular economy. The company aims to minimize its environmental footprint while helping clients achieve their sustainability objectives.

Continuous investment in technological upgrades and process improvements is a key strategy. This ensures the company maintains its leadership in the environmental services sector. It focuses on in-house development and potentially collaborates with external innovators.

By focusing on in-house development and potential collaborations with external innovators, Clean Harbors aims to introduce new platforms and technical capabilities. These advancements contribute directly to its growth objectives. They also strengthen its competitive edge.

Clean Harbors leverages technology and innovation as critical drivers for sustained growth. The company focuses on enhancing operational efficiency and improving service delivery. It also develops advanced environmental solutions.

Clean Harbors employs several key technologies and strategies to drive its growth and maintain its position in the waste management industry. These include investments in R&D, digital transformation, and sustainability initiatives. These efforts support the company's long-term growth potential and its ability to meet the evolving demands of the environmental services market.

- Research and Development: Ongoing investment in R&D to improve waste treatment processes and develop new technologies.

- Digital Transformation: Implementing automation and data analytics to optimize operations and reduce costs.

- Sustainability Initiatives: Integrating environmentally sound practices and exploring solutions for a circular economy.

- In-House Development: Focusing on internal innovation and potential collaborations with external innovators.

- Continuous Improvement: Regularly upgrading technologies and processes to maintain a competitive edge.

Clean Harbors PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Clean Harbors’s Growth Forecast?

Clean Harbors anticipates continued robust financial performance, supported by its strategic growth initiatives and the essential nature of its services. The company's financial outlook reflects confidence in its ability to maintain strong earnings and operational efficiency within the environmental services market.

For the full year 2024, Clean Harbors projects revenue between $5.42 billion and $5.62 billion, indicating a steady upward trend. This growth is driven by the non-discretionary demand for its services, which include hazardous waste disposal and environmental remediation services, making it a key player in the waste management industry.

Adjusted EBITDA is forecasted to be between $910 million and $950 million, demonstrating healthy profitability margins. Clean Harbors' financial ambitions are supported by its consistent historical performance, which has shown resilience even amidst economic fluctuations. You can learn more about the company's financial strategies by reviewing information on Owners & Shareholders of Clean Harbors.

Clean Harbors anticipates revenue in the range of $5.42 billion to $5.62 billion for 2024. This projection highlights the company's expectation of continued growth in the environmental services market.

Adjusted EBITDA is forecasted to be between $910 million and $950 million. This reflects the company's expectation of maintaining strong profitability margins.

Investment levels are expected to align with the growth strategy. Capital will be allocated towards expansion initiatives, technological upgrades, and potential acquisitions.

Clean Harbors maintains a solid balance sheet to support ongoing operations and strategic investments. The company often uses operating cash flow and strategic financing.

Clean Harbors' financial strategy focuses on sustainable growth, driven by market demand and operational execution. The company's performance is shaped by several factors:

- Non-discretionary demand for environmental and industrial services.

- Prudent financial management and strategic investments.

- Consistent historical performance, even amidst economic fluctuations.

- Focus on expanding services like hazardous waste disposal and environmental remediation.

Clean Harbors Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Clean Harbors’s Growth?

The path to growth for Clean Harbors, like any company in the environmental services market, is fraught with potential risks and obstacles. These challenges span from competitive pressures and regulatory changes to operational hurdles and the need to adapt to technological advancements. Understanding these risks is crucial for assessing the company's long-term potential and making informed investment decisions.

Competition within the waste management industry is fierce, with both large and small players vying for market share. Regulatory shifts, such as stricter environmental standards for hazardous waste disposal, can increase compliance costs. Supply chain disruptions and internal resource constraints, including a shortage of skilled labor, also pose significant challenges to Clean Harbors' operational efficiency and expansion plans.

Clean Harbors' ability to navigate these challenges is key to its future prospects. The company's strategies for mitigating risks include diversification of service offerings, robust risk management frameworks, and scenario planning to prepare for various contingencies. These proactive measures are essential for maintaining a competitive edge and ensuring sustained revenue growth.

The Environmental services market is highly competitive, with numerous companies vying for contracts. This competition can affect pricing and market share. The competitive landscape includes both national and regional players, influencing Clean Harbors' ability to expand and maintain profitability.

Changes in environmental regulations, particularly regarding hazardous waste disposal and emissions standards, can significantly impact operations. Stricter regulations may lead to increased compliance costs and require investments in new technologies. Staying ahead of regulatory changes is critical for long-term sustainability.

Reliance on specialized equipment and chemicals makes Clean Harbors vulnerable to supply chain disruptions. Delays in receiving essential materials can impact service delivery timelines. Diversifying suppliers and maintaining strategic inventory levels can help mitigate these risks.

The rapid pace of technological innovation presents both opportunities and risks. Failure to adapt to new technologies could render existing methods less efficient or obsolete. Investing in research and development and staying abreast of technological advancements are crucial for maintaining a competitive edge.

Shortages of skilled labor and specialized technical expertise can hinder the company's ability to execute its expansion plans. Addressing these constraints through training programs and strategic hiring is essential. The availability of qualified personnel directly impacts service quality and operational efficiency.

Economic downturns can affect demand for environmental services. During periods of economic uncertainty, companies may reduce spending on waste management and remediation projects. Diversifying its customer base and service offerings can help Clean Harbors weather economic volatility.

Clean Harbors employs several strategies to mitigate risks, including diversification of services and customer base. This approach reduces reliance on any single sector or client. Robust risk management frameworks are used to identify and evaluate potential threats. Scenario planning prepares the company for various contingencies, such as economic downturns or regulatory shifts.

The company's financial performance is closely tied to its ability to manage these risks effectively. Revenue Streams & Business Model of Clean Harbors provides additional insights into how the company generates revenue. Clean Harbors' market share and competitive position are influenced by its ability to adapt to changing market dynamics and regulatory requirements. The company's recent earnings reports and financial performance analysis provide insight into its current standing.

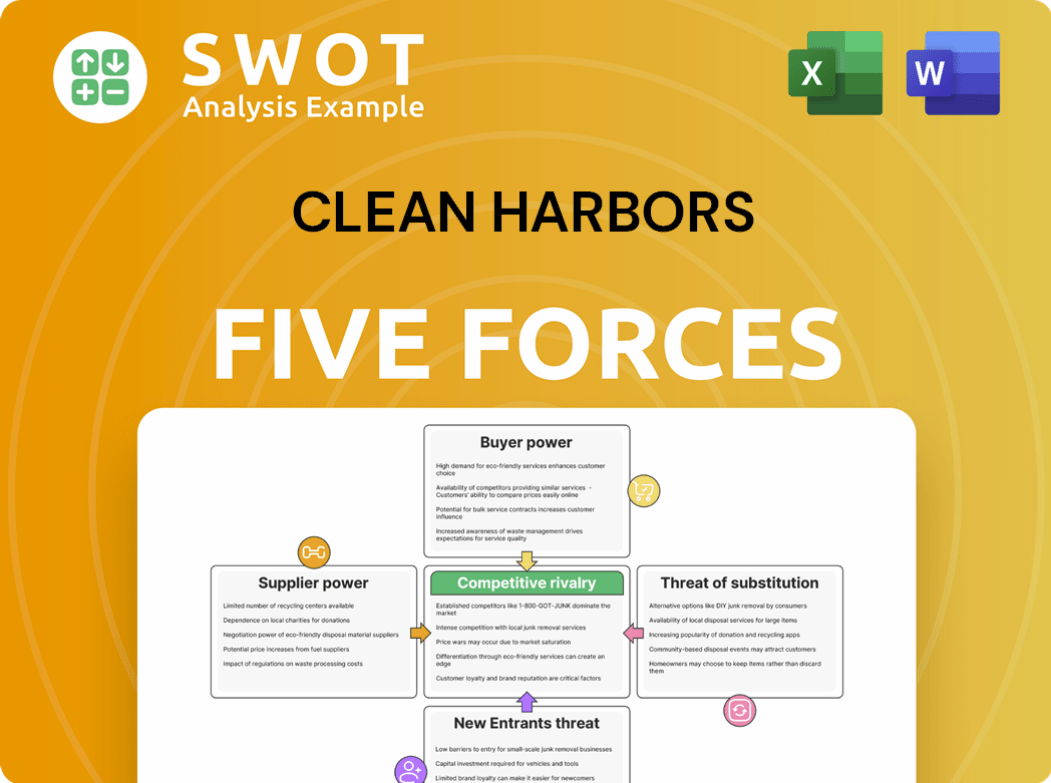

Clean Harbors Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Clean Harbors Company?

- What is Competitive Landscape of Clean Harbors Company?

- How Does Clean Harbors Company Work?

- What is Sales and Marketing Strategy of Clean Harbors Company?

- What is Brief History of Clean Harbors Company?

- Who Owns Clean Harbors Company?

- What is Customer Demographics and Target Market of Clean Harbors Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.