Dr. Martens Bundle

Can Dr. Martens March Forward?

Dr. Martens, a brand synonymous with iconic footwear, is not just resting on its laurels. The company's recent investment in sustainable manufacturing signals a commitment to an environmentally conscious future, a move that is reshaping its Dr. Martens SWOT Analysis. This strategic shift is vital for capturing the evolving consumer demand for ethical products and maintaining its competitive edge. From its humble beginnings, Dr. Martens has transformed into a global powerhouse, but what does the future hold for this iconic brand?

This deep dive into Dr. Martens' growth strategy and future prospects will explore its market position, brand strategy, and financial performance. We'll examine its expansion plans, particularly in key markets like Asia, and assess its sustainability initiatives. Furthermore, this analysis will delve into the company's online sales strategy, target market demographics, and the impact of social media on its brand. By understanding these elements, we can better evaluate Dr. Martens' ability to navigate the footwear industry trends and achieve sustainable growth.

How Is Dr. Martens Expanding Its Reach?

The expansion initiatives of Dr. Martens are central to its growth strategy, focusing on both geographical and product diversification. The company aims to broaden its global footprint, particularly in markets with high growth potential, while also expanding its product offerings beyond core footwear. These strategies are designed to increase revenue streams and enhance brand presence in key markets.

A key aspect of Dr. Martens' expansion strategy involves strengthening its direct-to-consumer (DTC) channels. This includes both e-commerce and retail store expansions, especially in the United States, Europe, and Asia. The shift towards DTC allows for greater control over the customer experience and potentially higher profit margins, which is crucial for long-term financial performance. Revenue Streams & Business Model of Dr. Martens provides additional insights into the company's financial structure.

In the fiscal year 2024, Dr. Martens reported a 2% constant currency revenue growth, with DTC revenue up 13% at constant currency. DTC sales reached 62% of total revenue, highlighting the success of this strategy. The company is also exploring product diversification, including apparel and accessories, to capture a larger share of the lifestyle market. New designs and collaborations are continually being developed to keep up with evolving fashion trends.

Dr. Martens is actively targeting underserved international markets to boost its global presence. This expansion is a key part of its growth strategy, focusing on regions with strong growth potential. The company aims to increase its market share by establishing a stronger presence in these areas.

The company is focusing on expanding its DTC channels, including e-commerce and retail stores. This strategy is particularly emphasized in the United States, Europe, and Asia. DTC expansion allows for greater control over brand experience and potentially higher profit margins.

Dr. Martens is expanding its product categories beyond its core boot and shoe offerings. This includes expanding its apparel and accessories lines to capture a larger share of the lifestyle market. The company is also focusing on new product development to maintain consumer interest.

The company plans to open new retail stores in key cities to enhance brand visibility and accessibility. These new locations are designed to strengthen the brand's presence and improve customer engagement. This strategy supports the overall growth strategy.

Dr. Martens' expansion strategy includes international market growth, DTC channel expansion, product diversification, and retail store openings. These initiatives are designed to drive revenue growth and strengthen the brand's position in the market. The company is also focused on new product development and collaborations to maintain consumer interest.

- International Expansion: Targeting underserved markets for growth.

- DTC Focus: Strengthening e-commerce and retail presence.

- Product Diversification: Expanding beyond footwear into apparel and accessories.

- New Designs: Continually refreshing product lines with new designs and collaborations.

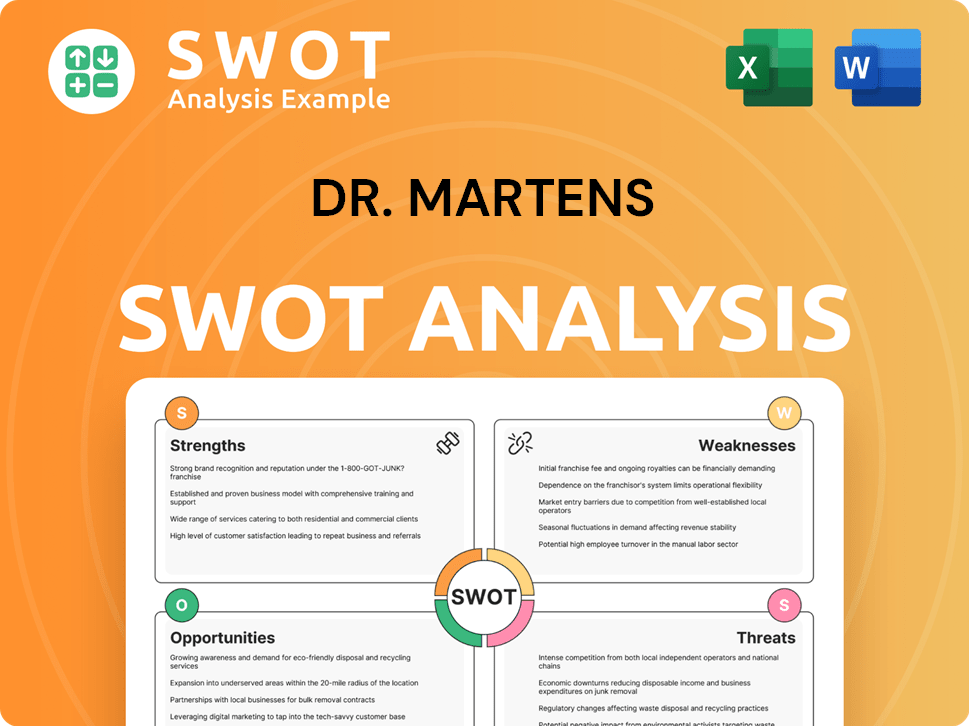

Dr. Martens SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Dr. Martens Invest in Innovation?

The company is increasingly leveraging technology and innovation to drive sustained growth and enhance its operational efficiency. The focus is on digital transformation within its retail and e-commerce operations to improve the customer experience and streamline supply chain management. Digital solutions are being implemented to gain deeper insights into consumer behavior and market trends, enabling more agile product development and targeted marketing campaigns. This approach is crucial for the company's overall Dr. Martens growth strategy.

A key aspect of the company's innovation strategy involves sustainability initiatives, often incorporating technological advancements in materials and manufacturing processes. This includes exploring more environmentally friendly materials and production methods to reduce its carbon footprint. The company's commitment to durable footwear also inherently contributes to sustainability by extending product lifespans. These efforts are aligned with growing consumer demand for sustainable products, influencing the Dr. Martens future prospects.

While specific details on extensive R&D investments in cutting-edge technologies like AI or IoT are not broadly publicized, the company's continuous evolution of its iconic styles and expansion into new product categories demonstrates an ongoing commitment to innovation within its established brand identity. The company's approach to innovation supports its Dr. Martens company analysis.

The company is focused on optimizing its online platforms to improve the customer experience. This includes streamlining supply chain management and enhancing data analytics capabilities to gain deeper insights into consumer behavior.

The company is committed to sustainability, often involving technological advancements in materials and manufacturing. They are exploring more environmentally friendly materials and production methods to reduce their carbon footprint.

The company's continuous evolution of its iconic styles and expansion into new product categories demonstrates an ongoing commitment to innovation. This approach supports its brand identity and growth.

Investing in digital solutions to gain deeper insights into consumer behavior and market trends is a key part of their strategy. This allows for more agile product development and targeted marketing campaigns.

Streamlining supply chain management is a focus area within the digital transformation efforts. This enhances operational efficiency and supports overall growth.

Improving the customer experience through online platform optimization is a priority. This is a key component of their digital transformation strategy.

The company's approach to innovation is multifaceted, encompassing digital transformation, sustainability, and continuous product development. The focus on digital solutions, including enhanced data analytics, supports more targeted marketing and agile product development. Sustainability initiatives, often involving technological advancements, align with consumer demand. The ongoing evolution of iconic styles and expansion into new categories demonstrates a commitment to innovation within its established brand. For a deeper understanding of the company's core values, consider reading about the Mission, Vision & Core Values of Dr. Martens.

The company focuses on digital transformation, sustainability, and product development to drive growth and efficiency. This includes optimizing online platforms, streamlining supply chains, and leveraging data analytics.

- Digital Transformation: Optimizing online platforms and enhancing data analytics.

- Sustainability Initiatives: Exploring eco-friendly materials and production methods.

- Product Development: Continuous evolution of styles and expansion into new categories.

- Supply Chain Management: Streamlining operations for greater efficiency.

- Customer Experience: Improving online platforms for a better customer journey.

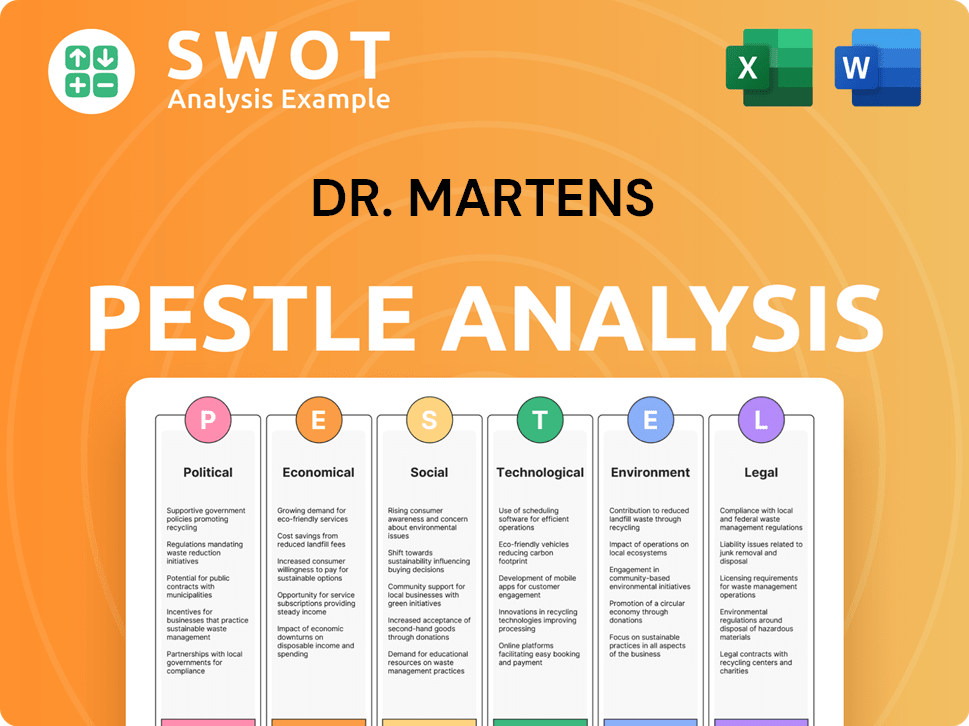

Dr. Martens PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Dr. Martens’s Growth Forecast?

The financial outlook for Dr. Martens reflects a period of strategic investment aimed at driving future growth. The company's performance in fiscal year 2024 shows a mixed picture, with revenue increasing at constant currency but declining in reported terms. This indicates the complexities of navigating global markets and managing currency fluctuations. Understanding the Marketing Strategy of Dr. Martens is crucial for assessing its financial trajectory.

In fiscal year 2024, Dr. Martens reported a revenue increase of 2% at constant currency, reaching £972.5 million. However, reported revenue saw a 5% decline. The direct-to-consumer (DTC) channel showed strong growth, increasing by 13% at constant currency and accounting for 62% of total revenue. This shift towards direct sales is a key element of the company's brand strategy. The wholesale business, however, experienced a 16% decline at constant currency, indicating challenges in certain markets.

Looking ahead, Dr. Martens anticipates a high single-digit percentage decline in revenue for fiscal year 2025. The wholesale business is expected to be down by a double-digit percentage, reflecting ongoing market challenges. Despite these short-term headwinds, the company is investing in its future, with plans to increase capital expenditure and focus on long-term growth.

In fiscal year 2024, revenue increased by 2% at constant currency, reaching £972.5 million. However, reported revenue decreased by 5% due to currency impacts. This highlights the importance of international market growth strategies.

DTC revenue grew by 13% at constant currency, accounting for 62% of total revenue. This strong performance indicates a successful online sales strategy and customer loyalty programs.

The wholesale business declined by 16% at constant currency, impacting overall revenue. This decline underscores the need for a diversified market strategy and potential adjustments to retail store locations.

The company expects a high single-digit percentage decline in revenue, with the wholesale business down by a double-digit percentage. This outlook considers the footwear industry trends and competitive landscape analysis.

For fiscal year 2025, Dr. Martens projects its EBITDA margin to be approximately 13% to 15%, a decrease from the 18% achieved in fiscal year 2024. This is due to factors such as inflation, increased marketing spend, and the impact of the declining wholesale business. The company plans to increase its capital expenditure to between £70 million and £80 million in fiscal year 2025, up from £52.7 million in fiscal year 2024. This increased investment is aimed at supporting long-term growth initiatives, including potential expansion plans in Asia and other international markets. The long-term financial goals include achieving mid-single-digit revenue growth and an EBITDA margin in the high-teens.

EBITDA margin is projected to be approximately 13% to 15% in fiscal year 2025, down from 18% in 2024. This reflects the impact of inflation and increased marketing spend.

Capital expenditure will increase to between £70 million and £80 million in fiscal year 2025. This investment supports infrastructure and strategic initiatives.

Long-term goals include mid-single-digit revenue growth and an EBITDA margin in the high-teens. This demonstrates the company's commitment to sustained financial performance.

The company is focusing on strategic investments to improve its financial performance. These investments support various initiatives, including new product development and digital marketing strategy.

The forecast reflects ongoing challenges in certain wholesale markets. Understanding the competitive landscape analysis is critical for navigating these challenges.

The company's long-term strategy likely includes sustainability initiatives. These initiatives can enhance brand value and appeal to a broader customer base.

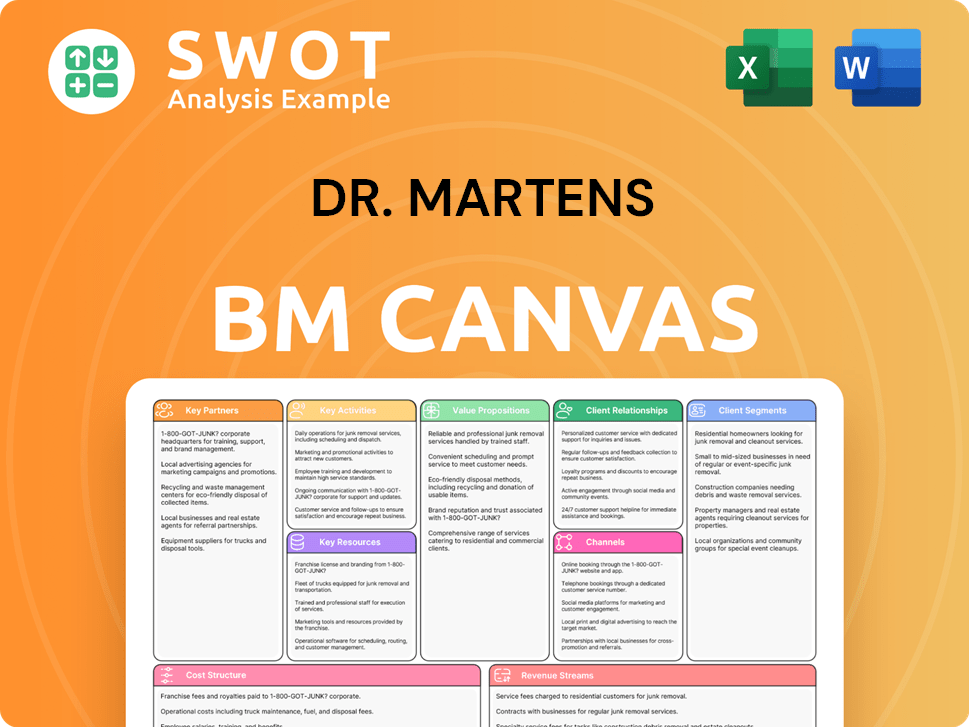

Dr. Martens Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Dr. Martens’s Growth?

The company faces several potential risks and obstacles that could influence its ability to achieve its growth objectives. Competition in the footwear and apparel markets is intense, requiring continuous innovation and differentiation to maintain market share. Factors such as supply chain disruptions and shifting consumer preferences also pose challenges, demanding adaptability in product development and marketing.

Regulatory changes, particularly concerning international trade and environmental standards, could potentially increase operational costs or restrict market access. The company's reliance on its iconic designs presents a risk if consumer tastes significantly shift away from its core aesthetic. Moreover, challenges in the wholesale business, especially in the US, highlight the need for strategic adjustments.

To mitigate these risks, the company employs internal risk management frameworks and scenario planning. Recent performance, such as the decline in wholesale revenue, underscores the need to adapt strategies, including a stronger focus on direct-to-consumer channels. Understanding these risks is crucial for a comprehensive Brief History of Dr. Martens and its future prospects.

The footwear and apparel markets are highly competitive, with numerous established and emerging brands. The company must consistently innovate and differentiate its products to maintain its competitive edge and market share. This requires continuous monitoring of industry trends and consumer preferences.

Supply chain disruptions, including those from geopolitical events, natural disasters, or labor shortages, can impact production and delivery timelines. The company has acknowledged ongoing challenges in its wholesale business, particularly in the US. Addressing these vulnerabilities is critical for operational efficiency.

Shifts in consumer preferences and fashion trends represent a constant risk, necessitating agile product development and marketing strategies. Maintaining relevance across diverse demographics and evolving fashion cycles requires continuous adaptation. The company must stay ahead of trends to meet customer demands.

The company's reliance on its iconic designs presents a risk if consumer tastes significantly shift away from its core aesthetic. While the brand has a strong identity, maintaining relevance requires continuous adaptation. The company must balance its heritage with contemporary trends.

Regulatory changes, particularly concerning international trade and environmental standards, could pose obstacles. Economic downturns or fluctuations in currency exchange rates can also impact financial performance. The company needs to navigate these factors effectively to sustain growth.

Recent challenges in the wholesale business, especially in the US, highlight the need to adapt strategies. A stronger focus on direct-to-consumer channels may be necessary to overcome market-specific obstacles. This shift can impact revenue distribution.

The footwear market is highly competitive, with numerous brands vying for market share. The company's ability to maintain its competitive edge depends on its brand strategy and product innovation. Understanding the competitive landscape is crucial for strategic planning and

Disruptions in the supply chain, including those related to geopolitical events or natural disasters, can significantly impact production and delivery timelines. The company must implement robust risk management strategies to mitigate these challenges. Managing supply chain challenges is critical for operational efficiency.

Shifts in consumer preferences and fashion trends require agile product development and marketing. Maintaining relevance across diverse demographics and evolving fashion cycles is essential for long-term success. The company's brand strategy must adapt to changing consumer tastes.

The company's financial performance is subject to various economic factors and market conditions. Strategic adjustments, such as focusing on direct-to-consumer channels, are necessary to overcome market-specific obstacles. Analyzing

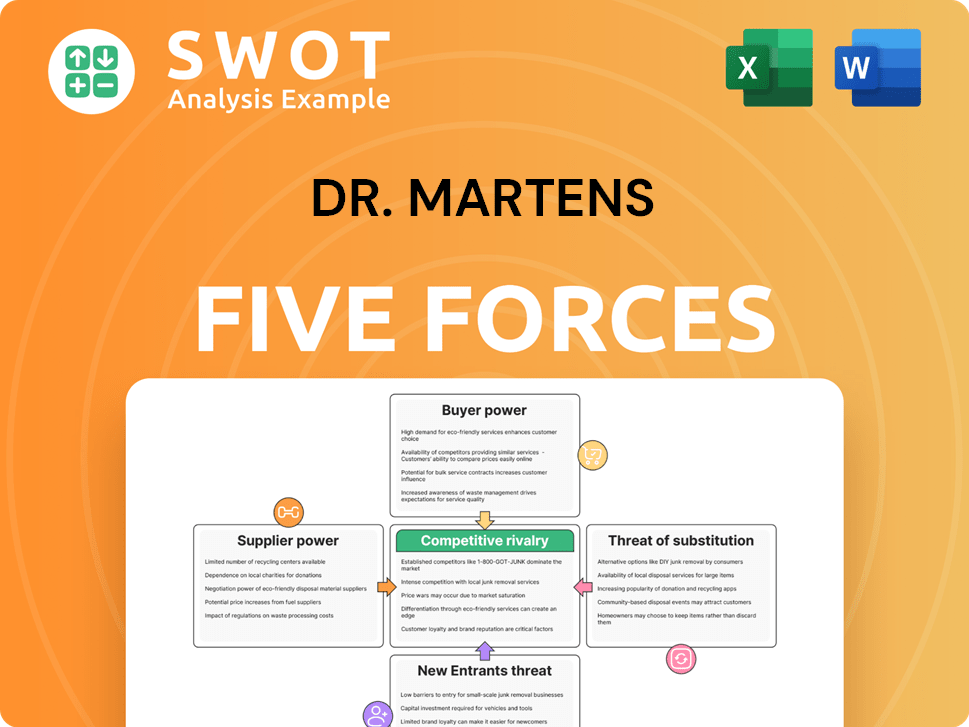

Dr. Martens Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dr. Martens Company?

- What is Competitive Landscape of Dr. Martens Company?

- How Does Dr. Martens Company Work?

- What is Sales and Marketing Strategy of Dr. Martens Company?

- What is Brief History of Dr. Martens Company?

- Who Owns Dr. Martens Company?

- What is Customer Demographics and Target Market of Dr. Martens Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.