Dr. Martens Bundle

Who Really Owns Dr. Martens Today?

Understanding the Dr. Martens SWOT Analysis is crucial, but have you ever wondered about the hands that steer this iconic brand? From its humble beginnings to its current global presence, the Dr. Martens company has undergone significant ownership shifts. Knowing who owns Dr. Martens is key to understanding its strategic direction and future prospects.

The Dr. Martens brand, with its rich Dr. Martens history, has evolved from family ownership to private equity and, finally, to a publicly traded entity. Exploring the Dr. Martens ownership structure reveals insights into its financial performance and strategic decisions. This exploration will unveil the Dr. Martens parent company and its key players, offering a comprehensive view of this enduring footwear giant.

Who Founded Dr. Martens?

The story of Dr. Martens ownership begins with a German doctor and a British shoemaking family. Initially, Dr. Klaus Maertens developed the innovative air-cushioned sole, which was later recognized and adopted by the R. Griggs Group Ltd. This marked the start of the Dr. Martens brand as we know it.

The Griggs family, with their long-standing history in shoemaking, acquired the rights to manufacture the boots in the UK. This pivotal moment set the stage for the brand's evolution, shaping its early ownership structure and strategic direction.

The foundational ownership of the Dr. Martens company was rooted in two distinct but interconnected stories. The initial innovation came from Dr. Klaus Maertens, a German doctor, who, after a skiing accident in 1945, developed an air-cushioned sole to alleviate discomfort. He partnered with Herbert Funk, a mechanical engineer, to produce these soles, eventually selling their product to the British footwear manufacturer R. Griggs Group Ltd. in 1959. The Griggs family, specifically Bill Griggs, recognized the potential of the air-cushioned sole for work boots. The Griggs family, with a long history in shoemaking dating back to 1901, acquired the exclusive license to manufacture the boots in the UK.

Dr. Klaus Maertens's air-cushioned sole was the initial innovation.

Herbert Funk partnered with Maertens to produce the soles.

The Griggs family recognized the potential for work boots.

The Griggs family acquired the exclusive license in the UK.

They had a long history in shoemaking since 1901.

Bill Griggs played a key role in the brand's early development.

Ownership was entirely private and family-held initially.

R. Griggs Group Ltd. controlled manufacturing and distribution.

No external equity or angel investors in the early stages.

The Griggs family aimed for high-quality, durable workwear.

They wanted the brand to resonate with subcultures.

Their control shaped the brand's early direction.

Early agreements were internal to the family business.

They focused on operational control and brand development.

Shareholding structures were not external.

The brand's roots are in post-war Germany and the UK.

The air-cushioned sole was a key innovation.

The Griggs family's shoemaking history dates back to the early 1900s.

At its inception, the Dr. Martens brand was entirely under the private ownership of the Griggs family through R. Griggs Group Ltd. This structure allowed the family to control all aspects of the business, from manufacturing to marketing. This early phase of the Dr. Martens company focused on building a brand known for its durability and its appeal across various subcultures. For further insights into the brand's strategies, consider reading about the Marketing Strategy of Dr. Martens.

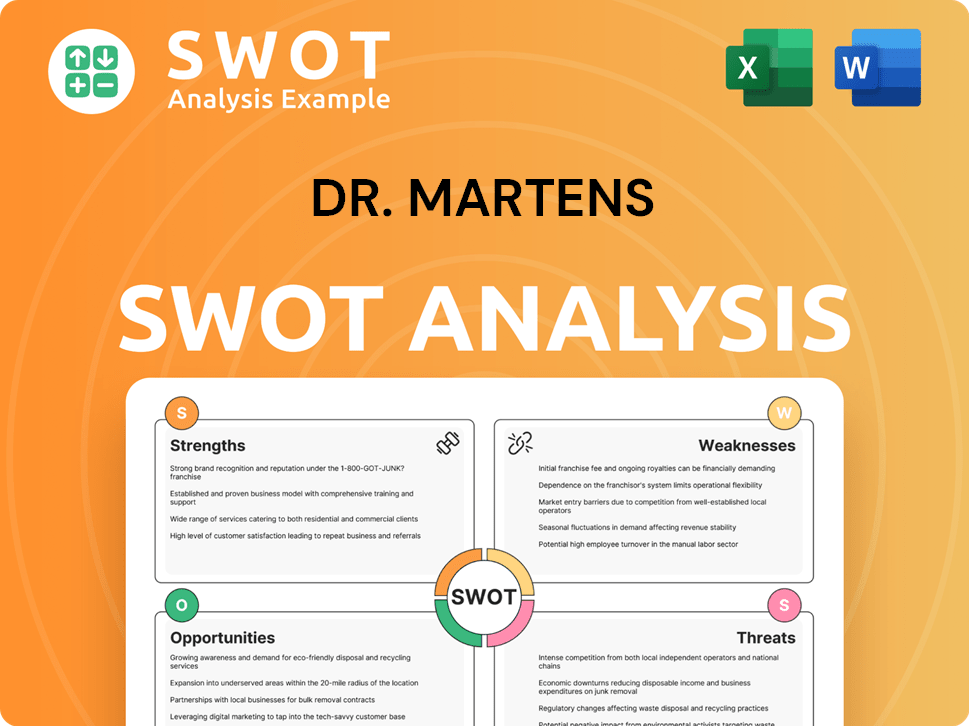

Dr. Martens SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Dr. Martens’s Ownership Changed Over Time?

The ownership of the Dr. Martens company has seen significant changes over time, beginning with the Griggs family's private ownership through R. Griggs Group Ltd. The brand's journey took a major turn in 2014 when Permira, a private equity firm, acquired it for £300 million. This move shifted the company from family control to private equity, with the goal of boosting global expansion and direct-to-consumer sales. Permira invested heavily in the brand, which led to the expansion of its retail presence and e-commerce capabilities.

A pivotal moment in the Dr. Martens company history came on January 29, 2021, when Dr. Martens plc launched its IPO on the London Stock Exchange. The IPO valued the company at £3.7 billion, with shares priced at 370 pence. Although Permira reduced its stake after the IPO, it initially remained a significant shareholder. The shift to public ownership brought greater scrutiny and accountability, influencing the company's strategy toward sustainable growth and shareholder value. To learn more about the brand's past, you can read a Brief History of Dr. Martens.

| Event | Date | Impact |

|---|---|---|

| Permira Acquisition | 2014 | Private equity takeover; focus on global growth. |

| IPO on London Stock Exchange | January 29, 2021 | Valuation of £3.7 billion; shift to public ownership. |

| Institutional Investors | Early 2024 | Institutional investors, such as Capital Research Global Investors, BlackRock, and Vanguard, hold significant shares. |

As of early 2024, the current owner of Dr. Martens is primarily composed of institutional investors, marking a significant change in the Dr. Martens ownership structure. Key shareholders include major asset managers and investment funds. Permira still maintains a notable stake, reflecting its continued interest in the company. The transition to being publicly traded has influenced the company's direction, emphasizing sustainable growth and value for shareholders. The company's financial performance is now closely watched by the public market.

The Dr. Martens brand has evolved from family ownership to private equity and then to a publicly traded company.

- Permira acquired Dr. Martens in 2014.

- The IPO occurred in January 2021.

- Institutional investors are now major shareholders.

- Permira still holds a significant stake.

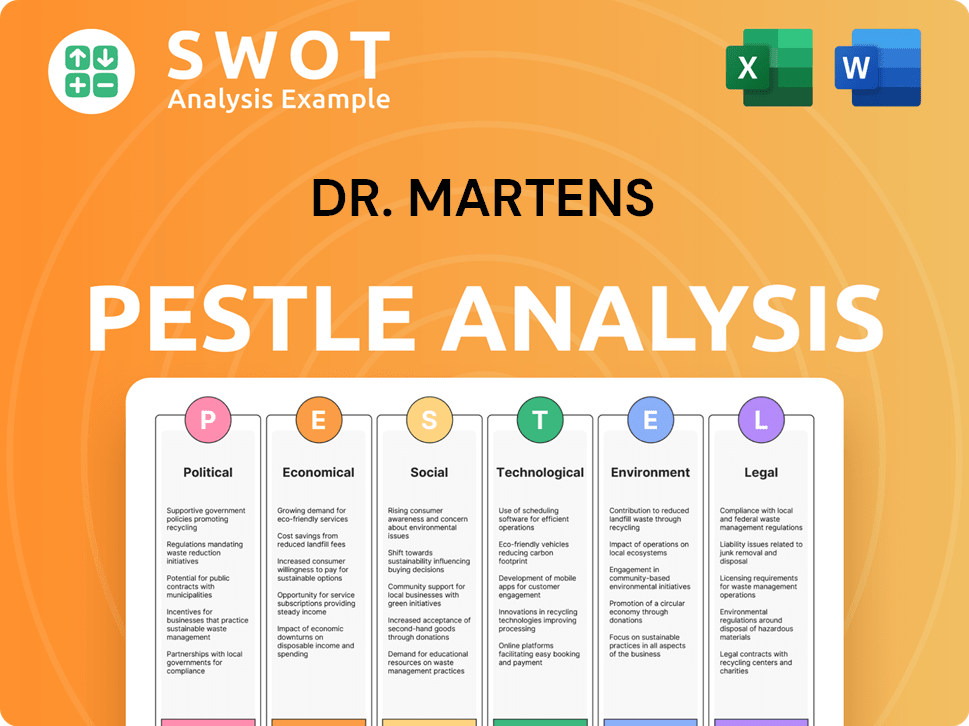

Dr. Martens PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Dr. Martens’s Board?

The current board of directors of the Dr. Martens company reflects a structure typical of publicly listed companies, combining independent non-executive directors with individuals possessing significant industry experience. As of early 2025, the board's composition generally includes a mix of independent directors, who provide external oversight and expertise, and representatives who may be affiliated with major institutional shareholders. This structure is designed to ensure diverse perspectives and effective governance for the Dr. Martens brand.

The specific names and affiliations of board members can change over time. However, the overall structure aims to maintain a balance that supports strategic decision-making and accountability to shareholders. The board's role includes overseeing the company's financial performance, setting strategic direction, and ensuring compliance with corporate governance standards. This is crucial for a company like Dr. Martens, which has a global presence and a strong brand reputation.

| Board Role | Description | Typical Responsibilities |

|---|---|---|

| Chairman | Leads the board and ensures its effectiveness. | Setting the board's agenda, facilitating discussions, and representing the board externally. |

| CEO | Chief Executive Officer, responsible for the company's overall strategy and operations. | Overseeing day-to-day operations, implementing the board's strategic decisions, and managing the executive team. |

| Independent Non-Executive Directors | Directors who are independent of the company's management. | Providing objective oversight, scrutinizing management's performance, and representing shareholder interests. |

| Chief Financial Officer (CFO) | Responsible for the company's financial strategy and reporting. | Overseeing financial planning, accounting, and reporting. |

The voting structure for Dr. Martens plc follows a one-share-one-vote principle. Each ordinary share carries one vote, ensuring that voting power is directly proportional to the number of shares held. There are typically no special voting rights, golden shares, or founder shares that would grant outsized control to any single individual or entity within the company. This standard voting structure promotes transparency and equal shareholder rights, which is a common practice in the London Stock Exchange where Dr. Martens is listed.

Shareholders' voting power is directly proportional to their shareholdings, with each share typically carrying one vote. Major institutional shareholders can influence company decisions.

- The board regularly reviews its composition and decisions.

- Shareholders vote on key resolutions and director appointments at annual general meetings.

- Major shareholders can engage with the board on strategic matters.

- The company's governance structure emphasizes transparency and equal rights.

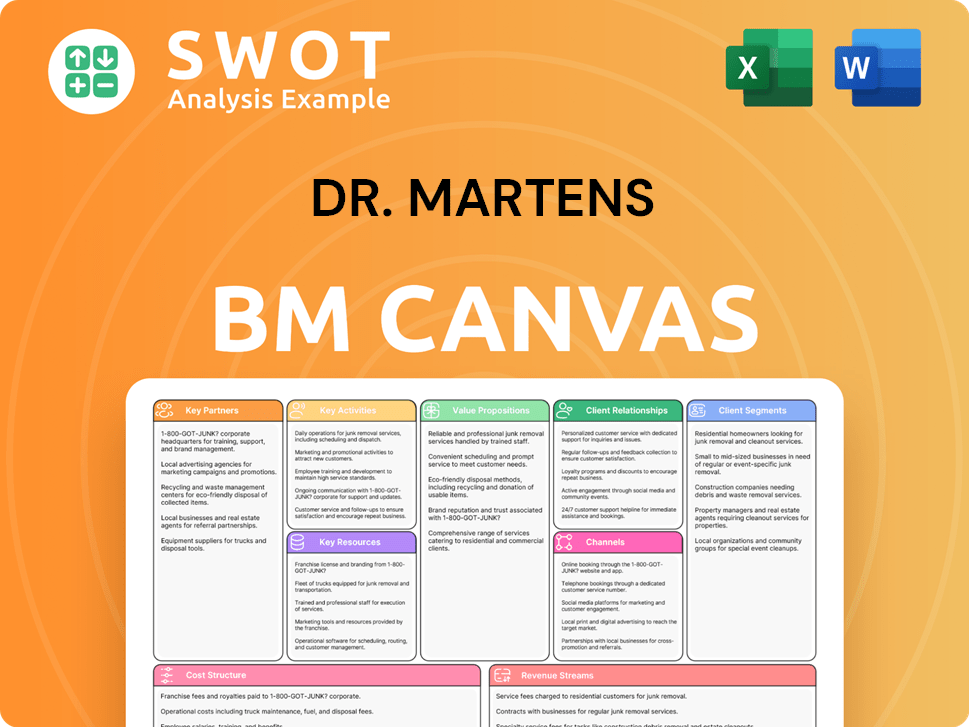

Dr. Martens Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Dr. Martens’s Ownership Landscape?

In the past few years, the Dr. Martens company has seen significant shifts in its ownership structure, primarily due to its transition to a publicly traded entity. Following its initial public offering (IPO) in 2021, the ownership profile has evolved as initial private equity investors, such as Permira, have reduced their stakes. This is a typical trend for companies moving from private equity to public markets, with institutional investors gradually increasing their holdings.

The Dr. Martens ownership landscape has been influenced by the company's strategic focus on direct-to-consumer channels and global expansion. Market analyses and financial reports indicate that these strategies impact investor sentiment and ownership trends. Although there have been no major share buybacks or secondary offerings publicly announced recently, the company's performance and market conditions continually affect institutional investor activity. As of April 2025, there have been no public statements about a privatization or a major leadership change that would drastically alter the ownership structure.

| Metric | Data | Source/Notes |

|---|---|---|

| IPO Year | 2021 | Public Offering |

| Primary Investor (Post-IPO) | Institutional Investors | Asset managers, index funds |

| Recent Ownership Trend | Decrease in Private Equity Stake | Permira reducing holdings |

Industry trends show that publicly listed companies like the Dr. Martens brand often see increasing institutional ownership, as large funds seek established brands for long-term investments. Strategic updates from the company generally focus on operational performance and market growth, which indirectly impact investor confidence and ownership stability. For more detailed information, you can explore the Dr. Martens company history timeline.

The shift from private equity to public ownership has been a key factor in the evolution of Dr. Martens ownership. This transition involved a gradual reduction in the stakes held by initial investors, such as Permira. The Dr. Martens parent company structure has adapted to include a broader range of institutional investors.

The company's focus on direct-to-consumer channels and global expansion influences investor sentiment. The Dr. Martens stock ownership is affected by the company's performance and market conditions. These factors play a crucial role in shaping the ownership structure.

Institutional investors are increasingly involved, seeking stable brands for long-term investment. The Dr. Martens publicly traded status attracts large funds. The activity of these investors impacts the Dr. Martens ownership structure.

Company updates focus on operational performance and market growth. These updates indirectly impact investor confidence. The strategic moves influence who owns Dr. Martens.

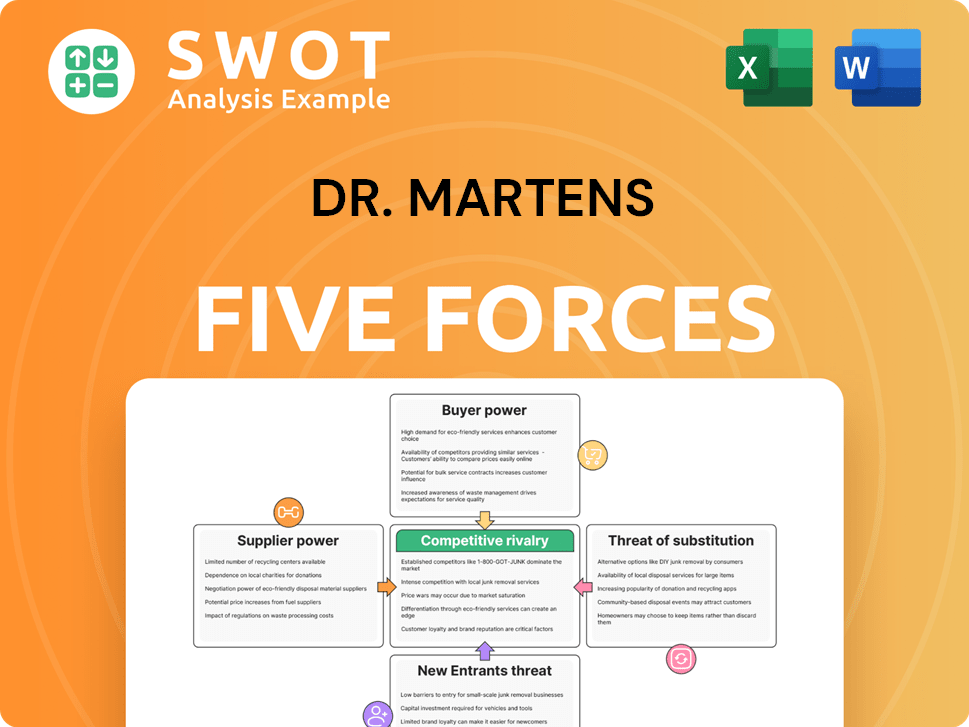

Dr. Martens Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dr. Martens Company?

- What is Competitive Landscape of Dr. Martens Company?

- What is Growth Strategy and Future Prospects of Dr. Martens Company?

- How Does Dr. Martens Company Work?

- What is Sales and Marketing Strategy of Dr. Martens Company?

- What is Brief History of Dr. Martens Company?

- What is Customer Demographics and Target Market of Dr. Martens Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.