Suzhou Dongshan Precision Manufacturing Bundle

Can Suzhou Dongshan Precision Maintain Its Growth Trajectory?

Suzhou Dongshan Precision Manufacturing Company (DSBJ) has rapidly transformed from a regional player to a global force in the Suzhou Dongshan Precision Manufacturing SWOT Analysis. This evolution, fueled by a strategic acquisition and a commitment to innovation, positions DSBJ at the forefront of the precision manufacturing industry. Understanding DSBJ's growth strategy is crucial for anyone looking to navigate the complexities of the market.

DSBJ's success story, built on strategic acquisitions and technological integration, offers valuable insights into the future of the manufacturing industry. This exploration will analyze DSBJ's expansion plans and assess its investment potential, considering its competitive advantages and the challenges it faces. By examining its growth strategy, we can better understand how Suzhou Dongshan Precision aims to capitalize on emerging opportunities and solidify its market leadership, especially in the 5G era.

How Is Suzhou Dongshan Precision Manufacturing Expanding Its Reach?

DSBJ, also known as Suzhou Dongshan Precision Manufacturing Company, is implementing a comprehensive expansion strategy to fuel its growth strategy and broaden its market presence. This involves strategic initiatives across various sectors and geographies, designed to enhance revenue streams and mitigate risks. The company's focus on high-growth areas and geographical diversification highlights its proactive approach to adapting to market changes and securing future prospects.

A key component of DSBJ's expansion is its deep penetration into high-growth sectors. This includes new energy vehicles (NEVs), artificial intelligence (AI), and advanced communication technologies. The company is actively increasing its production capacity for components used in electric vehicles, aligning with the global shift towards sustainable transportation. Furthermore, DSBJ is developing and manufacturing advanced modules and components for next-generation devices, including those supporting AI functionalities.

Geographical expansion is another critical element of DSBJ's strategy. The company is exploring opportunities in new markets, particularly in Southeast Asia, to reduce geopolitical risks and gain access to emerging manufacturing hubs. This involves potential investments in new facilities or strategic partnerships to establish a stronger regional presence. DSBJ is also continuously evaluating potential mergers and acquisitions (M&A) that align with its strategic objectives, especially those that offer complementary technologies or expand its customer base in key industries.

DSBJ is significantly increasing its production of NEV components. This expansion is in response to the growing demand for electric vehicles worldwide. The company aims to increase the proportion of revenue derived from NEV components to over 20% by 2026.

DSBJ is actively seeking to establish new production bases outside of China. This strategy aims to reduce reliance on a single market and capitalize on emerging manufacturing hubs. The company plans to establish at least one new overseas production base within the next three years.

DSBJ's expansion plans are multifaceted, focusing on both sectoral and geographical growth. The company aims to increase its market share in key industries through strategic investments and partnerships. These initiatives are designed to enhance DSBJ's competitive advantages and ensure long-term sustainability.

- EMS Expansion: DSBJ is expanding into Electronic Manufacturing Services (EMS) to provide comprehensive manufacturing solutions, increasing value capture across the supply chain.

- Strategic Partnerships: The company is actively seeking strategic partnerships to enhance its technological capabilities and market reach.

- M&A Activities: DSBJ is evaluating potential mergers and acquisitions to acquire complementary technologies and expand its customer base.

- Technological Advancements: Focusing on advanced modules and components for next-generation devices, including those supporting AI functionalities.

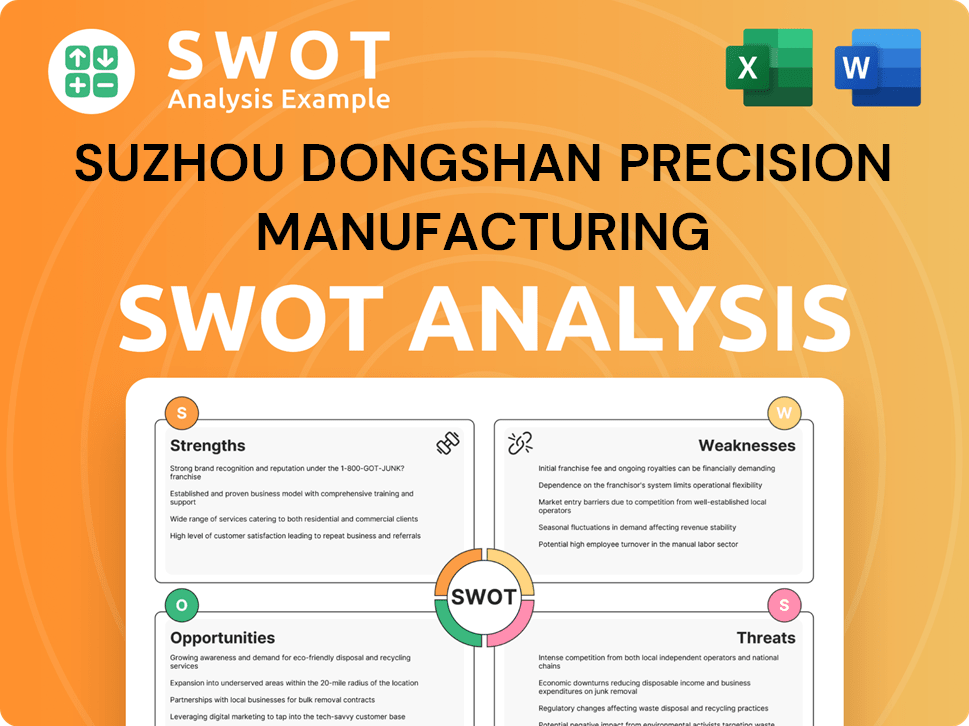

Suzhou Dongshan Precision Manufacturing SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Suzhou Dongshan Precision Manufacturing Invest in Innovation?

Innovation and technology are central to the Growth Strategy of Suzhou Dongshan Precision (DSBJ), driving its competitive advantage within the Manufacturing Industry. The company's commitment to continuous improvement is evident through substantial investments in research and development (R&D).

DSBJ's strategic focus on technological advancement is designed to enhance operational efficiencies and product quality. This approach is crucial for navigating the evolving demands of the market and maintaining a leading position. The company's strategic investments in R&D and its proactive approach to technological integration highlight its dedication to sustainable growth.

The company's dedication to innovation is reflected in its financial commitments and strategic partnerships. By focusing on advanced manufacturing processes and embracing digital transformation, DSBJ is well-positioned to capitalize on future opportunities. This approach ensures that DSBJ remains competitive and adaptable in a rapidly changing market environment.

DSBJ allocated approximately 5.8% of its operating revenue to R&D in 2023. This significant investment underscores its commitment to technological advancement and innovation within the precision manufacturing sector. This financial commitment is crucial for the company's long-term success.

DSBJ's R&D efforts are concentrated on developing advanced manufacturing processes and materials. Key areas include high-precision stamping, complex module assembly, and flexible circuit board technology. These innovations are vital for maintaining a competitive edge.

DSBJ actively collaborates with external innovators, including universities and research institutions. These partnerships aim to accelerate the development of cutting-edge solutions and enhance its technological capabilities. This collaborative approach is key to staying at the forefront of innovation.

The company is embracing digital transformation through intelligent manufacturing systems, automation, and the integration of AI and IoT. These technologies are implemented across production lines to enhance efficiency, quality, and predictive maintenance. This digital strategy is essential for operational excellence.

The implementation of AI-driven quality inspection systems has led to a reported 15% reduction in defect rates in certain product lines. This improvement highlights the effectiveness of AI in enhancing product quality and reducing waste. This is a significant benefit for the company.

DSBJ is committed to sustainability, developing eco-friendly manufacturing processes and materials. These initiatives align with global environmental trends and open new market opportunities. This commitment is crucial for long-term viability.

DSBJ is focused on developing new products and platforms, such as advanced antenna modules for 5G communication and high-density flexible printed circuits for foldable devices. The company has secured numerous patents in precision manufacturing and electronic components, demonstrating its leadership in innovation. For further insights into the company's operations, consider exploring the Revenue Streams & Business Model of Suzhou Dongshan Precision Manufacturing.

- Advanced antenna modules for 5G communication.

- High-density flexible printed circuits for foldable devices.

- Numerous patents in precision manufacturing and electronic components.

- These developments are directly linked to its Growth Strategy.

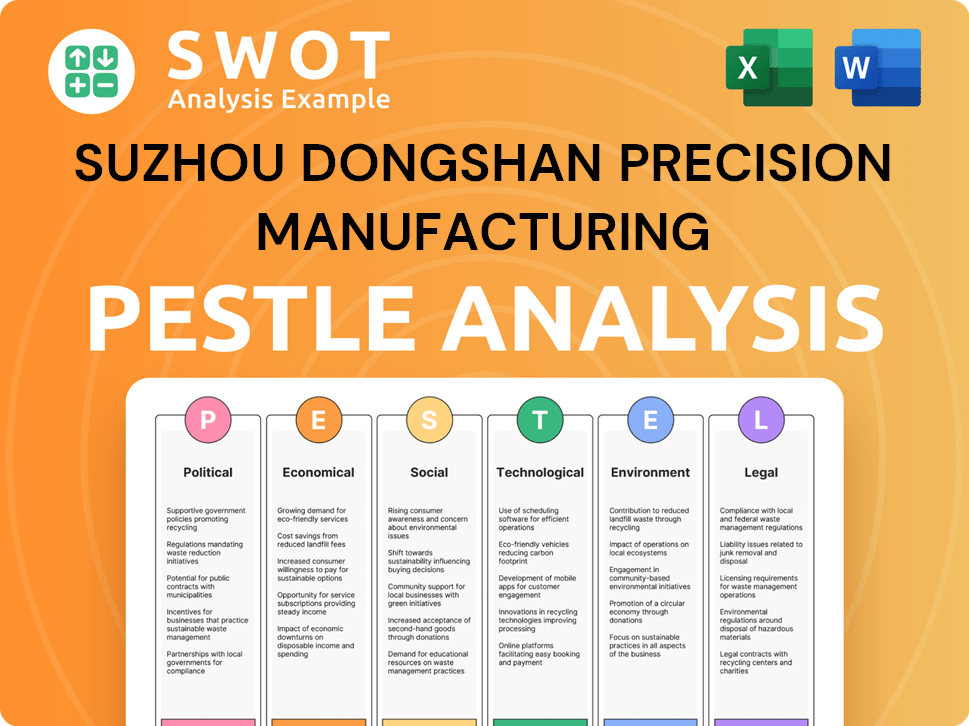

Suzhou Dongshan Precision Manufacturing PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Suzhou Dongshan Precision Manufacturing’s Growth Forecast?

The financial outlook for Suzhou Dongshan Precision Manufacturing Company (DSBJ) is positive, supported by its strategic growth initiatives. The company's commitment to innovation and expansion in key sectors positions it for sustained financial success. A focus on cost optimization and operational efficiency further strengthens its financial standing.

In 2023, DSBJ reported a net profit of approximately RMB 1.1 billion, demonstrating a solid financial foundation. This performance reflects the company's ability to navigate market dynamics and capitalize on growth opportunities. The company's strategic investments in high-value products and R&D are expected to drive future revenue and profitability.

Analysts anticipate robust revenue growth for DSBJ in 2024, with projections ranging from 15-20%. This growth is primarily driven by strong demand in key segments such as new energy vehicles and advanced consumer electronics. DSBJ's ability to adapt to market shifts, as highlighted in an article about the Target Market of Suzhou Dongshan Precision Manufacturing, is a key factor in its financial performance.

DSBJ is expected to achieve a revenue growth rate of around 15-20% in 2024, driven by strong demand in key segments. This growth is fueled by the company's strategic focus on high-value products and its ability to meet market demands.

DSBJ aims to maintain a healthy gross profit margin, projected to be in the range of 18-20% in the coming years. This is achieved through cost optimization and enhanced operational efficiency, ensuring sustainable profitability.

The company plans to maintain high investment levels, focusing on expanding production capacity for high-value products and R&D for next-generation technologies. This investment strategy supports long-term growth and market leadership.

DSBJ's long-term financial goals include solidifying its position as a global leader in precision manufacturing and achieving sustainable profitability. This ambition is supported by its diversified business model and market adaptability.

DSBJ’s financial performance reflects its strategic growth initiatives and market adaptability. The company's focus on innovation and operational efficiency supports its long-term financial goals.

- Revenue Growth: Projected at 15-20% in 2024.

- Gross Profit Margin: Targeted at 18-20%.

- Net Profit 2023: Approximately RMB 1.1 billion.

- Investment Focus: Expanding production capacity and R&D.

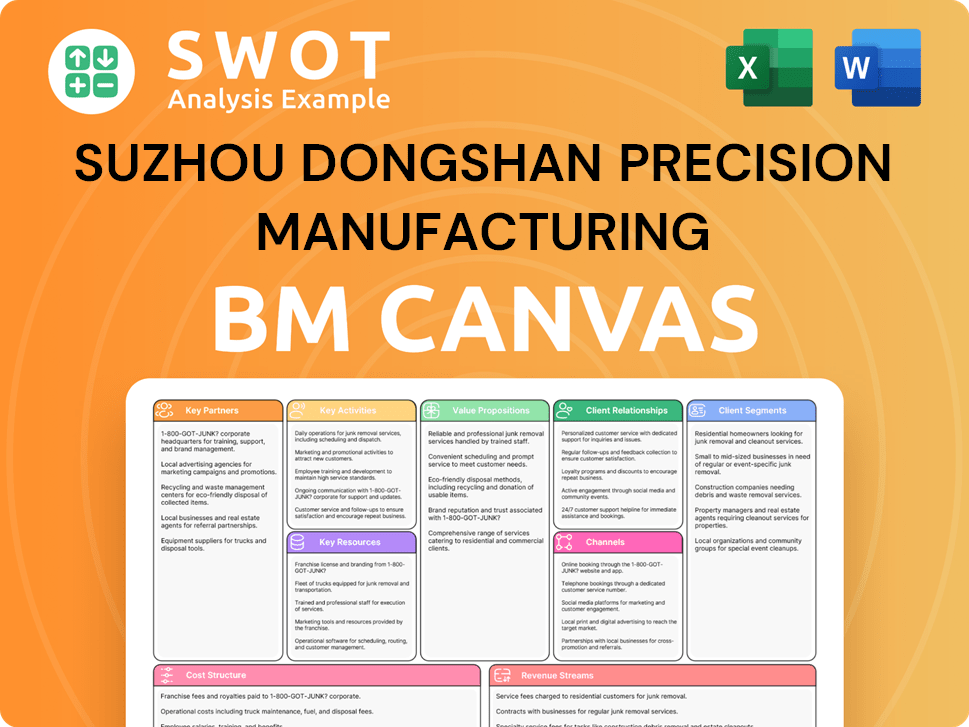

Suzhou Dongshan Precision Manufacturing Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Suzhou Dongshan Precision Manufacturing’s Growth?

The Suzhou Dongshan Precision faces various risks that could impact its Growth Strategy and Future Prospects. These challenges include intense competition, regulatory changes, and supply chain vulnerabilities. Addressing these risks is crucial for DSBJ to maintain its growth trajectory in the Manufacturing Industry.

Competition from both domestic and international players in the precision components and EMS sectors puts pressure on pricing and profit margins. Regulatory changes, especially in international trade, environmental protection, and labor laws, can also affect production costs and market access. Moreover, supply chain issues and geopolitical tensions pose significant threats to its operations.

Technological disruption requires continuous investment in research and development. Internal challenges like managing rapid expansion while ensuring quality control and operational efficiency also pose risks. To mitigate these challenges, DSBJ implements diversification strategies, robust risk management, and proactive planning.

Intense competition from domestic and international players in the precision components and EMS sectors puts pressure on pricing and profit margins. This requires continuous innovation and efficiency improvements. The Manufacturing Industry is highly competitive, requiring constant adaptation.

Regulatory changes, especially those related to international trade, environmental protection, and labor laws in its key markets, could impact production costs and market access. Changes in trade policies and tariffs, particularly those impacting the US and China, pose significant challenges. Compliance costs can also increase.

Reliance on a limited number of suppliers for critical raw materials or components poses a risk to production continuity and cost stability. Disruptions, whether due to natural disasters, geopolitical events, or supplier issues, can severely impact operations. Diversifying the supplier base is a key mitigation strategy.

Geopolitical tensions and trade disputes, such as those between the US and China, could disrupt supply chains and market demand. Tariffs and trade restrictions can increase costs and limit market access. Monitoring and adapting to these changes is crucial for maintaining competitiveness.

Rapid advancements by competitors could render existing products or processes obsolete, necessitating continuous R&D investment to stay ahead. The pace of technological change requires constant innovation. Investing in new technologies is essential for long-term success.

Managing rapid expansion while maintaining quality control and operational efficiency across its diverse product lines and geographical locations presents a significant challenge. Scaling operations efficiently requires strong management and streamlined processes. Ensuring consistent quality is also vital.

DSBJ addresses these risks through diversification of its customer base and product offerings. Implementing robust risk management frameworks and proactive scenario planning to anticipate and mitigate potential disruptions is also crucial. For instance, the company has actively sought to diversify its supplier base to reduce dependence on single sources and has invested in automated production lines to enhance efficiency and reduce labor-related risks.

Increasing cybersecurity threats to intellectual property and operational systems are emerging risks. Enhanced IT security measures are essential. As the company expands, it must also address the challenges of protecting its intellectual property and ensuring the security of its operational systems. Further insights can be found in our article on the Marketing Strategy of Suzhou Dongshan Precision Manufacturing.

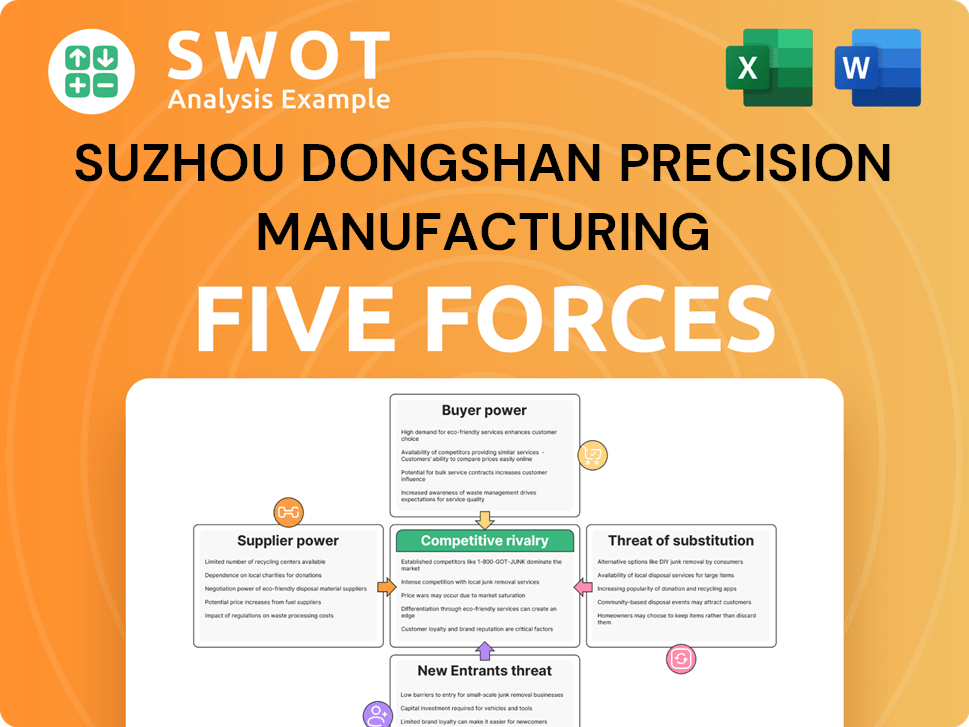

Suzhou Dongshan Precision Manufacturing Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Suzhou Dongshan Precision Manufacturing Company?

- What is Competitive Landscape of Suzhou Dongshan Precision Manufacturing Company?

- How Does Suzhou Dongshan Precision Manufacturing Company Work?

- What is Sales and Marketing Strategy of Suzhou Dongshan Precision Manufacturing Company?

- What is Brief History of Suzhou Dongshan Precision Manufacturing Company?

- Who Owns Suzhou Dongshan Precision Manufacturing Company?

- What is Customer Demographics and Target Market of Suzhou Dongshan Precision Manufacturing Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.