Suzhou Dongshan Precision Manufacturing Bundle

How Does Suzhou Dongshan Precision Thrive in the Tech World?

Suzhou Dongshan Precision Manufacturing Co., Ltd. (DSBJ) is a powerhouse in advanced intelligent manufacturing, but how does it actually work? Ranked among China's top private enterprises, DSBJ's influence spans telecommunications, consumer electronics, and automotive industries. This article unveils the inner workings of this industry leader, exploring its core value propositions and strategic moves.

To truly grasp the potential of Suzhou Dongshan Precision Manufacturing SWOT Analysis, one must understand its operational mechanics. From its precision manufacturing capabilities to its Electronics Manufacturing Services (EMS), DSBJ's ability to adapt and innovate is key. This deep dive will provide a comprehensive overview of the DSBJ Company, its financial performance, and its strategic positioning within the competitive landscape of Suzhou China and beyond, offering insights for investors and industry watchers alike.

What Are the Key Operations Driving Suzhou Dongshan Precision Manufacturing’s Success?

Suzhou Dongshan Precision Manufacturing (DSBJ) operates across three main segments: electronic circuits, photoelectric displays, and precision manufacturing. This diversified approach allows DSBJ to serve a broad customer base. The company provides a wide range of products and services, catering to several key industries.

The company's value proposition centers on its ability to offer comprehensive solutions. DSBJ provides everything from design and R&D to manufacturing, tailored to meet specific customer needs. This integrated model, combined with its focus on precision and quality, sets DSBJ apart in the competitive electronics manufacturing landscape.

DSBJ's core operations are supported by a vertically integrated structure. This includes sheet metal manufacturing, die-casting, machining, and surface treatment. This allows DSBJ to maintain tight control over quality and costs, ensuring it delivers high-value products to its customers. The company's strategic focus on innovation and customer satisfaction has solidified its position in the market.

DSBJ offers one-stop solutions for electronic circuit products, including flexible printed circuit boards (FPC), rigid PCBs, and rigid-flex PCBs. The company is a top global manufacturer in both FPC and PCB by revenue. This segment is crucial for its supply chain offerings.

DSBJ manufactures touch display modules and LED display components. The company is expanding its applications in the vehicle domain, particularly for on-board displays in new energy vehicles. This segment is experiencing growth due to increasing demand.

This segment focuses on precision metal structural parts and components. These are used in new energy vehicles (e.g., heat sinks, battery structural parts) and communication equipment (e.g., antennas). This segment is essential for its precision manufacturing capabilities.

DSBJ provides comprehensive solutions from design to manufacturing, focusing on high precision and quality. This integrated approach allows DSBJ to offer tailored components essential for advanced electronic devices. This strategy differentiates it from competitors.

DSBJ's strengths include its vertical integration, which ensures high quality and competitive pricing. The company's ability to offer a wide range of precision components is also a key advantage. DSBJ's focus on innovation and customer satisfaction has led to its strong market position.

- Vertical Integration: Controls the entire manufacturing process.

- Comprehensive Solutions: Offers design, R&D, and manufacturing.

- Precision Manufacturing: Provides high-quality components.

- Customer Focus: Tailors solutions to meet specific needs.

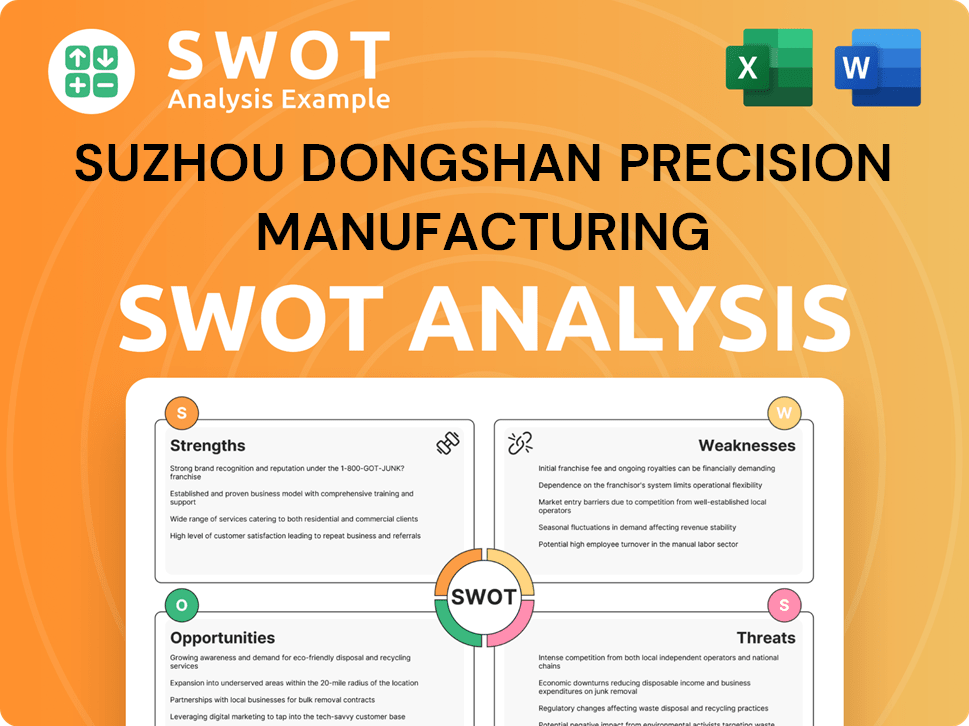

Suzhou Dongshan Precision Manufacturing SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Suzhou Dongshan Precision Manufacturing Make Money?

Suzhou Dongshan Precision Manufacturing (DSBJ Company) generates revenue through its core business segments: electronic circuits, photoelectric displays, and precision manufacturing. The company's financial performance reflects its diverse revenue streams and strategic focus on growth and shareholder value. This article will provide an overview of DSBJ's revenue streams and monetization strategies.

In 2024, DSBJ achieved a total revenue of 36.77 billion yuan, marking a 9.3% year-on-year increase. The first quarter of 2025 saw revenue reach 8.6 billion yuan, an 11% increase year-on-year, with net income attributable to the parent company increasing by 57.55% to 0.456 billion yuan. As of March 31, 2025, the company's trailing 12-month revenue was approximately $5.22 billion USD.

The electronic circuit segment, which includes flexible printed circuit boards (FPC), rigid PCBs, and rigid-flex PCBs, is a significant revenue driver. DSBJ ranks as the second-largest FPC manufacturer and the third-largest PCB manufacturer globally by revenue. The photoelectric display segment generates revenue from LED devices, touch panels, and liquid crystal display modules. The precision manufacturing segment contributes through the design, manufacture, and sale of precision metal structural components and assemblies, serving industries such as telecommunications, consumer electronics, and automotive. For a deeper dive into DSBJ's target market, consider reading the article Target Market of Suzhou Dongshan Precision Manufacturing.

DSBJ's monetization strategy includes a 'dual-engine Global Strategy,' focusing on the rapid growth of its New Energy Fund Business while continuing to emphasize consumer electronics. The new energy business generated approximately RMB 2.630 billion in sales revenue in Q1 2025, a 43.79% increase. The company also engages in strategic share buyback plans, with a recent plan announced on April 10, 2025, to buy back shares worth CNY 100-200 million, and a completed buyback of 4.2022 million shares for CNY 100.08 million.

- The electronic circuit segment is a key revenue source, with DSBJ being a global leader in FPC and PCB manufacturing.

- The photoelectric display segment contributes through LED devices, touch panels, and LCD modules.

- The precision manufacturing segment supports various industries, including telecommunications and automotive.

- The 'dual-engine Global Strategy' focuses on new energy and consumer electronics.

- Strategic share buybacks aim to enhance shareholder value.

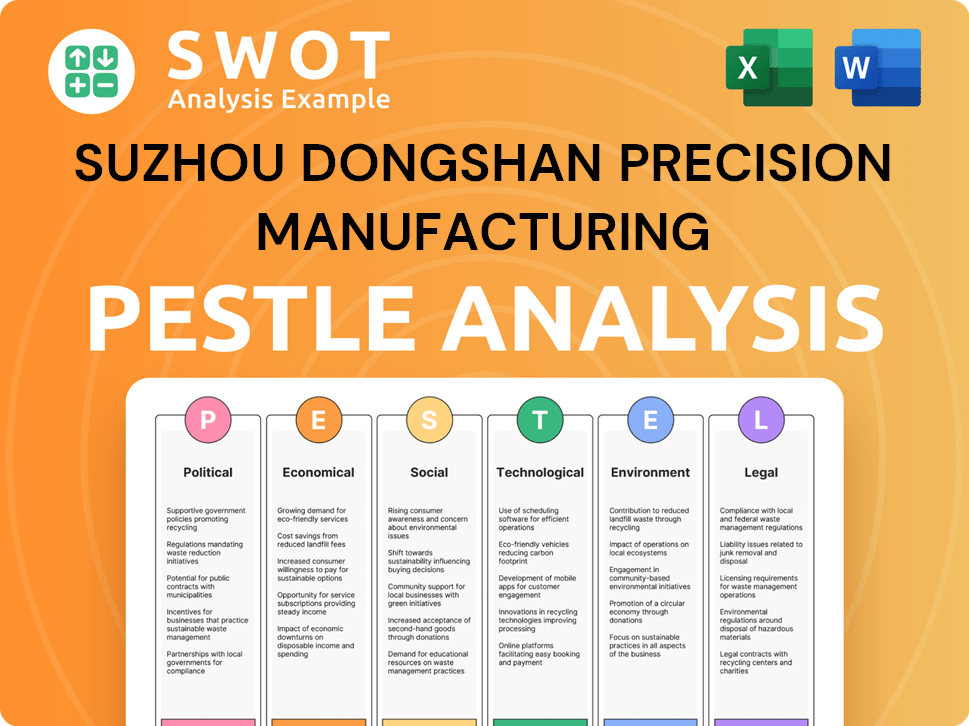

Suzhou Dongshan Precision Manufacturing PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Suzhou Dongshan Precision Manufacturing’s Business Model?

DSBJ Company, also known as Suzhou Dongshan Precision Manufacturing, has strategically positioned itself in the precision manufacturing sector. Its journey is marked by significant milestones and strategic moves aimed at enhancing its market presence and operational capabilities. The company's focus on innovation and global expansion has been crucial in navigating the dynamic electronics manufacturing landscape.

A key strategic decision has been the adoption of a 'two-wheel drive' strategy, focusing on consumer electronics and the rapidly growing new energy vehicle sector. This dual approach has allowed DSBJ to diversify its revenue streams and capitalize on emerging market trends. The company's expansion strategy includes establishing a global footprint through overseas acquisitions and the establishment of operating entities.

The company's financial performance reflects its strategic initiatives. For instance, the new energy business's sales revenue increased by approximately 43.79% in Q1 2025, reaching around RMB 2.630 billion. This growth indicates the effectiveness of DSBJ's strategic focus on the new energy vehicle sector. The company's commitment to its shareholders is evident through share buyback plans, with a recent equity buyback announced on April 10, 2025, for CNY 200 million worth of its shares.

DSBJ has expanded its global footprint by entering the PCB industry and establishing operations in North America, Europe, and Southeast Asia. The Mexico production base became operational in 2023, and the Thai production base commenced construction. These expansions enhance the company's global operating capabilities.

The 'two-wheel drive' strategy, focusing on consumer electronics and the new energy vehicle sector, is a key strategic move. DSBJ has also engaged in share buyback plans, demonstrating its commitment to shareholder value. These moves reflect DSBJ's proactive approach to adapt to market dynamics.

DSBJ's competitive advantages include strong technological innovation capabilities and a forward-looking global layout. The company has an integrated R&D and manufacturing system. Its position as a leading global manufacturer in flexible printed circuit boards (FPC) and printed circuit boards (PCB) further solidifies its competitive edge.

DSBJ faces challenges such as customer concentration, rapid technological upgrades, and exchange rate fluctuations. Despite these challenges, its strong technological innovation capabilities and global layout help mitigate these risks. For more insights, check out the Brief History of Suzhou Dongshan Precision Manufacturing.

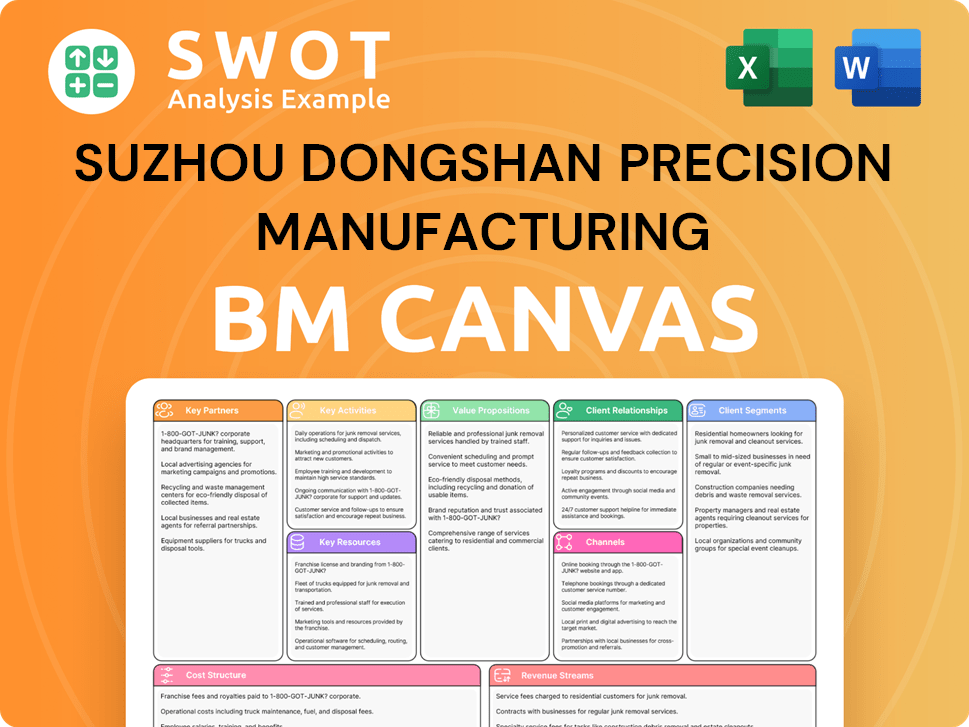

Suzhou Dongshan Precision Manufacturing Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Suzhou Dongshan Precision Manufacturing Positioning Itself for Continued Success?

Suzhou Dongshan Precision Manufacturing (DSBJ Company) holds a significant position in the precision manufacturing and electronics manufacturing industries. In 2024, the company ranked 399th among China's top 500 private enterprises and 270th among the top 500 private manufacturing enterprises, solidifying its presence in the market. DSBJ is a global leader, ranking second in flexible printed circuit boards (FPC) and third in printed circuit boards (PCB) by revenue for several years, showcasing its strong market share and competitive advantage. Its diverse customer base, spanning telecommunications, consumer electronics, and automotive sectors, highlights its broad market penetration and customer loyalty.

Several risks could affect DSBJ's operations. These include potential customer concentration, rapid technological advancements, exchange rate fluctuations, and risks related to product quality, safety, ethics, and anti-corruption. These factors could impact the company's financial performance and operational stability.

DSBJ is a leading player in the precision manufacturing sector, particularly in FPC and PCB production. The company's high rankings among top Chinese enterprises and its global market positions indicate strong industry influence and competitiveness. Its diverse customer base across multiple sectors further strengthens its market position.

DSBJ faces risks related to customer concentration, technological changes, and currency fluctuations. Furthermore, product quality, ethical standards, and anti-corruption measures are crucial for maintaining its reputation. These risks could lead to financial and operational challenges.

DSBJ is focusing on its 'dual-engine Global Strategy,' emphasizing new energy vehicles and consumer electronics. The company aims for a '100-billion advanced and intelligent manufacturing platform'. Strategic initiatives include optimizing overseas bases and enhancing financial management.

DSBJ is investing in R&D, particularly in AI hardware and advanced electronic components. The company has set ambitious environmental goals, including carbon peaking by 2024 and operational-level carbon neutrality by 2030. Analysts project substantial earnings growth, with a projected annual growth rate of 36.9%.

DSBJ is actively pursuing strategic initiatives to drive growth and improve operational efficiency. These include optimizing the layout and improving the operating capabilities of its overseas bases and enhancing comprehensive budget management to maintain financial health. The company is also increasing its investment in R&D and innovation to meet evolving market demands, particularly in areas like AI hardware and advanced electronic components.

- Focus on new energy vehicles and consumer electronics.

- Investment in research and development.

- Enhancement of overseas operations.

- Ambitious environmental targets.

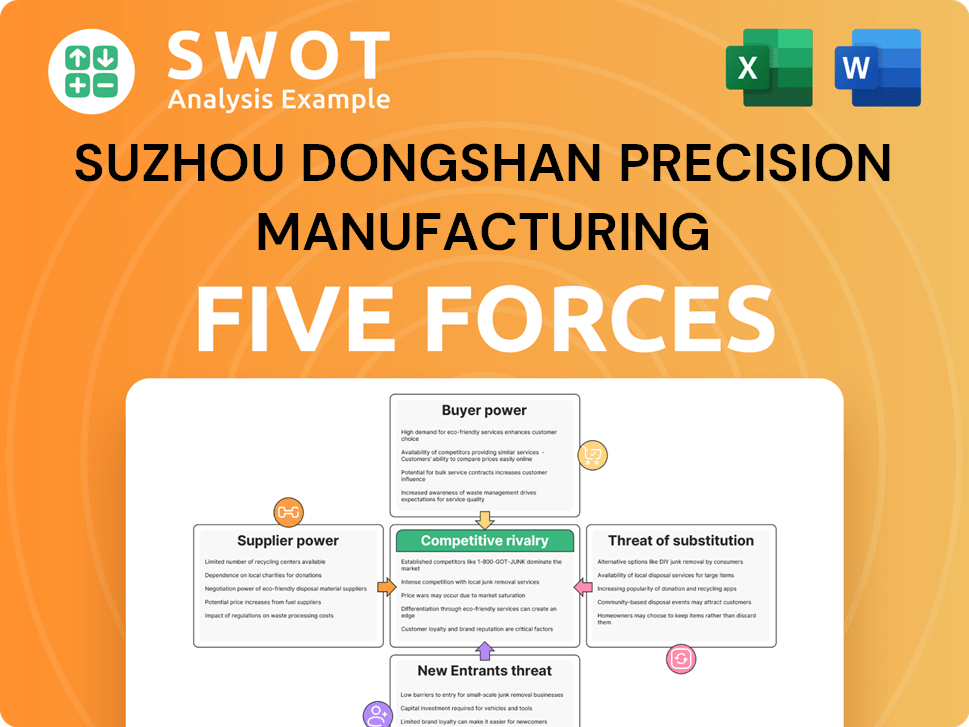

Suzhou Dongshan Precision Manufacturing Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Suzhou Dongshan Precision Manufacturing Company?

- What is Competitive Landscape of Suzhou Dongshan Precision Manufacturing Company?

- What is Growth Strategy and Future Prospects of Suzhou Dongshan Precision Manufacturing Company?

- What is Sales and Marketing Strategy of Suzhou Dongshan Precision Manufacturing Company?

- What is Brief History of Suzhou Dongshan Precision Manufacturing Company?

- Who Owns Suzhou Dongshan Precision Manufacturing Company?

- What is Customer Demographics and Target Market of Suzhou Dongshan Precision Manufacturing Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.