eClerx Services Bundle

Can eClerx Services Continue Its Ascent in the BPO Arena?

eClerx Services Limited has carved a significant niche in the business process management landscape, but what does the future hold? This analysis dissects the eClerx Services SWOT Analysis, exploring its strategic pivots and expansion strategies. We'll examine its journey from a Mumbai startup to a global player, investigating the key drivers behind its growth and its vision for sustained success.

From its financial services roots, eClerx has broadened its reach, adapting to evolving client demands and technological advancements. This deep dive into eClerx's eClerx Growth Strategy and eClerx Future Prospects will provide a comprehensive eClerx Services market analysis. We will also explore its eClerx Business Model and eClerx Financial Performance, offering actionable insights for investors and business strategists alike.

How Is eClerx Services Expanding Its Reach?

As part of its eClerx Growth Strategy, the company is actively pursuing a multi-pronged expansion approach. This strategy focuses on both geographical reach and diversifying its service portfolio. The goal is to tap into new markets and customer segments, especially in regions with high potential for digital transformation and business process outsourcing (BPO).

The company's expansion includes strengthening its presence in North America and Europe. Simultaneously, it is exploring opportunities in emerging markets to access new customer segments and talent pools. This geographical expansion involves leveraging existing delivery centers and potentially establishing new ones. This is to support increased demand and offer localized services, which is a critical component of their eClerx Future Prospects.

In terms of service expansion, the company continually enhances its offerings to meet evolving client needs and industry trends. This includes a strong emphasis on expanding its automation, analytics, and artificial intelligence (AI) capabilities. This aligns with the increasing demand for data-driven insights and operational efficiency.

The company focuses on expanding its footprint in key regions like North America and Europe. It also explores emerging markets for growth. This includes establishing new delivery centers to support increased demand and offer localized services.

The company is enhancing its service offerings to address evolving client needs. This includes a strong emphasis on expanding its automation, analytics, and AI capabilities. The company is focused on developing new solutions within its existing verticals.

Strategic partnerships and potential bolt-on acquisitions are vital. These allow the company to quickly gain new capabilities. The Personiv acquisition is a key example, adding significant capabilities in digital marketing and creative services.

The company's inorganic growth strategy is likely to continue. It seeks targets that complement its existing strengths or open new avenues for growth. This approach supports the company's overall expansion goals.

The company's expansion strategy involves both geographical and service diversification. This approach aims to capitalize on the growing demand for digital transformation and BPO services. The eClerx Business Model is designed to support these initiatives.

- Geographical Expansion: Strengthening presence in North America and Europe, exploring emerging markets.

- Service Expansion: Enhancing automation, analytics, and AI capabilities.

- Strategic Acquisitions: Leveraging partnerships and acquisitions to gain new capabilities. For more details on the company's revenue streams and business model, see Revenue Streams & Business Model of eClerx Services.

- Inorganic Growth: Pursuing strategic acquisitions to complement existing strengths.

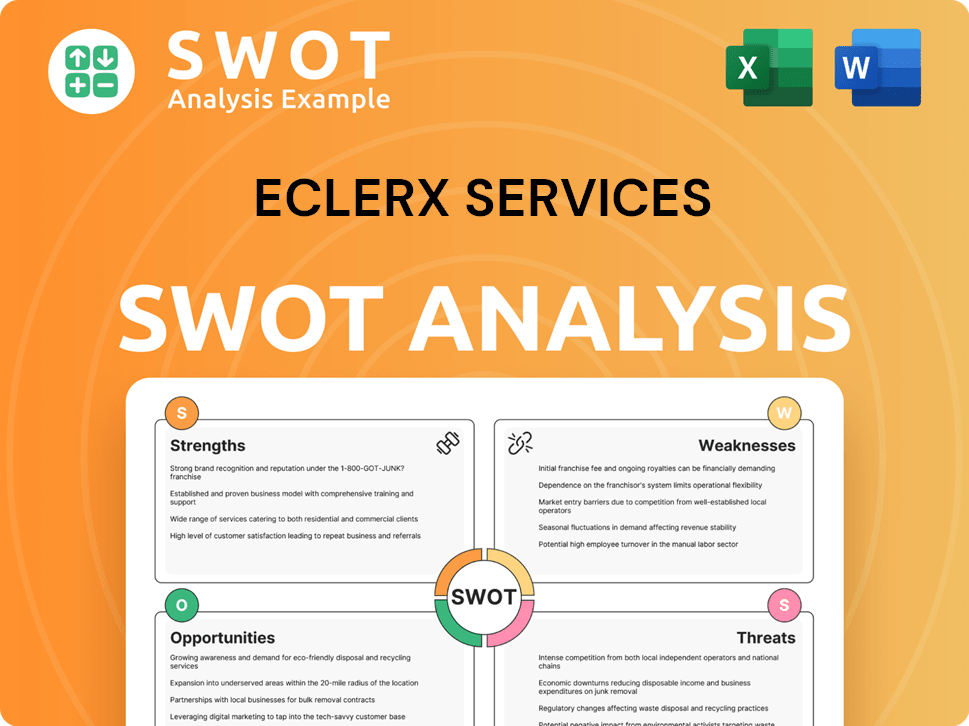

eClerx Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does eClerx Services Invest in Innovation?

The eClerx Growth Strategy is heavily reliant on its innovation and technology initiatives. The company focuses on delivering enhanced value to its clients by leveraging cutting-edge solutions. This approach is crucial for maintaining a competitive edge in the Business Process Outsourcing (BPO) sector.

A key aspect of the eClerx Business Model involves significant investment in research and development (R&D). This investment supports the in-house development of proprietary tools and platforms. These tools include advanced automation frameworks and AI-powered solutions, which streamline complex business processes and improve efficiency.

Digital transformation is a core pillar of eClerx Services strategy. The company assists clients in their digital journeys by offering services that facilitate cloud adoption, data modernization, and the implementation of intelligent automation. This focus on technology allows eClerx to differentiate itself in a competitive market and drive tangible business outcomes for its clients.

eClerx invests heavily in research and development to create proprietary tools. This includes developing advanced automation frameworks and machine learning algorithms. These investments are crucial for the company's long-term growth potential.

The company develops advanced automation frameworks to streamline processes. These frameworks use machine learning algorithms for predictive analytics. This focus on automation helps improve operational efficiency.

eClerx utilizes AI-powered solutions to streamline complex business processes. These solutions enhance accuracy and scalability. This approach allows eClerx to offer more efficient services.

eClerx offers services that enable cloud adoption and data modernization. They also implement intelligent automation solutions. These services are key to helping clients navigate their digital journeys.

eClerx collaborates with technology startups and academic institutions. These partnerships provide access to emerging technologies. This open innovation approach fosters continuous improvement.

The company uses Robotic Process Automation (RPA) for task automation. They also use Natural Language Processing (NLP) for data extraction and analysis. These technologies contribute to efficiency gains.

The company's commitment to digital transformation includes the use of Robotic Process Automation (RPA), Natural Language Processing (NLP), and computer vision. These technologies contribute to eClerx's Financial Performance by improving efficiency and accuracy. For more details, you can read a Brief History of eClerx Services.

eClerx leverages several key technologies to enhance its service offerings and drive growth. These technologies contribute to cost reduction, improved operational efficiency, and enhanced customer experience.

- Robotic Process Automation (RPA): Used for automating repetitive tasks, increasing efficiency, and reducing human error.

- Natural Language Processing (NLP): Applied for data extraction and analysis, enabling better insights and faster decision-making.

- Computer Vision: Utilized for image and video analytics, providing enhanced capabilities in various service areas.

- Machine Learning and AI: Integrated into various solutions for predictive analytics and process optimization, leading to improved service delivery.

- Cloud Computing: Facilitates scalable and flexible service delivery, allowing for better resource management and client support.

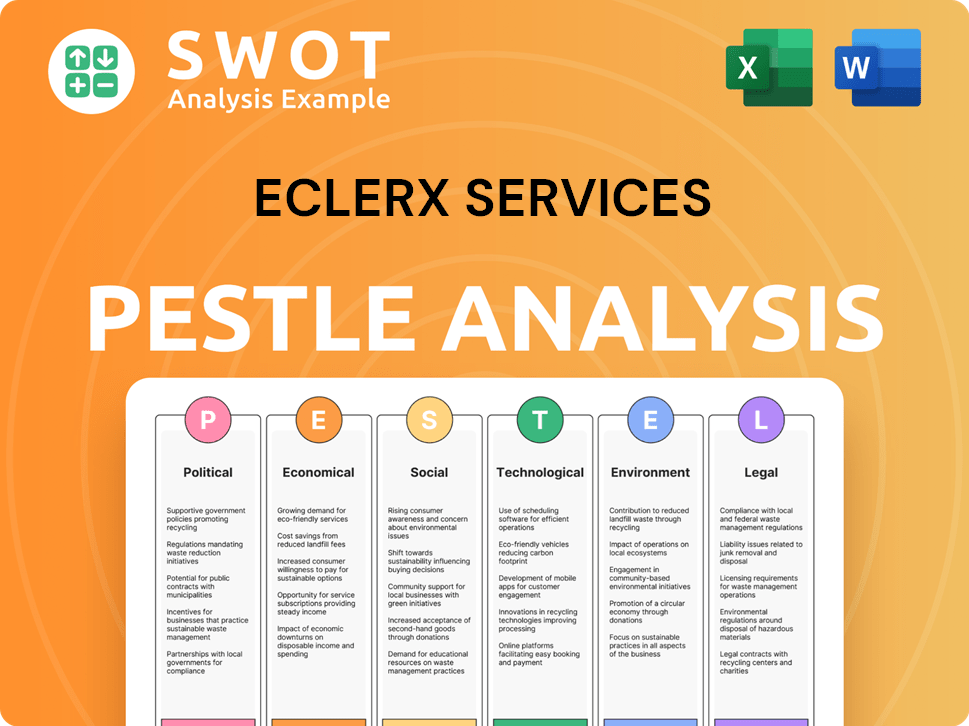

eClerx Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is eClerx Services’s Growth Forecast?

The financial outlook for eClerx Services is promising, underscored by its strong eClerx Financial Performance in recent years. For the fiscal year ending March 31, 2024, the company reported a consolidated revenue of ₹2,883.3 crore, reflecting a substantial 14.5% year-over-year increase. This growth demonstrates the effectiveness of its eClerx Growth Strategy and its ability to capitalize on market opportunities.

The company's profitability is also robust. The profit after tax for the same period was ₹605.3 crore, indicating healthy profit margins and efficient operations. This financial health provides a solid base for future investments and expansion. The company's strategic investments in technology and expansion initiatives are key drivers for its continued success, as highlighted in a recent analysis of the Target Market of eClerx Services.

Analysts anticipate sustained growth for eClerx, driven by its strategic investments in technology and expansion initiatives. The company's management focuses on maintaining healthy operating margins while investing in capabilities that will fuel long-term growth. While specific forward-looking revenue targets and profit margin percentages are subject to market conditions and company performance, eClerx’s historical financial discipline and strategic acquisitions suggest a positive trajectory. The company's strong balance sheet and consistent cash flow generation provide the necessary capital for further R&D, market expansion, and potential M&A activities. eClerx Future Prospects are further enhanced by its focus on sustainable growth, balancing profitability with investments that enhance its competitive advantage and market share.

eClerx has consistently demonstrated revenue growth. The eClerx Business Model supports this growth through its diversified service offerings and client base. Revenue growth is a key indicator of the company's ability to capture market share and expand its service portfolio.

Profitability is a critical aspect of eClerx's financial health. The company's ability to maintain healthy profit margins, as seen in the 2024 fiscal year, reflects its operational efficiency and effective cost management. This profitability supports sustainable growth and investment in future initiatives.

Consistent cash flow generation is a strength of eClerx. Strong cash flow allows the company to invest in R&D, market expansion, and potential acquisitions. This financial flexibility supports the company’s strategic initiatives and long-term growth plans.

eClerx's strategic investments in technology and expansion are vital. These investments enhance its service offerings and competitive advantage. The company's focus on innovation and expansion is crucial for its eClerx Services long-term growth.

eClerx aims to increase its market share through strategic initiatives. The company's ability to gain market share is a key indicator of its success and competitive positioning. Expanding market share is a core component of its growth strategy.

eClerx focuses on enhancing its competitive advantage through innovation and service excellence. This advantage helps the company retain clients and attract new business. The company's competitive edge is crucial for its long-term sustainability.

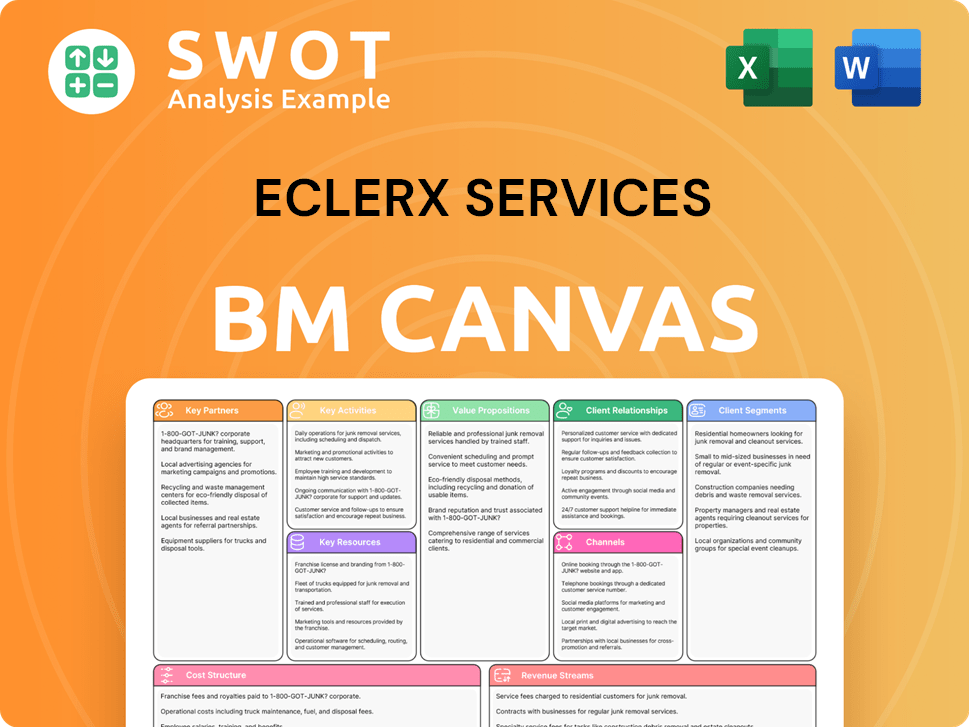

eClerx Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow eClerx Services’s Growth?

Analyzing the potential risks and obstacles is crucial for understanding the eClerx Growth Strategy and its eClerx Future Prospects. Like any global service provider, the company faces challenges that could impact its growth trajectory. Understanding these risks is essential for investors, analysts, and anyone interested in the eClerx Services company's long-term potential.

Market competition, regulatory changes, and technological disruption are significant areas of concern. These factors can affect pricing, operational costs, and the need for continuous innovation. Internal resource constraints, such as attracting and retaining top talent, also pose challenges. Addressing these risks proactively is key to ensuring sustained growth and maintaining a competitive edge in the business process management (BPM) and analytics space.

To mitigate these risks, eClerx employs various strategies. These include diversifying its client base, implementing robust risk management frameworks, and investing in talent development. The company's proactive approach to innovation and market intelligence allows it to adapt to emerging risks, ensuring its long-term resilience and sustained growth. For more insights into the company's foundational principles, you can explore the Mission, Vision & Core Values of eClerx Services.

Intense competition from established players and emerging niche providers can pressure pricing and demand continuous innovation. The business process management and analytics space is highly competitive, requiring constant adaptation to maintain market share. This dynamic necessitates a focus on efficiency and value-added services.

Evolving regulations across diverse industries, especially in financial services and data privacy, pose compliance challenges. Continuous monitoring and adaptation of processes and systems are essential, which can lead to increased costs and operational complexities. Staying compliant is critical.

Rapid advancements in AI, automation, and other technologies require continuous investment in R&D and skill development. To avoid obsolescence, eClerx must ensure its service offerings remain cutting-edge. This necessitates strategic investments in new technologies.

Attracting and retaining top talent in a competitive labor market can hinder growth. The ability to secure skilled professionals is crucial for delivering high-quality services. Investing in employee development and retention strategies is essential.

Diversifying the client base across multiple industries reduces reliance on any single sector. Employing robust risk management frameworks, including scenario planning, prepares for unforeseen events. Investing in workforce upskilling and talent development is also crucial.

A proactive approach to innovation and market intelligence allows anticipation of emerging risks. This enables eClerx to adapt and ensure long-term resilience and sustained growth. Staying ahead of industry trends is key.

In recent financial reports, eClerx has shown a focus on expanding its service offerings to mitigate risks. As of Q1 2024, the company reported revenue growth, indicating its ability to navigate market challenges. The company's investment in technology and talent demonstrates its commitment to long-term growth.

The BPO sector's growth is influenced by global economic conditions and technological advancements. The competitive landscape includes both large multinational corporations and specialized niche providers. eClerx must continuously assess market dynamics and adapt its strategies to maintain a competitive edge. In 2024, the market is expected to grow significantly.

eClerx's diversified client base across various industries reduces its dependency on any single sector, mitigating risk. The company's focus on data analytics and AI services provides a competitive edge. Continuous investment in these areas is crucial for future growth. In 2024, these advantages are expected to become even more critical.

eClerx's innovation in data analytics and AI services is a key driver of its growth. By focusing on these areas, the company can offer cutting-edge solutions and stay ahead of industry trends. This focus also enhances its value proposition to clients. Continuous innovation remains a priority.

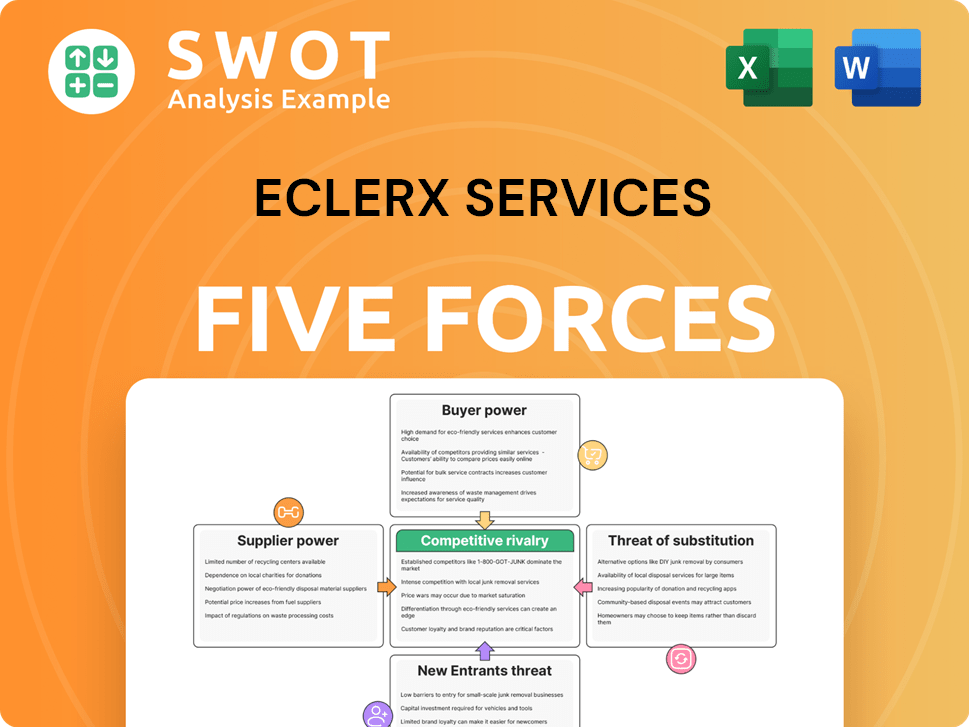

eClerx Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of eClerx Services Company?

- What is Competitive Landscape of eClerx Services Company?

- How Does eClerx Services Company Work?

- What is Sales and Marketing Strategy of eClerx Services Company?

- What is Brief History of eClerx Services Company?

- Who Owns eClerx Services Company?

- What is Customer Demographics and Target Market of eClerx Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.