eClerx Services Bundle

Who Really Owns eClerx Services?

Understanding the ownership of a company is crucial for grasping its strategic direction and potential for growth. eClerx Services, a pioneer in the knowledge processing (KPO) sector, offers a compelling case study. This exploration into eClerx's ownership structure reveals key players and their influence.

Founded in 2000 and going public in 2007, eClerx Services eClerx Services SWOT Analysis has become a significant player in business process management and analytics. With a market capitalization of approximately $2.02 billion as of June 2025, understanding the eClerx ownership is vital. This analysis will examine the eClerx owner, including founder stakes, major shareholders, and the evolution of the eClerx company's ownership over time, providing insights into its future trajectory. The eClerx India based company serves clients globally, making its ownership structure a key factor in its continued success within the eClerx financial services sector.

Who Founded eClerx Services?

The story of eClerx Services Limited begins in 2000, with its foundation by Priyadarshan Mundhra and Anjan Malik. These two individuals, who met at the Wharton School of Business at the University of Pennsylvania, brought their backgrounds in investment banking and consulting to create the company. Their initial focus was on providing innovative solutions, especially within the financial services, cable, and telecommunications sectors.

From the outset, the primary owners of the company were PD Mundhra and Anjan Malik. Their vision was to address the evolving needs of clients in a rapidly changing business environment. This early focus set the stage for the company's growth and its eventual public listing.

As of June 2025, the ownership structure of eClerx Services shows a clear commitment from its founders. Priyadarshan Mundhra remains the largest individual shareholder, holding 27% of the outstanding shares. Anjan Malik also holds a significant stake, owning 27% of the common stock. This substantial founder ownership is a key aspect of the eClerx ownership structure.

The founders' significant shareholding in eClerx indicates a strong alignment with the company's long-term strategic goals. The company went public in 2007, which broadened the shareholder base. The co-founders' combined ownership of 54% of the company highlights their continued influence and vested interest in eClerx's success. For more details on the company's strategic direction, consider reading about the Growth Strategy of eClerx Services.

- The co-founders, Priyadarshan Mundhra and Anjan Malik, collectively control a majority stake.

- The company's initial focus was on financial services and related sectors.

- The public listing in 2007 introduced a wider group of shareholders.

- The ownership structure reflects a strong commitment from the founders.

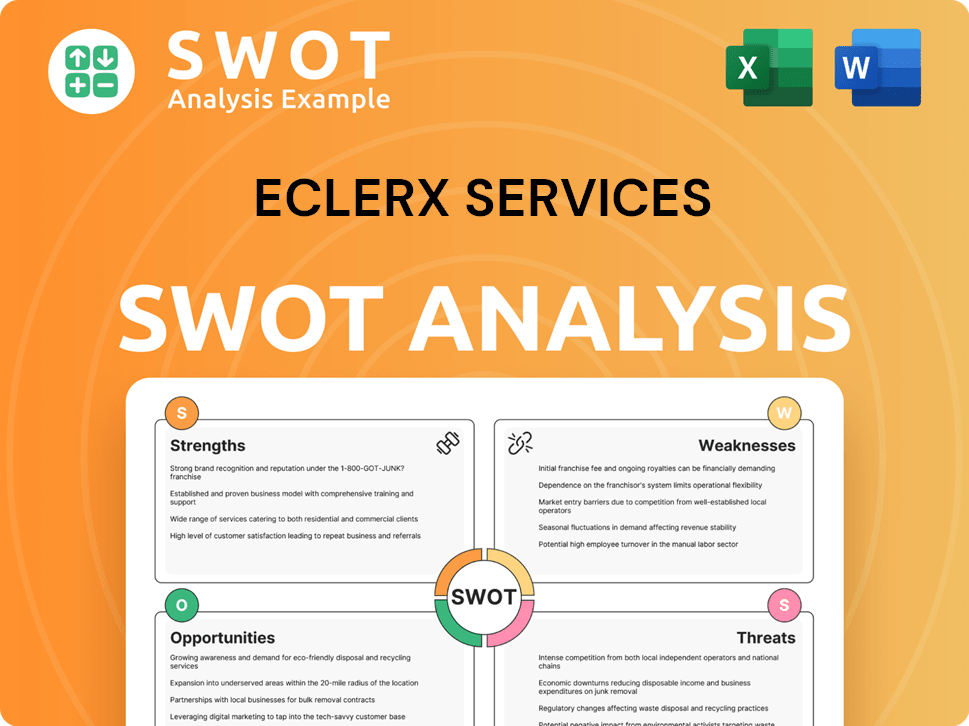

eClerx Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has eClerx Services’s Ownership Changed Over Time?

The ownership structure of eClerx Services has evolved significantly since its inception. A pivotal moment was the company's Initial Public Offering (IPO) in 2007, which led to its listing on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE). This transition marked a shift from a privately held entity to a publicly traded one, opening the door for broader investor participation and changing the dynamics of the eClerx ownership. The IPO was a strategic move that enabled the company to raise capital and increase its visibility in the financial services sector.

The ownership of eClerx has been shaped by various factors, including market dynamics and investor sentiment. The company's ownership structure reflects a mix of stakeholders, including promoters, institutional investors, and the general public. The shifts in ownership, especially among institutional investors, indicate the company's attractiveness and the strategic positioning of investors within the market. Understanding the eClerx ownership is crucial for investors and stakeholders to assess the company's stability and growth potential.

| Shareholder Category | March 31, 2025 | June 2024 |

|---|---|---|

| Promoters | 53.81% | N/A |

| Domestic Institutional Investors (DIIs) | 25.11% | 22.49% |

| Foreign Institutional Investors (FIIs) | 10.12% | 11.78% |

| General Public | Approximately 13% (June 2025) | N/A |

The promoters, including the founders, continue to hold a significant stake in eClerx, demonstrating their ongoing commitment and control. Institutional investors, both domestic and foreign, play a crucial role, with DIIs increasing their holdings. The decrease in FII holdings, coupled with the increase in DIIs, reflects the dynamic nature of the eClerx ownership and investor confidence. For more insights, explore the Growth Strategy of eClerx Services.

eClerx Services' ownership structure includes promoters, institutional investors, and the public.

- Promoters maintain a majority stake, ensuring significant control.

- DIIs have increased their holdings, indicating growing domestic investor confidence.

- FIIs remain significant shareholders, despite a recent decrease in holdings.

- The general public holds a notable percentage, reflecting broad market participation.

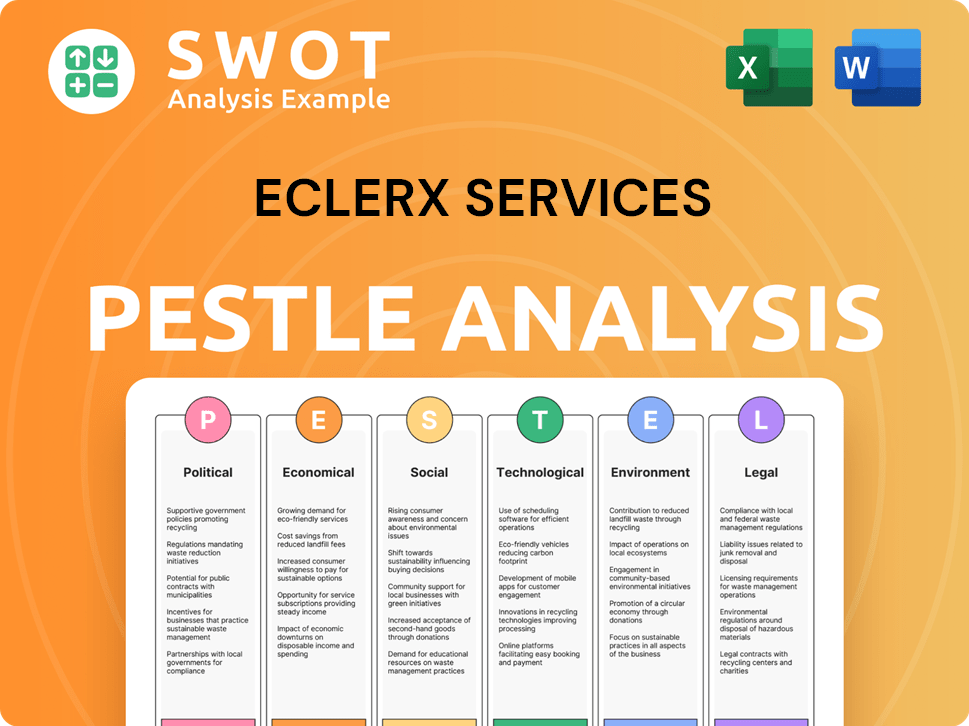

eClerx Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on eClerx Services’s Board?

The current Board of Directors of eClerx Services Limited, as of 2024, includes a mix of executive, non-executive, and independent directors. This structure is designed to balance ownership interests with independent oversight. The board includes key figures like Anjan Malik (Non-Executive Director), Naresh Gupta (Independent Director), P D Mundhra (Executive Director), Shailesh Kekre (Chairman & Independent Director), and Srinjay Sengupta (Independent Director). Additionally, Naval Bir Kumar, Bala C Deshpande, and Amit Piyush Majmudar serve as Non-Executive Independent Directors. Kapil Jain serves as the Managing Director and Chief Executive Officer and is also on the Executive Board.

The composition of the board reflects a commitment to good corporate governance. As of March 31, 2024, the board consisted of a total of 11 Directors: 2 Executive Directors, 1 Non-Executive Director, and 8 Non-Executive Independent Directors, including 2 Independent Woman Directors. This setup ensures a blend of operational expertise and independent oversight, which is crucial for strategic decision-making and maintaining stakeholder trust. The presence of independent directors, such as Shailesh Kekre, who serves as the Chairman, further reinforces the company's dedication to transparency and accountability.

| Director | Role | Category |

|---|---|---|

| Anjan Malik | Director | Non-Executive Director |

| Naresh Gupta | Director | Independent Director |

| P D Mundhra | Director | Executive Director |

| Shailesh Kekre | Chairman | Independent Director |

| Srinjay Sengupta | Director | Independent Director |

| Naval Bir Kumar | Director | Non-Executive Independent Director |

| Bala C Deshpande | Director | Non-Executive Independent Director |

| Amit Piyush Majmudar | Director | Non-Executive Independent Director |

| Kapil Jain | Managing Director & CEO | Executive Director |

The co-founders, Priyadarshan Mundhra and Anjan Malik, hold substantial ownership, collectively controlling approximately 54% of the company's shares. This significant ownership stake gives them considerable influence over the company's strategic direction. The company operates on a one-share-one-vote structure. This structure is important for understanding the eClerx ownership and how decisions are made within the company. For more insights into the company's background, you can read the Brief History of eClerx Services.

Understanding eClerx's ownership structure is crucial for investors and stakeholders.

- Co-founders hold significant shares, influencing strategic decisions.

- The board includes a mix of executive, non-executive, and independent directors.

- The one-share-one-vote structure ensures voting equality.

- The presence of independent directors promotes good governance.

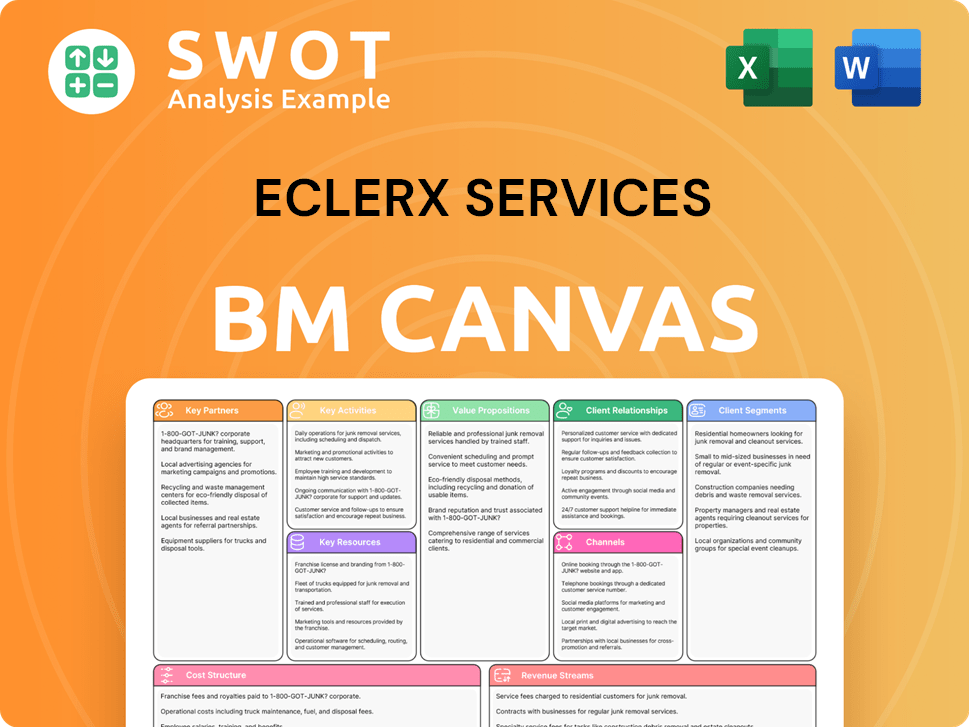

eClerx Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped eClerx Services’s Ownership Landscape?

Over the past few years, the ownership structure of eClerx Services has undergone notable shifts, reflecting broader trends within the financial services industry. The promoters' holding in eClerx has remained relatively stable, showcasing a consistent commitment from the founders. Simultaneously, there's been a discernible increase in institutional ownership, particularly from domestic institutional investors (DIIs) and mutual funds, signaling growing confidence in the company's performance and future prospects. These changes provide insights into the evolution of the eClerx's ownership dynamics.

A closer look reveals that DIIs have steadily increased their stake, moving from 22.49% in June 2024 to 25.11% in March 2025. Mutual funds have also shown strong confidence, with their holdings rising from 22.07% in December 2024 to 23.15% in March 2025, accompanied by an increase in the number of schemes invested, growing from 20 to 24. However, Foreign Institutional Investors (FIIs) have slightly decreased their holdings, from 11.78% in June 2024 to 10.12% in March 2025. The general public's ownership stands at approximately 13% as of June 2025. These trends highlight the evolving investor sentiment and the company's position within the market.

| Shareholder Category | June 2024 | March 2025 |

|---|---|---|

| Promoters | 53.61% | 53.81% |

| DIIs | 22.49% | 25.11% |

| FIIs | 11.78% | 10.12% |

Strategic initiatives have also influenced the eClerx ownership landscape. In 2024, the company announced a buyback offer at ₹2,800.00 per share, aiming to return surplus cash to shareholders and optimize its capital structure, with a record date of July 4, 2024. Furthermore, the launch of a new AI-driven analytics platform in 2023 is expected to contribute to revenue growth. These developments, coupled with consistent dividend payouts and a strong balance sheet, underscore eClerx's stable financial position and proactive market approach. For more details on the company's strategic positioning, consider exploring the Target Market of eClerx Services.

Promoters' holding has remained stable, indicating continued commitment.

DIIs and mutual funds have increased their stake, showing growing confidence.

FIIs have slightly decreased their holdings, but still represent a significant portion.

Buyback offers and new platform launches are shaping the company's future.

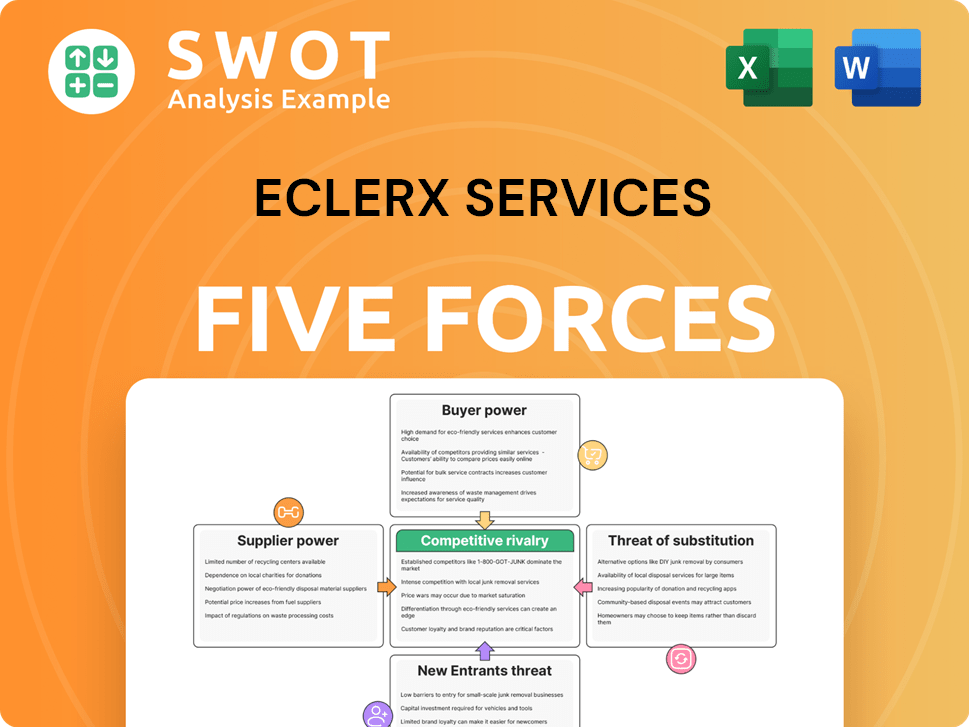

eClerx Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of eClerx Services Company?

- What is Competitive Landscape of eClerx Services Company?

- What is Growth Strategy and Future Prospects of eClerx Services Company?

- How Does eClerx Services Company Work?

- What is Sales and Marketing Strategy of eClerx Services Company?

- What is Brief History of eClerx Services Company?

- What is Customer Demographics and Target Market of eClerx Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.