Elekta Bundle

Can Elekta Revolutionize Cancer Care Again?

Elekta, a pioneer in medical technology, has reshaped oncology since 1972. From its groundbreaking beginnings in Stockholm, Elekta has evolved into a global leader in precision radiation medicine. This Elekta SWOT Analysis will help you understand the company's growth strategy and future prospects.

Elekta's journey from a Swedish startup to a global force in radiation therapy is a testament to its commitment to innovation. Today, the company's focus on oncology solutions positions it to capitalize on the growing medical technology market. Understanding Elekta's strategic initiatives, including its global expansion strategy and robust research and development, is crucial for assessing its long-term investment potential and navigating the Elekta competitive landscape.

How Is Elekta Expanding Its Reach?

The company's expansion strategy is multifaceted, focusing on geographical and product category growth, along with strategic partnerships and acquisitions. This approach aims to tap into new customer bases, diversify revenue streams, and maintain a competitive edge in the rapidly evolving oncology market. The company's commitment to improving global access to precision radiation medicine drives these initiatives, solidifying its leadership position.

A key aspect of the company's strategy involves expanding its presence in emerging markets. These markets often have a significant unmet need for advanced cancer care solutions. This involves adapting offerings to local market requirements and establishing robust distribution and service networks. This is part of a broader strategy to enhance its global footprint and cater to the increasing demand for its products and services.

In terms of product expansion, the company continues to invest in its product pipeline, aiming to introduce new and enhanced solutions. These solutions address specific clinical needs and improve patient outcomes. This includes advancements in its linear accelerators, such as the Elekta Unity MR-Linac, which combines an MRI scanner with a linear accelerator to provide real-time, high-resolution imaging during radiation therapy.

The company is actively expanding its presence in emerging markets. This includes regions where there's a significant need for advanced cancer care solutions. The strategy involves tailoring offerings to local market requirements and establishing strong distribution networks.

The company invests in its product pipeline to introduce new and improved solutions. These are designed to meet specific clinical needs and improve patient outcomes. The focus is on advancements in linear accelerators and other innovative technologies.

Partnerships are crucial for leveraging complementary expertise and extending reach. Collaborations with research institutions and technology providers accelerate new solutions and enhance market penetration. This strategy helps to foster innovation and market growth.

The company explores new business models to provide greater flexibility and accessibility. This includes subscription-based services and managed equipment services. These models aim to improve customer access and enhance the value proposition.

The company's expansion strategy is driven by a commitment to improve global access to precision radiation medicine. The company's focus on these initiatives is driven by its commitment to improving global access to precision radiation medicine and solidifying its leadership position. Strategic acquisitions and partnerships play a crucial role in this strategy.

- Geographical Expansion: Targeting emerging markets with high growth potential.

- Product Innovation: Continuous investment in R&D to enhance product offerings.

- Strategic Alliances: Forming partnerships to leverage expertise and expand reach.

- New Business Models: Exploring subscription-based services for greater accessibility.

The company's approach to expansion is also influenced by its strategic acquisitions. These acquisitions are aimed at strengthening its product portfolio and market position. For instance, the company acquired a company in 2024 to enhance its software capabilities in radiation therapy. The company's focus on these initiatives is driven by its commitment to improving global access to precision radiation medicine and solidifying its leadership position. For more insights, you can explore the Revenue Streams & Business Model of Elekta.

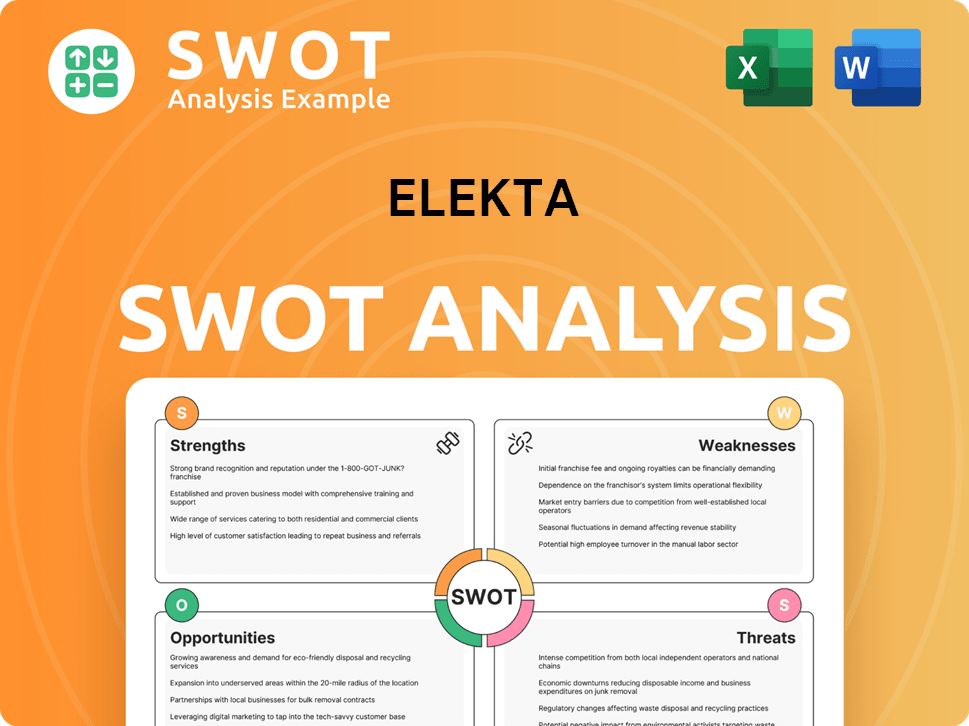

Elekta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Elekta Invest in Innovation?

Elekta's sustained growth is significantly driven by its robust innovation and technology strategy. This strategy is characterized by substantial investments in research and development, in-house development initiatives, and strategic collaborations. The company consistently allocates a considerable portion of its resources to push the boundaries of precision radiation medicine, which is a critical aspect of its overall Elekta company analysis.

The company focuses on developing cutting-edge hardware and software solutions to enhance treatment accuracy, efficiency, and patient comfort. This approach is central to achieving its growth objectives. The company is also leveraging advanced technologies such as artificial intelligence (AI) and machine learning.

Elekta's commitment to innovation is further evidenced by its consistent stream of new product launches and enhancements. The company's leadership in innovation is reflected in its numerous patents and industry accolades, underscoring its continuous efforts to advance cancer treatment technologies and contribute to improved patient outcomes.

Elekta dedicates a significant portion of its resources to research and development. This commitment is crucial for driving innovation in the medical technology market. These investments are a key component of the company's Elekta growth strategy.

The Elekta Unity MR-Linac is a prime example of Elekta's innovation. This technology allows for real-time tumor visualization during treatment. This leads to more precise and adaptive radiation therapy, improving patient outcomes.

Elekta is focused on digital transformation, particularly through AI and machine learning. These technologies optimize treatment planning and personalize patient care. This also improves workflow efficiency within oncology departments.

AI algorithms are integrated into Elekta's software platforms. These tools assist clinicians in contouring tumors and predicting treatment responses. They also help identify optimal treatment delivery strategies.

Elekta explores the potential of the Internet of Things (IoT) to connect its devices. This allows for gathering valuable data for predictive maintenance and performance optimization. This is a forward-looking approach for Elekta's future prospects.

Elekta consistently launches new products and enhancements. This demonstrates its commitment to advancing cancer treatment technologies. These innovations contribute to improved patient outcomes and support Elekta's global expansion strategy.

Elekta's innovation strategy is focused on several key areas, including advanced imaging, AI-driven treatment planning, and enhanced delivery systems. These advancements are critical for maintaining a competitive edge in the radiation therapy market. The company's focus on these areas drives Elekta's market share analysis.

- Advanced Imaging: Real-time tumor visualization with technologies like MR-Linac.

- AI-Driven Treatment Planning: AI algorithms for optimizing treatment plans and predicting patient responses.

- Enhanced Delivery Systems: Innovations in radiation therapy delivery for improved precision and patient comfort.

- Digital Integration: Leveraging IoT for predictive maintenance and performance optimization.

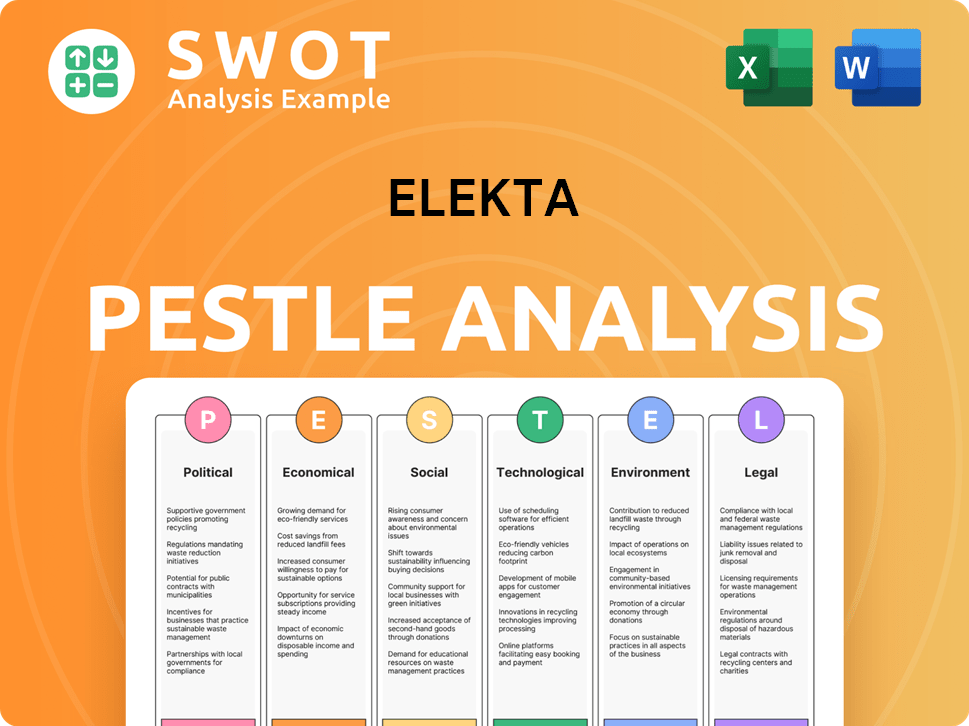

Elekta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Elekta’s Growth Forecast?

The financial outlook for Elekta is centered on its strategic growth initiatives, focusing on sustained revenue expansion and enhanced profitability. The company's aim is to achieve long-term financial performance through its expanding market presence and innovative product offerings. Elekta's recent financial reports demonstrate a consistent increase in both orders and net sales, underpinning its financial ambitions.

For the third quarter of fiscal year 2023/24, Elekta reported a significant order intake, showcasing its strong market position. The company's financial strategy is further supported by its substantial order backlog, which provides a foundation for future revenue, and its focus on operational efficiency, which helps to manage costs and improve profitability. This strategic approach is designed to deliver value to shareholders over the long term.

Elekta's investments are strategically aligned with its innovation and expansion plans, particularly in research and development for new technologies and market penetration efforts. The company also focuses on optimizing its capital structure to support future growth, potentially through a mix of internal funds and strategic financing. The Brief History of Elekta provides context to the company's evolution.

Elekta's revenue growth is driven by several factors. These include the adoption of its advanced oncology solutions, expansion into new markets, and strategic partnerships. The company's focus on innovation in radiotherapy and its comprehensive product portfolio also contribute significantly to its revenue streams.

Elekta holds a significant position in the medical technology market, particularly in radiation therapy. Market share analysis indicates a competitive landscape with other major players. Elekta's strategic acquisitions and focus on innovation help maintain and potentially increase its market share.

Elekta's financial performance is characterized by steady growth, as demonstrated by its recent financial reports. For the third quarter of fiscal year 2023/24, the company reported an order intake of SEK 4,964 million, a 10% increase in constant currency. Net sales for the same period amounted to SEK 4,494 million, a 9% increase in constant currency.

The competitive landscape for Elekta includes other major players in the medical technology market. Elekta's competitive advantage comes from its innovative product portfolio and strong market presence. Strategic partnerships and acquisitions also play a crucial role in maintaining its competitive edge.

Elekta's product portfolio includes a range of oncology solutions, such as linear accelerators and software for treatment planning. The company also offers products for neurosurgery and other related areas. Continuous innovation and upgrades to its product line are crucial for maintaining its market position.

Strategic acquisitions are an important part of Elekta's growth strategy. These acquisitions help to expand its product offerings and market reach. They also allow the company to integrate new technologies and strengthen its position in the medical technology market.

Research and development are critical for Elekta's continued success. The company invests heavily in R&D to develop new technologies and improve existing products. This focus on innovation allows Elekta to stay ahead of the competition and meet the evolving needs of its customers.

Elekta is at the forefront of innovation in radiotherapy. The company's advancements in this field include precision treatments and advanced imaging techniques. These innovations improve patient outcomes and enhance the efficiency of cancer treatment.

Elekta maintains a strong investor relations program to communicate its financial performance and strategic plans. This includes regular updates, investor presentations, and financial reports. Transparent communication helps to build investor confidence and support the company's long-term goals.

Elekta's global expansion strategy involves entering new markets and increasing its presence in existing ones. This includes establishing partnerships, opening new offices, and adapting its products to meet local needs. This strategy is crucial for driving revenue growth.

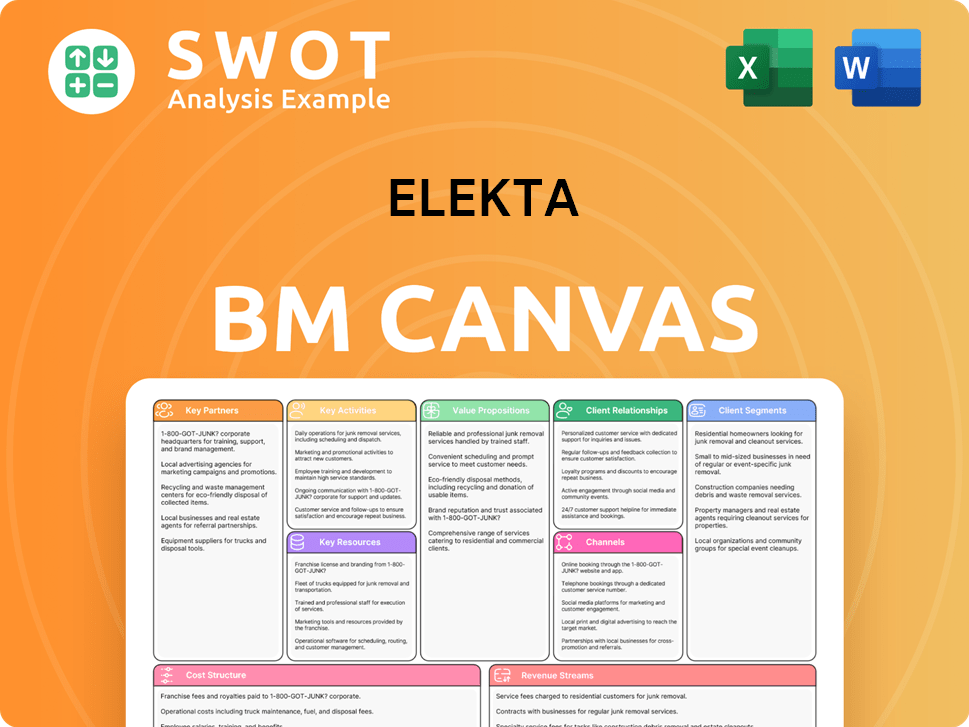

Elekta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Elekta’s Growth?

The path of Elekta's growth strategy is paved with potential risks and obstacles, crucial to consider within the medical technology market. Competition is fierce, with both established and emerging entities vying for market share in radiation therapy and oncology solutions. This necessitates continuous investment in research and development, as well as strategic differentiation to maintain a competitive edge.

Regulatory changes present another significant hurdle; the medical device industry is heavily regulated. Any shifts in approval processes, reimbursement policies, or product standards can impact market access and profitability. Navigating the diverse regulatory frameworks across different geographical markets demands substantial resources and expertise. These factors are essential to consider when performing an Elekta company analysis.

Supply chain vulnerabilities, technological disruptions, and internal resource constraints also pose challenges. Elekta addresses these risks through a comprehensive risk management framework, diversification of its product portfolio and geographical markets, and scenario planning to anticipate and prepare for potential disruptions.

The medical technology market is highly competitive, with numerous players vying for market share. Established companies and innovative startups continuously challenge Elekta's position. This competitive landscape demands constant innovation and strategic adaptation.

The medical device industry is subject to stringent regulations globally. Changes in approval processes, reimbursement policies, and product standards can significantly impact Elekta's market access and profitability. Navigating these complex regulatory frameworks requires substantial resources.

Global events can disrupt supply chains, affecting manufacturing and delivery capabilities. Mitigation strategies include diversifying suppliers and robust inventory management. These measures are crucial for ensuring operational continuity.

Rapid advancements in AI and personalized medicine require continuous adaptation. Elekta must invest in research and development to prevent its solutions from becoming obsolete. Staying ahead of technological trends is essential for long-term success.

Attracting and retaining top talent in specialized fields can be challenging. These resource constraints could impact Elekta's ability to execute its innovation roadmap. Effective human capital management is vital for sustaining growth.

Geopolitical instability and economic downturns can affect Elekta's global operations. Currency fluctuations, trade restrictions, and political risks can impact revenue and profitability. Diversifying markets and having robust risk management are important.

Elekta's financial performance is closely tied to its ability to navigate these risks. The company's revenue growth drivers, such as new product launches and strategic acquisitions, must be carefully managed. In fiscal year 2023/24, Elekta reported a net sales growth of around 6% at constant exchange rates, indicating its resilience in the face of market challenges. Understanding Elekta's financial performance is key to assessing its long-term investment potential.

The medical technology market is dynamic, with continuous shifts in demand and technological advancements. Elekta's product portfolio, including its oncology solutions and radiation therapy systems, must remain competitive. Elekta's ability to adapt to market dynamics is crucial for its strategic acquisitions and overall Elekta future prospects. As of late 2024, the global radiation therapy market is projected to continue growing, providing opportunities for Elekta.

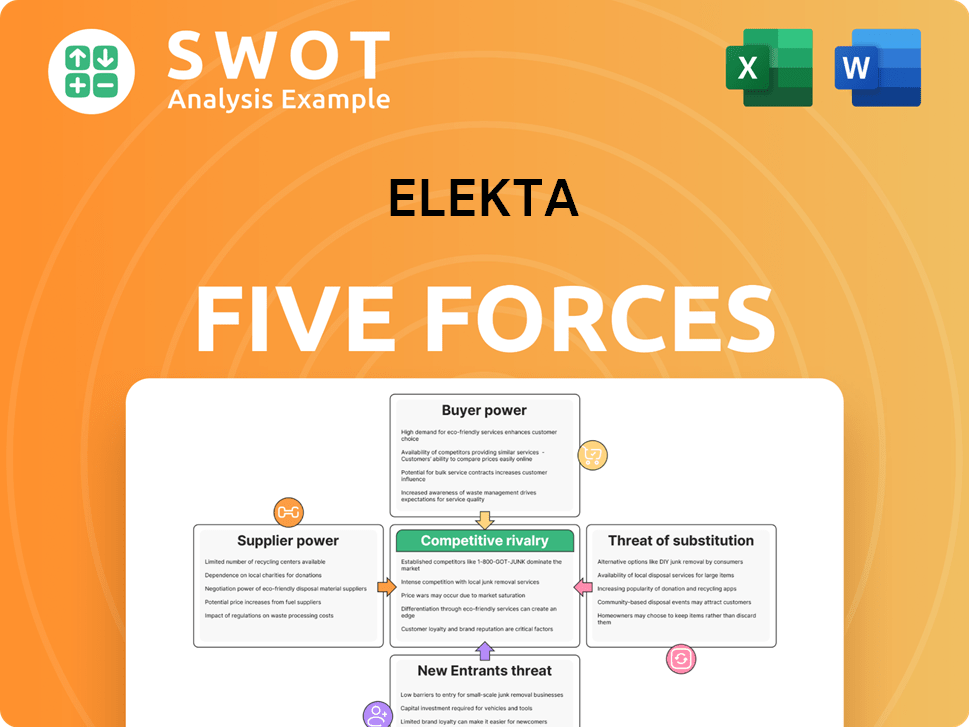

Elekta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Elekta Company?

- What is Competitive Landscape of Elekta Company?

- How Does Elekta Company Work?

- What is Sales and Marketing Strategy of Elekta Company?

- What is Brief History of Elekta Company?

- Who Owns Elekta Company?

- What is Customer Demographics and Target Market of Elekta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.