Elekta Bundle

Who Really Owns Elekta?

Unraveling the Elekta SWOT Analysis is just the beginning; understanding its ownership is key to grasping its future. Major shifts in Elekta's shareholder base can signal significant strategic changes, influencing everything from product development to market expansion. As a leader in medical technology, Elekta's ownership structure is a critical factor for investors and industry watchers alike.

This deep dive into "Who owns Elekta" will explore the Elekta company's ownership, from its founding to the present day. We'll examine the influence of Elekta investors, including major shareholders, and how their decisions impact the company's trajectory. Discover how Elekta's ownership structure shapes its response to market dynamics and technological advancements, providing valuable insights for anyone interested in Elekta stock and its long-term prospects.

Who Founded Elekta?

The Elekta company was established in 1972. The founders were Professor Lars Leksell and his son, Laurent Leksell. Lars Leksell, a neurosurgeon, developed the Leksell Gamma Knife, a pioneering tool for non-invasive brain surgery.

Laurent Leksell, with a background in economics and business, played a key role in commercializing his father's invention. The early focus was on advancing medical technology for cancer and brain disorders. The company's initial ownership was largely controlled by the Leksell family.

While specific initial equity splits are not publicly available, the Leksell family maintained significant control during the company's early years. This control was crucial for guiding the strategic direction of the company. Early backing likely came from the founders' personal capital and potentially early-stage investors.

The founders' vision shaped the company's mission. Early agreements focused on establishing the operational framework and securing intellectual property. The early ownership structure was designed to ensure the founders' control.

- Who owns Elekta: Primarily, the Leksell family held significant ownership initially.

- Elekta shareholders: Over time, Elekta transitioned to a public company, with ownership distributed among institutional investors and the public.

- Elekta investors: Early investors likely included individuals or firms that saw the potential of the Gamma Knife technology.

- Elekta stock: The company's stock is traded on the Nasdaq Stockholm, with ownership details updated regularly in the company's annual reports.

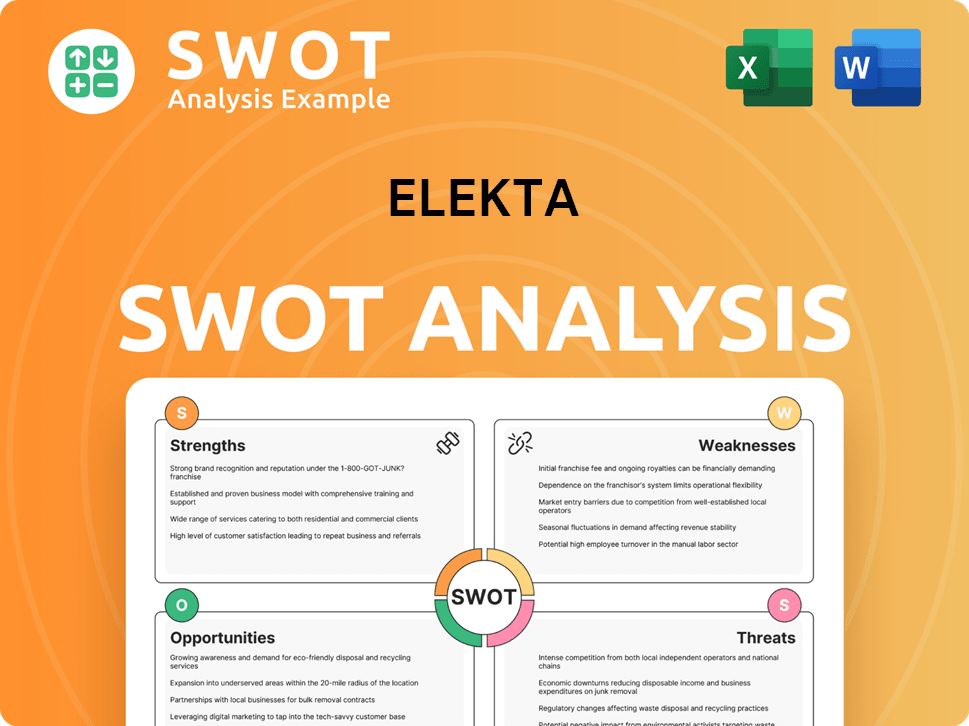

Elekta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Elekta’s Ownership Changed Over Time?

The evolution of Elekta's ownership has been marked by significant milestones, particularly its initial public offering (IPO) in 1994 on the Stockholm Stock Exchange (now Nasdaq Stockholm). This event was a pivotal moment, transforming the company from a privately held entity to a publicly traded one. The IPO enabled access to greater capital, fueling expansion and research and development initiatives. Over time, the ownership structure of the Elekta company has shifted, attracting a diverse group of investors, primarily institutional investors.

The shift in ownership reflects the typical trajectory of a publicly traded company, where market capitalization and liquidity draw a broad range of investors. The influence of these institutional investors is primarily exerted through their voting rights at annual general meetings and their engagement with the company's management and board. The Leksell family, the original founders, may still retain some shares, but their direct control has likely decreased as the company has grown and its ownership has diversified. The composition of Elekta shareholders affects the company's strategy through investment mandates and expectations for financial performance and governance. This evolution is a key aspect of understanding Who owns Elekta.

| Event | Impact | Year |

|---|---|---|

| IPO on Stockholm Stock Exchange | Broadened ownership base, increased capital | 1994 |

| Growth and Expansion | Attracted institutional investors | Ongoing |

| Increased Market Capitalization | Higher liquidity, wider investor base | Ongoing |

As of early 2025, major Elekta investors include institutional investors such as mutual funds, pension funds, and asset management firms. For example, Swedbank Robur Fonder, Alecta Pensionsförsäkring, and Handelsbanken Fonder are often among the top shareholders. This reflects the company's appeal to long-term institutional capital seeking exposure to the medical technology sector. The company's financial performance and strategic direction are influenced by these major shareholders. To learn more about the company's strategic direction, you can read about the Growth Strategy of Elekta.

Elekta ownership has evolved significantly since its IPO, with institutional investors now holding a major stake. The shift highlights the transition from private to public ownership, impacting the company's strategic direction and financial performance.

- Institutional investors play a key role in shaping Elekta's strategy.

- The IPO in 1994 was a major turning point.

- The Leksell family's influence has diminished over time.

- Elekta stock is traded on Nasdaq Stockholm.

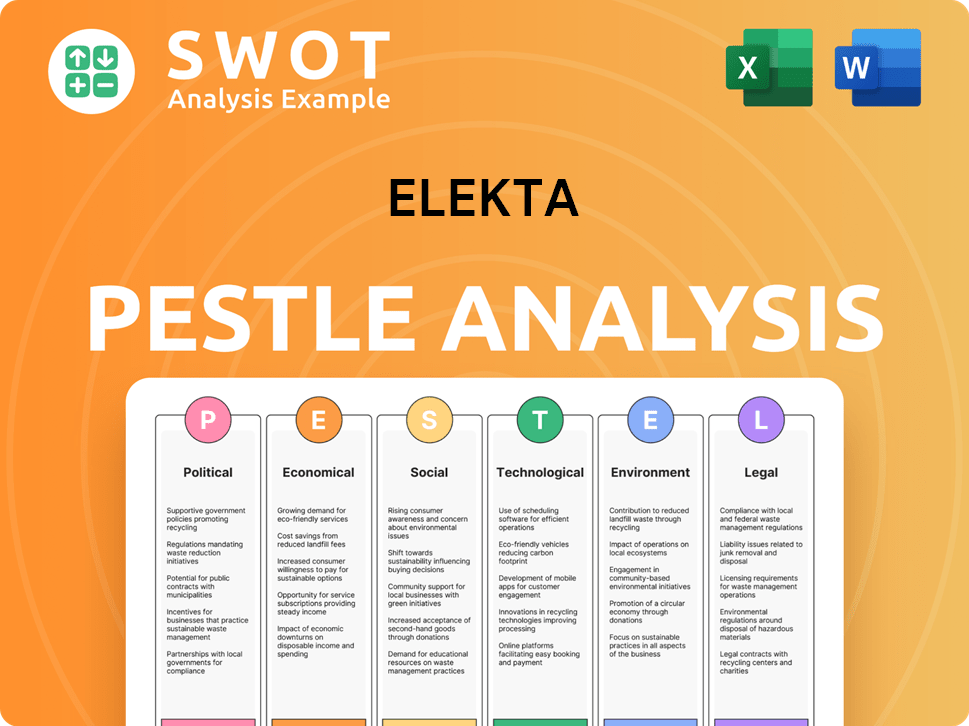

Elekta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Elekta’s Board?

The Board of Directors at Elekta, crucial for guiding the company's strategic direction and ensuring good corporate governance, typically includes a mix of independent directors and those with significant industry experience. As of early 2025, the board often features individuals with backgrounds in finance, technology, and healthcare management, bringing diverse perspectives to decision-making. The chairman of the board leads the board's activities and liaises with management, ensuring effective oversight and leveraging expertise for growth. The composition of the board reflects a balance aimed at providing oversight while leveraging expertise for growth. Understanding Elekta's brief history can provide additional context to the company's evolution.

The structure of the board and its influence are key aspects of understanding who owns Elekta. The board's decisions are subject to shareholder approval at the annual general meeting, reinforcing accountability to the owners. This structure ensures that the interests of Elekta shareholders are considered in major strategic decisions.

| Board Member | Title | Background |

|---|---|---|

| To be updated | Chairman | Finance |

| To be updated | Director | Technology |

| To be updated | Director | Healthcare |

Elekta operates with a one-share-one-vote structure, meaning each share carries equal voting power. This standard arrangement for public companies ensures that voting power is directly proportional to shareholding. While there haven't been widely publicized proxy battles or activist investor campaigns in recent years, the distribution of voting power among Elekta shareholders, including institutional investors, means that significant decisions require broad shareholder consensus. This structure is a key element of Elekta ownership.

The Board of Directors at Elekta is responsible for strategic direction and corporate governance.

- Board members often have backgrounds in finance, technology, and healthcare.

- Elekta uses a one-share-one-vote system.

- Major decisions require shareholder approval.

- The board's decisions are subject to shareholder approval at the annual general meeting.

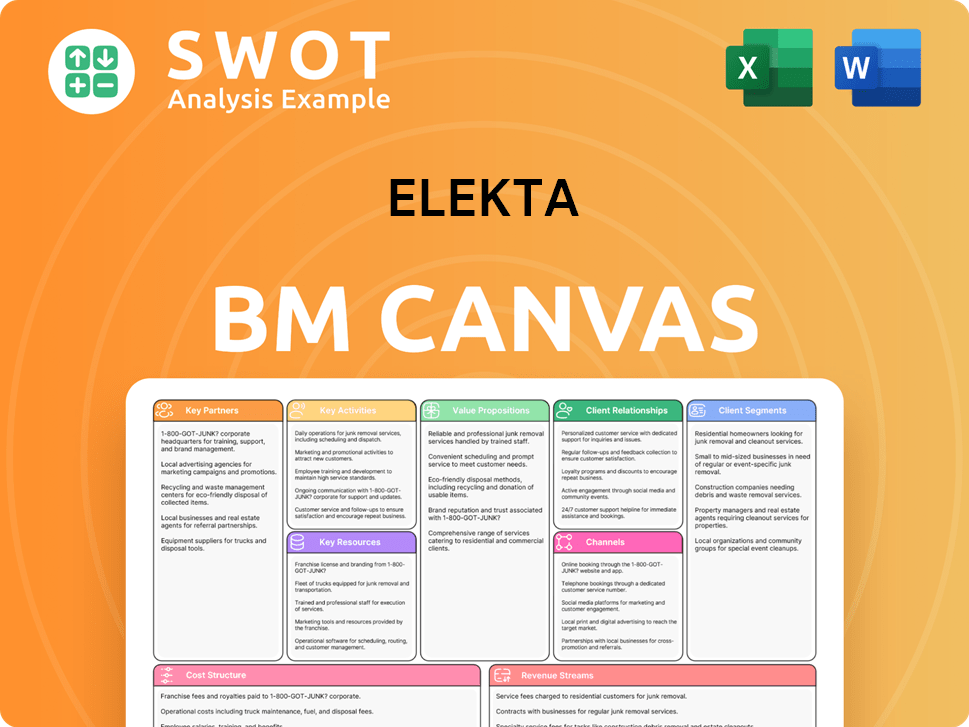

Elekta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Elekta’s Ownership Landscape?

In the past few years (2022-2025), the Elekta company's ownership has been influenced by broader trends in the medical technology sector. Institutional investors, including major asset managers and pension funds, have maintained or increased their stakes, reflecting confidence in the healthcare sector's growth. This trend is partly due to the company's strong market position in oncology and its commitment to innovation and market leadership.

Elekta's financial performance and strategic initiatives, such as product innovation and market expansion, continuously influence investor interest and ownership composition. The focus on ESG (Environmental, Social, and Governance) factors by institutional investors also plays a role, as large funds consider these criteria when allocating capital. Elekta's ongoing efforts in research and development, particularly in precision radiation medicine and AI-driven oncology solutions, are likely to continue shaping its appeal to Elekta investors and its ownership structure.

| Metric | Value (2024) | Notes |

|---|---|---|

| Market Capitalization | Approximately $5.5 billion USD | As of late 2024, subject to daily fluctuations. |

| Institutional Ownership | Around 70% | Estimate based on recent filings. |

| Revenue (Fiscal Year 2024) | Approximately $1.9 billion USD | Based on preliminary reports. |

Elekta ownership structure continues to evolve, with institutional investors playing a significant role. The company's focus on innovation and market expansion is key to attracting and retaining investor confidence, influencing the composition of its Elekta shareholders. The company's financial performance and strategic initiatives are key drivers for attracting and retaining investor confidence, influencing the composition of its Elekta shareholders.

Elekta is primarily owned by institutional investors. Major shareholders include large asset managers and pension funds. These investors often hold significant stakes, reflecting confidence in the company's long-term growth potential.

The Elekta stock price has fluctuated, influenced by its financial performance and market conditions. Recent performance reflects industry trends and investor sentiment. Investors can track the stock's performance through financial news and investment platforms.

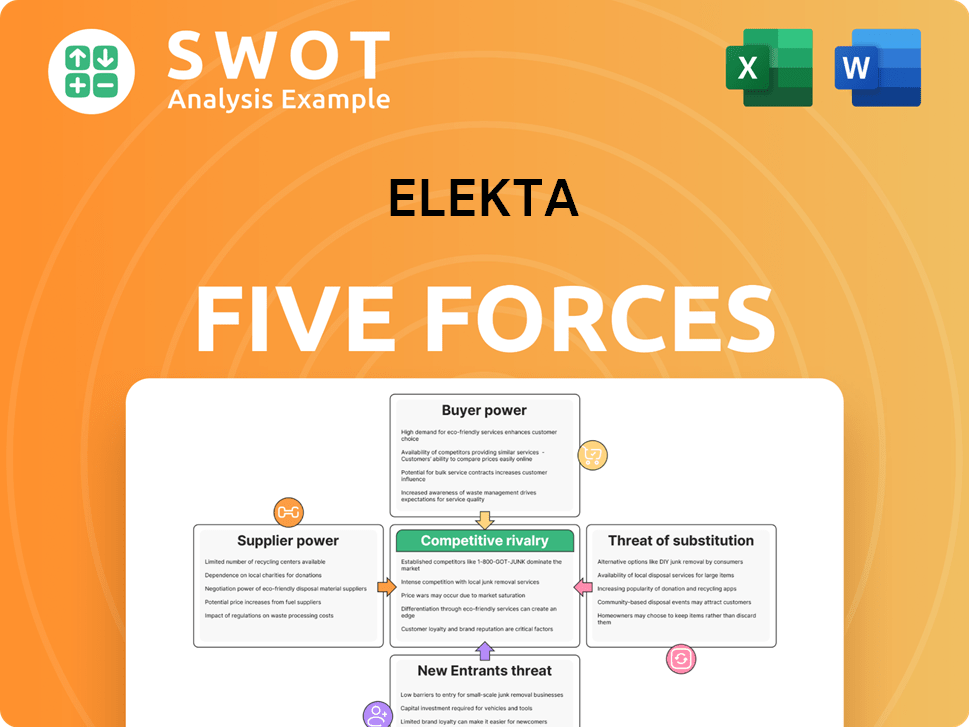

Elekta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Elekta Company?

- What is Competitive Landscape of Elekta Company?

- What is Growth Strategy and Future Prospects of Elekta Company?

- How Does Elekta Company Work?

- What is Sales and Marketing Strategy of Elekta Company?

- What is Brief History of Elekta Company?

- What is Customer Demographics and Target Market of Elekta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.