EXFO Bundle

Can EXFO Navigate the Telecom Revolution and Thrive?

Founded in 1984, EXFO has become a key player in the global communications industry, providing vital test and monitoring solutions. With the telecommunications landscape rapidly evolving, understanding EXFO's EXFO SWOT Analysis is essential for grasping its strategic positioning. As data creation explodes, driven by 5G and AI, EXFO's future hinges on its ability to adapt and innovate.

This deep dive into EXFO's EXFO growth strategy and EXFO future prospects will dissect its expansion plans, technological advancements, and financial outlook. We'll explore how EXFO aims to capitalize on the burgeoning demand for fiber optic solutions and other services within the dynamic telecommunications industry, while also assessing potential risks. This EXFO company analysis provides critical insights into the company's long-term growth potential and its ability to maintain its market share amidst fierce competition.

How Is EXFO Expanding Its Reach?

The Owners & Shareholders of EXFO are actively driving expansion through strategic initiatives focused on the evolving needs of the telecommunications industry. This includes a strong emphasis on 5G deployments, fiber optic infrastructure, and the growth of data centers. The company's strategy involves launching new products and solutions designed to meet the demands of high-speed networks and next-generation technologies. This approach is crucial for maintaining a competitive edge in the optical test and measurement market.

EXFO's growth strategy also encompasses geographical expansion and the strengthening of strategic partnerships. By focusing on specific regional markets and enhancing network rollout efficiency, EXFO aims to broaden its market reach and customer base. The company's focus on innovation and strategic partnerships is critical for its future prospects.

EXFO's commitment to inorganic growth is evident through its acquisition strategy. The company has made a number of acquisitions across various sectors, aimed at expanding its capabilities and market reach. This strategy is designed to drive EXFO's long-term growth potential.

In April 2025, EXFO unveiled the telecom industry's first 1.6T validation system, supporting the entire 1.6T ecosystem. In March 2025, the company introduced the FTB Lite 700 series of Optical Time Domain Reflectometers (OTDRs) with seamless connectivity to the Exchange cloud-based solution. These launches demonstrate EXFO's commitment to innovation in fiber optic solutions.

In September 2024, EXFO launched the FIP-200 Connector Checker and AXS-120 mini-OTDR, showcasing these solutions at Connected Britain in London. In January 2025, EXFO collaborated with CityFibre, adopting EXFO Exchange for cloud-based testing. These initiatives highlight EXFO's focus on expanding its customer base and market opportunities.

EXFO has made 14 acquisitions across various sectors, with EHVA, INOPTICALS, and Astellia being its latest. This acquisition strategy is a key component of EXFO's expansion plans, aimed at enhancing its capabilities and market reach. The company's focus on inorganic growth is designed to drive its long-term growth potential.

In February 2025, EXFO responded to AI-driven usage demands on fiber-dense data centers with an innovative test solution. The pro version of its PXM/LXM OLTS was introduced for faster Tier 1 certification. This demonstrates EXFO's commitment to adapting to emerging technologies and market trends.

EXFO's expansion initiatives are centered around new product launches, geographical expansion, strategic partnerships, and a robust acquisition strategy. These initiatives are designed to address the evolving needs of the telecommunications industry and drive EXFO's future prospects. The company's focus on innovation and strategic partnerships is critical for its success in the competitive landscape.

- Launching new products and solutions for high-speed networks.

- Expanding geographically and strengthening partnerships.

- Acquiring companies to broaden capabilities and market reach.

- Adapting to AI-driven demands in data centers.

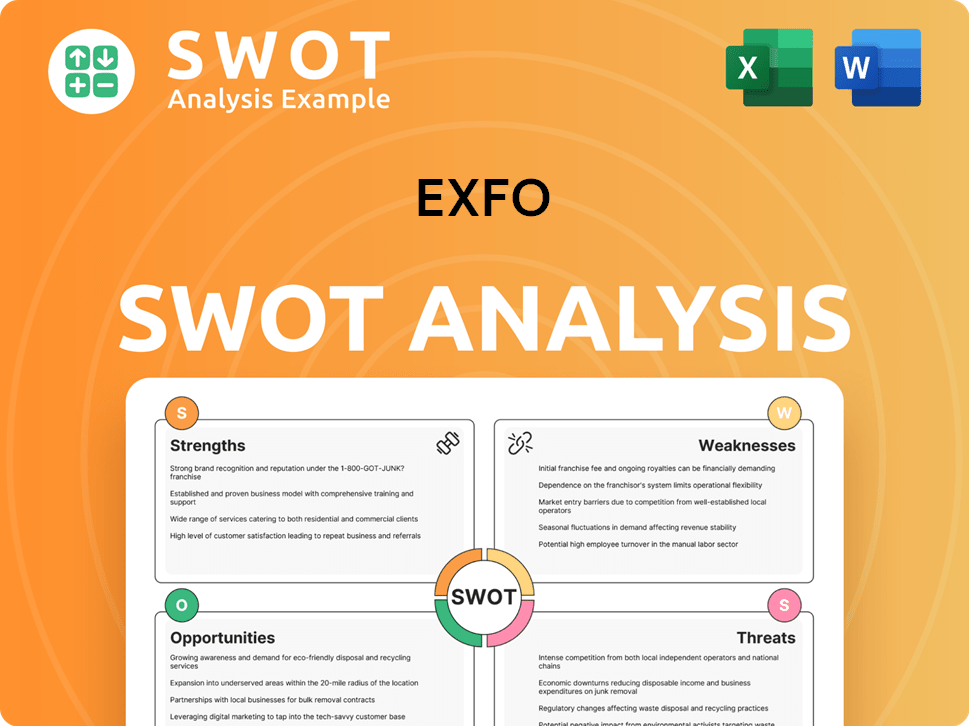

EXFO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does EXFO Invest in Innovation?

The company's innovation and technology strategy is central to its sustained growth within the telecommunications industry. EXFO's approach focuses on anticipating and meeting the evolving needs of next-generation networks and the digital transformation occurring within the sector. This commitment is evident in its significant investment in research and development and its consistent stream of new product releases.

EXFO's dedication to innovation is reflected in its continuous development of new products and technologies. The company's strategy includes a strong emphasis on in-house development, which allows it to maintain control over its intellectual property and quickly adapt to market changes. This approach supports EXFO's goal of maintaining a competitive edge in the optical test and measurement market.

EXFO's strategic focus on innovation is crucial for maintaining its competitive position and driving future growth. The company leverages its technological advancements to address the increasing demands of high-speed networks and the rapid adoption of new technologies like generative AI. This proactive approach ensures that EXFO remains at the forefront of the telecommunications industry.

In April 2025, EXFO introduced the BA-1600 1.6T Bit Analyser, a key product designed for high-speed testing. This launch highlights EXFO's commitment to supporting the latest network technologies.

EXFO integrates AI-driven diagnostics and cloud-based data solutions into its products. This integration enhances network performance and service reliability for customers.

The Exchange cloud-based solution provides seamless connectivity for EXFO's FTB Lite 700 series OTDRs. This enhances fiber network testing capabilities.

EXFO has patented methods to enhance OTDR measurements by reducing Rayleigh coherence noise. This demonstrates its leadership in innovation and commitment to improving testing accuracy.

From 2024 to 2026, EXFO plans to increase investment in talent development to foster innovation. This includes continuous learning and knowledge sharing.

EXFO showcased its automated PIC testing and transceiver testing capabilities at OFC 2024. This highlights its commitment to advancing testing solutions.

EXFO's innovation strategy includes the use of AI and automation to enhance network performance and service reliability. This focus allows the company to offer advanced solutions that meet the evolving needs of its customers.

- AI-Driven Diagnostics: Integration of AI to improve testing and analysis.

- Cloud-Based Data Integration: Use of cloud solutions for enhanced connectivity and data management.

- Patented OTDR Enhancements: Technologies to reduce noise and improve measurement accuracy.

- Focus on High-Speed Networks: Development of products like the BA-1600 to support 1.6T speeds.

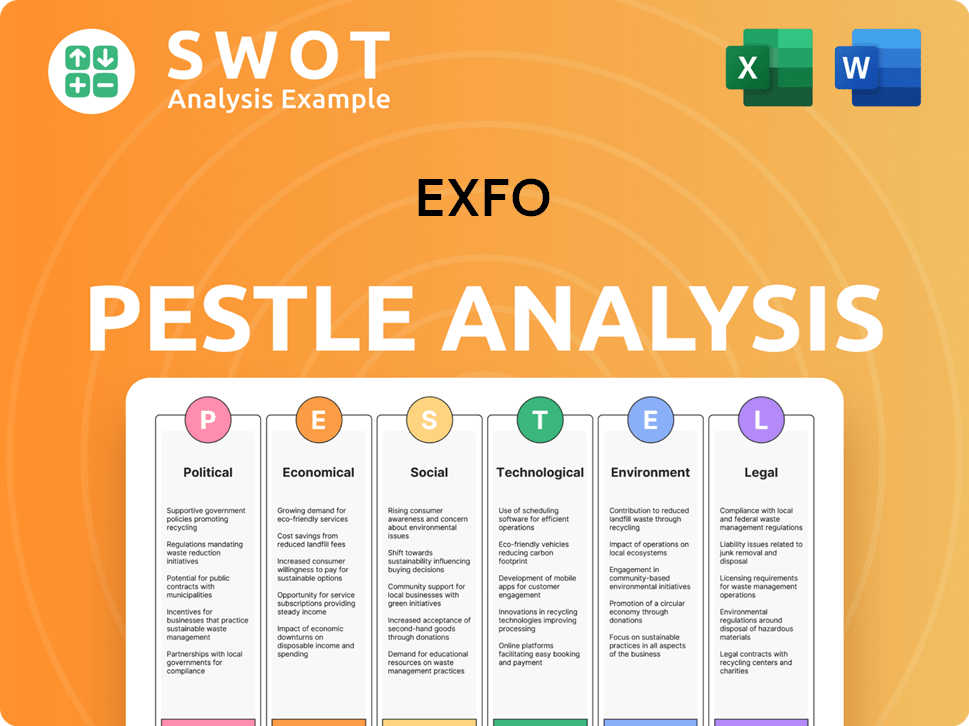

EXFO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is EXFO’s Growth Forecast?

The financial outlook for EXFO indicates potential for continued growth, driven by strategic initiatives and industry trends. As of May 2025, the company's annual revenue reached approximately $750 million. This performance is supported by the expanding market for optical test and measurement equipment, particularly within the telecommunications industry.

The fiber optic test equipment market is projected to experience substantial growth. It is expected to increase from USD 1,052.6 million in 2024 to USD 1,903 million by 2034. This growth represents a Compound Annual Growth Rate (CAGR) of 6.10% between 2025 and 2034. This expansion is primarily fueled by the deployment of 5G networks and the growth of data center infrastructure, which creates significant market opportunities for fiber optic solutions.

While specific profit margins for EXFO are not readily available, the company's focus on high-growth areas suggests a strategy aimed at capturing higher-value segments of the market. EXFO's consistent product launches and strategic acquisitions, such as the 14 acquisitions made across various sectors, indicate ongoing investment in its growth trajectory. This expansion is further supported by government contributions like the $15.9 million received from the Canadian federal government in October 2022 to advance 5G telecommunications.

EXFO's revenue is supported by the overall growth of the fiber optic test equipment market. The market is forecasted to reach USD 1,903 million by 2034, indicating a positive trend for EXFO's future prospects. This growth is driven by the expansion of 5G and data center infrastructure, which are key drivers for EXFO's business.

EXFO's position in the market is strengthened by the telecommunications segment, which held over 56% of the global fiber optic test equipment market share in 2024. As a key player in this market, EXFO benefits from the increasing demand for its products and services. This market share trend highlights the importance of the telecommunications industry for EXFO.

The EXFO stock price is expected to show a positive trend, with a potential increase from $6.245 USD to $8.410 USD in one year. A five-year investment could yield a revenue of approximately +176.09%, reaching $17.242 USD by August 2026. This forecast suggests a favorable outlook for EXFO's stock performance, reflecting confidence in its long-term growth potential.

EXFO's product innovation strategy focuses on high-growth areas like 400G and 800G testing, and AI-driven solutions, indicating a focus on capturing higher-value segments of the market. The company consistently launches new products and makes strategic acquisitions. These initiatives support EXFO's expansion plans and enhance its competitive edge in the telecommunications industry.

The competitive landscape for EXFO includes various players in the optical test and measurement market. EXFO's ability to innovate and adapt to market demands, as highlighted in this article about EXFO by placing ONLY ONE natual link with anchor text (EXFO company analysis), positions it well within this competitive environment. The company's focus on 5G and data center solutions allows it to address the evolving needs of the telecommunications industry.

- EXFO's strategic acquisitions and product launches contribute to its competitive advantage.

- The company's focus on AI-driven solutions and high-speed testing technologies helps to differentiate it in the market.

- EXFO's ability to secure government funding demonstrates its commitment to innovation and expansion.

- The company's strong presence in the telecommunications sector supports its market share and revenue growth.

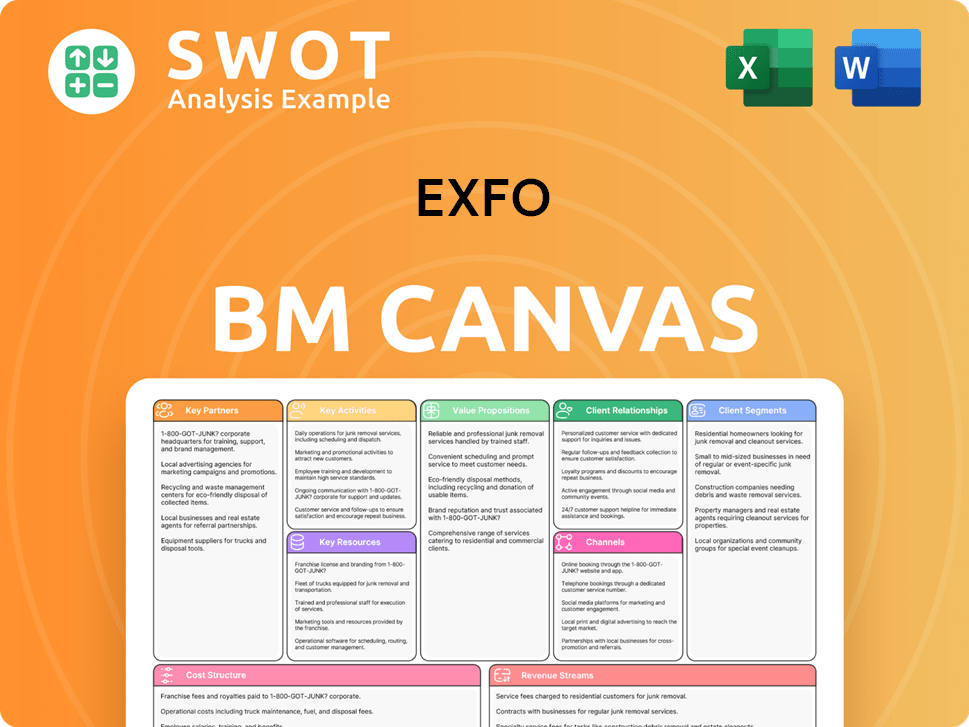

EXFO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow EXFO’s Growth?

The journey of the company towards its growth strategy and future prospects faces several potential risks and obstacles. These challenges are common within the telecommunications and technology sectors, where the company operates. Understanding these hurdles is crucial for assessing its long-term viability and success.

The telecommunications industry's dynamic nature and the rapid evolution of technology create a complex environment for the company. Staying ahead of market trends and adapting to technological advancements are critical for maintaining a competitive edge. The company's ability to navigate these challenges will significantly impact its growth trajectory.

Market competition is a significant factor impacting the company. The company operates in a competitive market with around 249 competitors, including major players like Sandvine, NetScout, and Neusoft. The intense competition in the portable optical time domain reflectometer market, driven by demand from telecom, data centers, and network service providers, adds to the challenges.

The rapid pace of technological innovation, especially with the emergence of generative AI, 5G, and IoT, presents a significant risk. Continuous adaptation and investment in new solutions are essential for the company to stay competitive. Failure to keep up with these advancements could hinder its competitive edge.

Evolving global regulations pose potential obstacles. New regulations concerning AI, cybersecurity, and environmental sustainability are continuously coming into effect. Compliance with these regulations is crucial for the company's operations and future prospects.

Supply chain vulnerabilities and internal resource constraints can impact operations. Managing a global employee base of approximately 1,900 across over 25 countries requires robust operational frameworks. These factors can affect the company's ability to meet its goals.

The company faces intense competition from numerous players in the telecommunications industry. This competitive environment requires continuous innovation and strategic adaptation to maintain market share and drive growth. The company needs to differentiate itself through its products and services to succeed.

The company must invest heavily in research and development to stay ahead of technological advancements. The demand for advanced OTDR solutions with automation, AI-driven diagnostics, and cloud-based data integration requires ongoing innovation. This investment is crucial for its EXFO growth strategy.

Economic downturns or fluctuations can impact the telecommunications industry. These conditions can affect customer spending and investment in new technologies. The company needs to be prepared for economic uncertainties.

The company operates within a highly competitive landscape, which includes both established and emerging players. This competition necessitates continuous innovation and strategic adaptation to maintain market share. The ability to differentiate through product offerings and customer service is critical for success. The company's competitive positioning will influence its EXFO future prospects.

The rapid pace of technological change, particularly in areas like 5G, IoT, and AI, presents both opportunities and challenges. The company must invest in research and development to stay ahead of these trends and integrate new technologies into its products. Failure to adapt could lead to obsolescence, impacting its EXFO company analysis.

The company must navigate an evolving global regulatory landscape, including new rules related to AI, cybersecurity, and sustainability. Compliance with these regulations is essential to avoid penalties and maintain market access. The EU AI Act, set to be finalized in 2025, will establish a comprehensive regulatory framework for AI applications. The Cyber Resilience Act (CRA) in Autumn 2024 will also impose cybersecurity requirements.

Internal resource constraints and supply chain vulnerabilities could affect the company's operations. Effective management of a global workforce and the ability to mitigate supply chain disruptions are crucial for maintaining operational efficiency. The company's ability to manage these aspects will influence its long-term growth potential. To understand more about the company's history, you can read Brief History of EXFO.

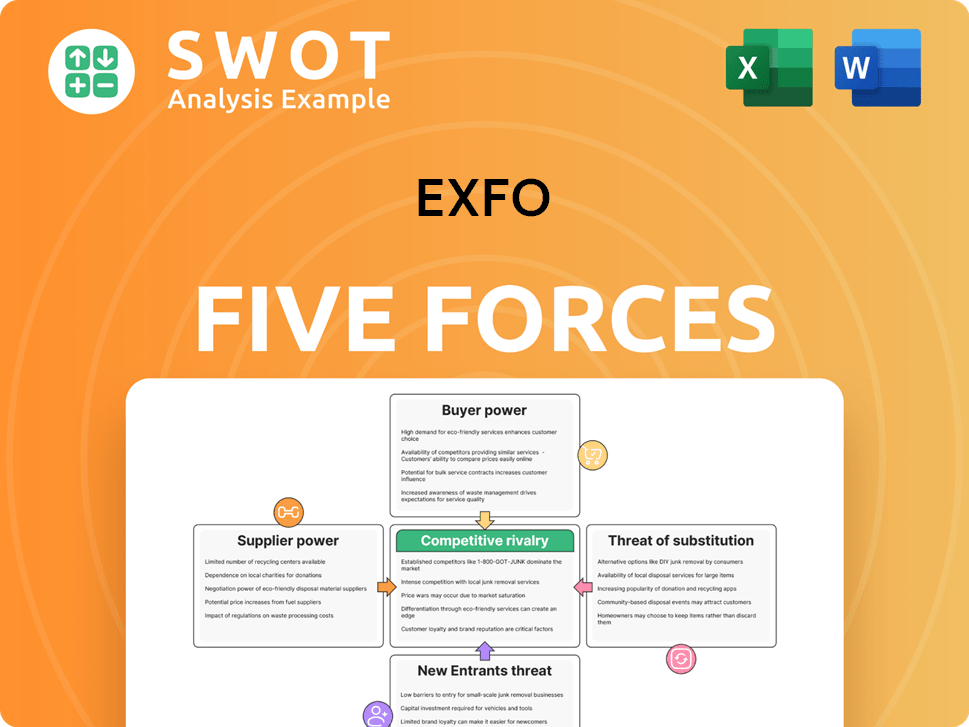

EXFO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EXFO Company?

- What is Competitive Landscape of EXFO Company?

- How Does EXFO Company Work?

- What is Sales and Marketing Strategy of EXFO Company?

- What is Brief History of EXFO Company?

- Who Owns EXFO Company?

- What is Customer Demographics and Target Market of EXFO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.