EXFO Bundle

Who Really Controls EXFO?

Understanding the EXFO SWOT Analysis is crucial, but have you ever wondered who truly calls the shots at EXFO, a key player in the global communications industry? The ownership structure of a company dictates its strategic direction, influencing everything from innovation to market dominance. A deep dive into EXFO's ownership reveals critical insights into its past, present, and future.

EXFO's journey, from its founding by Germain Lamonde to its current status, is a fascinating case study in corporate evolution. Examining the shifts in EXFO ownership, from its initial stakeholders to the current EXFO shareholders and executives, provides a comprehensive understanding of the company's trajectory. Knowing who owns EXFO is essential for anyone seeking to understand its financial performance and strategic positioning within the competitive telecommunications landscape, including details on EXFO's leadership team and EXFO's major shareholders list.

Who Founded EXFO?

The story of EXFO's company began in 1985. Germain Lamonde established the company in Quebec, Canada. His vision was to create innovative solutions for the growing telecommunications industry.

From the start, the ownership of EXFO was closely tied to its founder. Lamonde's influence was significant, shaping the company's direction. This early structure set the stage for EXFO's future.

Before the privatization on June 7, 2021, Germain Lamonde held considerable control. He directly or indirectly controlled 61.46% of the issued and outstanding shares. He also held 93.53% of the voting rights. This control was maintained through a mix of share types, with Lamonde owning all the multiple voting shares.

The early ownership of EXFO highlights Lamonde's central role. While specific details about early investors are not available, Lamonde's enduring control is clear. His vision guided EXFO's operations and strategy from the beginning.

- Germain Lamonde founded EXFO in 1985.

- Lamonde's control was substantial before privatization.

- He held a significant percentage of shares and voting rights.

- His influence shaped EXFO's direction from its inception.

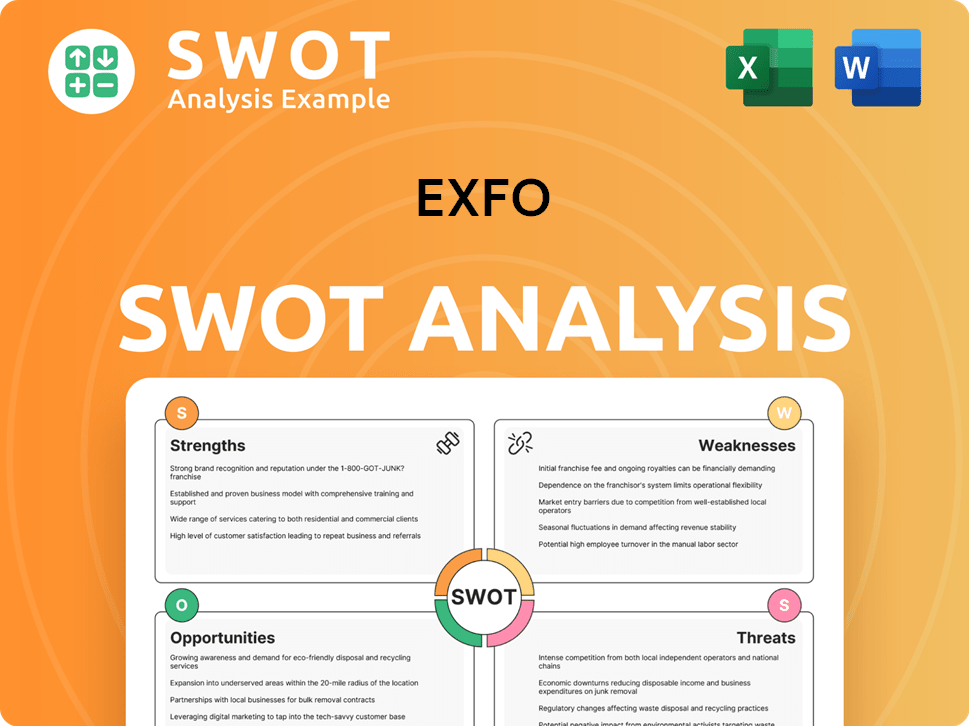

EXFO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has EXFO’s Ownership Changed Over Time?

The ownership of the EXFO company underwent a significant shift, culminating in its privatization in 2021. Previously listed on both the NASDAQ and the Toronto Stock Exchange (TSX) under the ticker EXF.TO, EXFO's ownership structure was largely influenced by its founder, Germain Lamonde. This evolution is key to understanding who owns EXFO and how control was consolidated over time. The company's history, including its transition from public to private ownership, provides insights into its current structure.

A major turning point occurred on June 7, 2021, when Lamonde, the majority shareholder, initiated a deal to take the company private. This transaction involved 11172239 Canada Inc., a corporation controlled by Lamonde, acquiring all outstanding subordinate voting shares of EXFO not already owned by him. The initial offer was US$6.00 per share, later increased to US$6.25. This move significantly altered the landscape of EXFO shareholders and the company's overall direction. For a more detailed look at the company's past, consider reading the Brief History of EXFO.

| Key Event | Date | Details |

|---|---|---|

| Going-Private Announcement | June 7, 2021 | Germain Lamonde, founder and majority shareholder, announced a deal to take the company private. |

| Initial Offer Price | June 7, 2021 | US$6.00 per subordinate voting share, representing a significant premium. |

| Revised Offer Price | August 9, 2021 | Offer increased to US$6.25 per subordinate voting share. |

| Completion of Privatization | 2021 | Germain Lamonde, directly or indirectly, controlled all issued and outstanding shares. |

Before privatization, Lamonde held a significant portion of the company, with 61.46% of issued shares and 93.53% of voting rights. This dual-class share structure gave him considerable control. Other key figures included Philippe Morin, the CEO, who held approximately 2.78% of the subordinate voting shares as of July 15, 2021. Institutional investors and mutual funds also held shares before the privatization. The ultimate outcome of the going-private transaction was the consolidation of control under Lamonde, impacting future strategy and governance by centralizing decision-making. This shift is crucial for understanding the current EXFO ownership structure and the influence of major stakeholders.

The privatization of EXFO in 2021 marked a significant change in its ownership structure, with Germain Lamonde consolidating control.

- Lamonde's initial offer to take the company private was US$6.00 per share, later increased to US$6.25.

- Before privatization, Lamonde controlled over 60% of the issued shares and over 90% of the voting rights.

- The privatization resulted in Lamonde holding direct or indirect control of all outstanding shares, centralizing decision-making.

- The shift from public to private ownership has implications for EXFO's future strategy and governance.

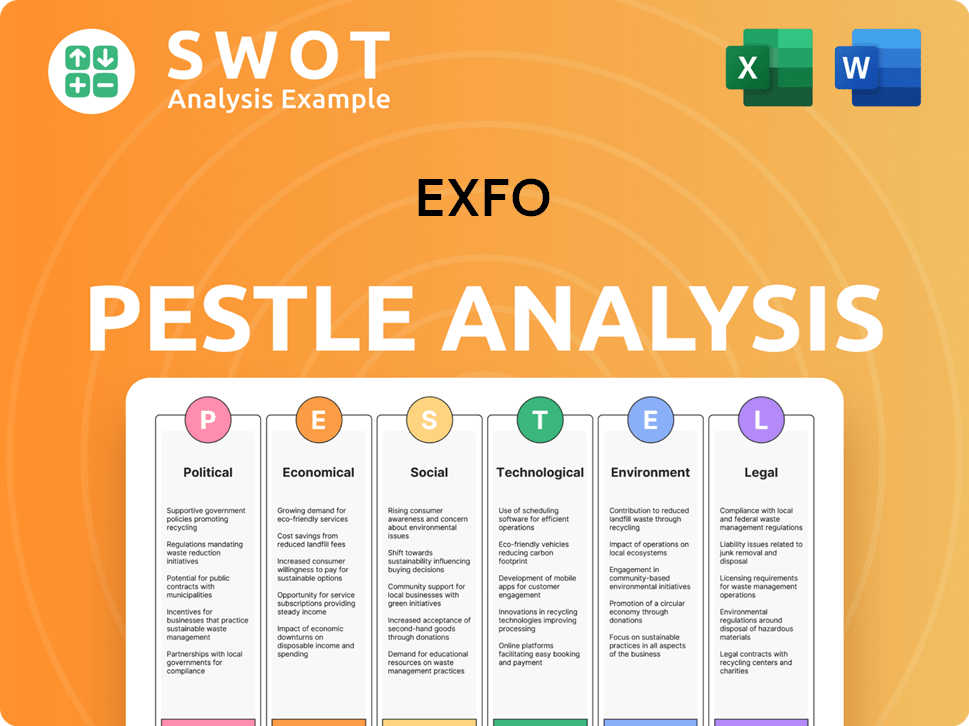

EXFO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on EXFO’s Board?

Prior to the privatization of the EXFO company, the board of directors and the voting structure were crucial for governance. However, since EXFO is now a privately held entity, specific details about the current board members are not publicly available in the provided sources. The information available focuses on the period leading up to and during the company's transition to private ownership.

During the going-private transaction in 2021, the EXFO board of directors, excluding Germain Lamonde and Philippe Morin, acted on the unanimous recommendation of a special committee composed entirely of independent directors. This committee assessed Lamonde's offer to take the company private, along with other competing proposals. This highlights the board's role in overseeing significant corporate actions, particularly during ownership changes. The board's decisions were critical in navigating the complex process of EXFO ownership.

| Role | Name | Details |

|---|---|---|

| Founder | Germain Lamonde | Controlled a significant portion of the voting rights. |

| Special Committee | Independent Directors | Unanimously recommended the privatization plan. |

| Former Board | Various Members | Acted on the recommendation of the special committee. |

EXFO operated with a dual-class share structure, which concentrated voting power with its founder. Germain Lamonde held 61.46% of the issued and outstanding shares and 93.53% of the voting rights. This structure gave him significant control, as each multiple voting share had ten votes compared to one vote per subordinate voting share. This concentration of power was evident during unsolicited takeover proposals, where Lamonde's stance effectively blocked any sale to a competitor, emphasizing the impact of EXFO ownership on strategic decisions. You can learn more about the company's growth strategy in this article: Growth Strategy of EXFO.

The board of directors played a critical role in the privatization of EXFO, particularly through the special committee of independent directors.

- The dual-class share structure gave the founder significant voting power.

- This control influenced major decisions, including the company's transition to private ownership.

- The board's actions were crucial in navigating the privatization process.

- EXFO's ownership structure significantly impacted strategic decisions.

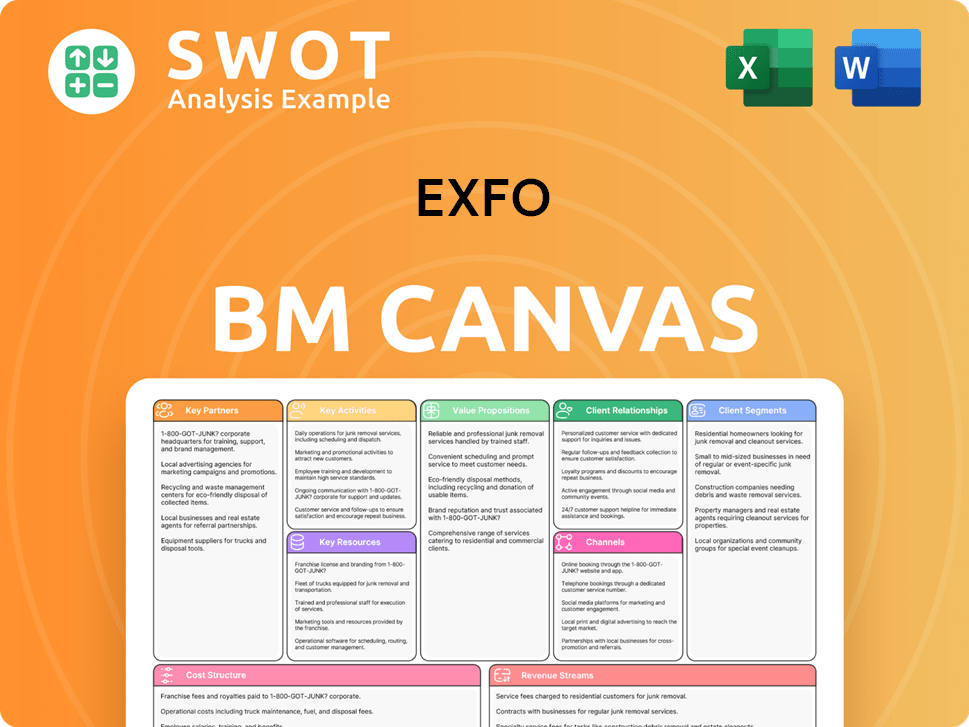

EXFO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped EXFO’s Ownership Landscape?

The most significant shift in the ownership structure of the EXFO company in recent years has been its transition from a publicly traded entity to a privately held one. This pivotal change occurred in 2021 when Germain Lamonde, the founder and principal shareholder, finalized a going-private transaction. This strategic move consolidated ownership under Lamonde's control, with shareholders receiving US$6.25 per subordinate voting share.

This privatization effectively removed EXFO from public stock exchanges, such as NASDAQ and TSX, thereby eliminating its obligations for public financial reporting, which is typical of publicly traded companies. As a result, detailed financial data and ownership breakdowns readily available for public companies are no longer as accessible in the 2024-2025 timeframe. Consequently, EXFO's ownership is now concentrated with Germain Lamonde, who, at the time of privatization, controlled 61.46% of the issued and outstanding shares and 93.53% of the voting rights.

| Metric | Details | As of |

|---|---|---|

| Ownership Structure | Privately held | 2024-2025 |

| Major Shareholder | Germain Lamonde | 2021 (Privatization) |

| Shares Controlled by Lamonde (at privatization) | 61.46% of issued shares, 93.53% of voting rights | 2021 |

Industry trends often show increased institutional ownership and founder dilution in publicly traded companies. However, EXFO's trajectory diverged from this pattern, moving towards founder re-consolidation of control. Lamonde's decision to take the company private was influenced by concerns about the trading price and liquidity of EXFO's shares, alongside his belief that operating as a private company would be more beneficial for EXFO's long-term prospects. This move demonstrates a counter-trend, with the founder reasserting complete control.

EXFO transitioned from a publicly traded company to a privately held entity in 2021. This shift consolidated ownership under the founder, Germain Lamonde. The move was driven by concerns about share trading and a belief in the benefits of private operation.

Germain Lamonde, the founder, is the primary owner of EXFO. EXFO shareholders received US$6.25 per share during the privatization. The company is now focused on innovation in 5G, cloud-native, and fiber optic networks.

As of 2024-2025, EXFO operates as a leading provider of test and monitoring solutions. The company's ownership is stable under Germain Lamonde's leadership. The company is focused on the global communications industry.

With its current ownership structure, EXFO is positioned for a stable, founder-led direction. Specific details about future ownership changes are not widely available. The company continues to innovate in key areas.

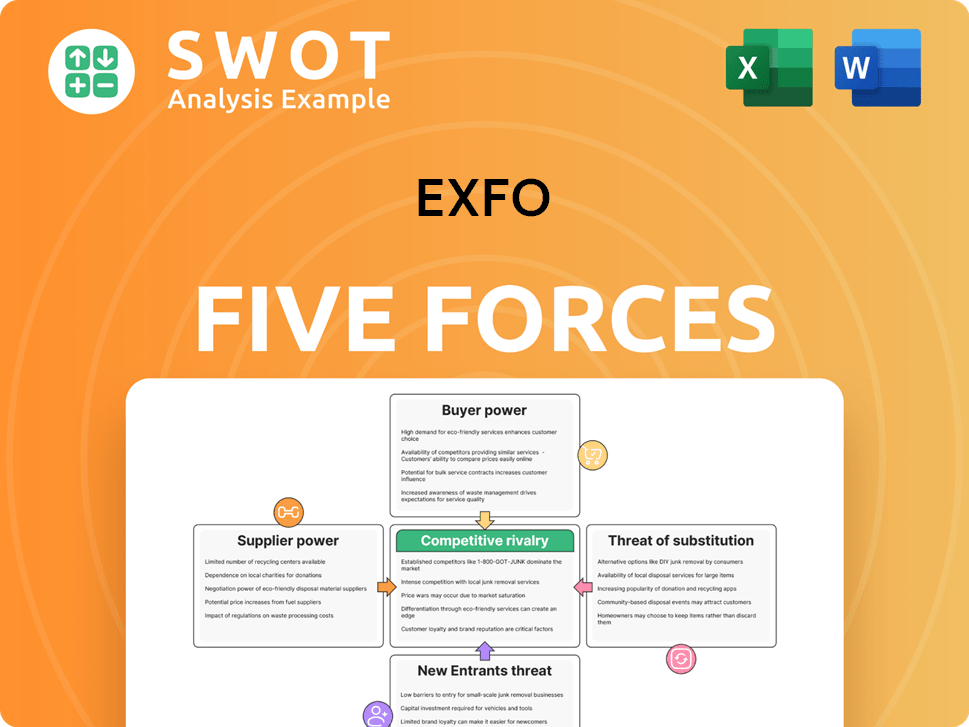

EXFO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EXFO Company?

- What is Competitive Landscape of EXFO Company?

- What is Growth Strategy and Future Prospects of EXFO Company?

- How Does EXFO Company Work?

- What is Sales and Marketing Strategy of EXFO Company?

- What is Brief History of EXFO Company?

- What is Customer Demographics and Target Market of EXFO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.