Exosens Bundle

Can Exosens Revolutionize Detection & Imaging?

Exosens, a pioneer in advanced detection and imaging technologies, made a splash with its June 2024 IPO, raising €180 million to fuel its ambitious growth plans. This strategic move, following the French state's intervention to maintain its independence, signals Exosens' commitment to becoming a global leader. With a rich history spanning over 85 years and a diverse product portfolio, including critical components for technologies like night vision, Exosens is poised for significant expansion.

This Exosens SWOT Analysis delves into the company's Exosens growth strategy and explores its promising Exosens future prospects. We'll dissect the Exosens company analysis, examining its impressive 2024 financial performance, driven by a 35% revenue increase, and evaluate its potential in a competitive market. The analysis will cover key aspects like Exosens market share, its established Exosens business model, and the overall Exosens industry outlook to provide a comprehensive view of this innovative company.

How Is Exosens Expanding Its Reach?

The company is heavily focused on expanding its operations, particularly through strategic market entries and acquisitions. This approach is designed to capitalize on the increasing global demand for night vision systems, especially within the defense sector. The strategy involves significant investments in production capacity and technological advancements to meet rising needs.

A key part of the company's strategy includes a €20 million investment planned for 2025-2026. This investment aims to boost production capacity in both Europe and the United States. The expansion is driven by the growing global market for night vision systems, with a focus on meeting the needs of NATO and Tier-1 allies.

The company's strategy also involves mergers and acquisitions to broaden its technological capabilities and market reach. This includes acquisitions like Noxant in Q1 2025, which strengthens its position in high-performance cooled infrared imaging. These moves complement earlier acquisitions in 2024, such as Centronic and LR Tech Inc., further expanding its expertise and market presence. For more details on the company's financial structure, consider reading Revenue Streams & Business Model of Exosens.

The company is actively entering new markets to increase its reach and customer base. This includes expanding its production facilities in the United States, a strategic move to tap into the North American market. These initiatives are designed to support long-term growth.

The acquisition of Noxant in Q1 2025 is a key element of the company's growth strategy. This acquisition strengthens its position in high-performance cooled infrared imaging, particularly in the Defense and Surveillance markets. This move enhances the company's technological capabilities and market share.

Strategic partnerships are crucial for securing significant orders and maintaining market leadership. The company's role as a key supplier to Senop, for night vision image intensifier tubes, highlights its commitment to collaborative ventures. These partnerships are vital for achieving sustainable business practices.

The company aims to progressively balance its revenue mix between the Amplification and Detection & Imaging segments. This diversification strategy is designed to reduce reliance on a single segment. It supports the overall financial performance review and long-term growth potential.

The company's growth strategy is centered on expanding its market presence and technological capabilities. This involves strategic investments in production capacity and targeted acquisitions to meet growing demand. The company is focused on capitalizing on the increasing global market demand for night vision systems.

- Expansion of production capacity in Europe and the United States.

- Strategic acquisitions to broaden technological capabilities.

- Focus on partnerships to secure significant orders.

- Diversifying the revenue mix between segments.

Exosens SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Exosens Invest in Innovation?

Innovation and technology are pivotal to the Exosens growth strategy, ensuring its future prospects in a competitive market. The company's commitment to continuous research and development (R&D) and strategic collaborations underpins its ability to maintain a leading position in the optoelectronics industry. This focus drives the development of cutting-edge technologies, supporting Exosens' strategic goals.

A significant portion of Exosens' resources is dedicated to R&D, reflecting its dedication to technological advancement. This commitment is evident in its investment in next-generation technologies and its strategic partnerships. These efforts are essential for maintaining and expanding its market share.

Exosens' approach to innovation is multifaceted, combining internal expertise with external collaborations to enhance its capabilities. The company's focus on innovation is also reflected in its ability to offer tailor-made solutions for demanding environments, solidifying its reputation as a major innovator in optoelectronics.

In FY 2024, Exosens allocated €30.4 million to R&D, representing 7.7% of sales. This investment marks a 35% increase from FY 2023, demonstrating a strong commitment to technological advancement.

Exosens employs a highly skilled workforce, including 85 PhDs among its 1,500 permanent employees. This high level of expertise supports the development of advanced technologies and innovative solutions.

Exosens leverages a network of partners to foster innovation. Collaborations include partnerships with UPSL in Switzerland for raw materials and a French startup for Artificial Intelligence, enhancing its technological capabilities.

The company maintains a robust patent portfolio, with over 230 active patents. This extensive portfolio protects its innovations and supports its competitive advantage in the market.

Recent product developments, such as the Dione XP under the Xenics brand and Telops' Radia V60 camera with a new high-temperature calibration mode (April 2025), highlight its commitment to introducing new products and technical capabilities.

Investments are geared towards developing next-generation technologies, such as 5G image intensifier tubes for defense night vision applications and advanced detectors for Life Sciences and Nuclear sectors, to maintain market leadership.

Exosens' technology advancements and market expansion strategies are driven by significant R&D investments and strategic partnerships. These efforts support the company's long-term growth potential and competitive landscape analysis.

- 5G Image Intensifier Tubes: Development for defense night vision applications.

- Advanced Detectors: Focus on Life Sciences and Nuclear sectors.

- AI Integration: Collaborations with startups to enhance capabilities.

- Tailor-Made Solutions: Designed for demanding environments.

Exosens PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Exosens’s Growth Forecast?

The financial outlook for the company is robust, built upon a strong performance in 2024. This positive trajectory is supported by significant revenue growth and improved profitability. The company's strategic planning seems to be effective, leading to positive financial outcomes.

In FY 2024, the company demonstrated substantial growth, with total revenue reaching €394.1 million, a 35% increase from FY 2023. This performance exceeded the initial IPO guidance, indicating effective execution of its business model. The company's approach to market expansion strategies appears to be yielding positive results.

Adjusted EBITDA for FY 2024 reached €118.5 million, a 37.8% increase, resulting in a margin of 30.1%. Net profit also saw substantial growth, increasing by 66.7% to €30.7 million in FY 2024. These figures highlight the company's strong financial performance review and operational efficiency. For a deeper dive into the company's target market and how it drives these results, consider reading about the Target Market of Exosens.

The company anticipates continued strong performance in 2025, with revenue growth expected in the high teens. This forecast reflects the company's confidence in its market expansion strategies and product development roadmap.

Adjusted EBITDA growth is projected to be in the low twenties compared to 2024. The company also expects a high-teens adjusted EBITDA CAGR for the 2024-2026 period, demonstrating its long-term growth potential.

The company anticipates a cash conversion ratio in the range of 70%-75%. This indicates efficient management of cash flow and strong financial health. This also shows a sustainable business practices.

A proposed cash dividend of €0.10 per share for the 2024 fiscal year reflects the company's strong financial health. Cash generation reached €55.4 million in FY 2024.

The company maintains a robust balance sheet with a net leverage ratio of 1.2x at year-end 2024, significantly down from 3.3x in 2023. This provides ample capacity for future investments and growth.

Analysts forecast the company to grow earnings and revenue by 25.3% and 10.9% per annum respectively, with EPS expected to grow by 23.1% per annum. These projections highlight the company's strong long-term growth potential.

Exosens Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Exosens’s Growth?

The growth strategy and future prospects of Exosens face several potential risks and obstacles. These challenges span geopolitical uncertainties, supply chain disruptions, and intense competition within the technology and defense sectors. Understanding these factors is crucial for a comprehensive Exosens company analysis.

Geopolitical tensions can significantly impact market stability and demand, especially given the company's presence in the defense sector. Supply chain issues, which affected over 76% of European shippers in 2024, could continue to disrupt production and delivery. Moreover, dependence on specialized minerals and potential export restrictions pose additional risks.

Furthermore, regulatory changes in key markets and the evolving priorities of CFOs could influence operational strategies. Exosens acknowledges these risks, as detailed in Chapter 3 “Risk Factors” of its registration document approved on May 22, 2024. The company must navigate these challenges to maintain its revenue growth forecast and capitalize on investment opportunities.

Geopolitical instability can impact market demand and operational stability. This is especially relevant given the company's significant presence in the defense sector. Addressing these risks is essential for Exosens to maintain its competitive edge and ensure long-term growth potential.

Supply chain disruptions pose a considerable risk, potentially affecting production timelines and delivery schedules. In 2024, over 76% of European shippers experienced supply chain issues. Proactive risk management and adaptability are crucial for mitigating these challenges.

The competitive landscape in the technology and defense sectors presents ongoing challenges. Exosens must continuously innovate and refine its strategies to maintain its market share and achieve its business model objectives. This requires constant attention to market trends and analysis.

Regulatory changes in key markets can significantly influence operational strategies. The company must stay informed and adapt to evolving regulations to ensure compliance and maintain a strong market position. This is crucial for its sustainable business practices.

Economic instability introduces uncertainty and can affect investment decisions and market demand. This is a key factor for Exosens to consider in its strategic planning. Understanding these conditions is vital for navigating market trends and analysis effectively.

Cybersecurity threats, such as ransomware, are on the rise, with attempts increasing. Exosens must prioritize robust cybersecurity measures to protect its operations and data. This is critical for maintaining customer trust and operational continuity.

Despite a challenging environment, Exosens exceeded its IPO guidance in 2024, demonstrating resilience. This performance highlights the company's ability to navigate complex market conditions. This success is a crucial element of its long-term growth potential.

Exosens must implement effective market expansion strategies to overcome challenges. This includes assessing new markets and strengthening its competitive position. Detailed insights into the company's strategies can be found in this article about Exosens.

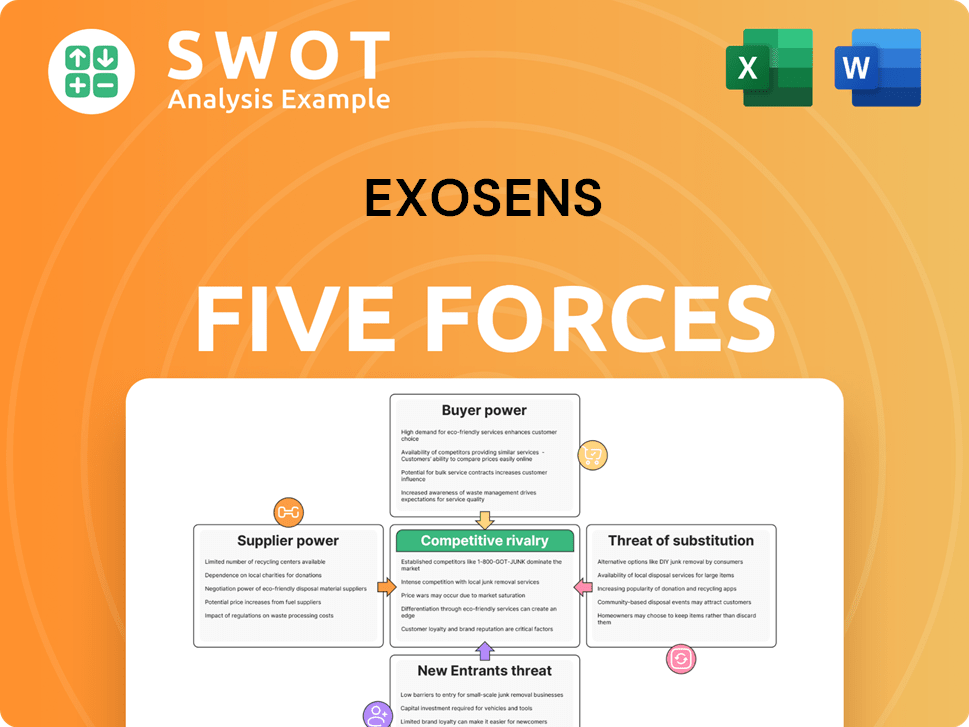

Exosens Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exosens Company?

- What is Competitive Landscape of Exosens Company?

- How Does Exosens Company Work?

- What is Sales and Marketing Strategy of Exosens Company?

- What is Brief History of Exosens Company?

- Who Owns Exosens Company?

- What is Customer Demographics and Target Market of Exosens Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.