Exosens Bundle

How Does Exosens Thrive in a Tech-Driven World?

Exosens, a global leader with over 85 years of experience, is making waves in advanced detection and imaging technologies. With impressive revenue growth and a successful IPO, the Exosens SWOT Analysis reveals the company's strategic positioning. But how does this high-tech powerhouse actually operate, and what fuels its remarkable success?

This exploration of How Exosens works will delve into its core operations, examining its diverse product range and the industries it serves, from medical to defense. Understanding the Exosens company business model is crucial for investors and industry watchers alike, especially given its strong performance and expansion plans. We'll uncover the key technologies and strategies that position Exosens as a key player in a competitive market, offering insights into its future trajectory.

What Are the Key Operations Driving Exosens’s Success?

The Exosens company creates value through its expertise in electro-optical technologies, focusing on amplification, detection, and imaging. Their core offerings include night vision tubes, various imaging solutions, and detection and imaging products for multiple sectors. These solutions cater to diverse customer segments, including defense, nuclear safety, and life sciences.

Operational processes at Exosens involve advanced manufacturing and continuous technology development. The company has 11 production and R&D sites across Europe and North America. They emphasize sustained investments in R&D, with 7.7% of their 2024 revenue allocated to these efforts, resulting in a portfolio of over 130 patents.

What makes Exosens unique is its dual focus on amplification and detection & imaging, with a strong position in niche value-added markets. In the defense sector, Exosens is a strategic supplier of night vision image intensifier tubes. This operational framework provides high-performance, reliable solutions, crucial for critical applications and market differentiation. The company also benefits from a close-to-zero attrition rate with its top customers, many of whom have ordered products annually since 2016.

The Exosens product range includes night vision tubes, ultraviolet, visible, and infrared imaging solutions, and detection and imaging products. They also offer nuclear instrumentation and high-performance IR cameras. These products serve various sectors, including defense, nuclear safety, and industrial control.

The company's operations rely on advanced manufacturing and continuous technology development. Exosens invests heavily in R&D, with 7.7% of its 2024 revenue dedicated to these efforts. This investment has resulted in a portfolio of over 130 patents, showcasing its technological leadership.

Exosens provides tailored solutions to meet complex needs in demanding environments. Their solutions are crucial for critical applications and market differentiation. They focus on amplification and detection & imaging segments, with a strong position in niche value-added markets.

Customers benefit from high-performance, reliable solutions. The company has a close-to-zero attrition rate with top clients, many of whom have been ordering products annually since 2016. This indicates strong customer loyalty and embeddedness within their clients' operations.

The core operations of Exosens involve advanced manufacturing, continuous technology development, and strategic sourcing. The company operates 11 production and R&D sites across Europe and North America. They focus on amplification and detection & imaging segments.

- Advanced Manufacturing Capabilities

- Continuous Technology Development

- Strategic Sourcing

- Strong Customer Relationships

Exosens SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Exosens Make Money?

The core of how the Growth Strategy of Exosens works revolves around its revenue streams and monetization strategies. The company primarily generates income through the sale of advanced electro-optical detection and imaging systems and components, which are integral to its operations. This approach allows Exosens to focus on its core competencies, ensuring quality and innovation in its offerings.

In 2024, Exosens reported a total revenue of €394.1 million, demonstrating a substantial growth of 35% compared to the previous year. This financial performance underscores the effectiveness of its revenue model and its ability to capitalize on market opportunities. The company's strategic focus on high-tech solutions has been a key driver of its financial success.

The company's revenue streams are divided into two main segments: Amplification and Detection & Imaging. The Amplification segment, which includes systems that use electron or electromagnetic wave amplification, contributed €280.2 million to the total revenue in FY 2024, showing a 33.5% increase over 2023. The Detection & Imaging segment generated €117.5 million in revenue in FY 2024, marking a 42.5% increase compared to 2023.

The monetization strategies of Exosens are multifaceted, including strategic acquisitions to broaden its technological capabilities and market presence. Acquisitions such as Telops, El-Mul, and others have played a crucial role in expanding its product offerings and market reach. Recurring sales throughout the lifecycle of its systems also contribute significantly to revenue, especially after a product has been approved by the customer.

- Strategic Acquisitions: Acquisitions of companies like Telops and El-Mul have expanded Exosens' technological capabilities.

- Recurring Sales: Recurring sales throughout the lifecycle of its systems, especially after customer approval, contribute significantly to revenue.

- Geographic Distribution: In 2024, net sales were distributed across various regions, including Greece (39.5%), Europe (excluding France and Greece) (23.3%), Asia (20.8%), the United States (11.4%), and France (2.9%).

- Future Outlook: For 2025, Exosens anticipates continued strong performance with revenue growth in the high-teens compared to 2024.

Exosens PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Exosens’s Business Model?

The journey of the Exosens company has been marked by significant milestones and strategic decisions that have shaped its operations and financial performance. A crucial step was its successful IPO in June 2024, which included a capital increase of €180 million and a complete debt refinancing. This move allowed the company to join the Euronext Tech Leaders segment, increasing its visibility and access to Europe's technology ecosystem.

The company has actively pursued a bolt-on acquisition strategy to strengthen its portfolio and market position. Notable acquisitions in 2023 included Telops, El-Mul, and Photonis Germany (formerly ProxiVision). In 2024, this strategy continued with the acquisitions of Centronic (July), LR Tech (September), and the announced acquisition of NVLS (October), expected to close in Q2 2025, and Noxant (November), set to close in Q1 2025. These acquisitions have been instrumental in driving growth, with inorganic growth contributing 10 points to the 35% revenue increase in 2024.

Exosens' competitive advantages are rooted in its technological leadership, strong brand, and strategic market positioning. The company invests significantly in R&D, with 7.7% of its 2024 revenue allocated to it, leading to a strong patent portfolio and continuous innovation. Its position as a strategic supplier to NATO and Tier-1 allies for night vision image intensifier tubes highlights its strong standing in the defense sector. Exosens also benefits from economies of scale and operational excellence, which contributed to a significant increase in its adjusted gross margin to 48.1% in FY 2024. The company's ability to adapt to new trends is evident in its focus on technological developments driven by artificial intelligence for industrial control, nuclear energy, and healthcare.

Exosens' financial performance in 2024 was robust, demonstrating its strong market position and effective strategic execution. The company's revenue increased by 35%, driven by organic and inorganic growth. The adjusted gross margin improved to 48.1% in FY 2024, showcasing operational efficiency.

- €180 million raised through IPO in June 2024.

- Inorganic growth contributed 10 points to the 35% revenue increase in 2024.

- R&D investment accounted for 7.7% of 2024 revenue.

- Adjusted gross margin reached 48.1% in FY 2024.

Exosens Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Exosens Positioning Itself for Continued Success?

The company, a prominent player in the design and manufacture of components for detecting low levels of light, ions, and electrons, holds a strong market position. It is a leader in the Light Amplification market outside the United States and a significant participant in the Detection and Imaging markets. The company's performance in 2024, with revenues of €394.1 million, demonstrates substantial market share and growth momentum. Its success is further underscored by high customer loyalty, with nearly zero attrition among its top ten customers.

Despite its robust position, the company faces several risks. Geopolitical tensions, supply chain disruptions, and a competitive landscape in technology and defense sectors could affect its operations. Regulatory changes and dependence on specialized minerals also pose potential challenges. However, the company is strategically positioned to navigate these risks and capitalize on future opportunities.

The company is recognized as a global leader, particularly in the Light Amplification market outside the United States. Its strong performance in 2024, with a 35% increase in revenue from the previous year, reflects its significant market share and growth potential. The company's global reach is extensive, with 97% of its 2024 revenue coming from overseas operations across over 70 countries.

Key risks include geopolitical tensions and supply chain disruptions, which could impact market stability and production. The competitive landscape in technology and defense requires continuous R&D investment. Regulatory changes in key markets and dependence on specialized minerals also present challenges. These factors could affect the company's ability to meet its growth targets.

The company anticipates sustained growth, projecting revenue growth in the high teens and adjusted EBITDA growth in the low twenties for 2025. This positive outlook is driven by increased market demand, especially from NATO and Tier-1 allies for night vision systems. Strategic initiatives include expanding production capacity and continuing its acquisition strategy.

The company aims to maintain a leverage ratio of around 2x and expects a high-teens adjusted EBITDA CAGR over the 2024-2026 period. It anticipates a cash conversion ratio in the range of 70%-75%. The company’s focus on innovation and operational excellence is geared towards long-term profitability and expansion, as highlighted in the article Owners & Shareholders of Exosens.

The company plans to invest €20 million over the next two years to expand production capacity in Europe and establish its first manufacturing site in the United States. This expansion is intended to meet growing demand and support the company's strategic goals. The company is also pursuing a bolt-on acquisition strategy to balance its revenue mix.

- Expansion of production capacity in Europe and the United States.

- Continued investment in R&D to maintain a competitive edge.

- Strategic acquisitions to diversify revenue streams.

- Focus on operational excellence to improve profitability.

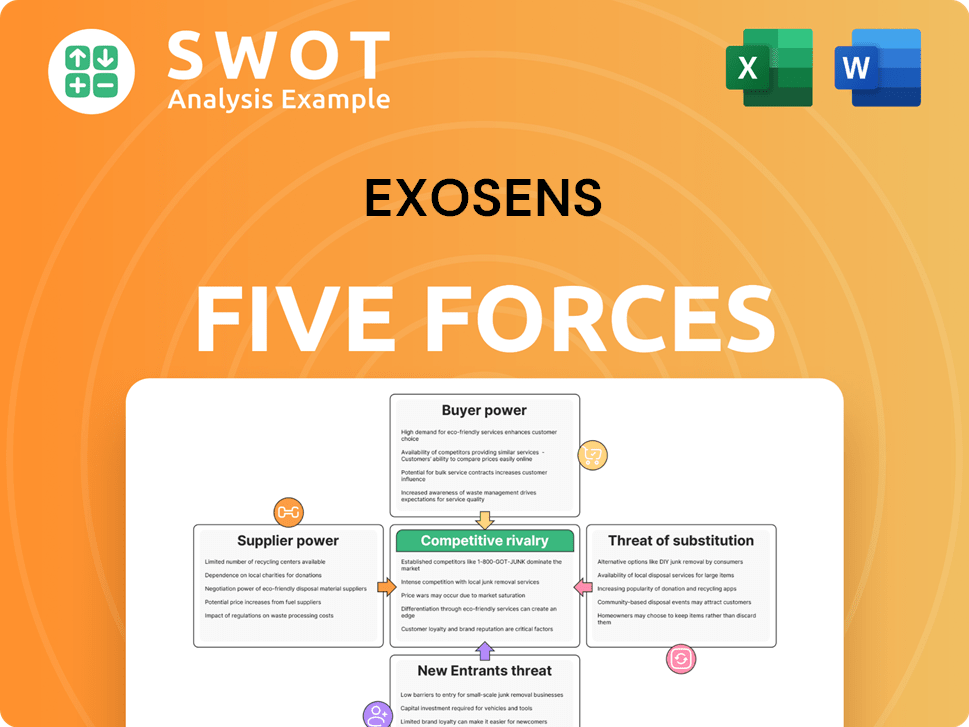

Exosens Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exosens Company?

- What is Competitive Landscape of Exosens Company?

- What is Growth Strategy and Future Prospects of Exosens Company?

- What is Sales and Marketing Strategy of Exosens Company?

- What is Brief History of Exosens Company?

- Who Owns Exosens Company?

- What is Customer Demographics and Target Market of Exosens Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.