Fidelity Investments Bundle

Can Fidelity Investments Maintain Its Momentum?

Fidelity Investments, a titan in the financial services industry, has consistently demonstrated its ability to adapt and thrive. Founded in 1946, this Investment Company has evolved from a mutual fund pioneer to a global asset management powerhouse. With a staggering $15.1 trillion in assets under administration as of late 2024, understanding Fidelity's Fidelity Investments SWOT Analysis is crucial for anyone looking to understand its strategic direction.

This exploration into Fidelity Investments' Growth Strategy and Future Prospects will analyze the company's recent moves, including its expansion into digital assets with spot Bitcoin and Ethereum ETFs and no-fee cryptocurrency trading in individual retirement accounts. A thorough Market Analysis reveals how Fidelity plans to leverage strategic initiatives and continuous innovation to secure its position in the evolving financial landscape and capitalize on future trends. Understanding Fidelity Investments' business model and its long-term strategy is key to assessing its investment outlook and growth opportunities.

How Is Fidelity Investments Expanding Its Reach?

Fidelity Investments, a prominent Investment Company, is actively pursuing several expansion initiatives to bolster its Growth Strategy and capitalize on future opportunities. These initiatives are designed to broaden its market reach and diversify its offerings, ensuring sustained Financial Services to its diverse customer base. The company’s strategic moves are geared towards enhancing its competitive position in the dynamic financial landscape, aiming to meet evolving client needs and industry trends.

The firm's expansion efforts are multifaceted, encompassing new product launches, enhancements to existing services, and strategic partnerships. These initiatives are carefully planned to align with market demands and technological advancements, ensuring Fidelity Investments remains a leader in the financial sector. Through these strategic investments, Fidelity aims to solidify its position and drive long-term sustainable growth.

Fidelity Investments’ Future Prospects are closely tied to its ability to successfully execute these expansion plans. The company’s focus on innovation, customer service, and strategic partnerships positions it well for continued growth and success in the competitive financial market. By continuously adapting to market changes and client needs, Fidelity aims to maintain its leadership and deliver value to its customers.

A key area of focus for Fidelity is the expansion of its exchange-traded fund (ETF) lineup. In April 2025, Fidelity launched two new fixed income ETFs, the Fidelity Municipal Bond Opportunities ETF and the Fidelity Systematic Municipal Bond Index ETF. These additions bring Fidelity's full exchange-traded lineup to 78 strategies with approximately $109 billion in assets as of March 31, 2025. This expansion aims to meet client demand in the municipal bond market and provide investors with superior value.

Fidelity is also focused on enhancing its offerings for wealth management firms. In February 2025, Fidelity expanded its model portfolio lineup for wealth management firms with the launch of two new all-ETF model portfolio suites, which are designed for various risk profiles and goals. This initiative responds to the increasing allocation to active ETFs by advisors, which surged from 13% in 2022 to 40% by the end of 2024, with an average allocation of around 21%.

Fidelity introduced new technology offerings in August 2024 specifically for smaller and mid-sized registered investment advisors (RIAs) to help them establish and grow their businesses by addressing common technology barriers like resources and cost. This strategic move underscores Fidelity's commitment to supporting the growth of RIAs and providing them with the tools they need to succeed in a competitive market.

Fidelity is expanding its workplace benefits offerings. In Q1 2025, Fidelity expanded its Student Debt Retirement benefit offering to employers with multiple retirement plans, making this benefit available to one in five of Fidelity's largest clients. The company also transitioned over one million customer accounts to its Unified Managed Household platform since its launch in 2024, facilitating comprehensive, goal-based investment plans.

These expansion initiatives are designed to attract new customers, diversify revenue streams, and stay ahead of industry changes. The focus on ETFs, wealth management, technology for RIAs, and workplace benefits demonstrates a comprehensive approach to meeting the diverse needs of its clients. These efforts are critical for maintaining and enhancing Fidelity Investments' competitive position within the Financial Services industry.

- Municipal Bond ETFs: Launching new ETFs to capitalize on market demand and provide value to investors.

- Model Portfolio Suites: Expanding offerings for wealth management firms to meet the growing demand for active ETFs.

- Technology for RIAs: Providing technology solutions to support the growth of smaller and mid-sized RIAs.

- Workplace Benefits: Enhancing workplace benefits to attract and retain clients and improve employee financial wellness.

For a detailed Market Analysis of Fidelity Investments and its competitors, including insights into their strategies and market share, consider exploring the Competitors Landscape of Fidelity Investments.

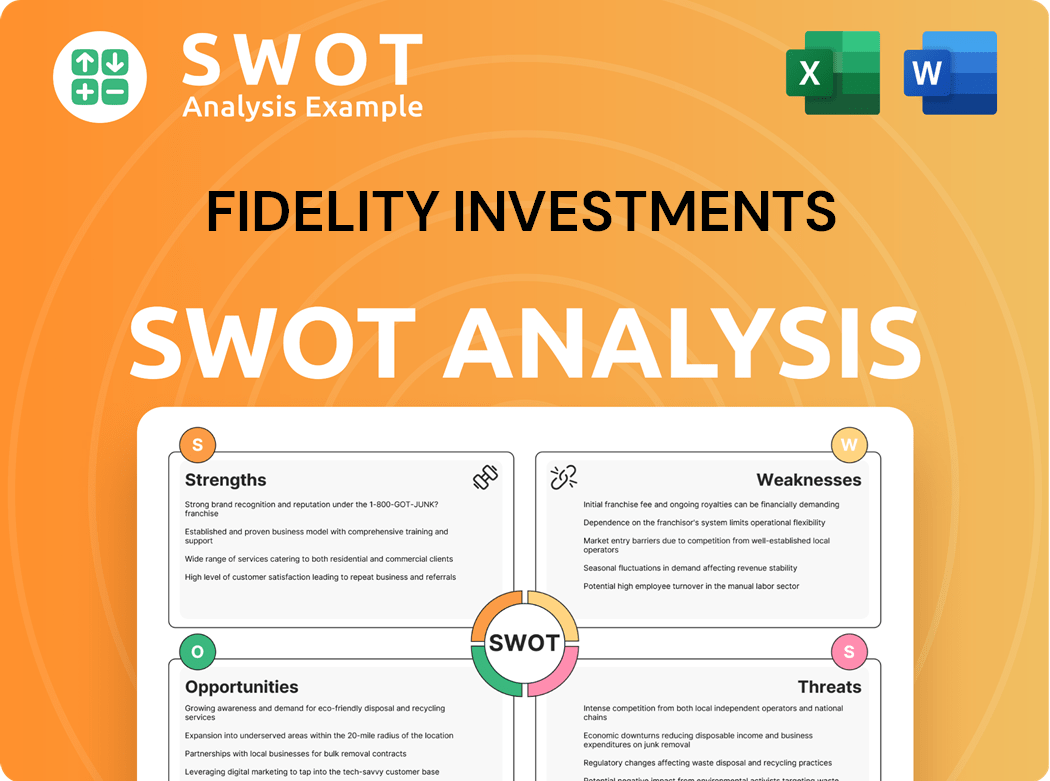

Fidelity Investments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fidelity Investments Invest in Innovation?

Fidelity Investments is strategically positioning itself as a technology-driven financial services provider, focusing heavily on innovation to fuel its Growth Strategy and secure its Future Prospects. This approach emphasizes leveraging technology to enhance customer experiences, improve operational efficiency, and drive business expansion within the Financial Services sector.

The company's commitment extends to embracing emerging technologies like artificial intelligence and digital assets, aiming to stay ahead of industry trends and meet evolving customer needs. Fidelity's proactive stance in these areas is designed to maintain its competitive edge and capitalize on new market opportunities.

Fidelity Investments' focus on technological advancements is a core element of its overall Growth Strategy.

Fidelity is actively integrating artificial intelligence (AI) across various facets of its operations. This includes AI-powered chatbots for personalized customer support and the application of AI in portfolio management and risk assessment.

Fidelity has been at the forefront of digital asset innovation, launching spot Bitcoin and Ethereum ETFs in 2024. In April 2025, it introduced no-fee cryptocurrency trading in individual retirement accounts.

The company has explored immersive virtual experiences, such as 'The Fidelity Stack' in Decentraland, offering new ways to learn investing basics in the metaverse.

Fidelity has focused on enhancing its digital experience, simplifying options trading with new web and mobile onboarding, research, and trading features. They also began rolling out a new version of their Active Trader Pro software.

Fidelity Digital Assets anticipates that the on-chain value of tokenized assets will double from $14 billion in 2024 to $30 billion in 2025, highlighting tokenization as a 'killer application'.

Fidelity rolled out a new version of its Active Trader Pro software, 'ATP Beta,' designed for more real-time insights and streamlined trade execution.

Fidelity's technological initiatives are geared towards improving customer engagement, streamlining operations, and introducing innovative financial products and services. These advancements are crucial for achieving its Growth Strategy and maintaining a strong position in the Investment Company landscape.

- AI Adoption: Fidelity is investing in AI to enhance customer service and improve operational efficiency. While widespread AI adoption may take time, even short-term gains could be significant.

- Digital Assets: The launch of Bitcoin and Ethereum ETFs and no-fee cryptocurrency trading in retirement accounts demonstrates Fidelity's commitment to digital assets.

- Digital Experience: Enhancements to web and mobile platforms, including simplified options trading and the new ATP Beta software, aim to improve customer experience and streamline trading.

- Tokenization: Fidelity anticipates substantial growth in the value of tokenized assets, viewing tokenization as a key technology for the future.

Fidelity Investments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Fidelity Investments’s Growth Forecast?

In 2024, Fidelity Investments showcased strong financial performance, crucial for its growth strategy. The company's revenue reached $32.7 billion, a notable 16% increase compared to the previous year. This financial success is underscored by a significant rise in operating income, which grew by 21% to $10.3 billion.

The company's robust financial position is further supported by substantial assets under administration, totaling $15.1 trillion, and discretionary assets under management of $5.9 trillion as of December 31, 2024. These figures highlight Fidelity's substantial presence in the financial services industry and its ability to manage and grow assets effectively. This strong performance sets a solid foundation for future prospects.

Looking ahead to 2025, the financial outlook for Fidelity Investments remains positive, although it anticipates new challenges and opportunities within the market. The strong market returns experienced in 2024, driven by earnings growth and rising price-earnings ratios, may evolve in 2025, with stock gains potentially more closely mirroring earnings growth. This shift requires a strategic approach to navigate potential market fluctuations.

Fidelity Investments reported a revenue of $32.7 billion, marking a 16% increase from 2023. Operating income grew by 21% to $10.3 billion, demonstrating strong operational efficiency.

As of December 31, 2024, Fidelity managed $15.1 trillion in assets under administration. Discretionary assets under management reached $5.9 trillion, reflecting significant market presence.

The company anticipates that stock gains in 2025 might more closely align with earnings growth. This shift requires a strategic approach to navigate potential market fluctuations.

Average 401(k), 403(b), and IRA balances were slightly lower due to market swings. However, employer and employee savings rates remained high, with the total 401(k) savings rate increasing to a record 14.3% as of March 31, 2025.

Fidelity's growth strategy involves enhancing products and services, focusing on operational quality, and reducing unit costs. The company's diverse revenue streams, including money market funds and managed accounts, contribute to its stable financial results.

- Ongoing enhancements to products and services.

- Focus on operational quality.

- Efforts to reduce unit costs.

- Diversified revenue streams.

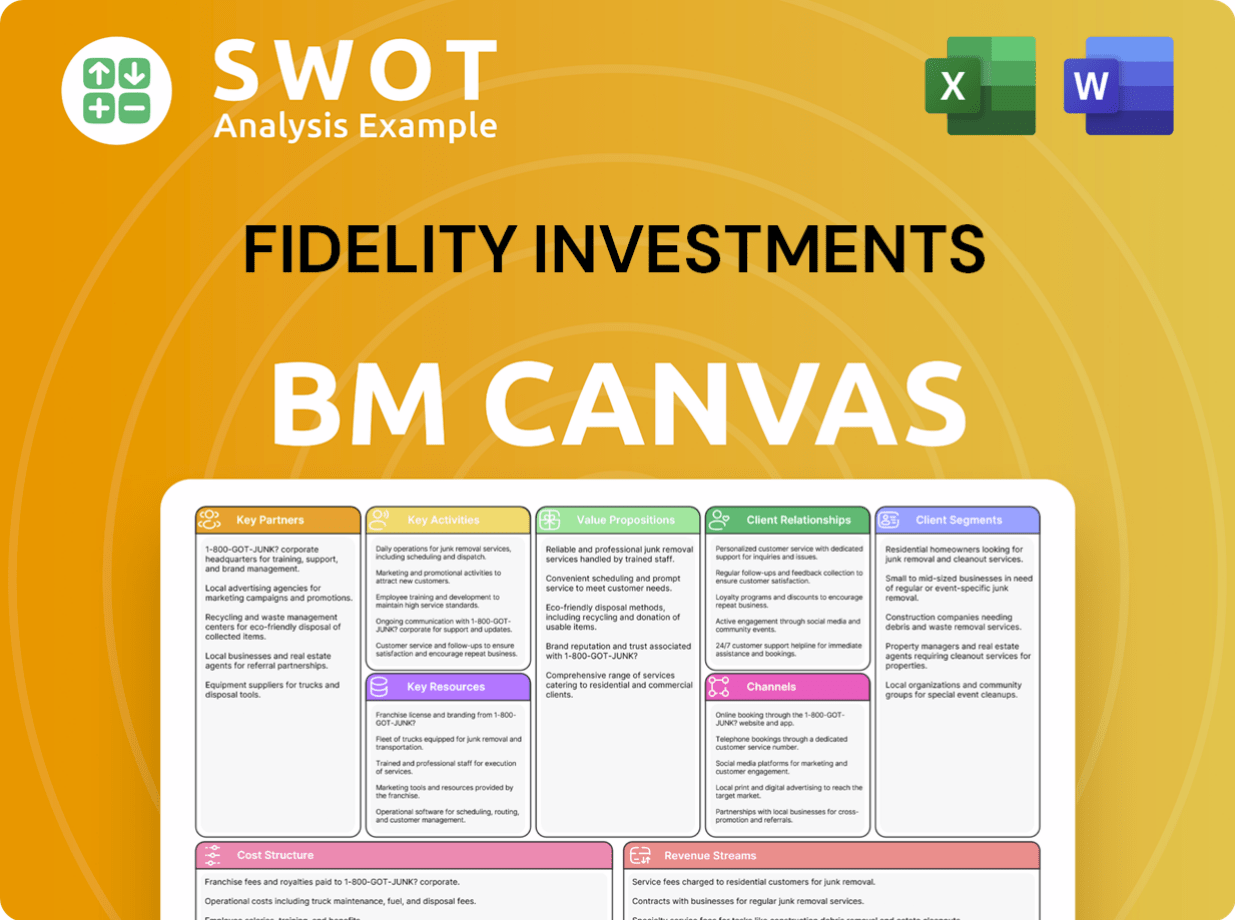

Fidelity Investments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Fidelity Investments’s Growth?

The Investment Company, faces several risks that could affect its Growth Strategy and Future Prospects. These challenges range from intense competition within the Financial Services industry to the rapid pace of technological disruption. Understanding these potential obstacles is crucial for evaluating the long-term viability of the firm's strategic initiatives.

Market competition, regulatory changes, and technological advancements are all areas of concern. The firm must navigate these complexities to maintain its market position. The firm's ability to adapt and innovate will be key to its success in the coming years.

One of the primary risks is the increasingly competitive landscape. The Financial Services sector is characterized by numerous players vying for market share. New entrants and existing competitors are constantly innovating, putting pressure on pricing and service offerings. This environment requires continuous adaptation and strategic agility to remain competitive.

Intense competition across all segments of the Financial Services industry poses a significant risk. Competitors are constantly introducing new products and services, which requires the firm to innovate to maintain its market position. This dynamic environment demands strategic agility and constant adaptation.

Regulatory changes represent a continuous risk, as new rules and compliance requirements can impact operational procedures and profitability. The firm must adapt to evolving regulations to avoid penalties and maintain compliance. This requires ongoing monitoring and adaptation of internal processes.

The rapid evolution of technologies like AI and digital assets requires constant adaptation. The firm must invest in new technologies to stay ahead of competitors and emerging threats. The financial costs associated with implementing and scaling AI technologies are substantial.

Geopolitical tensions and economic divergence across major economies present risks. These factors can lead to increased market volatility, requiring a diversified investment approach. The firm must be prepared to adjust its strategies to navigate these uncertainties effectively.

The prospect of tariffs and trade disputes, particularly between the US and China, could push inflation higher and negatively affect economic growth. This creates uncertainty in credit and currency markets. The firm needs to monitor economic indicators closely.

Internal resource constraints and operational challenges can impact the firm's ability to build new online tools and capabilities. Maintaining operational quality is essential for resilience. The firm needs to ensure its internal processes are efficient and scalable.

Diversifying product offerings and client base helps mitigate the impact of downturns in any single market segment. The firm's broad lineup of ETFs and mutual funds provides a buffer against market fluctuations. This strategy enhances resilience against market-specific risks.

The firm emphasizes risk management frameworks and scenario planning to prepare for potential obstacles. In Q1 2025, the firm advised clients to manage risk through diversified portfolios. This proactive approach helps to protect client assets during market volatility.

Building new online tools and capabilities enhances resilience against internal resource constraints and operational challenges. The firm's focus on operational excellence is crucial for maintaining a competitive edge. This includes continuous improvement of internal processes.

The firm's investments in AI and digital assets are essential for staying competitive. However, the financial costs of implementation and scaling are substantial. According to a December 2024 survey, only 6.3% of businesses were using AI tools, indicating challenges in widespread adoption.

For more details on the firm's history, consider reading Brief History of Fidelity Investments.

Fidelity Investments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fidelity Investments Company?

- What is Competitive Landscape of Fidelity Investments Company?

- How Does Fidelity Investments Company Work?

- What is Sales and Marketing Strategy of Fidelity Investments Company?

- What is Brief History of Fidelity Investments Company?

- Who Owns Fidelity Investments Company?

- What is Customer Demographics and Target Market of Fidelity Investments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.