Fiverr Bundle

Can Fiverr Conquer the Future of Freelancing?

Fiverr, the pioneering online marketplace, revolutionized the gig economy by connecting businesses with freelancers for just $5. From its humble beginnings in Tel Aviv, this Fiverr SWOT Analysis reveals the company's strategic evolution in a dynamic market. Today, it's a global freelance platform, offering diverse digital services from graphic design to programming.

This deep dive explores Fiverr's current Fiverr growth strategy, including how it navigates challenges and seizes opportunities in the competitive landscape. While facing fluctuations in active buyers, Fiverr's focus on high-value projects and services revenue growth paints a compelling picture of its Fiverr future prospects. We'll analyze its business model, market share, financial performance, and expansion strategies to understand the Fiverr company's long-term growth potential.

How Is Fiverr Expanding Its Reach?

Fiverr's expansion strategy centers on broadening its service offerings and attracting higher-value clients. The company focuses on diversifying revenue streams and enhancing its appeal to larger enterprises. This approach is designed to boost financial performance and solidify its position in the competitive freelance platform market.

A key element of this strategy involves the growth of its 'Services' segment. This includes value-added services such as Promoted Gigs and Seller Plus. The goal is to increase revenue from these services and make them a significant part of the overall business model.

Furthermore, the company is actively pursuing upmarket opportunities to attract higher-value buyers and projects. This includes initiatives like Fiverr Pro, which connects businesses with vetted, high-quality freelance talent and has facilitated significant deals.

The 'Services' segment is a major growth driver for Fiverr. In Q1 2025, revenue from this segment surged by 94.0% year-over-year, reaching $29.5 million. This growth is expected to continue, with the segment projected to account for over 30% of total revenue in 2025, up from 23% in 2024.

Fiverr Pro connects businesses with top-tier freelance talent. This initiative has already led to substantial deals, such as a $200,000 engagement with a book publishing company. The 2025 Winter Product Release supports this strategy by introducing features like Team Accounts and new Fiverr Pro subscription plans.

Acquisitions, such as AutoDS, have expanded Fiverr's presence in e-commerce. AutoDS, a subscription-based solution for dropshippers, adds new revenue streams. These strategic moves support Fiverr's overall growth strategy.

While the number of annual active buyers decreased by 10.6% to 3.5 million as of March 31, 2025, the annual spend per buyer increased by 8.8% to $309. This shift highlights the company's focus on attracting higher-value clients. This approach is a core part of its expansion strategy.

Fiverr's expansion initiatives aim to broaden its market reach and increase revenue through several key strategies. These strategies include the growth of the services segment, upmarket initiatives, and strategic acquisitions.

- Focusing on value-added services like Promoted Gigs and Seller Plus.

- Attracting larger enterprises through Fiverr Pro and tailored subscription plans.

- Expanding into e-commerce via acquisitions like AutoDS.

- Prioritizing higher-value buyers to increase revenue per user.

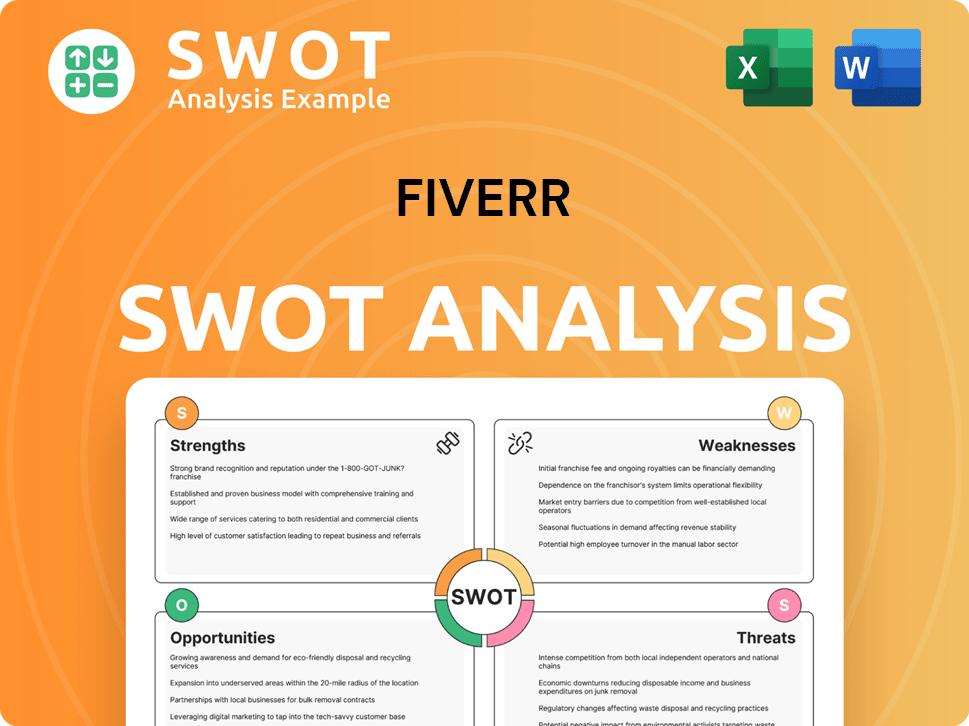

Fiverr SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fiverr Invest in Innovation?

The Fiverr growth strategy heavily relies on innovation and technology to maintain its position in the competitive freelance platform landscape. The company continually invests in AI and platform enhancements to improve user experience and drive growth within the online marketplace.

Fiverr's future prospects are closely tied to its ability to leverage technological advancements, particularly in AI, to meet the evolving needs of both freelancers and businesses. The company's commitment to integrating AI tools suggests a strategic shift towards automation and efficiency within the gig economy.

The

Fiverr launched 'Fiverr Go' in February 2025, an AI-driven platform designed to empower freelancers. This platform provides personalized AI tools to streamline project management and improve buyer conversion rates.

Early data indicates a 56% increase in one-hour conversion rates for sellers utilizing AI features on Fiverr Go. This highlights the effectiveness of AI in enhancing platform efficiency.

Fiverr's AI strategy includes 'Dynamic Matching,' an AI-powered tool designed to improve service complexity and attract higher-quality buyers. This leads to increased fulfillment rates.

Fiverr's Spring 2025 Business Trends Index highlights the rising demand for AI agents and services. Businesses are actively reimagining how work gets done with the help of freelancers and AI.

The 2025 Winter Product Release introduced features like Team Accounts for businesses and new Fiverr Pro subscription plans. These features aim to provide greater flexibility and control for users.

While specific details on R&D investments or key patents are not extensively highlighted in recent reports, the continuous product launches and the emphasis on AI integration demonstrate a strong commitment to technological advancement. Management stated that 2024 was a year of significant innovation and investment in AI.

Fiverr's technology and innovation strategy focuses on AI integration and platform enhancements to drive growth. The company is investing in in-house development and AI-driven tools to improve user experience and attract higher-quality buyers.

- AI-Powered Tools: Development of AI tools like 'Fiverr Go' and 'Dynamic Matching' to improve service efficiency and buyer conversion.

- Platform Enhancements: Continuous product launches and updates, such as Team Accounts and Fiverr Pro subscriptions, to provide greater flexibility.

- Investment in AI: Significant investments in AI to futureproof operations and keep creators at the center of the creative economy.

- Market Trends: Focus on trends highlighted in the Spring 2025 Business Trends Index, including the rising demand for AI agents and services.

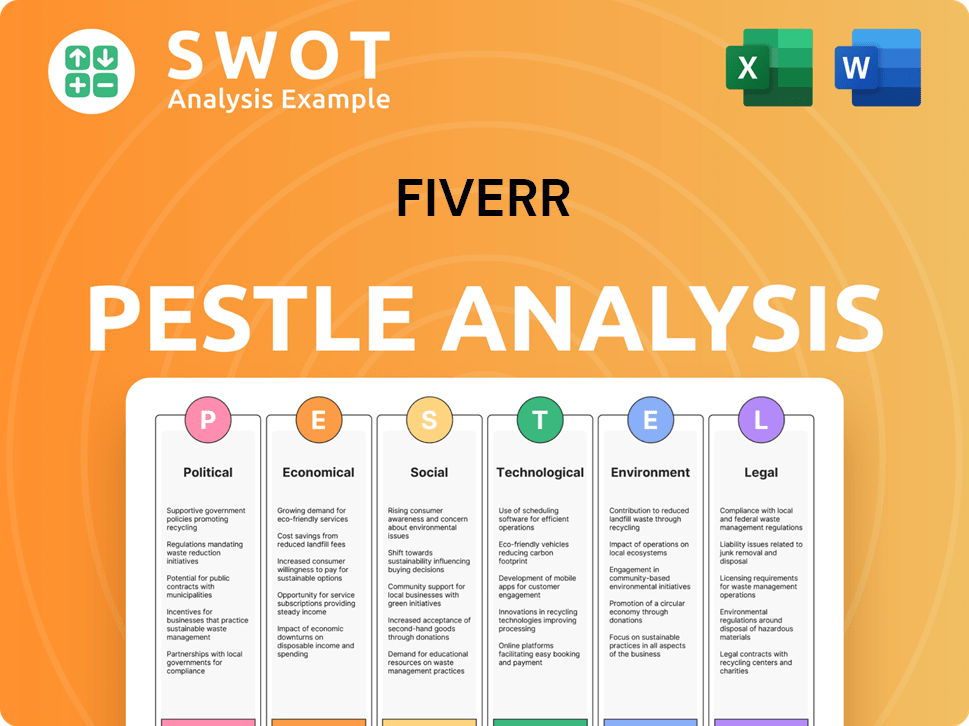

Fiverr PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Fiverr’s Growth Forecast?

The financial outlook for the Fiverr company in 2025 centers on profitable growth, strong cash flow, and strategic investments, particularly in AI. This strategy aims to solidify its position as a leading freelance platform within the gig economy.

For the full year 2025, Fiverr projects revenue between $425 million and $438 million, indicating a year-over-year growth of 9% to 12%. While this guidance was slightly narrowed in May 2025, it still reflects a positive trajectory. The company's focus is on balancing growth with profitability, as seen in its adjusted EBITDA targets.

In the first quarter of 2025, Fiverr reported revenue of $107.2 million, a 14.6% increase compared to $93.5 million in Q1 2024. This performance exceeded the midpoint of its own guidance. The company's financial strategy is geared towards sustainable expansion and market leadership.

Fiverr's Q1 2025 revenue increased by 14.6% year-over-year to $107.2 million.

Adjusted EBITDA for Q1 2025 was $19.4 million, up from $16.0 million in Q1 2024, with an 18.1% margin.

Services revenue surged by 94.0% to $29.5 million in Q1 2025, a key driver of overall growth.

Free cash flow increased by 31.6% year-over-year in Q1 2025, reaching $27.4 million.

The company anticipates adjusted EBITDA for the full year 2025 to be between $84 million and $90 million, with a target of a 20% margin at the midpoint. This demonstrates a commitment to balancing growth with profitability improvement. The strong performance in services revenue, which is projected to surpass 30% of total revenue, is a key factor in the overall revenue growth. For more insights into the competitive environment, consider exploring the Competitors Landscape of Fiverr.

Marketplace revenue in Q1 2025 saw a slight decline of 0.8% year-over-year to $77.7 million.

Fiverr has authorized an additional $100 million for share buybacks, demonstrating confidence in its financial health.

The company is on track for its 2027 targets, including a 25% adjusted EBITDA margin.

Fiverr is making strategic investments, particularly in AI, to enhance its platform.

The strong growth in the services segment is a key driver for the overall revenue growth in 2025.

Fiverr's financial strategy is focused on achieving long-term growth and market leadership.

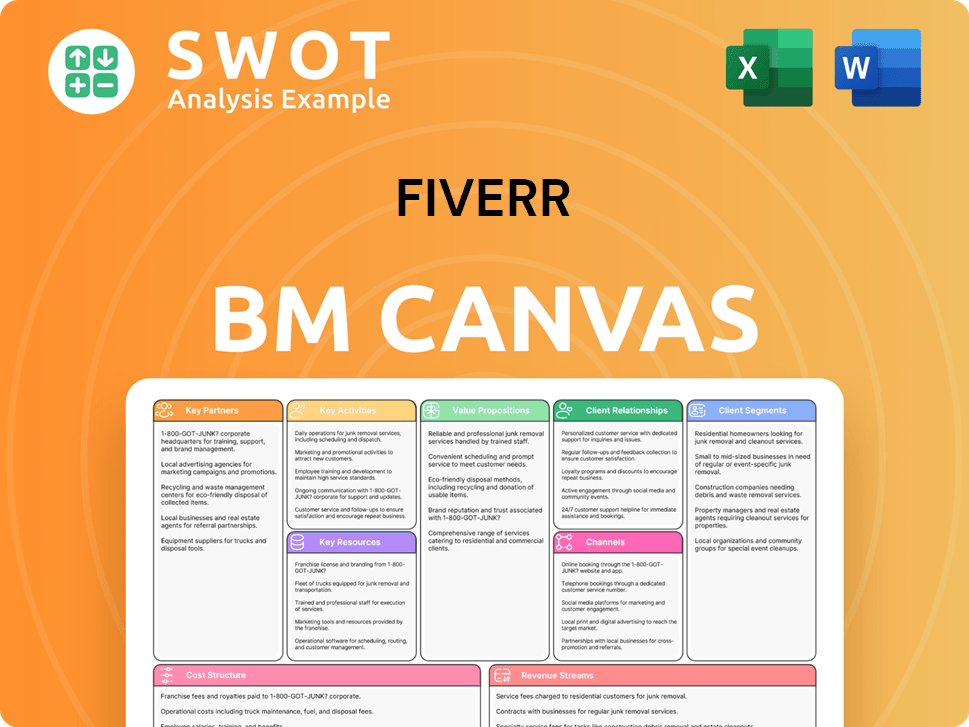

Fiverr Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Fiverr’s Growth?

The future prospects of the Fiverr company are influenced by several potential risks and obstacles. These challenges primarily stem from market competition, macroeconomic conditions, and rapid technological advancements. Addressing these issues is critical for the platform's continued growth and sustainability within the gig economy.

One of the most significant risks is the decline in the active buyer base. The Fiverr growth strategy is heavily impacted by this trend, as a shrinking user base can hinder overall expansion. Macroeconomic uncertainty also poses a substantial threat, potentially reducing demand for freelance services. The company's ability to navigate these challenges will be crucial for its long-term success.

Technological disruption, particularly from AI, presents a double-edged sword. While AI integration offers opportunities, it also carries the risk of automating tasks and impacting service pricing. The company must strategically manage these risks to maintain its market position and revenue streams. For more insights into the Fiverr business model analysis, consider checking out Owners & Shareholders of Fiverr.

Fiverr faces a challenge with its active buyer base, which decreased by 10.6% year-over-year to 3.5 million as of March 31, 2025. This decline could impede overall growth if not offset by increased spending per buyer or other revenue streams. Addressing this trend is crucial for maintaining the Fiverr future prospects.

Macroeconomic conditions significantly impact the demand for freelance services. A survey in December 2024 showed that over 38% of small business owners were concerned about an economic recession. This economic sensitivity could lead to decreased spending on the freelance platform, affecting Fiverr’s revenue and growth.

Advancements in AI present both opportunities and risks. AI could automate freelance tasks, potentially reducing demand and impacting service pricing. This could negatively affect the Gross Merchandise Value (GMV) and take rates on the online marketplace. Fiverr must strategically integrate AI to adapt to these changes.

Intense competition within the gig economy sector poses a threat. Rivals may undercut pricing or introduce competing AI features, potentially eroding Fiverr's market share. The Fiverr company needs to differentiate itself through unique services and strategic partnerships to stay competitive.

The scalability of Fiverr’s services revenue depends on consistent demand for high-value projects. The company must demonstrate its ability to stabilize or reverse the trend of declining active buyers without sacrificing margins. This requires continuous innovation and strategic market positioning.

Fiverr's upmarket initiatives aim to attract higher-value buyers and projects. Expanding high-margin services revenue and making strategic investments in AI are key strategies. These efforts are designed to mitigate the impact of a shrinking active buyer base and macroeconomic volatility.

Fiverr's management focuses on upmarket initiatives and expanding high-margin services revenue. The company is also making strategic investments in AI to address technological disruption. These strategies aim to reduce the impact of a shrinking active buyer base and macroeconomic challenges, ensuring the Fiverr future prospects remain strong.

The company's ability to adapt to market changes is crucial. This includes attracting higher-value buyers and projects and diversifying income streams through services. Consistent demand for high-value projects is essential. Fiverr must continue to demonstrate its ability to stabilize or reverse the trend of declining active buyers, maintaining margins.

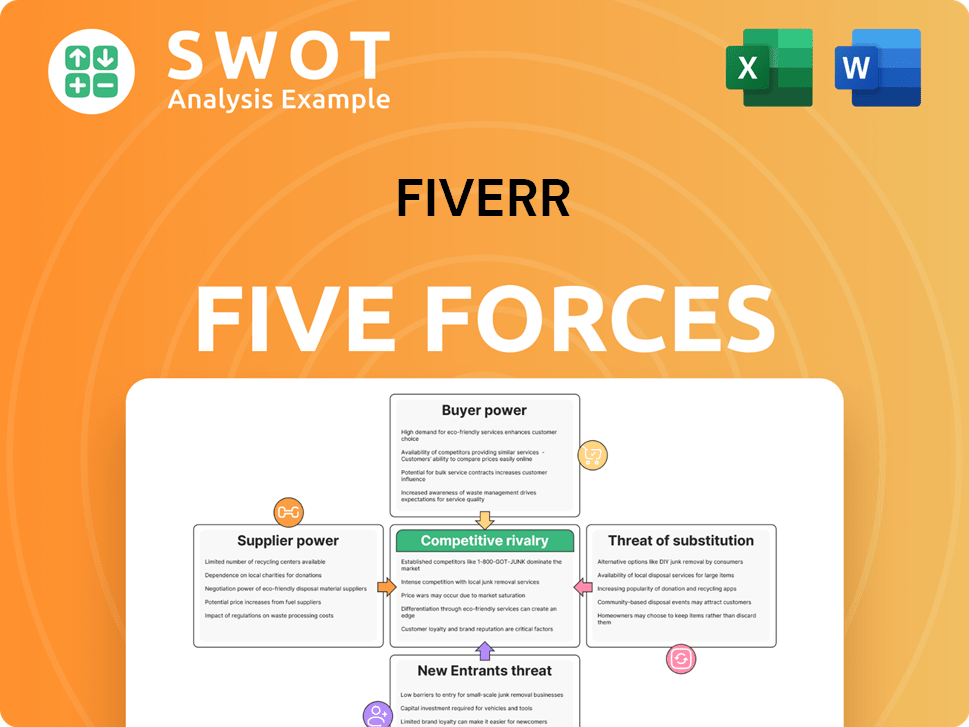

Fiverr Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fiverr Company?

- What is Competitive Landscape of Fiverr Company?

- How Does Fiverr Company Work?

- What is Sales and Marketing Strategy of Fiverr Company?

- What is Brief History of Fiverr Company?

- Who Owns Fiverr Company?

- What is Customer Demographics and Target Market of Fiverr Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.