Fiverr Bundle

Who Really Owns Fiverr?

Understanding the ownership structure of a company is vital for investors and business strategists alike. Fiverr, a leading online marketplace connecting businesses with freelancers, has a fascinating ownership journey. From its inception in 2010, the company has evolved significantly, particularly after its IPO in 2019. This exploration will unravel the intricacies of Fiverr's ownership, offering critical insights for informed decision-making.

Fiverr's Fiverr SWOT Analysis provides a comprehensive view of the company's strengths and weaknesses, which is essential for understanding its market position. Founded by Micha Kaufman and Shai Wininger, the Fiverr company's evolution from a startup to a publicly traded entity has reshaped its ownership dynamics. This analysis will examine the key players in Fiverr's ownership, from the founders to the current major shareholders, providing a clear picture of who controls this dynamic platform. The current CEO of Fiverr and its overall corporate structure will be discussed.

Who Founded Fiverr?

The story of Fiverr begins with its founders, Micha Kaufman and Shai Wininger, who launched the company in 2010. Understanding the evolution of Fiverr ownership is key to grasping its journey from a startup to a publicly traded company. The initial ownership structure and the early investors played a critical role in shaping the company's trajectory.

Who owns Fiverr and how that ownership changed over time provides valuable insights into its growth. From seed funding to its initial public offering (IPO), the company attracted various investors. Examining the early ownership structure reveals the financial backing that fueled the company's expansion and eventual success. The evolution of the company's ownership structure reflects the various stages of its development.

Fiverr company was founded by Micha Kaufman, who currently serves as the Fiverr CEO, and Shai Wininger. Wininger later founded Lemonade in 2014. The initial seed funding of $1 million came from angel investors Guy Gamzu and Jonathan Kolber. This early investment was a crucial step in getting the company off the ground.

The initial seed funding for Fiverr was $1 million, provided by angel investors. This early investment was vital for the company's initial operations and growth.

Bessemer Venture Partners (BVP) made a significant early investment in January 2011. BVP's investment was a key step in Fiverr's early development.

Accel joined as an investor in 2012, further supporting Fiverr's expansion. Accel held a 10% stake at the time of the IPO.

Qumra Capital led a $30 million Series C round, investing $10 million six years prior to August 2020. This investment helped fuel further growth.

Jonathan Kolber held a 13.2% stake, valued at $86 million at IPO, while Guy Gamzu's 4.3% stake grew to $28 million at IPO. These figures highlight the value created.

Micha Kaufman held approximately 7.5% of the company's shares at the time of the IPO in 2019. As of September 2023, he owned 4.81% of the company shares, valued at $50 million.

The early investment by Bessemer Venture Partners (BVP) in January 2011 was a significant step. BVP invested $2.9 million in a $4 million round alongside existing angel investors at a pre-money valuation of $14 million. BVP's resulting ownership was 19.4% after these transactions. Understanding the Fiverr company ownership structure is essential for anyone looking to understand the company's financial history and trajectory. For more insights into the company's marketing strategies, consider exploring the Marketing Strategy of Fiverr.

- Initial seed funding: $1 million from angel investors.

- Bessemer Venture Partners (BVP) invested $2.9 million in 2011.

- Accel joined as an investor in 2012, holding a 10% stake at IPO.

- Micha Kaufman held approximately 7.5% of shares at the time of the IPO in 2019.

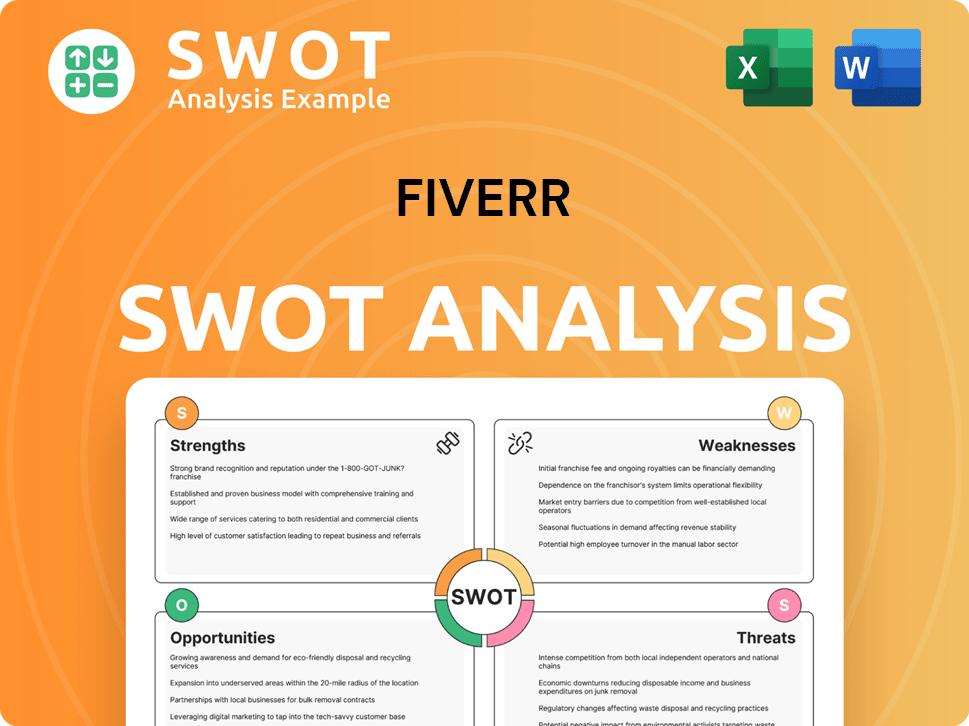

Fiverr SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Fiverr’s Ownership Changed Over Time?

The evolution of Fiverr's ownership structure is marked by its transition from a privately held startup to a publicly traded company. The pivotal moment occurred on June 13, 2019, when Fiverr went public on the New York Stock Exchange (NYSE) under the ticker symbol 'FVRR'. The initial public offering (IPO) priced shares at $21.00, raising approximately $111 million in new funding. This event significantly altered the ownership landscape, introducing a diverse group of shareholders and institutional investors.

The IPO's impact was immediate, with the share price surging by 90% on the first day of trading, reaching $39.90. This surge highlighted the market's confidence in the company's potential. As of June 6, 2025, the share price was $33.78, reflecting a 37.09% increase from June 10, 2024, when the share price was $24.64. This growth indicates continued investor interest and the company's evolving market position. The initial public offering was a key event in the Fiverr ownership journey, transforming its financial structure and broadening its investor base.

| Metric | Details | Date |

|---|---|---|

| IPO Date | June 13, 2019 | |

| Initial Share Price | $21.00 | June 13, 2019 |

| First Day Closing Price | $39.90 | June 13, 2019 |

| Share Price (June 6, 2025) | $33.78 | |

| Share Price (June 10, 2024) | $24.64 |

As a publicly traded entity, who owns Fiverr is a question answered by examining its shareholder base. As of March 31, 2025, institutional investors held a significant 64.1% of the shares, while individual insiders held 13.5%, and the general public held 22.2%. This distribution highlights the influence of institutional investors in the company's direction. The major shareholders include entities like Wellington Management Group LLP, Columbia Management Investment Advisers, LLC, and Capital Research and Management Company. The ownership structure reflects a mix of institutional and individual investors, with key executives also holding substantial stakes, influencing the company's strategic decisions and long-term vision.

Fiverr's ownership structure is primarily influenced by institutional investors.

- The IPO in 2019 was a significant event, transitioning the company from private to public.

- As of March 31, 2025, institutions held 64.1% of the shares.

- Fiverr CEO Micha Kaufman and board member Jonathan Kolber hold notable shares.

- The market capitalization reached approximately $1.2 billion after the IPO.

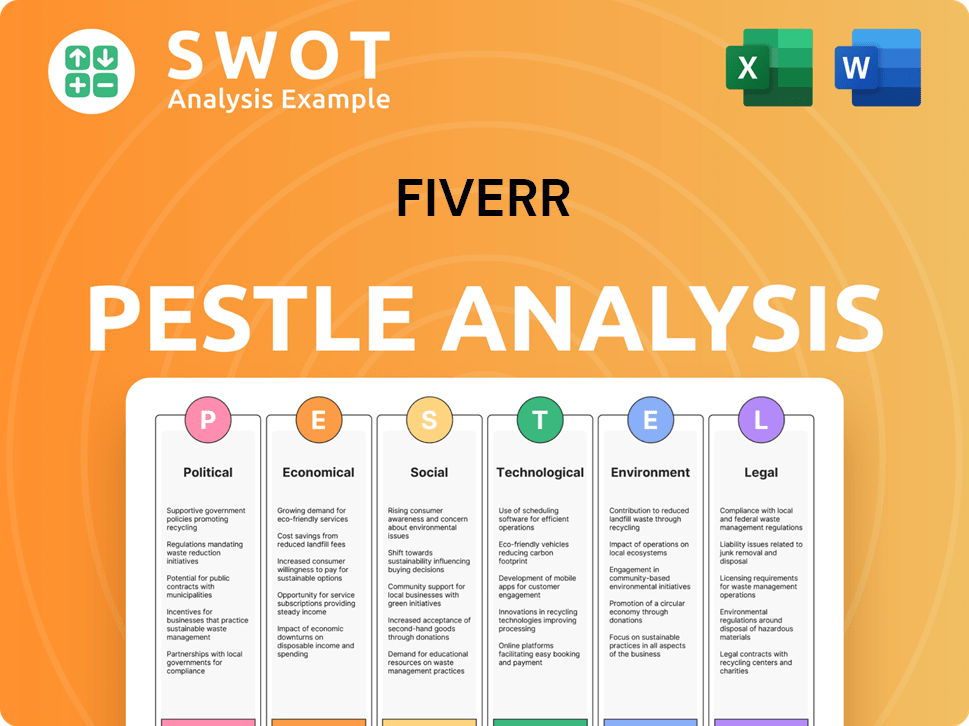

Fiverr PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Fiverr’s Board?

The corporate governance of the Fiverr company is overseen by a board of directors, responsible for the company's strategic direction and financial performance. As of February 2025, Jonathan Kolber, an early investor, serves as a member of the Board of Directors and an independent director. The board includes individuals with expertise in technology, finance, and marketing. The specific affiliations of board members to major shareholders are not explicitly detailed in the available search results for 2024-2025, but it is known that Micha Kaufman, the co-founder and CEO, holds a substantial ownership stake.

Detailed information on the board of directors, including their backgrounds and affiliations, is typically found in the company's annual reports. The annual report on Form 20-F for the fiscal year ended December 31, 2024, was filed with the SEC on February 19, 2025, and provides comprehensive data on corporate governance. The structure ensures that the interests of the shareholders are aligned with the company's leadership.

| Board Member | Role | Affiliation |

|---|---|---|

| Jonathan Kolber | Board Member, Independent Director | Early Investor |

| Micha Kaufman | Co-founder, CEO | Major Shareholder |

| Additional Board Members | Various | Diverse backgrounds in technology, finance, and marketing |

Fiverr operates under a standard one-share-one-vote structure, common for publicly traded companies. The company's commitment to transparency is evident through regular communication with shareholders via financial reports and investor presentations. There have been no significant governance controversies or proxy battles reported within the provided information for 2024-2025. To learn more about the company's origins, you can read a Brief History of Fiverr.

The Fiverr ownership structure includes a board of directors and a standard one-share-one-vote system. The company's commitment to transparency is reflected in its financial reports.

- The board of directors oversees the company's strategic direction.

- Micha Kaufman, the Fiverr CEO, holds a substantial ownership stake.

- Annual reports provide detailed information on corporate governance.

- There are no dual-class shares or special voting rights.

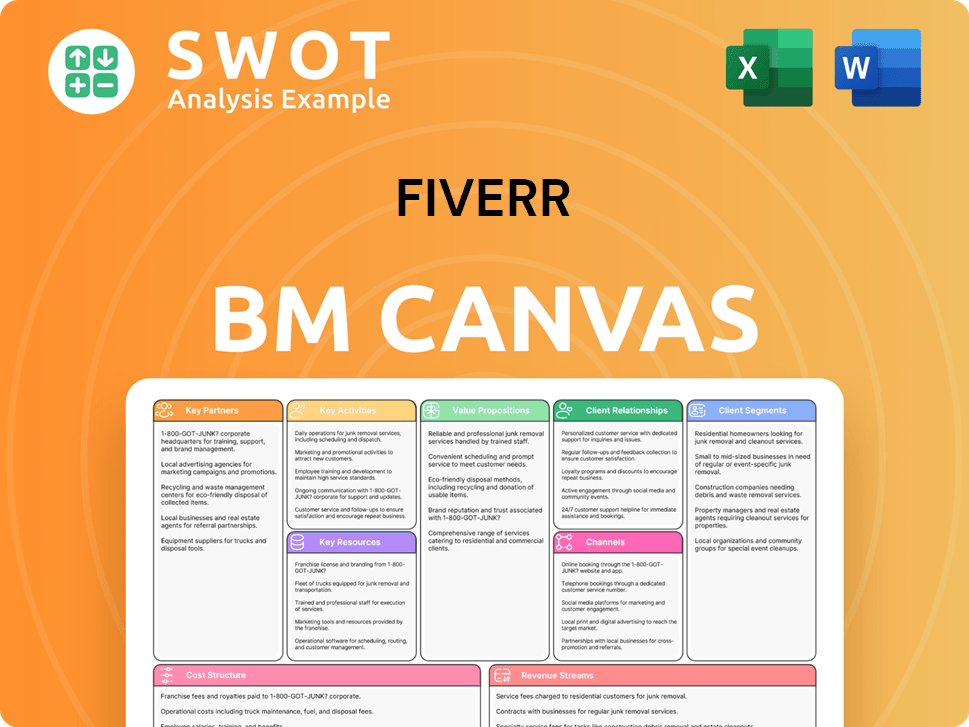

Fiverr Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Fiverr’s Ownership Landscape?

In recent years, the ownership structure of the company has seen significant developments. On March 10, 2025, the Board of Directors authorized an additional $100 million for share repurchases, signaling a commitment to shareholder value. This is part of a broader strategy that includes driving growth, optimizing the balance sheet, and evaluating strategic merger and acquisition (M&A) opportunities. This reflects the company's ongoing efforts to manage its capital effectively and reward its investors.

The company has also been active in M&A, completing 8 acquisitions with an average acquisition amount of $95 million as of April 2025. The most recent acquisition was AutoDS, a dropshipping solution, acquired in July 2024 for $55.7 million. Other notable acquisitions include Stoke (November 2021, $95 million), CreativeLive (October 2021), and Working Not Working (February 2021). These strategic moves aim to expand its service offerings and market reach. To understand more about their business model, you can read about the Revenue Streams & Business Model of Fiverr.

| Metric | Details | Date |

|---|---|---|

| Institutional Ownership | 71.82% of shares outstanding | June 2025 |

| Institutional Owners | 229 | June 2025 |

| Shares Held by Institutions | 25,860,862 | June 2025 |

| Mutual Fund Holdings | Decreased from 25.01% to 24.91% | January 2025 |

A key development is the introduction of the Freelancer Equity Program, announced on February 18, 2025. This program offers shares to top-performing freelancers, aiming to foster a sense of ownership and empower creators within the ecosystem. Institutional ownership remains a dominant trend, with 229 institutional owners holding a total of 25,860,862 shares as of June 2025, representing 71.82% of shares outstanding. The company continues to prioritize profitable growth and strong cash flow generation, with leadership statements emphasizing capital return to shareholders.

The company's ownership structure includes institutional investors, with a significant portion of shares held by these entities. The Freelancer Equity Program is a unique initiative. The company's capital allocation strategy focuses on growth and shareholder value.

Recent acquisitions, such as AutoDS, highlight the company's expansion efforts. The share repurchase program demonstrates a commitment to returning value to shareholders. The introduction of the AI platform, Fiverr Go, marks an innovative step.

The company's focus on profitable growth and strong cash flow generation is evident. Leadership emphasizes capital return to shareholders through buybacks. The company is actively pursuing M&A opportunities.

The company is likely to continue its strategic acquisitions to expand its service offerings. The Freelancer Equity Program could reshape its relationship with top freelancers. The company's ability to maintain profitable growth is crucial.

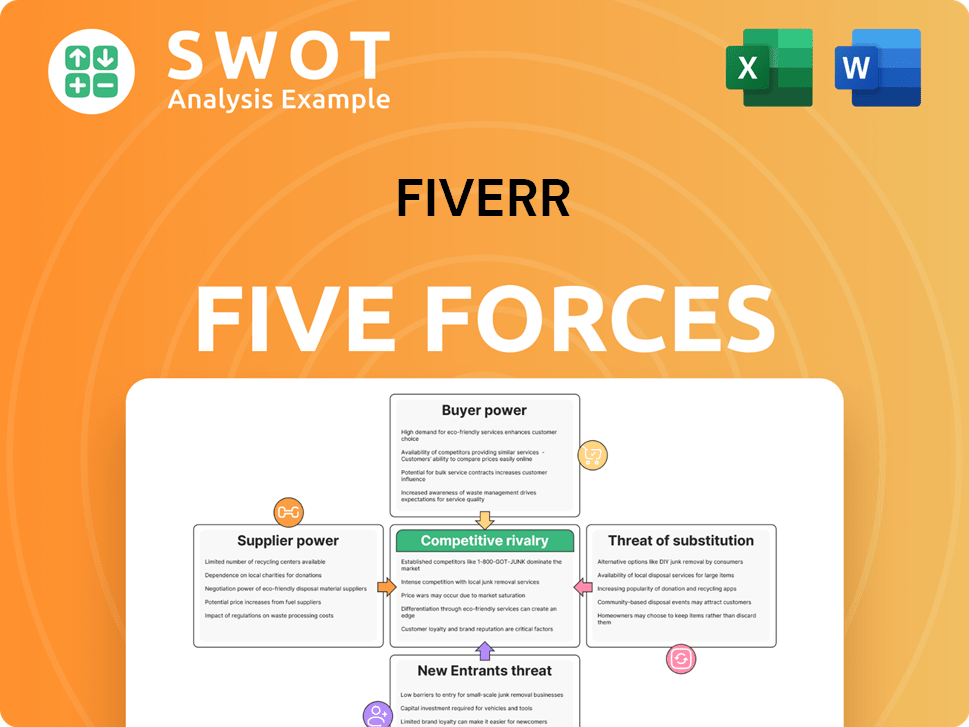

Fiverr Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fiverr Company?

- What is Competitive Landscape of Fiverr Company?

- What is Growth Strategy and Future Prospects of Fiverr Company?

- How Does Fiverr Company Work?

- What is Sales and Marketing Strategy of Fiverr Company?

- What is Brief History of Fiverr Company?

- What is Customer Demographics and Target Market of Fiverr Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.