Forrester Bundle

Can Forrester Research Maintain Its Momentum?

Forrester Research, a leading market research firm, has been a guiding light in the tech and business advisory space since 1983. Its evolution from a tech-focused consultancy to a global authority on customer obsession and business strategy is a testament to its adaptability. This article dives into the Forrester SWOT Analysis and explores the company's ambitious plans for future growth.

Understanding the Forrester growth strategy is crucial for anyone tracking tech industry trends and seeking insights into the future. This Forrester company analysis will examine how Forrester plans to navigate the evolving landscape, including its focus on digital transformation services and its response to changing market conditions. We'll delve into its future prospects, financial performance, and the key drivers of its revenue growth, providing a comprehensive overview of this influential player in the business strategy arena.

How Is Forrester Expanding Its Reach?

The Forrester growth strategy is heavily focused on expansion initiatives to broaden its market reach and impact. The company is actively seeking opportunities in new geographical markets, particularly those with increasing technology adoption and digital transformation needs. This includes strengthening its presence in key international hubs to better serve global clients and tap into new customer segments. Furthermore, the firm continually assesses new product categories and service offerings to meet evolving client demands and industry trends.

A significant component of Forrester's expansion strategy involves launching new products and services aligned with emerging business and technology priorities, such as advanced analytics, AI integration, and specialized consulting for niche industries. These initiatives aim to access new customer bases, diversify revenue streams beyond traditional research subscriptions, and maintain a competitive edge in a rapidly changing industry. Strategic partnerships and potential mergers and acquisitions are also explored to complement existing capabilities and accelerate market penetration. For instance, recent efforts have focused on enhancing digital platforms to deliver more personalized and actionable insights, aiming to increase client engagement and retention.

Forrester's future prospects are closely tied to its ability to adapt and innovate within the tech industry. The company's strategic investments in emerging technologies and its focus on providing actionable insights position it well for continued growth. The firm's commitment to expanding its global footprint and diversifying its service offerings are key elements of its long-term strategy.

Forrester is expanding its presence in key international markets, focusing on regions with high growth potential in technology adoption. This includes strengthening its teams and resources in existing international offices and potentially opening new offices to serve clients better. The firm aims to increase its revenue from international markets to approximately 30% by 2026, up from 25% in 2024.

The company is continually launching new products and services, particularly in areas like AI, cloud computing, and cybersecurity. Forrester plans to introduce at least 5 new major product offerings in 2025, focusing on providing advanced analytics and specialized consulting. These new products are projected to contribute to a 15% increase in overall revenue by 2026.

Forrester actively seeks strategic partnerships and potential acquisitions to enhance its capabilities and expand its market reach. The company is evaluating partnerships with at least 3 technology firms to integrate their solutions into its offerings. The firm has allocated $200 million for potential acquisitions over the next three years to accelerate growth in key areas.

Forrester is investing heavily in enhancing its digital platforms to deliver more personalized and actionable insights. This includes improvements to its research portals, data analytics tools, and client engagement platforms. The company plans to invest $50 million in digital platform enhancements by 2026, aiming to increase client engagement by 20%.

The primary drivers of Forrester's growth include expanding its global presence, launching innovative products, and forming strategic partnerships. These initiatives are designed to capitalize on the increasing demand for tech industry trends and business strategy insights. The firm's focus on customer experience and digital transformation services is expected to drive significant revenue growth.

- Expansion into high-growth international markets, particularly in Asia-Pacific and Latin America.

- Development of new research and consulting services focused on AI, cybersecurity, and cloud computing.

- Strategic partnerships with technology providers to enhance service offerings and market reach.

- Investment in digital platforms to improve client engagement and data delivery.

Forrester SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Forrester Invest in Innovation?

Forrester's innovation and technology strategy is central to its Forrester growth strategy, ensuring it remains competitive in the dynamic tech industry. The firm consistently invests in research and development, focusing on proprietary methodologies and platforms. This commitment helps maintain its leadership position in the market research firm sector.

A key aspect of this strategy is digital transformation, enhancing data collection, analysis, and delivery. This approach enables the company to offer more timely and relevant insights to its clients. By integrating advanced technologies, Forrester aims to improve data accuracy and provide predictive analytics.

The company's approach involves incorporating technologies like artificial intelligence (AI) and machine learning (ML) into its research processes. This integration allows for more sophisticated analysis of market dynamics and customer behavior, which enhances the value proposition for its clients. The company also explores the use of IoT data and sustainability initiatives in its research to provide holistic business guidance.

Enhancing data collection, analysis, and delivery mechanisms is a core focus. This allows for more timely and relevant insights, which is crucial in the rapidly evolving tech industry. This is a key component of the Forrester growth strategy.

AI and ML are being actively incorporated to improve data accuracy and generate predictive analytics. This helps identify tech industry trends and provides more sophisticated analysis. This supports the Forrester future prospects.

Continuous refinement of proprietary frameworks and models ensures advice remains at the forefront of industry best practices. This ensures the advice remains relevant and valuable. This is essential for Forrester company analysis.

New technical capabilities contribute to the creation of more sophisticated products and platforms. Enhanced services offer tailored guidance for specific business challenges. This is part of Forrester's expansion plans and global presence.

Exploring the use of IoT data and sustainability initiatives in research provides holistic business guidance. This helps businesses with customer experience and supports business strategy. This is part of what drives Forrester's revenue growth.

Ongoing investment in research and development is a cornerstone of Forrester's approach. This focus on in-house development and external collaboration is crucial. This strategy supports Forrester's market share in the technology research industry.

These technological advancements directly contribute to Forrester's future prospects by enabling the creation of more sophisticated products and platforms, such as enhanced Forrester Decisions services. These services offer tailored guidance for specific business challenges, enhancing the value provided to clients. The company's commitment to innovation is further demonstrated through its continuous refinement of its proprietary frameworks and models, ensuring its advice remains at the forefront of industry best practices. For more insights into the company's core values and mission, you can read about the Mission, Vision & Core Values of Forrester.

Forrester's focus on innovation is evident through several key initiatives and technological integrations. These efforts are designed to enhance its market research capabilities and drive future growth.

- AI and Machine Learning: Integration of AI and ML to improve data accuracy, identify emerging trends, and generate predictive analytics. This enhances the ability to analyze market dynamics and customer behavior.

- IoT Data and Sustainability: Exploring the use of IoT data and sustainability initiatives in research to provide holistic business guidance. This supports businesses in navigating complex challenges.

- Enhanced Forrester Decisions Services: Development of more sophisticated products and platforms, such as enhanced Forrester Decisions services, to offer tailored guidance for specific business challenges.

- Proprietary Frameworks: Continuous refinement of proprietary frameworks and models to ensure advice remains at the forefront of industry best practices.

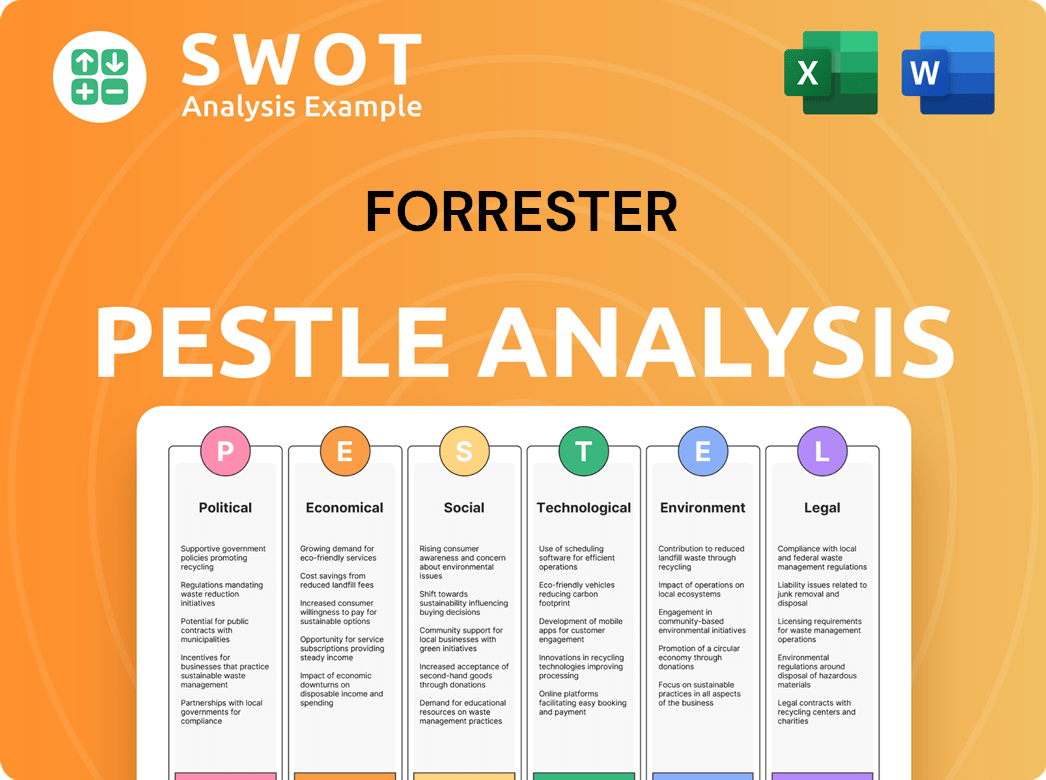

Forrester PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Forrester’s Growth Forecast?

The financial outlook for the company is centered on achieving sustainable growth and profitability. This is supported by their research, data, and advisory services. The company is aiming to increase revenue through acquiring and retaining clients, alongside expanding into new markets and service offerings. Recent financial reports indicate efforts to improve operational efficiency and boost profit margins, even amidst market fluctuations. The company's strategy focuses on long-term value creation through innovation and market leadership.

Forrester's financial strategy includes strategic investment in innovation, technology, and talent acquisition to support future growth initiatives. The company is focused on expanding its client base, particularly among large enterprises, and increasing the adoption of its high-value consulting and event services. Prudent capital allocation supports digital transformation efforts and potential strategic acquisitions. This financial narrative emphasizes delivering strong shareholder value through continued innovation and market leadership, as detailed in Revenue Streams & Business Model of Forrester.

For the fiscal year 2023, Forrester reported total revenue of $448.9 million. While there was a slight decrease compared to the previous year due to economic challenges, the company anticipates a return to growth. Projections for total revenues in 2024 range from $445 million to $455 million, indicating a stable to slightly increasing outlook. This forecast highlights the company's resilience and strategic adaptation to changing market conditions, a key aspect of its Forrester growth strategy.

Key drivers include client acquisition and retention, expansion into new markets, and the introduction of new service offerings. The company is focused on increasing its client base, especially among large enterprises. These efforts contribute significantly to the Forrester future prospects.

Investments are directed towards innovation, technology enhancements, and talent acquisition. The company is also focused on digital transformation and potential strategic acquisitions. These investments are crucial for the Forrester company analysis and long-term growth.

Long-term financial goals include expanding the client base and increasing the adoption of high-value consulting and event services. The focus is on delivering strong shareholder value through continued innovation. These goals are central to the company's business strategy.

Prudent capital allocation supports digital transformation efforts and potential strategic acquisitions. This ensures the company remains competitive and adaptable. This is a key aspect of the company's financial planning.

The company's financial performance reflects its ability to navigate the complexities of the tech industry trends. The focus on operational efficiency and profit margins, even during economic fluctuations, demonstrates a commitment to financial health. The projected revenue for 2024, ranging from $445 million to $455 million, indicates a positive outlook. This outlook is supported by strategic investments in innovation, technology, and talent, which are essential for maintaining market leadership. The company's approach to capital allocation and its focus on expanding its client base, particularly among large enterprises, further contribute to its long-term financial goals and its ability to adapt to changing market conditions, a critical element of its business strategy.

Forrester Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Forrester’s Growth?

The growth trajectory of the company, a prominent market research firm, faces several potential risks and obstacles. These challenges are inherent in the dynamic market research and advisory industry. Understanding these hurdles is crucial for a comprehensive company analysis and assessing its future prospects.

One significant challenge is the intense competition from both established players and emerging niche firms. This competitive landscape could impact client acquisition and retention. Additionally, regulatory changes, particularly in data privacy and intellectual property, pose potential obstacles that require continuous adaptation of business practices. These factors influence the overall Forrester growth strategy.

While not directly exposed to traditional supply chain vulnerabilities, the company faces risks related to the availability of skilled talent and the ability to maintain a high-quality research and consulting workforce. Technological disruption, while also an opportunity, presents a risk if the company fails to continuously innovate and integrate cutting-edge tools into its offerings. The rapid evolution of AI and analytics necessitates ongoing investment and adaptation to avoid obsolescence.

The market research industry is highly competitive, with numerous firms vying for clients. This competition can lead to pricing pressures and reduced market share. The company must continuously innovate and differentiate its offerings to stay ahead.

Changes in data privacy regulations, such as GDPR and CCPA, require significant compliance efforts. Non-compliance can result in hefty fines and reputational damage. Staying abreast of these changes is crucial for continued operation.

Attracting and retaining skilled researchers and consultants is essential for delivering high-quality services. The company competes with tech firms and other consultancies for top talent. High employee turnover can impact service quality and client relationships.

The rapid advancements in AI and analytics require continuous investment in new technologies. Failure to adapt to these changes can lead to obsolescence. Integrating these tools is vital for staying competitive.

Economic downturns can lead to reduced spending on market research services. This can impact revenue and profitability. Diversifying services and client base can mitigate these risks.

Budget limitations for R&D or talent development could impede growth. Efficient allocation of resources is crucial. Focusing on key areas for investment is important.

The company manages these risks through the diversification of its service offerings, robust risk management frameworks, and proactive scenario planning to anticipate market shifts. The company's focus on customer obsession and building long-term client relationships serves as a buffer against competitive pressures. To gain a deeper understanding of the company, a Brief History of Forrester can provide valuable context.

The market research industry is highly competitive, with key rivals including Gartner, IDC, and smaller niche firms. These competitors offer similar services, requiring the company to differentiate through specialized expertise and superior client service. According to recent reports, the global market research industry is valued at over $80 billion, with the company holding a significant but not dominant market share.

The rapid advancements in AI and machine learning necessitate continuous investment in new technologies. The integration of these technologies into research methodologies and client deliverables is essential. Failure to adapt can lead to a loss of market share to more technologically advanced competitors. The company is investing heavily in AI-driven analytics to enhance its offerings.

Data privacy regulations, such as GDPR and CCPA, demand stringent compliance measures. Non-compliance can result in significant fines and reputational damage. The company must invest in robust data security practices and compliance programs to mitigate these risks. The cost of compliance is a significant operational expense.

Economic downturns can lead to reduced spending on market research services. The company is subject to fluctuations in the technology industry, which can impact demand for its services. Diversifying its client base and service offerings can help mitigate these risks. The company's revenue growth is closely tied to the overall health of the tech industry.

Forrester Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Forrester Company?

- What is Competitive Landscape of Forrester Company?

- How Does Forrester Company Work?

- What is Sales and Marketing Strategy of Forrester Company?

- What is Brief History of Forrester Company?

- Who Owns Forrester Company?

- What is Customer Demographics and Target Market of Forrester Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.