Foster Farms Bundle

Can Foster Farms Continue to Thrive in the Evolving Poultry Market?

In a landscape shaped by shifting consumer tastes and fierce competition, understanding the Foster Farms SWOT Analysis is crucial for any investor or industry observer. Founded in 1939, this iconic brand has evolved from a family farm to a major player in the poultry industry. This article delves into Foster Farms' growth strategy, exploring its past successes and future prospects within the dynamic food market.

This exploration will examine the company's strategic initiatives, including its expansion into new markets and diversification of product offerings. We'll also analyze Foster Farms' innovation and technology strategy, focusing on how it aims to maintain its competitive edge through advancements in poultry processing. Furthermore, we'll review the company's financial outlook, providing a comprehensive understanding of its path forward and the potential challenges and opportunities it faces within the chicken market trends and the broader poultry industry analysis.

How Is Foster Farms Expanding Its Reach?

The growth strategy of the company, a prominent player in the poultry industry, is significantly shaped by its expansion initiatives. These initiatives are geared towards enhancing its geographical footprint and diversifying its product offerings. The company's approach typically involves strengthening its presence in existing markets, particularly within the Western U.S., and exploring opportunities in adjacent regions or product categories. This strategy aims to access new customer segments, diversify revenue streams, and adapt to changing consumer preferences for poultry products.

A key aspect of the company's expansion strategy involves adapting to consumer demands. For instance, the growing demand for organic, antibiotic-free, and value-added poultry products presents avenues for new product launches or strategic partnerships. The company’s historical approach suggests a continued focus on adapting to evolving consumer demands for poultry products. The company’s vertical integration, from hatching to distribution, provides a strong foundation for efficient expansion, allowing it to control quality and supply chain logistics.

The company has historically expanded its product pipeline by introducing various cuts, marinated options, and prepared meals to cater to convenience-seeking consumers. While specific timelines for new product launches in 2024-2025 are proprietary, the industry trend indicates a move towards more sustainable and ethically sourced poultry, which could influence the company's product development. The company’s expansion initiatives are often influenced by the competitive landscape and market dynamics. Strategic partnerships with retailers or foodservice operators could enable deeper market penetration.

The company likely focuses on strengthening its presence in existing Western U.S. markets. Exploring opportunities in adjacent regions is also a key part of the strategy. Expansion might involve entering new states or increasing distribution within current markets, aiming to increase market share and revenue.

The company diversifies its product offerings to meet evolving consumer demands. This includes introducing new cuts, marinated options, and prepared meals. The focus is also on sustainable and ethically sourced poultry products to cater to health-conscious consumers.

Strategic partnerships with retailers and foodservice operators can enable deeper market penetration. These collaborations can improve distribution networks and increase product visibility. Partnerships help to reach a wider customer base and enhance brand presence.

The company's vertical integration, from hatching to distribution, supports efficient expansion. This allows for better control over quality and supply chain logistics. Vertical integration provides a competitive advantage by streamlining operations and reducing costs.

The company's expansion is driven by factors such as accessing new customer segments and adapting to consumer demands. The poultry industry is experiencing trends towards organic, antibiotic-free, and value-added products. These trends influence the company's product development and market strategies.

- Market Demand: Increasing demand for organic and antibiotic-free poultry products.

- Consumer Preferences: Growing preference for convenience-oriented and value-added meals.

- Sustainability: Emphasis on sustainable and ethically sourced poultry.

- Competitive Landscape: The need to maintain and enhance market share in a competitive environment. For more insights, check out the Competitors Landscape of Foster Farms.

Foster Farms SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Foster Farms Invest in Innovation?

The company utilizes innovation and technology to maintain its competitive edge, focusing on operational efficiency, product quality, and sustainability. The approach to digital transformation likely involves optimizing processing plants and supply chains through automation and data analytics. While specific R&D investments for 2024-2025 are not publicly detailed, the poultry industry is seeing increased adoption of cutting-edge technologies.

For instance, IoT sensors are used to monitor environmental conditions in poultry houses, improving bird health and welfare, and leading to higher yields and better product quality. The application of AI in areas such as predictive maintenance for equipment or optimizing feed formulations can significantly reduce operational costs and enhance efficiency. The commitment to providing high-quality, affordable products suggests ongoing investment in technologies that ensure food safety and traceability throughout the production process.

In terms of sustainability, the company likely invests in technologies that reduce its environmental footprint, such as optimizing water usage, managing waste, and exploring renewable energy sources for its operations. The continuous improvement in these areas demonstrates a commitment to innovation that contributes directly to growth objectives by enhancing product consistency, reducing costs, and meeting evolving consumer and regulatory demands. For more insights, consider reading the Marketing Strategy of Foster Farms.

Automation and data analytics are key in optimizing processing plants and supply chains. This includes the use of AI for predictive maintenance and feed formulation optimization. These technologies help reduce operational costs and enhance overall efficiency.

IoT sensors are used to monitor environmental conditions in poultry houses. This improves bird health and welfare, leading to higher yields and better product quality. Investments in food safety and traceability technologies are also crucial.

The company likely invests in technologies to reduce its environmental footprint. This includes optimizing water usage, managing waste, and exploring renewable energy sources. Such initiatives align with evolving consumer and regulatory demands.

Ongoing investment in technologies ensures food safety and traceability throughout the production process. This commitment enhances product consistency and meets consumer expectations. These measures are vital for maintaining consumer trust.

Continuous improvement in poultry processing contributes to growth objectives. This includes enhancing product consistency and reducing costs. The focus is on meeting evolving consumer and regulatory demands.

Leveraging technology and innovation helps maintain a competitive edge. This includes operational efficiency, product quality, and sustainability. These strategies are essential for long-term growth.

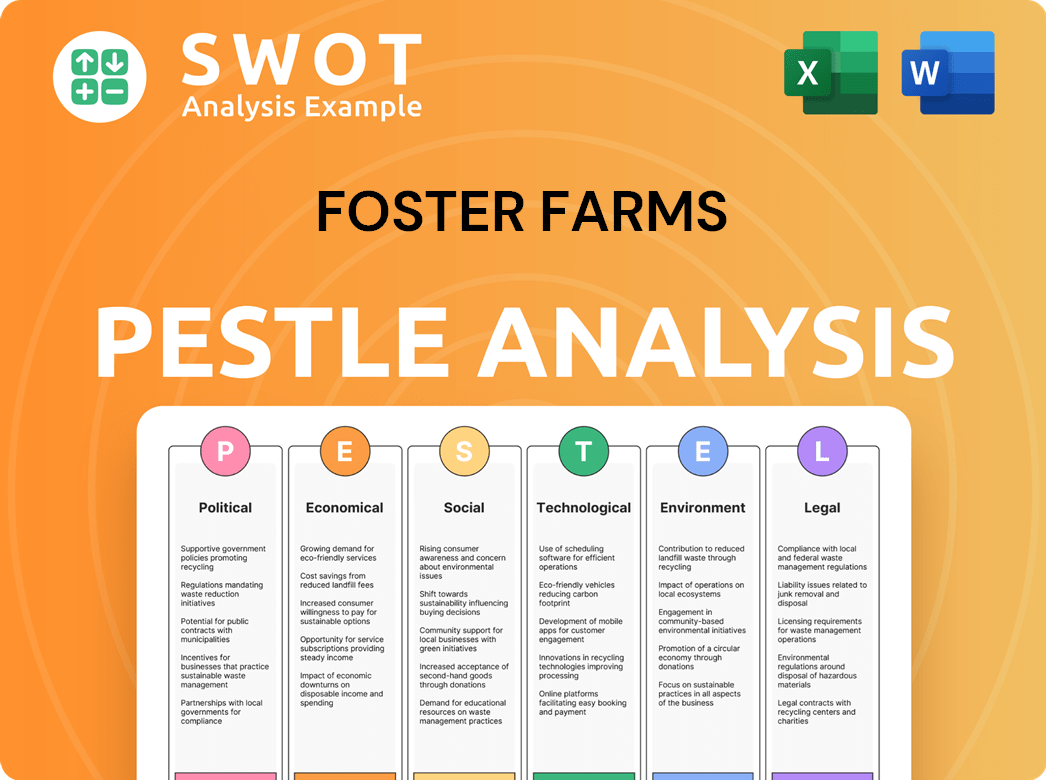

Foster Farms PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Foster Farms’s Growth Forecast?

Due to its status as a privately held company, detailed financial data for Foster Farms, including specific revenue figures, profit margins, and detailed financial forecasts for 2024-2025, are not publicly available. However, the company's strategic direction and financial health can be inferred from industry trends and its operational scale. The U.S. poultry market's projected growth offers a favorable backdrop for Foster Farms' continued expansion and profitability.

Foster Farms, a significant player in the Western U.S. poultry market, likely focuses on sustained financial performance through efficient production and strong brand recognition. This strategy is supported by its vertically integrated operations, which help manage costs and maintain quality control. The company's financial outlook is closely tied to its ability to navigate market dynamics, manage operational efficiencies, and adapt to consumer preferences.

Investment strategies for Foster Farms are expected to concentrate on maintaining and improving existing facilities, adopting new technologies for enhanced efficiency and sustainability, and potential initiatives for expansion. While specific funding rounds or capital raises for 2024-2025 are not publicly disclosed, privately held companies often utilize reinvested earnings or private financing to support their growth strategies. Understanding the Owners & Shareholders of Foster Farms can provide additional context on the company's financial management and strategic decisions.

The U.S. broiler market is forecast to reach a value of $39.7 billion in 2024, presenting a positive environment for Foster Farms. The company's financial performance is closely linked to its ability to capitalize on these positive market trends. This growth is driven by increasing consumer demand for chicken products and the industry's capacity to adapt to changing consumer preferences.

Consumer demand for chicken remains robust, supported by its affordability and versatility. Foster Farms' financial strategies likely include product innovation and brand awareness to maintain market share. The company's focus on operational efficiency and supply chain management is crucial for navigating price fluctuations and maintaining profitability.

Foster Farms may explore expansion into new markets and product lines to drive growth. This could involve strategic investments in processing capabilities and distribution networks. The company's financial planning probably includes allocations for research and development to support new product development and maintain a competitive edge.

While specific market share data for 2024 is not publicly available, Foster Farms maintains a significant presence in the Western U.S. The company's financial success depends on its ability to maintain and grow its market share. This is likely supported by strong brand recognition and effective sales and marketing strategies.

Foster Farms' financial performance is likely evaluated through internal metrics such as revenue growth, cost management, and profitability. The company's strategic investments in operational efficiency and sustainability are key factors influencing its financial outcomes. These factors are essential for long-term business goals.

Innovation in product offerings is a key component of Foster Farms' growth strategy. This includes developing new poultry products and expanding its product lines to meet evolving consumer demands. The company's financial plans likely allocate resources for research and development to support these initiatives.

Sustainability is increasingly important in the food industry, and Foster Farms may invest in sustainable practices. This could involve initiatives to reduce environmental impact and improve resource efficiency. These investments can also enhance brand reputation and appeal to environmentally conscious consumers.

The poultry industry is competitive, and Foster Farms must continually analyze its competitive landscape. This involves monitoring competitors' strategies, market share, and product offerings. Understanding the competitive environment informs strategic decisions and helps maintain market position.

Expanding into new geographic markets can be a key driver of Foster Farms' growth. This involves assessing market opportunities, understanding consumer preferences, and establishing distribution networks. Strategic investments in these areas are essential for long-term growth and market penetration.

Efficient supply chain management is critical for Foster Farms to control costs and ensure product availability. This involves optimizing sourcing, production, and distribution processes. Effective supply chain management contributes to profitability and customer satisfaction.

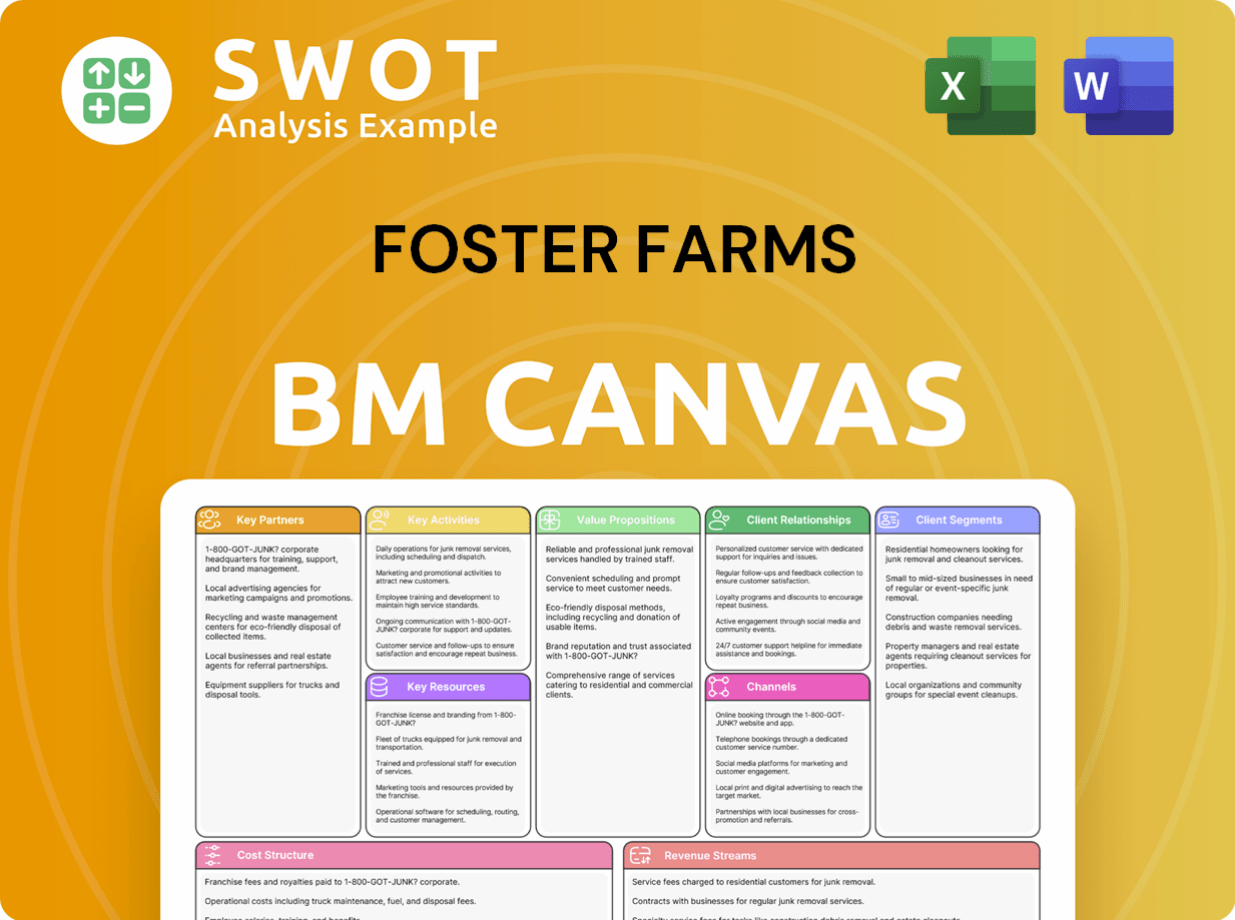

Foster Farms Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Foster Farms’s Growth?

The path ahead for the company is not without its challenges. The poultry industry is highly competitive, and the company must navigate several potential risks to maintain and grow its market position. Understanding these obstacles is crucial for assessing the company's long-term growth potential and future prospects, as well as for making informed investment decisions.

Several factors could impede the company's progress. These include market competition, regulatory changes, supply chain vulnerabilities, and the need to adapt to technological advancements. The company's ability to effectively manage these risks will significantly influence its performance in the coming years.

The company's strategic planning must also consider internal resource constraints and evolving consumer preferences. The following sections detail the key risks and obstacles facing the company, providing a comprehensive view of the challenges it must overcome.

The poultry industry is fiercely competitive, with numerous large and regional players vying for market share. This intense competition can lead to price wars and pressure on profit margins, potentially impacting the company's financial performance. The competitive landscape requires constant innovation and efficiency to maintain a strong position. According to industry reports, the top four poultry producers in the U.S. control a significant portion of the market, highlighting the competitive environment.

Regulatory changes, particularly concerning animal welfare, environmental standards, and food safety, pose ongoing risks. Compliance with new regulations can require substantial investments in infrastructure and processes. The increasing scrutiny of farming practices by consumers and regulatory bodies necessitates continuous adaptation and investment. For example, the implementation of new animal welfare standards can lead to increased operational costs.

Supply chain disruptions represent a significant obstacle. External factors such as disease outbreaks (like avian influenza), fluctuations in feed costs, and labor shortages can disrupt production. The company's vertically integrated model helps mitigate some risks, but it is still vulnerable to external shocks. Outbreaks of highly pathogenic avian influenza (HPAI) have significantly impacted the U.S. poultry industry, leading to culling of flocks and impacting supply in recent years, as reported by the USDA. The company's supply chain management must be robust and adaptable to address these challenges effectively.

Technological disruption can be a risk if the company fails to adopt new processing or distribution technologies as rapidly as competitors. The poultry industry is increasingly reliant on automation, data analytics, and advanced processing techniques. Failure to invest in and implement these technologies could lead to a loss of competitiveness and efficiency. The adoption of technologies like automated grading systems and advanced packaging solutions is crucial for maintaining operational efficiency and product quality.

Internal resource constraints, such as access to skilled labor or capital for large-scale investments, could impede growth. The company's ability to attract and retain skilled workers, as well as secure funding for expansion and innovation, is critical. Labor shortages and rising labor costs can significantly impact operational expenses. The company must effectively manage its resources to support its growth strategy. For instance, the cost of feed and labor in 2023 increased significantly, impacting overall profitability.

Increasing consumer demand for alternative proteins and stricter environmental regulations could shape its future trajectory and necessitate continuous adaptation. The shift towards plant-based alternatives and the growing emphasis on sustainable practices require the company to adapt its product offerings and operational strategies. The company's ability to innovate and respond to these evolving consumer preferences will be crucial for its long-term success. The demand for organic and free-range poultry products continues to grow, reflecting changing consumer values.

The company likely employs robust risk management frameworks, including diversification of product offerings and geographical reach where feasible, and engages in scenario planning to prepare for potential disruptions. The company's long history suggests an ability to adapt to and overcome various challenges, such as managing through past disease outbreaks or navigating economic downturns. The company's resilience is a critical factor in its ability to navigate these challenges. The Brief History of Foster Farms provides insights into the company's past adaptations.

Emerging risks like increasing consumer demand for alternative proteins or stricter environmental regulations could shape its future trajectory and necessitate continuous adaptation. The company must proactively address these challenges to maintain its competitive edge. The ability to innovate and adapt to changing market conditions will be essential. The company's strategic responses to these challenges will be critical for its long-term growth and sustainability. The poultry industry is expected to see continued growth, but it will require strategic agility.

Foster Farms Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Foster Farms Company?

- What is Competitive Landscape of Foster Farms Company?

- How Does Foster Farms Company Work?

- What is Sales and Marketing Strategy of Foster Farms Company?

- What is Brief History of Foster Farms Company?

- Who Owns Foster Farms Company?

- What is Customer Demographics and Target Market of Foster Farms Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.