Foster Farms Bundle

Who Really Owns Foster Farms?

Understanding a company's ownership is crucial for investors and strategists alike. The story of Foster Farms, a leading name in American poultry, offers a compelling case study in corporate evolution. From its family-owned roots to its current structure, the journey of Foster Farms reveals key insights into market dynamics and strategic shifts. This exploration dives deep into the Foster Farms SWOT Analysis, its ownership, and its position in the competitive food industry.

The Foster Farms ownership structure has undergone a significant transformation. Initially a family-run business, the poultry giant now operates under different ownership. The acquisition of Foster Farms by Atlas Holdings in June 2022 marked a pivotal moment, changing its trajectory. This shift raises questions about the future of Foster Farms and its strategic direction, making it essential to understand who owns Foster Farms and its implications for the company's future, including its products and market share.

Who Founded Foster Farms?

The story of Foster Farms begins in 1939 with Max and Verda Foster, who, with a $1,000 loan secured against a life insurance policy, launched their poultry business. Their initial focus was on raising turkeys on an 80-acre farm in Modesto, California. This marked the beginning of what would become a significant player in the poultry industry.

In the early years, the Fosters were deeply involved in every aspect of the operation. Max Foster left his reporting job in 1942 to fully dedicate himself to the growing farm. They expanded into raising cattle and chickens, demonstrating a commitment to diversification within their agricultural enterprise. The company's foundation was built on family ownership and a hands-on approach.

The early ownership structure of Foster Farms was straightforward: it was entirely family-owned and operated. Details regarding specific equity splits or shareholding percentages during this period are not publicly available. However, the Fosters' dedication to quality and their hands-on management style were central to their early success and expansion.

As the business grew, Foster Farms made strategic moves to enhance its operations and market position. In the 1950s, they acquired another farm and a feed mill, which provided them with greater independence from external suppliers. A significant step was the 1959 acquisition of the Sunland Poultry processing plant in Livingston, California, followed by the relocation of headquarters there in 1960. This move towards vertical integration allowed Foster Farms to control the entire production process, from raising livestock to processing and packaging, setting the stage for its future. For more details, you can read a Brief History of Foster Farms.

- The Fosters started with a humble beginning, borrowing $1,000 to start their business.

- Max Foster's full-time commitment in 1942 marked a pivotal moment for the company's growth.

- The acquisition of the Sunland Poultry processing plant in 1959 was a key step toward vertical integration.

- The company's headquarters moved to Livingston, California, in 1960.

Foster Farms SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Foster Farms’s Ownership Changed Over Time?

The journey of Foster Farms, a major player in the poultry industry, began in 1939 as a family-run business. Max and Verda Foster started the company, and it remained under family control for many years. In 1969, their son, Paul Foster, took over, and later, his brother Thomas became president. The company saw significant growth during this period, becoming the largest poultry producer on the West Coast by 1996, with approximately $900 million in annual sales. The leadership evolved over time, with Robert Fox, a non-family member, taking on the roles of president and CEO in 1992, while family members remained on the board.

A pivotal change occurred on June 7, 2022, marking a significant shift in the company’s ownership. Atlas Holdings, a private equity firm based in Greenwich, Connecticut, acquired Foster Farms from the Foster family. The financial details of the deal were not made public. This acquisition transitioned Foster Farms from a family-owned entity to one backed by private equity. Atlas Holdings, established in 2002, manages a portfolio of 25 companies, employing around 50,000 people across more than 300 facilities worldwide. These companies generate approximately $14.5 billion in combined annual revenues. This change typically indicates a focus on operational improvements and strategic growth, with the private equity firm eventually aiming for an exit strategy.

| Key Event | Date | Details |

|---|---|---|

| Founding | 1939 | Max and Verda Foster establish the company. |

| Leadership Transition | 1969 | Paul Foster takes over the company. |

| Non-Family Leadership | 1992 | Robert Fox becomes president and CEO. |

| Atlas Holdings Acquisition | June 7, 2022 | Atlas Holdings acquires Foster Farms. |

The shift to Atlas Holdings as the Foster Farms parent company marked a new chapter for the company. This change in ownership structure often leads to strategic adjustments aimed at enhancing operational efficiency and expanding market presence. The involvement of a private equity firm like Atlas Holdings often introduces new strategies to drive growth and improve profitability. The poultry industry is highly competitive, and these changes are crucial for maintaining a strong market position.

Foster Farms transitioned from family ownership to private equity control in 2022. Atlas Holdings now owns the company.

- Family-owned from 1939 to 2022.

- Atlas Holdings acquired the company in June 2022.

- Focus on operational improvements and strategic growth.

- Potential for future acquisitions or restructuring.

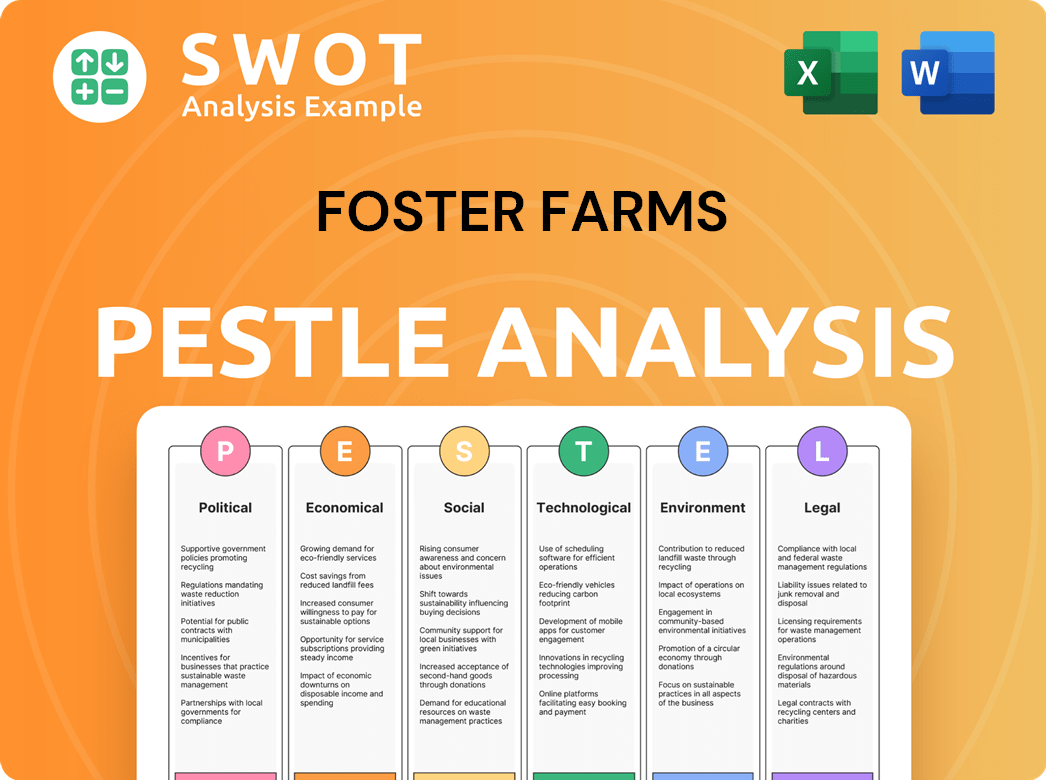

Foster Farms PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Foster Farms’s Board?

| Board Member | Title | Affiliation |

|---|---|---|

| Jayson Penn | CEO | Foster Farms |

| (Details not publicly available) | Board Members | Atlas Holdings and industry experts |

| (Details not publicly available) | Board Members | Atlas Holdings and industry experts |

Atlas Holdings acquired Foster Farms in 2022, changing the board's composition and leadership.

- Jayson Penn is the current CEO, appointed in March 2024.

- The Board of Directors is primarily influenced by Atlas Holdings and industry experts.

- Foster Farms is a privately held company, so Atlas Holdings controls the voting power.

- The company's structure enables more flexible decision-making.

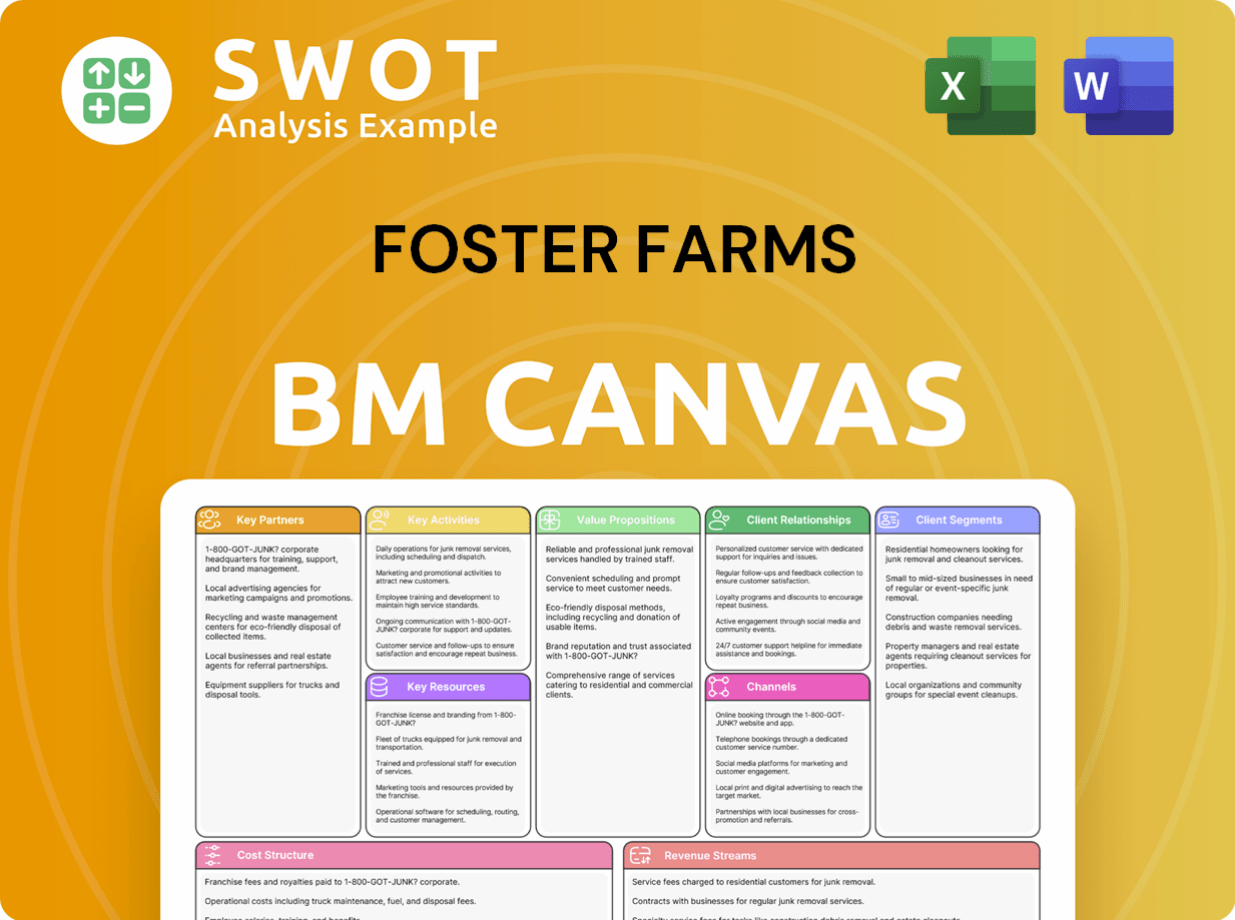

Foster Farms Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Foster Farms’s Ownership Landscape?

Foster Farms Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Foster Farms Company?

- What is Competitive Landscape of Foster Farms Company?

- What is Growth Strategy and Future Prospects of Foster Farms Company?

- How Does Foster Farms Company Work?

- What is Sales and Marketing Strategy of Foster Farms Company?

- What is Brief History of Foster Farms Company?

- What is Customer Demographics and Target Market of Foster Farms Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.