Gartner Bundle

Can Gartner Conquer the Future of Business Advisory?

Gartner, a titan in the research and advisory realm since 1979, has become indispensable for leaders navigating today's complex business landscape. From its roots in IT, Gartner has broadened its scope, offering critical insights across various functions, including finance and marketing. Its evolution reflects a strategic shift, positioning the company at the forefront of Gartner SWOT Analysis and other vital services.

This deep dive into Gartner's Gartner growth strategy and Gartner future prospects will explore how the company plans to maintain its leadership in the IT research market. We'll examine its Gartner company analysis, focusing on its strategic initiatives, revenue growth drivers, and competitive landscape. Understanding Gartner's market share Gartner and its adaptation to evolving client needs is key to grasping its long-term success in technology consulting.

How Is Gartner Expanding Its Reach?

Gartner's expansion initiatives are primarily focused on enhancing its core offerings and strategically growing its client base. The company aims for mid-to-high single-digit sales headcount growth in 2025, a deliberate strategy to enhance contract value growth. This investment in quota-carrying sales personnel is anticipated to generate significant future contract value growth, with a projected cash flow breakeven occurring within the early stages of the second year following the investment's implementation. This approach is a key part of the overall Gartner growth strategy.

The company's expansion also includes strategic investments in high-growth areas such as AI-driven consulting services. Gartner's consulting segment demonstrated strong performance in Q4 2024, with a 19% increase in revenue, reaching $153 million. This growth is further supported by successful contract optimization, exceeding expectations with $50 million in revenue. These initiatives are crucial for understanding Gartner's future prospects.

Gartner's Q1 2025 results show a 4% increase in sales headcount, contributing to a 7% year-over-year rise in global contract value. While Gartner's offerings and client mix are highly diversified, challenges such as falling U.S. federal government contracts (which represented about 4% of Gartner's total contract value) are being addressed through this diversification. The company continues to focus on prudent investments to foster future growth and remains interested in opportunistic share repurchases to maintain financial flexibility. For a deeper dive into the business model, consider reading about the Revenue Streams & Business Model of Gartner.

Gartner is investing in high-growth areas, particularly AI-driven consulting services. This strategic move aims to capitalize on the increasing demand for advanced technology solutions. The consulting segment's revenue increased by 19% in Q4 2024, reaching $153 million, demonstrating the effectiveness of these investments.

The company is targeting mid-to-high single-digit sales headcount growth in 2025. This expansion is designed to drive contract value growth, which is expected to result in significant future revenue. The investment in sales personnel is projected to reach cash flow breakeven within the first two years.

Gartner is focusing on contract optimization to enhance revenue. Successful contract optimization efforts exceeded expectations, generating $50 million in revenue. These efforts are critical to maintaining and improving financial performance.

Gartner is diversifying its offerings and client mix to mitigate risks, such as the decline in U.S. federal government contracts. The company is also focused on prudent investments to foster future growth and remains interested in opportunistic share repurchases to maintain financial flexibility. This approach is essential for a comprehensive Gartner company analysis.

Gartner's expansion strategies focus on enhancing its core offerings, strategic investments in high-growth areas, and prudent financial management. These strategies are designed to drive revenue growth and maintain a strong market position in the IT research market and technology consulting sectors.

- Investment in AI-driven consulting services to capitalize on market demand.

- Targeted sales headcount growth to enhance contract value.

- Focus on contract optimization to improve revenue generation.

- Diversification of offerings and client mix to mitigate risks.

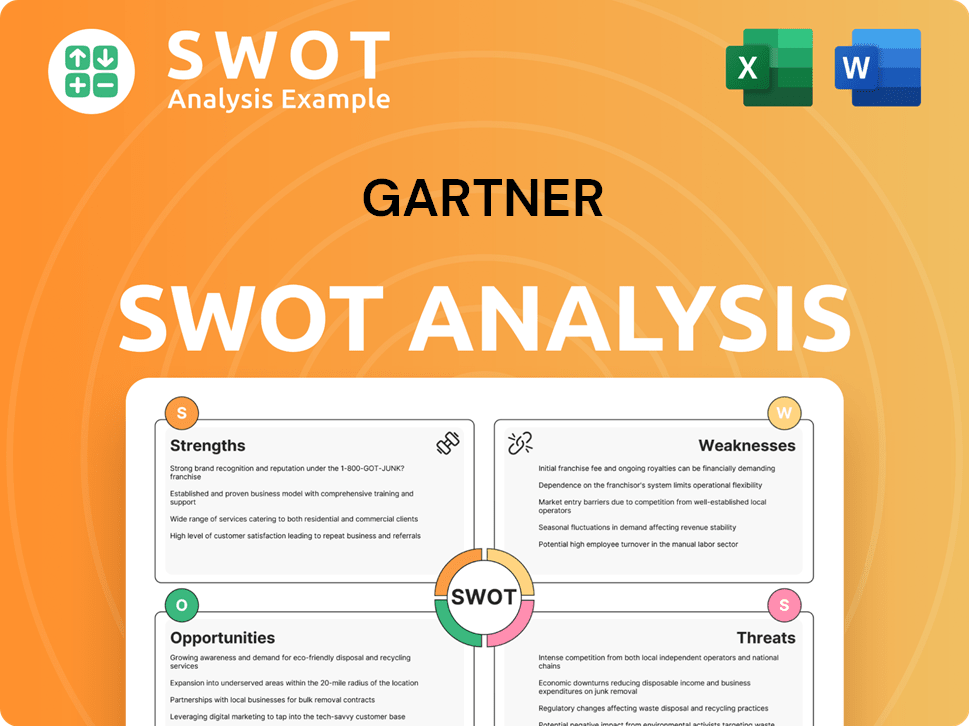

Gartner SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Gartner Invest in Innovation?

Gartner's innovation and technology strategy is centered on understanding and guiding clients through the rapidly evolving technological landscape. The company's focus on artificial intelligence (AI), digital transformation, and emerging technologies like disinformation security positions it as a critical resource for organizations navigating complex shifts. This strategic approach directly supports Gartner's growth objectives by driving demand for its research and advisory services.

The firm's strategic initiatives are heavily influenced by the pervasive impact of AI across various industries. Gartner identifies AI imperatives, new frontiers of computing, and human-machine synergy as core themes for its 2025 strategic technology trends. This foresight allows Gartner to provide valuable insights and guidance to its clients, helping them stay ahead of the curve in a competitive market.

Gartner's commitment to innovation and technology is evident in its forward-looking predictions and analysis. By providing detailed insights into emerging trends, Gartner helps its clients make informed decisions and capitalize on new opportunities. This proactive approach strengthens Gartner's market position and contributes to its long-term growth.

Gartner predicts that by 2028, at least 15% of day-to-day work decisions will be made autonomously through agentic AI. This is a significant increase from 0% in 2024, highlighting the growing influence of AI in the workplace.

Companies using AI governance platforms are projected to see a 30% higher customer trust rating and 25% better regulatory compliance scores by 2028. This showcases the importance of responsible AI practices.

Gartner forecasts that 80% of humans will engage with smart robots daily by 2030, up from 10% today. These robots are expected to perform multiple tasks and work alongside humans.

By 2028, 50% of enterprises are expected to adopt products or services to address disinformation cybersecurity use cases, a substantial rise from less than 5% in 2024. This reflects the growing concern over cybersecurity.

Gartner's role is to provide in-depth research and advisory services to help organizations navigate these technological shifts. This positions the company as a thought leader and essential guide in the IT research market.

Gartner's strategic focus on AI, digital transformation, and emerging technologies is a key driver for its revenue growth. This focus enables the company to maintain a strong market position.

Gartner's strategic initiatives are designed to capitalize on the growing demand for technology consulting and IT research. The company's ability to anticipate and analyze technology trends allows it to offer valuable insights to its client base. As the technology landscape continues to evolve, Gartner's market forecast remains positive, driven by its commitment to innovation and its strong market position.

- Gartner's focus on AI and digital transformation is a key driver of its growth strategy.

- The company's expansion plans include investments in research and advisory services.

- Gartner's competitive landscape analysis highlights its strong position in the IT research market.

- Gartner’s Mission, Vision & Core Values of Gartner guide its strategic direction and impact on the IT industry.

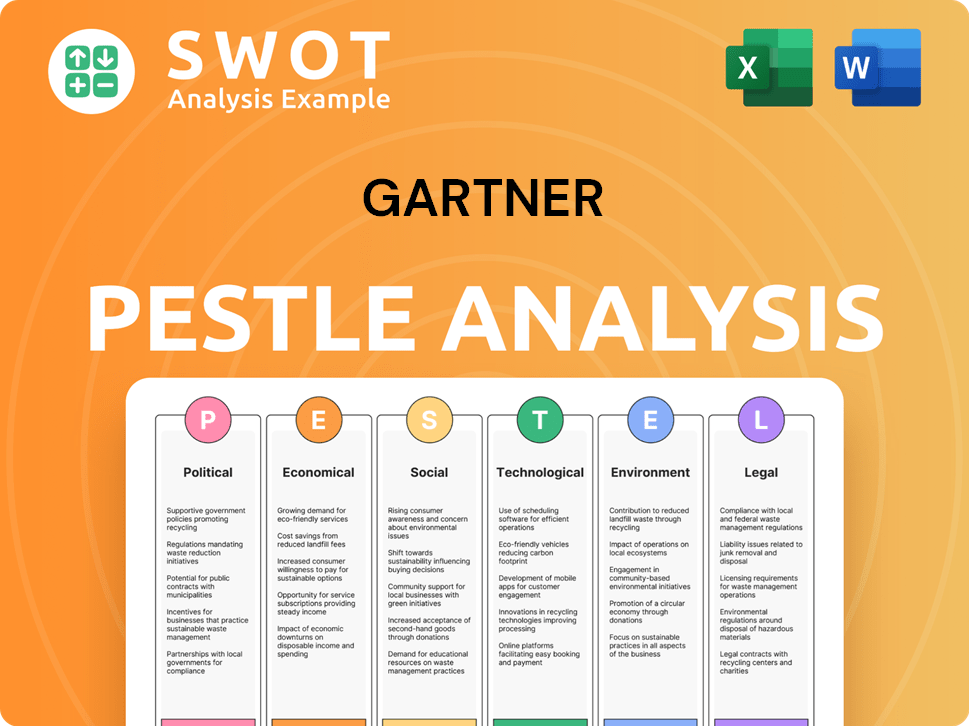

Gartner PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Gartner’s Growth Forecast?

The Gartner growth strategy for 2025 is built upon a solid foundation of financial performance in 2024. The company's strategic focus continues to be on expanding its market presence and delivering value to its clients within the IT research market and technology consulting sectors. This approach is designed to capitalize on the increasing demand for data-driven insights and expert guidance in the rapidly evolving technology landscape, ensuring sustained growth and reinforcing its market position.

Looking ahead, Gartner's future prospects appear promising, with a clear emphasis on revenue diversification and operational efficiency. The company's strategic initiatives include strengthening its research capabilities, expanding its consulting services, and exploring new market opportunities. These efforts are supported by a robust financial outlook, which includes ambitious revenue and profitability targets for 2025, indicating confidence in its ability to navigate the competitive landscape and drive long-term value for stakeholders.

Gartner's company analysis reveals a consistent track record of delivering strong financial results. The company's ability to adapt to changing market dynamics and invest in strategic growth areas has been key to its success. This includes a focus on innovation within its research methodology, expanding its client base, and leveraging its market share to maintain a competitive edge. The company's financial performance in 2024 and its projections for 2025 highlight its resilience and its potential for continued growth within the IT industry.

Gartner anticipates at least $6.535 billion in revenue for 2025, reflecting approximately 4% FX-neutral growth. This includes expected research revenue of at least $5.34 billion, conference revenue of $625 million, and consulting revenue of $575 million.

The company projects adjusted EBITDA to be at least $1.535 billion, an increase of $25 million from prior guidance. Adjusted EPS is expected to be a minimum of $11.70.

Free cash flow guidance for 2025 is set at a minimum of $1.145 billion, indicating strong financial flexibility and the ability to invest in future growth.

In 2024, Gartner reported total revenues of $6.3 billion, a 6% increase compared to 2023, and a net income of $1.3 billion. Diluted earnings per share reached $16.00, an increase from $11.08 in 2023.

The Q1 2025 earnings report further underscores Gartner's strong financial position. Revenues reached $1.5 billion, a 4.2% increase year-over-year. Adjusted EPS was $2.98, surpassing analyst estimates. Operating cash flow surged by 66% to $314 million, and free cash flow jumped by 73% to $288 million, demonstrating robust financial health. These figures, coupled with the company's consistent high single-digit growth in contract value, support its long-term revenue and profit growth.

Gartner's revenue growth is primarily driven by its research subscriptions, consulting services, and conference revenues. The company's ability to retain and expand its client base is crucial for sustained growth.

Strategic acquisitions have played a role in expanding Gartner's service offerings and market reach. These acquisitions often enhance the company's capabilities in specific technology areas.

The IT research market is expected to continue growing, supported by increasing demand for data-driven insights. Gartner is well-positioned to capitalize on this trend.

Gartner operates in a competitive market with other research and consulting firms. Its strong brand recognition and comprehensive service offerings provide a competitive advantage.

Gartner's expansion plans include geographic growth and the introduction of new services. These initiatives are designed to broaden its market presence and client base.

The company's stock performance reflects its financial health and growth prospects. Investors often use stock performance as an indicator of the company's overall success. Read more about 0.

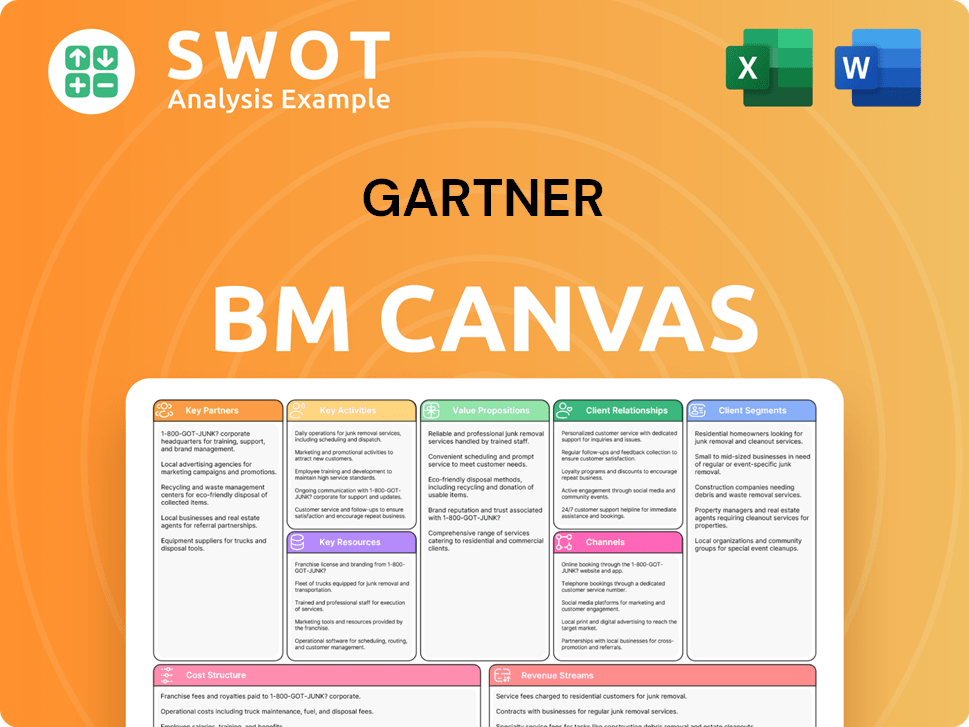

Gartner Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Gartner’s Growth?

Assessing the potential risks and obstacles is crucial for understanding the Gartner growth strategy and its future prospects. Several factors could impede the company's ability to achieve its objectives and maintain its leading position in the IT research market. These challenges range from external market pressures to internal operational constraints, all of which require careful management.

One of the most significant risks facing Gartner is the evolving regulatory and legal environment. This has moved from the third most cited risk in late 2024 to the foremost concern in early 2025. The company must navigate increasing compliance complexity and costs, particularly concerning the varied approaches to AI regulation across different regions. This, coupled with intense competition and internal resource limitations, presents a complex landscape for Gartner to navigate.

Gartner’s company analysis reveals that the competitive landscape remains a constant challenge. While the company maintains a strong market share, the dynamic nature of the technology and business advisory landscape means continuous pressure from competitors. Technological disruption, especially from rapidly evolving AI capabilities, presents both opportunities and risks. For instance, the 'trough of disillusionment' in GenAI could impact client investment patterns, affecting demand for Gartner's advisory services.

The regulatory and legal environment is now the primary risk, surpassing other concerns. Increased complexity and costs associated with compliance, especially in AI regulation, are major challenges.

Gartner faces constant pressure from competitors in the technology and business advisory space. Rapid technological advancements, particularly in AI, create both opportunities and risks.

The rapid evolution of AI capabilities poses both opportunities and risks. The 'trough of disillusionment' in GenAI could affect client investment patterns.

Internal resource constraints, such as cybersecurity burnout, pose a significant challenge. The potential loss of experienced CISOs impacts operational stability.

Non-renewals and terminations of contracts from U.S. government agencies could lead to potential revenue decline. This trend is a notable obstacle, although these contracts represent a smaller portion of overall revenue.

Client investment patterns in new technologies could be affected by the perceived value of AI capabilities, potentially impacting demand for Gartner's advisory services.

Gartner addresses these risks through diversification of its offerings and client base. It also provides guidance on risk management frameworks and scenario planning to its clients, indirectly strengthening its own resilience. This approach helps mitigate the impact of market fluctuations and regulatory changes.

Addressing internal resource constraints, such as the potential for cybersecurity burnout among CISOs, is crucial. Gartner needs robust talent retention and development programs to maintain its competitive edge and operational stability. The company can benefit from the insights provided in an article about the Marketing Strategy of Gartner.

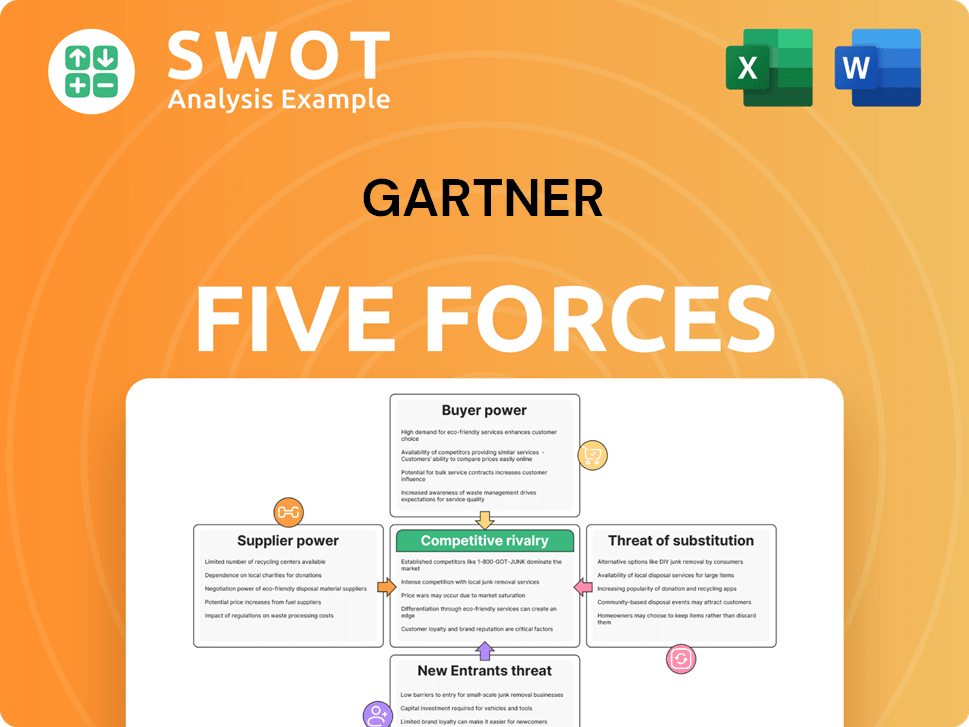

Gartner Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gartner Company?

- What is Competitive Landscape of Gartner Company?

- How Does Gartner Company Work?

- What is Sales and Marketing Strategy of Gartner Company?

- What is Brief History of Gartner Company?

- Who Owns Gartner Company?

- What is Customer Demographics and Target Market of Gartner Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.