Gartner Bundle

How Does Gartner Shape the Future of Business?

Gartner, a global powerhouse in research and advisory, is a critical resource for leaders across various industries. With revenues soaring to $6.3 billion in 2024, and a significant rise in net income, the Gartner SWOT Analysis reveals the company's strong position in the market. This financial success highlights Gartner's crucial role in guiding strategic decisions.

Gartner's influence extends to global IT spending, which is projected to reach $5.61 trillion in 2025, making it a key influencer of technology trends. Understanding the Gartner SWOT Analysis is crucial for investors and industry observers to grasp how this company operates and generates profit. Dive into the operational model of Gartner to understand its strategic frameworks and market impact, including insights into Gartner research and IT consulting.

What Are the Key Operations Driving Gartner’s Success?

The Gartner company operates through three main segments: Research, Conferences, and Consulting. Its core value lies in delivering expert insights, data-driven analysis, and actionable advice to a diverse client base. This approach helps clients make informed decisions and navigate complex market dynamics.

The Research segment is the largest, offering subscription-based access to proprietary research. Conferences provide networking and expert presentations, while Consulting offers project-based strategic advice. This integrated approach allows Gartner to provide comprehensive services tailored to its clients' needs, supporting their strategic initiatives.

The Gartner company creates value by providing deep domain expertise and objective insights. Its extensive research library and direct analyst engagement differentiate its offerings, enabling clients to make better decisions. The company's focus on disciplined execution and consistent best practices further enhances its operational effectiveness and market differentiation. For a deeper understanding of the company's origins, consider reading a brief history of Gartner.

The Research segment provides subscription-based access to proprietary research, expert insights, and data. It serves a broad range of customers, including large corporations and government agencies. In 2024, Research revenues increased by 5% to $5.1 billion.

This segment organizes industry-leading events, providing networking opportunities and expert presentations. In 2024, Gartner held 51 in-person conferences. Revenues from this segment increased by 15% to $583.2 million in 2024.

The Consulting segment offers project-based services, providing customized strategic advice and support. Consulting revenues grew by 9% to $558.5 million in 2024. Its backlog increased by 17% to $191.5 million.

Contract value, a key metric, grew by 8% on a foreign currency-neutral basis to $5.3 billion by year-end. This growth was particularly strong in manufacturing, healthcare, and the public sector.

What sets Gartner apart is its deep domain expertise and ability to translate complex information into actionable advice. The company's extensive research library and direct analyst engagement differentiate its offerings.

- Extensive data collection and rigorous analysis.

- Development of frameworks like the Hype Cycle.

- Direct engagement between analysts and clients.

- Focus on disciplined execution and best practices.

Gartner SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Gartner Make Money?

The Gartner company generates revenue through three main segments: Research, Conferences, and Consulting. This diversified approach allows for multiple income streams, contributing to the company's financial stability and growth. The structure of its revenue streams is designed to cater to various client needs within the technology and business sectors.

In fiscal year 2024, the Research segment was the largest contributor, accounting for 81.78% of total revenue, generating $5.13 billion. Conferences brought in $583.2 million, or 9.31%, and Consulting generated $558.5 million, representing 8.91% of total revenue. This demonstrates the significant role of research subscriptions in the company's overall financial performance.

For the first quarter of 2025, total revenue reached $1.8 billion, marking a 4% year-over-year increase. Research revenue in Q1 2025 was $1.32 billion, up 4% year-over-year and constituting 74% of revenue, consistent with Q1 2024. Consulting and Conference revenue also saw growth, with both increasing by 4% in Q1 2025.

The company employs various monetization strategies across its business segments. These strategies are designed to maximize revenue and cater to diverse client needs within the market analysis and IT consulting sectors.

- Research Subscriptions: Tiered pricing models offer different levels of access and engagement.

- Conferences: Revenue is generated through attendee fees, sponsorships, and exhibitor participation.

- Consulting Services: Project-based fees are charged for customized engagements.

- Contract Value: The company's contract value, a key indicator for its subscription-based Research business, grew 8% on a foreign currency neutral basis to $5.3 billion at the end of 2024.

Gartner PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Gartner’s Business Model?

The evolution of the Gartner company has been marked by significant milestones that have shaped its operations and financial performance. A key aspect of its strategy involves continuous investment in its core research capabilities and expanding its global sales force. This strategic move aims to capture a large untapped market opportunity.

The company has demonstrated resilience in navigating market challenges, such as a volatile and uncertain global environment. Despite these conditions, Gartner delivered strong financial results in 2024, with revenues of $6.3 billion and adjusted EBITDA of $1.6 billion, both growing 6% year-over-year. Net income significantly increased by 42% to $1.3 billion in 2024, partly boosted by a $300 million gain from the settlement of event cancellation insurance claims.

Gartner's competitive advantages are rooted in its strong brand strength, deep expertise, and the highly valuable and objective insights it provides. Its subscription-based Research business provides a stable and recurring revenue base. The company is also actively leveraging artificial intelligence internally, building prototypes that associates use to match its vast library of insights to client situations, thereby enhancing productivity and client service. Gartner's commitment to returning capital to shareholders is evident through its share repurchase program, having bought approximately $735 million in stock in 2024 and over $4 billion in the past four years. The company continues to adapt to new trends, such as the rise of Agentic AI, AI governance platforms, and disinformation security, which Gartner has identified among its top strategic technology trends for 2025.

Gartner's journey includes consistent growth, marked by strategic acquisitions and expansions. These moves have broadened its service offerings and global reach, solidifying its position in the market analysis sector. The company's ability to adapt to changing market dynamics has been crucial to its success.

Gartner's strategic moves focus on enhancing its research capabilities and expanding its global sales force. In 2024, the company increased its Global Technology Sales (GTS) quota-bearing headcount mid-single digits and Global Business Sales (GBS) quota-bearing headcount high single digits. These actions aim to capture a larger share of the market.

Gartner's competitive edge stems from its strong brand, deep expertise, and valuable insights. Its subscription-based research model provides a stable revenue base. The company actively leverages AI internally to enhance productivity and client service, ensuring its continued relevance in the IT consulting landscape.

In 2024, Gartner reported revenues of $6.3 billion and adjusted EBITDA of $1.6 billion, both growing 6% year-over-year. Net income increased by 42% to $1.3 billion, partly due to a $300 million gain. The company's share repurchase program reflects its commitment to returning capital to shareholders, with approximately $735 million in stock bought in 2024.

Gartner's key focus areas include continuous investment in research and expanding its sales force. The company is also adapting to technology trends such as Agentic AI and AI governance platforms. For more insights, you can explore the Marketing Strategy of Gartner.

- Emphasis on AI and automation to improve efficiency and client service.

- Focus on emerging technologies and their impact on business decisions.

- Continued expansion of global operations and market reach.

- Strategic investments in research and development to maintain a competitive edge.

Gartner Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Gartner Positioning Itself for Continued Success?

As of June 30, 2024, the firm, a leading global research and advisory company, held a market value of $33.6 billion. It offers objective insights to executives across various functions. The company's diversified client base and service offerings contribute to its resilience in the market, despite potential challenges.

The loss of contracts with the U.S. federal government in Q1 2025, representing approximately 4% of the total contract value, is a notable factor. The firm's ability to adapt to these shifts and maintain its market position is crucial for its continued success in the IT consulting and market analysis sectors.

Regulatory changes, the emergence of new competitors, and rapid technological disruption, especially in AI, pose risks. The 'trough of disillusionment' for Generative AI, due to high failure rates in initial proof-of-concept work, could impact client investment decisions and, consequently, the company's advisory services. This could affect the company's future technology predictions.

The company is focused on sustaining and expanding its revenue through strategic initiatives and innovation. It plans to accelerate hiring to drive long-term, sustained, double-digit growth. The company's strategic focus on AI imperatives, new computing frontiers, and human-machine synergy positions it to adapt to evolving market dynamics.

For 2025, the company projects total consolidated revenue of at least $6.535 billion. Research revenue is expected to reach at least $5.34 billion, conference revenue at least $625 million, and consulting revenue at least $575 million. The firm is investing heavily in AI to enhance its ability to match insights to client needs. Learn more about the Growth Strategy of Gartner.

Worldwide IT spending is projected to reach $5.61 trillion in 2025, with significant growth in data center systems, devices, and software. The company's reports provide key insights into technology trends. The company's role in IT is vital for business decisions.

The company's key focus areas include AI imperatives, new computing frontiers, and human-machine synergy. The company provides market share analysis and technology vendor evaluations. The company's consulting services overview is a valuable tool for businesses.

- Gartner's Magic Quadrant explained.

- How the company ranks vendors.

- Gartner's competitive landscape reports.

- Gartner's research methodology.

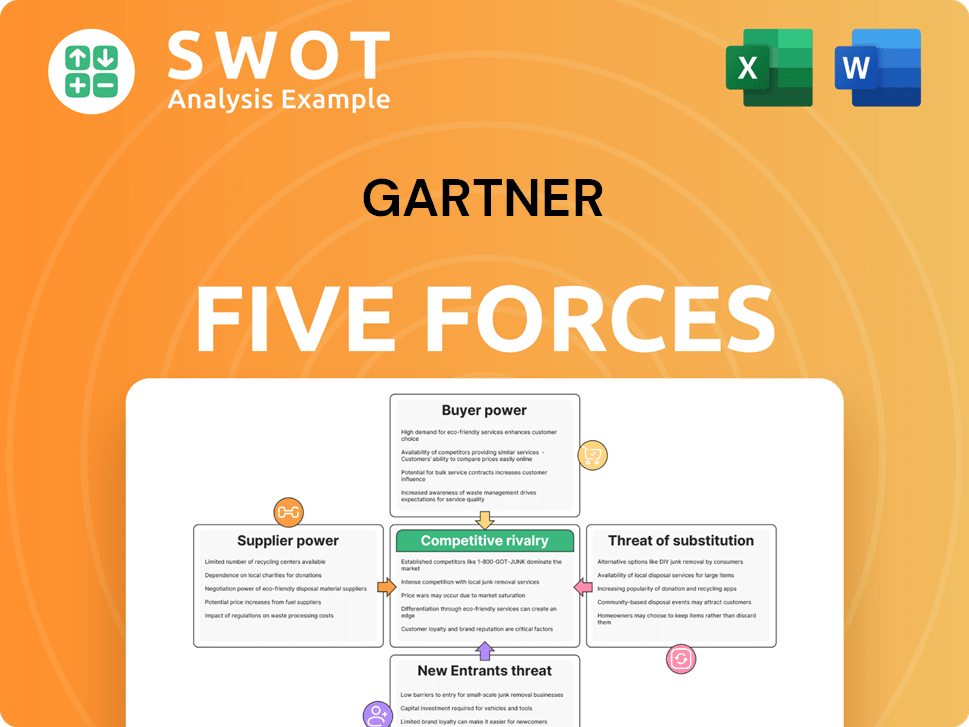

Gartner Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gartner Company?

- What is Competitive Landscape of Gartner Company?

- What is Growth Strategy and Future Prospects of Gartner Company?

- What is Sales and Marketing Strategy of Gartner Company?

- What is Brief History of Gartner Company?

- Who Owns Gartner Company?

- What is Customer Demographics and Target Market of Gartner Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.