Hennes & Mauritz Bundle

Can H&M Reclaim Its Fashion Throne?

Hennes & Mauritz (H&M), a global fashion icon since 1947, has consistently redefined accessible style. From its humble beginnings in Sweden, H&M has grown into a retail behemoth, adapting to the ever-changing demands of the fashion retail market. This exploration dives into H&M's current strategic direction, examining its path toward sustainable and profitable growth.

The fashion industry faces constant evolution, and H&M's Hennes & Mauritz SWOT Analysis provides a crucial overview of its position. This analysis will reveal how H&M's growth strategy is evolving to meet the challenges of the fast fashion industry. We'll explore H&M's prospects, including its sustainability initiatives and digital transformation strategy, to understand its future in a competitive landscape, including H&M expansion plans in Asia.

How Is Hennes & Mauritz Expanding Its Reach?

The H&M Group is actively pursuing an expansion strategy, focusing on optimizing its existing store portfolio while strategically entering new markets and enhancing its digital footprint. This approach aims to strengthen its position in the fashion retail market. The company's plans for growth are multifaceted, encompassing both physical and digital channels to provide a seamless customer experience.

This strategic direction includes a focus on sustainable fashion H&M initiatives and adapting to e-commerce. The group is investing in refurbishments and expanding its presence in key emerging markets. The company is also scaling its circular fashion initiatives, reflecting a commitment to extend product lifecycles and meet growing consumer demand.

In 2025, H&M plans to open approximately 80 new stores. Simultaneously, the company will close around 190 stores, primarily in established markets. This reflects an ongoing effort to optimize the store portfolio and adapt to changing consumer behavior. The company's expansion plans in Asia and other emerging markets are a key part of its growth strategy.

H&M is expanding its presence in key emerging markets. The first H&M store in Brazil is slated to open in São Paulo towards the end of 2025, with plans for nationwide stores within three years. Additionally, H&M is set to debut in El Salvador in 2025. Paraguay will become a new H&M market with its first store opening in 2026.

Beyond the core H&M brand, its portfolio brands are also expanding. For instance, COS opened on the SSF marketplace in South Korea in the first quarter of 2025, and ARKET is planned to launch its first Greek physical store in Athens in 2025. This diversification supports the overall Hennes & Mauritz future prospects.

H&M continues to scale its circular fashion initiatives. By 2024, pre-owned offerings were available in 26 markets through both physical retail and digital channels. This includes 38 H&M Group stores and Sellpy, the group's dedicated resale platform. This aligns with the company's commitment to extend product lifecycles.

These expansion initiatives are part of H&M's broader strategy to adapt to the evolving fashion retail market. The company's approach includes a focus on digital transformation strategy and ethical sourcing practices, which are essential for maintaining its competitive landscape. For more insights into the target market, consider reading about the Target Market of Hennes & Mauritz.

H&M's expansion strategy involves a balance of new store openings and strategic closures. The company is investing in both physical and digital channels to enhance the customer experience. Sustainable fashion initiatives are a core component of H&M’s strategy.

- Approximately 80 new store openings planned for 2025.

- Around 190 store closures, primarily in established markets.

- Expansion into new markets like Brazil, El Salvador, and Paraguay.

- Continued scaling of circular fashion initiatives in 26 markets.

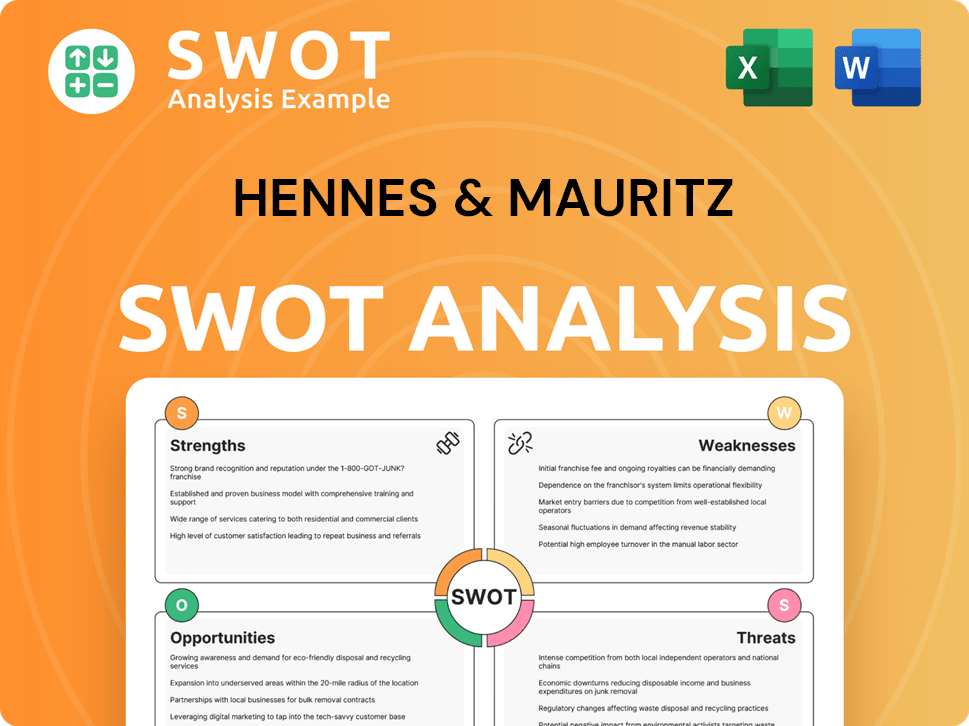

Hennes & Mauritz SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hennes & Mauritz Invest in Innovation?

The H&M Group is heavily investing in innovation and technology to drive its growth, focusing on digital transformation and sustainability. This strategy includes substantial investments in artificial intelligence (AI), big data, and cloud technologies to enhance supply chain efficiency and personalize customer experiences. This approach is crucial for navigating the fast-evolving fashion retail market.

A hybrid organizational structure, combining product teams with platform thinking, is enabling faster decision-making. This structure allows for greater agility and responsiveness to market trends. H&M's digital transformation strategy is designed to improve operational efficiency and customer engagement, which is vital for maintaining its competitive edge.

The company's commitment to sustainability is also a key driver, with significant investments in technologies that support environmental goals. These initiatives are crucial for the future of the fast fashion industry and aligning with consumer preferences for ethical and sustainable practices.

AI is used to predict demand, reducing overproduction risks. This helps H&M manage inventory more efficiently. This is a key aspect of the H&M growth strategy.

AI digital twins are used to create models for product campaigns. These models enhance marketing and social media efforts without logistical challenges. This innovation supports H&M's brand positioning strategy.

Machine learning algorithms curate collections aligned with regional preferences. These algorithms also increase order values through features like size recommendations. This is part of H&M's customer loyalty programs.

A team of over 200 data scientists works on AI algorithms. These algorithms are crucial for personalization and operational efficiency. This team supports H&M's digital transformation strategy.

Blockchain technology tracks 78% of raw materials. This enhances transparency and supports ethical sourcing practices. This is a key element of H&M's sustainability initiatives.

H&M aims for 100% sustainable or recycled materials by 2030. In 2024, 89% of materials were sustainable or recycled. The company almost reached its 30% recycled content goal for 2025 a year ahead of schedule, reaching 29.5%.

H&M is committed to sustainability, using technology to reduce its environmental impact. The company is also investing in renewable energy. This approach is important for Hennes & Mauritz future.

- 96% of electricity came from renewable sources in 2024.

- Target is to reach 100% renewable electricity by 2030.

- 'Looop' recycling system diverted 1,200 tonnes of textiles from landfills in 2024.

- AI optimizes logistics to reduce carbon emissions.

For a more in-depth look at how H&M approaches its marketing efforts, consider exploring the Marketing Strategy of Hennes & Mauritz.

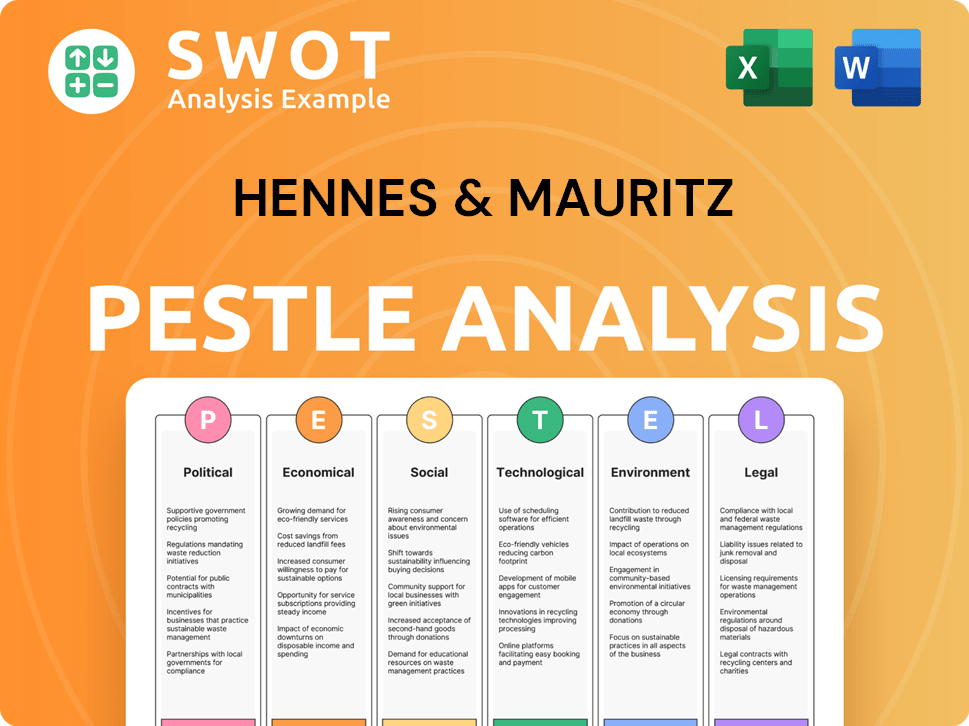

Hennes & Mauritz PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hennes & Mauritz’s Growth Forecast?

The financial outlook for H&M Group reveals a mixed performance with a focus on strengthening profitability and cost control. The company navigates ongoing investments while adapting to evolving market dynamics. This financial overview provides insights into H&M's recent performance and future prospects within the fashion retail market.

For the fiscal year ending November 30, 2024, H&M Group reported net sales of SEK 234,478 million, reflecting a 1% increase in local currencies. Gross profit increased by 4% to SEK 125,299 million, resulting in a gross margin of 53.4%. Operating profit for the full year rose to SEK 17,306 million, corresponding to an operating margin of 7.4%.

Looking ahead, H&M's Competitors Landscape of Hennes & Mauritz and its growth strategy are crucial. The company aims for at least 10% annual sales growth and an operating margin exceeding 10%. Capital expenditure for 2025 is planned at SEK 11-12 billion, primarily for store upgrades and supply chain enhancements. H&M's financial performance review indicates a strong emphasis on long-term growth and strategic investments.

Net sales reached SEK 234,478 million, with a 1% increase in local currencies. Gross profit rose by 4% to SEK 125,299 million. The operating margin was 7.4%.

Net sales increased by 2% in local currencies, totaling SEK 55,333 million. Operating profit decreased by 42% to SEK 1.2 billion. The gross margin was 49.1%.

H&M targets at least 10% annual sales growth. The company aims for an operating margin exceeding 10%. These goals reflect the company's commitment to sustainable fashion H&M and long-term value creation.

Capital expenditure for 2025 is planned at SEK 11-12 billion. Investments will focus on store portfolio upgrades and supply chain enhancements. This strategy supports H&M's expansion plans in Asia and other key markets.

H&M's liquidity remains robust, with cash and cash equivalents totaling SEK 20.82 billion as of February 29, 2024. This strong financial position supports the company's strategic initiatives and investments in its business model.

- Strong cash reserves.

- Supports strategic investments.

- Ensures financial stability.

- Facilitates H&M's digital transformation strategy.

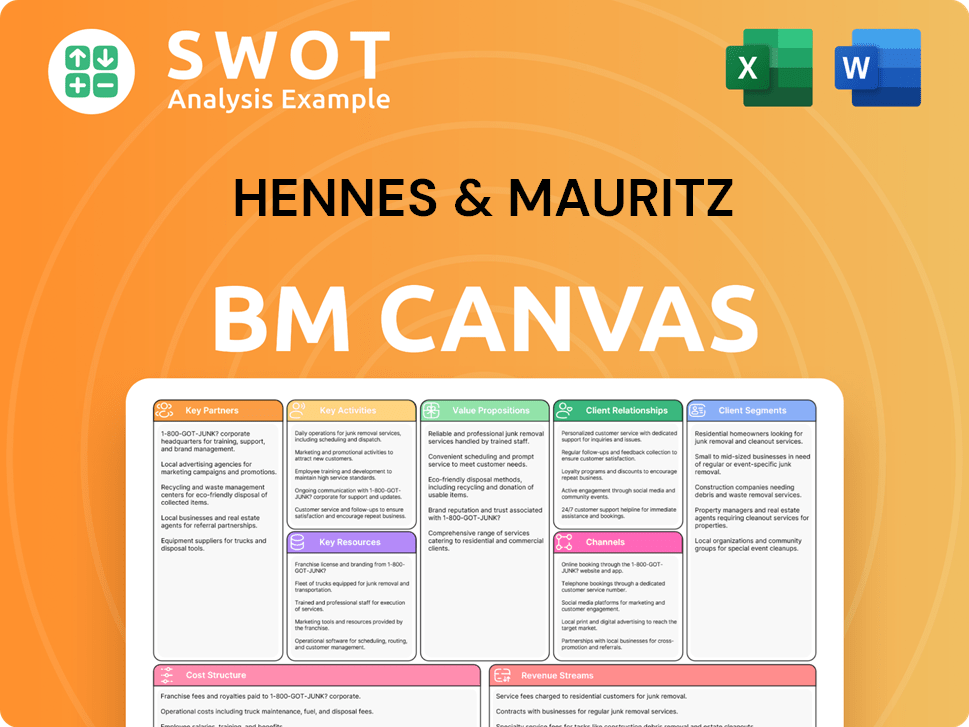

Hennes & Mauritz Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hennes & Mauritz’s Growth?

The success of H&M's H&M growth strategy faces several hurdles in the fast-paced fashion retail market. The company must navigate intense competition and evolving consumer preferences to sustain its Hennes & Mauritz future. External factors like economic shifts and supply chain disruptions further complicate its path, impacting its H&M prospects.

A key challenge for H&M is staying ahead in the competitive fashion industry. The rise of online retailers and the need to adapt quickly to changing trends require constant innovation. The company's ability to manage these risks will be crucial for its long-term performance.

One of the most significant risks is the intense competition from both traditional rivals and emerging online retailers. Additionally, external factors like high inflation and weaker consumer demand have impacted H&M's profitability, leading to increased markdowns and affecting gross margins. In Q1 2025, H&M's operating profit decreased by 42%, partly due to these external factors.

H&M faces significant competition from both established players and fast-growing online retailers. This pressure impacts pricing and profitability. Adapting to these competitive dynamics is essential for maintaining market share.

H&M's global supply chain is susceptible to disruptions, including ethical sourcing issues and extended transport times. These challenges can affect inventory levels and product availability. The company is working to increase flexibility.

Consumer tastes and fashion trends shift rapidly, requiring H&M to be agile in its offerings. This includes investing in increased trend responsiveness and improved relevance. The company focuses on adapting to evolving demands.

Geopolitical uncertainties and currency fluctuations can affect financial performance. H&M’s diversified supply chain aims to mitigate these external impacts. Economic shifts and consumer sentiment also play a role.

Efficient inventory management is crucial to minimize markdowns and optimize profitability. Extended transport times, such as those associated with the situation in the Red Sea, can impact inventory levels. The company is actively working to accelerate improvements in its supply chain.

Increasing consumer demand for sustainable fashion H&M and ethical practices poses a challenge. H&M must continue to improve its H&M ethical sourcing practices and sustainability initiatives to meet these expectations. This is vital for brand reputation.

The company's need to adapt to changing consumer preferences and rapid shifts in fashion trends also presents a continuous obstacle. H&M must remain agile and adapt its product offerings to meet evolving demands. This is a core focus of its new leadership under CEO Daniel Ervér. For more insights, you can read the Brief History of Hennes & Mauritz.

H&M competes with both established brands and fast-fashion online retailers. This requires constant innovation and adaptation. Intense competition impacts pricing and market share, influencing the Hennes & Mauritz market share analysis.

The global supply chain is vulnerable to disruptions, including extended transport times and ethical sourcing issues. H&M is working to increase flexibility and improve inventory management. This impacts product availability and costs.

Evolving consumer preferences and rapid shifts in fashion trends are key challenges. H&M needs to be agile and adapt its offerings. The company is investing in trend responsiveness and enhancing its brand relevance.

Geopolitical uncertainties and currency movements can affect financial performance. H&M's diversified supply chain aims to mitigate these impacts. Economic conditions and consumer sentiment also play a significant role in the H&M's financial performance review.

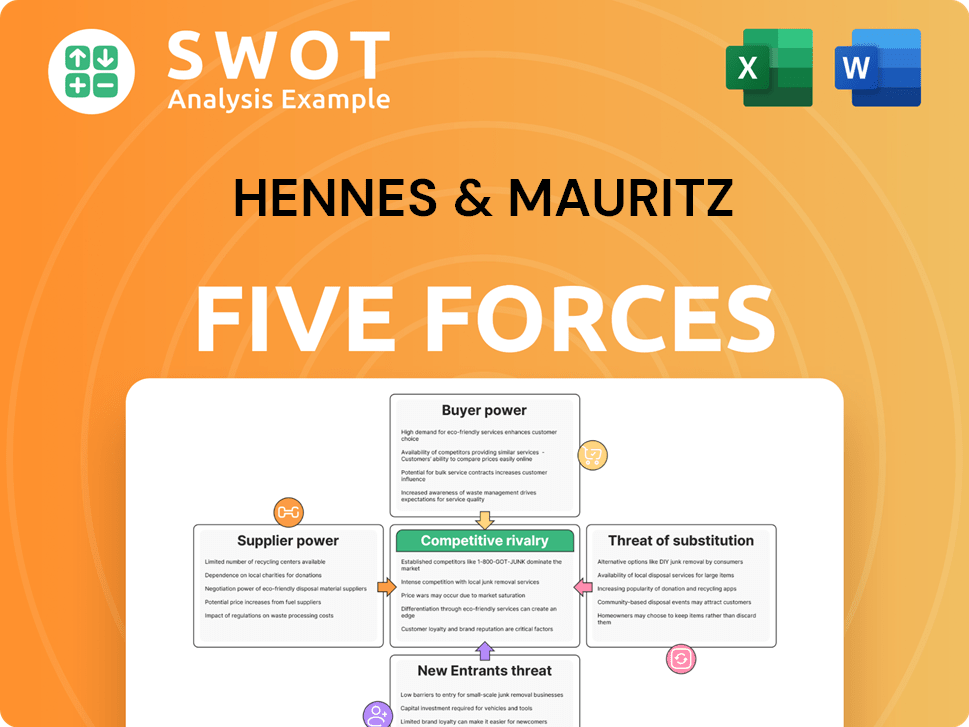

Hennes & Mauritz Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hennes & Mauritz Company?

- What is Competitive Landscape of Hennes & Mauritz Company?

- How Does Hennes & Mauritz Company Work?

- What is Sales and Marketing Strategy of Hennes & Mauritz Company?

- What is Brief History of Hennes & Mauritz Company?

- Who Owns Hennes & Mauritz Company?

- What is Customer Demographics and Target Market of Hennes & Mauritz Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.