Invacare Bundle

Can Invacare Reclaim Its Market Leadership?

Invacare's strategic landscape is undergoing a significant transformation. Following the November 2024 acquisition of its North American business by MIGA Holdings LLC, the company is poised for a new era of growth. Founded in 1885 with a mission to 'Make Life's Experiences Possible,' Invacare is refocusing its efforts. As of May 2025, with a $5 billion annual revenue, the company is set to redefine its Invacare SWOT Analysis.

This strategic realignment is crucial for understanding Invacare's future prospects within the evolving medical device market. The company's ability to navigate healthcare industry trends, particularly in the wheelchair market and related mobility solutions, will be key. This analysis delves into Invacare's growth strategy, examining strategic initiatives, financial performance, and competitive landscape to provide actionable insights for investors and stakeholders alike, considering the impact of an aging population and the challenges and opportunities ahead.

How Is Invacare Expanding Its Reach?

The expansion strategy of the company is primarily focused on operational optimization and accelerating growth in key regions. A significant move in November 2024 was the acquisition of the company's North American business by MIGA Holdings LLC. This strategic shift aims to streamline core operations, allowing each regional business to concentrate on specific customer needs. This is expected to benefit both the North American and European/Asia Pacific divisions.

Product expansion and innovation remain central to the company's growth strategy. The company continuously introduces new products to meet evolving market demands. The company's commitment to global initiatives, such as 'Move for Mobility,' further demonstrates its dedication to expanding access to mobility solutions worldwide.

The company's growth strategy is multifaceted, encompassing strategic acquisitions, product innovation, and global initiatives. These efforts are designed to strengthen its market position and capitalize on opportunities within the medical device market. The company's focus on innovation and strategic partnerships positions it to address the evolving needs of its customers and stakeholders effectively.

The company consistently introduces new products to meet market demands. In May 2024, the company launched the Alber e-motion DuoDrive power-assist system for manual wheelchairs, enhancing flexibility and independence for users. In June 2024, the company introduced the Essentials™ Mattress, a cost-effective sleep solution for various care environments, demonstrating its focus on innovation and customer needs.

The acquisition of the company's North American business by MIGA Holdings LLC in November 2024 is a key strategic move. This allows the company to focus on core operations and regional market needs. The 'Move for Mobility' campaign, which raised over $28,000 in 2024, providing 294 wheelchairs, highlights the company's commitment to global partnerships.

The company actively participates in global fundraising initiatives like 'Move for Mobility'. The 2025 campaign, launched in May, aims to provide wheelchairs to individuals in remote communities worldwide. This initiative is crucial for expanding access to mobility solutions globally through strategic partnerships.

The company's strategic initiatives are designed to strengthen its market position within the medical device market. The company's focus on innovation and strategic partnerships helps address the evolving needs of its customers and stakeholders. For more insights, consider exploring the Competitors Landscape of Invacare.

The company's expansion strategy is centered on product innovation, strategic acquisitions, and global outreach. These initiatives are designed to enhance its market presence and address the evolving needs of its customers. The company's focus on innovation and strategic partnerships is key to its growth.

- Product Development: Continuous introduction of new products like the Alber e-motion DuoDrive and Essentials™ Mattress.

- Strategic Acquisitions: The North American business acquisition by MIGA Holdings LLC.

- Global Initiatives: Participation in campaigns like 'Move for Mobility' to provide wheelchairs worldwide.

- Market Expansion: Focusing on key regions and customer needs to drive growth.

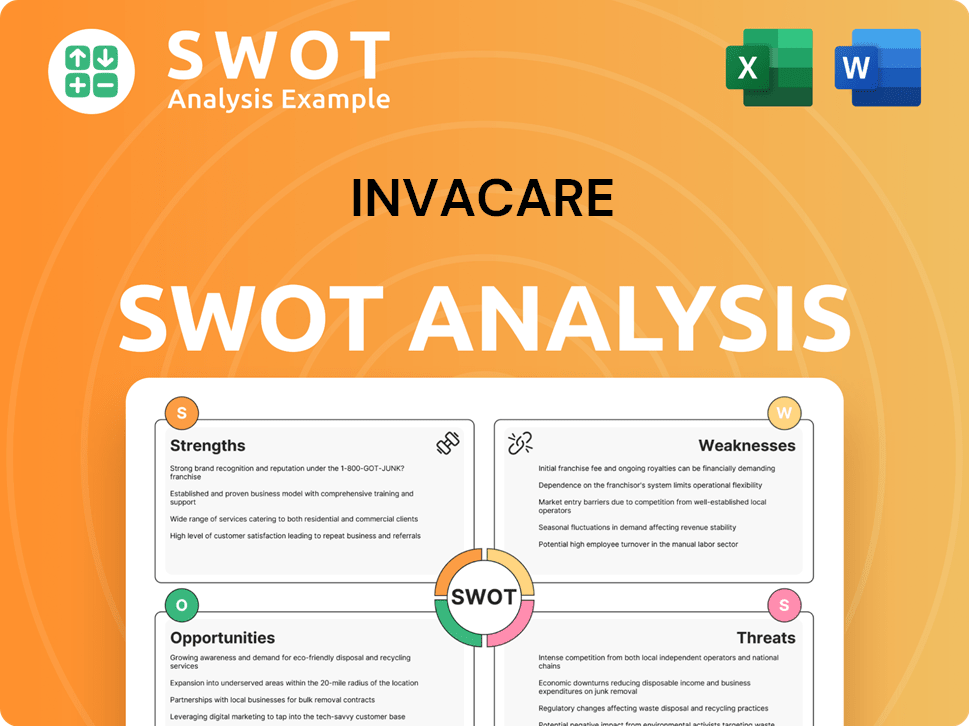

Invacare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Invacare Invest in Innovation?

The company's approach to innovation and technology is a key driver of its sustained growth. This involves a focus on new product development and strategic collaborations within the medical device market. Their commitment to these areas is evident in their recent product launches and industry participation.

The company actively showcases its latest advancements at industry events such as Rehacare International. This platform allows them to present new technologies and designs in home healthcare, power, and manual mobility solutions. These efforts are crucial for maintaining a competitive edge and meeting evolving customer needs.

The company's commitment to innovation is further demonstrated through the launch of the Alber e-motion DuoDrive power-assist system in April 2024. This device redefines the mobility experience for wheelchair users globally.

In September 2024, they presented new technologies at Rehacare International. This included previews of the Matrx MAC seating and positioning range. These showcases highlight the company's focus on innovation within the wheelchair market.

The Matrx MAC back won the Mobility Product Award for 2024. This recognition underscores the company's success in developing innovative and effective products. This highlights the company's impact on the healthcare industry trends.

In April 2024, the Alber e-motion DuoDrive power-assist system was launched. This product is designed to improve the mobility experience for wheelchair users globally. The launch of the new Robin EVO ceiling hoist in March 2025 further demonstrates the company's commitment to innovation.

The company's strategic initiatives include a focus on environmental responsibility. They announced ISO 14001 Environmental certification in March 2024. This certification reflects the company's commitment to sustainability.

The company's innovation strategy includes new product development and strategic collaborations. Recent launches and industry showcases highlight their commitment to these areas. For more insight into the company's business model, consider reading Revenue Streams & Business Model of Invacare.

- Rehacare International Participation: Showcasing new technologies and designs in home healthcare, power, and manual mobility.

- Matrx MAC Back: Winner of the Mobility Product Award for 2024.

- Alber e-motion DuoDrive: Launched in April 2024, designed to redefine the mobility experience.

- Robin EVO Ceiling Hoist: Launch in March 2025, meeting evolving needs in care environments.

- Environmental Certification: ISO 14001 Environmental certification announced in March 2024, emphasizing sustainability.

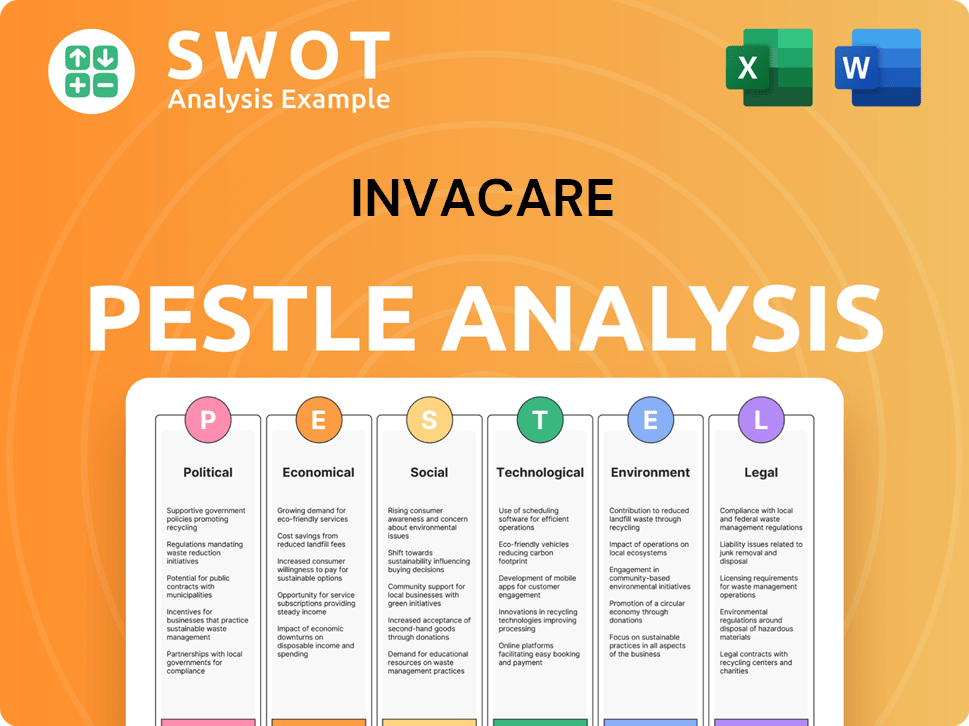

Invacare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Invacare’s Growth Forecast?

The financial outlook for Invacare in 2024 and 2025 reveals a mixed picture of challenges and opportunities. Despite facing headwinds, the company is projected to experience revenue growth. Understanding the financial projections and strategic initiatives is crucial for assessing the company's future prospects.

Analysts' forecasts provide insight into the expected financial performance. For the first quarter of 2024, Oppenheimer projected an earnings per share (EPS) of ($0.39). The consensus estimate for the full year 2024 is an EPS of ($2.76). Looking ahead to fiscal year 2025, Oppenheimer estimates an EPS of ($1.12).

Invacare's recent financial performance and strategic actions are key to understanding its current position. The company reported revenue of $170.41 million for a recent quarter, which was below analysts' expectations. However, Invacare's annual revenue reached $5 billion as of May 2025. The company's financial restructuring in 2023, which included a $75 million rights offering and securing new financing, aimed to recapitalize its balance sheet and support long-term growth. This restructuring is a critical part of the Invacare target market analysis.

Invacare's sales are projected to reach $904.43 million in 2025.

This represents a 19.48% increase from the $756.97 million recorded in the previous year.

The global electric wheelchair market is a significant segment for Invacare. It is expected to grow from an estimated $2.74 billion in 2025 to $5.54 billion by 2032.

This market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 10.6% between 2025 and 2032.

This growth is driven by technological advancements and an increasing focus on accessibility.

Invacare's strategic initiatives include financial restructuring and a focus on key market segments like electric wheelchairs.

Analyzing Invacare's financial performance involves monitoring revenue, earnings per share, and the impact of restructuring efforts.

Understanding Invacare's market share in key regions, such as North America, is crucial for evaluating its competitive position.

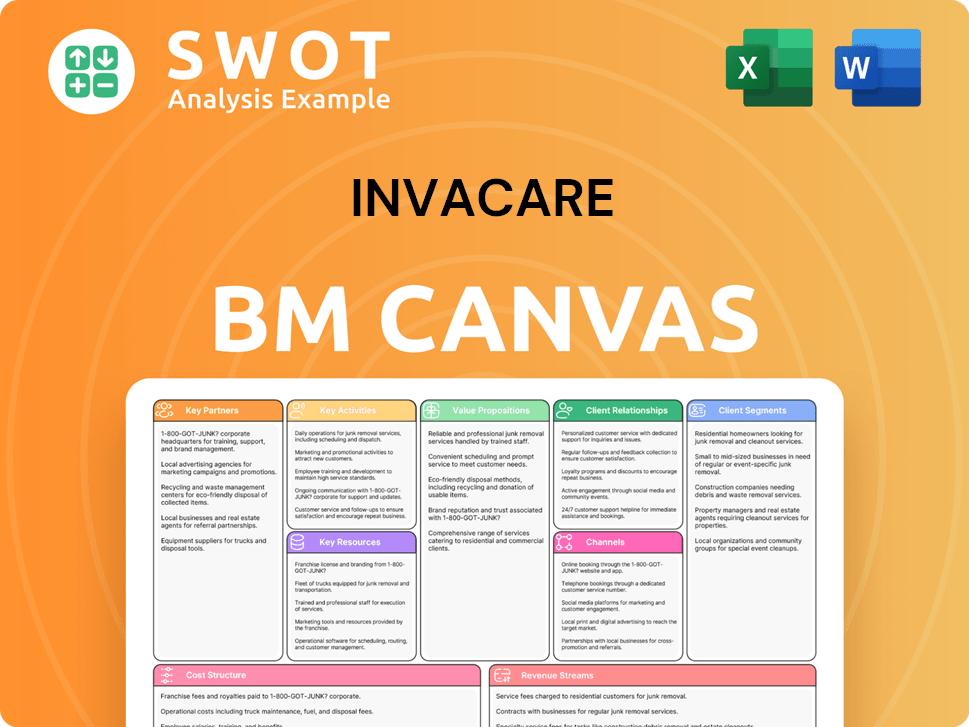

Invacare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Invacare’s Growth?

The path forward for the company, and its Invacare growth strategy, is fraught with potential risks and obstacles. These challenges include intense competition within the medical device market and the need to navigate evolving regulatory landscapes. Furthermore, the company must address ongoing supply chain vulnerabilities and financial restructuring efforts to secure its Invacare future prospects.

The medical equipment sector is highly competitive, with numerous players vying for market share. This competitive environment, combined with the rise of e-commerce, puts pressure on pricing and distribution strategies. Regulatory compliance, particularly concerning medical devices, adds another layer of complexity, requiring continuous adaptation and investment.

Supply chain disruptions and financial challenges have also significantly impacted the company. The company’s ability to execute its strategic initiatives and achieve sustainable growth depends on successfully mitigating these risks and adapting to the dynamic healthcare industry trends.

The wheelchair market and broader medical device market are fiercely competitive, featuring established companies like Sunrise Medical, and Pride Mobility Products Corp. The presence of numerous competitors necessitates continuous innovation and strategic market positioning. The rise of online retailers also challenges traditional distribution models.

Evolving regulations, such as the Medical Device Regulation (MDR) in Europe, demand constant monitoring and compliance. The UK's new legislation, expected to go into force in 2025, will align more closely with EU MDR/IVDR. Compliance with requirements like unique device identifiers (UDI) and strengthened quality management systems is critical for market access and product safety.

Supply chain disruptions, exacerbated by the COVID-19 pandemic, have caused delays and increased costs. Managing these vulnerabilities is crucial for maintaining production efficiency and meeting customer demand. Diversifying suppliers and improving supply chain resilience are key strategies.

The company faced financial challenges, including a voluntary prearranged Chapter 11 case in 2023 to strengthen its financial position. Restructuring efforts, including reducing net debt by approximately 65%, are essential for long-term financial stability. The ability to retain key personnel is also a risk during these periods.

The growth of e-commerce presents both opportunities and challenges. Online retailers can offer competitive pricing, but also disrupt traditional distribution channels. The company must adapt its sales and marketing strategies to compete effectively in the digital marketplace and ensure its Invacare market share in North America.

Retaining experienced senior management and key personnel during periods of restructuring is critical. Their expertise is vital for navigating challenges and implementing strategic initiatives. The departure of key employees could hinder the company's ability to execute its plans and achieve its growth objectives. Read more about the company in Brief History of Invacare.

The company's Invacare strategic initiatives 2024 are focused on restructuring, cost reduction, and operational improvements. These efforts aim to enhance financial performance and competitiveness. The company's financial performance analysis will reveal the effectiveness of these strategies in improving profitability and cash flow. The company's revenue growth drivers will be closely monitored to assess the success of these initiatives.

Understanding the Invacare competitive landscape analysis is crucial for developing effective strategies. The company faces competition from both established players and emerging online retailers. The impact of the aging population and the increasing demand for mobility solutions will influence the healthcare industry trends. The company's ability to adapt to these changing market dynamics will be key to its success.

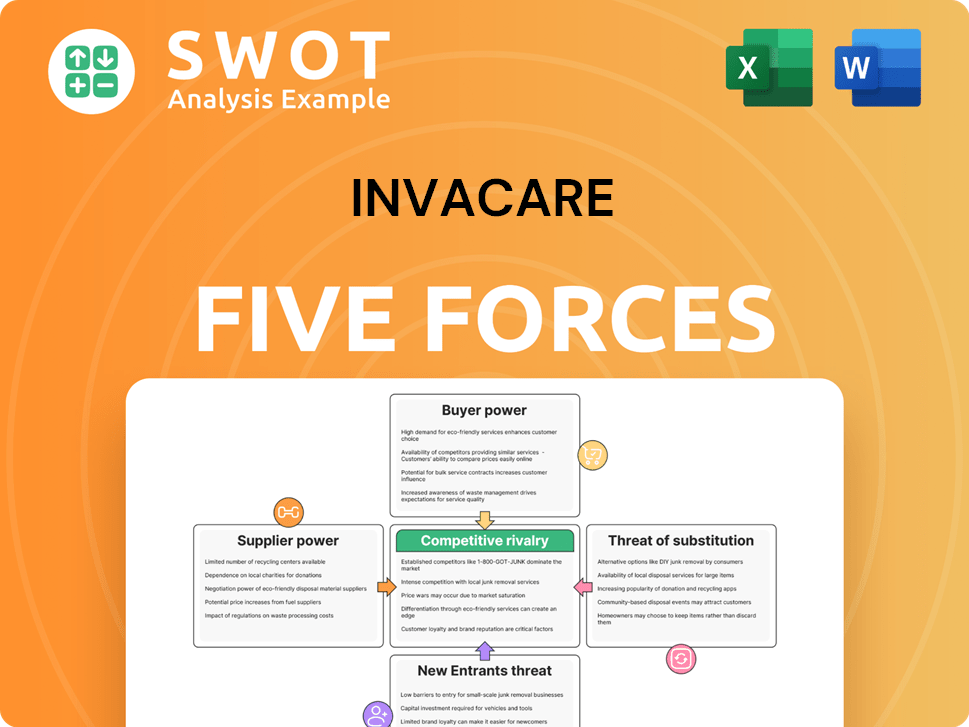

Invacare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Invacare Company?

- What is Competitive Landscape of Invacare Company?

- How Does Invacare Company Work?

- What is Sales and Marketing Strategy of Invacare Company?

- What is Brief History of Invacare Company?

- Who Owns Invacare Company?

- What is Customer Demographics and Target Market of Invacare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.