Konica Minolta Bundle

Can Konica Minolta's Growth Strategy Propel It to New Heights?

Konica Minolta, a technology pioneer with a rich history, has consistently reinvented itself since its inception in 1873. From its origins in photography to its current status as a global provider of digital solutions, the Konica Minolta SWOT Analysis reveals the company's adaptability. With a market capitalization of $1.94 billion as of February 2025, understanding its growth trajectory is crucial for investors and strategists alike.

This exploration of the Konica Minolta Company will dissect its strategic initiatives and future prospects within the dynamic technology sector. We'll examine how Konica Minolta plans to leverage innovation and strategic planning to achieve sustainable growth. The analysis will cover Konica Minolta's market analysis, including its expansion into new markets, and its response to industry trends, offering actionable insights for informed decision-making.

How Is Konica Minolta Expanding Its Reach?

Konica Minolta is actively pursuing several expansion initiatives to drive future growth. These initiatives focus on market share acceleration, diversification, and strategic alliances. The company's business objectives for fiscal year 2024 include a growth mindset supported by programs to accelerate market share, increasing print volume with production print, and driving service revenue.

A key recommendation for achieving market share growth is diversification, particularly through value-added services. This approach is part of the broader Konica Minolta Growth Strategy, aiming to strengthen its position in a competitive market. The company's focus on innovation and customer-centric solutions is central to its strategic vision.

The company is also focused on its Konica Minolta Future Prospects, which include expansion into new markets and the introduction of innovative products and services. By adapting to industry trends and customer needs, Konica Minolta aims to sustain its growth trajectory. This strategy is supported by strategic partnerships and investments in research and development.

In April 2024, Konica Minolta announced a strategic alliance with FUJIFILM Business Innovation in the multifunction printer (MFP), office printer, and production printer segments. This collaboration aims to address industry challenges such as declining print volume, strengthening supply chain capabilities, and developing procurement systems that consider environmental regulations and human rights.

Konica Minolta is planning significant expansion in the Saudi Arabian market over the next two years, driven by the Kingdom's Vision 2030 initiatives and the rising demand for professional and industrial printing solutions. The company is actively exploring opportunities to enhance its presence in the region by offering innovative technologies and expanding partnerships with local businesses.

Konica Minolta kicked off 2025 with new corporate offices in Mumbai and Kolkata, India, to optimize talent deployment and market responsiveness. These offices serve as comprehensive business hubs for sales, business development, technical pre-sales, service infrastructure, and human capital management. This expansion is part of the company's broader strategy to strengthen its global presence and improve operational efficiency.

In the production and industrial print segment, Konica Minolta is set to introduce new products in Q4 2025 to replace the AccurioPress C12000/C14000 series, along with a new AccurioLabel 400 digital label press and new JETvarnish 3D digital embellishment technology. These product launches are designed to meet the evolving needs of the printing industry and enhance the company's competitive edge.

Konica Minolta's expansion strategy involves strategic alliances, geographic expansion, and new product launches. These initiatives are supported by investments in infrastructure and talent development. The company's focus on innovation and customer needs is central to its growth plans. For more details on the company's business model, see Revenue Streams & Business Model of Konica Minolta.

- Strategic Alliances: Partnering with industry leaders to strengthen market position.

- Geographic Expansion: Targeting high-growth markets like Saudi Arabia and India.

- Product Innovation: Introducing new products to meet evolving customer demands.

- Operational Efficiency: Optimizing talent deployment and market responsiveness.

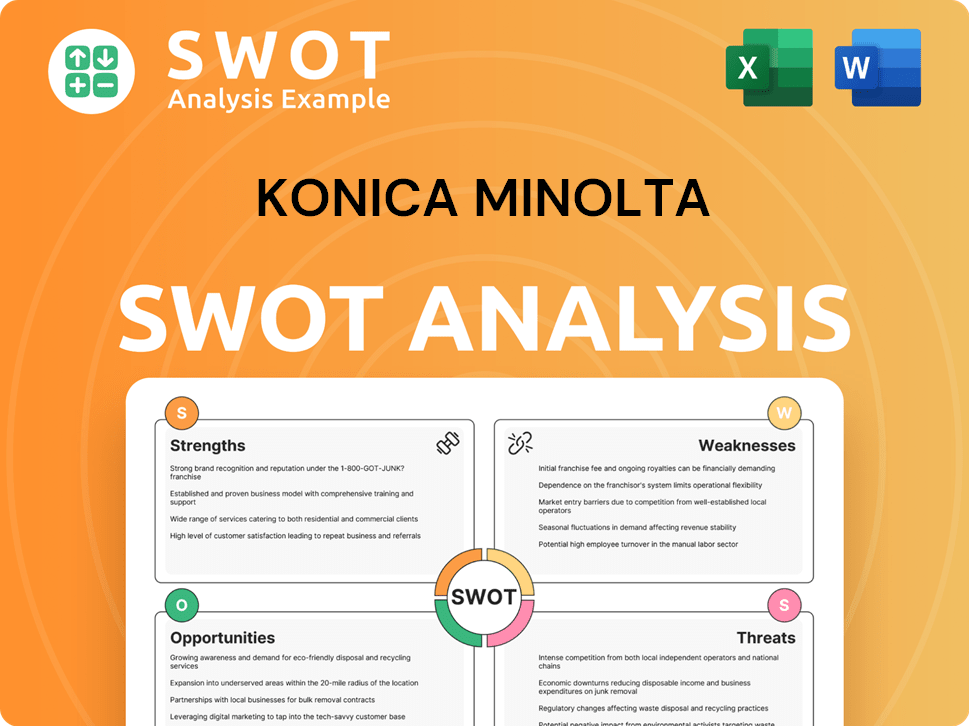

Konica Minolta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Konica Minolta Invest in Innovation?

Konica Minolta's Konica Minolta Growth Strategy centers on technological innovation and digital transformation to drive future growth. The company is actively integrating AI, cloud solutions, and IoT data to create new business opportunities and enhance existing services. This approach is crucial for adapting to evolving market demands and maintaining a competitive edge.

The company's focus on innovation extends to its sustainability efforts, with initiatives like using renewable energy in data centers and promoting a circular economy. These efforts align with the growing demand for environmentally responsible business practices, which are increasingly important to customers and stakeholders. Konica Minolta's commitment to these areas is a key part of its Konica Minolta Future Prospects.

As part of its strategic plan, Konica Minolta is implementing global structural reforms aimed at improving productivity. This includes automating operations, leveraging generative AI, and allowing employees to focus on high-value tasks. These efforts are designed to improve efficiency and support the company's long-term goals.

Konica Minolta is driving digital transformation through AI, cloud, and IoT solutions. This includes developing smart printing solutions and integrating these technologies into its core business operations.

The company is at the forefront of integrating AI and machine learning in the printing industry. This helps in optimizing print quality, reducing waste, and personalizing outputs.

Konica Minolta is committed to sustainability, with data centers running on renewable energy. They are also focused on improving their circular economy approach.

Konica Minolta was named among the Top 100 Global Innovators 2024 by Clarivate. This recognition highlights the company's strong intellectual property and patent data.

Konica Minolta aims to solve social issues through co-creation with customers. This involves leveraging their relationships, technology integration, and diverse human capital.

The company is focused on the symbiotic relationship between humans and technology in the printing industry. They aim to empower printing companies through open workflow systems.

Konica Minolta's strategic initiatives emphasize technological advancements and sustainability to ensure long-term growth and market leadership. The company's approach is designed to meet the evolving needs of its customers and the broader market.

- Automation and AI Integration: Promoting automation and the use of generative AI to improve productivity.

- Digital Transformation: Utilizing cloud, AI, and IoT to drive digital transformation across its business.

- Sustainability: Implementing sustainable practices, including renewable energy and circular economy solutions.

- Innovation in Printing: Integrating AI and machine learning to create smarter and more efficient printing solutions.

- Customer Co-creation: Collaborating with customers to solve social issues and develop innovative solutions.

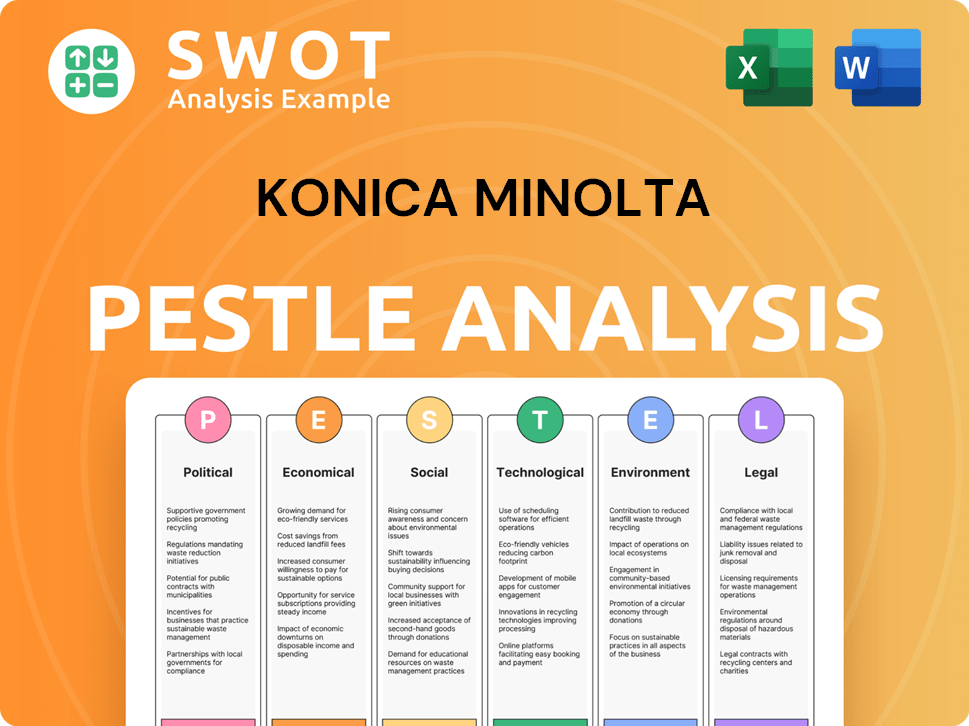

Konica Minolta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Konica Minolta’s Growth Forecast?

Konica Minolta's financial strategy centers on achieving sustainable growth and improving profitability. The company's outlook for fiscal year 2025 includes ambitious targets for revenue and profit margins. This strategic focus is designed to build a solid financial foundation and enhance shareholder value.

The company is actively working on improving its Return on Equity (ROE) to 5% or more. This is a key metric for assessing the company's financial health and efficiency. Achieving this goal requires a balanced approach to financial management and strategic investments.

In the first half of fiscal year 2024, Konica Minolta reported consolidated revenue of ¥583.7 billion, a 5.6% increase year-over-year. This growth, however, was offset by an operating loss of ¥0.7 billion. Despite the operating loss, the business contribution profit significantly improved, driven by cost reductions and improved gross margins across key segments. These results highlight the company's efforts to streamline operations and enhance profitability.

Konica Minolta's consolidated revenue for the six months ending September 30, 2024, reached ¥583.7 billion. This represents a 5.6% increase compared to the previous year. The rise in revenue indicates positive momentum in the company's sales performance.

Business contribution profit saw a substantial increase of 679.4%. This significant improvement reflects the positive impact of cost reduction measures and enhanced gross margins. The growth in business contribution profit is a key indicator of improved operational efficiency.

Despite revenue growth, Konica Minolta reported an operating loss of ¥0.7 billion. This loss was influenced by structural reform expenses and the cessation of production at its Chinese subsidiary. These factors impacted the overall profitability during the period.

Konica Minolta's strategic focus includes strengthening its core business sectors and implementing global structural reforms. These initiatives are designed to improve financial performance and ensure sustainable growth. The company is also investing in Marketing Strategy of Konica Minolta.

For the first nine months of fiscal year 2024 (ending December 31, 2024), Konica Minolta's total revenue was JPY 831.8 billion (USD 5.5 billion), marking a 3% increase year-over-year. Business contribution profit improved by 59% to JPY 28.8 billion (USD 190 million). However, the company recorded an operating loss of JPY -18.5 billion (USD -122 million) and a net loss of JPY 13.4 billion (USD 88 million). The company anticipates continued revenue stabilization and profit improvement, with key strategies including global structural reforms and focusing on strengthening business sectors. Konica Minolta expects a profit improvement of approximately ¥15 billion in fiscal 2025 from structural reforms initiated in fiscal 2024.

The financial outlook for Konica Minolta reflects strategic initiatives aimed at bolstering profitability and achieving sustainable growth. The company's performance is influenced by various factors, including revenue growth, cost management, and strategic investments. Key areas of focus include:

- Revenue Stabilization and Profit Improvement: The company is focused on stabilizing revenue streams and improving profitability through strategic initiatives.

- Global Structural Reforms: Implementing global structural reforms is a key strategy to enhance operational efficiency and reduce costs.

- Strengthening Business Sectors: Konica Minolta is concentrating on strengthening its core business sectors to drive growth and improve financial performance.

- Profit Improvement: The company anticipates a profit improvement of approximately ¥15 billion in fiscal 2025 from structural reforms initiated in fiscal 2024.

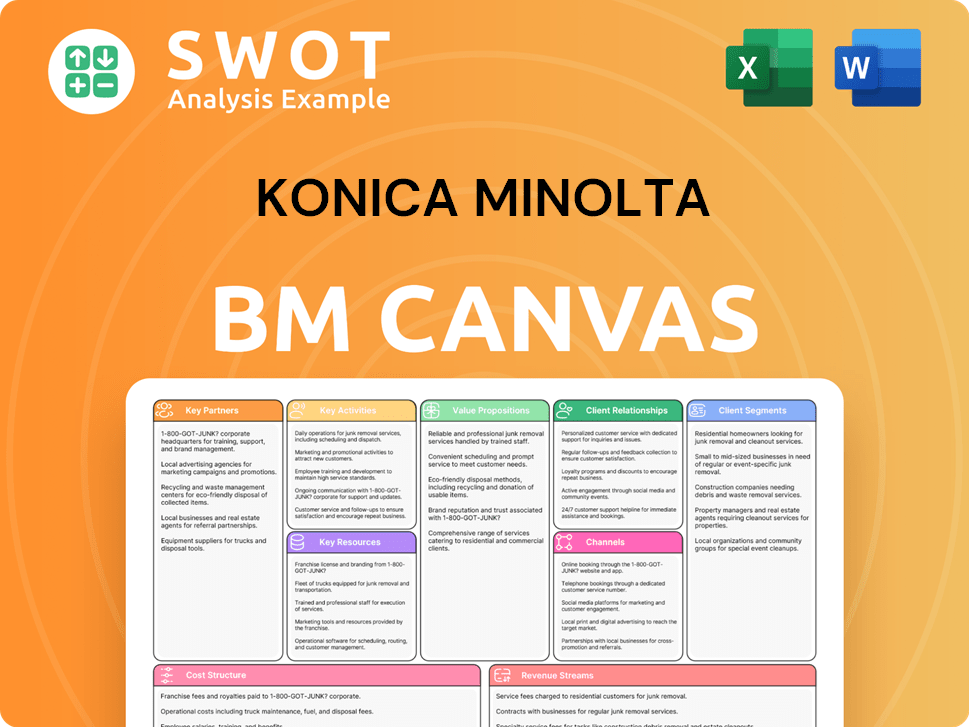

Konica Minolta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Konica Minolta’s Growth?

The Konica Minolta Company faces several potential risks and obstacles that could influence its Konica Minolta Growth Strategy and Konica Minolta Future Prospects. These challenges include market competition, technological disruptions, and internal resource constraints. The company must navigate these issues to achieve its growth ambitions and maintain its market position.

One significant hurdle is the decline in print volume, a trend affecting the MFP and office printer industry, which impacts Konica Minolta's Business. Additionally, the increasing sophistication of cyberattacks, particularly those leveraging AI, poses a growing threat, necessitating enhanced cloud security measures. Supply chain vulnerabilities, exacerbated by natural disasters and geopolitical risks, also present significant concerns for the company.

To address these challenges, Konica Minolta is implementing global structural reforms and strategic business selection and concentration. The company is focused on promoting the automation of operations, including the use of generative AI, to shift employees to high-value-added operations, aiming to improve overall productivity. As highlighted in a Brief History of Konica Minolta, the company has a long history of adapting to market changes.

Intense competition from other players in the printing and imaging market poses a continuous challenge. Competitors' pricing strategies and product innovations can directly impact Konica Minolta's Market Analysis and sales. This requires continuous innovation and competitive pricing strategies.

Rapid technological advancements, such as the shift towards digital workflows and cloud-based solutions, require constant adaptation. The company must invest in Konica Minolta Innovation to stay relevant and competitive. Failure to adapt can lead to decreased market share.

Limited resources, including financial and human capital, can hinder Konica Minolta's Company ability to invest in R&D, expand into new markets, and implement strategic initiatives. Efficient resource allocation is crucial for sustained growth. This includes managing costs and optimizing operations.

The increasing sophistication of cyberattacks, especially those using AI, poses a significant risk to data security and operational continuity. Konica Minolta needs to invest heavily in cybersecurity measures. Data breaches can damage reputation and lead to financial losses.

Disruptions in the supply chain due to natural disasters, geopolitical tensions, or other unforeseen events can impact production and distribution. Diversifying suppliers and building resilient supply chains are critical. This can affect product availability and increase costs.

Economic downturns can reduce demand for products and services, impacting revenue and profitability. The company must be prepared to adjust its strategies during economic fluctuations. This includes cost-cutting measures and exploring new revenue streams.

In fiscal 2024, Konica Minolta plans to reduce its total number of employees by 2,400 compared to the original plan for fiscal 2025. This restructuring is expected to boost profits by approximately ¥5 billion in fiscal 2024 and ¥15 billion in fiscal 2025. The company anticipates a one-time expense of approximately ¥20 billion in fiscal 2024 due to these reforms.

Despite a recent downturn in the Industry Business due to reduced demand in its sensing unit, the medium-to-long-term growth potential for fiscal 2025 and beyond remains unchanged. In the Office Business, Konica Minolta is focusing on improving sales and service efficiency through AI and optimizing its production system. This includes terminating production at its Chinese subsidiary by the first half of 2025.

Konica Minolta's strategic alliance with FUJIFILM Business Innovation is a key move to enhance resilience as global manufacturers and strengthen global competitiveness. This partnership aims to improve market reach and share resources. Such alliances are crucial for navigating the competitive landscape.

The company is actively addressing challenges and believes in its medium-to-long-term growth prospects. These efforts include cost management, strategic partnerships, and investment in innovation. This approach is designed to build a more resilient and competitive Konica Minolta Company.

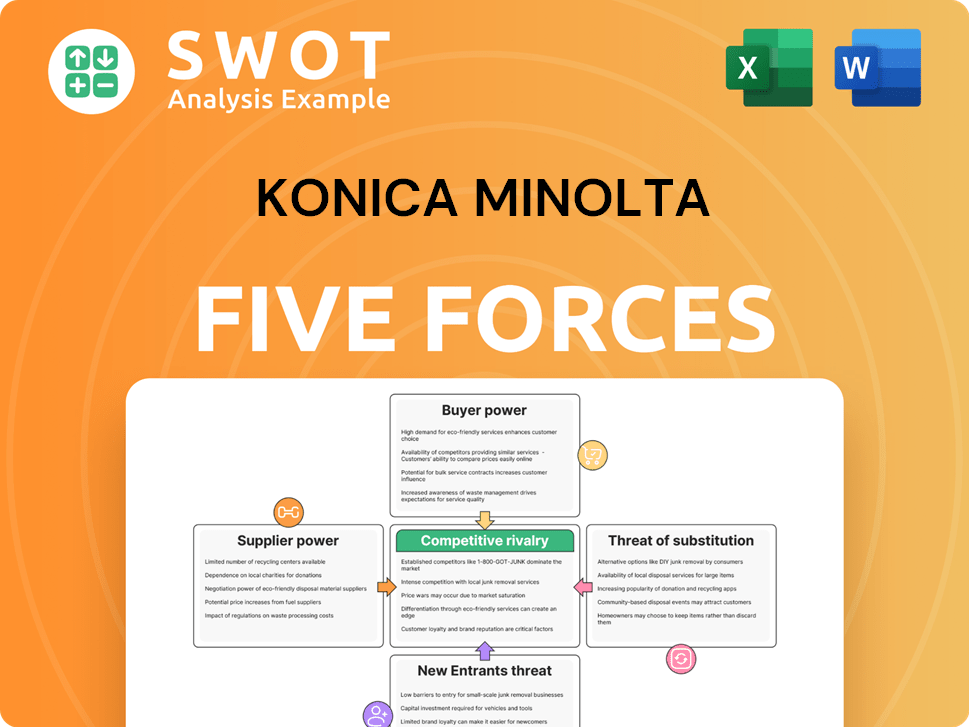

Konica Minolta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Konica Minolta Company?

- What is Competitive Landscape of Konica Minolta Company?

- How Does Konica Minolta Company Work?

- What is Sales and Marketing Strategy of Konica Minolta Company?

- What is Brief History of Konica Minolta Company?

- Who Owns Konica Minolta Company?

- What is Customer Demographics and Target Market of Konica Minolta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.