Konica Minolta Bundle

Who Really Controls Konica Minolta?

Ever wondered who pulls the strings at a global tech giant like Konica Minolta? Understanding the Konica Minolta SWOT Analysis is just the beginning. This deep dive into Konica Minolta's ownership structure reveals critical insights into its strategic direction and market influence. From its Japanese roots to its global presence, the ownership story is key.

Konica Minolta's Konica Minolta SWOT Analysis and overall success are deeply intertwined with its ownership. The company's history, including its merger and subsequent restructuring, has significantly shaped its current form. Knowing the Konica Minolta SWOT Analysis and the Konica Minolta parent company allows for a better understanding of the company's future. This exploration will uncover the major shareholders and provide a comprehensive Konica Minolta company profile.

Who Founded Konica Minolta?

The story of Konica Minolta ownership begins with the merger of two Japanese giants: Konica Corporation and Minolta Co., Ltd. This union, finalized in August 2003, aimed to bolster competitiveness. The merger created Konica Minolta Holdings, Inc., marking a new chapter in the history of these established companies.

Konica Corporation, with roots dating back to 1873, and Minolta Co., Ltd., established in 1928, brought together their expertise in imaging technology. The merger was driven by a shared history of collaboration, especially in business technologies. Details regarding the initial equity split or specific shareholding percentages of the original founders at the time of the merger are not readily available in public records.

The merged entity initially operated as a holding company. Later, in April 2013, this holding company absorbed its seven operating companies, becoming Konica Minolta, Inc. The strategic focus of the combined company, rooted in imaging technology and innovation, continued to shape its direction. To understand more about the company's origins, you can read a Brief History of Konica Minolta.

The Konica Minolta parent company structure evolved from a merger of two established Japanese firms. The merger in 2003 was a strategic move to enhance market competitiveness. The initial ownership structure reflected the shareholdings of the former Konica and Minolta companies.

- The merger in 2003 formed Konica Minolta Holdings, Inc.

- In April 2013, the holding company was restructured as Konica Minolta, Inc.

- The company's focus has remained on imaging technology and innovation.

- Specific details on early shareholders or initial shareholding percentages are not readily available.

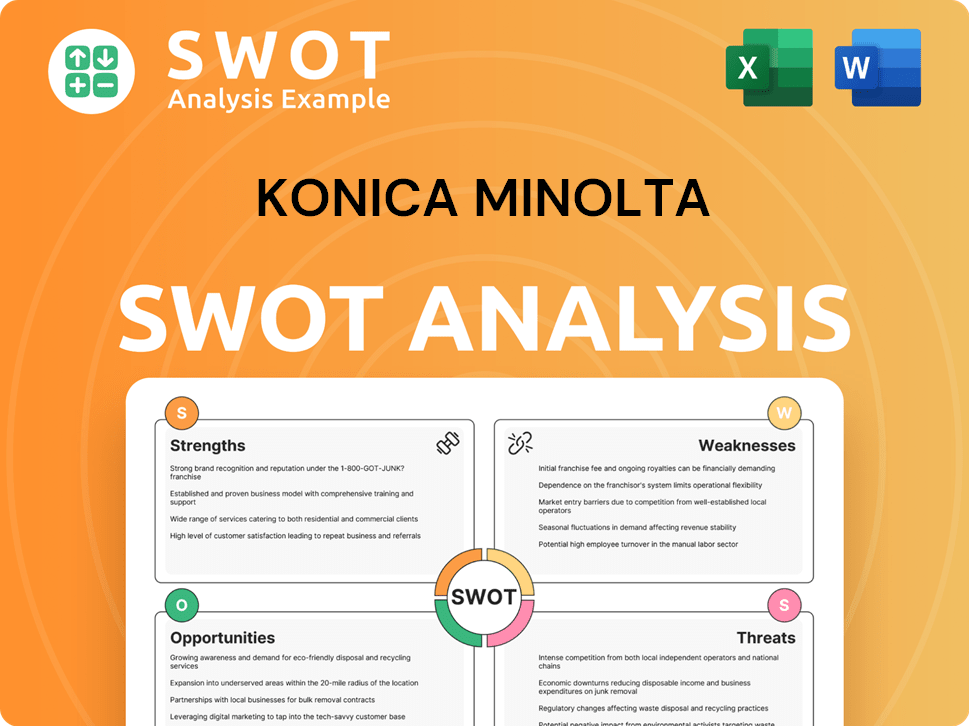

Konica Minolta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Konica Minolta’s Ownership Changed Over Time?

Konica Minolta, Inc. is a publicly traded company, which means that the Konica Minolta ownership is distributed among various shareholders. The company's stock is listed on the Tokyo Stock Exchange (Securities Code: 4902). The Konica Minolta history includes significant developments in its ownership structure, particularly with the evolution of its major stakeholders over time.

The company's ownership structure is primarily institutional. As of March 31, 2024, the total number of authorized shares was 502,664,337, with 114,252 shareholders. This distribution indicates a strong influence from institutional investors in the company's decision-making processes. The Konica Minolta company structure explained reveals the importance of understanding its major shareholders to grasp the company's strategic direction and financial performance.

| Shareholder | Shareholding Percentage | Shares Held (as of Date) |

|---|---|---|

| Mitsubishi UFJ Trust and Banking Corporation, Asset Management Arm | 7.62% | 37,726,522 (September 29, 2024) |

| Effissimo Capital Management Pte Ltd. | 5.90% | 29,192,600 (October 14, 2024) |

| MUFG Bank, Ltd., Investment Banking Arm | 5.77% | 28,558,800 (September 29, 2024) |

| MUFG Bank, Ltd., Retirement Benefit Trust | 5.20% | 25,707,300 (September 29, 2024) |

| Nomura Asset Management Co., Ltd. | 4.72% | 23,375,900 (January 30, 2025) |

| Sumitomo Mitsui Trust Asset Management Co., Ltd. | 3.62% | 17,931,800 (March 30, 2024) |

| The Vanguard Group, Inc. | 3.44% | 17,019,030 (March 30, 2025) |

| Mitsubishi UFJ Asset Management Co., Ltd. | 3.12% | 15,440,600 (September 29, 2024) |

| Arcus Investment Ltd. | 2.93% | 14,487,900 (September 29, 2024) |

The significant holdings by institutional investors, such as Mitsubishi UFJ Trust and Banking Corporation and MUFG Bank, Ltd., highlight the institutional nature of the company's ownership. The general public holds approximately 24% of the shares, while individual insiders own less than 1%. Strategic alliances, like the joint venture with FUJIFILM Business Innovation Corp., also affect the Konica Minolta parent company structure, with FUJIFILM Business Innovation holding a 75% share in their collaborative venture established in September 2024. For more insights into the company's growth strategy, you can read Growth Strategy of Konica Minolta.

Understanding the Konica Minolta major shareholders is crucial for investors and stakeholders.

- Institutional investors hold the majority of shares, influencing corporate decisions.

- Public ownership is significant, indicating broad market interest.

- Strategic partnerships, like the one with FUJIFILM, shape the company's structure.

- The Tokyo Stock Exchange listing provides Konica Minolta stock information and transparency.

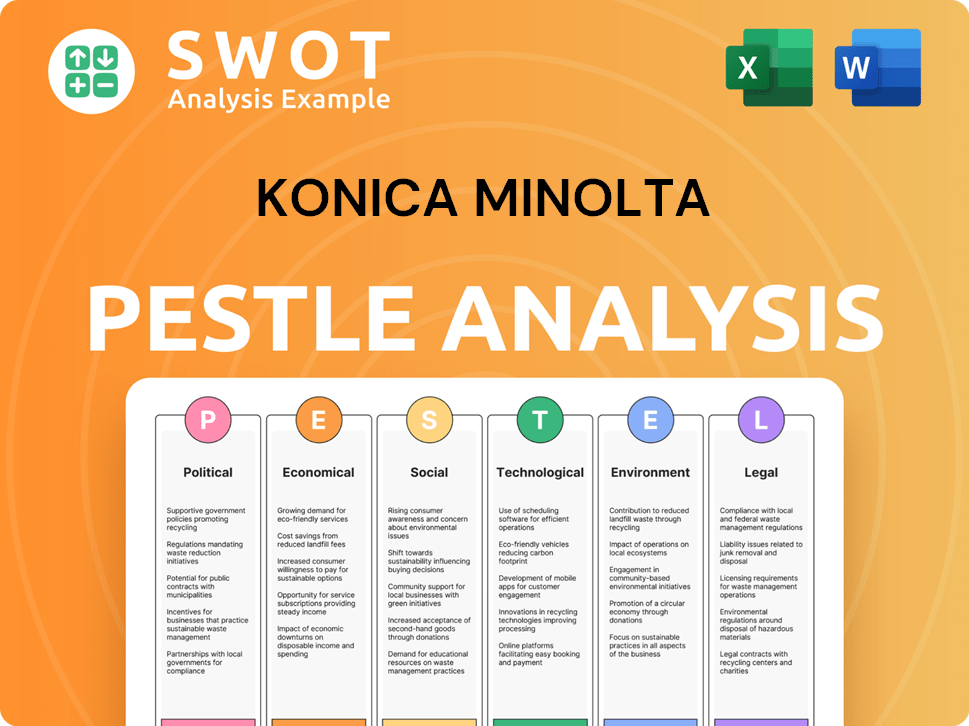

Konica Minolta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Konica Minolta’s Board?

The board of directors at Konica Minolta, Inc. oversees the company's operations, with accountability to its shareholders. While specific details on each board member's affiliations aren't readily available, the significant institutional ownership suggests a strong influence on board decisions from major shareholders. This structure is crucial for understanding the overall Konica Minolta ownership and how the company is governed. The company's focus on strengthening profitability and its financial base, as outlined in its Medium-term Business Plan (Fiscal 2023-2025), is a key area of focus for the board.

The board's role is pivotal in guiding the company's strategic direction, especially given the ongoing structural reforms and business concentration efforts. These initiatives are designed to enhance financial performance and ensure long-term sustainability. Understanding the board's composition and its alignment with shareholder interests is essential for anyone looking into who owns Konica Minolta and its operational strategies. The board's decisions are critical in shaping the company's response to market challenges and opportunities.

| Board Member | Title | Affiliation |

|---|---|---|

| Toshimitsu Tanaka | Representative Director, Chairman | Konica Minolta, Inc. |

| Masahiro Kitazawa | Representative Director, President and CEO | Konica Minolta, Inc. |

| Tetsuya Tanaka | Director | Konica Minolta, Inc. |

The voting structure at Konica Minolta is based on a one-share-one-vote principle, with a minimum trading unit of 100 shares. No information indicates dual-class shares or special voting rights. The company's corporate governance is influenced by its financial performance and strategic plans. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Konica Minolta.

The board of directors at Konica Minolta is accountable to shareholders, with decisions likely influenced by major institutional owners. The voting structure follows a one-share-one-vote principle, ensuring fair representation. The company's strategic plans and financial health are key focuses for the board.

- Board decisions are influenced by major shareholders.

- Voting is based on one-share-one-vote.

- The board focuses on profitability and financial base.

- The company is undergoing structural reforms.

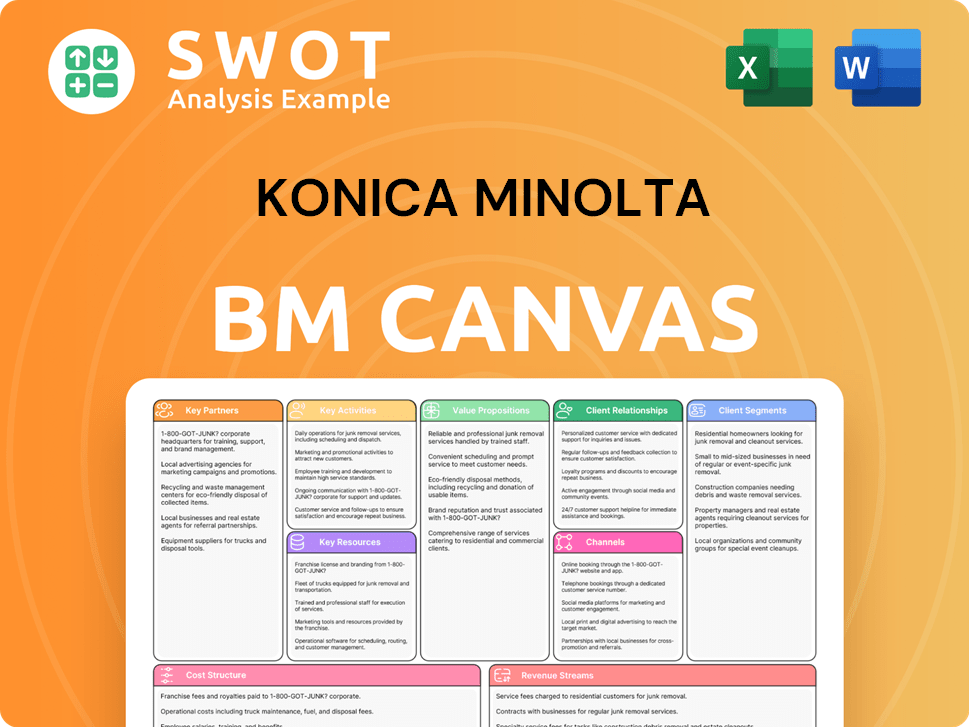

Konica Minolta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Konica Minolta’s Ownership Landscape?

Over the past few years, Konica Minolta has been undergoing significant strategic adjustments that impact its ownership profile and business focus. This includes divesting from non-core businesses and concentrating on core profitable areas, as outlined in its Medium-term Business Plan (Fiscal 2023-2025). These moves reflect an industry-wide trend toward consolidation and strategic partnerships, aiming to strengthen supply chains, optimize operations, and focus on core profitable areas. The company's efforts are geared towards returning to a highly profitable state in fiscal 2025.

Recent developments include divestitures, operational restructuring, and strategic alliances. For example, Konica Minolta sold Ambry Genetics to Tempus AI in November 2024, with the merger expected to close in early 2025. In March 2025, the company announced the sale of its shares in Konica Minolta Marketing Services Holding and MOBOTIX AG. Furthermore, Konica Minolta is optimizing its production system, including the planned cessation of manufacturing activities at Konica Minolta Business Technologies (WUXI) in China during the first half of 2025. These changes are part of a broader strategy to optimize resources and improve financial performance. The company aims to reduce its total number of regular and non-regular employees by 2,400 in fiscal year 2024 as part of global structural reforms to optimize human capital and boost profits.

| Development | Details | Impact |

|---|---|---|

| Divestitures | Sale of Ambry Genetics to Tempus AI, Konica Minolta Marketing Services Holding, and MOBOTIX AG | Operating losses expected for fiscal year ending March 31, 2025 |

| Operational Restructuring | Cessation of manufacturing in WUXI, China; employee reduction | Optimizing production and workforce |

| Strategic Alliances | Joint venture with FUJIFILM Business Innovation Corp. for procurement | Strengthening business foundations and streamlining processes |

In July 2024, Konica Minolta and FUJIFILM Business Innovation Corp. formed a joint venture for coordinating the procurement of raw materials and parts, with FUJIFILM holding a 75% stake and Konica Minolta holding 25%. This alliance aims to strengthen business foundations and streamline processes. Effective April 1, 2025, Kentaro Itamoto was appointed President of Konica Minolta Business Solutions Europe. Despite an operating loss of 0.7 billion yen, the company reported consolidated revenue of 583.7 billion yen for the six months ending September 30, 2024, a 5.6% increase year-over-year. For the fiscal year ending March 31, 2025, Konica Minolta has revised its forecast, anticipating a slight reduction in expected annual revenue to 1,134 billion yen. Konica Minolta's current ownership details are subject to change as the company continues to adapt to market dynamics.

Konica Minolta is a publicly traded company. The company's ownership structure is influenced by its strategic decisions, including divestitures and partnerships. Understanding who owns Konica Minolta is crucial for investors and stakeholders. The company's focus on core business areas is reshaping its ownership profile.

Konica Minolta's financial reports show a mixed performance. The company's annual revenue forecast for the fiscal year ending March 31, 2025, is approximately 1,134 billion yen. The company reported an operating loss of 0.7 billion yen in the six months ending September 30, 2024, despite revenue growth.

Konica Minolta is undergoing significant strategic shifts. The company is actively pursuing 'selection and concentration of businesses'. Strategic alliances, such as the joint venture with FUJIFILM Business Innovation Corp., are aimed at strengthening business foundations.

Leadership changes include the appointment of Kentaro Itamoto as President of Konica Minolta Business Solutions Europe. Operational restructuring includes the planned cessation of manufacturing activities in China. These changes are part of the company's strategy to optimize operations and drive profitability.

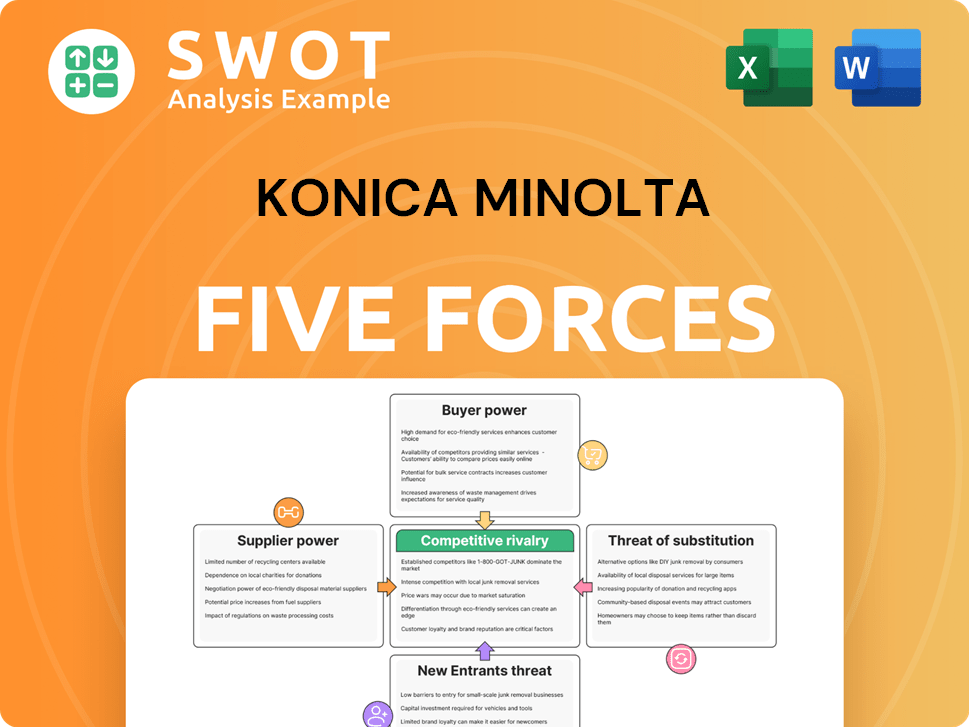

Konica Minolta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Konica Minolta Company?

- What is Competitive Landscape of Konica Minolta Company?

- What is Growth Strategy and Future Prospects of Konica Minolta Company?

- How Does Konica Minolta Company Work?

- What is Sales and Marketing Strategy of Konica Minolta Company?

- What is Brief History of Konica Minolta Company?

- What is Customer Demographics and Target Market of Konica Minolta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.