LegalZoom Bundle

Can LegalZoom Continue to Disrupt the Legal Industry?

LegalZoom revolutionized legal services by making them accessible online, but what's next for this legal tech pioneer? This deep dive explores the LegalZoom SWOT Analysis, examining its innovative business model and its impact on the online legal services landscape. We'll analyze how LegalZoom's strategic shifts are poised to shape its future in a rapidly evolving market.

This LegalZoom company analysis will delve into its growth strategy, scrutinizing its financial performance and market share within the legal tech market. We'll also explore the future prospects of LegalZoom, considering both its challenges and opportunities, and assess its potential for sustainable growth in the competitive online legal services sector. Understanding LegalZoom's long-term vision and goals is crucial for investors and anyone interested in the future of law.

How Is LegalZoom Expanding Its Reach?

The LegalZoom growth strategy focuses on expanding its subscription services, acquiring new market segments, and diversifying its service offerings. This strategic approach aims to strengthen its market position and provide a wider range of solutions to its customers. The company's initiatives are geared towards enhancing its revenue streams and improving customer engagement within the legal tech market.

A key aspect of LegalZoom's future prospects involves strategic acquisitions to broaden its market reach. The company is actively pursuing opportunities to integrate new brands and services, which supports its long-term growth objectives. These moves are designed to increase the company's overall value and market share in the online legal services sector.

The company's expansion strategy includes a focus on subscription products and compliance offerings. By increasing the adoption of subscription services, LegalZoom aims to create a more predictable revenue base. This shift is also intended to improve customer lifetime value and strengthen the company's position in the competitive landscape.

The acquisition of Formation Nation, Inc. on February 10, 2025, was a significant move. This acquisition included brands like Inc Authority and NCH. This acquisition is expected to be accretive to non-GAAP earnings per share. It will also contribute positively to adjusted EBITDA in its first year.

Formation Nation brings a scaled outbound sales force. It is anticipated to generate approximately $60 million in revenue. This represents about 9% of LegalZoom's 2024 revenue. This strategic move enhances LegalZoom's market position with differentiated premium and value brand segmentation.

LegalZoom is increasing its emphasis on subscription products. It reports growth in e-signature, accounting solutions, and compliance subscriptions. This aims to create a more stable revenue base. It will also improve customer lifetime value by encouraging subscription uptake.

LegalZoom is expanding its compliance offerings with improved status monitoring and notifications. It performs ongoing reviews of legal and government developments. This keeps customers informed of changes to filing requirements. This is a key component of LegalZoom's business model.

LegalZoom's expansion initiatives are multi-faceted, including strategic acquisitions and increased focus on subscription services. These strategies are designed to enhance the company's market position and drive revenue growth. The company is also focused on increasing customer engagement through bundling and personalized recommendations.

- Acquisition of Formation Nation to expand market reach.

- Increased focus on subscription products like e-signature and accounting solutions.

- Expansion of compliance offerings with improved monitoring and notifications.

- Experimentation with new business formation workflows and bundling.

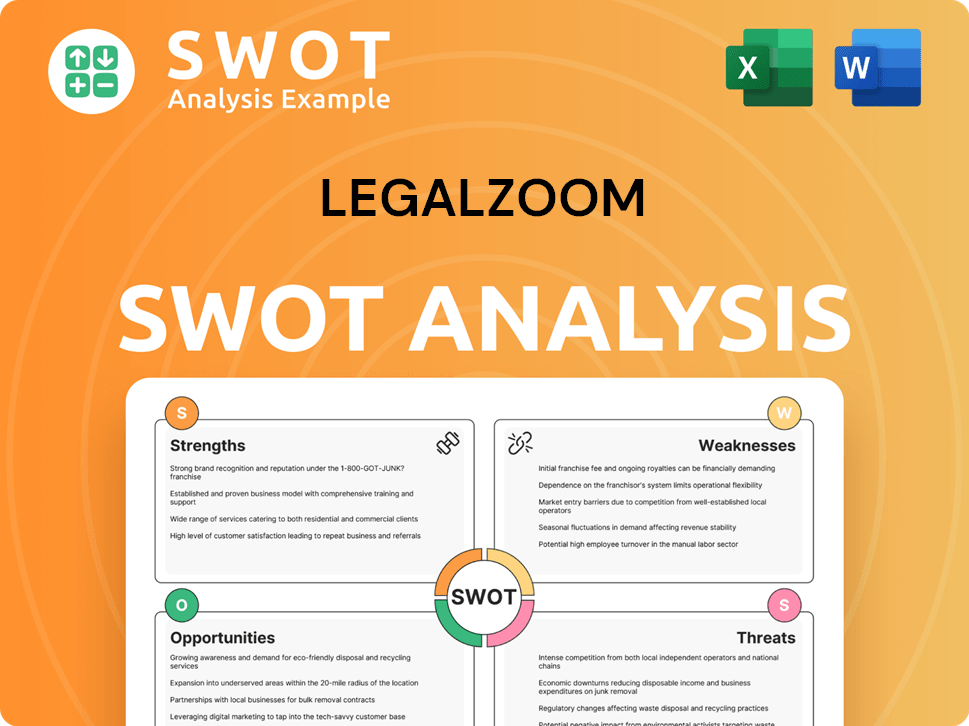

LegalZoom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does LegalZoom Invest in Innovation?

The core of LegalZoom's strategy involves leveraging technology and innovation to foster sustained growth. This approach is centered on digital transformation, automation, and the integration of advanced technologies, particularly artificial intelligence (AI). The company's focus on enhancing its service offerings through AI is a key element of its innovation strategy, aiming to improve customer service and operational efficiency within the online legal services market.

LegalZoom's commitment to digital transformation is evident in its continuous efforts to refine its platform. The goal is to provide an intuitive and user-friendly experience that meets customer expectations. This also involves offering high-quality products and services. The strategic shift toward high-margin subscription offerings is also supported by technological advancements, enabling more streamlined service delivery.

The company's innovation strategy is further demonstrated by its incorporation of generative AI into offerings like 'Doc Assist.' This feature aims to enhance customer service and streamline internal processes. In addition, LegalZoom is actively working on improved business license alerts. These alerts track requirements across approximately 90,000 jurisdictions, showcasing its dedication to providing comprehensive and compliant legal solutions.

LegalZoom is dedicated to digital transformation, aiming to provide an intuitive platform that meets customer expectations. This includes offering high-quality products and services. The company's strategic shift towards subscription offerings is also supported by technological advancements.

AI is a key area of innovation for LegalZoom, with a focus on improving customer service and operational efficiency. Generative AI is incorporated into offerings such as 'Doc Assist.' The company is also enhancing business license alerts.

LegalZoom's move towards a subscription-based model is supported by technological advancements. This allows for a more efficient delivery of services. The subscription model is a key component of the LegalZoom business model.

LegalZoom's commitment to compliance is evident in its business license alerts. These alerts track requirements across approximately 90,000 jurisdictions. This ensures that customers are aware of the legal obligations.

The company prioritizes an intuitive platform to improve the customer experience. This includes providing high-quality products and services. The goal is to meet and exceed customer expectations.

While specific details on R&D investments in 2024-2025 are not extensively detailed, the emphasis on AI integration and enhanced compliance offerings demonstrates LegalZoom's commitment to technological leadership. LegalZoom's use of technology and innovation is a key driver.

LegalZoom's innovation strategy is focused on digital transformation and AI integration. This includes enhancing customer service and operational efficiency through features like 'Doc Assist.' The company is also improving its compliance offerings.

- AI-Powered Tools: Development of AI-driven tools to enhance customer service and streamline legal processes.

- Platform Enhancements: Continuous improvement of the platform to provide an intuitive user experience.

- Compliance Solutions: Expansion of compliance offerings, such as business license alerts, to cover a broader range of jurisdictions.

- Subscription Model Support: Leveraging technology to streamline the delivery of services within the subscription model.

- Customer-Centric Approach: Prioritizing the customer experience through high-quality products and services.

For more insights into how LegalZoom approaches its market, consider exploring the Marketing Strategy of LegalZoom.

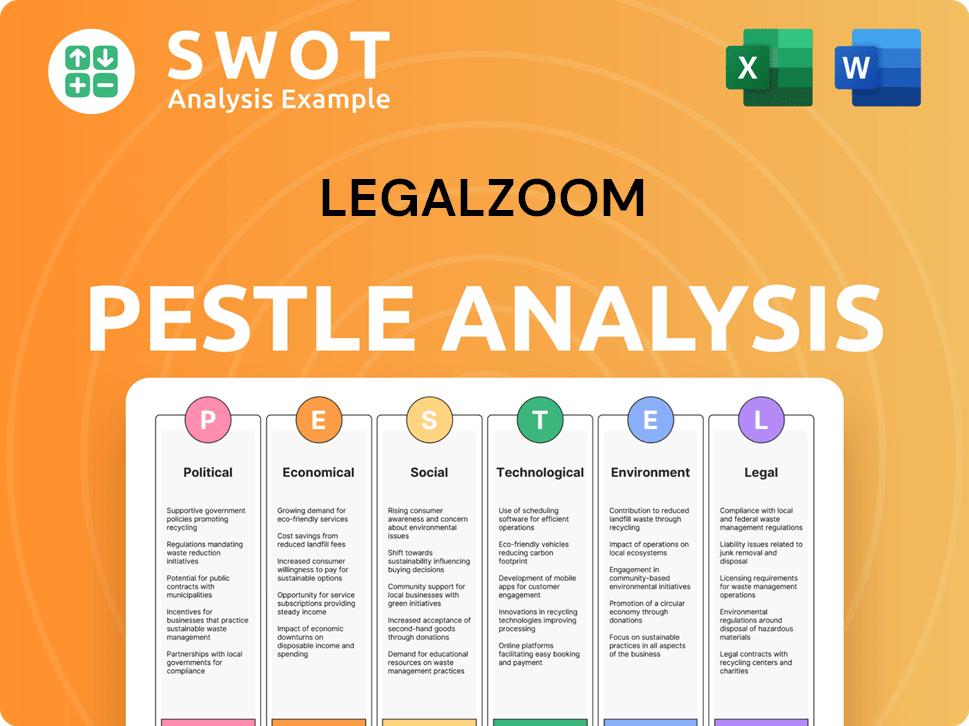

LegalZoom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is LegalZoom’s Growth Forecast?

The financial outlook for LegalZoom in 2025 highlights a strategic focus on sustained revenue growth and enhanced profitability. This outlook underscores the company's commitment to strengthening its position in the online legal services market. A key element of this strategy involves leveraging its established business model and expanding its service offerings to capture a larger share of the legal tech market.

LegalZoom's financial projections for 2025 indicate a steady trajectory, with an anticipated revenue increase of approximately 5% year-over-year. This growth is expected to translate into an Adjusted EBITDA of around $165 million, reflecting an Adjusted EBITDA margin of approximately 23%. The company's financial performance analysis suggests a disciplined approach to cost management and operational efficiency.

The company's strong performance in Q1 2025, with a 5% year-over-year revenue increase, provides a solid foundation for achieving its financial goals. The growth in subscription revenue and the surge in Adjusted EBITDA demonstrate LegalZoom's ability to drive both top-line and bottom-line results. For more insights into the company's customer base, consider exploring the Target Market of LegalZoom.

Total revenue reached $183.1 million, a 5% year-over-year increase. This growth reflects the company's ability to attract and retain customers. The increase shows the effectiveness of its business model.

Subscription revenue grew 8% year-over-year to $116.3 million in Q1 2025. This growth is a key indicator of the company's success in retaining customers. Subscription units increased to 1.92 million.

Adjusted EBITDA surged 33% year-over-year to $37.0 million in Q1 2025. This significant increase reflects a 20% margin. This demonstrates improved operational efficiency.

For Q2 2025, revenue is expected to be between $181 million and $185 million. This represents 3% year-over-year growth at the midpoint. Adjusted EBITDA is projected between $37 million and $41 million.

As of December 31, 2024, the company held a strong financial position.

- Cash and cash equivalents totaled $142.1 million.

- There was no outstanding debt.

- The sale of the operating headquarters in Austin, Texas, is expected to close in March 2025.

- This sale is expected to further optimize the capital structure.

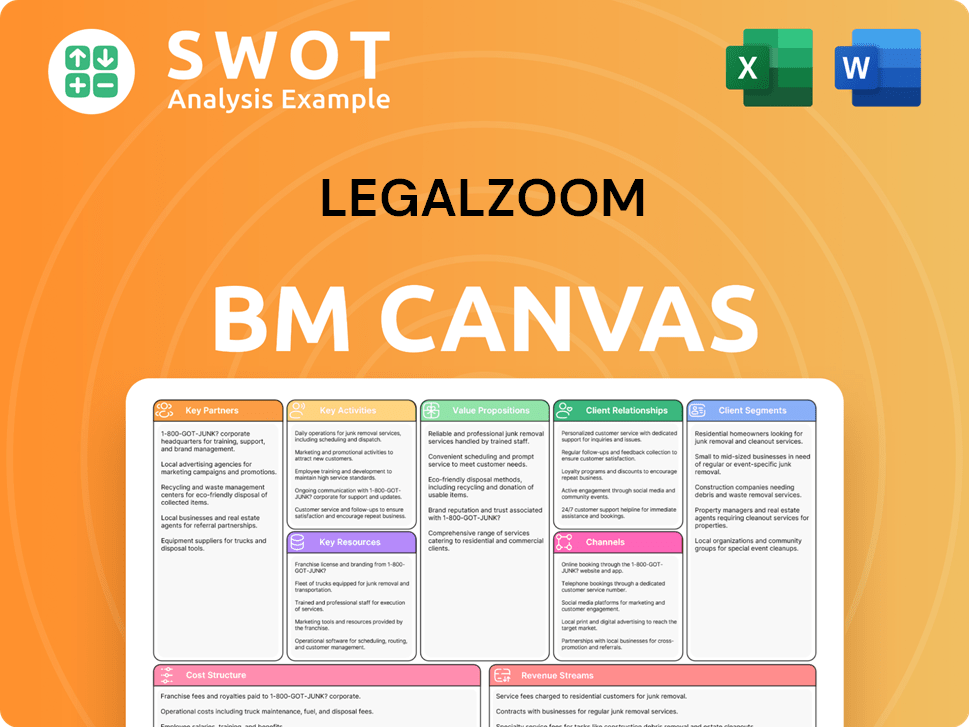

LegalZoom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow LegalZoom’s Growth?

The growth strategy of LegalZoom faces several potential risks and obstacles. The company's reliance on business formations, subscription models, and competitive market dynamics poses ongoing challenges. Understanding these risks is crucial for assessing the future prospects of LegalZoom and its ability to maintain its position in the online legal services sector.

A significant hurdle is the competitive landscape within the legal tech market. LegalZoom must navigate the evolution of online legal services, including the integration of AI, to stay ahead. The company's ability to adapt to these changes and retain its customer base will be critical for its long-term success.

LegalZoom's future prospects are also influenced by its ability to manage operational challenges, such as integrating acquisitions and mitigating compliance and reputational risks associated with new technologies. These factors contribute to the overall LegalZoom company analysis.

LegalZoom's revenue is heavily dependent on business formations, which can fluctuate due to economic conditions and regulatory changes. For example, the suspension of the Beneficial Ownership Information Report (BOIR) requirement is expected to soften revenue for December 2024. This impacts demand for certain services, potentially leading to a 5.5% year-over-year decline in business formations for Q1 2025.

The online legal services market is highly competitive, with new entrants and technologies like generative AI increasing pressure. Competitors such as ZenBusiness, Northwest Registered Agent, and Incfile (now Bizee) pose significant challenges. LegalZoom must innovate and provide competitive services to maintain its market position.

LegalZoom relies on converting transactional customers into subscribers and retaining them. Fluctuating subscription renewal rates and customer satisfaction issues impact revenue stability. The addition of only 0.2 million net new subscription units over twelve months in 2024 suggests challenges in the customer acquisition funnel.

Integrating acquisitions like Formation Nation presents operational challenges, including the need to expand infrastructure and manage headcount. Incorporating generative AI introduces compliance and reputational risks. These risks include potential inaccuracies and biases in AI-generated content, which could affect Brief History of LegalZoom.

Acquiring new customers and retaining existing ones are critical for LegalZoom's financial performance analysis. The effectiveness of customer acquisition strategies and the ability to maintain high customer satisfaction levels directly affect subscription revenue and overall growth. This is key for understanding LegalZoom's market share and growth rate.

Economic downturns and regulatory changes can significantly impact LegalZoom's business. These factors influence demand for legal services and the company's ability to maintain its revenue streams. LegalZoom must adapt to these external factors to mitigate risks and ensure sustainable growth.

LegalZoom's expansion strategy faces risks related to market competition and the need for continuous innovation. The company must adapt to changing customer needs and technological advancements to maintain its competitive edge. This includes addressing challenges and opportunities in the legal tech market.

The integration of acquisitions and the management of new technologies, such as AI, pose operational risks. LegalZoom must effectively manage its resources, ensure compliance, and mitigate potential reputational damage. This includes analyzing LegalZoom's use of technology and innovation.

LegalZoom's financial performance is subject to risks associated with customer acquisition costs, subscription renewal rates, and market volatility. These factors directly influence the company's profitability and long-term financial health. The subscription model explained is key to understanding the financial risks.

Changes in the legal tech market, including increased competition and evolving customer expectations, present market risks. LegalZoom must adapt to these changes to maintain its market share and ensure its long-term viability. This includes understanding the future of online legal services like LegalZoom.

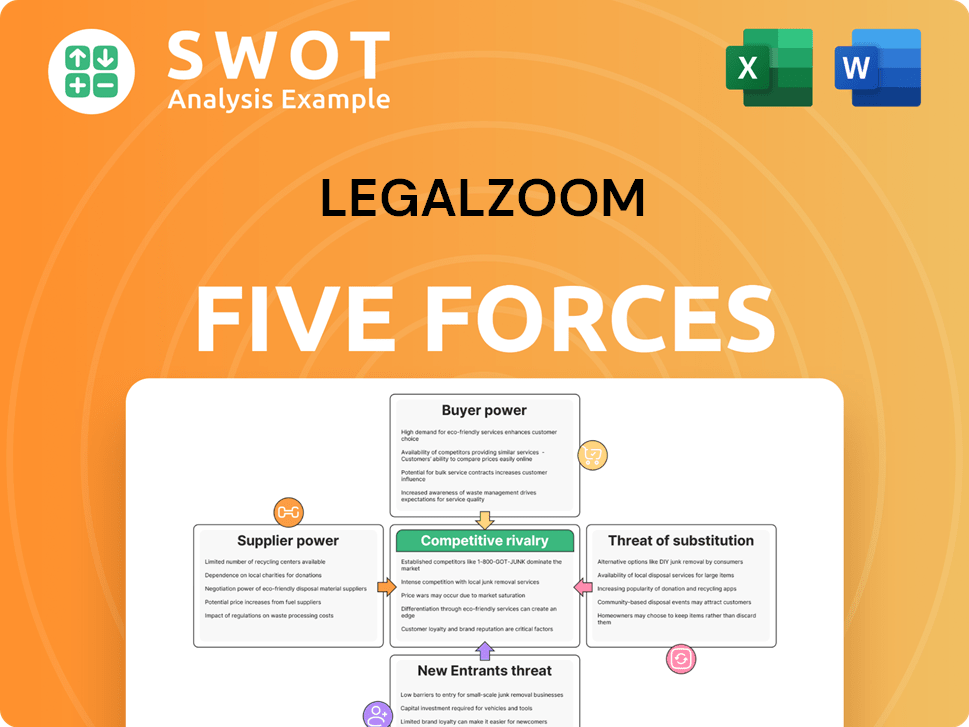

LegalZoom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LegalZoom Company?

- What is Competitive Landscape of LegalZoom Company?

- How Does LegalZoom Company Work?

- What is Sales and Marketing Strategy of LegalZoom Company?

- What is Brief History of LegalZoom Company?

- Who Owns LegalZoom Company?

- What is Customer Demographics and Target Market of LegalZoom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.