LegalZoom Bundle

How Does LegalZoom Really Work?

LegalZoom has revolutionized access to legal help, becoming a dominant player in the legal tech industry. With a reported $210.0 million in cash and cash equivalents as of March 31, 2025, and $183.11 million in revenue in Q1 2025, LegalZoom showcases a robust financial standing. Its mission is to make legal services more accessible and affordable for individuals and businesses across the U.S.

This platform provides a wide array of LegalZoom SWOT Analysis, business formation, and estate planning services, supported by a network of over 1,000 attorneys. Understanding the operational framework of LegalZoom, including its revenue streams and competitive advantages, is vital. This analysis will provide a comprehensive LegalZoom review, exploring its impact on the landscape of online legal services and its long-term viability, including LegalZoom cost and other factors.

What Are the Key Operations Driving LegalZoom’s Success?

LegalZoom delivers value by providing accessible and affordable online legal solutions. It caters to individuals, families, and small businesses, offering a range of services designed to simplify legal processes. This approach makes legal help more convenient and cost-effective, bridging the gap between traditional legal services and DIY options.

The core offerings include business formation services, intellectual property services, and consumer offerings like estate planning documents. LegalZoom also provides ongoing compliance and tax advice, business licenses, accounting, virtual mailbox, and e-signature solutions. The platform uses user-friendly online tools and customizable legal documents, with access to attorney consultations.

The operational processes are built on proprietary technology that automates complex legal and compliance procedures. This digital platform enables flat-fee pricing and facilitates seamless customer interactions. The company's supply chain primarily involves its digital infrastructure and its network of independent attorneys. Its distribution network is its online platform, which allows for broad reach across the U.S. LegalZoom has also been expanding through strategic partnerships, such as its collaboration with 1-800Accountant and Perplexity.

LegalZoom offers business formation services, including LLC and corporation setup. This helps entrepreneurs and small business owners to establish their legal entities efficiently. The process is streamlined through online tools and expert guidance.

LegalZoom provides intellectual property services, such as trademarks and copyrights. These services help protect a business's brand and creative assets. The platform simplifies the often complex process of securing IP rights.

LegalZoom offers estate planning documents, including wills and trusts. These documents help individuals manage their assets and plan for the future. The platform makes it easier to create these important legal documents.

LegalZoom provides ongoing compliance and tax advice. This helps businesses navigate the complexities of legal and financial regulations. The services ensure businesses stay compliant and informed.

LegalZoom's operations are unique due to its blend of technology and professional legal expertise. This hybrid approach makes legal help more affordable and convenient, while also providing professional guidance. The acquisition of Formation Nation in February 2025 enhanced its market position.

- Technology-Driven Automation: Utilizes proprietary technology to automate legal and compliance procedures.

- Access to Legal Experts: Provides access to a network of over 1,000 independent attorneys.

- Flat-Fee Pricing: Offers transparent pricing models, making legal services more predictable.

- Strategic Partnerships: Collaborates with companies like 1-800Accountant and Perplexity to expand service offerings.

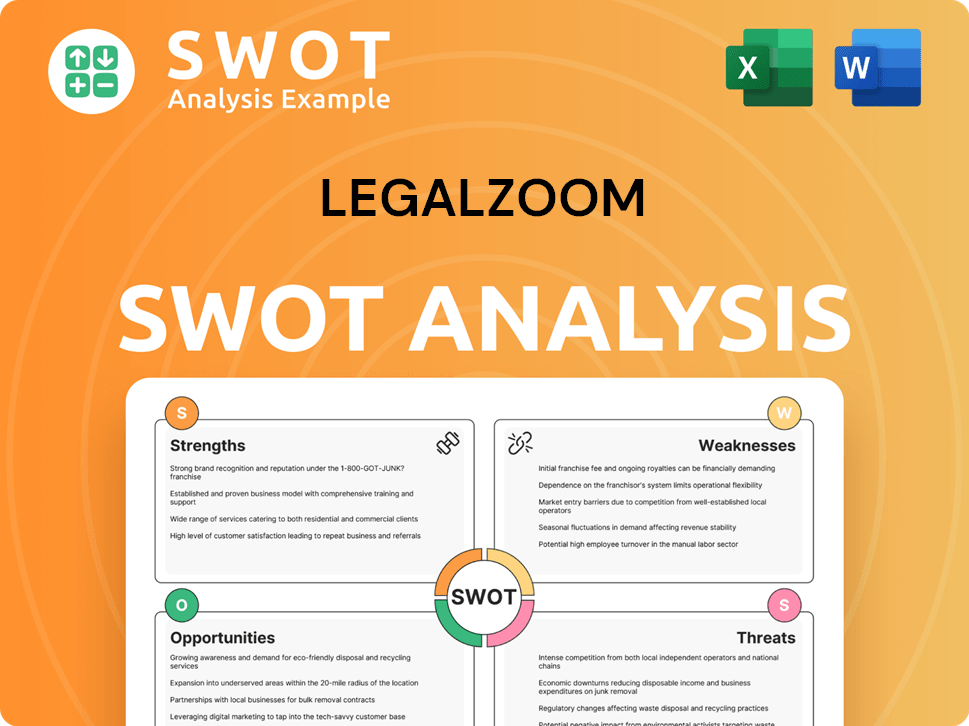

LegalZoom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does LegalZoom Make Money?

LegalZoom's revenue streams are primarily divided into subscription services and transaction-based services. The company's financial performance for 2024 showed a robust revenue of $681.9 million, with a strategic focus on growing its subscription base. This dual approach allows LegalZoom to capture both recurring and one-time revenue opportunities within the online legal services market.

The company's monetization strategies include tiered pricing, cross-selling, and strategic acquisitions. These methods are designed to enhance customer value and drive long-term revenue growth. By offering various service packages and integrating additional solutions, LegalZoom aims to increase customer lifetime value and improve its overall financial performance.

LegalZoom's business model is built around providing accessible and affordable legal solutions. The company leverages technology to streamline legal processes, making it easier for individuals and businesses to handle their legal needs. This efficiency is reflected in its revenue streams and monetization strategies, supporting its position in the market.

LegalZoom generates revenue through subscription and transaction-based services. In 2024, total revenue reached $681.9 million. Subscription revenue is a key driver, with a 6% year-over-year increase in 2024, reaching $436.2 million. Transaction revenue contributed to the overall income, with $53.0 million in Q4 2024.

- Subscription Revenue Growth: Subscription revenue increased by 10% year-over-year in Q1 2025, reaching $107.9 million.

- Customer Retention: Customer retention rates improved, increasing by 100 basis points year-over-year to 64% in Q3 2024.

- Transaction Revenue: Transaction revenue saw a 2% year-over-year increase in Q4 2024.

- Business Formations: Business formations decreased from 139,000 in Q1 2024 to 131,000 in Q1 2025.

LegalZoom employs various monetization strategies to maximize revenue. These include tiered pricing, cross-selling, and strategic acquisitions. The company focuses on enhancing customer lifetime value and driving revenue growth through these methods.

- Tiered Pricing: Offers various service packages to match different customer needs and budgets.

- Cross-selling and Upselling: Utilizes the 'customer funnel' to introduce additional business solutions.

- Pricing Adjustments: Makes strategic pricing adjustments and reduces free service visibility to encourage subscription uptake.

- Strategic Acquisitions: The acquisition of Formation Nation in February 2025 is expected to contribute approximately $60 million in revenue. This acquisition is expected to be accretive to non-GAAP net income per share in the first year.

The company's approach to marketing and business development plays a crucial role in its revenue generation. By focusing on customer acquisition and retention, LegalZoom aims to sustain its financial growth and strengthen its market position. The combination of subscription and transaction-based services, along with effective monetization strategies, supports LegalZoom's long-term financial objectives.

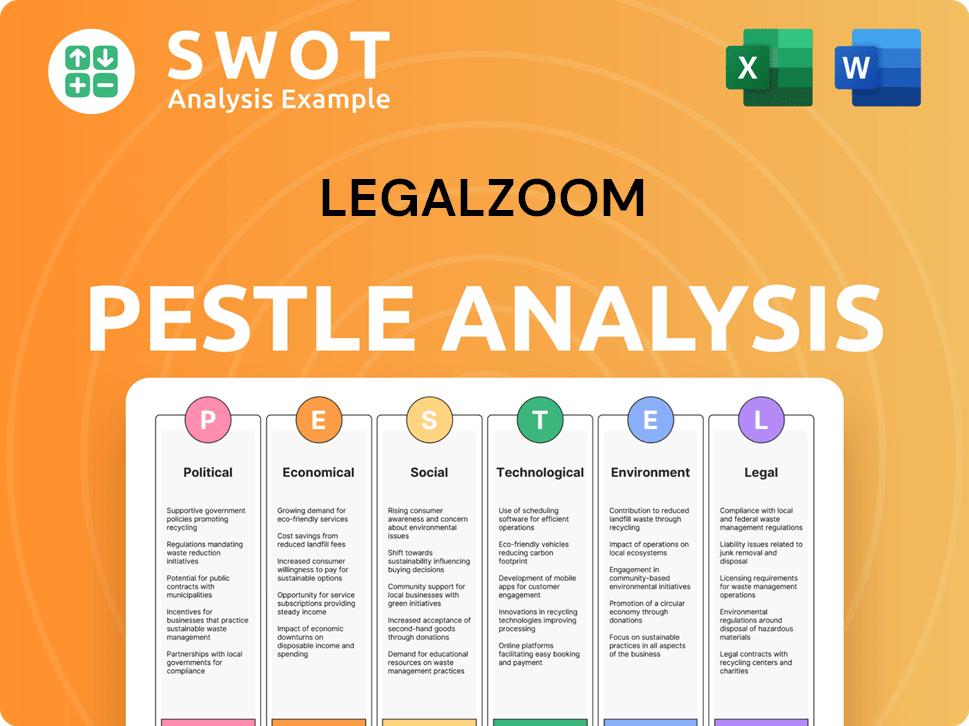

LegalZoom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped LegalZoom’s Business Model?

LegalZoom has achieved several significant milestones and strategic shifts that have shaped its operations and financial performance. A key focus has been transitioning to a subscription-based business model, which aims to provide more predictable revenue streams and enhance customer lifetime values. This strategic move is evident in the company's financial results.

Recent strategic actions include acquisitions and partnerships designed to expand its service offerings. These moves are aimed at enhancing its business formation services and integrating AI to improve its legal support capabilities. Despite facing some market challenges, LegalZoom has responded by concentrating on profitability and operational efficiencies.

LegalZoom's competitive advantages include strong brand recognition and its position as a leading provider of legal services. The company leverages a proprietary technology platform to automate legal and compliance processes, offering cost-effective solutions. It continues to adapt to market trends by investing in AI and enhancing its compliance offerings, positioning it well in the evolving legal tech landscape.

In February 2025, LegalZoom acquired Formation Nation for $64.8 million in cash and 2,205,445 restricted shares, aiming to enhance its business formation services. A partnership with 1-800Accountant, effective January 2025, was established to offer comprehensive tax and bookkeeping solutions. In June 2025, LegalZoom announced a partnership with Perplexity to integrate legal services into AI search, marking a step in leveraging AI for legal support.

LegalZoom's full-year subscription revenue in 2024 was $436.2 million, reflecting a 6% year-over-year increase. The company aims for double-digit subscription revenue growth by the end of 2025. Despite a 3% year-over-year decline in U.S. business applications in Q4 2024, LegalZoom increased its full-year net income to $30.0 million in 2024, a 115% increase, with an Adjusted EBITDA margin of 22%.

LegalZoom benefits from strong brand recognition and its position as a primary service provider for business formations. Its proprietary technology platform automates legal and compliance processes, offering cost-effective solutions. The company is adapting to new trends by investing in AI and enhancing its compliance offerings, helping it to maintain its competitive edge in the Growth Strategy of LegalZoom.

LegalZoom faced a decline in business formations, with U.S. business applications falling. The company responded with a focus on profitability and operational efficiencies. The company is also leveraging AI to improve its service offerings, including enhanced business license alerts.

LegalZoom is focused on expanding its subscription-based revenue and enhancing its service offerings through acquisitions and partnerships. The company is leveraging AI to improve its services and maintain a competitive edge in the market. The company also focuses on profitability and operational efficiency.

- Subscription revenue growth is a key focus, with a target of double-digit growth by the end of 2025.

- Strategic acquisitions like Formation Nation are aimed at expanding service capabilities.

- Partnerships, such as the one with Perplexity, are designed to integrate AI and enhance legal support.

- Focus on profitability, as evidenced by a significant increase in net income in 2024.

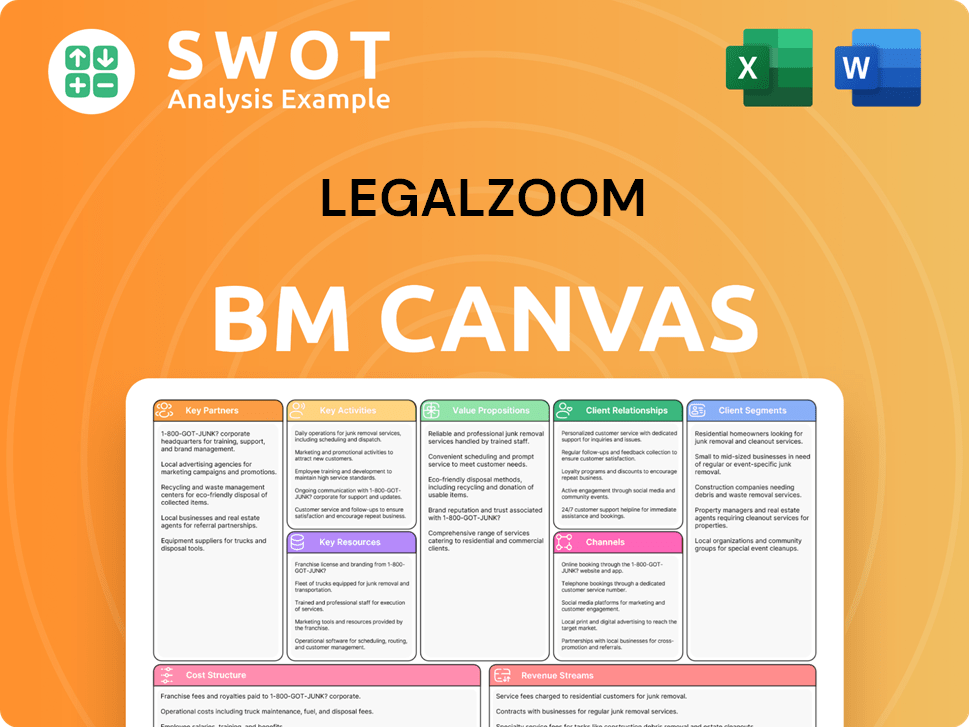

LegalZoom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is LegalZoom Positioning Itself for Continued Success?

LegalZoom holds a significant position in the online legal services market, particularly for business formation. However, the market is becoming more competitive, with rivals like ZenBusiness and Northwest Registered Agent gaining ground. Despite a slight dip in its market share of website visits, LegalZoom remains a leader, having formed over 4.6 million businesses as of December 31, 2024. Customer loyalty is improving, as seen in the rise of its customer retention rates to 64% in Q3 2024.

Several risks and challenges could impact LegalZoom's operations. Regulatory changes, such as the suspension of the Beneficial Ownership Information Report (BOIR) requirement, could affect revenue. The decline in U.S. business applications, which fell by 3% year-over-year in Q4 2024, poses another challenge. Competition from new market entrants and the integration of acquired entities also present operational hurdles. For a detailed look at the company's structure, you can learn more about the Owners & Shareholders of LegalZoom.

LegalZoom is a leading provider of Online legal services, particularly in business formation. The company has a substantial market share, although competition is increasing from rivals. Despite a slight decrease in market share, LegalZoom's customer retention rates are improving, reflecting strong customer loyalty.

Key risks include regulatory changes and the decline in U.S. business applications. Increased competition and the integration of new acquisitions also present challenges. These factors could impact LegalZoom's revenue and operational efficiency, requiring strategic adaptation.

LegalZoom is focusing on subscription revenue and attracting higher-value customers. The company is leveraging AI to improve customer experience and expand service offerings. The company anticipates approximately 5% revenue growth for the full year ending December 31, 2025.

LegalZoom projects approximately 5% revenue growth for the full year ending December 31, 2025. The company expects an Adjusted EBITDA of approximately $165 million, reflecting an Adjusted EBITDA margin of approximately 23%. This showcases the company's commitment to financial health and strategic growth.

LegalZoom is implementing several strategic initiatives to drive growth and enhance its service offerings. These initiatives include a focus on recurring subscription revenue, attracting higher-value customers, and integrating AI to improve customer experience.

- Prioritizing recurring subscription revenue to ensure financial stability.

- Reorienting the go-to-market strategy to attract higher-value customers.

- Leveraging artificial intelligence to improve customer experience and enhance services.

- Enhancing compliance offerings with improved status monitoring and notifications.

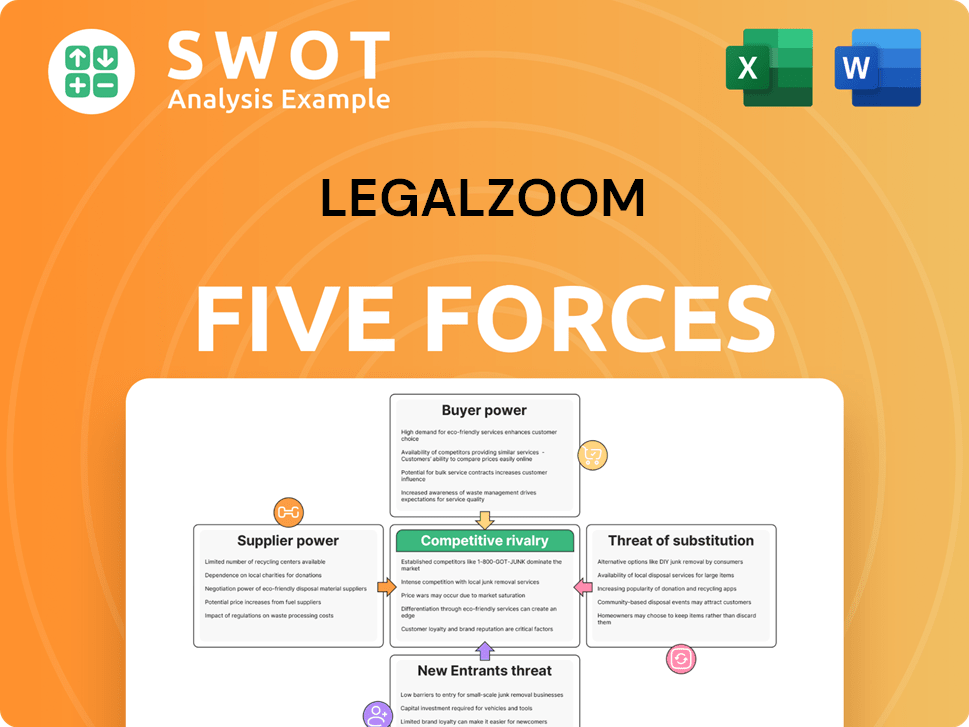

LegalZoom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LegalZoom Company?

- What is Competitive Landscape of LegalZoom Company?

- What is Growth Strategy and Future Prospects of LegalZoom Company?

- What is Sales and Marketing Strategy of LegalZoom Company?

- What is Brief History of LegalZoom Company?

- Who Owns LegalZoom Company?

- What is Customer Demographics and Target Market of LegalZoom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.